SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

REGIS

CORPORATION

(Name of Issuer)

Common Stock, $0.05 par value per share

(Title of Class of Securities)

758932206

(CUSIP Number)

Galloway Capital Partners, LLC

323 Sunny Isles Blvd., 7th Floor

Sunny Isles Beach, FL 33160

(212) 247-1339

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

With Copies To:

Andrew Hulsh, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

919 Third Avenue

New York, NY 10022

(212) 935-3000

December 28, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

* The remainder

of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this

cover page shall not be deemed to be ‘filed’ for the purpose of Section 18 of the Securities Exchange Act of 1934 (‘Act’)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 758932206

| 1 |

NAME

OF REPORTING PERSONS

Galloway

Capital Partners, LLC |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐ (b) ☒ |

| 3 |

SEC

USE ONLY |

|

| |

|

| 4 |

SOURCE

OF FUNDS (see instructions)

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d)

or 2(e)

☐ |

| |

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware,

United States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

111,800(1) |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| |

|

| 10 |

SHARED

DISPOSITIVE POWER

111,800(1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

111,800(1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES (see

instructions)

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

4.90%*(2) |

| 14 |

TYPE

OF REPORTING PERSON (see instructions)

OO |

| (1) | The

securities are held and managed by Galloway Capital Partners, LLC (‘GCP’). Bruce

Galloway is the managing member of GCP. Mr. Galloway has sole voting and dispositive control

of GCP. Mr. Galloway may be deemed to have beneficial ownership of the common stock held

directly by GCP. |

| (2) | This

percentage is calculated based upon 2,279,417

shares of Common Stock outstanding as of November 29, 2023, as reported in the Issuer’s

Form 8K filed with the Securities and Exchange Commission on December 1, 2023. The Issuer

effectuated a 1:20 reverse stock split on November 29, 2023. |

| 1 |

NAME

OF REPORTING PERSONS

Bruce

Galloway |

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (see instructions)

(a)

☐ (b) ☐ |

| 3 |

SEC

USE ONLY |

|

| |

|

| 4 |

SOURCE

OF FUNDS (see instructions)

OO |

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM

2(d)

or 2(e)

☐ |

| |

|

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Florida,

United States of America |

NUMBER

OF

SHARES

BENEFICIALLY

OWNED

BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE

VOTING POWER

0 |

| 8 |

SHARED

VOTING POWER

111,800(1) |

| 9 |

SOLE

DISPOSITIVE POWER

0 |

| |

|

| 10 |

SHARED

DISPOSITIVE POWER

111,800(1) |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

111,800(1) |

| 12 |

CHECK

IF THE AGGREGATE AMOUNT IN ROW 11 EXCLUDES CERTAIN SHARES (see

instructions)

☐ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW 11

4.90%*(2) |

| 14 |

TYPE

OF REPORTING PERSON (see instructions)

IN |

| (1) | The

securities are held and managed by Galloway Capital Partners, LLC (‘GCP’). Bruce

Galloway is the managing member of GCP. Mr. Galloway has sole voting and dispositive control

of GCP. Mr. Galloway may be deemed to have beneficial ownership of the common stock held

directly by GCP. |

| (2) | This

percentage is calculated based upon 2,279,417

shares of Common Stock outstanding as of November 29, 2023, as reported in the Issuer’s

Form 8K filed with the Securities and Exchange Commission on December 1, 2023. The Issuer

effectuated a 1:20 reverse stock split on November 29, 2023. |

Item 1. Security and Issuer

This Schedule 13D relates to

the common stock, par value $0.05 per share (‘Common Stock’), of Regis Corporation, a Minnesota corporation (the ‘Issuer’).

The principal executive office of the Issuer is located at 3901 Wayzata Boulevard, Minneapolis, MN 55416. Information given in response

to each item below shall be deemed incorporated by reference in all other items below.

As

of December 28, 2023, the Reporting Persons (defined below) beneficially owned an aggregate of 111,800 shares

of Common Stock, representing approximately 4.90% of the outstanding shares of Common Stock. The Issuer effectuated a 1:20 reverse

stock split on November 29, 2023.

Item 2. Identity and Background

This Schedule 13D is being filed on behalf of each

of the following persons (collectively, the ‘Reporting Persons’):

| |

(i) |

Galloway Capital Partners, LLC |

| |

|

|

| |

(ii) |

Bruce Galloway |

Galloway Capital Partners, LLC

is a Delaware limited liability company, and Bruce Galloway is a citizen of Florida. Bruce Galloway is the managing member of Galloway

Capital Partners, LLC.

The address of the principal

business office of each Reporting Person is 323 Sunny Isles Blvd, 7th Floor, Sunny Isles Beach, FL 33160.

During the last five years, neither

Reporting Person nor any executive officer or director of Galloway Capital Partners, LLC has (i) been convicted in any criminal proceeding

or (ii) been a party to any civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which he was

subject to any judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal

or state securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount of Funds or other Consideration.

Galloway

Capital Partners, LLC acquired 111,800 shares of Common Stock in open market purchases from January 2023 through December 2023. The aggregate

purchase price for the shares of Common Stock was approximately $13.65 per share. Such shares of Common Stock were purchased with investment

capital of Galloway Capital Partners, LLC and Mr. Galloway. The Issuer effectuated a 1:20 reverse stock split on November 29, 2023.

The Reporting Persons have effectuated

transactions to acquire shares of Common Stock within the past 60 days, as reflected in Schedule 1 to this Report. Other than as set forth

in this Report, none of the Reporting Persons has effected any transactions in the shares of Common Stock within the past 60 days.

Item 4. Purpose of Transaction.

Each Reporting Person acquired

the securities described in this Schedule 13D for investment purposes and intend to review its investment in the Issuer on a continuing

basis. Each Reporting Person may from time to time acquire additional securities of the Issuer or retain or sell all or a portion of the

shares then held by such Reporting Person, in the open market, block trades, underwritten public offerings or privately negotiated transactions.

Any actions any Reporting Person might undertake with respect to its investment in the Issuer may be made at any time and from time to

time and will be dependent upon such Reporting Person’s review of numerous factors, including, but not limited to: ongoing evaluation

of the Issuer’s business, financial condition, operations, prospects and strategic alternatives; price levels of the Issuer’s

securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities;

tax considerations; liquidity of the Issuer’s securities; and other factors and future developments.

Each

Reporting Person may consider, explore and/or develop plans and/or make proposals (whether preliminary or final) with respect to, among

other things, the Issuer’s performance, operations, management, governance (including potential changes to the Board), conflicted

party transactions, capital allocation policies, and strategy and plans of the Issuer. Each Reporting Person intends to engage the Board

and management with respect to the matters referred to in the preceding sentence. In addition, each Reporting Person may, at any time

and from time to time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect

thereto and (ii) propose or consider one or more of the actions described in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

On December

28, 2023, the Reporting Persons delivered a letter to the Issuer’s Chairman and Chief Executive Officer. In the letter, the Reporting

Persons highlighted disappointment with management’s performance in enhancing shareholder value. A copy of the letter is attached

hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 5. Interest in Securities of the

Issuer.

| |

(a) |

See

Items 11 and 13 on the cover pages to this Schedule 13D for the aggregate number and percentage of the class of securities

identified pursuant to Item 1 owned by the Reporting Person. |

| |

|

|

| |

(b) |

Number of shares as to which the Reporting Persons have: |

| |

i. |

Sole

power to vote or to direct the vote: See Item 7 on cover pages to this Statement. |

| |

|

|

| |

ii. |

Shared

power to vote or to direct the vote: See Item 8 on cover pages to this Statement. |

| |

|

|

| |

iii. |

Sole

power to dispose or direct the disposition: See Item 9 on cover pages to this Statement. |

| |

|

|

| |

iv. |

Shared

power to dispose or direct the disposition: See Item 10 on cover pages to this Statement. |

| |

(c) |

Other

than as set forth in response to Item 3 above, no other transactions in the Issuer’s Common Stock by the Reporting Persons were

effected in the past 60 days. |

| |

|

|

| |

(d) |

No

other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale

of, the Common Stock beneficially owned by the Reporting Persons. |

| |

|

|

| |

(e) |

Not

applicable. |

Item 6. Contracts, Arrangements, Understandings or Relationships with

Respect to Securities of the Issuer.

Except for the relationships

described above and in the responses to Items 4 and 5 herein, none of the Reporting Persons, nor, to the best of their knowledge, any

persons identified in Item 2 hereof has any contracts, arrangements, understandings or relationships (legal or otherwise) with any person,

with respect to any securities of the Issuer.

Item 7. Material to be Filed as Exhibits.

[The remainder of this page intentionally left blank]

SIGNATURE

After reasonable inquiry and to the best of the knowledge

and belief of each of the undersigned, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: December 28, 2023

| |

By: |

/s/ Bruce Galloway |

| |

Name: |

Bruce Galloway |

| |

GALLOWAY CAPITAL PARTNERS, LLC |

| |

|

| |

By: |

/s/

Bruce Galloway |

| |

Name: |

Bruce Galloway |

| |

Title: |

Managing Member |

Exhibit 99.1

JOINT FILING AGREEMENT

The undersigned

hereby agree that the statement on Schedule 13D with respect to the Common Stock of Regis Corporation dated as of December 28, 2023

is, and any amendments thereto (including amendments on Schedule 13G) signed by each of the undersigned shall be, filed on behalf of each

of us pursuant to and in accordance with the provisions of Rule 13d-1(k) under the Securities Exchange Act of 1934.

| |

GALLOWAY CAPITAL

PARTNERS, LLC |

| |

|

| |

By: |

/s/ Bruce Galloway |

| |

|

Name: Bruce Galloway |

| |

|

Title: Managing Member |

| |

|

/s/ Bruce Galloway |

| |

|

Bruce Galloway |

Schedule 1

Purchases by the Reporting Persons

| Date | |

Shares | |

Share

Price |

| | |

| |

|

| | November

1, 2023 | | |

| 1,000 | | |

$ | 11.62 | |

| | November

6, 2023 | | |

| 1,000 | | |

$ | 12.04 | |

| | November

8, 2023 | | |

| 800 | | |

$ | 9.80 | |

| | November

14, 2023 | | |

| 2,200 | | |

$ | 9.90 | |

| | November

20, 2023 | | |

| 1,150 | | |

$ | 7.90 | |

| | November

29, 2023 | | |

| 900 | | |

$ | 7.50 | |

| | | | |

| | | |

| | |

| | December

4, 2023 | | |

| 1,800 | | |

$ | 7.16 | |

| | December

11, 2023 | | |

| 2,000 | | |

$ | 10.05 | |

| | December

14, 2023 | | |

| 1,400 | | |

$ | 7.65 | |

| | December

19, 2023 | | |

| 2,000 | | |

$ | 6.80 | |

| | December

20, 2023 | | |

| 1,850 | | |

$ | 6.08 | |

EXHIBIT 99.2

Galloway Capital Partners, LLC

December 28, 2023

David J. Grissen, Chairman

Matthew Doctor, Chief Executive Officer

Regis Corporation

3701 Wayzata Boulevard

Minneapolis, MN 55416

Dear Mssrs. Grissen and Doctor:

We have been shareholders of Regis Corporation

(the ‘Company’ or ‘Regis’) for over a year. We are quite disappointed with the performance of the Company’s

common stock, which is -98% in the past four years, and -60% in just the past six months. We believe the Company is significantly

undervalued and requires our support and expertise in creating shareholder value.

Recently, the Company announced the formation

of a Special Committee to explore strategic alternatives to enhance shareholder value. We believe the Company is solidly profitable

at $30MM EBITDA and off to a very good start. While management has done a very good job in cutting costs and converting to a franchise

system, this is certainly not reflected in the stock price. We believe the Company’s stock is undervalued by 5-10x. It’s

obvious to us that Wall Street is viewing this strategic review as a potential dilutive outcome which in our opinion is not necessary.

We believe there is still a long way to go

to enhance revenue in the Company’s systemwide ‘footprint.’ At present, each location generates barely $300,000

in gross revenue, and only from haircuts. Your competitor, Hair Cuttery Salons generates double the sales volume because they are

more effective in offering ancillary services and products to their clients. We strongly believe that with over 4,800 locations

generating $1.25 billion in systemwide sales and 50 million customers annually, the Company can significantly enhance its sales

volume and EBITDA by offering additional services.

Galloway Capital Partners and its founder,

Bruce Galloway, have significant experience investing in undervalued publicly traded companies, including franchise companies.

We would like to assist in the process of growing the Company, improving the financial structure and enhancing shareholder value.

We request that the Special Committee consider two candidates of our selection with strong public company experience to be added

to the Board of Directors.

Our interests are clearly aligned, and we believe

that we can bring strong insight and constructive actions which will benefit all of the Company’s shareholders. We believe

we can accomplish this without the need to dilute the shareholders while still protecting the value of the Company’s stock.

Please let me know when you would be available

to discuss these important matters. I can be reached at: bgalloway@gallowaycap.com or 917-405-4591.

Very truly yours,

Bruce Galloway

President and Chief Investment

Officer

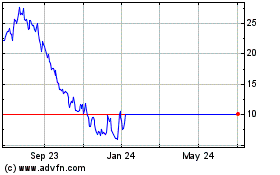

Regis (NYSE:RGS)

Historical Stock Chart

From Jan 2025 to Feb 2025

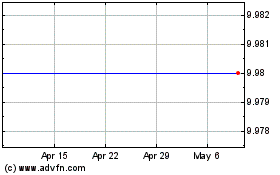

Regis (NYSE:RGS)

Historical Stock Chart

From Feb 2024 to Feb 2025