Urges Shareholders to Vote “FOR” All of

SilverBow’s Highly Qualified Directors on the WHITE Proxy Card

SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today announced that it has filed its definitive proxy

materials with the U.S. Securities and Exchange Commission (the

“SEC”) in connection with the Company’s 2024 Annual Meeting of

Shareholders (the “2024 Annual Meeting”), scheduled to be held on

May 21, 2024. Shareholders of record as of March 22, 2024, will be

entitled to vote at the meeting.

In conjunction with the definitive proxy filing, the Company has

mailed a letter to SilverBow shareholders recommending they vote

for SilverBow’s three independent, highly qualified directors on

the WHITE proxy card – Gabriel L. Ellisor, Kathleen McAllister and

Charles W. Wampler. The full letter has been filed with the SEC and

can be found at https://www.futureofsilverbow.com. Highlights from

the letter include:

- SilverBow is successfully advancing its long-term value

creation strategy.

- SilverBow’s highly qualified Board has proposed significant

corporate governance improvements at the upcoming 2024 Annual

Meeting, including declassifying the Board, adopting a majority

voting standard in uncontested elections of directors and

eliminating supermajority vote requirements for shareholders.

- Kimmeridge is pursuing a proxy fight to further its attempt to

gain control of the Company and force a combination between

SilverBow and KTG on terms that are unfavorable to SilverBow

shareholders.

- SilverBow has been and continues to be open to exploring

transactions at appropriate valuations.

The full text of the letter follows:

April 9, 2024

Dear Fellow Shareholders,

The SilverBow Resources, Inc. (“SilverBow” or the “Company”)

Board of Directors (the “Board”) and management team are committed

to maximizing shareholder value. SilverBow’s recent results

underscore the strength of that commitment, and we have

consistently delivered significant total shareholder returns with a

one-year and three-year TSR of 45% and 336%, respectively outpacing

the XOP E&P Index by a wide margin over near and long-term

periods.1

We also have a history of open engagement with our investors. In

this spirit, we are communicating with you to provide important

information regarding the decisions you will be asked to make at

this year’s annual meeting of shareholders (the “2024 Annual

Meeting”). As you may have seen, this year, Kimmeridge Energy

Management Company, LLC (“Kimmeridge”) has nominated three

directors with close ties to or history with its fund to replace

three of the Company’s directors, who have been overseeing the

successful execution of the Company’s proven value creation

strategy.

Kimmeridge has nominated these director candidates in connection

with its ongoing attempts to force a combination between SilverBow

and Kimmeridge Texas Gas (“KTG”) on terms that we believe

undervalue the Company and are not in ALL of our shareholders’ best

interests. While SilverBow is open to exploring transactions with

KTG at appropriate valuations, we do not believe it is in our

shareholders’ best interests to elect any of the Kimmeridge

nominees to the Board, giving Kimmeridge undue influence over the

strategic direction of the Company, including the evaluation of

other potential value-maximizing opportunities.

To protect your investment, we strongly recommend that you

vote using the enclosed WHITE proxy card today “FOR” all of the

SilverBow independent director nominees:

- Gabriel L. Ellisor;

- Kathleen McAllister; and

- Charles W. Wampler.

WE ARE SUCCESSFULLY ADVANCING OUR LONG-TERM

VALUE CREATION STRATEGY

SilverBow’s outperformance has been driven by the successful

execution of our strategy across four key elements:

- Investing in a scalable and durable portfolio

- More than doubled our inventory to ~1,000 gross

locations across 220,000 acres (YE20 vs. YE23);

Decade+ of high-return drilling opportunities

- Recent South Texas acquisition established SilverBow as

largest pure play Eagle Ford operator with increased

regional scale, balanced commodity exposure and expanded low-cost

operating platform

- Driving efficiencies and enhancing margins

- Nearly doubled EBITDA margins2 while almost halving

G&A2 on $/Boe terms (FY20 vs. FY23)

- Peer-leading EBITDA margins and G&A per unit reinforce

status as a proven operator driving enhanced results on

acquired assets

- Maintaining a strong balance sheet with deep liquidity

- Completed $1.4B in acquisitions since year-end 2020, while

increasing liquidity and significantly reducing

leverage

- Positive net income since FY21

- Four consecutive years of free cash flow generation

(FY20-FY23)

- Committed to long-term leverage target of <1.0x

- Delivering profitable growth

- Average three-year ROCE of 21%2 (FY21-FY23)

- Significantly increased production and FCF per

share since 2020

SILVERBOW HAS A STRONG BOARD AND IS

COMMITTED TO BEST-IN-CLASS CORPORATE GOVERNANCE

We believe that having a strong Board and governance practices

aligned with our strategy is critical to sustained value creation.

We are in constant dialogue with our shareholders – we hear and

appreciate your feedback and value your perspectives. Consistent

with these values, the Board is proposing significant governance

changes at the upcoming 2024 Annual Meeting, including to:

- Declassify the Board and provide for the annual election

of all directors,

- Adopt a majority voting standard in uncontested

elections of directors, and

- Eliminate supermajority vote requirements for

shareholders to amend certain provisions of our certificate of

incorporation.

We have a Board of value creators, with public company

leadership experience, substantial sector experience, relevant

financial and operational expertise, and strategic planning and

risk management backgrounds.

Recently, we appointed Leland T. “Lee” Jourdan to our Board, a

highly qualified director with a demonstrated track record in

international and domestic LNG markets, natural gas trading,

business development and, most recently, being at the forefront of

diversity and inclusion efforts at Chevron Corporation. Lee’s

appointment builds on our ongoing commitment to enhance the Board

with new skill sets and collective experiences to successfully

execute our strategy – as well as further improve the Board’s

diversity profile, which is an important priority for us. Also of

note, Kathleen McAllister was added to our Board in January 2023

and joined both our Audit Committee and Nominating and Strategy

Committee in May 2023. Since early 2023, SilverBow has added four

new independent directors to our Board, while significantly

increasing the Board’s diversity.

Independent Directors

Kathleen McAllister

Up For Election Service Commenced: January 2023

Ellen R. DeSanctis

Service Commenced: November 2023

Jennifer M. Grigsby

Service Commenced: January 2023

Leland “Lee” T. Jourdan

Service Commenced:

March 2024

Board Committees Audit

Nominating and Strategy

Board Committees

Nominating and Strategy

Board Committees Audit

Compensation

Board Committees To be

assigned

Highlighted

Qualifications

- Accounting & Financial Reporting and Finance / Capital

Allocation

- Corporate Governance

- Strategic Planning and Risk Management

- Business Development / Mergers and Acquisitions

Highlighted

Qualifications

- E&P Industry Experience

- Strategic Planning and Risk Management

- Corporate Governance

- Finance / Capital Allocation

- Sustainability / ESG Experience

Highlighted

Qualifications

- Accounting & Financial Reporting and Finance / Capital

Allocation

- E&P Industry Experience

- Strategic Planning and Risk Management Experience

- Business Development / Mergers and Acquisitions

Highlighted

Qualifications

- Business Development / Mergers and Acquisitions

- E&P Industry Experience

- Sustainability / ESG Experience

- Executive Leadership

KIMMERIDGE IS PURSUING A SELF-SERVING PROXY

FIGHT TO FORCE A COMBINATION BETWEEN SILVERBOW AND KTG ON TERMS

UNFAVORABLE TO SILVERBOW SHAREHOLDERS

Kimmeridge is pursuing a proxy fight to further its attempt to

gain control of the Company and force a combination between

SilverBow and KTG on terms that are unfavorable to SilverBow

shareholders. Its nominations were made after two years of

extensive engagement between SilverBow and Kimmeridge regarding a

potential combination, and Kimmeridge’s proxy fight is being

pursued concurrently with its public proposal to combine the two

companies. Importantly, each of Kimmeridge’s nominees have been

promised a board seat on the proposed combined company board,

making them personally interested in rubberstamping Kimmeridge’s

proposed transaction instead of pursuing potential opportunities

that could better enhance the Company’s value.

SilverBow has been and remains open to exploring transactions at

appropriate valuations. Over the last two years, we have worked in

good faith to find a path toward a value-creating transaction for

ALL SilverBow shareholders, and not just Kimmeridge. Our engagement

has included 30+ meetings, multiple NDAs and confidential

information sharing, multiple proposals exchanged between the

parties and a verbally accepted offer for an all-cash acquisition

of SilverBow by Kimmeridge – which Kimmeridge failed to consummate

due to its inability to obtain financing (contradicting

Kimmeridge’s earlier insistence that its proposal was not subject

to any financing contingencies and even its assurances that it had

confirmed financing).

The SilverBow Board reviewed Kimmeridge’s latest proposal in

consultation with its independent financial and legal advisors and

determined that the proposal undervalues SilverBow and would not be

in the best interests of shareholders.

THE CHOICE IS CLEAR – SUPPORT SILVERBOW’S INDEPENDENT

DIRECTORS AGAINST KIMMERIDGE’S SELF-SERVING ATTEMPT TO CONTROL

SILVERBOW WITHOUT PAYING FAIR VALUE TO SHAREHOLDERS

Kimmeridge’s intentions are clear – it is attempting to gain

control of the Board to force an undervalued transaction.

Kimmeridge’s decision to pursue a proxy fight serves only its own

interests – and not those of ALL SilverBow shareholders.

Kimmeridge’s selection of nominees exposes its self-serving

agenda. All three of Kimmeridge’s nominees have close ties to or

history with Kimmeridge, calling into question their independence

and ability to represent the interests of all SilverBow

shareholders. These connections include:

- Douglas Brooks served as a director at California Resources

during Kimmeridge’s campaign at the company.

- Carrie Fox has a $3 million limited partnership interest in

Kimmeridge Fund VI and served as a director alongside Ben Dell,

Kimmeridge’s Managing Partner, at two Kimmeridge-controlled

companies, Extraction Oil and Civitas Resources.

- Katherine Minyard was appointed to Ovintiv’s board as a

Kimmeridge nominee.

Each of the Kimmeridge nominees has been promised a board seat

on the proposed combined company board of SilverBow and KTG – a

“special deal” that personally conflicts them from independently

evaluating Kimmeridge’s proposal against other opportunities

available to SilverBow. SilverBow has provided additional

information about the Kimmeridge nominees at www.FutureOfSilverBow.com.

In contrast, the Company’s proposed slate is made up of three

independent, highly qualified directors – Gabriel L. Ellisor,

Kathleen McAllister and Charles W. Wampler – with extensive public

company board and executive leadership experience.

SilverBow’s Board composition achieves an ideal balance of

longer-term directors possessing deep institutional knowledge with

fresh perspectives from four extensively vetted and qualified

directors added since 2023. This Board is committed to maintaining

a diversity of perspectives and experience, and the Company’s

nominees – Gabriel L. Ellisor, Kathleen McAllister and Charles W.

Wampler – embody that commitment. Additional information about the

SilverBow nominees can be found at www.FutureOfSilverBow.com.

PROTECT THE VALUE OF YOUR INVESTMENT

VOTE THE WHITE

PROXY CARD AND SUPPORT ALL OF SILVERBOW’S HIGHLY QUALIFIED,

INDEPENDENT DIRECTOR NOMINEES

Your vote is critical to protecting SilverBow against

Kimmeridge’s self-interested agenda. No matter how many or few

shares you own, we encourage you to protect your investments by

voting “FOR” the Company’s proposed slate of three independent,

highly qualified directors – Gabriel L. Ellisor, Kathleen

McAllister and Charles W. Wampler.

We appreciate your continued investment in the Company.

Sincerely,

The SilverBow Board of Directors

Your

Vote Is Important! Please vote on the WHITE proxy

card “FOR” the Company’s three nominees, “WITHHOLD” on

Kimmeridge’s nominees, and “FOR” ALL other Company proposals using

one of the following options:

- Follow the instructions set forth on the enclosed WHITE

proxy card to vote via the internet,

- Follow the instructions set forth on the enclosed WHITE

proxy card to vote by telephone, or

- Mark, sign and date the enclosed WHITE proxy card and

return it in the enclosed postage-paid envelope.

Remember, please discard and do

not sign any gold Kimmeridge proxy card. If you have already voted

using a gold proxy card, you may cancel that vote simply by voting

again using the Company’s WHITE proxy card. Only your

latest-dated vote will count!

If you have any questions about

how to vote your shares, please call the firm assisting us with the

solicitation of proxies:

INNISFREE M&A

INCORPORATED Shareholders may call: 1 (877) 825-8793 (toll-free

from the U.S. and Canada) or +1 (412) 232-3651 (from other

countries)

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development and

production of oil and gas in the Eagle Ford Shale and Austin Chalk

in South Texas. With over 30 years of history operating in South

Texas, the Company possesses a significant understanding of

regional reservoirs that it leverages to assemble high quality

drilling inventory while continuously enhancing its operations to

maximize returns on capital invested.

FORWARD-LOOKING STATEMENTS

This communication includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent management’s

expectations or beliefs concerning future events, and it is

possible that the results described in this communication will not

be achieved. These forward-looking statements are based on current

expectations and assumptions and are subject to a number of risks

and uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this communication, including those regarding our strategy, the

benefits of the acquisitions, future operations, guidance and

outlook, financial position, prospects, plans and objectives of

management are forward-looking statements. When used in this

report, the words “will,” “could,” “believe,” “anticipate,”

“intend,” “estimate,” “budgeted,” “guidance,” “expect,” “may,”

“continue,” “potential,” “plan,” “project,” “positioned,” “should”

and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. Important factors that could cause actual

results to differ materially from our expectations include, but are

not limited to, the following risks and uncertainties: risk related

to recently completed acquisitions and integrations of these

acquisitions; volatility in natural gas, oil and natural gas

liquids prices; cash flow and liquidity, including our ability to

satisfy our short- or long-term liquidity needs; general economic

and political conditions, including inflationary pressures, further

increases in interest rates, a general economic slowdown or

recession, instability in financial institutions, political

tensions and war (including future developments in the ongoing

conflicts in Ukraine and the Gaza Strip); the severity and duration

of world health events, including health crises, and related

economic repercussions, including disruptions in the oil and gas

industry, supply chain disruptions, and operational challenges; our

ability to execute on strategic initiatives; effectiveness of our

risk management activities, including hedging strategy;

counterparty and credit market risk; actions by third parties,

including customers, service providers and shareholders; current

and future governmental regulation and taxation of the oil and

natural gas industry; developments in world oil and natural gas

markets and in oil and natural gas-producing countries; uncertainty

regarding our future operating results; and other risks and

uncertainties discussed in the Company’s reports filed with the

U.S. Securities and Exchange Commission (the “SEC”), including its

annual report on Form 10-K for the year ended December 31,

2023.

All forward-looking statements speak only as of the date of this

communication. You should not place undue reliance on these

forward-looking statements. The Company’s capital budget, operating

plan, service cost outlook and development plans are subject to

change at any time. Although we believe that our plans, intentions

and expectations reflected in or suggested by the forward-looking

statements we make in this communication are reasonable, we can

give no assurance that these plans, intentions or expectations will

be achieved. The risk factors and other factors noted herein and in

the Company’s SEC filings could cause its actual results to differ

materially from those contained in any forward-looking statement.

These cautionary statements qualify all forward-looking statements

attributable to us or persons acting on our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such forward-looking statements that may be made to reflect events

or circumstances after the date of this communication or to reflect

the occurrence of unanticipated events, except as required by

law.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

The Company, its directors and certain of its executive officers

and employees are or will be participants in the solicitation of

proxies from shareholders in connection with the 2024 Annual

Meeting. The Company has filed the Definitive Proxy Statement with

the SEC on April 9, 2024 in connection with the solicitation of

proxies for the 2024 Annual Meeting, together with a WHITE proxy

card.

The identity of the participants, their direct or indirect

interests, by security holdings or otherwise, and other information

relating to the participants are available in the Definitive Proxy

Statement (available here) in the section entitled “Security

Ownership of Board of Directors and Management” and Appendix F. To

the extent holdings of the Company’s securities by the Company’s

directors and executive officers changes from the information

included in this communication, such information will be reflected

on Statements of Change in Ownership on Forms 3, 4 or 5 filed with

the SEC. These documents are available free of charge as described

below.

SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

AND ANY OTHER DOCUMENTS TO BE FILED BY THE COMPANY WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION. Shareholders are able to obtain,

free of charge, copies of all of the foregoing documents, any

amendments or supplements thereto at the SEC’s website

(http://www.sec.gov). Copies of the foregoing documents, any

amendments or supplements thereto are also available, free of

charge, at the “Investor Relations” section of the Company’s

website (https://www.sbow.com/investor-relations).

1 Total shareholder returns as of April 8, 2024. Assumes

dividends reinvested when received. 2 Non-GAAP measure. Refer to

Appendix A to SilverBow’s March 28, 2024 Shareholder Letter (as

filed with the Securities and Exchange Commission on March 28,

2024) for definitions and reconciliations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240408262631/en/

INVESTOR CONTACT: ir@sbow.com (281) 874-2700, (888)

991-SBOW MEDIA CONTACT: Adam Pollack / Jed Repko Joele

Frank, Wilkinson Brimmer Katcher (212) 355-4449

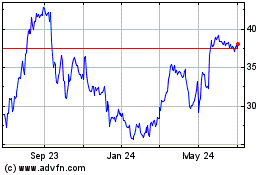

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Oct 2024 to Nov 2024

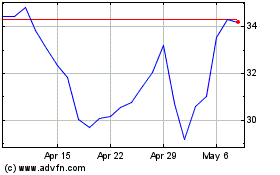

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Nov 2023 to Nov 2024