Salesforce: New Blue Chip Flashes a Green Light -- Heard on the Street

August 26 2020 - 6:29AM

Dow Jones News

By Dan Gallagher

The Curse of the Dow apparently takes some time to catch on.

Salesforce.com, named Monday as one of the blue-chip index's

latest entrants, posted surprisingly strong results for its fiscal

second quarter on Tuesday afternoon. Surprising because -- as one

of the largest sellers of software to businesses -- Salesforce was

seemingly well exposed to reports of corporate customers cutting

back their tech budgets as they cope with the coronavirus

pandemic.

But those cuts seemed to have spared the San Francisco-based

cloud pioneer. Revenue for the period ended July 31 jumped 29% year

over year to $5.15 billion. Billings, a measure of business

transacted during the quarter that serves as a leading indicator

for subscription-based cloud businesses, surged 34% to $4.75

billion -- well ahead of Wall Street's estimates. Salesforce also

projected better-than-expected revenue for the fiscal third quarter

and nudged up its forecast for the full fiscal year -- three months

after trimming it back on worries about the pandemic's impact.

Salesforce shares were up 14% in after-hours trading, having lagged

behind many of its cloud peers so far this year.

Per its name, the company has long been a sales machine. In

fact, it has only missed Wall Street's revenue targets once in the

past five years, according to FactSet. But its inclusion in the Dow

puts the company in a different light. With trailing 12-month

revenue of just under $20 billion, Salesforce is the largest

pure-play provider of cloud-based software. It will also be one of

the smallest companies on the blue-chip index by trailing revenue

-- ranking only above McDonald's. And it replaces oil titan Exxon

Mobil.

Salesforce doesn't plan to be at that sales level for long. The

company already speaks of hitting $30 billion in annual revenue,

which Wall Street expects to happen by 2024. Salesforce also spoke

Tuesday of the need to make a strategic shift to better position

the company "in this new all-digital work-from-anywhere

environment," which suggests the hyperacquisitive company may soon

be shopping again. That could prove to be controversial for those

who think Salesforce is becoming too addicted to big deals. But for

now, the company's strong performance in a crippling pandemic will

quiet a lot of critics.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

August 26, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

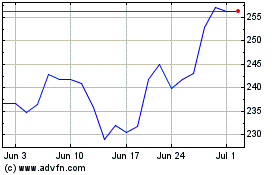

Salesforce (NYSE:CRM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Sep 2023 to Sep 2024