Phillips 66 (NYSE: PSX) and Plains All American Pipeline

(Plains) (NYSE: PAA) announced that they have formed a 50/50 joint

venture, Red Oak Pipeline LLC, and are proceeding with construction

of the Red Oak Pipeline system (Red Oak). The pipeline system will

provide crude oil transportation service from Cushing, Oklahoma,

and the Permian Basin in West Texas to Corpus Christi, Ingleside,

Houston and Beaumont, Texas. Red Oak is underpinned with long-term

shipper volume commitments. Initial service from Cushing to the

Gulf Coast is targeted to commence as early as the first quarter of

2021, subject to receipt of applicable permits and regulatory

approvals.

“We are pleased to partner with Plains to build Red Oak,” said

Greg Garland, Phillips 66 chairman and CEO. “The pipeline

provides a competitive outlet for shippers to access the key market

centers along the Texas Gulf Coast from Cushing and the

Permian. This investment aligns with our long-term strategy to

grow our Midstream business with projects generating stable,

fee-based earnings while further enhancing integration across our

value chain.”

“Red Oak represents a capital-efficient industry solution that

will utilize existing assets and provide pull-through benefits to

our systems,” stated Willie Chiang, CEO of Plains All American. “We

look forward to working closely with Phillips 66 and our committed

shippers to bring Red Oak into service and further optimize our

assets upstream and downstream of the new pipeline system. We also

look forward to creating jobs and supporting economic growth in

Oklahoma and Texas.”

The Red Oak joint venture will lease capacity in Plains’ Sunrise

Pipeline system, which extends from Midland to Wichita Falls,

Texas. The joint venture plans to construct a new 30-inch pipeline

from Cushing to Wichita Falls and Sealy, Texas. From Sealy, the

joint venture will construct a 30-inch pipeline segment to Corpus

Christi and Ingleside and a 20-inch pipeline segment to Houston and

Beaumont. Where feasible, Red Oak will utilize existing pipeline

and utility corridors and advanced construction techniques to limit

environmental and community impact. Plains will lead project

construction on behalf of the joint venture, and Phillips 66 will

operate the pipeline. The project is expected to cost approximately

$2.5 billion.

The joint venture plans to hold a supplemental binding open

season to be announced at a later date that will enable additional

shippers to enter into long-term transportation services

agreements.

About Phillips 66

Phillips 66 is a diversified energy manufacturing and logistics

company. With a portfolio of Midstream, Chemicals, Refining, and

Marketing and Specialties businesses, the company processes,

transports, stores and markets fuels and products globally.

Phillips 66 Partners, the company’s master limited partnership, is

integral to the portfolio. Headquartered in Houston, the company

has 14,300 employees committed to safety and operating excellence.

Phillips 66 had $58 billion of assets as of March 31, 2019. For

more information, visit http://www.phillips66.com or follow us on

Twitter @Phillips66Co.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE

"SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This news release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created thereby. Words and phrases such as “is anticipated,” “is

estimated,” “is expected,” “is planned,” “is scheduled,” “is

targeted,” “believes,” “continues,” “intends,” “will,” “would,”

“objectives,” “goals,” “projects,” “efforts,” “strategies” and

similar expressions are used to identify such forward-looking

statements. However, the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements

relating to Phillips 66’s operations (including joint venture

operations) are based on management’s expectations, estimates and

projections about the company, its interests and the energy

industry in general on the date this news release was prepared.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include fluctuations in NGL, crude oil,

and natural gas prices, and petrochemical and refining margins;

unexpected changes in costs for constructing, modifying or

operating our facilities; unexpected difficulties in manufacturing,

refining or transporting our products; lack of, or disruptions in,

adequate and reliable transportation for our NGL, crude oil,

natural gas, and refined products; potential liability from

litigation or for remedial actions, including removal and

reclamation obligations under environmental regulations; limited

access to capital or significantly higher cost of capital related

to illiquidity or uncertainty in the domestic or international

financial markets; the impact of adverse market conditions or other

similar risks to those identified herein affecting PSXP, as well as

the ability of PSXP to successfully execute its growth plans; and

other economic, business, competitive and/or regulatory factors

affecting Phillips 66’s businesses generally as set forth in our

filings with the Securities and Exchange Commission. Phillips 66 is

under no obligation (and expressly disclaims any such obligation)

to update or alter its forward-looking statements, whether as a

result of new information, future events or otherwise.

About Plains All American Pipeline

Plains All American Pipeline (NYSE: PAA) is a publicly traded

master limited partnership that owns and operates midstream energy

infrastructure and provides logistics services for crude oil, NGLs

and natural gas. PAA owns an extensive network of pipeline

transportation, terminalling, storage, and gathering assets in key

crude oil and NGL producing basins and transportation corridors and

at major market hubs in the United States and Canada. On average,

PAA handles more than 6 million barrels per day of crude oil and

NGL in its Transportation segment. PAA is headquartered in Houston,

Texas. More information is available at

www.plainsallamerican.com.

FORWARD-LOOKING STATEMENTS

Certain matters discussed in this release are forward-looking

statements that involve risks and uncertainties that could cause

actual results or outcomes to differ materially from results or

outcomes anticipated in the forward-looking statements. These risks

and uncertainties include, among other things, shortages, cost

increases or delay in receipt of supplies, materials or labor;

failure to implement or capitalize, or delays in implementing or

capitalizing, on expansion projects, whether due to permitting

delays, permitting withdrawals or other factors; the effects of

competition, including the effects of capacity overbuild in areas

where we operate; the impact of current and future laws, rulings,

orders, governmental regulations, accounting standards and

statements and related interpretations; weather interference with

business operations or project construction, including the impact

of extreme weather events or conditions; environmental liabilities,

issues or events that result in construction delays or otherwise

impact targeted in-service dates; interruptions in service on

third-party pipelines or facilities; general economic, market or

business conditions and the amplification of other risks caused by

volatile financial markets, capital constraints and pervasive

liquidity concerns; and other factors and uncertainties inherent in

the transportation, storage, terminalling and marketing of crude

oil as discussed in PAA's filings with the Securities and Exchange

Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190610005720/en/

Phillips 66

Jeff Dietert (investors)832-765-2297jeff.dietert@p66.com

Brent Shaw (investors)832-765-2297Brent.D.Shaw@p66.com

Dennis Nuss (media)832-765-1850dennis.h.nuss@p66.com

Plains All American Pipeline

Roy Lamoreaux (investors)866-809-1291

Brett Magill (investors)866-809-1291

Brad Leone (media)866-809-1290

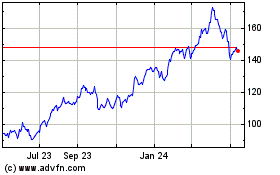

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Oct 2024 to Nov 2024

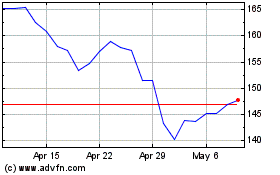

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Nov 2023 to Nov 2024