Adjusted earnings of $548 million or $1.07 per

share

Highlights

Fourth Quarter

- Generated $1.9 billion in cash from

operations

- Returned $816 million to shareholders

through dividends and share repurchases

- Achieved 100 percent capacity

utilization in Refining

- Reached mechanical completion at

CPChem's Cedar Bayou world-scale ethane cracker

- Completed $2.4 billion dropdown to

Phillips 66 Partners

- Announced $2.3 billion 2018 capital

budget

Full-Year 2017

- Achieved record-low recordable injury

rate

- Delivered $5.1 billion of earnings and

$2.3 billion of adjusted earnings

- Generated $3.6 billion of operating

cash flow

- Returned $3.0 billion to shareholders

through dividends and share repurchases

- Increased quarterly dividend 11 percent

to $0.70 per common share

- Achieved 95 percent capacity

utilization in Refining during heavy turnaround year

- Started up the Bakken Pipeline and

commissioned additional storage at the Beaumont Terminal

- Reached commercial operations at

CPChem's Old Ocean polyethylene units

Phillips 66 (NYSE: PSX), an energy manufacturing and logistics

company, announces fourth-quarter 2017 earnings of $3.2 billion,

compared with $823 million in the third quarter of 2017. Excluding

special items, primarily a $2.7 billion benefit from U.S. tax

reform, adjusted earnings were $548 million, compared with

third-quarter adjusted earnings of $858 million.

“We ended 2017 with a strong quarter, running at record levels

and delivering solid financial results,” said Greg Garland,

chairman and CEO of Phillips 66. “In our Midstream business, we

achieved significant growth at Phillips 66 Partners through our

recent dropdown. In Refining, we ran at 100 percent capacity

utilization and continued to operate safely and reliably. In

Chemicals, CPChem has recovered from Hurricane Harvey at its Cedar

Bayou facility and is commissioning its new world-scale ethane

cracker.”

“Our strategy for long-term value creation remains

unchanged. This includes capturing growth opportunities in our

Midstream and Chemicals businesses and enhancing returns in

Refining and Marketing. Also fundamental to our strategy are

shareholder distributions consisting of a competitive, secure and

growing dividend complemented with share repurchases.”

Midstream

Millions of Dollars Net Income

Adjusted Net Income Q4 2017 Q3 2017

Q4 2017 Q3 2017 Transportation $ 105

119 108 98 NGL and Other 20

(3

)

20 — DCP Midstream 14 1 14 1

Midstream $ 139

117 142 99

Midstream's fourth-quarter net income was $139 million, compared

with $117 million in the third quarter of 2017. Midstream net

income in the fourth quarter included hurricane-related costs of $3

million. Third-quarter results included a favorable legal

settlement of $23 million, partially offset by hurricane-related

costs of $3 million and pension settlement expense of $2

million.

Transportation adjusted net income for the fourth quarter of

2017 was $108 million, an increase of $10 million from the third

quarter. The increase reflects higher terminal and pipeline

throughput volumes.

NGL and Other adjusted net income was $20 million in the fourth

quarter compared with break-even results in the third quarter. The

increase primarily reflects the acquisition of Merey Sweeny, L.P.

by Phillips 66 Partners (PSXP) during the quarter.

The company’s equity investment in DCP Midstream generated

adjusted net income of $14 million in the fourth quarter, compared

with $1 million in the prior quarter. This increase was primarily

due to the absence of third-quarter asset impairments, as well as

higher NGL prices and improved volumes.

Chemicals

Millions of Dollars Net Income

Adjusted Net Income Q4 2017 Q3 2017

Q4 2017 Q3 2017 Olefins and Polyolefins

(O&P) $ 1 105 95 137 Specialties, Aromatics and Styrenics

(SA&S) 34 22 34 22 Other

(8

)

(6

)

(8

)

(6

)

Chemicals $ 27 121

121 153

The Chemicals segment reflects Phillips 66's equity investment

in Chevron Phillips Chemical Company LLC (CPChem). Chemicals'

fourth-quarter net income was $27 million, compared with $121

million in the third quarter of 2017. Chemicals net income in the

fourth quarter of 2017 included hurricane-related costs of $75

million and an asset impairment of $19 million, compared with $32

million of hurricane-related costs in the third quarter.

CPChem's O&P business contributed $95 million of adjusted

net income to the Chemicals segment in the fourth quarter of 2017.

The $42 million decrease from the prior quarter was due primarily

to lower sales volumes and higher depreciation, maintenance and

operating costs, partially offset by improved polyethylene margins.

Global O&P utilization was 79 percent for the quarter,

reflecting hurricane-related downtime at the Cedar Bayou facility

and an unplanned outage impacting a Q-Chem II facility.

CPChem's SA&S business contributed $34 million of adjusted

net income in the fourth quarter of 2017, an increase of $12

million from the prior quarter. The improvement was primarily

related to higher margins and lower operating costs.

Refining

Millions of Dollars Net Income

Adjusted Net Income Q4 2017 Q3

2017 Q4 2017 Q3 2017 Refining

$ 371 550 358

548

Refining's fourth-quarter net income was $371 million, compared

with $550 million in the third quarter of 2017. Refining results in

the fourth quarter included favorable U.K. tax credits of $23

million, partially offset by hurricane-related costs of $7 million

and pension settlement expense of $3 million. Third-quarter net

income included favorable tax and other settlements of $18 million,

mostly offset by pension settlement expense of $8 million and

hurricane-related costs of $8 million.

Refining's adjusted net income was $358 million in the fourth

quarter of 2017, compared with $548 million in the third quarter.

The decrease was primarily due to a 35 percent decline in gasoline

market crack spreads and higher turnaround costs, partially offset

by improved clean product differentials and increased volumes.

Realized margins for the quarter were $8.98 per barrel, compared

with $10.49 per barrel in the third quarter. Phillips 66’s

worldwide crude utilization rate was 100 percent. Pre-tax

turnaround costs for the fourth quarter were $99 million, compared

with third-quarter costs of $43 million. Clean product yield was 87

percent in the fourth quarter, compared with 85 percent in the

third quarter.

Marketing and Specialties

Millions of Dollars Net Income

Adjusted Net Income Q4 2017 Q3

2017 Q4 2017 Q3 2017 Marketing and Other $

86 160 87 163 Specialties 37 48

37 48

Marketing and Specialties

$ 123 208 124 211

Marketing and Specialties (M&S) fourth-quarter net income

was $123 million, compared with $208 million in the third quarter

of 2017. M&S fourth-quarter net income included pension

settlement expense of $1 million. Third-quarter results included a

charge of $2 million for pension settlement expense and

hurricane-related costs of $1 million.

Adjusted net income for Marketing and Other was $87 million in

the fourth quarter of 2017, a decrease of $76 million from the

prior quarter. The decrease was largely due to reduced margins as

well as seasonally lower demand for branded volumes. Refined

product exports in the fourth quarter were 236,000 barrels per day

(BPD).

Phillips 66’s Specialties businesses generated adjusted net

income of $37 million during the fourth quarter. The $11

million decrease from the prior quarter was mainly due to lower

base oil and finished lubricant margins.

Corporate and Other

Millions of Dollars Net Income

Adjusted Net Income Q4 2017 Q3

2017 Q4 2017 Q3 2017 Corporate and

Other $ 2,595

(147

)

(140

)

(127

)

Corporate and Other’s fourth-quarter net income was $2.6

billion, compared with net costs of $147 million in the third

quarter of 2017. Corporate and Other fourth-quarter net income

included a $2.7 billion benefit from U.S. tax reform, primarily

associated with the revaluation of the company's net deferred tax

liabilities. Third-quarter results included $20 million in charges

for legal and pension settlement expenses.

The $13 million increase in adjusted net costs in the fourth

quarter was primarily due to tax adjustments in the third

quarter.

Financial Position, Liquidity and Return of Capital

During the fourth quarter, Phillips 66 generated $1.9 billion in

cash from operations. Excluding working capital impacts, operating

cash flow was $1.0 billion. In addition, PSXP raised $1.0 billion

through equity issuances to partially fund the acquisition of

assets from Phillips 66.

Phillips 66 funded $537 million of capital expenditures and

investments, $463 million in share repurchases and $353 million in

dividends during the quarter. The company ended the quarter with

502 million shares outstanding.

As of Dec. 31, 2017, cash and cash equivalents were $3.1

billion, and consolidated debt was $10.1 billion, including $2.9

billion at PSXP. The company's consolidated debt-to-capital ratio

and net-debt-to-capital ratio were 27 percent and 20 percent,

respectively. Excluding PSXP, the debt-to-capital ratio was 22

percent and net-debt-to-capital ratio was 14 percent.

Strategic Update

Phillips 66 continues to execute its plan to selectively grow

higher-valued businesses. Capital spending for 2017 was $1.8

billion, including $352 million at PSXP. Capital expenditures

funded growth projects in Midstream, return-enhancing investments

in Refining, and sustaining capital to maintain asset integrity and

ensure safe, reliable and environmentally responsible operations.

Phillips 66's proportionate share of capital spending by joint

ventures CPChem, DCP Midstream and WRB Refining in 2017 was $1.2

billion.

In Midstream, the company completed expansion of the Beaumont

Terminal’s export facilities from 400,000 BPD to 600,000 BPD in the

fourth quarter. An additional 3.5 million barrels of crude storage

is expected to be in service by the end of 2018, bringing the

terminal's total crude and products storage capacity to 14.6

million barrels.

In December 2017, Phillips 66 and Enbridge Inc. announced an

open season for the Gray Oak Pipeline project to transport crude

oil from the Permian Basin to markets along the Texas Gulf Coast.

Depending on shipper interest, the pipeline is expected to have

initial throughput capacity of 385,000 BPD and be placed in service

during the second half of 2019.

The Bayou Bridge Pipeline, in which PSXP holds a 40 percent

interest, currently operates from the Phillips 66 Beaumont Terminal

to Lake Charles, Louisiana. The segment from Lake Charles to St.

James, Louisiana, has received all permits and construction is

underway. Commercial operations on the St. James segment are

expected to begin in the second half of 2018.

PSXP is proceeding with the construction of a new 25,000 BPD

isomerization unit at the Lake Charles Refinery. The unit will

increase production of higher octane gasoline blend components,

with completion anticipated by the end of 2019.

DCP Midstream’s expansion of the Sand Hills NGL Pipeline

capacity from 280,000 BPD to 365,000 BPD is expected to be complete

in the first quarter of 2018. In addition, further expansion of the

line to 450,000 BPD is expected in the second half of 2018. Sand

Hills is owned two-thirds by DCP and one-third by Phillips 66

Partners. DCP continues construction of two additional gas

processing plants in the high-growth DJ basin. The Mewbourn 3 plant

is anticipated to be complete in the third quarter of 2018, and the

O’Connor 2 plant is scheduled for completion in mid-2019.

DCP Midstream announced a final investment decision to proceed

with joint development of the Gulf Coast Express Pipeline project,

which will provide an outlet for natural gas production in the

Permian Basin to markets along the Texas Gulf Coast. DCP holds a 25

percent equity interest in the project, which is expected to be

complete in the fourth quarter of 2019.

In Chemicals, CPChem is nearing completion of its U.S. Gulf

Coast Petrochemicals Project with the commissioning of its new

world-scale ethane cracker at Cedar Bayou. The startup of the

cracker is expected in the first quarter, with ramp up to full

production in the second quarter. The Project will increase

CPChem’s global ethylene and polyethylene capacity by approximately

one-third.

In Refining, the company continues to focus on high-return,

quick-payout projects. Refining has multiple yield enhancing

projects that are expected to deliver 25,000 BPD of additional

clean products by the end of 2018. This includes the diesel

recovery project at the Ponca City Refinery, which was completed in

the fourth quarter. In addition, the company is modernizing fluid

catalytic cracking (FCC) units at both the Bayway and Wood River

refineries with anticipated completion during the second quarter of

2018. Refining also has projects to reduce feedstock costs, such as

at the Lake Charles Refinery where efforts are underway to increase

advantaged North American crude processing capability.

In December 2017, Phillips 66 announced a 2018 capital budget of

$2.3 billion, which includes $595 million at PSXP. Phillips 66's

proportionate share of capital spending by joint ventures CPChem,

DCP Midstream and WRB Refining is expected to be $946 million.

Investor Webcast

Later today, members of Phillips 66 executive management will

host a webcast at noon EST to discuss the company’s fourth-quarter

performance and provide an update on strategic initiatives. To

access the webcast and view related presentation materials, go to

www.phillips66.com/investors and click

on "Events & Presentations." For detailed supplemental

information, go to www.phillips66.com/supplemental.

Earnings

Millions of Dollars 2017 2016 Q4

Q3 Year Q4

Year Midstream $ 139 117 464 35 280 Chemicals 27 121 525 136

583 Refining 371 550 1,404

(38

)

374 Marketing and Specialties 123 208 686 190 891 Corporate and

Other 2,595

(147

)

2,169

(129

)

(484

)

Net Income 3,255 849 5,248 194

1,644 Less: Noncontrolling interests 57

26 142 31 89

Phillips 66

$ 3,198 823

5,106 163 1,555

Adjusted

Earnings

Millions of Dollars 2017 2016 Q4

Q3 Year Q4

Year Midstream $ 142 99 454 69 289 Chemicals 121 153 671 124

660 Refining 358 548 1,137

(95

)

277 Marketing and Specialties 124 211 694 140 841 Corporate and

Other

(140

)

(127

)

(545

)

(124

)

(480

)

Net Income 605 884 2,411 114

1,587 Less: Noncontrolling interests 57

26 142 31 89

Phillips 66

$ 548 858

2,269 83 1,498

About Phillips 66

Phillips 66 is a diversified energy manufacturing and logistics

company. With a portfolio of Midstream, Chemicals, Refining, and

Marketing and Specialties businesses, the company processes,

transports, stores and markets fuels and products globally.

Phillips 66 Partners, the company's master limited partnership, is

an integral asset in the portfolio. Headquartered in Houston, the

company has 14,600 employees committed to safety and operating

excellence. Phillips 66 had $54 billion of assets as of

Dec. 31, 2017. For more information, visit www.phillips66.com or follow us on Twitter

@Phillips66Co.

CAUTIONARY STATEMENT FOR THE PURPOSES OF THE

"SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This news release contains certain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbors

created thereby. Words and phrases such as “is anticipated,” “is

estimated,” “is expected,” “is planned,” “is scheduled,” “is

targeted,” “believes,” “continues,” “intends,” “will,” “would,”

“objectives,” “goals,” “projects,” “efforts,” “strategies” and

similar expressions are used to identify such forward-looking

statements. However, the absence of these words does not mean that

a statement is not forward-looking. Forward-looking statements

relating to Phillips 66’s operations (including joint venture

operations) are based on management’s expectations, estimates and

projections about the company, its interests and the energy

industry in general on the date this news release was prepared.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include fluctuations in NGL, crude oil,

and natural gas prices, and petrochemical and refining margins;

unexpected changes in costs for constructing, modifying or

operating our facilities; unexpected difficulties in manufacturing,

refining or transporting our products; lack of, or disruptions in,

adequate and reliable transportation for our NGL, crude oil,

natural gas, and refined products; potential liability from

litigation or for remedial actions, including removal and

reclamation obligations under environmental regulations; limited

access to capital or significantly higher cost of capital related

to illiquidity or uncertainty in the domestic or international

financial markets; and other economic, business, competitive and/or

regulatory factors affecting Phillips 66’s businesses generally as

set forth in our filings with the Securities and Exchange

Commission. Phillips 66 is under no obligation (and expressly

disclaims any such obligation) to update or alter its

forward-looking statements, whether as a result of new information,

future events or otherwise.

Use of Non-GAAP Financial Information—This news release

includes the terms adjusted earnings, adjusted earnings per share,

and adjusted net income. These are non-GAAP financial measures that

are included to help facilitate comparisons of company operating

performance across periods and with peer companies, by excluding

items that don't reflect the core operating results of our

businesses in the current period. This release includes realized

refining margin, a non-GAAP financial measure that demonstrates how

well we performed relative to benchmark industry margins. This

release also includes a debt-to-capital ratio excluding PSXP. This

non-GAAP measure is provided to differentiate the capital structure

of Phillips 66 compared with that of Phillips 66 Partners.

References in the release to earnings refer to net income

attributable to Phillips 66. References to adjusted earnings refer

to earnings excluding special items, as detailed in the tables to

this release. References to net income are inclusive of

noncontrolling interests.

Millions of Dollars Except as Indicated

2017 2016 Q4 Q3

Year Q4 Year Reconciliation

of Earnings to Adjusted Earnings

Consolidated Earnings $ 3,198 823

5,106 163 1,555 Pre-tax adjustments: Pending

claims and settlements — (36 ) (60 ) — (117 ) Pension settlement

expense 7 21 83 — — Equity affiliate ownership restructuring — — —

33 33 Impairments by equity affiliates 31 — 64 — 95 Certain tax

impacts (23 ) — (23 ) (32 ) (32 ) Recognition of deferred logistics

commitments — — — — 30 Gain on consolidation of business — — (423 )

— — Railcar lease residual value deficiencies and related costs — —

— 40 40 Hurricane-related costs 140 70 210 — — Tax impact of

adjustments* (70 ) (20 ) 47 (27 ) 4 U.S. tax reform (2,735 ) —

(2,735 ) — — Other tax impacts — —

— (94 ) (110 )

Adjusted earnings

$ 548 858

2,269 83 1,498

Earnings per share of common stock (dollars)

$ 6.25 1.60 9.85 0.31

2.92 Adjusted earnings per share of common stock

(dollars)† $ 1.07

1.66 4.38 0.16

2.82 Reconciliation of Net

Income to Adjusted Net Income by Segment Midstream Net

Income $ 139 117 464 35

280 Pre-tax adjustments: Pending claims and settlements —

(37 ) (37 ) — (45 ) Equity affiliate ownership restructuring

—

—

—

33 33 Impairments by equity affiliates

—

— — — 6 Pension settlement expense 1 3 12 — — Hurricane-related

costs 6 4 10 — — Tax impact of adjustments* (4 ) 12 5 (12 ) 2 Other

tax impacts — — —

13 13

Adjusted net income

$ 142 99

454 69 289

Chemicals Net Income $ 27 121

525 136 583 Pre-tax adjustments: Impairments

by equity affiliates 31 — 64 — 89 Hurricane-related costs 122 53

175 — — Tax impact of adjustments* (59 ) (21 ) (93 ) — — Other tax

impacts — — — (12

) (12 )

Adjusted net income $

121 153 671

124 660 Refining Net

Income $ 371 550 1,404 (38

) 374 Pre-tax adjustments: Pending claims and

settlements — (30 ) (51 ) — (70 ) Gain on consolidation of business

— — (423 ) — — Recognition of deferred logistics commitments — — —

— 30 Certain tax impacts (23 ) — (23 ) (32 ) (32 ) Railcar lease

residual value deficiencies and related costs — — — 40 40 Pension

settlement expense 5 13 53 — — Hurricane-related costs 12 12 24 — —

Tax impact of adjustments* (7 ) 3 153 (15 ) 1 Other tax impacts

— — — (50 )

(66 )

Adjusted net income $ 358

548 1,137

(95 ) 277 Marketing

and Specialties Net Income $ 123 208

686 190 891 Pre-tax adjustments: Pension

settlement expense 1 3 11 — — Hurricane-related costs — 1 1 — — Tax

impact of adjustments* — (1 ) (4 ) — — Other tax impacts

— — — (50 ) (50 )

Adjusted net income $ 124

211 694 140

841 Corporate and Other Net Income

(Loss) $ 2,595 (147 ) 2,169

(129 ) (484 ) Pre-tax adjustments:

Pending claims and settlements — 31 28 — (2 ) Pension settlement

expense — 2 7 — — Tax impact of adjustments* — (13 ) (14 ) — 1 U.S.

tax reform (2,735 ) — (2,735 ) — — Other tax impacts

— — — 5 5

Adjusted net income (loss) $

(140 ) (127 ) (545

) (124 ) (480 )

*We generally tax effect taxable

U.S.-based special items using a combined federal and state

statutory income tax rate of approximately 38 percent. Taxable

special items attributable to foreign locations likewise use a

local statutory income tax rate. Nontaxable events reflect zero

income tax. These events include, but are not limited to, most

goodwill impairments, transactions legislatively exempt from income

tax, transactions related to entities for which we have made an

assertion that the undistributed earnings are permanently

reinvested, or transactions occurring in jurisdictions with a

valuation allowance.

†Weighted-average diluted shares

outstanding and income allocated to participating securities, if

applicable, in the adjusted earnings per share calculation are the

same as those used in the GAAP diluted earnings per share

calculation.

Millions of Dollars Except as Indicated

2017 Q4 Q3 Realized Refining

Margins Net income $ 371 550 Plus: Income tax expense 145 313

Taxes other than income taxes 69 47 Depreciation, amortization and

impairments 213 205 Selling, general and administrative expenses 54

50 Operating expenses 875 818 Equity in earnings of affiliates (162

)

(144

)

Other segment (income) expense, net (2 ) 8 Proportional share of

refining gross margins contributed by equity affiliates 339 305

Special items: Certain tax impacts (23 ) — Realized

refining margins $ 1,879 2,152 Total

processed inputs (thousands of barrels) 187,489 183,010 Adjusted

total processed inputs (thousands of barrels)*

209,297 205,218

Net income (dollars per

barrel)** $ 1.98 3.01

Realized refining margins (dollars per

barrel)*** 8.98 10.49

* Adjusted total processed inputs include

our proportional share of processed inputs of equity

affiliates.

** Net income divided by total processed

inputs.

*** Realized refining margins per barrel,

as presented, are calculated using the underlying realized refining

margin amounts, in dollars, divided by adjusted total processed

inputs, in barrels. As such, recalculated per barrel amounts using

the rounded margins and barrels presented may differ from the

presented per barrel amounts due to rounding.

Millions of Dollars December 31,

2017 Debt-to-Capital Ratio

Phillips 66

Consolidated

PSXP* Phillips 66

Excluding PSXP

Total Debt $ 10,110 2,945 7,165 Total Equity

27,428 2,314 25,114

Debt-to-Capital Ratio 27 % 22 %

Total Cash $ 3,119 185

2,934

Net-Debt-to-Capital Ratio

20 % 14 %

*PSXP's third-party debt and Phillips 66's

noncontrolling interests attributable to PSXP.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180202005134/en/

Phillips 66Jeff Dietert, 832-765-2297

(investors)jeff.dietert@p66.comorRosy

Zuklic, 832-765-2297

(investors)rosy.zuklic@p66.comorDennis

Nuss, 832-765-1850 (media)dennis.h.nuss@p66.com

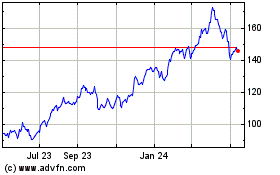

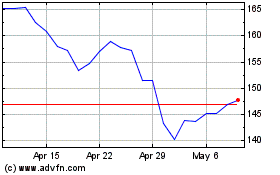

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Nov 2023 to Nov 2024