Northeast Utilities (NYSE: NU) today reported first quarter 2014

earnings of $236 million, or $0.74 per share, compared with

earnings of $228.1 million, or $0.72 per share, in the first

quarter of 2013. Excluding integration costs of $5.8 million in

2014 and $1.8 million in 2013, NU earned $241.8 million, or $0.76

per share, in the first quarter of 2014, compared with earnings of

$229.9 million, or $0.73 per share, in the first quarter of

2013.

Thomas J. May, NU chairman, president and chief executive

officer, said, “These financial results are consistent with our

previously announced recurring earnings guidance of between $2.60

and $2.75 per share for this year and represent a strong start to

2014.”

Also today, the NU Board of Trustees declared a regular

quarterly dividend of $0.3925 per share, payable June 30, 2014 to

shareholders of record as of May 30, 2014.

Electric Distribution and

Generation

NU’s electric distribution and generation segment earned $112.2

million in the first quarter of 2014, compared with earnings of

$99.5 million in the first quarter of 2013. Improved results

primarily reflect colder weather in the first quarter of 2014,

compared with the same period of 2013. First quarter 2014 heating

degree days in Boston and Hartford averaged approximately 14

percent higher than 2013 levels and 12 percent above normal. As a

result, NU’s retail electric sales in the first quarter of 2014

were 4 percent higher than 2013 levels. They were 1.3 percent

higher on a weather adjusted basis.

Electric Transmission

NU’s transmission segment earned $74.9 million in the first

quarter of 2014, compared with $79.9 million in the first quarter

of 2013. Lower transmission earnings were due primarily to a higher

effective tax rate in the first quarter of 2014. A state tax

settlement last year resulted in a lower effective tax rate at both

The Connecticut Light and Power Company (CL&P) and NU parent in

the first quarter of 2013, compared with the same period of

2014.

Earnings of Electric Utility Subsidiaries

(net of preferred dividends)

CL&P earned $77.9 million in the first quarter of 2014,

compared with earnings of $83.6 million in the first quarter of

2013. Results reflect a higher effective tax rate in the first

quarter of 2014 due to the impact last year of the previously

mentioned 2013 tax settlement. The higher tax rate was partially

offset by a 4.7 percent increase in retail sales in the first

quarter of 2014, compared with the first quarter of 2013.

NSTAR Electric earned $57.6 million in the first quarter of

2014, compared with earnings of $47.6 million in the first quarter

of 2013. Improved results were due in part to a 3.2 percent

increase in retail sales in the first quarter of 2014, compared

with the first quarter of 2013, and higher transmission

earnings.

Public Service Company of New Hampshire earned $32.6 million in

the first quarter of 2014, compared with earnings of $29 million in

the first quarter of 2013. Improved results reflect a 4.2 percent

increase in retail sales in the first quarter of 2014, compared

with the first quarter of 2013.

Western Massachusetts Electric Company earned $18.1 million in

the first quarter of 2014, compared with earnings of $18.6 million

in the first quarter of 2013.

Natural Gas Distribution

NU’s natural gas distribution segment, which includes both

Yankee Gas Services Company and NSTAR Gas Company, earned $52.1

million in the first quarter of 2014, compared with earnings of

$43.3 million in the first quarter of 2013. Improved results

primarily reflect much colder weather in 2014, which increased firm

natural gas sales. NU’s firm natural gas sales were 15.5 percent

higher in the first quarter of 2014 as compared to the first

quarter of 2013. They rose 3.6 percent on a weather-adjusted

basis.

NU parent and other companies

NU parent and other companies earned $2.6 million in the first

quarter of 2014, excluding $5.8 million of integration-related

expenses, compared with earnings of $7.2 million in the first

quarter of 2013, excluding $1.8 million of integration-related

expenses. The results primarily reflect a higher effective tax rate

in the first quarter of 2014 due to the impact last year of the

2013 tax settlement. The following table reconciles earnings per

share for the first quarters of 2014 and 2013.

First Quarter

2013 Reported EPS

$0.72 Higher electric sales in 2014

$0.03 Higher firm natural gas

sales in 2014 $0.04 Lower

non-tracked O&M in 2014 $0.02

Higher property tax, depreciation expense in 2014

($0.02) Lower transmission earnings in

2014 ($0.02) Lower NU parent and

other in 2014, ex. integration expenses

($0.01)

Other ($0.01)

Higher integration costs in 2014 ($0.01)

2014 Reported EPS

$0.74

Financial results for the first quarters of 2014 and 2013 for

NU’s business segments and NU parent and other companies are noted

below:

Three months ended:

(in millions, except EPS)

March 31, 2014

March 31, 2013

Increase/

(Decrease)

2014 EPS1

Electric Distribution/Generation $112.2

$99.5 $12.7 $0.35 Natural Gas

Distribution $52.1 $43.3

$8.8 $0.16 Electric Transmission $74.9

$79.9 ($5.0) $0.24 NU

Parent and Other Companies,

ex. integration expenses

$2.6

$7.2

($4.6)

$0.01

Earnings, ex. integration expenses

$241.8 $229.9

$11.9 $0.76 Integration expenses

($5.8) ($1.8) ($4.0)

($0.02)

Reported Earnings $236.0

$228.1 $7.9

$0.74

Retail sales data:

March 31, 2014

March 31, 2013

% Change

Actual

% Change

Weather Norm.

Electric distribution

Gwh for three

months ended 14,348 13,796

4.0% 1.3%

Natural

Gas Distribution

Firm volumes in mmcf for

three

months ended

45,550

39,422

15.5%

3.6%

NU has approximately 316 million common shares outstanding. It

operates New England’s largest energy delivery system, serving

approximately 3.6 million customers in Connecticut, Massachusetts

and New Hampshire.

Note: NU will webcast a conference call with senior

management on May 2, 2014, beginning at 9 a.m. Eastern Time.

The webcast can be accessed through NU’s website at

www.nu.com.

1 All per share amounts in this news release are reported on a

diluted basis. The only common equity securities that are publicly

traded are common shares of NU parent. The earnings and EPS of each

business do not represent a direct legal interest in the assets and

liabilities allocated to such business, but rather represent a

direct interest in NU's assets and liabilities as a whole. EPS by

business is a non-GAAP (not determined using generally accepted

accounting principles) measure that is calculated by dividing the

net income or loss attributable to controlling interests of each

business by the weighted average diluted NU parent common shares

outstanding for the period. In addition, first quarter 2014 and

2013 earnings and EPS excluding certain integration expenses

related to the April 10, 2012 closing of the merger between NU and

NSTAR are non-GAAP financial measures. Management uses these

non-GAAP financial measures to evaluate earnings results and to

provide details of earnings results by business and to more fully

compare and explain our first quarter 2014 and 2013 results without

including the impact of the non-recurring integration costs.

Management believes that this measurement is useful to investors to

evaluate the actual and projected financial performance and

contribution of NU’s businesses. Non-GAAP financial measures should

not be considered as alternatives to NU consolidated net income

attributable to controlling interests or EPS determined in

accordance with GAAP as indicators of NU’s operating

performance.

This news release includes statements concerning NU’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts. These

statements are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995. In some

cases, readers can identify these forward-looking statements

through the use of words or phrases such as “estimate, “expect,”

“anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,”

“should,” “could,” and other similar expressions. Forward-looking

statements involve risks and uncertainties that may cause actual

results or outcomes to differ materially from those included in the

forward-looking statements. Factors that may cause actual results

to differ materially from those included in the forward-looking

statements include, but are not limited to, cyber breaches, acts of

war or terrorism, or grid disturbances; actions or inaction of

local, state and federal regulatory and taxing bodies; changes in

business and economic conditions, including their impact on

interest rates, bad debt expense and demand for NU’s products and

services; fluctuations in weather patterns; changes in laws,

regulations or regulatory policy; changes in levels or timing of

capital expenditures; disruptions in the capital markets or other

events that make NU’s access to necessary capital more difficult or

costly; developments in legal or public policy doctrines;

technological developments; changes in accounting standards and

financial reporting regulations; actions of rating agencies; and

other presently unknown or unforeseen factors. Other risk factors

are detailed from time to time in NU’s reports filed with the

Securities and Exchange Commission. Any forward-looking statement

speaks only as of the date on which such statement is made, and NU

undertakes no obligation to update the information contained in any

forward-looking statements to reflect developments or circumstances

occurring after the statement is made or to reflect the occurrence

of unanticipated events.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

March 31, December 31, (Thousands of Dollars)

2014 2013

ASSETS

Current Assets: Cash and Cash Equivalents $ 89,150 $ 43,364

Receivables, Net 980,033 765,391 Unbilled Revenues 202,867 224,982

Fuel, Materials and Supplies 228,192 303,233 Regulatory Assets

573,028 535,791 Prepayments and Other Current Assets 292,539

214,288 Total Current Assets 2,365,809

2,087,049 Property, Plant and Equipment, Net

17,713,027 17,576,186 Deferred Debits and Other

Assets: Regulatory Assets 3,486,645 3,758,694 Goodwill 3,519,401

3,519,401 Marketable Securities 507,931 488,515 Other Long-Term

Assets 504,057 365,692 Total Deferred Debits and

Other Assets 8,018,034 8,132,302

Total Assets $ 28,096,870 $ 27,795,537

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to present shareholders about Northeast

Utilities and Subsidiaries and is not a representation, prospectus

or intended for use in connection with any purchase or sale of

securities.

NORTHEAST UTILITIES AND

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

March 31, December 31, (Thousands of Dollars)

2014 2013

LIABILITIES AND

CAPITALIZATION

Current Liabilities: Notes Payable $ 571,147 $ 1,093,000

Long-Term Debt - Current Portion 530,533 533,346 Accounts Payable

711,594 742,251 Regulatory Liabilities 263,754 204,278 Other

Current Liabilities 713,116 702,776

Total Current Liabilities 2,790,144 3,275,651

Deferred Credits and Other Liabilities: Accumulated

Deferred Income Taxes 4,209,969 4,029,026 Regulatory Liabilities

591,468 502,984 Derivative Liabilities 546,387 624,050 Accrued

Pension, SERP and PBOP 890,019 896,844 Other Long-Term Liabilities

871,050 923,053 Total Deferred Credits

and Other Liabilities 7,108,893 6,975,957

Capitalization: Long-Term Debt 8,318,332

7,776,833 Noncontrolling Interest -

Preferred Stock of Subsidiaries 155,568

155,568

Equity:

Common Shareholders' Equity: Common Shares 1,666,580 1,665,351

Capital Surplus, Paid In 6,185,027 6,192,765 Retained Earnings

2,237,710 2,125,980 Accumulated Other Comprehensive Loss (44,321 )

(46,031 ) Treasury Stock (321,063 ) (326,537 ) Common

Shareholders' Equity 9,723,933 9,611,528

Total Capitalization 18,197,833

17,543,929 Total Liabilities and Capitalization $

28,096,870 $ 27,795,537

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to present shareholders about Northeast

Utilities and Subsidiaries and is not a representation, prospectus

or intended for use in connection with any purchase or sale of

securities.

NORTHEAST UTILITIES AND

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited) For the Three Months Ended

March 31, (Thousands of Dollars, Except Share Information)

2014 2013 Operating Revenues $

2,290,590 $ 1,995,023 Operating Expenses:

Purchased Power, Fuel and Transmission

978,150 747,809 Operations and Maintenance 351,688 346,092

Depreciation 150,807 154,977 Amortization of Regulatory Assets, Net

57,898 54,049 Amortization of Rate Reduction Bonds - 34,499 Energy

Efficiency Programs 138,825 105,771 Taxes Other Than Income Taxes

145,533 132,881 Total Operating Expenses

1,822,901 1,576,078

Operating Income

467,689 418,945 Interest Expense: Interest on Long-Term Debt

87,377 85,906 Other Interest 2,598 (9,651 ) Interest

Expense 89,975 76,255 Other Income, Net 1,667 7,765

Income Before Income Tax Expense 379,381 350,455 Income Tax

Expense 141,545 120,487 Net Income 237,836

229,968 Net Income Attributable to Noncontrolling Interests

1,879 1,879 Net Income Attributable to Controlling

Interest $ 235,957 $ 228,089 Basic Earnings Per

Common Share $ 0.75 $ 0.72 Diluted Earnings Per

Common Share $ 0.74 $ 0.72 Dividends Declared Per

Common Share $ 0.39 $ 0.37 Weighted Average Common

Shares Outstanding: Basic 315,534,512 315,129,782

Diluted 316,892,119 316,002,538

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to present shareholders about Northeast

Utilities and Subsidiaries and is not a representation, prospectus

or intended for use in connection with any purchase or sale of

securities.

NORTHEAST UTILITIES AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

For the Three

Months Ended March 31, (Thousands of Dollars)

2014 2013 Operating Activities: Net Income $

237,836 $ 229,968 Adjustments to Reconcile Net Income to Net Cash

Flows Provided by Operating Activities: Depreciation 150,807

154,977 Deferred Income Taxes 137,417 168,938 Pension, SERP and

PBOP Expense 24,995 53,102 Pension and PBOP Contributions (6,622 )

(47,048 ) Regulatory Overrecoveries, Net 872 39,218 Amortization of

Regulatory Assets, Net 57,898 54,049 Amortization of Rate Reduction

Bonds - 34,499 Proceeds from DOE Damages Claim 163,300 77,936

Deferred DOE Proceeds (163,300 ) - Other

(7,574

)

(51,106 ) Changes in Current Assets and Liabilities:

Receivables and Unbilled Revenues, Net

(182,221 ) (129,431 ) Fuel, Materials and Supplies 75,041 28,487

Taxes Receivable/Accrued, Net (59,840 ) (21,295 ) Accounts Payable

53,905 (86,916 ) Other Current Assets and Liabilities, Net

11,282 (32,235 ) Net Cash Flows Provided by Operating

Activities

493,796

473,143 Investing Activities:

Investments in Property, Plant and Equipment (348,691 ) (388,950 )

Proceeds from Sales of Marketable Securities

128,505

98,070 Purchases of Marketable Securities

(132,605

)

(184,030 ) Other Investing Activities 1,637

27,997 Net Cash Flows Used in Investing Activities

(351,154

)

(446,913 ) Financing Activities: Cash Dividends on

Common Shares (118,460 ) (116,431 ) Cash Dividends on Preferred

Stock (1,879 ) (1,879 ) Decrease in Short-Term Debt (299,500 )

(228,000 ) Issuance of Long-Term Debt 400,000 400,000 Retirements

of Long-Term Debt (75,000 ) - Retirements of Rate Reduction Bonds -

(62,529 ) Other Financing Activities (2,017 ) (2,322

) Net Cash Flows Used in Financing Activities (96,856 )

(11,161 ) Net Increase in Cash and Cash Equivalents 45,786

15,069 Cash and Cash Equivalents - Beginning of Period

43,364 45,748 Cash and Cash Equivalents - End

of Period $ 89,150 $ 60,817

The data contained in this report is preliminary and is

unaudited. This report is being submitted for the sole purpose of

providing information to present shareholders about Northeast

Utilities and Subsidiaries and is not a representation, prospectus

or intended for use in connection with any purchase or sale of

securities.

Northeast UtilitiesJeffrey R. Kotkin, 860-665-5154

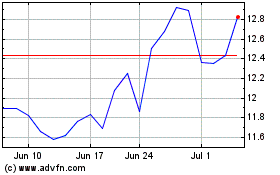

Nu (NYSE:NU)

Historical Stock Chart

From Jun 2024 to Jul 2024

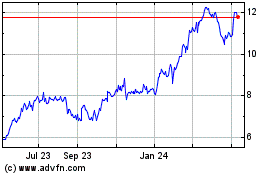

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2023 to Jul 2024