0001164727FALSE00011647272024-07-242024-07-24

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

Newmont Corporation

(Exact name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6900 E. Layton Avenue, Denver, Colorado 80237

(Address of principal executive offices) (zip code)

(303) 863-7414

(Registrant's telephone number, including area code)

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange on which registered |

| Common stock, par value $1.60 per share | | NEM | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 24, 2024, Newmont Corporation, a Delaware corporation, issued a news release announcing its results and related information for its second quarter ended June 30, 2024. A copy of the news release is attached hereto as Exhibit 99.1 and is incorporated by reference in its entirety into this Item 2.02.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit Number Description of Exhibit

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NEWMONT CORPORATION |

| | |

| Date: July 24, 2024 | By: | /s/ Karyn F. Ovelmen |

| | Karyn F. Ovelmen |

| | Executive Vice President and

Chief Financial Officer |

| | | | | |

NYSE: NEM, ASX: NEM, TSX: NGT, PNGX: NEM | Exhibit 99.1 |

Newmont Reports Second Quarter 2024 Results

DENVER, July 24, 2024 – Newmont Corporation (NYSE: NEM, ASX: NEM, TSX: NGT, PNGX: NEM) (Newmont or the Company) today announced second quarter 2024 results and declared a second quarter dividend of $0.25 per share.

"Newmont delivered a solid second quarter, producing 2.1 million gold equivalent ounces and generating $594 million in free cash flow," said Tom Palmer, Newmont's President and Chief Executive Officer. "We continued to advance our divestiture program and, to date, have announced $527 million in proceeds this year. With this momentum, we completed $250 million in share repurchases and repaid $250 million in debt. As we head into the second half of the year, we remain confident in our ability to continue executing on shareholder returns, meet our full year guidance and deliver on our commitments."

Q2 2024 Results1

▪Announced monetization of Batu Hijau contingent payments; expect to receive $153 million in cash proceeds in the third quarter, in addition to $44 million of cash associated with contingent payments

▪Expect to achieve at least $2 billion in gross divestiture proceeds from high-quality, non-core asset sales

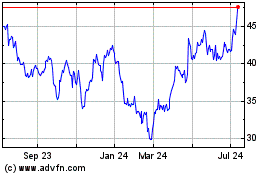

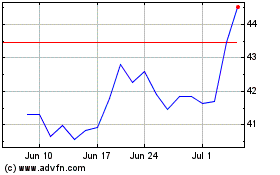

▪Since our last earnings release, repurchased 5.7 million shares at an average price of $43.34 for a total cost of $250 million, of which $104 million was repurchased during the second quarter and $146 million was repurchased in July 2024

▪Reduced nominal debt by $250 million for a cash cost of $227 million

▪Delivered $539 million in total returns to shareholders through share repurchases and dividend payments in the second quarter2; declared a dividend of $0.25 per share of common stock for the second quarter of 20243

▪Produced 1.6 million attributable gold ounces and 477 thousand gold equivalent ounces (GEOs)4 from copper, silver, lead and zinc, including 38 thousand tonnes of copper; primarily driven by production of 1.3 million gold ounces from Newmont's Tier 1 Portfolio5

▪Generated $1.4 billion of cash from operating activities, net of working capital changes of $(263) million; reported $594 million in Free Cash Flow6

▪Reported Net Income of $857 million, Adjusted Net Income (ANI) of $0.72 per share and Adjusted EBITDA of $2.0 billion for the quarter6

▪Achieved $100 million in synergies during the second quarter, for a total of $205 million to date from the Newcrest acquisition; on track to realize $500 million in annual synergies by the end of 20257

▪On track to deliver 2024 guidance for production, costs and capital spend; anticipating a sequential increase in production in the second half of the year, weighted towards the fourth quarter8

▪Published Newmont's 2023 Climate Performance Update, summarizing the climate performance for Newmont's managed operating sites throughout 2023

1 Newmont’s actual condensed consolidated financial results remain subject to completion and final review by management and external auditors for the quarter ended June 30, 2024. Newmont intends to file its Q2 2024 Form 10-Q on or about the close of business on July 25, 2024. See notes at the end of this release.

2 Total returns to shareholders includes $146 million of shares repurchased in July 2024.

3 Newmont's Board of Directors declared a dividend of $0.25 per share of common stock for the second quarter of 2024, payable on September 30, 2024 to holders of record at the close of business on September 5, 2024.

4 Gold equivalent ounces (GEOs) calculated using Gold ($1,400/oz.), Copper ($3.50/lb.), Silver ($20.00/oz.), Lead ($1.00/lb.) and Zinc ($1.20/lb.) pricing for 2024.

5 Newmont’s go-forward portfolio is focused on Tier 1 assets, consisting of (1) six managed Tier 1 assets (Boddington, Tanami, Cadia, Lihir, Peñasquito and Ahafo), (2) assets owned through two non-managed joint ventures at Nevada Gold Mines and Pueblo Viejo, including four Tier 1 assets (Carlin, Cortez, Turquoise Ridge and Pueblo Viejo), (3) three emerging Tier 1 assets (Merian, Cerro Negro and Yanacocha), which do not currently meet the criteria for Tier 1 Asset, and (4) an emerging Tier 1 district in the Golden Triangle in British Columbia (Red Chris and Brucejack), which does not currently meet the criteria for Tier 1 Asset. Newmont’s Tier 1 portfolio also includes attributable production from the Company’s equity interest in Lundin Gold (Fruta del Norte). Tier 1 Portfolio cost and capital metrics include the proportional share of the Company’s interest in the Nevada Gold Mines joint venture.

6 Non-GAAP metrics; see reconciliations at the end of this release.

7 Synergies are a management estimate provided for illustrative purposes and should not be considered a GAAP or non-GAAP financial measure. Synergies represent management’s combined estimate of pre-tax synergies, supply chain efficiencies and Full Potential improvements, as a result of the integration of Newmont’s and Newcrest’s businesses that have been monetized for the purposes of the estimation. Such estimates are necessarily imprecise and are based on numerous judgments and assumptions. See cautionary statement at the end of this release regarding forward-looking statements.

8 See discussion of outlook and cautionary statement at the end of this release regarding forward-looking statements.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 1

Advancing Portfolio Optimization with Monetization of Batu Hijau Deferred Payment Rights

Newmont today announced it has entered into an agreement to sell 100 percent of the entity holding Newmont's deferred payment rights associated with the Batu Hijau copper and gold mine in Indonesia for total consideration of $153 million in cash, with closing to occur no later than September 30, 2024. Furthermore, an additional $10 million cash payment associated with these deferred payment rights was received in July. During the second quarter of 2024, Newmont also received a $34 million cash payment, bringing total proceeds to $197 million for 2024.

Summary of Second Quarter Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2024 |

| | Q1 | Q2 | Q3 | Q4 | FY | | Q1 | Q2 | | | FY |

| Average realized gold price ($/oz) | | $ | 1,906 | | $ | 1,965 | | $ | 1,920 | | $ | 2,004 | | $ | 1,954 | | | $ | 2,090 | | $ | 2,347 | | | | $ | 2,216 | |

Attributable gold production (Moz)1 | | 1.27 | | 1.24 | | 1.29 | | 1.74 | | 5.55 | | | 1.68 | | 1.61 | | | | 3.28 | |

Gold CAS ($/oz)2,3 | | $ | 1,025 | | $ | 1,054 | | $ | 1,019 | | $ | 1,086 | | $ | 1,050 | | | $ | 1,057 | | $ | 1,152 | | | | $ | 1,103 | |

Gold AISC ($ per ounce)3 | | $ | 1,376 | | $ | 1,472 | | $ | 1,426 | | $ | 1,485 | | $ | 1,444 | | | $ | 1,439 | | $ | 1,562 | | | | $ | 1,500 | |

| GAAP net income (loss) from continuing operations ($M) | | $ | 339 | | $ | 153 | | $ | 157 | | $ | (3,170) | | $ | (2,521) | | | $ | 166 | | $ | 838 | | | | $ | 1,004 | |

Adjusted net income ($M)4 | | $ | 320 | | $ | 266 | | $ | 286 | | $ | 452 | | $ | 1,324 | | | $ | 630 | | $ | 834 | | | | $ | 1,464 | |

Adjusted net income per share ($/diluted share)4 | | $ | 0.40 | | $ | 0.33 | | $ | 0.36 | | $ | 0.46 | | $ | 1.57 | | | $ | 0.55 | | $ | 0.72 | | | | $ | 1.27 | |

Adjusted EBITDA ($M)4 | | $ | 990 | | $ | 910 | | $ | 933 | | $ | 1,382 | | $ | 4,215 | | | $ | 1,694 | | $ | 1,966 | | | | $ | 3,660 | |

Cash from operations before working capital ($M)5 | | $ | 843 | | $ | 763 | | $ | 874 | | $ | 787 | | $ | 3,267 | | | $ | 1,442 | | $ | 1,657 | | | | $ | 3,099 | |

Net cash from operating activities of continuing operations ($M) | | $ | 481 | | $ | 656 | | $ | 1,001 | | $ | 616 | | $ | 2,754 | | | $ | 776 | | $ | 1,394 | | | | $ | 2,170 | |

Capital expenditures ($M)6 | | $ | 526 | | $ | 616 | | $ | 604 | | $ | 920 | | $ | 2,666 | | | $ | 850 | | $ | 800 | | | | $ | 1,650 | |

Free cash flow ($M)7 | | $ | (45) | | $ | 40 | | $ | 397 | | $ | (304) | | $ | 88 | | | $ | (74) | | $ | 594 | | | | $ | 520 | |

SECOND QUARTER 2024 PRODUCTION AND FINANCIAL SUMMARY

Attributable gold production1 decreased 4 percent to 1,607 thousand ounces from the prior quarter primarily due to lower production at Cerro Negro as a result of the suspension of operations during the quarter following the tragic fatalities of two members of the Newmont workforce on April 9, 2024. Operations at Cerro Negro safely resumed on May 24, 2024. In addition, operations were suspended as of April 14, 2024 at Telfer, one of Newmont's non-core assets, as further work is completed to remediate the safe operation of the tailings storage facility. Second quarter production was also impacted by lower production at Lihir due to heavy rainfall impacting mine sequencing, as well as lower production at Akyem due to lower grades as a result of the ongoing stripping campaign. These impacts were partially offset by higher production at Porcupine, Brucejack and Peñasquito.

Full year production for 2024 is expected to be second-half weighted as previously indicated, with a sequential increase weighted towards the fourth quarter. The second-half weighting is expected to be driven primarily by improved grades at Peñasquito, Ahafo and Tanami, improved throughput from Lihir and Boddington and sequential improvements delivered from our non-managed joint venture operations.

Average realized gold price was $2,347, an increase of $257 per ounce over the prior quarter. Average realized gold price includes $2,344 per ounce of gross price received, a favorable impact of $17 per ounce mark-to-market on provisionally-priced sales and reductions of $14 per ounce for treatment and refining charges.

Gold CAS2 totaled $1.8 billion for the quarter. Gold CAS per ounce3 increased 9 percent to $1,152 per ounce compared to the prior quarter primarily due to lower sales volumes, processing of stockpiles at Porcupine and Tanami and higher third party royalties as a result of higher gold prices.

Gold AISC per ounce3 increased 9 percent to $1,562 per ounce compared to the prior quarter primarily due to higher CAS and higher sustaining capital spend.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 2

Attributable gold equivalent ounce (GEO) production from other metals was largely in line with the prior quarter at 477 thousand ounces.

CAS from other metals2 totaled $379 million for the quarter. CAS per GEO3 was largely in line with the prior quarter at $836 per ounce.

AISC per GEO3 increased 5 percent to $1,207 per ounce compared to the prior quarter primarily due to higher sustaining capital spend.

Net income from continuing operations attributable to Newmont stockholders was $838 million or $0.73 per diluted share, an increase of $672 million from the prior quarter primarily due to the loss on assets held for sale of $485 million recognized during the first quarter of 2024, as well as higher average realized prices for all metals in the second quarter of 2024.

Adjusted net income4 was $834 million or $0.72 per diluted share, compared to $630 million or $0.55 per diluted share in the prior quarter. Primary adjustments to second quarter net income include a loss on assets held for sale of $246 million, a gain on asset and investment sales of $55 million primarily related to the previously announced sale of the Lundin Stream Credit Facility Agreement and the purchase and sale of foreign currency bonds8, a gain of $14 million on the partial redemption of certain Senior notes, and Newcrest transaction and integration costs of $16 million.

Adjusted EBITDA4 increased 16 percent to $2.0 billion for the quarter, compared to $1.7 billion for the prior quarter.

Consolidated cash from operations before working capital5 increased 15 percent from the prior quarter to $1.7 billion primarily due to higher realized prices for all metals in the second quarter.

Consolidated net cash from operating activities increased 80 percent from the prior quarter to $1.4 billion primarily due to the improvement in cash from operations. Net cash from operating activities in the second quarter was impacted by a $263 million reduction in operating cash flow due to changes in working capital, including a build in inventories, stockpiles and ore on leach pads of $185 million and reclamation spend of $107 million, primarily related to the construction of the Yanacocha water treatment facilities.

Free Cash Flow7 was $594 million compared to $(74) million in the prior quarter primarily due to improvements in consolidated net cash from operating activities, partially offset by higher capital expenditures before capital accruals.

Capital expenditures (net of capital accruals)6 decreased 6 percent from the prior quarter to $800 million primarily due to an increase of capital accruals offsetting higher sustaining and development capital expenditures. Sustaining capital spend increased from the first quarter due to the ramp-up of spend on the tailings project at Cadia and the purchase of updated fleet equipment at Merian. Development capital expenditures in 2024 primarily relate to Tanami Expansion 2, Ahafo North, Cadia Block Caves and Cerro Negro expansion projects.

Balance sheet and liquidity remained strong in the second quarter, ending the quarter with $2.6 billion of consolidated cash, cash of $205 million included in Assets held for sale and time deposits of $28 million, with approximately $6.8 billion of total liquidity; reported net debt to pro forma adjusted EBITDA of 1.0x9.

NON-MANAGED JOINT VENTURE AND EQUITY METHOD INVESTMENTS10

Nevada Gold Mines (NGM) attributable gold production decreased 4 percent to 253 thousand ounces, with a 4 percent increase in CAS to $1,220 per ounce3 and a 7 percent increase in AISC to $1,689 per ounce3 compared to the prior quarter.

Pueblo Viejo (PV) attributable gold production decreased 2 percent to 53 thousand ounces compared to the prior quarter. Cash distributions received for the Company's equity method investment in Pueblo Viejo totaled $12 million in the second quarter. Capital contributions of $5 million were made during the quarter related to the expansion project at Pueblo Viejo.

Fruta del Norte attributable gold production is reported on a quarter lag. Production reported in the second quarter of 2024 increased 67 percent to 35 thousand ounces compared to the prior quarter. Cash distributions received from the Company's equity method investment in Fruta del Norte were $8 million for the second quarter.

1 Attributable gold production includes ounces from the Company's equity method investment in Pueblo Viejo (40%) and in Lundin Gold (32.0%).

2 Consolidated Costs applicable to sales (CAS) excludes Depreciation and amortization and Reclamation and remediation.

3 Non-GAAP measure. See end of this release for reconciliation to Costs applicable to sales.

4 Non-GAAP measure. See end of this release for reconciliation to Net income (loss) attributable to Newmont stockholders.

5 Cash from operations before working capital is a non-GAAP metric with the most directly comparable GAAP financial metric being to Net cash provided by (used in) operating activities, as shown reconciled in the Condensed Consolidated Statements of Cash Flows.

6 Capital expenditures refers to Additions to property plant and mine development from the Consolidated Statements of Cash Flows.

7 Non-GAAP measure. See end of this release for reconciliation to Net cash provided by operating activities.

8 In June 2024, the Company entered into AUD and CAD denominated fixed forward contracts to mitigate variability in the USD functional cash flows related to capital and operating expenditures for certain development projects and mines in Australia and Canada.

9 Non-GAAP measure. See end of this release for reconciliation.

10 Newmont has a 38.5% interest in Nevada Gold Mines, which is accounted for using the proportionate consolidation method. In addition, Newmont has a 40% interest in Pueblo Viejo, which is accounted for as an equity method investment, as well as a 32.0% interest in Lundin Gold, who wholly owns and operates the Fruta del Norte mine, which is accounted for as an equity method investment on a quarter lag.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 3

Committed to Concurrent Reclamation

Since mines operate for a finite period, careful closure planning is crucial to address the diverse social, economic, environmental and regulatory impacts associated with the end of mining operations. Newmont’s global Closure Strategy integrates closure planning throughout each operation’s lifespan, aiming to create enduring positive and sustainable legacies that last long after mining ceases. Newmont continues to accrue to reclamation and remediation spend through the year. Newmont expects to incur a cash outflow of approximately $600 million in 2024 and $700 million in 2025, primarily related to the construction of two new water treatment plants and post-closure management at Yanacocha. The operation’s ongoing closure planning study advanced to the feasibility state in December 2023 and continues to address several complex closure issues, including water management, social impacts and tailings. A long-term water management solution will replace five existing water treatment facilities with two, addressing the watersheds along the continental divide. Certain estimated costs remain subject to revision as ongoing study work and assessment of opportunities that incorporates the latest design considerations remain in progress.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 4

Newmont's 2024 Outlook

For a more detailed discussion, see the Company’s 2024 Outlook released on February 22, 2024, available on Newmont.com. Please see the cautionary statement and footnotes for additional information.

| | | | | |

| Guidance Metric | 2024E |

Attributable Gold Production (Koz) |

| Managed Tier 1 Portfolio | 4,100 |

| Non-Managed Tier 1 Portfolio | 1,530 |

| Total Tier 1 Portfolio | 5,630 |

| Non-Core Assets | 1,300 |

| Total Newmont Attributable Gold Production (Koz) | 6,930 |

Attributable Gold CAS ($/oz) ($1,900/oz price assumption) |

| Managed Tier 1 Portfolio | 980 |

| Non-Managed Tier 1 Portfolio | 1,130 |

| Total Tier 1 Portfolio | 1,000 |

| Non-Core Assets | 1,400 |

Total Newmont Gold CAS ($/oz)a | 1,050 |

Attributable Gold AISC ($/oz) ($1,900/oz price assumption) |

| Managed Tier 1 Portfolio | 1,250 |

| Non-Managed Tier 1 Portfolio | 1,440 |

| Total Tier 1 Portfolio | 1,300 |

| Non-Core Assets | 1,750 |

Total Newmont Gold AISC ($/oz)a | 1,400 |

Copper ($8,818/tonne price assumption)a | |

| Copper Production - Tier 1 Portfolio (ktonne) | 144 |

| Copper Production - Non-Core Assets (ktonne) | 8 |

| Total Newmont Copper Production (ktonne) | 152 |

| Copper CAS - Tier 1 Portfolio ($/tonne) | $5,050 |

| Copper CAS - Non-Core Assets ($/tonne) | $11,050 |

Total Newmont Copper CAS ($/tonne)b | $5,080 |

| Copper AISC - Tier 1 Portfolio ($/tonne) | $7,350 |

| Copper AISC - Non-Core Assets ($/tonne) | $12,540 |

Total Newmont Copper AISC ($/tonne)b | $7,380 |

Silver ($23.00/oz price assumption) | |

| Silver Production (Moz) | 34 |

Silver CAS ($/oz)b | $11.00 |

Silver AISC ($/oz)b | $15.40 |

Lead ($2,205/tonne price assumption)a | |

| Lead Production (ktonne) | 95 |

Lead CAS ($/tonne)b | $1,220 |

Lead AISC ($/tonne)b | $1,570 |

Zinc ($2,976/tonne price assumption)a | |

| Zinc Production (ktonne) | 245 |

Zinc CAS ($/tonne)b | $1,550 |

Zinc AISC ($/tonne)b | $2,300 |

| Attributable Capital |

Sustaining Capital ($M)a | $1,800 |

Development Capital ($M)a | $1,300 |

| Consolidated Expenses |

| Exploration & Advanced Projects ($M) | $450 |

| General & Administrative ($M) | $300 |

| Interest Expense ($M) | $365 |

| Depreciation & Amortization ($M) | $2,850 |

Adjusted Tax Rate c,d | 34% |

aCo-product metal pricing assumptions in imperial units equate to Copper ($4.00/lb.), Lead ($1.00/lb.) and Zinc ($1.35/lb.).

bConsolidated basis

c The adjusted tax rate excludes certain items such as tax valuation allowance adjustments.

d Assuming average prices of $1,900 per ounce for gold, $4.00 per pound for copper, $23.00 per ounce for silver, $1.00 per pound for lead, and $1.35 per pound for zinc and achievement of production, sales and cost estimates, Newmont estimates its consolidated adjusted effective tax rate related to continuing operations for 2024 will be 34%.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2024 |

| Operating Results | | Q1 | Q2 | Q3 | Q4 | FY | | Q1 | Q2 | Q3 | Q4 | FY |

| Attributable Sales (koz) | | | | | | | | | | | | |

Attributable gold ounces sold (1) | | 1,188 | | 1,197 | | 1,229 | | 1,726 | | 5,340 | | | 1,581 | | 1,528 | | | | 3,109 | |

| Attributable gold equivalent ounces sold | | 265 | | 251 | | 59 | | 321 | | 896 | | | 502 | | 453 | | | | 955 | |

| | | | | | | | | | | | |

| Average Realized Price ($/oz, $/lb) | | | | | | | | | | | | |

| Average realized gold price | | $ | 1,906 | | $ | 1,965 | | $ | 1,920 | | $ | 2,004 | | $ | 1,954 | | | $ | 2,090 | | $ | 2,347 | | | | $ | 2,216 | |

| Average realized copper price | | $ | 4.18 | | $ | 3.26 | | $ | 3.68 | | $ | 3.69 | | $ | 3.71 | | | $ | 3.72 | | $ | 4.47 | | | | $ | 4.10 | |

Average realized silver price (2) | | $ | 19.17 | | $ | 20.56 | | N.M. | $ | 19.45 | | $ | 19.97 | | | $ | 20.41 | | $ | 26.20 | | | | $ | 23.00 | |

Average realized lead price (2) | | $ | 0.86 | | $ | 0.92 | | N.M. | $ | 0.90 | | $ | 0.90 | | | $ | 0.92 | | $ | 1.05 | | | | $ | 0.97 | |

Average realized zinc price (2) | | $ | 1.18 | | $ | 0.73 | | N.M. | $ | 3.71 | | $ | 0.96 | | | $ | 0.92 | | $ | 1.31 | | | | $ | 1.10 | |

| | | | | | | | | | | | |

Attributable Gold Production (koz) | | | | | | | | | | | | |

| Boddington | | 199 | | 209 | | 181 | | 156 | | 745 | | | 142 | | 147 | | | | 289 | |

| Tanami | | 63 | | 126 | | 123 | | 136 | | 448 | | | 90 | | 99 | | | | 189 | |

| Cadia | | — | | — | | — | | 97 | | 97 | | | 122 | | 117 | | | | 239 | |

| Lihir | | — | | — | | — | | 134 | | 134 | | | 181 | | 141 | | | | 322 | |

| Ahafo | | 128 | | 137 | | 133 | | 183 | | 581 | | | 190 | | 184 | | | | 374 | |

Peñasquito (2) | | 85 | | 38 | | — | | 20 | | 143 | | | 45 | | 64 | | | | 109 | |

| Cerro Negro | | 67 | | 48 | | 71 | | 83 | | 269 | | | 81 | | 19 | | | | 100 | |

| Yanacocha | | 56 | | 65 | | 87 | | 68 | | 276 | | | 91 | | 78 | | | | 169 | |

| Merian (75%) | | 62 | | 40 | | 62 | | 78 | | 242 | | | 57 | | 46 | | | | 103 | |

| Brucejack | | — | | — | | — | | 29 | | 29 | | | 37 | | 60 | | | | 97 | |

Red Chris (70%) | | — | | — | | — | | 5 | | 5 | | | 6 | | 9 | | | | 15 | |

Managed Tier 1 Portfolio | | 660 | | 663 | | 657 | | 989 | | 2,969 | | | 1,042 | | 964 | | | | 2,006 | |

Nevada Gold Mines (38.5%) | | 261 | | 287 | | 300 | | 322 | | 1,170 | | | 264 | | 253 | | | | 517 | |

Pueblo Viejo (40%) (3) | | 60 | | 51 | | 52 | | 61 | | 224 | | | 54 | | 53 | | | | 107 | |

Fruta Del Norte (32%) (4) | | — | | — | | — | | — | | — | | | 21 | | 35 | | | | 56 | |

Non-Managed Tier 1 Portfolio | | 321 | | 338 | | 352 | | 383 | | 1,394 | | | 339 | | 341 | | | | 680 | |

Total Tier 1 Portfolio | | 981 | | 1,001 | | 1,009 | | 1,372 | | 4,363 | | | 1,381 | | 1,305 | | | | 2,686 | |

Telfer | | — | | — | | — | | 43 | | 43 | | | 31 | | 14 | | | | 45 | |

| Akyem | | 71 | | 49 | | 75 | | 100 | | 295 | | | 69 | | 47 | | | | 116 | |

| CC&V | | 48 | | 41 | | 45 | | 38 | | 172 | | | 28 | | 35 | | | | 63 | |

| Porcupine | | 66 | | 60 | | 64 | | 70 | | 260 | | | 61 | | 91 | | | | 152 | |

| Éléonore | | 66 | | 48 | | 50 | | 68 | | 232 | | | 56 | | 61 | | | | 117 | |

| Musselwhite | | 41 | | 41 | | 48 | | 50 | | 180 | | | 49 | | 54 | | | | 103 | |

Non-Core Assets (5) | | 292 | | 239 | | 282 | | 369 | | 1,182 | | | 294 | | 302 | | | | 596 | |

Total Attributable Gold Production | | 1,273 | | 1,240 | | 1,291 | | 1,741 | | 5,545 | | | 1,675 | | 1,607 | | | | 3,282 | |

| | | | | | | | | | | | |

Attributable Co-Product GEO Production (kGEO) | | | | | | | | | | | | |

| Boddington | | 64 | | 67 | | 58 | | 56 | | 245 | | | 49 | | 55 | | | | 104 | |

| Cadia | | — | | — | | — | | 90 | | 90 | | | 118 | | 117 | | | | 235 | |

Peñasquito (2) | | 224 | | 189 | | — | | 116 | | 529 | | | 288 | | 268 | | | | 556 | |

Red Chris (70%) | | — | | — | | — | | 20 | | 20 | | | 28 | | 35 | | | | 63 | |

Tier 1 Portfolio | | 288 | | 256 | | 58 | | 282 | | 884 | | | 483 | | 475 | | | | 958 | |

| Telfer | | — | | — | | — | | 7 | | 7 | | | 6 | | 2 | | | | 8 | |

Non-Core Assets (5) | | — | | — | | — | | 7 | | 7 | | | 6 | | 2 | | | | 8 | |

Total Attributable Co-Product GEO Production | | 288 | | 256 | | 58 | | 289 | | 891 | | | 489 | | 477 | | | | 966 | |

| | | | | | | | | | | | |

Gold CAS Consolidated ($/oz) | | | | | | | | | | | | |

| Boddington | | $ | 841 | | $ | 777 | | $ | 848 | | $ | 941 | | $ | 847 | | | $ | 1,016 | | $ | 1,022 | | | | $ | 1,019 | |

| Tanami | | $ | 936 | | $ | 829 | | $ | 655 | | $ | 702 | | $ | 759 | | | $ | 902 | | $ | 1,018 | | | | $ | 962 | |

| Cadia | | $ | — | | $ | — | | $ | — | | $ | 1,079 | | $ | 1,079 | | | $ | 648 | | $ | 624 | | | | $ | 636 | |

| Lihir | | $ | — | | $ | — | | $ | — | | $ | 1,117 | | $ | 1,117 | | | $ | 936 | | $ | 1,101 | | | | $ | 1,010 | |

| Ahafo | | $ | 992 | | $ | 910 | | $ | 969 | | $ | 924 | | $ | 947 | | | $ | 865 | | $ | 976 | | | | $ | 920 | |

Peñasquito (2) | | $ | 1,199 | | $ | 831 | | N.M. | $ | 1,306 | | $ | 1,219 | | | $ | 853 | | $ | 827 | | | | $ | 838 | |

| Cerro Negro | | $ | 1,146 | | $ | 1,655 | | $ | 1,216 | | $ | 1,132 | | $ | 1,257 | | | $ | 861 | | $ | 2,506 | | | | $ | 1,310 | |

| Yanacocha | | $ | 1,067 | | $ | 1,187 | | $ | 1,057 | | $ | 975 | | $ | 1,069 | | | $ | 972 | | $ | 1,000 | | | | $ | 985 | |

| Merian (75%) | | $ | 1,028 | | $ | 1,501 | | $ | 1,261 | | $ | 1,155 | | $ | 1,207 | | | $ | 1,221 | | $ | 1,546 | | | | $ | 1,368 | |

| Brucejack | | $ | — | | $ | — | | $ | — | | $ | 1,898 | | $ | 1,898 | | | $ | 2,175 | | $ | 1,390 | | | | $ | 1,723 | |

Red Chris (70%) | | $ | — | | $ | — | | $ | — | | $ | 905 | | $ | 905 | | | $ | 940 | | $ | 951 | | | | $ | 945 | |

| Managed Tier 1 Portfolio | | $ | 984 | | $ | 977 | | $ | 975 | | $ | 1,027 | | $ | 995 | | | $ | 955 | | $ | 1,048 | | | | $ | 1,000 | |

Nevada Gold Mines (38.5%) | | $ | 1,109 | | $ | 1,055 | | $ | 992 | | $ | 1,125 | | $ | 1,070 | | | $ | 1,177 | | $ | 1,220 | | | | $ | 1,198 | |

| Non-Managed Tier 1 Portfolio | | $ | 1,109 | | $ | 1,055 | | $ | 992 | | $ | 1,125 | | $ | 1,070 | | | $ | 1,177 | | $ | 1,220 | | | | $ | 1,198 | |

| Total Tier 1 Portfolio | | $ | 1,019 | | $ | 1,001 | | $ | 980 | | $ | 1,050 | | $ | 1,016 | | | $ | 1,000 | | $ | 1,083 | | | | $ | 1,040 | |

| Telfer | | $ | — | | $ | — | | $ | — | | $ | 1,882 | | $ | 1,882 | | | $ | 2,632 | | $ | 2,548 | | | | $ | 2,585 | |

| Akyem | | $ | 810 | | $ | 1,087 | | $ | 1,032 | | $ | 877 | | $ | 931 | | | $ | 1,006 | | $ | 1,716 | | | | $ | 1,280 | |

| CC&V | | $ | 1,062 | | $ | 1,186 | | $ | 1,253 | | $ | 1,122 | | $ | 1,156 | | | $ | 1,394 | | $ | 1,361 | | | | $ | 1,376 | |

| Porcupine | | $ | 1,071 | | $ | 1,225 | | $ | 1,189 | | $ | 1,186 | | $ | 1,167 | | | $ | 1,042 | | $ | 1,068 | | | | $ | 1,058 | |

| Éléonore | | $ | 1,095 | | $ | 1,477 | | $ | 1,338 | | $ | 1,224 | | $ | 1,263 | | | $ | 1,441 | | $ | 1,404 | | | | $ | 1,422 | |

| Musselwhite | | $ | 1,313 | | $ | 1,356 | | $ | 1,045 | | $ | 1,068 | | $ | 1,186 | | | $ | 1,175 | | $ | 993 | | | | $ | 1,077 | |

Non-Core Assets (5) | | $ | 1,043 | | $ | 1,264 | | $ | 1,159 | | $ | 1,214 | | $ | 1,169 | | | $ | 1,306 | | $ | 1,398 | | | | $ | 1,354 | |

Total Gold CAS (6) | | $ | 1,025 | | $ | 1,054 | | $ | 1,019 | | $ | 1,086 | | $ | 1,050 | | | $ | 1,057 | | $ | 1,152 | | | | $ | 1,103 | |

Total Gold CAS (by-product) (6) | | $ | 916 | | $ | 1,024 | | $ | 1,022 | | $ | 1,060 | | $ | 1,011 | | | $ | 891 | | $ | 892 | | | | $ | 891 | |

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2024 |

| Operating Results (continued) | | Q1 | Q2 | Q3 | Q4 | FY | | Q1 | Q2 | Q3 | Q4 | FY |

Co-Product CAS Consolidated ($/GEO) | | | | | | | | | | | | |

| Boddington | | $ | 809 | | $ | 766 | | $ | 816 | | $ | 944 | | $ | 830 | | | $ | 942 | | $ | 1,031 | | | | $ | 985 | |

| Cadia | | $ | — | | $ | — | | $ | — | | $ | 1,017 | | $ | 1,017 | | | $ | 594 | | $ | 552 | | | | $ | 572 | |

Peñasquito (2) | | $ | 954 | | $ | 1,162 | | N.M. | $ | 1,602 | | $ | 1,283 | | | $ | 843 | | $ | 904 | | | | $ | 870 | |

Red Chris (70%) | | $ | — | | $ | — | | $ | — | | $ | 1,020 | | $ | 1,020 | | | $ | 1,011 | | $ | 915 | | | | $ | 959 | |

| Tier 1 Portfolio | | $ | 918 | | $ | 1,062 | | $ | 1,636 | | $ | 1,235 | | $ | 1,118 | | | $ | 807 | | $ | 822 | | | | $ | 814 | |

| Telfer | | $ | — | | $ | — | | $ | — | | $ | 1,703 | | $ | 1,703 | | | $ | 2,882 | | $ | 1,940 | | | | $ | 2,387 | |

Non-Core Assets (5) | | $ | — | | $ | — | | $ | — | | $ | 1,703 | | $ | 1,703 | | | $ | 2,882 | | $ | 1,940 | | | | $ | 2,387 | |

Total Co-Product GEO CAS (6) | | $ | 918 | | $ | 1,062 | | $ | 1,636 | | $ | 1,254 | | $ | 1,127 | | | $ | 829 | | $ | 836 | | | | $ | 832 | |

| | | | | | | | | | | | |

Gold AISC Consolidated ($/oz) | | | | | | | | | | | | |

| Boddington | | $ | 1,035 | | $ | 966 | | $ | 1,123 | | $ | 1,172 | | $ | 1,067 | | | $ | 1,242 | | $ | 1,237 | | | | $ | 1,240 | |

| Tanami | | $ | 1,219 | | $ | 1,162 | | $ | 890 | | $ | 1,046 | | $ | 1,060 | | | $ | 1,149 | | $ | 1,276 | | | | $ | 1,215 | |

| Cadia | | $ | — | | $ | — | | $ | — | | $ | 1,271 | | $ | 1,271 | | | $ | 989 | | $ | 1,064 | | | | $ | 1,028 | |

| Lihir | | $ | — | | $ | — | | $ | — | | $ | 1,517 | | $ | 1,517 | | | $ | 1,256 | | $ | 1,212 | | | | $ | 1,236 | |

| Ahafo | | $ | 1,366 | | $ | 1,237 | | $ | 1,208 | | $ | 1,114 | | $ | 1,222 | | | $ | 1,010 | | $ | 1,123 | | | | $ | 1,066 | |

Peñasquito (2) | | $ | 1,539 | | $ | 1,078 | | N.M. | $ | 1,670 | | $ | 1,590 | | | $ | 1,079 | | $ | 1,038 | | | | $ | 1,055 | |

| Cerro Negro | | $ | 1,379 | | $ | 1,924 | | $ | 1,438 | | $ | 1,412 | | $ | 1,509 | | | $ | 1,120 | | $ | 3,010 | | | | $ | 1,635 | |

| Yanacocha | | $ | 1,332 | | $ | 1,386 | | $ | 1,187 | | $ | 1,198 | | $ | 1,266 | | | $ | 1,123 | | $ | 1,217 | | | | $ | 1,166 | |

| Merian (75%) | | $ | 1,235 | | $ | 2,010 | | $ | 1,652 | | $ | 1,454 | | $ | 1,541 | | | $ | 1,530 | | $ | 2,170 | | | | $ | 1,820 | |

| Brucejack | | $ | — | | $ | — | | $ | — | | $ | 2,646 | | $ | 2,646 | | | $ | 2,580 | | $ | 1,929 | | | | $ | 2,206 | |

Red Chris (70%) | | $ | — | | $ | — | | $ | — | | $ | 1,439 | | $ | 1,439 | | | $ | 1,277 | | $ | 1,613 | | | | $ | 1,453 | |

| Managed Tier 1 Portfolio | | $ | 1,372 | | $ | 1,386 | | $ | 1,376 | | $ | 1,433 | | $ | 1,397 | | | $ | 1,327 | | $ | 1,455 | | | | $ | 1,389 | |

Nevada Gold Mines (38.5%) | | $ | 1,405 | | $ | 1,388 | | $ | 1,307 | | $ | 1,482 | | $ | 1,397 | | | $ | 1,576 | | $ | 1,689 | | | | $ | 1,631 | |

| Non-Managed Tier 1 Portfolio | | $ | 1,405 | | $ | 1,388 | | $ | 1,307 | | $ | 1,482 | | $ | 1,397 | | | $ | 1,576 | | $ | 1,689 | | | | $ | 1,631 | |

| Tier 1 Portfolio | | $ | 1,381 | | $ | 1,387 | | $ | 1,355 | | $ | 1,444 | | $ | 1,397 | | | $ | 1,378 | | $ | 1,503 | | | | $ | 1,438 | |

| Telfer | | $ | — | | $ | — | | $ | — | | $ | 1,988 | | $ | 1,988 | | | $ | 3,017 | | $ | 3,053 | | | | $ | 3,037 | |

| Akyem | | $ | 1,067 | | $ | 1,461 | | $ | 1,332 | | $ | 1,110 | | $ | 1,210 | | | $ | 1,254 | | $ | 1,952 | | | | $ | 1,523 | |

| CC&V | | $ | 1,375 | | $ | 1,631 | | $ | 1,819 | | $ | 1,793 | | $ | 1,644 | | | $ | 1,735 | | $ | 1,700 | | | | $ | 1,716 | |

| Porcupine | | $ | 1,412 | | $ | 1,587 | | $ | 1,644 | | $ | 1,665 | | $ | 1,577 | | | $ | 1,470 | | $ | 1,366 | | | | $ | 1,408 | |

| Éléonore | | $ | 1,420 | | $ | 2,213 | | $ | 2,107 | | $ | 1,796 | | $ | 1,838 | | | $ | 1,920 | | $ | 1,900 | | | | $ | 1,910 | |

| Musselwhite | | $ | 1,681 | | $ | 2,254 | | $ | 1,715 | | $ | 1,771 | | $ | 1,843 | | | $ | 1,766 | | $ | 1,397 | | | | $ | 1,568 | |

Non-Core Assets (5) | | $ | 1,359 | | $ | 1,808 | | $ | 1,685 | | $ | 1,629 | | $ | 1,610 | | | $ | 1,712 | | $ | 1,770 | | | | $ | 1,743 | |

Total Gold AISC (6) | | $ | 1,376 | | $ | 1,472 | | $ | 1,426 | | $ | 1,485 | | $ | 1,444 | | | $ | 1,439 | | $ | 1,562 | | | | $ | 1,500 | |

Total Gold AISC (by-product) (6) | | $ | 1,354 | | $ | 1,531 | | $ | 1,467 | | $ | 1,540 | | $ | 1,480 | | | $ | 1,373 | | $ | 1,412 | | | | $ | 1,392 | |

| | | | | | | | | | | | |

Co-Product AISC Consolidated ($/GEO) | | | | | | | | | | | | |

| Boddington | | $ | 1,019 | | $ | 977 | | $ | 1,108 | | $ | 1,181 | | $ | 1,067 | | | $ | 1,081 | | $ | 1,254 | | | | $ | 1,165 | |

| Cadia | | $ | — | | $ | — | | $ | — | | $ | 1,342 | | $ | 1,342 | | | $ | 1,027 | | $ | 1,024 | | | | $ | 1,025 | |

Peñasquito (2) | | $ | 1,351 | | $ | 1,581 | | N.M. | $ | 2,098 | | $ | 1,756 | | | $ | 1,102 | | $ | 1,164 | | | | $ | 1,130 | |

Red Chris (70%) | | $ | — | | $ | — | | $ | — | | $ | 1,660 | | $ | 1,660 | | | $ | 1,400 | | $ | 1,560 | | | | $ | 1,486 | |

| Tier 1 Portfolio | | $ | 1,322 | | $ | 1,492 | | $ | 2,422 | | $ | 1,666 | | $ | 1,565 | | | $ | 1,120 | | $ | 1,189 | | | | $ | 1,153 | |

| Telfer | | $ | — | | $ | — | | $ | — | | $ | 2,580 | | $ | 2,580 | | | $ | 3,745 | | $ | 2,742 | | | | $ | 3,218 | |

Non-Core Assets (5) | | $ | — | | $ | — | | $ | — | | $ | 2,580 | | $ | 2,580 | | | $ | 3,745 | | $ | 2,742 | | | | $ | 3,218 | |

Total Co-Product GEO AISC (6) | | $ | 1,322 | | $ | 1,492 | | $ | 2,422 | | $ | 1,703 | | $ | 1,579 | | | $ | 1,148 | | $ | 1,207 | | | | $ | 1,176 | |

(1)Attributable gold ounces sold excludes ounces related to the Pueblo Viejo mine, which is 40% owned by Newmont and accounted for as an equity method investment, and the Fruta del Norte mine, which is wholly owned by Lundin Gold whom the Company holds a 32.0% interest and is accounted for as an equity method investment.

(2)For the three months ended June 30, 2023 and September 30, 2023, Peñasquito production was impacted due to the suspension of operations as a result of the Union labor strike. Sales activity recognized in the third quarter of 2023 was related to adjustments on provisionally price concentrate sales subject to final settlement. Consequently, price per ounce/pound metrics are not meaningful ("N.M").

(3)Represents attributable gold from Newmont's 40% interest in Pueblo Viejo, which is accounted for as an equity method investment. Attributable gold ounces produced at Pueblo Viejo are not included in attributable gold ounces sold, as noted in footnote (1). Income and expenses of equity method investments are included in Equity income (loss) of affiliates.

(4)Represents attributable gold from Newmont's 32.0% interest in Lundin Gold, who wholly owns and operates the Fruta del Norte mine, which is accounted for on a quarterly-lag as an equity method investment. Attributable gold ounces produced by Lundin Gold represent prior quarter production and are not included in attributable gold ounces sold, as noted in footnote (1). Income and expenses of equity method investments are included in Equity income (loss) of affiliates.

(5)Sites are classified as held for sale as of June 30, 2024.

(6)Non-GAAP measure. See end of this release for reconciliation.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 7

NEWMONT CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited, in millions except per share) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (1) | | 2024 |

| Q1 | | Q2 | | Q3 | | Q4 | | FY | | Q1 | | Q2 | | Q3 | | Q4 | | FY |

| | | | | | | | | | | | | | | | | | | |

| Sales | $ | 2,679 | | | $ | 2,683 | | | $ | 2,493 | | | $ | 3,957 | | | $ | 11,812 | | | $ | 4,023 | | | $ | 4,402 | | | | | | | $ | 8,425 | |

| | | | | | | | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | |

Costs applicable to sales (2) | 1,482 | | | 1,543 | | | 1,371 | | | 2,303 | | | 6,699 | | | 2,106 | | | 2,156 | | | | | | | 4,262 | |

| Depreciation and amortization | 461 | | | 486 | | | 480 | | | 681 | | | 2,108 | | | 654 | | | 602 | | | | | | | 1,256 | |

| Reclamation and remediation | 66 | | | 66 | | | 166 | | | 1,235 | | | 1,533 | | | 98 | | | 94 | | | | | | | 192 | |

| Exploration | 48 | | | 66 | | | 78 | | | 73 | | | 265 | | | 53 | | | 57 | | | | | | | 110 | |

| Advanced projects, research and development | 35 | | | 44 | | | 53 | | | 68 | | | 200 | | | 53 | | | 49 | | | | | | | 102 | |

| General and administrative | 74 | | | 71 | | | 70 | | | 84 | | | 299 | | | 101 | | | 100 | | | | | | | 201 | |

| Loss on assets held for sale | — | | | — | | | — | | | — | | | — | | | 485 | | | 246 | | | | | | | 731 | |

Impairment charges | 4 | | | 4 | | | 2 | | | 1,881 | | | 1,891 | | | 12 | | | 9 | | | | | | | 21 | |

| | | | | | | | | | | | | | | | | | | |

| Other expense, net | 4 | | | 37 | | | 35 | | | 441 | | | 517 | | | 61 | | | 50 | | | | | | | 111 | |

| 2,174 | | | 2,317 | | | 2,255 | | | 6,766 | | | 13,512 | | | 3,623 | | | 3,363 | | | | | | | 6,986 | |

| Other income (expense): | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other income (loss), net | 99 | | | (17) | | | 42 | | | (212) | | | (88) | | | 121 | | | 100 | | | | | | | 221 | |

| Interest expense, net of capitalized interest | (65) | | | (49) | | | (48) | | | (81) | | | (243) | | | (93) | | | (103) | | | | | | | (196) | |

| 34 | | | (66) | | | (6) | | | (293) | | | (331) | | | 28 | | | (3) | | | | | | | 25 | |

| Income (loss) before income and mining tax and other items | 539 | | | 300 | | | 232 | | | (3,102) | | | (2,031) | | | 428 | | | 1,036 | | | | | | | 1,464 | |

| Income and mining tax benefit (expense) | (213) | | | (163) | | | (73) | | | (77) | | | (526) | | | (260) | | | (191) | | | | | | | (451) | |

| Equity income (loss) of affiliates | 25 | | | 16 | | | 3 | | | 19 | | | 63 | | | 7 | | | (3) | | | | | | | 4 | |

| Net income (loss) from continuing operations | 351 | | | 153 | | | 162 | | | (3,160) | | | (2,494) | | | 175 | | | 842 | | | | | | | 1,017 | |

| Net income (loss) from discontinued operations | 12 | | | 2 | | | 1 | | | 12 | | | 27 | | | 4 | | | 15 | | | | | | | 19 | |

| Net income (loss) | 363 | | | 155 | | | 163 | | | (3,148) | | | (2,467) | | | 179 | | | 857 | | | | | | | 1,036 | |

| Net loss (income) attributable to noncontrolling interests | (12) | | | — | | | (5) | | | (10) | | | (27) | | | (9) | | | (4) | | | | | | | (13) | |

| Net income (loss) attributable to Newmont stockholders | $ | 351 | | | $ | 155 | | | $ | 158 | | | $ | (3,158) | | | $ | (2,494) | | | $ | 170 | | | $ | 853 | | | | | | | $ | 1,023 | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to Newmont stockholders: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | $ | 339 | | | $ | 153 | | | $ | 157 | | | $ | (3,170) | | | $ | (2,521) | | | $ | 166 | | | $ | 838 | | | | | | | $ | 1,004 | |

| Discontinued operations | 12 | | | 2 | | | 1 | | | 12 | | | 27 | | | 4 | | | 15 | | | | | | | 19 | |

| $ | 351 | | | $ | 155 | | | $ | 158 | | | $ | (3,158) | | | $ | (2,494) | | | $ | 170 | | | $ | 853 | | | | | | | $ | 1,023 | |

| | | | | | | | | | | | | | | | | | | |

Weighted average common shares (millions): | | | | | | | | | | | | | | | | | | | |

| Basic | 794 | | 795 | | 795 | | 978 | | 841 | | 1,153 | | | 1,153 | | | | | | | 1,153 | |

| Effect of employee stock-based awards | 1 | | | — | | | 1 | | | 1 | | | — | | | — | | | 2 | | | | | | | 1 | |

| Diluted | 795 | | 795 | | 796 | | 979 | | 841 | | 1,153 | | | 1,155 | | | | | | | 1,154 | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) attributable to Newmont stockholders per common share: | | | | | | | | | | | | | | | | | | | |

| Basic: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | $ | 0.42 | | | $ | 0.19 | | | $ | 0.20 | | | $ | (3.24) | | | $ | (3.00) | | | $ | 0.15 | | | $ | 0.73 | | | | | | | $ | 0.87 | |

| Discontinued operations | 0.02 | | | — | | | — | | | 0.01 | | | 0.03 | | | — | | | 0.01 | | | | | | | 0.02 | |

| $ | 0.44 | | | $ | 0.19 | | | $ | 0.20 | | | $ | (3.23) | | | $ | (2.97) | | | $ | 0.15 | | | $ | 0.74 | | | | | | | $ | 0.89 | |

| Diluted: | | | | | | | | | | | | | | | | | | | |

| Continuing operations | $ | 0.42 | | | $ | 0.19 | | | $ | 0.20 | | | $ | (3.24) | | | $ | (3.00) | | | $ | 0.15 | | | $ | 0.73 | | | | | | | $ | 0.87 | |

| Discontinued operations | 0.02 | | | — | | | — | | | 0.01 | | | 0.03 | | | — | | | 0.01 | | | | | | | 0.02 | |

| $ | 0.44 | | | $ | 0.19 | | | $ | 0.20 | | | $ | (3.23) | | | $ | (2.97) | | | $ | 0.15 | | | $ | 0.74 | | | | | | | $ | 0.89 | |

(1)Certain amounts and disclosures in the prior year have been reclassified to conform to the current year presentation.

(2)Excludes Depreciation and amortization and Reclamation and remediation.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 8

NEWMONT CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (1) | | 2024 |

| MAR | | JUN | | SEP | | DEC | | MAR | | JUN | | SEP | | DEC |

| ASSETS | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 2,657 | | | $ | 2,829 | | | $ | 3,190 | | | $ | 3,002 | | | $ | 2,336 | | | $ | 2,602 | | | | | |

Trade receivables | 348 | | | 185 | | | 78 | | | 734 | | | 782 | | | 955 | | | | | |

Investments | 847 | | | 409 | | | 24 | | | 23 | | | 23 | | | 50 | | | | | |

| Inventories | 1,067 | | | 1,111 | | | 1,127 | | | 1,663 | | | 1,385 | | | 1,467 | | | | | |

| Stockpiles and ore on leach pads | 905 | | | 858 | | | 829 | | | 979 | | | 745 | | | 681 | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Derivative assets | — | | | — | | | — | | | 198 | | | 114 | | | 71 | | | | | |

| Other current assets | 735 | | | 742 | | | 707 | | | 913 | | | 765 | | | 874 | | | | | |

Assets held for sale | — | | | — | | | — | | | — | | | 5,656 | | | 5,370 | | | | | |

| Current assets | 6,559 | | | 6,134 | | | 5,955 | | | 7,512 | | | 11,806 | | | 12,070 | | | | | |

| Property, plant and mine development, net | 24,097 | | | 24,284 | | | 24,474 | | | 37,563 | | | 33,564 | | | 33,655 | | | | | |

| Investments | 3,216 | | | 3,172 | | | 3,133 | | | 4,143 | | | 4,138 | | | 4,141 | | | | | |

| Stockpiles and ore on leach pads | 1,691 | | | 1,737 | | | 1,740 | | | 1,935 | | | 1,837 | | | 2,002 | | | | | |

| Deferred income tax assets | 170 | | | 166 | | | 138 | | | 268 | | | 210 | | | 273 | | | | | |

| Goodwill | 1,971 | | | 1,971 | | | 1,971 | | | 3,001 | | | 2,792 | | | 2,792 | | | | | |

| Derivative assets | — | | | — | | | — | | | 444 | | | 412 | | | 181 | | | | | |

| Other non-current assets | 670 | | | 669 | | | 673 | | | 640 | | | 576 | | | 564 | | | | | |

| | | | | | | | | | | | | | | |

| Total assets | $ | 38,374 | | | $ | 38,133 | | | $ | 38,084 | | | $ | 55,506 | | | $ | 55,335 | | | $ | 55,678 | | | | | |

| | | | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | | | | |

| Accounts payable | $ | 648 | | | $ | 565 | | | $ | 651 | | | $ | 960 | | | $ | 698 | | | $ | 683 | | | | | |

| Employee-related benefits | 302 | | | 313 | | | 345 | | | 551 | | | 414 | | | 457 | | | | | |

| Income and mining taxes payable | 213 | | | 155 | | | 143 | | | 88 | | | 136 | | | 264 | | | | | |

| Lease and other financing obligations | 96 | | | 96 | | | 94 | | | 114 | | | 99 | | | 104 | | | | | |

| Debt | — | | | — | | | — | | | 1,923 | | | — | | | — | | | | | |

| Other current liabilities | 1,493 | | | 1,564 | | | 1,575 | | | 2,362 | | | 1,784 | | | 1,819 | | | | | |

Liabilities held for sale | — | | | — | | | — | | | — | | | 2,351 | | | 2,405 | | | | | |

| Current liabilities | 2,752 | | | 2,693 | | | 2,808 | | | 5,998 | | | 5,482 | | | 5,732 | | | | | |

| Debt | 5,572 | | | 5,574 | | | 5,575 | | | 6,951 | | | 8,933 | | | 8,692 | | | | | |

| Lease and other financing obligations | 451 | | | 441 | | | 418 | | | 448 | | | 436 | | | 429 | | | | | |

| Reclamation and remediation liabilities | 6,603 | | | 6,604 | | | 6,714 | | | 8,167 | | | 6,652 | | | 6,620 | | | | | |

| Deferred income tax liabilities | 1,800 | | | 1,795 | | | 1,696 | | | 2,987 | | | 3,094 | | | 3,046 | | | | | |

| Employee-related benefits | 395 | | | 399 | | | 397 | | | 655 | | | 610 | | | 616 | | | | | |

| Silver streaming agreement | 805 | | | 786 | | | 787 | | | 779 | | | 753 | | | 733 | | | | | |

| Other non-current liabilities | 437 | | | 426 | | | 429 | | | 316 | | | 300 | | | 247 | | | | | |

| | | | | | | | | | | | | | | |

| Total liabilities | 18,815 | | | 18,718 | | | 18,824 | | | 26,301 | | | 26,260 | | | 26,115 | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Commitments and contingencies | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| EQUITY | | | | | | | | | | | | | | | |

| Common stock | 1,281 | | | 1,281 | | | 1,281 | | | 1,854 | | | 1,855 | | | 1,851 | | | | | |

| Treasury stock | (261) | | | (261) | | | (263) | | | (264) | | | (274) | | | (274) | | | | | |

| Additional paid-in capital | 17,386 | | | 17,407 | | | 17,425 | | | 30,419 | | | 30,436 | | | 30,394 | | | | | |

| Accumulated other comprehensive income (loss) | 23 | | | 13 | | | 8 | | | 14 | | | (16) | | | (7) | | | | | |

| (Accumulated deficit) Retained earnings | 948 | | | 785 | | | 623 | | | (2,996) | | | (3,111) | | | (2,585) | | | | | |

| Newmont stockholders' equity | 19,377 | | | 19,225 | | | 19,074 | | | 29,027 | | | 28,890 | | | 29,379 | | | | | |

| Noncontrolling interests | 182 | | | 190 | | | 186 | | | 178 | | | 185 | | | 184 | | | | | |

| Total equity | 19,559 | | | 19,415 | | | 19,260 | | | 29,205 | | | 29,075 | | | 29,563 | | | | | |

| Total liabilities and equity | $ | 38,374 | | | $ | 38,133 | | | $ | 38,084 | | | $ | 55,506 | | | $ | 55,335 | | | $ | 55,678 | | | | | |

(1)Certain amounts and disclosures in the prior year have been reclassified to conform to the current year presentation.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 9

NEWMONT CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited, in millions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2023 (1) | | 2024 |

| Q1 | | Q2 | | Q3 | | Q4 | | FY | | Q1 | | Q2 | | Q3 | | Q4 | | FY |

| Operating activities: | | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | 363 | | | $ | 155 | | | $ | 163 | | | $ | (3,148) | | | $ | (2,467) | | | $ | 179 | | | $ | 857 | | | | | | | $ | 1,036 | |

| Non-cash adjustments: | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | 461 | | | 486 | | | 480 | | | 681 | | | 2,108 | | | 654 | | | 602 | | | | | | | 1,256 | |

| Loss on assets held for sale | — | | | — | | | — | | | — | | | — | | | 485 | | | 246 | | | | | | | 731 | |

| Net loss (income) from discontinued operations | (12) | | | (2) | | | (1) | | | (12) | | | (27) | | | (4) | | | (15) | | | | | | | (19) | |

| Reclamation and remediation | 61 | | | 59 | | | 167 | | | 1,219 | | | 1,506 | | | 94 | | | 88 | | | | | | | 182 | |

| (Gain) loss on asset and investment sales, net | (36) | | | — | | | 2 | | | 231 | | | 197 | | | (9) | | | (55) | | | | | | | (64) | |

| Stock-based compensation | 19 | | | 23 | | | 16 | | | 22 | | | 80 | | | 21 | | | 23 | | | | | | | 44 | |

| Deferred income taxes | 15 | | | 6 | | | (24) | | | (101) | | | (104) | | | 53 | | | (95) | | | | | | | (42) | |

| Change in fair value of investments | (41) | | | 42 | | | 41 | | | 5 | | | 47 | | | (31) | | | 9 | | | | | | | (22) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Impairment charges | 4 | | | 4 | | | 2 | | | 1,881 | | | 1,891 | | | 12 | | | — | | | | | | | 12 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other non-cash adjustments | 9 | | | (10) | | | 28 | | | 9 | | | 36 | | | (12) | | | (3) | | | | | | | (15) | |

Cash from operations before working capital (2) | 843 | | | 763 | | | 874 | | | 787 | | | 3,267 | | | 1,442 | | | 1,657 | | | | | | | 3,099 | |

| Net change in operating assets and liabilities | (362) | | | (107) | | | 127 | | | (171) | | | (513) | | | (666) | | | (263) | | | | | | | (929) | |

| Net cash provided by (used in) operating activities of continuing operations | 481 | | | 656 | | | 1,001 | | | 616 | | | 2,754 | | | 776 | | | 1,394 | | | | | | | 2,170 | |

| Net cash provided by (used in) operating activities of discontinued operations | — | | | 7 | | | 2 | | | — | | | 9 | | | — | | | 34 | | | | | | | 34 | |

| Net cash provided by (used in) operating activities | 481 | | | 663 | | | 1,003 | | | 616 | | | 2,763 | | | 776 | | | 1,428 | | | | | | | 2,204 | |

| | | | | | | | | | | | | | | | | | | |

| Investing activities: | | | | | | | | | | | | | | | | | | | |

| Additions to property, plant and mine development | (526) | | | (616) | | | (604) | | | (920) | | | (2,666) | | | (850) | | | (800) | | | | | | | (1,650) | |

| Proceeds from asset and investment sales | 181 | | | 33 | | | 5 | | | 15 | | | 234 | | | 35 | | | 217 | | | | | | | 252 | |

| Purchases of investments | (525) | | | (17) | | | (3) | | | (6) | | | (551) | | | (23) | | | (83) | | | | | | | (106) | |

| Return of investment from equity method investees | — | | | 30 | | | — | | | 6 | | | 36 | | | 25 | | | 16 | | | | | | | 41 | |

| Contributions to equity method investees | (41) | | | (23) | | | (26) | | | (18) | | | (108) | | | (15) | | | (5) | | | | | | | (20) | |

| Proceeds from maturities of investments | 557 | | | 424 | | | 374 | | | 8 | | | 1,363 | | | — | | | — | | | | | | | — | |

| Acquisitions, net | — | | | — | | | — | | | 668 | | | 668 | | | — | | | — | | | | | | | — | |

| Other | 12 | | | 11 | | | 1 | | | (2) | | | 22 | | | 30 | | | 14 | | | | | | | 44 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net cash provided by (used in) investing activities | (342) | | | (158) | | | (253) | | | (249) | | | (1,002) | | | (798) | | | (641) | | | | | | | (1,439) | |

| | | | | | | | | | | | | | | | | | | |

| Financing activities: | | | | | | | | | | | | | | | | | | | |

| Repayment of debt | — | | | — | | | — | | | — | | | — | | | (3,423) | | | (227) | | | | | | | (3,650) | |

| Proceeds from issuance of debt, net | — | | | — | | | — | | | — | | | — | | | 3,476 | | | — | | | | | | | 3,476 | |

| Dividends paid to common stockholders | (318) | | | (318) | | | (318) | | | (461) | | | (1,415) | | | (288) | | | (289) | | | | | | | (577) | |

| Repurchases of common stock | — | | | — | | | — | | | — | | | — | | | — | | | (104) | | | | | | | (104) | |

| Distributions to noncontrolling interests | (34) | | | (32) | | | (41) | | | (43) | | | (150) | | | (41) | | | (36) | | | | | | | (77) | |

| Funding from noncontrolling interests | 41 | | | 34 | | | 32 | | | 31 | | | 138 | | | 22 | | | 31 | | | | | | | 53 | |

| Payments on lease and other financing obligations | (16) | | | (16) | | | (16) | | | (19) | | | (67) | | | (18) | | | (22) | | | | | | | (40) | |

| Payments for withholding of employee taxes related to stock-based compensation | (22) | | | — | | | (2) | | | (1) | | | (25) | | | (10) | | | — | | | | | | | (10) | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other | (1) | | | (2) | | | (36) | | | (45) | | | (84) | | | (17) | | | (11) | | | | | | | (28) | |

| Net cash provided by (used in) financing activities | (350) | | | (334) | | | (381) | | | (538) | | | (1,603) | | | (299) | | | (658) | | | | | | | (957) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (8) | | | 4 | | | (5) | | | 7 | | | (2) | | | (3) | | | (11) | | | | | | | (14) | |

Net change in cash, cash equivalents and restricted cash, including cash and restricted cash reclassified to assets held for sale | (219) | | | 175 | | | 364 | | | (164) | | | 156 | | | (324) | | | 118 | | | | | | | (206) | |

Less: cash and restricted cash reclassified to assets held for sale (3) | — | | | — | | | — | | | — | | | — | | | (395) | | | 137 | | | | | | | (258) | |

| Net change in cash, cash equivalents and restricted cash | (219) | | | 175 | | | 364 | | | (164) | | | 156 | | | (719) | | | 255 | | | | | | | (464) | |

| Cash, cash equivalents and restricted cash at beginning of period | 2,944 | | | 2,725 | | | 2,900 | | | 3,264 | | | 2,944 | | | 3,100 | | | 2,381 | | | | | | | 3,100 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 2,725 | | | $ | 2,900 | | | $ | 3,264 | | | $ | 3,100 | | | $ | 3,100 | | | $ | 2,381 | | | $ | 2,636 | | | | | | | $ | 2,636 | |

| | | | | | | | | | | | | | | | | | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | $ | 2,657 | | | $ | 2,829 | | | $ | 3,190 | | | $ | 3,002 | | | $ | 3,002 | | | $ | 2,336 | | | $ | 2,602 | | | | | | | $ | 2,602 | |

| Restricted cash included in Other current assets | 1 | | | 1 | | | 1 | | | 11 | | | 11 | | | 6 | | | 6 | | | | | | | 6 | |

| Restricted cash included in Other non-current assets | 67 | | | 70 | | | 73 | | | 87 | | | 87 | | | 39 | | | 28 | | | | | | | 28 | |

| Total cash, cash equivalents and restricted cash | $ | 2,725 | | | $ | 2,900 | | | $ | 3,264 | | | $ | 3,100 | | | $ | 3,100 | | | $ | 2,381 | | | $ | 2,636 | | | | | | | $ | 2,636 | |

(1)Certain amounts and disclosures in the prior year have been reclassified to conform to the current year presentation.

(2)Cash from operations before working capital is a non-GAAP metric with the most directly comparable GAAP financial metric being to Net cash provided by (used in) operating activities, as shown reconciled above.

(3)During the first quarter of 2024, certain non-core assets were determined to meet the criteria for assets held for sale. As a result, the related assets and liabilities, including $205 of Cash and cash equivalents and $53 of restricted cash, included in Other current assets and Other non-current assets, were reclassified to Assets held for sale and Liabilities held for sale, respectively.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 10

Non-GAAP Financial Measures

Non-GAAP financial measures are intended to provide additional information only and do not have any standard meaning prescribed by GAAP. These measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. Refer to Non-GAAP Financial Measures within Part II, Item 7 within our Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 for further information on the non-GAAP financial measures presented below, including why management believes that its presentation of non-GAAP financial measures provides useful information to investors.

Adjusted net income (loss)

Net income (loss) attributable to Newmont stockholders is reconciled to Adjusted net income (loss) as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2024 | | Six Months Ended

June 30, 2024 |

| | | per share data (1) | | | | per share data (1) |

| | | basic | | diluted | | | | basic | | diluted |

| Net income (loss) attributable to Newmont stockholders | $ | 853 | | | $ | 0.74 | | | $ | 0.74 | | | $ | 1,023 | | | $ | 0.89 | | | $ | 0.89 | |

| Net loss (income) attributable to Newmont stockholders from discontinued operations | (15) | | | (0.01) | | | (0.01) | | | (19) | | | (0.02) | | | (0.02) | |

Net income (loss) attributable to Newmont stockholders from continuing operations | 838 | | | 0.73 | | | 0.73 | | | 1,004 | | | 0.87 | | | 0.87 | |

Loss on assets held for sale (2) | 246 | | | 0.22 | | | 0.22 | | | 731 | | | 0.63 | | | 0.63 | |

(Gain) loss on asset and investment sales, net (3) | (55) | | | (0.05) | | | (0.05) | | | (64) | | | (0.06) | | | (0.06) | |

Newcrest transaction and integration costs (4) | 16 | | | 0.01 | | | 0.01 | | | 45 | | | 0.04 | | | 0.04 | |

Settlement costs (5) | 5 | | | — | | | — | | | 26 | | | 0.03 | | | 0.03 | |

Change in fair value of investments (6) | 9 | | | 0.01 | | | 0.01 | | | (22) | | | (0.01) | | | (0.01) | |

Impairment charges (7) | 9 | | | 0.01 | | | 0.01 | | | 21 | | | 0.02 | | | 0.02 | |

Restructuring and severance (8) | 9 | | | 0.01 | | | 0.01 | | | 15 | | | 0.01 | | | 0.01 | |

Gain on debt extinguishment, net (9) | (14) | | | (0.01) | | | (0.01) | | | (14) | | | (0.01) | | | (0.01) | |

Reclamation and remediation charges (10) | — | | | — | | | — | | | 6 | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Tax effect of adjustments (11) | (87) | | | (0.07) | | | (0.07) | | | (234) | | | (0.20) | | | (0.20) | |

Valuation allowance and other tax adjustments (12) | (142) | | | (0.14) | | | (0.14) | | | (50) | | | (0.05) | | | (0.05) | |

| Adjusted net income (loss) | $ | 834 | | | $ | 0.72 | | | $ | 0.72 | | | $ | 1,464 | | | $ | 1.27 | | | $ | 1.27 | |

| | | | | | | | | | | |

Weighted average common shares (millions): (13) | | | 1,153 | | | 1,155 | | | | | 1,153 | | | 1,154 | |

(1)Per share measures may not recalculate due to rounding.

(2)Loss on assets held for sale, included in Loss on assets held for sale, represents the loss recorded for the six non-core assets and the development project that met the requirements to be presented as held for sale in 2024.

(3)(Gain) loss on asset and investment sales, net, included in Other income (loss), net, primarily represents the gain recognized on the sale of the Stream Credit Facility Agreement ("SCFA") in the second quarter and the purchase and sale of foreign currency bonds.

(4)Newcrest transaction and integration costs, included in Other expense, net, represents costs incurred related to Newmont's acquisition of Newcrest completed in 2023 as well as subsequent integration costs.

(5)Settlement costs, included in Other expense, net, are primarily comprised of wind down and demobilization costs related to the French Guiana project.

(6)Change in fair value of investments, included in Other income (loss), net, primarily represents unrealized gains and losses related to the Company's investment in current and non-current marketable equity securities.

(7)Impairment charges, included in Other expense, net, represents non-cash write-downs of various assets that are no longer in use and materials and supplies inventories.

(8)Restructuring and severance, included in Other expense, net, primarily represents severance and related costs associated with significant organizational or operating model changes implemented by the Company.

(9)Gain on debt extinguishment, net, included in Other income (loss), net, primarily represents the net gain on the partial redemption of certain Senior Notes in the second quarter.

(10)Reclamation and remediation charges, included in Reclamation and remediation, represent revisions to reclamation and remediation plans at the Company's former operating properties and historic mining operations that have entered the closure phase and have no substantive future economic value.

(11)The tax effect of adjustments, included in Income and mining tax benefit (expense), represents the tax effect of adjustments in footnotes (2) through (10), as described above, and are calculated using the applicable regional tax rate.

(12)Valuation allowance and other tax adjustments, included in Income and mining tax benefit (expense), is recorded for items such as foreign tax credits, capital losses, disallowed foreign losses, and the effects of changes in foreign currency exchange rates on deferred tax assets and deferred tax liabilities. The adjustment for the three and six months ended June 30, 2024 reflects the net increase or (decrease) to net operating losses, capital losses, tax credit carryovers, and other deferred tax assets subject to valuation allowance of $20 and $(45), the effects of changes in foreign exchange rates on deferred tax assets and liabilities of $(93) and $(58), net reductions to the reserve for uncertain tax positions of $(50) and $(52), recording of a deferred tax liability for the outside basis difference at Akyem of $(37) and $80 due to the status change to held-for-sale, and other tax adjustments of $18 and $25.

(13)Adjusted net income (loss) per diluted share is calculated using diluted common shares in accordance with GAAP.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 11

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, 2023 | | Six Months Ended

June 30, 2023 |

| | | per share data (1) | | | | per share data (1) |

| | | basic | | diluted | | | | basic | | diluted |

| Net income (loss) attributable to Newmont stockholders | $ | 155 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 506 | | | $ | 0.64 | | | $ | 0.64 | |

| Net loss (income) attributable to Newmont stockholders from discontinued operations | (2) | | | — | | | — | | | (14) | | | (0.02) | | | (0.02) | |

| Net income (loss) attributable to Newmont stockholders from continuing operations | 153 | | | 0.19 | | | 0.19 | | | 492 | | | 0.62 | | | 0.62 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(Gain) loss on asset and investment sales, net (2) | — | | | — | | | — | | | (36) | | | (0.05) | | | (0.05) | |

Newcrest transaction-related costs (3) | 21 | | | 0.03 | | | 0.03 | | | 21 | | | 0.03 | | | 0.03 | |

Restructuring and severance (4) | 10 | | | 0.01 | | | 0.01 | | | 12 | | | 0.02 | | | 0.02 | |

Impairment charges (5) | 4 | | | — | | | — | | | 8 | | | 0.01 | | | 0.01 | |

Reclamation and remediation charges (6) | (2) | | | — | | | — | | | (2) | | | — | | | — | |

Change in fair value of investments (7) | 42 | | | 0.05 | | | 0.05 | | | 1 | | | — | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Other (8) | — | | | — | | | — | | | (4) | | | — | | | — | |

Tax effect of adjustments (9) | (17) | | | (0.02) | | | (0.02) | | | (1) | | | — | | | — | |

Valuation allowance and other tax adjustments (10) | 55 | | | 0.07 | | | 0.07 | | | 95 | | | 0.11 | | | 0.11 | |

| Adjusted net income (loss) | $ | 266 | | | $ | 0.33 | | | $ | 0.33 | | | $ | 586 | | | $ | 0.74 | | | $ | 0.74 | |

| | | | | | | | | | | |

Weighted average common shares (millions): (11) | | | 795 | | | 795 | | | | | 794 | | | 795 | |

(1)Per share measures may not recalculate due to rounding.

(2)(Gain) loss on asset and investment sales, net, included in Other income (loss), net, primarily represents the net gain recognized on the exchange of the previously held Maverix investment for Triple Flag and the subsequent sale of the Triple Flag investment.

(3)Newcrest transaction-related costs, included in Other expense, net, primarily represents costs incurred related to the Newcrest Transaction.

(4)Restructuring and severance, included in Other expense, net, primarily represents severance and related costs associated with significant organizational or operating model changes implemented by the Company.

(5)Impairment charges, included in Other expense, net, represents non-cash write-downs of various assets that are no longer in use and materials and supplies inventories.

(6)Reclamation and remediation charges, included in Reclamation and remediation, represent revisions to reclamation and remediation plans at the Company's former operating properties and historic mining operations that have entered the closure phase and have no substantive future economic value.

(7)Change in fair value of investments, included in Other income (loss), net, primarily represents unrealized gains and losses related to the Company's investment in current and non-current marketable equity securities.

(8)Other represents income received on the favorable settlement of certain matters that were outstanding at the time of sale of the related investment in 2022. Amounts included in Other income (loss), net.

(9)The tax effect of adjustments, included in Income and mining tax benefit (expense), represents the tax effect of adjustments in footnotes (2) through (8), as described above, and are calculated using the applicable regional tax rate.

(10)Valuation allowance and other tax adjustments, included in Income and mining tax benefit (expense), is recorded for items such as foreign tax credits, capital losses, disallowed foreign losses, and the effects of changes in foreign currency exchange rates on deferred tax assets and deferred tax liabilities. The adjustment for the three and six months ended June 30, 2023 reflects the net increase or (decrease) to net operating losses, capital losses, tax credit carryovers, and other deferred tax assets subject to valuation allowance of $47 and $57, the effects of changes in foreign exchange rates on deferred tax assets and liabilities of $4 and $21, net reductions to the reserve for uncertain tax positions of $3 and $14, other tax adjustments of $1 and $3.

(11)Adjusted net income (loss) per diluted share is calculated using diluted common shares in accordance with GAAP.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 12

Earnings before interest, taxes, depreciation and amortization and Adjusted earnings before interest, taxes, depreciation and amortization

Net income (loss) attributable to Newmont stockholders is reconciled to EBITDA and Adjusted EBITDA as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) attributable to Newmont stockholders | $ | 853 | | | $ | 155 | | | $ | 1,023 | | | $ | 506 | |

| Net income (loss) attributable to noncontrolling interests | 4 | | | — | | | 13 | | | 12 | |

Net (income) loss from discontinued operations | (15) | | | (2) | | | (19) | | | (14) | |

| Equity loss (income) of affiliates | 3 | | | (16) | | | (4) | | | (41) | |

| Income and mining tax expense (benefit) | 191 | | | 163 | | | 451 | | | 376 | |

| Depreciation and amortization | 602 | | | 486 | | | 1,256 | | | 947 | |

Interest expense, net of capitalized interest | 103 | | | 49 | | | 196 | | | 114 | |

| EBITDA | $ | 1,741 | | | $ | 835 | | | $ | 2,916 | | | $ | 1,900 | |

| Adjustments: | | | | | | | |

Loss on assets held for sale (1) | $ | 246 | | | $ | — | | | $ | 731 | | | $ | — | |

(Gain) loss on asset and investment sales, net (2) | (55) | | | — | | | (64) | | | (36) | |

Newcrest transaction and integration costs (3) | 16 | | | 21 | | | 45 | | | 21 | |

Settlement costs (4) | 5 | | | — | | | 26 | | | — | |

Change in fair value of investments (5) | 9 | | | 42 | | | (22) | | | 1 | |

Impairment charges (6) | 9 | | | 4 | | | 21 | | | 8 | |

Restructuring and severance (7) | 9 | | | 10 | | | 15 | | | 12 | |

Gain on debt extinguishment, net (8) | (14) | | | — | | | (14) | | | — | |

Reclamation and remediation charges (9) | — | | | (2) | | | 6 | | | (2) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other (10) | — | | | — | | | — | | | (4) | |

| Adjusted EBITDA | $ | 1,966 | | | $ | 910 | | | $ | 3,660 | | | $ | 1,900 | |

(1)Loss on assets held for sale, included in Loss on assets held for sale, represents the loss recorded for the six non-core assets and the development project that met the requirements to be presented as held for sale in 2024.

(2)(Gain) loss on asset and investment sales, net, included in Other income (loss), net, in 2024 primarily represents the gain recognized on the sale of the Stream Credit Facility Agreement ("SCFA") in the second quarter and the purchase and sale of foreign currency bonds. For 2023, primarily comprised of the net gain recognized on the exchange of the previously held Maverix investment for Triple Flag and the subsequent sale of the Triple Flag investment.

(3)Newcrest transaction and integration costs, included in Other expense, net, represents costs incurred related to Newmont's acquisition of Newcrest completed in 2023 as well as subsequent integration costs.

(4)Settlement costs, included in Other expense, net, are primarily comprised of wind-down and demobilization costs related to the French Guiana project in 2024 and litigation expenses in 2023.

(5)Change in fair value of investments, included in Other income (loss), net, primarily represents unrealized gains and losses related to the Company's investments in current and non-current marketable equity securities.

(6)Impairment charges, included in Other expense, net, represents non-cash write-downs of various assets that are no longer in use and materials and supplies inventories.

(7)Restructuring and severance, included in Other expense, net, primarily represents severance and related costs associated with significant organizational or operating model changes implemented by the Company for all periods presented.

(8)Gain on debt extinguishment, net, included in Other income (loss), net, primarily represents the net gain on the partial redemption of certain Senior Notes in the second quarter.

(9)Reclamation and remediation charges, included in Reclamation and remediation, represent revisions to reclamation and remediation plans at the Company's former operating properties and historic mining operations that have entered the closure phase and have no substantive future economic value.

(10)Other, included in Other income (loss), net, in 2023, represents income received during the first quarter of 2023, on the favorable settlement of certain matters that were outstanding at the time of sale of the related investment in 2022.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 13

Free Cash Flow

The following table sets forth a reconciliation of Free Cash Flow, a non-GAAP financial measure, to Net cash provided by (used in) operating activities, which the Company believes to be the GAAP financial measure most directly comparable to Free Cash Flow, as well as information regarding Net cash provided by (used in) investing activities and Net cash provided by (used in) financing activities.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net cash provided by (used in) operating activities (1) | $ | 1,428 | | | $ | 663 | | | $ | 2,204 | | | $ | 1,144 | |

| Less: Net cash used in (provided by) operating activities of discontinued operations | (34) | | | (7) | | | (34) | | | (7) | |

| Net cash provided by (used in) operating activities of continuing operations | 1,394 | | | 656 | | | 2,170 | | | 1,137 | |

| Less: Additions to property, plant and mine development | (800) | | | (616) | | | (1,650) | | | (1,142) | |

| Free Cash Flow | $ | 594 | | | $ | 40 | | | $ | 520 | | | $ | (5) | |

| | | | | | | |

Net cash provided by (used in) investing activities (2) | $ | (641) | | | $ | (158) | | | $ | (1,439) | | | $ | (500) | |

| Net cash provided by (used in) financing activities | $ | (658) | | | $ | (334) | | | $ | (957) | | | $ | (684) | |

(1)Includes payment of $291 for stamp duty tax, related to the Newcrest transaction, in the first quarter of 2024.

(2)Net cash provided by (used in) investing activities includes Additions to property, plant and mine development, which is included in the Company’s computation of Free Cash Flow.

NEWMONT SECOND QUARTER 2024 RESULTS | NEWS RELEASE 14

Attributable Free Cash Flow