By Rebecca Elliott and Bradley Olson

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 6, 2018).

From Exxon Mobil Corp. to Phillips 66, energy companies are

reaping banner profits by taking cheap oil landlocked in North

America and turning it into fuel.

Tremendous growth in oil output has overwhelmed pipelines and

depressed crude prices in some regions of Texas and Canada. That

has created a bonanza for companies in a position to take advantage

by converting it into gasoline and diesel.

Nowhere has the opportunity been bigger than near Canada, where

crude is trading for $43 a barrel below U.S. benchmark prices due

to bottlenecks. That is painful for producers there, but highly

lucrative for companies with nearby refineries in Canada or the

upper Midwest, from Exxon to smaller fuel makers like HollyFrontier

Corp.

"U.S. refining has really gone from being a dog to being a

fairly attractive business model," John Auers, an executive vice

president at consultancy Turner, Mason & Co., said. "I don't

think that's going to change any time soon."

Phillips 66, which says it is the largest industry buyer of

heavy Canadian crude, operated its nearby refineries at 108% of

capacity during the third quarter, earning an average $23.61 a

barrel processed there. That helped lift quarterly profits to

nearly $1.5 billion, an 81% increase from the same period last

year.

Exxon Chief Executive Darren Woods cited the company's access to

cheap crude from Canada and West Texas for its refineries as one of

the advantages that helped spur it to $6.2 billion in third-quarter

profits, its highest total in four years. The company said it can

process as much as 500,000 barrels a day of Canadian crude from

seven refineries.

"We are seeing the benefits of integration as we capture value

from advantaged feedstock from the Permian and Western Canada for

our North American refineries," Mr. Woods said.

Much as John D. Rockefeller amassed his fortune by refining

crude extracted in the first American oil boom, refiners are once

again finding an advantage as the U.S. has become one of the

world's largest crude producers.

North American oil production has soared as oil prices have

risen over the past two years, increasing 24% to more than 15

million barrels a day in July, according to the U.S. Energy

Information Administration.

The rapid growth has overwhelmed existing pipelines and made it

difficult for producers to move all their oil to market in areas

such as western Canada and the Permian Basin of West Texas and New

Mexico. The landlocked oil subsequently trades for far less in

those areas than oil shipped via pipelines to major selling hubs

such as Cushing, Okla.

Fuel makers with access to the inexpensive crude have reaped the

rewards.

BP PLC's underlying quarterly profit soared to $3.8 billion, the

highest level in five years, powered in part by the company's

massive refinery in Whiting, Ind. The plant, first opened by

Rockefeller's Standard Oil in 1889, is capable of running about

320,000 barrels a day of heavy crude from Canada.

Heavy Canadian crude traded for an average $28 a barrel below

U.S. benchmark prices during the third quarter, according to

S&P Global Platts, while oil sold in the Permian was discounted

by an average $14 a barrel. Oil in both regions is expected to

remain relatively cheap for at least another year, when new

pipelines are set to begin operating.

Permian, heavy Canadian and other similar crudes accounted for

about 57% of the oil HollyFrontier processed during the third

quarter, the company told investors Wednesday. The Dallas-based

refiner posted profits of more than $340 million, its highest

third-quarter income since 2012.

Refining companies that missed out on the Canadian trade showed

it in their results. Marathon Petroleum Corp. saw quarterly profits

decline 18% from the same period last year to $737 million, in part

because some of its Midwest refineries were offline for

maintenance. The company told investors it is now poised to process

about 500,000 barrels of Canadian crude daily. It also expects to

benefit in coming quarters from growing discounts on oil from North

Dakota's Bakken Shale.

"We kind of see this as a perfect storm," said Rick Hessling, a

senior vice president.

Oil in Clearbrook, Minn., one of the trading hubs for Bakken

crude, was selling for nearly $13 below U.S. benchmark prices this

week, according to S&P Global Platts.

Domestic demand for diesel and other fuel oils remains high, but

data from the Energy Information Administration show gasoline

demand has fallen off from a year ago as oil prices have risen and

refiners have operated at full tilt, boosting stockpiles.

"The real surprise, especially on the gasoline side, is just the

very high refinery utilization," said Gary Simmons, a senior vice

president for Valero Energy Corp. "You've had about a 2-to-1

increase in production over demand, and it's caused a surplus in

the inventory."

The export market has been a key release valve. U.S. exports of

refined products topped 5.3 million barrels daily in October, a 33%

increase from two years prior, according to the EIA. Top buyers

include Mexico, Canada and Japan.

"If you can get your hands on discounted crude oil, you're

incentivized to run it and then hope you can find a home for it,"

said Amy Kalt, a consultant for Baker & O'Brien Inc., an energy

consultancy.

Write to Rebecca Elliott at rebecca.elliott@wsj.com and Bradley

Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

November 06, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

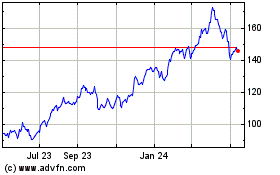

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Oct 2024 to Nov 2024

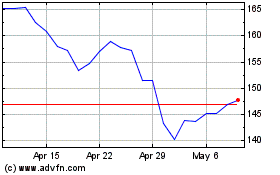

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Nov 2023 to Nov 2024