Highlights Recent Investor Presentation

Refuting Kimmeridge’s Continued Misstatements

Board Urges Shareholders to Vote “FOR” ALL of

SilverBow’s Highly Qualified Directors on the WHITE Proxy Card

SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today mailed a letter to shareholders in connection with

the Company’s 2024 Annual Meeting of Shareholders (the “2024 Annual

Meeting”). The letter will be filed with the U.S. Securities and

Exchange Commission. Additional company resources for the 2024

Annual Meeting, including SilverBow’s most recent investor

presentation addressing continued misstatements by Kimmeridge

Energy Management Company, LLC and facts about SilverBow’s strong

Board and successful M&A track record, can be found at

www.FutureOfSilverBow.com.

The full text of the letter follows:

Dear Fellow Shareholders,

SilverBow Resources recently released

outstanding first quarter financial and operating results,

demonstrating the merits of our business strategy and the value

that is being delivered by our prior acquisitions.

Our performance in the market is directly

attributable to a proven strategy, strong management and an

experienced Board of Directors. Despite our outperformance,

Kimmeridge Energy Management Company, LLC (“Kimmeridge”) continues

its self-serving quest to take control of SilverBow and force a

dilutive, value-destructive combination with Kimmeridge Texas Gas

("KTG").

We recommend our shareholders vote to

continue our strong momentum and path to further value

creation.

To protect the value of your investment, use

the WHITE proxy card to vote “FOR” all SilverBow director

nominees: Gabriel L. Ellisor, Kathleen McAllister and Charles W.

Wampler.

SilverBow is Building Momentum and

Delivering Value

Our year-to-date highlights:

- Delivered first quarter results ahead of consensus

expectations, with record quarterly EBITDA of $200 million,1

free cash flow of $56 million1 (more than 100% above consensus),

lower than expected capital investments of $109 million (20% below

consensus) and ongoing efficiency gains in well productivity and

cycle times.

- Strengthened our capital structure, reducing debt by

$178 million2 since November 2023, paying down 15% of SilverBow’s

debt in five months; leverage3 today stands at 1.35x. Since late

2023, at the closing of our South Texas acquisition, we have

reduced leverage and doubled liquidity.

- Increased full year 2024 outlook, with a 36% increase in

expected free cash flow. FY24 production raised 5% related to

higher well productivity and faster cycle times.

- Continued capital efficiency gains through our peer-leading

cost structure and margin profile. SilverBow’s EBITDA margin1

is 12% higher than peers. This is a result of operating expenses

that are more than 40% lower than peers and cash G&A4 that is

more than 70% lower than peers.

- Enhanced our already deep inventory through operational

excellence, adding 100 refracs and 30 U-shaped wells, as well

as adding liquids-rich locations through a land swap.

Third party energy research analysts

recognize SilverBow’s value proposition5:

- Northland Capital Markets (May 3, 2024): “In our view, SBOW

shareholders will be better off staying the course and waiting for

a recovery in natural gas prices to reveal the truly phenomenal

quality of the Eagle Ford as an asset, and SBOW's position, in

particular, within that. We would take advantage of the

significant discount to intrinsic value to accumulate shares.”

- KeyBanc Capital Markets (May 1, 2024): “Ahead of a shareholder

meeting on May 21, and ahead of a likely opinion on director

changes from Glass Lewis and ISS in the next few days, SilverBow

released a strong print that shows both field execution on its oily

Eagle Ford Shale acreage and financial execution with its debt

reduction efforts.”

- Johnson Rice & Company (May 1, 2024): “We expect SBOW

shares to be strong in the wake of this classic ‘beat and guide up’

quarterly report. In a bigger context, we continue to like SBOW

for the value it offers as well as the optionality the company has

across hydrocarbon windows in the Eagle Ford.”

SilverBow’s Acquisitions Are Delivering

Value

Under the direction of our highly experienced

Board, SilverBow has executed a successful M&A strategy since

2021. Over the last four years, we have successfully executed and

integrated eight value-enhancing acquisitions, improving our

portfolio by:

- Increasing our scale and asset durability, providing critical

capital allocation flexibility

- Adding high-quality inventory, allowing us to continually

high-grade our portfolio and invest in our highest return

opportunities

- Doubling our percentage of oil/liquids production and adding

balance to our commodity mix

- Capturing capital efficiency gains through our proven operating

practices

These accretive acquisitions today represent

approximately 75% of our YE23 proved developed reserves PV-10 and

more than 95% of YE23 proved undeveloped reserves PV-10. Moreover,

96% of our top quartile undeveloped net locations originate from

acquired assets, with 99% of our 2024 drilling and completion

capital expenditures dedicated to these high-performing

investments, highlighting our effective integration and resource

allocation. Assets are clearly better under SilverBow’s ownership.

Through operation of these assets, we have improved their value

by approximately 64% in aggregate.6 Our results have

been noticed by the market. SilverBow has delivered 484% in total

shareholder returns since 2021, significantly outperforming the

XOP’s 180%.7

Our Board has Deep Industry and M&A

Expertise

With track records of financial, operational

and M&A expertise, our directors have led extensive careers as

top executives at blue-chip, large- and mega-cap energy companies.

SilverBow’s Board has an average tenure of over 30 years in the oil

and gas industry and an average of over 35 total years of

professional experience. Collectively, our directors also bring

deep M&A experience at SilverBow and elsewhere, having executed

over 250 deals valued at more than $270 billion in the aggregate.

All nine of SilverBow’s directors have served at C-suite or senior

executive levels at E&P or oilfield services companies,

including five as CEO, three as COO, four as CFO, and one as chief

diversity and inclusion officer. Additionally, all nine have had

board experience at other public companies, including, but not

limited to, at E&P, oilfield services or midstream

companies.

Select Companies Where Our Directors Have

Held Key Roles

Chevron

ARCO

Texaco

ConocoPhillips

Burlington Resources

Baker Hughes

Chesapeake Energy

Berry Petroleum

Three Rivers

Petrohawk Energy

Ascent Resources

El Paso

Sentinel Peak Resources

Samson Resources

EOG Resources

Transocean Partners

FTS International

BNP Paribas

You can learn more about our directors at

www.FutureOfSilverBow.com/board. Notably, our directors up for

election this year each bring the right expertise to advance our

strategy and oversee M&A:

- Gabriel L. Ellisor: A private equity / investment banking

executive who has executed multiple transactions including serving

as CFO during the well-received sale of Three Rivers Operating

Company to Concho Resources

- Kathleen McAllister: A former CEO / CFO of Transocean Partners

LLC, where she led the IPO of the company and its acquisition by

Transocean Ltd., among other capital markets and M&A

experience

- Charles W. Wampler: One of the top operational executives in

the sector with operating roles at Resource Rock Exploration II

(Chairman, CEO and President), Lewis Energy (COO), Aspect Holdings

(COO) and EOG Resources

By contrast, Kimmeridge’s nominees are

self-interested and conflicted, with close ties to or history with

Kimmeridge, and lack the blue-chip industry experience of

SilverBow’s nominees. In fact, Kimmeridge’s nominees have

significantly less experience, on average, than SilverBow’s, and

one has no E&P experience at all:

- Carrie Fox has no public senior executive experience and less

than 15 years of E&P sector experience

- Douglas Brooks has a mixed track record, overseeing shareholder

value destruction during director and executive tenures at a number

of companies, with an average TSR underperformance of approximately

(60%)

- Katherine Minyard has zero experience working for an oil and

gas company and has no public senior executive experience, in the

oil and gas industry or otherwise

Kimmeridge’s Campaign Seeks to Force SilverBow Shareholders

to Bail Out KTG

Kimmeridge’s proposal to combine KTG with

SilverBow undervalued SilverBow while substantially overvaluing its

own KTG assets, and relied on a high-risk bet on a near-term return

to expensive gas in a period of historic low gas prices. Our Board

relied on its deep M&A experience when it rejected the highly

dilutive KTG proposal – while Kimmeridge is pushing candidates who

are far less experienced so they can rubber stamp a

value-destructive combination with KTG. SilverBow published our

analysis of the proposal and KTG in our April 22, 2024 shareholder

letter, also available at www.FutureOfSilverBow.com.

This is solely about

value. If their proposal or any other future proposal

created appropriate value for all shareholders, then SilverBow’s

Board has shown it will transact. This is why we agreed on terms

for an all-cash sale to Kimmeridge in winter 2023, which they

failed to deliver on when they were unable to secure financing.

Kimmeridge’s own data on KTG demonstrates:

- The value of KTG’s Laredo asset is

less than half of what they paid for it – Kimmeridge

purchased Laredo Energy (now part of KTG) for $825 million and its

YE23 proved reserve PV-10 value is $371 million despite a year of

outspend on the asset

- Kimmeridge’s proposal would have been

massively dilutive to SilverBow shareholders across all

per share operating cash flow and free cash flow metrics in both

2024 and 2025 – (29%-26%) dilutive on a FY24 cash flow per share

(CFPS)8 basis; (138%) dilutive on a FY24 free cash flow per share

(FCFPS) basis; (23%) dilutive on FY25 CFPS9 basis; (34%) dilutive

on a FY25 FCFPS10 basis

We have a clear track record of delivering

value for shareholders. Proxy advisory firms including

Institutional Shareholder Services (ISS) and Glass Lewis assess

companies’ performance using 1, 3 and 5-year TSR benchmarks. On the

other hand, Kimmeridge uses cherry-picked timeframes to paint a

misleading view. There is no denying our outperformance over the

relevant timeframes11:

1 Year: SBOW: 41% XOP: 31%

3 Year: SBOW: 197% XOP: 96%

5 Year: SBOW: 74% XOP: 44%

USE THE WHITE

PROXY CARD AND VOTE “FOR” SILVERBOW’S HIGHLY QUALIFIED, INDEPENDENT

DIRECTOR NOMINEES

- Gabriel L. Ellisor;

- Kathleen McAllister; and

- Charles W. Wampler

Thank you for your investment in

SilverBow.

Sincerely,

The SilverBow Board of Directors

If you have any questions or require any

assistance with voting your shares, please call SilverBow’s proxy

solicitor:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, New York 10022

Shareholders: (877) 825-8793 (toll-free

from the U.S. or Canada) or (412) 232-3651 (from other

countries)

Banks and brokers may call collect: (212)

750-5833

Vote “FOR” All of SilverBow’s Highly

Qualified Directors Today on the WHITE Proxy Card

Your Vote Is Important!

Please vote on the WHITE proxy card

“FOR” the Company’s three nominees, “WITHHOLD” on

Kimmeridge’s nominees, and “FOR” ALL other Company proposals using

one of the following options:

- Follow the instructions set forth on the enclosed WHITE

proxy card to vote via the internet,

- Follow the instructions set forth on the enclosed WHITE

proxy card to vote by telephone, or

- Mark, sign and date the enclosed WHITE proxy card and

return it in the enclosed postage-paid envelope.

Remember, please discard and do not sign

any gold Kimmeridge proxy card.

If you have already voted using a gold

proxy card, you may cancel that vote simply by voting again using

the Company’s WHITE proxy card.

Only your latest-dated vote will

count!

If you have any questions about how to

vote your shares,

please call the firm assisting us with the

solicitation of proxies:

INNISFREE M&A INCORPORATED

Shareholders may call:

1 (877) 825-8793 (toll-free from the U.S.

and Canada) or

+1 (412) 232-3651 (from other

countries)

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development and

production of oil and gas in the Eagle Ford Shale and Austin Chalk

in South Texas. With over 30 years of history operating in South

Texas, the Company possesses a significant understanding of

regional reservoirs that it leverages to assemble high quality

drilling inventory while continuously enhancing its operations to

maximize returns on capital invested.

FORWARD-LOOKING STATEMENTS

This communication includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent management’s

expectations or beliefs concerning future events, and it is

possible that the results described in this communication will not

be achieved. These forward-looking statements are based on current

expectations and assumptions and are subject to a number of risks

and uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this communication, including those regarding our strategy, the

benefits of the acquisitions, future operations, guidance and

outlook, financial position, prospects, plans and objectives of

management are forward-looking statements. When used in this

communication, words such as “will,” “could,” “believe,”

“anticipate,” “intend,” “estimate,” “budgeted,” “guidance,”

“expect,” “may,” “continue,” “potential,” “plan,” “project,”

“positioned,” “should” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain such identifying words.

Important factors that could cause actual results to differ

materially from our expectations include, but are not limited to,

the following risks and uncertainties: further actions by the

members of the Organization of the Petroleum Exporting Countries,

Russia and other allied producing countries with respect to oil

production levels and announcements of potential changes in such

levels; risks related to recently completed acquisitions and

integration of these acquisitions; volatility in natural gas, oil

and natural gas liquids prices; ability to obtain permits and

government approvals; our borrowing capacity, future covenant

compliance; cash flow and liquidity, including our ability to

satisfy our short- or long-term liquidity needs; asset disposition

efforts or the timing or outcome thereof; ongoing and prospective

joint ventures, their structures and substance, and the likelihood

of their finalization or the timing thereof; the amount, nature and

timing of capital expenditures, including future development costs;

timing, cost and amount of future production of oil and natural

gas; availability of drilling and production equipment or

availability of oil field labor; availability, cost and terms of

capital; timing and successful drilling and completion of wells;

availability and cost for transportation and storage capacity of

oil and natural gas; costs of exploiting and developing our

properties and conducting other operations; competition in the oil

and natural gas industry; general economic and political

conditions, including inflationary pressures, further increases in

interest rates, a general economic slowdown or recession,

instability in financial institutions, political tensions and war

(including future developments in the ongoing conflicts in Ukraine

and the Middle East); the severity and duration of world health

events, including health crises and pandemics and related economic

repercussions, including disruptions in the oil and gas industry,

supply chain disruptions, and operational challenges; opportunities

to monetize assets; our ability to execute on strategic

initiatives, including acquisitions; effectiveness of our risk

management activities, including hedging strategy; counterparty and

credit market risk; the impact of shareholder activism and any

changes in composition of the Company’s board of directors; pending

legal and environmental matters, including potential impacts on our

business related to climate change and related regulations; actions

by third parties, including customers, service providers and

shareholders; current and future governmental regulation and

taxation of the oil and natural gas industry; developments in world

oil and natural gas markets and in oil and natural gas-producing

countries; uncertainty regarding our future operating results; and

other risks and uncertainties discussed in the Company’s reports

filed with the U.S. Securities and Exchange Commission (“SEC”),

including its Annual Report on Form 10-K for the year ended

December 31, 2023, and subsequent quarterly reports on Form 10-Q

and current reports on Form 8-K.

All forward-looking statements speak only as of the date of this

communication. You should not place undue reliance on these

forward-looking statements. The Company’s capital budget, operating

plan, service cost outlook and development plans are subject to

change at any time. Although we believe that our plans, intentions

and expectations reflected in or suggested by the forward-looking

statements we make in this communication are reasonable, we can

give no assurance that these plans, intentions or expectations will

be achieved. The risk factors and other factors noted herein and in

the Company’s SEC filings could cause its actual results to differ

materially from those contained in any forward-looking statement.

These cautionary statements qualify all forward-looking statements

attributable to us or persons acting on our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such forward-looking statements that may be made to reflect events

or circumstances after the date of this communication or to reflect

the occurrence of unanticipated events, except as required by

law.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

The Company, its directors and certain of its executive officers

and employees are or will be participants in the solicitation of

proxies from shareholders in connection with the 2024 Annual

Meeting. The Company has filed the Definitive Proxy Statement with

the SEC on April 9, 2024 in connection with the solicitation of

proxies for the 2024 Annual Meeting, together with a WHITE proxy

card.

The identity of the participants, their direct or indirect

interests, by security holdings or otherwise, and other information

relating to the participants are available in the Definitive Proxy

Statement (available here) in the section entitled “Security

Ownership of Board of Directors and Management” and Appendix F. To

the extent holdings of the Company’s securities by the Company’s

directors and executive officers changes from the information

included in this communication, such information will be reflected

on Statements of Change in Ownership on Forms 3, 4 or 5 filed with

the SEC. These documents are available free of charge as described

below.

SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

AND ANY OTHER DOCUMENTS TO BE FILED BY THE COMPANY WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION. Shareholders are able to obtain,

free of charge, copies of all of the foregoing documents, any

amendments or supplements thereto at the SEC’s website

(http://www.sec.gov). Copies of the foregoing documents, any

amendments or supplements thereto are also available, free of

charge, at the “Investor Relations” section of the Company’s

website (https://www.sbow.com/investor-relations).

Appendix A

Definition of Non-GAAP Measures as Calculated by the Company

(Unaudited)

The following non-GAAP measures are presented in addition to

financial statements as SilverBow believes these metrics and

performance measures are widely used by the investment community,

including investors, research analysts and others, to evaluate and

useful in comparing upstream oil and gas companies in making

investment decisions or recommendations. These measures, as

presented, may have differing calculations among companies and

investment professionals and may not be directly comparable to the

same measures provided by others. A non-GAAP measure should not be

considered in isolation or as a substitute for the related GAAP

measure or any other measure of a company's financial or operating

performance presented in accordance with GAAP. A reconciliation of

each of these non-GAAP measures to the most directly comparable

GAAP measure or measures is presented below. These measures may not

be comparable to similarly titled measures of other companies.

Adjusted EBITDA: The Company presents Adjusted EBITDA

attributable to common stockholders in addition to reported net

income (loss) in accordance with GAAP. Adjusted EBITDA is

calculated as net income (loss) plus (less) depreciation, depletion

and amortization, accretion of asset retirement obligations,

interest expense, net losses (gains) on commodity derivative

contracts, amounts collected (paid) for commodity derivative

contracts held to settlement, income tax expense (benefit); and

share-based compensation expense. Adjusted EBITDA excludes certain

items that SilverBow believes affect the comparability of operating

results, including items that are generally non-recurring in nature

or whose timing and/or amount cannot be reasonably estimated.

Adjusted EBITDA is used by the Company's management and by external

users of SilverBow's financial statements, such as investors,

commercial banks and others, to assess the Company's operating

performance as compared to that of other companies, without regard

to financing methods, capital structure or historical cost basis.

It is also used to assess SilverBow's ability to incur and service

debt and fund capital expenditures. Adjusted EBITDA should not be

considered an alternative to net income (loss), operating income

(loss), cash flows provided by (used in) operating activities or

any other measure of financial performance or liquidity presented

in accordance with GAAP. Adjusted EBITDA is important as it is

considered among the financial covenants under the Company's First

Amended and Restated Senior Secured Revolving Credit Agreement with

JPMorgan Chase Bank, National Association, as administrative agent,

and certain lenders party thereto (as amended, the “Credit

Agreement”), a material source of liquidity for SilverBow. Please

reference the Company's 2023 Form 10-K for discussion of the Credit

Agreement and its covenants.

Adjusted EBITDA for Leverage Ratio: In accordance with

the Leverage Ratio calculation for SilverBow's Credit Facility, the

Company makes certain adjustments to its calculation of Adjusted

EBITDA. Adjusted EBITDA for Leverage Ratio is calculated as

Adjusted EBITDA plus (less) pro forma EBITDA contributions related

to closed acquisitions. The Company believes that Adjusted EBITDA

for Leverage Ratio is useful to investors because it reflects the

last twelve months EBITDA used by the administrative agent for

SilverBow's Credit Facility in the calculation of its leverage

ratio covenant.

Cash General and Administrative Expenses: Cash G&A

expenses is a non-GAAP measure calculated as net general and

administrative costs less share-based compensation. The Company

believes that cash G&A is commonly used by management, analysts

and investors as an indicator of cost management and operating

efficiency on a comparable basis from period to period. In

addition, SilverBow believes cash G&A expenses are used by

analysts and others in valuation, comparison and investment

recommendations of companies in the oil and gas industry to allow

for analysis of G&A spend without regard to stock-based

compensation which can vary substantially from company to company.

Cash G&A expenses should not be considered as an alternative

to, or more meaningful than, total G&A expenses. From time to

time the Company provides forward-looking cash G&A estimates or

targets; however, SilverBow is unable to provide a quantitative

reconciliation of these forward-looking non-GAAP measures to the

most directly comparable forward-looking GAAP measure because the

items necessary to estimate such forward-looking GAAP measure are

not accessible or estimable at this time without unreasonable

efforts. The reconciling items in future periods could be

significant.

Free Cash Flow: Free cash flow is calculated as Adjusted

EBITDA (defined above) plus (less) cash interest expense and bank

fees, capital expenditures and current income tax (expense)

benefit. The Company believes that free cash flow is useful to

investors and analysts because it assists in evaluating SilverBow's

operating performance, and the valuation, comparison, rating and

investment recommendations of companies within the oil and gas

industry. SilverBow uses this information as one of the bases for

comparing its operating performance with other companies within the

oil and gas industry. Free cash flow should not be considered an

alternative to net income (loss), operating income (loss), cash

flows provided by (used in) operating activities or any other

measure of financial performance or liquidity presented in

accordance with GAAP. From time to time the Company provides

forward-looking free cash flow estimates or targets; however,

SilverBow is unable to provide a quantitative reconciliation of

these forward-looking non-GAAP measures to the most directly

comparable forward-looking GAAP measure because the items necessary

to estimate such forward-looking GAAP measure are not accessible or

estimable at this time without unreasonable efforts. The

reconciling items in future periods could be significant.

Total Debt to Adjusted EBITDA (Leverage Ratio): Leverage

Ratio is calculated as total debt, defined as long-term debt

excluding unamortized discount and debt issuance costs, divided by

Adjusted EBITDA for the most recent twelve-month period.

Calculation of Adjusted EBITDA and Free Cash Flow

(Unaudited)

SilverBow Resources, Inc. and Subsidiary

The below tables provide the calculation of Adjusted EBITDA,

Free Cash Flow and EBITDA margin for the following periods (in

thousands, except per Boe information).

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Net Income (Loss)

$

(15,528

)

$

94,492

Plus:

Depreciation, depletion and

amortization

92,103

43,998

Accretion of asset retirement

obligations

316

224

Interest expense

36,017

16,745

Loss (gain) on commodity derivatives,

net

56,078

(92,249

)

Derivative cash settlements

collected/(paid)(1)

34,057

19,868

Income tax expense/(benefit)

(4,787

)

26,812

Share-based compensation expense

1,829

1,124

Adjusted EBITDA

$

200,085

$

111,014

Plus:

Cash interest expense and bank fees,

net

(34,073

)

(16,434

)

Capital expenditures(2)

(109,491

)

(108,033

)

Current income tax (expense)/benefit

(363

)

(200

)

Free Cash Flow

$

56,158

$

(13,653

)

EBITDA Margin (per Boe)(3)

$

24.07

$

24.36

(1) Amounts relate to settled contracts

covering the production months during the period.

(2) Excludes proceeds/(payments) related

to the divestiture/(acquisition) of oil and gas properties and

equipment, outside of regular way land and leasing costs.

(3) EBITDA margin is calculated as

Adjusted EBITDA divided by total production.

Last Twelve Months Ended March

31, 2024

Last Twelve Months Ended March

31, 2023

Net Income (Loss)

$

187,698

$

499,183

Plus:

Depreciation, depletion and

amortization

267,220

156,826

Accretion of asset retirement

obligations

1,077

660

Interest expense

99,391

52,136

Loss (gain) on commodity derivatives,

net

(92,982

)

(158,607

)

Derivative cash settlements

collected/(paid)(1)

104,584

(164,348

)

Income tax expense/(benefit)

52,013

39,166

Share-based compensation expense

6,231

5,164

Adjusted EBITDA

$

625,232

$

430,180

Plus:

Cash interest expense and bank fees,

net

(88,492

)

(54,656

)

Capital expenditures(2)

(410,048

)

(395,179

)

Current income tax (expense)/benefit

(690

)

(25

)

Free Cash Flow

$

126,002

$

(19,680

)

Adjusted EBITDA

$

625,232

$

430,180

Pro forma contribution from closed

acquisitions

189,033

119,109

Adjusted EBITDA for Leverage Ratio

(3)

$

814,265

$

549,289

(1) Amounts relate to settled contracts

covering the production months during the period.

(2) Excludes proceeds/(payments) related

to the divestiture/(acquisition) of oil and gas properties and

equipment, outside of regular way land and leasing costs.

(3) Adjusted EBITDA for Leverage Ratio,

which is calculated in accordance with SilverBow's Credit Facility,

includes pro forma EBITDA contributions reflecting the results of

acquired assets' operations for referenced time periods preceding

the acquired assets' close date. Leverage Ratio is calculated as

total debt, defined as Credit Facility borrowings plus Second Lien

notes, divided by Adjusted EBITDA for Leverage Ratio for the most

recently completed twelve-month period. The below table provides

the calculation for Leverage Ratio for the following periods:

March 31, 2024

March 31, 2023

Credit Facility Borrowings due 2026

$

596,000

$

559,000

Second Lien Notes due 2026

500,000

150,000

Total debt

$

1,096,000

$

709,000

Adjusted EBITDA for Leverage Ratio

814,265

549,289

Leverage Ratio

1.35x

1.29x

1 Non-GAAP measure. Refer to Appendix for definition and

reconciliations. 2 As of April 30, 2024, the Company had $573

million of outstanding borrowings under its Credit Facility. 3

Non-GAAP measure. Leverage Ratio = Total Debt / LTM Adjusted

EBITDA. Refer to Appendix for definition and reconciliations. 4

Non-GAAP measure. Refer to Appendix for definition. 5 Source: Wall

Street Research. Note: Emphasis added. Permissions to use quote

neither sought nor obtained. 6 Weighted by transaction size

(ranging from $24 million to $700 million). Asset value based on

Proved PV-10 from SEC year-end reserve report. PV-10 and free cash

flow are non-GAAP measures. For additional information see Appendix

to the Company’s Investor Update dated and included in the

additional soliciting materials filed with the U.S. Securities and

Exchange Commission on May 2, 2024. 7 As of 5/3/24. Represents the

total return earned on an investment in SilverBow common stock made

on 12/31/20. For XOP, assumes that dividends were invested when

received. 8 KTG FY24 CFFO not disclosed by Kimmeridge; range

includes EBITDA less interest expense at the high end and levered

FCF plus Capex on the low end. 9 KTG FY25 CFFO based on FY25 FCF

plus FY25 Capex of $443 million as disclosed by Kimmeridge. 10 KTG

FY25 FCF based on $1.1 billion equity value and 5% FCF yield as

disclosed by Kimmeridge. 11 As of 5/3/24. The 1, 3 and 5-year total

shareholder return (TSR) represents the total return earned on an

investment in SilverBow common stock made at the beginning of a 1,

3 and 5-year period, respectively. For XOP, assumes that dividends

were invested when received.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506414259/en/

INVESTOR CONTACT: ir@sbow.com (281) 874-2700, (888)

991-SBOW MEDIA CONTACT: Adam Pollack / Jed Repko Joele

Frank, Wilkinson Brimmer Katcher (212) 355-4449

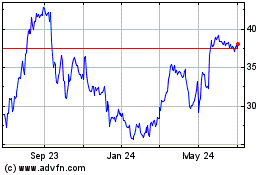

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Oct 2024 to Nov 2024

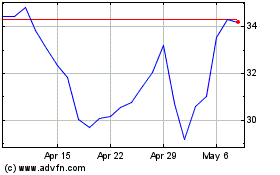

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Nov 2023 to Nov 2024