U.S. Hot Stocks: Hot Stocks to Watch

October 28 2016 - 9:50AM

Dow Jones News

Among the companies with shares expected to trade actively in

Friday's session are Baker Hughes Inc. (BHI), Goodyear Tire &

Rubber Co. (GT), and Novo Nordisk AS (NVO).

General Electric Co. (GE) is in talks to merge its oil-and-gas

business with Baker Hughes, according to people familiar with the

matter, a transaction that would dramatically reshape the

industrial giant. Shares of Baker Hughes rose 6.6% to $58.17 in

premarket trading.

Goodyear cut its outlook for the year amid what it said was a

volatile U.S. commercial truck tire business. Shares dropped 7.5%

to $28.65 premarket.

Shares in Novo Nordisk plummeted Friday as the Danish

pharmaceutical company slashed its long-term growth target, despite

reporting a forecast-beating 17% rise in third-quarter net profit.

The company's shares were down 13% at $35.75 premarket.

Amazon.com Inc. (AMZN) on Thursday reported a

smaller-than-expected increase in third-quarter profit as shipping

costs surged and the e-commerce company pumped revenue gains back

into product development and operations. Shares were down 5% at

$777.47 premarket.

Health-care giant McKesson Corp. (MCK) on Thursday sharply cut

its profit outlook for the year as income dropped by more than half

in its latest quarter. The company's shares fell 17% to $133.52

premarket.

Drugmaker AbbVie Inc. (ABBV) posted a rise in revenue and profit

in its latest quarter, boosted by climbing sales of its blockbuster

anti-inflammatory drug, Humira.

Exxon Mobil Corp. (XOM) on Friday posted a 38% decline in

quarterly profit as revenue slid worse-than-expected amid the

prolonged swoon in oil prices.

French drugmaker Sanofi (SNY) on Friday lifted its profit

outlook for the year after posting better-than-expected

third-quarter earnings, and said it planned to complete a EUR3.5

billion ($3.82 billion) share buyback by the end of 2017.

Royal Caribbean Cruises Ltd. (RCL) said its third-quarter

earnings rose 13%, beating expectations amid strong demand for

North American itineraries.

MasterCard Inc. (MA) profit grew 21% in the latest period, as

card companies have been trying to attract new customers and

increase transactions.

Google parent company Alphabet Inc. (GOOG) on reported rising

third-quarter profit Thursday, extending a streak of strength as

users spend more time on smartphones and advertisers spend more to

reach them there.

Whiting Petroleum Corp. (WLL) gained 1.6% to $8.86 after getting

upgraded to Strong Buy from Outperform at Raymond James.

Newell Brands Inc. (NWL) raised the bottom half of its guidance

for the year and reported revenue more than doubled and core sales

remained strong in the latest quarter as the company works through

a transformation.

CenturyLink Inc. (CTL) is in advanced talks to merge with Level

3 Communications Inc., a deal that would give the

business-telecommunications companies greater heft in a brutally

competitive industry.

Amgen Inc. (AMGN) on Thursday raised its financial projections

for the year after reporting an 8.3% increase in third-quarter

profit. Results beat expectations.

Chevron Corp. (CVX) reported profit plunged 35% in the latest

quarter and revenue slid more than expected amid continued deflated

oil prices. But earnings came in sharply above estimates and the

No. 2 energy company in the U.S. by revenue returned to the black

after three straight quarters in the red.

Baidu Inc. (BIDU) on Thursday reported lower-than-expected

revenue for the third quarter and its guidance missed expectations

as China's dominant search engine continued to implement stricter

standards for its online marketers.

Phillips 66 (PSX) on Friday said profit and revenue dropped in

its third quarter as low commodity prices continued to hurt

results.

Hershey Co. (HSY) said revenue and profit rose in its third

quarter as the chocolate maker continues to search for a new leader

and craft a path forward as an independent company after a rejected

takeover.

Calpine Corp. (CPN) on Friday posted revenue and profit gains in

the quarter but cut its guidance again.

Xerox Corp. (XRX) reached a settlement with shareholder Darwin

Deason granting him special shares in the copier maker's two

businesses after its split, clearing the way for the company to

finish its separation by year-end. The settlement comes as Xerox

also reported a bigger-than-expected decline in revenue but still

swung to a profit amid falling expenses.

Write to Jenny Roth at jenny.roth@wsj.com and Maria Armental at

maria.armental@wsj.com

(END) Dow Jones Newswires

October 28, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

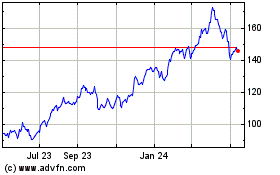

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Oct 2024 to Nov 2024

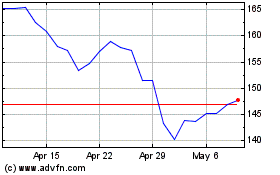

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Nov 2023 to Nov 2024