Northeast Utilities (NYSE: NU) today reported earnings of $127.4

million, or $0.40 per share, in the second quarter of 2014,

compared with $171 million, or $0.54 per share, in the second

quarter of 2013. Second quarter 2014 results include an after-tax

charge of $32.1 million, or $0.10 per share, related to Federal

Energy Regulatory Commission (FERC) orders issued in June 2014

concerning the authorized return on equity for the owners of New

England’s electric transmission system. Second quarter results also

include after-tax integration costs of $4.5 million in 2014 and

$1.8 million in 2013. Excluding those integration costs, NU earned

$131.9 million, or $0.42 per share, in the second quarter of 2014,

compared with $172.8 million, or $0.55 per share, in the second

quarter of 2013.

In the first half of 2014, NU earned $363.3 million, or $1.15

per share, compared with earnings of $399.1 million, or $1.26 per

share, in the first half of 2013. Excluding after-tax integration

costs, NU earned $373.7 million, or $1.18 per share, in the first

half of 2014, compared with earnings of $402.6 million, or $1.27

per share, in the first half of 2013.

Also today, NU narrowed its 2014 earnings guidance to between

$2.60 per share and $2.70 per share, including the $0.10 per share

transmission reserve.

“While we have joined other New England transmission owners in

asking FERC to clarify and rehear certain elements of its June 19

orders, we are encouraged that the commissioners concluded that the

continued build-out of the nation’s transmission grid is critical

and needs to be encouraged through supportive ratemaking,” said

Thomas J. May, NU chairman, president and chief executive officer.

“We continue to believe that our transmission construction program

provides a wide range of benefits to New England electric customers

and will be a cornerstone to achieving our long range guidance of

6-8 percent earnings per share growth.”

Electric Transmission

NU’s transmission segment earned $43.9 million in the second

quarter of 2014 and $118.8 million in the first half of 2014,

compared with earnings of $76.8 million in the second quarter of

2013 and $156.7 million in the first half of 2013. The lower

earnings were primarily the result of the second quarter

transmission reserve and a lower effective tax rate in 2013,

compared with 2014.

Electric Distribution and

Generation

NU’s electric distribution and generation segment earned $83.4

million in the second quarter of 2014 and $195.6 million in the

first half of 2014, compared with earnings of $91.2 million in the

second quarter of 2013 and $190.6 million in the first half of

2013. The results reflect a 2.9 percent reduction in second quarter

retail sales in 2014, primarily due to milder temperatures in late

May and June, compared with the same period of 2013. They also

reflect higher levels of depreciation, property tax and interest

expense, partially offset by lower operation and maintenance

expense. Over the first six months of 2014, retail electric sales

are up about 0.7 percent from the same period of 2013, but are

essentially flat on a weather-adjusted basis.

Earnings of Electric Utility Subsidiaries

(net of preferred dividends)

The Connecticut Light and Power Company earned $35.9 million in

the second quarter of 2014 and $113.9 million in the first half of

2014, compared with earnings of $66.5 million in the second quarter

of 2013 and $150.1 million in the first half of 2013. Lower second

quarter results were due primarily to lower transmission earnings

resulting from the reserve, a 2.8 percent reduction in retail

sales, and higher depreciation, property tax and interest

expense.

NSTAR Electric Company earned $59.6 million in the second

quarter of 2014 and $117.2 million in the first half of 2014,

compared with earnings of $57.4 million in the second quarter of

2013 and $105 million in the first half of 2013. Improved results

were due primarily to lower operation and maintenance expense.

Public Service Company of New Hampshire earned $24.1 million in

the second quarter of 2014 and $56.7 million in the first half of

2014, compared with $27.2 million in the second quarter of 2013 and

$56.2 million in the first half of 2013. Lower second quarter

results were due in part to the transmission reserve and lower

generation earnings.

Western Massachusetts Electric Company (WMECO) earned $7 million

in the second quarter of 2014 and $25.1 million in the first half

of 2014, compared with earnings of $16.4 million in the second

quarter of 2013 and $35 million in the first half of 2013. WMECO’s

2014 results declined primarily due to the transmission

reserve.

Natural Gas Distribution

NU’s natural gas distribution segment, which includes both

Yankee Gas Services Company and NSTAR Gas Company, earned $2

million in the second quarter of 2014 and $54.1 million in the

first half of 2014, compared with earnings of $1.2 million in the

second quarter of 2013 and $44.5 million in the first half of 2013.

Improved results in 2014 primarily reflect increased sales due to

this year’s colder temperatures and continued customer growth.

Combined firm natural gas sales for NSTAR Gas and Yankee Gas were

up 12.4 percent in the first half of 2014, compared with the first

half of 2013. They rose 4.1 percent on a weather-adjusted

basis.

“As a result of the foresight of public policy leaders in both

Connecticut and Massachusetts, we expect strong natural gas sales

growth for at least the next decade as New England homeowners and

businesses continue to take advantage of the significantly lower

cost and reduced environmental impact associated with natural gas,”

May said.

NU parent and other businesses

Excluding integration costs, NU parent and other businesses

earned $2.6 million in the second quarter of 2014 and $5.2 million

in the first half of 2014, compared with earnings of $3.6 million

in the second quarter of 2013 and $10.8 million in the first half

of 2013. Lower results in 2014 compared to 2013 are due primarily

to a higher effective tax rate.

The following table reconciles 2014 and 2013 second quarter and

first six months earnings per share:

Second Quarter

First Six Months

2013 Reported EPS

$0.54 $1.26 Lower

transmission earnings in 2014 ($0.11)

($0.13) Higher/lower retail electric revenues in 2014

($0.01) $0.02 Higher firm

natural gas sales in 2014 $0.01 $0.04

Lower non-tracked O&M in 2014 $0.02

$0.03 Higher property tax, depreciation

($0.01) ($0.02) Higher

non-tracked interest expense ($0.01)

($0.03) Other, including higher effective tax rate

($0.02) --- Higher

integration costs in 2014 vs. 2013 ($0.01)

($0.02)

2014 Reported EPS

$0.40 $1.15

Financial results for the second quarter and first half of 2014

and 2013 are noted below:

Three months ended:

(in millions, except EPS)

June 30, 2014 June 30, 2013

Increase/(Decrease)

2014 EPS1 Electric

Distribution/Generation $83.4

$91.2 ($7.8 ) $0.26

Natural Gas Distribution $2.0

$1.2 $0.8 $0.01

Electric Transmission $43.9

$76.8 ($32.9 ) $0.14 NU

Parent and Other Companies $2.6

$3.6 ($1.0 ) $0.01

Earnings, ex. integration costs $131.9

$172.8 ($40.9 )

$0.42 Integration costs

($4.5 ) ($1.8 ) ($2.7 )

($0.02 )

Reported Earnings $127.4

$171.0 ($43.6 )

$0.40

Six months ended:

(in millions, except EPS)

June 30, 2014 June 30, 2013

Increase/(Decrease)

2014 EPS1 Electric

Distribution/Generation $195.6

$190.6 $5.0 $0.62

Natural Gas Distribution $54.1

$44.5 $9.6 $0.17

Electric Transmission $118.8

$156.7 ($37.9 ) $0.37 NU

Parent and Other Companies $5.2

$10.8 ($5.6 ) $0.02

Earnings, ex. integration costs $373.7

$402.6 ($28.9 )

$

1.18 Integration impacts

($10.4 ) ($3.5 ) ($6.9 )

($0.03 )

Reported Earnings $363.3

$399.1 ($35.8 )

$

1.15

Retail sales data:

June 30, 2014

June 30, 2013

% ChangeActual

Electric Distribution

Gwh for three months ended

12,536 12,911 (2.9)% Gwh for six

months ended 26,884 26,707

0.7%

Natural Gas Distribution

Firm volumes in mmcf for three months

ended

15,895

15,238

4.3%

Firm volumes in mmcf for six months

ended

61,445

54,660

12.4%

NU has approximately 316 million common shares outstanding. It

operates New England’s largest energy delivery system, serving

approximately 3.6 million customers in Connecticut, Massachusetts

and New Hampshire.

Note: NU will webcast a conference call with senior

management on August 1, 2014, beginning at 9 a.m. Eastern Time. The

webcast can be accessed through NU’s website at

www.nu.com.

1 All per share amounts in this news release are reported on a

diluted basis. The only common equity securities that are publicly

traded are common shares of NU parent. The earnings and EPS of each

business do not represent a direct legal interest in the assets and

liabilities allocated to such business, but rather represent a

direct interest in NU's assets and liabilities as a whole. EPS by

business is a non-GAAP (not determined using generally accepted

accounting principles) measure that is calculated by dividing the

net income or loss attributable to controlling interests of each

business by the weighted average diluted NU parent common shares

outstanding for the period. In addition, second quarter and first

half 2014 and 2013 earnings and EPS excluding certain integration

expenses related to the April 10, 2012 closing of the merger

between NU and NSTAR are non-GAAP financial measures. Management

uses these non-GAAP financial measures to evaluate earnings results

and to provide details of earnings results by business and to more

fully compare and explain our second quarter and first half 2014

and 2013 results without including the impact of the non-recurring

integration costs. Management believes that this measurement is

useful to investors to evaluate the actual and projected financial

performance and contribution of NU’s businesses. Non-GAAP financial

measures should not be considered as alternatives to NU

consolidated net income attributable to controlling interests or

EPS determined in accordance with GAAP as indicators of NU’s

operating performance.

This news release includes statements concerning NU’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. In some

cases, readers can identify these forward-looking statements

through the use of words or phrases such as “estimate, “expect,”

“anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,”

“should,” “could,” and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements.

Factors that may cause actual results to differ materially from

those included in the forward-looking statements include, but are

not limited to, cyber breaches, acts of war or terrorism, or grid

disturbances; actions or inaction of local, state and federal

regulatory and taxing bodies; changes in business and economic

conditions, including their impact on interest rates, bad debt

expense and demand for NU’s products and services; fluctuations in

weather patterns; changes in laws, regulations or regulatory

policy; changes in levels or timing of capital expenditures;

disruptions in the capital markets or other events that make NU’s

access to necessary capital more difficult or costly; developments

in legal or public policy doctrines; technological developments;

changes in accounting standards and financial reporting

regulations; actions of rating agencies; and other presently

unknown or unforeseen factors. Other risk factors are detailed from

time to time in NU’s reports filed with the Securities and Exchange

Commission. Any forward-looking statement speaks only as of the

date on which such statement is made, and NU undertakes no

obligation to update the information contained in any

forward-looking statements to reflect developments or circumstances

occurring after the statement is made or to reflect the occurrence

of unanticipated events.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED CONSOLIDATED

BALANCE SHEETS (Unaudited) June 30, December 31,

(Thousands of Dollars) 2014 2013

ASSETS

Current Assets:

Cash and Cash Equivalents

$ 34,096 $ 43,364 Receivables, Net 807,510 765,391 Unbilled

Revenues 193,983 224,982 Fuel, Materials and Supplies 281,721

303,233 Regulatory Assets 467,156 535,791 Marketable Securities

115,987 92,427 Prepayments and Other Current Assets 168,022

121,861 Total Current Assets 2,068,475

2,087,049 Property, Plant and Equipment, Net

17,978,692 17,576,186 Deferred Debits and Other

Assets: Regulatory Assets 3,339,457 3,758,694 Goodwill 3,519,401

3,519,401 Marketable Securities 513,986 488,515 Other Long-Term

Assets 370,434 365,692 Total Deferred Debits and

Other Assets 7,743,278 8,132,302

Total Assets $ 27,790,445 $ 27,795,537

The data contained in this report is

preliminary and is unaudited. This report is being submitted for

the sole purpose of providing information to present shareholders

about Northeast Utilities and Subsidiaries and is not a

representation, prospectus, or intended for use in connection with

any purchase or sale of securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited) June

30, December 31, (Thousands of Dollars) 2014 2013

LIABILITIES AND

CAPITALIZATION

Current Liabilities: Notes Payable $ 905,000 $ 1,093,000

Long-Term Debt - Current Portion 395,583 533,346 Accounts Payable

561,699 742,251 Regulatory Liabilities 359,921 204,278 Other

Current Liabilities 580,605 702,776 Total Current

Liabilities 2,802,808 3,275,651 Deferred

Credits and Other Liabilities: Accumulated Deferred Income Taxes

4,270,050 4,029,026 Regulatory Liabilities 503,955 502,984

Derivative Liabilities 449,439 624,050 Accrued Pension, SERP and

PBOP 825,001 896,844 Other Long-Term Liabilities 882,688

923,053 Total Deferred Credits and Other Liabilities

6,931,133 6,975,957 Capitalization: Long-Term Debt

8,147,129 7,776,833 Noncontrolling Interest -

Preferred Stock of Subsidiaries 155,568 155,568

Equity: Common Shareholders' Equity: Common Shares 1,666,637

1,665,351 Capital Surplus, Paid In 6,201,555 6,192,765 Retained

Earnings 2,241,025 2,125,980 Accumulated Other Comprehensive Loss

(41,507) (46,031) Treasury Stock (313,903) (326,537)

Common Shareholders' Equity 9,753,807 9,611,528 Total

Capitalization 18,056,504 17,543,929 Total

Liabilities and Capitalization $ 27,790,445 $ 27,795,537

The data contained in this report is preliminary and

is unaudited. This report is being submitted for the sole purpose

of providing information to present shareholders about Northeast

Utilities and Subsidiaries and is not a representation, prospectus,

or intended for use in connection with any purchase or sale of

securities. NORTHEAST UTILITIES AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) For the Three Months Ended

June 30, For the Six Months Ended June 30, (Thousands of Dollars,

Except Share Information) 2014 2013 2014 2013

Operating Revenues $ 1,677,614 $ 1,635,862 $ 3,968,204 $ 3,630,885

Operating Expenses: Purchased Power, Fuel and Transmission

624,211 488,302 1,602,362 1,236,111 Operations and Maintenance

373,234 357,169 724,922 703,261 Depreciation 152,207 159,553

303,014 314,530 Amortization of Regulatory Assets/(Liabilities),

Net (3,542) 54,574 54,356 108,623 Amortization of Rate Reduction

Bonds - 8,082 - 42,581 Energy Efficiency Programs 102,711 94,142

241,536 199,913 Taxes Other Than Income Taxes 134,803

123,464 280,335 256,345 Total Operating Expenses

1,383,624 1,285,286 3,206,525 2,861,364

Operating Income 293,990 350,576 761,679 769,521 Interest

Expense: Interest on Long-Term Debt 87,491 85,999 174,868 171,294

Other Interest 5,004 851 7,603 (8,188)

Interest Expense 92,495 86,850 182,471 163,106 Other Income, Net

5,526 4,944 7,194 12,710 Income Before

Income Tax Expense 207,021 268,670 586,402 619,125 Income Tax

Expense 77,774 95,606 219,319 216,093

Net Income 129,247 173,064 367,083 403,032 Net Income Attributable

to Noncontrolling Interests 1,880 2,043 3,759

3,922 Net Income Attributable to Controlling Interest $

127,367 $ 171,021 $ 363,324 $ 399,110 Basic Earnings Per

Common Share $ 0.40 $ 0.54 $ 1.15 $ 1.27 Diluted Earnings

Per Common Share $ 0.40 $ 0.54 $ 1.15 $ 1.26 Dividends

Declared Per Common Share $ 0.39 $ 0.37 $ 0.79 $ 0.74

Weighted Average Common Shares Outstanding: Basic

315,950,510 315,154,130 315,742,511

315,141,956 Diluted 317,112,801 315,962,619

317,002,461 315,982,578 The data contained in

this report is preliminary and is unaudited. This report is being

submitted for the sole purpose of providing information to present

shareholders about Northeast Utilities and Subsidiaries and is not

a representation, prospectus, or intended for use in connection

with any purchase or sale of securities. NORTHEAST UTILITIES

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) For the Six Months

Ended June 30, (Thousands of Dollars) 2014 2013

Operating Activities: Net Income $ 367,083 $ 403,032 Adjustments to

Reconcile Net Income to Net Cash Flows Provided by Operating

Activities: Depreciation 303,014 314,530 Deferred Income Taxes

133,149 256,294 Pension, SERP and PBOP Expense 47,558 97,671

Pension and PBOP Contributions (40,640) (122,826) Regulatory

Over/(Under) Recoveries, Net 164,388 (4,793) Amortization of

Regulatory Assets, Net 54,356 108,623 Amortization of Rate

Reduction Bonds - 42,581 Proceeds from DOE Damages Claim, Net

125,658 - Other (9,359) 19,932 Changes in Current Assets and

Liabilities: Receivables and Unbilled Revenues, Net (57,570)

(101,229) Fuel, Materials and Supplies 26,633 10,964 Taxes

Receivable/Accrued, Net (62,900) (58,350) Accounts Payable

(112,954) (127,379) Other Current Assets and Liabilities, Net

(41,753) (70,026) Net Cash Flows Provided by

Operating Activities 896,663 769,024 Investing

Activities: Investments in Property, Plant and Equipment (724,043)

(700,252) Proceeds from Sales of Marketable Securities 256,309

342,251 Purchases of Marketable Securities (257,168) (424,096)

Decrease in Special Deposits 2,894 65,121 Other Investing

Activities 579 (843) Net Cash Flows Used in Investing

Activities (721,429) (717,819) Financing

Activities: Cash Dividends on Common Shares (237,161) (232,068)

Cash Dividends on Preferred Stock (3,759) (3,922) Decrease in

Short-Term Debt (213,000) (720,500) Issuance of Long-Term Debt

650,000 1,350,000 Retirements of Long-Term Debt (376,650) (360,635)

Retirements of Rate Reduction Bonds - (82,139) Other Financing

Activities (3,932) (11,634) Net Cash Flows Used in

Financing Activities (184,502) (60,898) Net Decrease

in Cash and Cash Equivalents (9,268) (9,693) Cash and Cash

Equivalents - Beginning of Period 43,364 45,748 Cash

and Cash Equivalents - End of Period $ 34,096 $ 36,055 The

data contained in this report is preliminary and is unaudited. This

report is being submitted for the sole purpose of providing

information to present shareholders about Northeast Utilities and

Subsidiaries and is not a representation, prospectus, or intended

for use in connection with any purchase or sale of securities.

Northeast UtilitiesJeffrey R. Kotkin, 860-665-5154

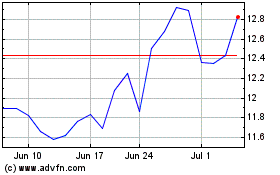

Nu (NYSE:NU)

Historical Stock Chart

From Jun 2024 to Jul 2024

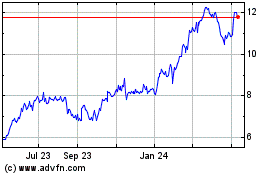

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2023 to Jul 2024