Transocean Ltd. (NYSE: RIG) today reported a net loss attributable

to controlling interest of $494 million, $0.58 per

diluted share, for the three months ended September 30, 2024.

Third quarter results included net unfavorable items of

$558 million or $0.58 per diluted share as follows:

- $617 million, $0.64 per

diluted share, loss on impairment of assets, net of tax.

Partially offset by:

- $21 million , $0.02 per

diluted share, gain on retirement of debt; and

- $38 million, $0.04 per

diluted share, discrete tax items, net.

After consideration of these net unfavorable items, third

quarter 2024 adjusted net income was $64 million.

Contract drilling revenues for the three months ended

September 30, 2024, increased sequentially by $87 million

to $948 million, primarily due to increased rig utilization,

increased dayrates for two rigs, higher reimbursement revenues and

a full quarter of revenues from the newbuild ultra-deepwater

drillship Deepwater Aquila, partially offset by lower revenue

efficiency across the fleet.

Operating and maintenance expense was $563 million,

compared with $534 million in the prior quarter. The

sequential increase was the result of increased fleet activity,

including a full quarter of operations from Deepwater Aquila,

partially offset by reduced operating costs related to Transocean

Norge following the acquisition of Orion Holdings (Cayman) Limited

in June 2024.

General and administrative expense was $47 million, down

from $59 million in the second quarter. The decrease was

primarily due to reduced costs associated with the early retirement

of certain personnel and lower professional fees.

Interest expense net of capitalized amounts was

$154 million, compared to $143 million in the prior

quarter, excluding the favorable adjustment of $74 million and

$69 million in the third and second quarter, respectively, for

the fair value of the bifurcated exchange feature related to the

4.625% exchangeable bonds. Interest income was $11 million,

compared to $14 million in the prior quarter.

The Effective Tax Rate(2) was 6.0%, down from

474.5% in the prior quarter. The decrease was primarily due to

rig impairments, rig sales and other ordinary movement in income

before tax. The Effective Tax Rate excluding discrete items

was 22.5% compared to 416.3% in the previous quarter.

Cash provided by operating activities was $194 million

during the third quarter of 2024, representing an increase of

$61 million compared to the prior quarter. The sequential

increase was primarily due to increased operating activities,

improved cash collected from customers and timing of payments to

suppliers, partially offset by higher interest payments.

Third quarter 2024 capital expenditures of

$58 million were primarily associated with

Deepwater Aquila. This compares with $84 million in the

prior quarter.

“As illustrated by the nearly $1.3 billion in backlog

booked in the third quarter, including the recent award for

Deepwater Conqueror, the demand for our fleet of high specification

ultra-deepwater and harsh environment rigs remains strong,” said

Chief Executive Officer, Jeremy Thigpen. “With these most

recent awards, more than 97% of Transocean’s active fleet is

contracted in 2025, once again demonstrating that our customers

clearly recognize Transocean’s unique capabilities – our rigs,

crews and superior operational performance – add value to their

programs.”

Thigpen concluded, “With approximately $9.3 billion in

backlog, and clear visibility to future demand, we will remain

focused on delivering safe, reliable and efficient operations for

our customers and continue to maximize cash generation to improve

our balance sheet, as we did in the third quarter with

$136 million of free cash flow.”Non-GAAP Financial

MeasuresWe present our operating results in accordance

with accounting principles generally accepted in the U.S. (“U.S.

GAAP”). We believe certain financial measures, such as Adjusted

Contract Drilling Revenues, EBITDA, Adjusted EBITDA and Adjusted

Net Income, which are non-GAAP measures, provide users of our

financial statements with supplemental information that may be

useful in evaluating our operating performance. We believe that

such non-GAAP measures, when read in conjunction with our operating

results presented under U.S. GAAP, can be used to better assess our

performance from period to period and relative to performance of

other companies in our industry, without regard to financing

methods, historical cost basis or capital structure. Such non-GAAP

measures should be considered as a supplement to, and not as a

substitute for, financial measures prepared in accordance with U.S.

GAAP.

All non-GAAP measure reconciliations to the most comparative

U.S. GAAP measures are displayed in quantitative schedules on the

company’s website at: www.deepwater.com.

About Transocean

Transocean is a leading international provider of offshore

contract drilling services for oil and gas wells. The company

specializes in technically demanding sectors of the global offshore

drilling business with a particular focus on ultra-deepwater and

harsh environment drilling services, and operates the highest

specification floating offshore drilling fleet in the world.

Transocean owns or has partial ownership interests in and

operates a fleet of 34 mobile offshore drilling units,

consisting of 26 ultra-deepwater floaters and eight harsh

environment floaters.

For more information about Transocean, please visit:

www.deepwater.com.

Conference Call Information

Transocean will conduct a teleconference starting at 9 a.m.

EDT, 2 p.m. CET, on Thursday, October 31, 2024, to

discuss the results. To participate, dial +1 785-424-1226 and

refer to conference code 827284 approximately 15 minutes

prior to the scheduled start time.

The teleconference will be simulcast in a listen-only mode at:

www.deepwater.com, by selecting Investors, News, and Webcasts.

Supplemental materials that may be referenced during the

teleconference will be available at: www.deepwater.com, by

selecting Investors, Financial Reports.

A replay of the conference call will be available after

12 p.m. EDT, 5 p.m. CET, on Thursday, October 31,

2024. The replay, which will be archived for approximately

30 days, can be accessed at +1 402-220-9184,

passcode 827284. The replay will also be available on the

company’s website.

Forward-Looking Statements

The statements described herein that are not historical facts

are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

These statements could contain words such as “possible,” “intend,”

“will,” “if,” “expect,” or other similar expressions.

Forward-looking statements are based on management’s current

expectations and assumptions, and are subject to inherent

uncertainties, risks and changes in circumstances that are

difficult to predict. As a result, actual results could differ

materially from those indicated in these forward-looking

statements. Factors that could cause actual results to differ

materially include, but are not limited to, estimated duration of

customer contracts, contract dayrate amounts, future contract

commencement dates and locations, planned shipyard projects and

other out-of-service time, sales of drilling units, timing of the

company’s newbuild deliveries, operating hazards and delays, risks

associated with international operations, actions by customers and

other third parties, the fluctuation of current and future prices

of oil and gas, the global and regional supply and demand for oil

and gas, the intention to scrap certain drilling rigs, the success

of our business following prior acquisitions, the effects of the

spread of and mitigation efforts by governments, businesses and

individuals related to contagious illnesses, and other factors,

including those and other risks discussed in the company's most

recent Annual Report on Form 10-K for the year ended

December 31, 2023, and in the company's other filings with the

SEC, which are available free of charge on the SEC's website at:

www.sec.gov. Should one or more of these risks or uncertainties

materialize (or the other consequences of such a development

worsen), or should underlying assumptions prove incorrect, actual

results may vary materially from those indicated or expressed or

implied by such forward-looking statements. All subsequent written

and oral forward-looking statements attributable to the company or

to persons acting on our behalf are expressly qualified in their

entirety by reference to these risks and uncertainties. You should

not place undue reliance on forward-looking statements. Each

forward-looking statement speaks only as of the date of the

particular statement, and we undertake no obligation to publicly

update or revise any forward-looking statements to reflect events

or circumstances that occur, or which we become aware of, after the

date hereof, except as otherwise may be required by law. All

non-GAAP financial measure reconciliations to the most comparative

GAAP measure are displayed in quantitative schedules on the

company’s website at: www.deepwater.com.

This press release, or referenced documents, do not constitute

an offer to sell, or a solicitation of an offer to buy, any

securities, and do not constitute an offering prospectus within the

meaning of the Swiss Financial Services Act (“FinSA”) or

advertising within the meaning of the FinSA. Investors must rely on

their own evaluation of Transocean and its securities, including

the merits and risks involved. Nothing contained herein is, or

shall be relied on as, a promise or representation as to the future

performance of Transocean.

Notes

|

(1) |

Revenue efficiency is defined as actual operating revenues,

excluding revenues for contract terminations and reimbursements,

for the measurement period divided by the maximum revenue

calculated for the measurement period, expressed as a percentage.

Maximum revenue is defined as the greatest amount of contract

drilling revenues the drilling unit could earn for the measurement

period, excluding revenues for incentive provisions, reimbursements

and contract terminations. See the accompanying schedule entitled

“Revenue Efficiency.” |

| (2) |

Effective Tax Rate is defined as

income tax expense or benefit divided by income or loss before

income taxes. See the accompanying schedule entitled “Supplemental

Effective Tax Rate Analysis.” |

Analyst Contact:Alison Johnson+1

713-232-7214

Media Contact:Pam Easton+1 713-232-7647

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In millions, except per share data) |

|

(Unaudited) |

| |

Three months ended |

|

Nine months ended |

| |

September 30, |

|

September 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Contract drilling revenues |

$ |

948 |

|

|

$ |

713 |

|

|

$ |

2,572 |

|

|

$ |

2,091 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Operating and maintenance |

|

563 |

|

|

|

524 |

|

|

|

1,620 |

|

|

|

1,417 |

|

|

Depreciation and amortization |

|

190 |

|

|

|

192 |

|

|

|

559 |

|

|

|

560 |

|

|

General and administrative |

|

47 |

|

|

|

44 |

|

|

|

158 |

|

|

|

137 |

|

|

|

|

800 |

|

|

|

760 |

|

|

|

2,337 |

|

|

|

2,114 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on impairment of assets |

|

(629 |

) |

|

|

(5 |

) |

|

|

(772 |

) |

|

|

(58 |

) |

| Loss on

disposal of assets, net |

|

(4 |

) |

|

|

(3 |

) |

|

|

(10 |

) |

|

|

(173 |

) |

|

Operating loss |

|

(485 |

) |

|

|

(55 |

) |

|

|

(547 |

) |

|

|

(254 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

11 |

|

|

|

12 |

|

|

|

40 |

|

|

|

42 |

|

|

Interest expense, net of amounts capitalized |

|

(80 |

) |

|

|

(232 |

) |

|

|

(271 |

) |

|

|

(649 |

) |

|

Gain (loss) on retirement of debt |

|

21 |

|

|

|

— |

|

|

|

161 |

|

|

|

(32 |

) |

|

Other, net |

|

8 |

|

|

|

12 |

|

|

|

32 |

|

|

|

35 |

|

|

|

|

(40 |

) |

|

|

(208 |

) |

|

|

(38 |

) |

|

|

(604 |

) |

|

Loss before income tax benefit |

|

(525 |

) |

|

|

(263 |

) |

|

|

(585 |

) |

|

|

(858 |

) |

| Income

tax benefit |

|

(31 |

) |

|

|

(43 |

) |

|

|

(66 |

) |

|

|

(8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

(494 |

) |

|

|

(220 |

) |

|

|

(519 |

) |

|

|

(850 |

) |

|

Net income attributable to noncontrolling interest |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss attributable to controlling interest |

$ |

(494 |

) |

|

$ |

(220 |

) |

|

$ |

(519 |

) |

|

$ |

(850 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per

share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.56 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.62 |

) |

|

$ |

(1.13 |

) |

|

Diluted |

$ |

(0.58 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.65 |

) |

|

$ |

(1.13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average

shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

879 |

|

|

|

774 |

|

|

|

840 |

|

|

|

755 |

|

|

Diluted |

|

954 |

|

|

|

774 |

|

|

|

915 |

|

|

|

755 |

|

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In millions, except share data) |

|

(Unaudited) |

| |

September 30, |

|

December 31, |

| |

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

435 |

|

|

$ |

762 |

|

| Accounts receivable, net of

allowance of $2 at September 30, 2024 and December 31, 2023 |

|

594 |

|

|

|

512 |

|

| Materials and supplies, net of

allowance of $176 and $198 at September 30, 2024 and December 31,

2023, respectively |

|

425 |

|

|

|

426 |

|

|

Assets held for sale |

|

345 |

|

|

|

49 |

|

| Restricted cash and cash

equivalents |

|

365 |

|

|

|

233 |

|

|

Other current assets |

|

179 |

|

|

|

144 |

|

|

Total current assets |

|

2,343 |

|

|

|

2,126 |

|

|

|

|

|

|

|

|

|

Property and equipment |

|

22,412 |

|

|

|

23,875 |

|

|

Less accumulated depreciation |

|

(6,424 |

) |

|

|

(6,934 |

) |

|

Property and equipment, net |

|

15,988 |

|

|

|

16,941 |

|

| Contract intangible

assets |

|

— |

|

|

|

4 |

|

|

Deferred tax assets, net |

|

165 |

|

|

|

44 |

|

|

Other assets |

|

1,014 |

|

|

|

1,139 |

|

|

Total assets |

$ |

19,510 |

|

|

$ |

20,254 |

|

|

|

|

|

|

|

|

| Liabilities and

equity |

|

|

|

|

|

|

Accounts payable |

$ |

255 |

|

|

$ |

323 |

|

|

Accrued income taxes |

|

13 |

|

|

|

23 |

|

|

Debt due within one year |

|

457 |

|

|

|

370 |

|

|

Other current liabilities |

|

706 |

|

|

|

681 |

|

|

Total current liabilities |

|

1,431 |

|

|

|

1,397 |

|

| |

|

|

|

|

|

| Long-term debt |

|

6,503 |

|

|

|

7,043 |

|

|

Deferred tax liabilities, net |

|

570 |

|

|

|

540 |

|

| Other

long-term liabilities |

|

778 |

|

|

|

858 |

|

|

Total long-term liabilities |

|

7,851 |

|

|

|

8,441 |

|

| |

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

| |

|

|

|

|

|

| Shares, $0.10 par value,

1,057,879,029 authorized, 141,262,093 conditionally authorized,

940,828,901 issued |

|

|

|

|

|

|

and 875,803,595 outstanding at September 30, 2024, and CHF 0.10 par

value, 1,021,294,549 authorized, |

|

|

|

|

|

|

142,362,093 conditionally authorized, 843,715,858 issued and

809,030,846 outstanding at December 31, 2023 |

|

87 |

|

|

|

81 |

|

|

Additional paid-in capital |

|

14,871 |

|

|

|

14,544 |

|

|

Accumulated deficit |

|

(4,552 |

) |

|

|

(4,033 |

) |

|

Accumulated other comprehensive loss |

|

(179 |

) |

|

|

(177 |

) |

|

Total controlling interest shareholders’ equity |

|

10,227 |

|

|

|

10,415 |

|

|

Noncontrolling interest |

|

1 |

|

|

|

1 |

|

|

Total equity |

|

10,228 |

|

|

|

10,416 |

|

|

Total liabilities and equity |

$ |

19,510 |

|

|

$ |

20,254 |

|

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In millions) |

|

(Unaudited) |

| |

Nine months ended |

| |

September 30, |

| |

2024 |

|

|

2023 |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

Net loss |

$ |

(519 |

) |

|

$ |

(850 |

) |

|

Adjustments to reconcile to net cash provided by operating

activities: |

|

|

|

|

|

|

Amortization of contract intangible asset |

|

4 |

|

|

|

45 |

|

|

Depreciation and amortization |

|

559 |

|

|

|

560 |

|

|

Share-based compensation expense |

|

38 |

|

|

|

30 |

|

|

Loss on impairment of assets |

|

772 |

|

|

|

58 |

|

|

Loss on impairment of investment in unconsolidated affiliate |

|

5 |

|

|

|

— |

|

|

Loss on disposal of assets, net |

|

10 |

|

|

|

173 |

|

|

Fair value adjustment to bifurcated compound exchange feature |

|

(153 |

) |

|

|

272 |

|

|

Amortization of debt-related balances, net |

|

39 |

|

|

|

38 |

|

|

(Gain) loss on retirement of debt |

|

(161 |

) |

|

|

32 |

|

|

Deferred income tax expense (benefit) |

|

(91 |

) |

|

|

1 |

|

|

Other, net |

|

(6 |

) |

|

|

21 |

|

|

Changes in deferred revenues, net |

|

98 |

|

|

|

40 |

|

|

Changes in deferred costs, net |

|

(26 |

) |

|

|

(125 |

) |

|

Changes in other operating assets and liabilities, net |

|

(328 |

) |

|

|

(229 |

) |

| Net

cash provided by operating activities |

|

241 |

|

|

|

66 |

|

| |

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

Capital expenditures |

|

(225 |

) |

|

|

(207 |

) |

|

Investment in loans to unconsolidated affiliates |

|

(3 |

) |

|

|

(3 |

) |

|

Investment in equity of unconsolidated affiliate |

|

— |

|

|

|

(10 |

) |

|

Proceeds from disposal of assets, net of costs to sell |

|

99 |

|

|

|

10 |

|

|

Cash acquired in acquisition of unconsolidated affiliates |

|

5 |

|

|

|

7 |

|

| Net

cash used in investing activities |

|

(124 |

) |

|

|

(203 |

) |

| |

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

Repayments of debt |

|

(2,073 |

) |

|

|

(1,707 |

) |

|

Proceeds from issuance of debt, net of issue costs |

|

1,767 |

|

|

|

1,664 |

|

|

Other, net |

|

(6 |

) |

|

|

(3 |

) |

| Net

cash used in financing activities |

|

(312 |

) |

|

|

(46 |

) |

| |

|

|

|

|

|

| Net

decrease in unrestricted and restricted cash and cash

equivalents |

|

(195 |

) |

|

|

(183 |

) |

|

Unrestricted and restricted cash and cash equivalents, beginning of

period |

|

995 |

|

|

|

991 |

|

|

Unrestricted and restricted cash and cash equivalents, end of

period |

$ |

800 |

|

|

$ |

808 |

|

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

FLEET OPERATING STATISTICS |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Three months ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| Contract Drilling

Revenues (in millions) |

2024 |

|

2024 |

|

2023 |

| Ultra-deepwater floaters |

$ |

668 |

|

$ |

606 |

|

$ |

516 |

| Harsh environment

floaters |

|

280 |

|

|

255 |

|

|

197 |

|

Total contract drilling revenues |

$ |

948 |

|

$ |

861 |

|

$ |

713 |

| |

Three months ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| Average Daily

Revenue (1) |

2024 |

|

2024 |

|

2023 |

|

Ultra-deepwater floaters |

$ |

426,700 |

|

$ |

433,900 |

|

$ |

406,500 |

| Harsh environment

floaters |

|

464,900 |

|

|

449,600 |

|

|

357,400 |

|

Total fleet average daily revenue |

$ |

436,800 |

|

$ |

438,300 |

|

$ |

391,300 |

| |

Three months ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| Utilization

(2) |

2024 |

|

2024 |

|

2023 |

|

Ultra-deepwater floaters |

60.7 |

% |

|

53.5 |

% |

|

45.0 |

% |

| Harsh environment

floaters |

75.0 |

% |

|

73.0 |

% |

|

63.0 |

% |

|

Total fleet average rig utilization |

63.9 |

% |

|

57.8 |

% |

|

49.4 |

% |

| |

Three months ended |

| |

September 30, |

|

June 30, |

|

September 30, |

| Revenue

Efficiency (3) |

2024 |

|

2024 |

|

2023 |

|

Ultra-deepwater floaters |

92.5 |

% |

|

96.5 |

% |

|

94.3 |

% |

| Harsh environment

floaters |

100.1 |

% |

|

98.1 |

% |

|

98.1 |

% |

|

Total fleet average revenue efficiency |

94.5 |

% |

|

96.9 |

% |

|

95.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Average daily revenue is defined as operating revenues,

excluding revenues for contract terminations, reimbursements and

contract intangible amortization, earned per operating day. An

operating day is defined as a day for which a rig is contracted to

earn a dayrate during the firm contract period after operations

commence. |

| |

|

|

|

|

|

|

|

|

|

(2) Rig utilization is defined as the total number of operating

days divided by the total number of rig calendar days in the

measurement period, expressed as a percentage. |

| |

|

|

|

|

|

|

|

|

|

(3) Revenue efficiency is defined as actual operating revenues,

excluding revenues for contract terminations and reimbursements,

for the measurement period divided by the maximum revenue

calculated for the measurement period, expressed as a percentage.

Maximum revenue is defined as the greatest amount of contract

drilling revenues the drilling unit could earn for the measurement

period, excluding revenues for incentive provisions, reimbursements

and contract terminations. |

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATIONS |

|

ADJUSTED NET INCOME (LOSS) AND ADJUSTED DILUTED EARNINGS

(LOSS) PER SHARE |

|

(in millions, except per share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

| |

09/30/24 |

|

09/30/24 |

|

06/30/24 |

|

06/30/24 |

|

03/31/24 |

| Adjusted Net Income

(Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to controlling interest, as

reported |

$ |

(519 |

) |

|

$ |

(494 |

) |

|

$ |

(25 |

) |

|

$ |

(123 |

) |

|

$ |

98 |

|

|

Loss on impairment of assets, net of tax |

|

755 |

|

|

|

617 |

|

|

|

138 |

|

|

|

138 |

|

|

|

— |

|

|

Loss on impairment of investment in unconsolidated affiliates |

|

5 |

|

|

|

— |

|

|

|

5 |

|

|

|

4 |

|

|

|

1 |

|

|

Gain on retirement of debt |

|

(161 |

) |

|

|

(21 |

) |

|

|

(140 |

) |

|

|

(140 |

) |

|

|

— |

|

|

Discrete tax items |

|

(161 |

) |

|

|

(38 |

) |

|

|

(123 |

) |

|

|

(2 |

) |

|

|

(121 |

) |

| Net income (loss), as

adjusted |

$ |

(81 |

) |

|

$ |

64 |

|

|

$ |

(145 |

) |

|

$ |

(123 |

) |

|

$ |

(22 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Diluted

Earnings (Loss) Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per

share, as reported |

$ |

(0.65 |

) |

|

$ |

(0.58 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.15 |

) |

|

$ |

0.11 |

|

|

Loss on impairment of assets, net of tax |

|

0.82 |

|

|

|

0.64 |

|

|

|

0.17 |

|

|

|

0.17 |

|

|

|

— |

|

|

Loss on impairment of investment in unconsolidated affiliates |

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Gain on retirement of debt |

|

(0.18 |

) |

|

|

(0.02 |

) |

|

|

(0.17 |

) |

|

|

(0.17 |

) |

|

|

— |

|

|

Discrete tax items |

|

(0.18 |

) |

|

|

(0.04 |

) |

|

|

(0.15 |

) |

|

|

— |

|

|

|

(0.14 |

) |

| Diluted earnings

(loss) per share, as adjusted |

$ |

(0.18 |

) |

|

$ |

— |

|

|

$ |

(0.18 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.03 |

) |

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

| |

12/31/23 |

|

12/31/23 |

|

09/30/23 |

|

09/30/23 |

|

06/30/23 |

|

06/30/23 |

|

03/31/23 |

| Adjusted Net

Loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to controlling interest, as reported |

$ |

(954 |

) |

|

$ |

(104 |

) |

|

$ |

(850 |

) |

|

$ |

(220 |

) |

|

$ |

(630 |

) |

|

$ |

(165 |

) |

|

$ |

(465 |

) |

|

Loss on impairment of assets |

|

57 |

|

|

|

(1 |

) |

|

|

58 |

|

|

|

5 |

|

|

|

53 |

|

|

|

53 |

|

|

|

— |

|

|

Loss on disposal of assets, net |

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

Loss on impairment of investment in unconsolidated affiliate |

|

5 |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss on conversion of debt to equity |

|

27 |

|

|

|

24 |

|

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

|

3 |

|

|

|

— |

|

|

(Gain) loss on retirement of debt |

|

31 |

|

|

|

(1 |

) |

|

|

32 |

|

|

|

— |

|

|

|

32 |

|

|

|

— |

|

|

|

32 |

|

|

Discrete tax items |

|

(74 |

) |

|

|

3 |

|

|

|

(77 |

) |

|

|

(65 |

) |

|

|

(12 |

) |

|

|

(1 |

) |

|

|

(11 |

) |

| Net loss, as

adjusted |

$ |

(739 |

) |

|

$ |

(74 |

) |

|

$ |

(665 |

) |

|

$ |

(280 |

) |

|

$ |

(385 |

) |

|

$ |

(110 |

) |

|

$ |

(275 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Diluted Loss

Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted loss per share, as

reported |

$ |

(1.24 |

) |

|

$ |

(0.13 |

) |

|

$ |

(1.13 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.85 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.64 |

) |

|

Loss on impairment of assets |

|

0.07 |

|

|

|

— |

|

|

|

0.08 |

|

|

|

0.01 |

|

|

|

0.07 |

|

|

|

0.07 |

|

|

|

— |

|

|

Loss on disposal of assets, net |

|

0.22 |

|

|

|

— |

|

|

|

0.23 |

|

|

|

— |

|

|

|

0.23 |

|

|

|

— |

|

|

|

0.23 |

|

|

Loss on impairment of investment in unconsolidated affiliate |

|

0.01 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Loss on conversion of debt to equity |

|

0.04 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

(Gain) loss on retirement of debt |

|

0.04 |

|

|

|

— |

|

|

|

0.04 |

|

|

|

— |

|

|

|

0.04 |

|

|

|

— |

|

|

|

0.04 |

|

|

Discrete tax items |

|

(0.10 |

) |

|

|

— |

|

|

|

(0.10 |

) |

|

|

(0.09 |

) |

|

|

(0.01 |

) |

|

|

— |

|

|

|

(0.01 |

) |

| Diluted loss per

share, as adjusted |

$ |

(0.96 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.88 |

) |

|

$ |

(0.36 |

) |

|

$ |

(0.52 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.38 |

) |

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATIONS |

|

|

ADJUSTED CONTRACT DRILLING REVENUES |

|

|

EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATION AND RELATED MARGINS |

|

|

(in millions, except percentages) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

| |

09/30/24 |

|

09/30/24 |

|

06/30/24 |

|

06/30/24 |

|

03/31/24 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract drilling revenues |

$ |

2,572 |

|

|

$ |

948 |

|

|

$ |

1,624 |

|

|

$ |

861 |

|

|

$ |

763 |

|

|

|

Contract intangible asset amortization |

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

| Adjusted Contract

Drilling Revenues |

$ |

2,576 |

|

|

$ |

948 |

|

|

$ |

1,628 |

|

|

$ |

861 |

|

|

$ |

767 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

$ |

(519 |

) |

|

$ |

(494 |

) |

|

$ |

(25 |

) |

|

$ |

(123 |

) |

|

$ |

98 |

|

|

|

Interest expense, net of interest income |

|

231 |

|

|

|

69 |

|

|

|

162 |

|

|

|

60 |

|

|

|

102 |

|

|

|

Income tax expense (benefit) |

|

(66 |

) |

|

|

(31 |

) |

|

|

(35 |

) |

|

|

156 |

|

|

|

(191 |

) |

|

|

Depreciation and amortization |

|

559 |

|

|

|

190 |

|

|

|

369 |

|

|

|

184 |

|

|

|

185 |

|

|

|

Contract intangible asset amortization |

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

| EBITDA |

|

209 |

|

|

|

(266 |

) |

|

|

475 |

|

|

|

277 |

|

|

|

198 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on impairment of assets |

|

772 |

|

|

|

629 |

|

|

|

143 |

|

|

|

143 |

|

|

|

— |

|

|

|

Loss on impairment of investment in unconsolidated affiliates |

|

5 |

|

|

|

— |

|

|

|

5 |

|

|

|

4 |

|

|

|

1 |

|

|

|

Gain on retirement of debt |

|

(161 |

) |

|

|

(21 |

) |

|

|

(140 |

) |

|

|

(140 |

) |

|

|

— |

|

|

| Adjusted

EBITDA |

$ |

825 |

|

|

$ |

342 |

|

|

$ |

483 |

|

|

$ |

284 |

|

|

$ |

199 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss) margin |

|

(20.2 |

) |

% |

|

(52.0 |

) |

% |

|

(1.5 |

) |

% |

|

(14.3 |

) |

% |

|

12.9 |

|

% |

| EBITDA margin |

|

8.1 |

|

% |

|

(28.1 |

) |

% |

|

29.2 |

|

% |

|

32.2 |

|

% |

|

25.8 |

|

% |

| Adjusted EBITDA margin |

|

32.0 |

|

% |

|

36.0 |

|

% |

|

29.7 |

|

% |

|

33.0 |

|

% |

|

26.0 |

|

% |

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

| |

12/31/23 |

|

12/31/23 |

|

09/30/23 |

|

09/30/23 |

|

06/30/23 |

|

06/30/23 |

|

03/31/23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract drilling revenues |

$ |

2,832 |

|

|

$ |

741 |

|

|

$ |

2,091 |

|

|

$ |

713 |

|

|

$ |

1,378 |

|

|

$ |

729 |

|

|

$ |

649 |

|

|

|

Contract intangible asset amortization |

|

52 |

|

|

|

7 |

|

|

|

45 |

|

|

|

8 |

|

|

|

37 |

|

|

|

19 |

|

|

|

18 |

|

|

| Adjusted Contract

Drilling Revenues |

$ |

2,884 |

|

|

$ |

748 |

|

|

$ |

2,136 |

|

|

$ |

721 |

|

|

$ |

1,415 |

|

|

$ |

748 |

|

|

$ |

667 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(954 |

) |

|

$ |

(104 |

) |

|

$ |

(850 |

) |

|

$ |

(220 |

) |

|

$ |

(630 |

) |

|

$ |

(165 |

) |

|

$ |

(465 |

) |

|

|

Interest expense, net of interest income |

|

594 |

|

|

|

(13 |

) |

|

|

607 |

|

|

|

220 |

|

|

|

387 |

|

|

|

157 |

|

|

|

230 |

|

|

|

Income tax expense (benefit) |

|

13 |

|

|

|

21 |

|

|

|

(8 |

) |

|

|

(43 |

) |

|

|

35 |

|

|

|

(16 |

) |

|

|

51 |

|

|

|

Depreciation and amortization |

|

744 |

|

|

|

184 |

|

|

|

560 |

|

|

|

192 |

|

|

|

368 |

|

|

|

186 |

|

|

|

182 |

|

|

|

Contract intangible asset amortization |

|

52 |

|

|

|

7 |

|

|

|

45 |

|

|

|

8 |

|

|

|

37 |

|

|

|

19 |

|

|

|

18 |

|

|

| EBITDA |

|

449 |

|

|

|

95 |

|

|

|

354 |

|

|

|

157 |

|

|

|

197 |

|

|

|

181 |

|

|

|

16 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss on impairment of assets |

|

57 |

|

|

|

(1 |

) |

|

|

58 |

|

|

|

5 |

|

|

|

53 |

|

|

|

53 |

|

|

|

— |

|

|

|

Loss on disposal of assets, net |

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

|

— |

|

|

|

169 |

|

|

|

Loss on impairment of investment in unconsolidated affiliate |

|

5 |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Loss on conversion of debt to equity |

|

27 |

|

|

|

24 |

|

|

|

3 |

|

|

|

— |

|

|

|

3 |

|

|

|

3 |

|

|

|

— |

|

|

|

(Gain) loss on retirement of debt |

|

31 |

|

|

|

(1 |

) |

|

|

32 |

|

|

|

— |

|

|

|

32 |

|

|

|

— |

|

|

|

32 |

|

|

| Adjusted

EBITDA |

$ |

738 |

|

|

$ |

122 |

|

|

$ |

616 |

|

|

$ |

162 |

|

|

$ |

454 |

|

|

$ |

237 |

|

|

$ |

217 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss margin |

|

(33.7 |

) |

% |

|

(14.0 |

) |

% |

|

(40.7 |

) |

% |

|

(30.9 |

) |

% |

|

(45.7 |

) |

% |

|

(22.6 |

) |

% |

|

(71.6 |

) |

% |

| EBITDA margin |

|

15.6 |

|

% |

|

12.7 |

|

% |

|

16.6 |

|

% |

|

21.8 |

|

% |

|

13.9 |

|

% |

|

24.2 |

|

% |

|

2.4 |

|

% |

| Adjusted EBITDA margin |

|

25.6 |

|

% |

|

16.3 |

|

% |

|

28.9 |

|

% |

|

22.5 |

|

% |

|

32.1 |

|

% |

|

31.7 |

|

% |

|

32.5 |

|

% |

|

TRANSOCEAN LTD. AND SUBSIDIARIES |

|

|

SUPPLEMENTAL EFFECTIVE TAX RATE ANALYSIS |

|

|

(in millions, except tax rates) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

Nine months ended |

|

| |

September 30, |

|

June 30, |

|

September 30, |

|

September 30, |

|

September 30, |

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

$ |

(525 |

) |

|

$ |

33 |

|

|

$ |

(263 |

) |

|

$ |

(585 |

) |

|

$ |

(858 |

) |

|

|

Loss on impairment of assets |

|

629 |

|

|

|

143 |

|

|

|

5 |

|

|

|

772 |

|

|

|

58 |

|

|

|

Loss on disposal of assets, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

169 |

|

|

|

Loss on impairment of investment in unconsolidated affiliates |

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

Loss on conversion of debt to equity |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3 |

|

|

|

(Gain) loss on retirement of debt |

|

(21 |

) |

|

|

(140 |

) |

|

|

— |

|

|

|

(161 |

) |

|

|

32 |

|

|

| Adjusted income (loss) before

income taxes |

$ |

83 |

|

|

$ |

40 |

|

|

$ |

(258 |

) |

|

$ |

31 |

|

|

$ |

(596 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense

(benefit) |

$ |

(31 |

) |

|

$ |

156 |

|

|

$ |

(43 |

) |

|

$ |

(66 |

) |

|

$ |

(8 |

) |

|

|

Loss on impairment of assets |

|

12 |

|

|

|

5 |

|

|

|

— |

|

|

|

17 |

|

|

|

— |

|

|

|

Loss on disposal of assets, net |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Loss on impairment of investment in unconsolidated affiliates |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Loss on conversion of debt to equity |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(Gain) loss on retirement of debt |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

Changes in estimates (1) |

|

38 |

|

|

|

2 |

|

|

|

65 |

|

|

|

161 |

|

|

|

77 |

|

|

| Adjusted income tax expense

(benefit) (2) |

$ |

19 |

|

|

$ |

163 |

|

|

$ |

22 |

|

|

$ |

112 |

|

|

$ |

69 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Tax

Rate (3) |

|

6.0 |

|

% |

|

474.5 |

|

% |

|

16.3 |

|

% |

|

11.3 |

|

% |

|

0.9 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effective Tax Rate,

excluding discrete items (4) |

|

22.5 |

|

% |

|

416.3 |

|

% |

|

(8.7 |

) |

% |

|

364.0 |

|

% |

|

(11.7 |

) |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Our estimates change as we file tax returns, settle disputes

with tax authorities, or become aware of changes in laws and other

events that have an effect on our (a) deferred taxes, (b) valuation

allowances on deferred taxes and (c) other tax liabilities. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) The three

months ended September 30, 2024 included $283 million of additional

tax benefit, reflecting the cumulative effect of a decrease in the

annual effective tax rate from the previous quarter estimate. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) Our effective

tax rate is calculated as income tax expense or benefit divided by

income or loss before income taxes. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) Our effective tax rate, excluding discrete items, is calculated

as income tax expense or benefit, excluding various discrete items

(such as changes in estimates and tax on items excluded from income

before income taxes), divided by income or loss before income

taxes, excluding gains and losses on sales and similar items

pursuant to the accounting standards for income taxes related to

estimating the annual effective tax rate. |

|

|

Transocean Ltd. and subsidiaries |

|

Non-GAAP Financial Measures and

Reconciliations |

|

Free Cash Flow and Levered Free Cash Flow |

|

(in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

| |

|

|

|

|

|

|

09/30/24 |

|

09/30/24 |

|

06/30/24 |

|

06/30/24 |

|

03/31/24 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by (used in)

operating activities |

|

|

|

|

|

|

$ |

241 |

|

|

$ |

194 |

|

|

$ |

47 |

|

|

$ |

133 |

|

|

$ |

(86 |

) |

| Capital expenditures |

|

|

|

|

|

|

|

(225 |

) |

|

|

(58 |

) |

|

|

(167 |

) |

|

|

(84 |

) |

|

|

(83 |

) |

|

Free Cash Flow |

|

|

|

|

|

|

|

16 |

|

|

|

136 |

|

|

|

(120 |

) |

|

|

49 |

|

|

|

(169 |

) |

| Debt repayments |

|

|

|

|

|

|

|

(2,073 |

) |

|

|

(258 |

) |

|

|

(1,815 |

) |

|

|

(1,664 |

) |

|

|

(151 |

) |

| Debt repayments, paid from

debt proceeds |

|

|

|

|

|

|

|

1,748 |

|

|

|

99 |

|

|

|

1,649 |

|

|

|

1,649 |

|

|

|

- |

|

|

Levered Free Cash Flow |

|

|

|

|

|

|

$ |

(309 |

) |

|

$ |

(23 |

) |

|

$ |

(286 |

) |

|

$ |

34 |

|

|

$ |

(320 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

| |

12/31/23 |

|

12/31/23 |

|

09/30/23 |

|

09/30/23 |

|

06/30/23 |

|

06/30/23 |

|

03/31/23 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash provided by (used in) operating activities |

$ |

164 |

|

|

$ |

98 |

|

|

$ |

66 |

|

|

$ |

(44 |

) |

|

$ |

110 |

|

|

$ |

157 |

|

|

$ |

(47 |

) |

| Capital expenditures |

|

(427 |

) |

|

|

(220 |

) |

|

|

(207 |

) |

|

|

(50 |

) |

|

|

(157 |

) |

|

|

(76 |

) |

|

|

(81 |

) |

|

Free Cash Flow |

|

(263 |

) |

|

|

(122 |

) |

|

|

(141 |

) |

|

|

(94 |

) |

|

|

(47 |

) |

|

|

81 |

|

|

|

(128 |

) |

| Debt repayments |

|

(1,717 |

) |

|

|

(10 |

) |

|

|

(1,707 |

) |

|

|

(139 |

) |

|

|

(1,568 |

) |

|

|

(4 |

) |

|

|

(1,564 |

) |

| Debt repayments, paid from

debt proceeds |

|

1,156 |

|

|

|

- |

|

|

|

1,156 |

|

|

|

- |

|

|

|

1,156 |

|

|

|

- |

|

|

|

1,156 |

|

|

Levered Free Cash Flow |

$ |

(824 |

) |

|

$ |

(132 |

) |

|

$ |

(692 |

) |

|

$ |

(233 |

) |

|

$ |

(459 |

) |

|

$ |

77 |

|

|

$ |

(536 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

|

QTD |

|

YTD |

| |

12/31/22 |

|

12/31/22 |

|

09/30/22 |

|

09/30/22 |

|

06/30/22 |

|

06/30/22 |

|

03/31/22 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by (used in)

operating activities |

$ |

448 |

|

|

$ |

178 |

|

|

$ |

270 |

|

|

$ |

230 |

|

|

$ |

40 |

|

|

$ |

41 |

|

|

$ |

(1 |

) |

| Capital expenditures |

|

(717 |

) |

|

|

(409 |

) |

|

|

(308 |

) |

|

|

(87 |

) |

|

|

(221 |

) |

|

|

(115 |

) |

|

|

(106 |

) |

|

Free Cash Flow |

|

(269 |

) |

|

|

(231 |

) |

|

|

(38 |

) |

|

|

143 |

|

|

|

(181 |

) |

|

|

(74 |

) |

|

|

(107 |

) |

| Debt repayments |

|

(554 |

) |

|

|

(101 |

) |

|

|

(453 |

) |

|

|

(196 |

) |

|

|

(257 |

) |

|

|

(92 |

) |

|

|

(165 |

) |

| Debt repayments, paid from

debt proceeds |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Levered Free Cash Flow |

$ |

(823 |

) |

|

$ |

(332 |

) |

|

$ |

(491 |

) |

|

$ |

(53 |

) |

|

$ |

(438 |

) |

|

$ |

(166 |

) |

|

$ |

(272 |

) |

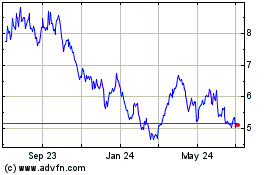

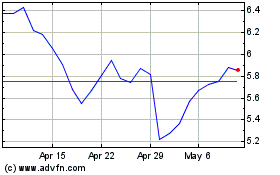

Transocean (NYSE:RIG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Transocean (NYSE:RIG)

Historical Stock Chart

From Dec 2023 to Dec 2024