Grupo Financiero Upped to Strong Buy - Analyst Blog

August 29 2013 - 7:30PM

Zacks

On Aug 28, Zacks Investment Research upgraded Grupo

Financiero Galicia S.A. (GGAL) to a Zacks Rank #1 (Strong

Buy).

Why the Upgrade?

Grupo Financiero has been witnessing rising earnings estimates

following the announcement of robust second-quarter 2013 results.

Moreover, this Argentinean bank has delivered an average beat of

5.6% in the past four quarters.

Grupo Financiero reported second-quarter 2013 results on Aug 8.

Earnings per share of 56 cents surpassed the Zacks Consensus

Estimate by 4 cents. Results benefited from top-line growth and a

rise in provision for credit losses, partially offset by higher

administrative expenses.

Results were also boosted by the income derived from Grupo

Financiero’s stake in Banco de Galicia y Buenos Aires S.A. and in

Sudamericana Holding S.A. and from the deferred tax adjustment of

15.1 million pesos ($2.9 million).

Financial income rose 7.4% sequentially to $2.9 billion pesos ($0.6

billion). Moreover, income from services jumped 14.3% to $1.0

billion pesos ($0.2 billion). On the flip side, administrative

expenses rose 9.2% from the prior quarter to $1.8 billion pesos.

($0.3 billion). However, provision for loan losses dropped 1.4% to

434.7 million pesos ($82.8 million).

Additionally, following the earnings release, the Zacks Consensus

Estimate for 2013 increased 3.4% to $2.11 per share over the last 7

days. Similarly, for 2014, the Zacks Consensus Estimate advanced

7.4% to $2.04 per share over the same time period.

Positive earnings surprises and favorable estimate revisions

stimulated the rank upgrade.

Other Stocks to Consider

While we prefer Grupo Financiero, other stocks carrying a Zacks

Rank #1 include Glacier Bancorp Inc. (GBCI),

Prosperity Bancshares Inc. (PB) and

Sumitomo Mitsui Financial Group Inc. (SMFG).

GLACIER BANCORP (GBCI): Free Stock Analysis Report

GRUPO GALIC ADR (GGAL): Free Stock Analysis Report

PROSPERITY BCSH (PB): Free Stock Analysis Report

SUMITOMO-MITSUI (SMFG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

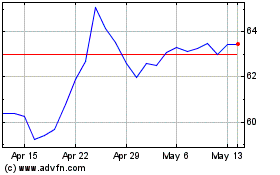

Prosperity Bancshares (NYSE:PB)

Historical Stock Chart

From Sep 2024 to Oct 2024

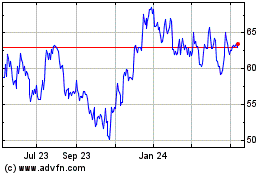

Prosperity Bancshares (NYSE:PB)

Historical Stock Chart

From Oct 2023 to Oct 2024