FOURTH QUARTER 2023

HIGHLIGHTS

- 4Q 2023 INVOICED SALES AMOUNTED TO €84.1 MILLION, REFLECTING

A DECREASE OF 27.8% COMPARED TO A STRONG 4Q 2022, WHICH BENEFITTED

FROM A €16.9 MILLION REDUCTION IN BACKLOG. NET OF THE BACKLOG

EFFECT, THE DECREASE WOULD HAVE BEEN OF 15.5%.

- DESPITE THE CHALLENGING MARKET CONDITIONS, WE CONTINUED

INVESTING TO STRENGTHEN OUR BRANDED BUSINESS AND TO ACCELERATE THE

RESTRUCTURING OF OUR OPERATIONS.

- IN 4Q 2023, BRANDED SALES REPRESENTED 92.2% OF TOTAL SALES,

CONFIRMING THE TRANSITION TO A LIFESTYLE BRAND, WHICH IS THE RESULT

OF MORE THAN A DECADE OF INVESTMENTS. SALES FROM RETAIL WERE 61.7%

OF THE TOTAL. THESE PERCENTAGES WERE RESPECTIVELY 85.3% AND 52.2%

AT THE BEGINNING OF 2021.

- IN 4Q 2023 WE COMPLETED THE ORGANIZATIONAL AND IT

INTERVENTIONS TO ENSURE A MODERN MANAGEMENT OF OUR RETAIL AND

COMMERCIAL OPERATIONS, WHICH SPREAD ACROSS 678 STORES AND 100

COUNTRIES.

- IN 4Q 2023 WE ACCELERATED THE RESTRUCTURING, BOTH WITHIN

FACTORIES AND HQ, AS A PART OF OUR LONG-TERM TRANSFORMATION PROCESS

TO INCREASE COMPETITIVENESS AND ENHANCE MARGIN GENERATION. IN

PARTICULAR, IN 4Q 2023, WE SUSTAINED €5.9 MILLION OF ONE-OFF

RESTRUCTURING COSTS.

- 4Q 2023 GROSS MARGIN, NET OF ONE-OFF RESTRUCTURING COSTS, IS

OF 36.2%, COMPARED TO 38.8% IN 4Q 2022 AND 34.6% IN 4Q

2019.

- NET OF ONE-OFF RESTRUCTURING COSTS, 4Q 2023 REPORTS AN

OPERATING LOSS OF (€1.4) MILLION.

- NET FINANCE COSTS OF (€2.8) MILLION, COMPARED TO NET FINANCE

COSTS OF (€4.8) MILLION IN 4Q 2022.

FULL YEAR 2023 HIGHLIGHTS

- 2023 INVOICED SALES AMOUNTED TO €328.6 MILLION, REFLECTING A

DECREASE OF 29.9% COMPARED TO 2022, WHICH BENEFITTED FROM A €58.4

MILLION REDUCTION IN BACKLOG. NET OF THE BACKLOG EFFECT THE

DECREASE WOULD HAVE BEEN OF 19.9% VS 2022.

- IN 2023, WE ACCELERATED OUR RESTRUCTURING, WITH €7.4 MILLION

OF ONE-OFF COSTS TO REDUCE THE WORKFORCE BY 514 PEOPLE. THIS

RESULTED IN A TOTAL REDUCTION OF 759 PEOPLE FROM 2021 TO 2023. THIS

REPRESENTS A REDUCTION OF 17.5%, LEADING TO €22.6 MILLION IN ANNUAL

SAVINGS COMPARED TO 2021 LABOUR COST.

- 2023 GROSS MARGIN, NET OF RESTRUCTURING COSTS, IS OF 36.3%,

COMPARED TO 35.6% IN 2022 AND 31.0% IN 2019.

- 2023 REPORTS AN OPERATING LOSS OF (€2.1) MILLION, EXCLUDING

THE IMPACT OF RESTRUCTURING COSTS.

- NET FINANCE COSTS OF (€8.5) MILLION, COMPARED TO NET FINANCE

COSTS OF (€5.2) MILLION IN 2022, MAINLY DUE TO PERSISTING RISING

INTEREST RATES.

- IN 2023 WE INVESTED €11.8 MILLION, OF WHICH €4.6 MILLION IN

RETAIL EXPANSION AND €7.2 MILLION TO UPGRADE PRODUCTION FACILITIES,

IN ADDITION TO THE ABOVE-MENTIONED RESTRUCTURING ONE-OFF

COSTS.

- AS OF DECEMBER 31, 2023, WE HELD €33.6 MILLION IN CASH,

COMPARED TO €37.1 MILLION OF CASH AS OF SEPTEMBER 30,

2023.

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the fourth quarter and full year ended December 31,

2023.

Pasquale Natuzzi, Chairman of the Group, commented: “Market

conditions for the furniture industry have remained challenging

during 2023. It's evident that the furniture industry faced

extraordinary conditions in 2023, with major markets experiencing a

significant slowdown in demand, following two consecutive strong

years post-COVID. In this context, we continued investing to

complete the transition to a lifestyle brand, with direct access to

consumers through retail. This is a process I initiated about 20

years ago, which represented a profound transformation of the Group

I founded 65 years ago as a manufacturing company, focused on the

value segment of the market. Being globally recognized as a Brand

in the high-end segment of the market and delivering a superior

in-store customer experience has been a long journey that forced us

to review our processes, competences, and industrial capabilities.

I am now witnessing the progress of this hard work, which, in the

current market conditions, is even more important to competing and

reaffirming our leadership. Our team has been working with

determination also to evolve our production and increase our

operational agility, dealing with the industrial legacy of our

origins. Drawing from my 65 years of experience, in times such as

these, it's imperative to persevere in investment to strengthen our

commercial core assets while pursuing restructuring initiatives;

this is the agenda our management has been focusing on in

2023.”

Antonio Achille, CEO of the Group, commented: “2023 has clearly

been a challenging year for the overall industry. In the main

markets of our operations, North America, China and Europe, the

real estate, which is a primary source of new demand, has been

stagnant, because of the negative economic situation and high

interest rates. Consumers remained very prudent when it comes to

invest in durable products. This has been reflected on our

business, with a decrease in sales.

In this context, we continue working and investing in the two

fundamentals pillars for our transformation: completing the

transition to a brand-life style and restructure our

operations.

On the commercial front, Natuzzi today has completed the

transition to a brand / retail group. 92.2% of our sales comes from

Branded and 61.7% comes from retail. These percentage were

respectively 85.3% and 52.2% at the beginning of 2021.

In 2023, with an acceleration in the last quarter, we have

invested significantly to increase the control of our global retail

and commercial operations. This has led to two initiatives,

respectively aimed at improving the retail and the other at

managing our galleries and wholesales business.

To improve retail performance, we have established the

Global Retail Division under the leadership of Diego Babbo,

a manager with more than 20 years’ experience in Retail.

This division is dedicated to modernizing and professionalizing

our retail approach by developing tools to support our Regions and

Dealers in enhancing the retail performances and elevate the

in-store customer experience. We have standardized all retail

related KPIs to accelerate the diagnosis of areas requiring

immediate intervention to foster organic growth. Leveraging the

experience we have matured in our direct stores, we now offer our

franchising partners turn-key retail programs, which include IT

systems, training, and guidelines on store layout, merchandising,

and visuals. To improve the productivity of our DOS and Franchise

partners we closed the tail of not performing stores.

On the wholesale front, we introduced the Natuzzi

Commercial Excellence Program. This program allows us to assign

specific targets to each business account and drive commercial

priorities for each of our 304 employees in the global commercial

team. This constitutes a significant change in our way of working,

which enables us to centrally manage and control the activities of

our field force and independent dealers globally. In our search to

become a consumer centric company, we introduced a Consumer CRM to

maintain a constant dialogue between our stores and clients,

serving also to increase loyalty and incentivize product

repurchase.

As a results of these investments and actions taken over the

last 12 months, the control on our retail and wholesale business is

now significantly stronger and we are confident that this will

allow us to accelerate organic growth.

In 2023, despite the negative market conditions, based on the

confidence of our brand and retail project, we opened 9 DOS, of

which 6 in North America, namely in San Diego, Houston, Miami,

Atlanta, Frisco. One notable new opening is the flagship in

Manhasset situated in one of the most performing streets in Long

Island. In addition, we opened 3 DOS managed by our JV in

China.

Today Natuzzi has 678 stores (DOS and FOS) around the world and

665 branded galleries. This constitutes a significant platform for

organic growth and a distinctive competitive advantage. Among the

100 markets where we distribute our products, we have identified 3

strategic regions where to prioritize our future investment, namely

the US, China, and Europe, with a focus on the UK and Italy. Let me

provide an update on each of these three markets.

In US, we opened 6 DOS, 1 FOS and 7 Natuzzi galleries. We

reviewed the leadership organization to ensure focus on the two

main components of our business: Lou Mossotti has been recently

appointed to lead the retail, with Scott Kruger focusing on the

development of our gallery and our wholesale business. We also

strengthen our commercial team in the US, with the introduction of

14 new agents, reaching the total of 24 agents.

Out of the 678 stores, 346 stores are located in China,

of which 97 Natuzzi Italia and 249 Natuzzi Editions. We do not

consolidate our China stores as they are part of our 49% stake in

the joint venture (JV) we established in 2018. In 2023, we made

significant investments to align the JV team with our modern retail

approach and to ensure visibility into the JV's performance at a

granular level within our IT system. This allows us to support the

local JV team in enhancing performance through strategic choices in

stores layout, merchandising, branding, and customer

experience.

Europe has been mostly exposed to the negative consumer

dynamics in 2023. In UK, which is our largest market in Europe, we

are working to reduce our presence in multi-brand distributors to

focus and favor the performance of the 30 mono-brand stores, of

which 13 Natuzzi Italia and 17 Natuzzi Editions. In Italy, we

operate 78 stores, 12 of which are Directly Operated Stores (DOS),

distributing our Natuzzi Editions collection under the historical

local banner Divani & Divani by Natuzzi. We are working to

elevate the positioning of our brand by leveraging the distinctive

assets of our Group and collections, in contrast to local

competitors who rely heavily on aggressive promotion and

communication.

On the restructuring front, we continued addressing the

industrial legacy of the group, particularly in Italy, as we

transition into a lifestyle brand with our brands positioned in the

high/medium price segments of the market. This legacy includes

large manufacturing facilities established during a time when

Natuzzi had a significant output, producing across various price

ranges and acting as a third-party producer. In 2023, we

accelerated our restructuring, with €7.4 million one-off costs to

reduce the workforce by 514 people. This resulted in a total

reduction of 759 workers from 2021 to 2023, of which 266 workers

from Italian factories and HQ. This, in total, represents a

reduction of 17.5%, leading to €22.6 million in annual savings

compared to 2021.

We executed the staff restructuring, in compliance with our

ethics standards and with the labor regulations of the different

markets which are particularly restrictive in some geographic areas

we operate, chiefly in Italy. In doing so, we always ensure that

this operations have a break-even of 12-16 months and we measure

their NPV on the mid-term.

Following is a recap of the number of people involved in

restructuring at Group level in the three-year period 2021-2023,

the related costs and expected savings.

2021

2022

2023

Total

People involved in restructuring

(units)

91

154

514

759

Restructuring cost (€/mln)

1.0

2.6

7.4

11.0

Yearly saving -labor costs only-

(€/mln)

3.6

5.7

13.3

22.6

€/mln

At the same time, we have invested to introduce the competences

which are needed to ensure the success of our brand retail business

which include marketing, retail, merchandising, finance and IT, to

better support growth activities and the digital transformation of

the Company.

***

4Q 2023 CONSOLIDATED REVENUE

4Q 2023 consolidated revenue amounted to €84.1 million, from

€116.5 million in 4Q 2022. 4Q 2023 were affected by the persisting

macroeconomic and industry-specific challenges, resulting in a

reduced consumers’ spending capacity and postponement of durable

purchases. Furthermore, 4Q 2023 compares with a strong 4Q 2022 that

benefitted from a €16.9 million reduction in post-COVID

backlog.

Excluding “other sales” of €2.4 million, 4Q 2023 invoiced sales

from upholstered and other home furnishings products amounted to

€81.7 million, compared to €113.4 million in 4Q 2022.

Revenues from upholstered and other home furnishings products

are hereafter described according to the main dimensions of the

Group’s business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with Natuzzi Italia,

Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brand strategy:

i) Natuzzi Italia, our

luxury furniture brand, offers products entirely designed and

manufactured in Italy and targets an affluent and more

sophisticated global consumer with a highly inspirational

collection that is largely the same across all our global stores to

best represent our Brand. Natuzzi Italia products are almost

exclusively sold in mono-brand stores (directly operated or

franchises).

ii) Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania and Brazil).

Natuzzi Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi, which is manufactured in Italy to

shorten the lead time to serve the Italian market where the brand

is distributed. The store merchandising of Natuzzi Editions,

starting from a common collection, is tailored to best fit the

opportunities of each market. The Natuzzi Editions products are

sold primarily through galleries and selected mono-brand franchise

stores.

In 4Q 2023, Natuzzi’s branded invoiced sales amounted to €75.3

million, compared to €103.9 million in 4Q 2022. In the context of

declining consumer spending and postponement of durable purchase,

Natuzzi Italia has been affected strongly given its premium

positioning versus Natuzzi Editions.

The following is the contribution of each Brand to 4Q 2023

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €26.6 million,

from €51.8 million in 4Q 2022. As anticipated, in the current

generalized context of declining consumer spending and postponement

of durable purchase, Natuzzi Italia has been strongly affected

given its premium positioning. In addition, 4Q 2023 compares to a

strong 4Q 2022, which benefitted from about €8 million of backlog

reduction. In China, sales continued to be affected by the

overstock and negative economic and industry-specific momentum

reported by our JV in China, whereas Europe still struggles with a

difficult macroeconomic context and geopolitical instability.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €48.7 million,

from €52.1 million in 4Q 2022. Specifically, while the

Divani&Divani by Natuzzi sales were affected by a more

aggressive competitive arena in Italy, Natuzzi Editions sales were

flat compared to 4Q 2022, thanks to the 6 Natuzzi Editions stores

opened in the US between the second part of 2022 and 2023, whose

overall productivity increased in 4Q 2023, offsetting the weak

performance in other regions.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €6.4 million in 4Q 2023, from €9.5 million in

4Q 2022. The Company’s strategy is to focus on selected large

accounts and serve them with a more efficient go-to-market

model.

B. Key Markets

Below is a breakdown of 4Q 2023 upholstery and home-furnishings

invoiced sales compared to 4Q 2022, according to the following

geographic areas.

4Q 2023

4Q 2022

Delta €

Delta %

North America

25.9

30.6

(4.7)

(15.4%)

Greater China

7.1

10.5

(3.4)

(32.1%)

West & South Europe

24.5

41.1

(16.6)

(40.4%)

Emerging Markets

11.8

16.6

(4.9)

(29.2%)

Rest of the World*

12.4

14.6

(2.1)

(14.6%)

Total

81.7

113.4

(31.7)

(27.9%)

Figures in €/million, except

percentage.

*Include South and Central America, Rest

of APAC.

The performance of invoiced sales in North America was curbed

mainly by the weak performance of the wholesale channel, as

distributors continue to be focused on reducing their stock rather

than placing new orders.

In Greater China, the furniture industry continues to face

persistent challenges, driven by a more prudent consumers’

willingness to invest in durables and the difficulties of the real

estate market. Additionally, the joint venture is actively working

to reduce the inventory of Natuzzi Italia products accumulated

during 2022, thus leading to a reduced level in new orders. In

China, we are stabilizing the organizational structure with the aim

to improve the performances as well as focusing on the upgrade of

the store concepts to provide a more comprehensive store

experience. Lastly, we are harmonizing the merchandising offer to

better represent the Natuzzi DNA while addressing the customers’

local taste.

C. Distribution

During 2023, the Group distributed its branded collections in

110 countries, according to the following table.

Direct Retail

FOS

Total retail stores as

of

Dec. 31, 2023

North America

21

(1)

8

29

West & South Europe

33

101

134

Greater China

21

(2)

325

346

Emerging Markets

─

75

75

Rest of the World

4

90

94

Total

79

599

678

In an effort to continuously improve the productivity of our DOS

and Franchise partners we closed the tail of not performing

stores.

The Group also sells its branded products by means of 665 points

of sales located in five continents, encompassing mostly

shop-in-shop galleries (including 12 Natuzzi Concessions, i.e.,

store-in-store points of sale directly managed by the Mexican

subsidiary of the Group).

(1) Included 3 DOS in the U.S. managed in joint venture with a

local partner. As the Natuzzi Group does not exert full control in

each of these DOS, we consolidate only the sell-in from such DOS.

(2) All directly operated by our joint venture in China. As the

Natuzzi Group owns a 49% stake in the joint venture and does not

control it, we consolidate only the sell-in from such DOS. FOS =

Franchise stores managed by independent partners.

During 4Q 2023, Group’s invoiced sales from direct retail, DOS

and Concessions directly operated by the Group, amounted to €19.2

million, compared to €22.2 million in 4Q 2022.

In 4Q 2023, invoiced sales from franchise stores amounted to

€31.3 million, compared to €46.6 million in 4Q 2022.

We continue executing our strategy to evolve into a

Brand/Retailer and improve the quality of our distribution network.

The weight of the invoiced sales generated by the retail network

(Direct retail and Franchise Operated Stores, or FOS) on total

upholstered and home furnishings business in 4Q 2023 was 61.7%

compared to 60.7% in 4Q 2022 and 51.5% in 4Q 2019.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 4Q 2023, invoiced sales from the wholesale channel amounted

to €31.3 million, compared to €44.6 million in 4Q 2022 and €46.4

million in 4Q 2019.

4Q 2023 GROSS MARGIN

During 4Q 2023, net of restructuring costs, we had a gross

margin of 36.2%.

The decrease in sales between 4Q 2023 and 4Q 2022 resulted in a

higher incidence of fixed costs on sales, which has been partially

offset by increased efficiency in the average consumption of raw

materials, improved brand and channel mix, as well as pricing

discipline.

Indeed, 4Q 2023 cost of labor included €5.1 of one-off

extraordinary costs connected to the reduction plan of workers,

especially within the Italian factories.

The application of the related accounting principle imposed us

to accrue the overall restructuring cost as soon as the

corresponding liability arises, the majority of which occurred in

the fourth quarter of 2023, while all the benefits will be

reflected starting from 2024.

We will continue to go in this direction, as the increase in the

Group’s flexibility to enhance gross margin is among our top

priorities of our plans.

4Q 2023 OPERATING EXPENSES

During 4Q 2023 we have reduced the operating expenses (which

include selling expenses, administrative expenses, other operating

income/expenses, and the impairment of trade receivables) by €8.7

million, passing from (€41.3) million in 4Q 2022 to (€32.6) million

in 4Q 2023.

While the Company is focused on decreasing those discretionary

costs that are not directly connected to sales, the limited

turnover reported in the quarter have hindered its ability to

effectively absorb fixed costs. Consequently, this has led to an

increase in the percentage weight of the overall operating expenses

in relation to revenue.

Specifically, the overall €8.7 million reduction is mainly due

to the following: ─ a €8.4 million reduction in transportation

costs, as result of renegotiation of transportation rates and lower

volume delivered; ─ a €1.2 million reduction in custom duties due

to fewer products manufactured in Asia.

Such reduction in costs was partially offset by: ─ a €0.7

million increase due to one-off costs in connection to the staff

reduction plan at the HQ in Italy, and ─ a €0.2 million increase in

amortization following the DOS openings in 2023.

The Company will continue to focus on reducing selling and

administrative expenses also in 2024, by renegotiating contracts

with suppliers, reviewing its staff allocation at retail level, and

by reviewing its overall processes, looking for further

efficiency.

4Q 2023 NET FINANCE INCOME/(COSTS)

During 4Q 2023, the Company accounted for (€2.8) million of Net

Finance costs compared to Net Finance costs of (€4.8) million in 4Q

2022. Rising interest rates continue to adversely impact our

results principally in terms of increased interest expense of

rental contracts as well as third-party financing, notwithstanding

the outstanding bank debt in the quarter on average decreased

compared to 4Q 2022.

KEY RESULTS: FULL YEAR 2023

During 2023, the Company reported the following results: ─ Total

revenue of €328.6 million, compared to €468.5 million in 2022. ─ We

had a gross margin of 34.3%, from 35.1% and 29.7% reported in 2022

and 2019, respectively. 2023 gross margin also includes (€6.3)

million of restructuring costs connected to the overall reduction

plan of workers at Group level. ─ Depreciation and amortization for

the period, which also include the depreciation charge of

right-of-use assets related to the operating leases and accounted

for in the cost of sales, selling and administrative expenses,

amounted to €22.4 million in 2023, compared to €21.7 million and

€25.1 million in 2022 and 2019, respectively. ─ We had an operating

loss of (€9.5) million, compared to an operating profit of €8.5

million in 2022 and an operating loss of (€22.5) million in 2019.

2023 operating loss of (€9.5) million includes (€7.4) million of

extraordinary costs to reduce the number of workforce, and

specifically:

- within the cost of sales, the above-mentioned (€6.3) million of

labor-related restructuring costs;

- within selling and administrative expenses, a (€1.1) million of

labor-related restructuring costs in connection to the reduction

plan of employees in Italy.

─ Net Finance costs were (€8.5) million, mainly as a result of

rising interest rates, compared to Net Finance costs of (€5.2)

million in 2022 and net finance costs of (€9.9) million in 2019. ─

We had a loss after tax for the period of (€16.2) million, which

compares to a profit after tax of €1.3 million in 2022 and to a

loss after tax of (€33.7) million in 2019.

BALANCE SHEET AND CASH FLOW

During 2023, €3.2 million of net cash were provided by operating

activities as a result of: ─ a loss for the period of (€16.2)

million; ─ adjustments for non-monetary items of €26.9 million, of

which depreciation and amortization of €22.4 million; ─ a €0.7

positive contribution from working capital change, mainly as a

result of a €8.0 million decrease in the inventory level, a €9.8

million decrease in trade receivables and other assets, partially

offset by a (€11.2) million decrease in trade payables and other

liabilities, and (€4.4) million for payments connected to the

reduction of workforce; ─ interest and taxes paid for (€8.3)

million.

During 2023, (€7.9) million of cash were used in investing

activities, as a result of (€11.8) million of net capital

expenditure partially offset by €3.0 million collected from our JV

in China at the beginning of the year following the share capital

reduction, and a €0.9 million of public grant received by the

Italian Government in connection with the modernization plan of the

Italian factories.

In the same period, (€15.7) million of cash were used in

financing activities, mainly due to the repayment of long-term

borrowing for (€8.7) million, (€6.7) million for short-term

borrowing repayment and (€11.1) million for lease-related payments,

partially offset by the €10.9 million of new financing, namely €6.4

million as subsidized loans in connection with a program of public

incentives aimed at upgrading the Italian plants and €4.5 in favor

of our Romanian subsidiary.

As a result, as of December 31, 2023, cash and cash equivalents

was €33.6 million.

As of December 31, 2023, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€6.6) million,

compared to €7.9 million as of December 31, 2022.

*******

CONFERENCE CALL

The Company will host a conference call on Monday April 8,

2024, at 10:00 a.m. U.S. Eastern time (4.00 p.m. Italy time, or

3.00 p.m. UK time) to discuss financial information.

To join live the conference call, interested persons will need

to either:

- dial-in the following number: Toll/International: +

1-412-717-9633, then passcode 39252103#, or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have option to listen via phone after

registering to the link.

*******

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the fourth quarter of 2023 and 2022

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

Fourth quarter ended on

Change Percentage of revenue 31-Dec-23

31-Dec-22 % 31-Dec-23

31-Dec-22 Revenue

84.1

116.5

-27.8

%

100.0

%

100.0

%

Cost of Sales

(58.8

)

(73.4

)

-19.9

%

-69.9

%

-63.0

%

Gross profit

25.4

43.1

-41.2

%

30.1

%

37.0

%

Gross profit, net of restructuring

30.5

45.2

-32.5

%

36.2

%

38.8

%

Other income

1.1

1.7

1.3

%

1.5

%

Selling expenses

(23.2

)

(32.1

)

-27.9

%

-27.5

%

-27.6

%

Administrative expenses

(10.4

)

(9.5

)

8.6

%

-12.3

%

-8.2

%

Impairment on trade receivables

0.1

(0.0

)

0.1

%

0.0

%

Other expenses

(0.3

)

(1.4

)

-0.3

%

-1.2

%

Operating profit/(loss)

(7.3

)

1.8

-8.6

%

1.5

%

Operating profit/(loss), net of restructuring

(1.4

)

4.2

-1.6

%

3.6

%

Finance income

0.2

0.2

0.3

%

0.2

%

Finance costs

(2.6

)

(2.7

)

-3.1

%

-2.3

%

Net exchange rate gains/(losses)

(0.4

)

(2.4

)

-0.5

%

-2.0

%

Net finance income/(costs)

(2.8

)

(4.8

)

-3.4

%

-4.1

%

Share of profit/(loss) of equity-method investees

0.5

(1.6

)

0.6

%

-1.4

%

Profit/(Loss) before tax

(9.6

)

(4.6

)

-11.4

%

-4.0

%

Income tax expense/(benefit)

(0.2

)

(0.6

)

-0.3

%

-0.5

%

Profit/(Loss) for the period

(9.8

)

(5.3

)

-11.6

%

-4.5

%

Profit/(Loss) attributable to: Owners of the Company

(9.8

)

(6.0

)

Non-controlling interests

(0.0

)

0.7

Natuzzi S.p.A. and

Subsidiaries Unaudited consolidated statement of profit or loss

for the twelve months of 2023 and 2022 on the basis of IFRS-IAS

(expressed in millions Euro, except as otherwise indicated)

Twelve months ended on Change Percentage of

revenue 31-Dec-23 31-Dec-22 %

31-Dec-23 31-Dec-22 Revenue

328.6

468.5

-29.9

%

100.0

%

100.0

%

Cost of Sales

(215.8

)

(304.2

)

-29.1

%

-65.7

%

-64.9

%

Gross profit

112.9

164.3

-31.3

%

34.3

%

35.1

%

Gross profit, net of restructuring

119.2

166.6

-28.4

%

36.3

%

35.6

%

Other income

7.1

6.5

2.2

%

1.4

%

Selling expenses

(91.4

)

(124.9

)

-26.9

%

-27.8

%

-26.7

%

Administrative expenses

(37.6

)

(35.5

)

6.0

%

-11.4

%

-7.6

%

Impairment on trade receivables

(0.0

)

(0.3

)

0.0

%

-0.1

%

Other expenses

(0.5

)

(1.7

)

-0.1

%

-0.4

%

Operating profit/(loss)

(9.5

)

8.5

-2.9

%

1.8

%

Operating profit/(loss), net of restructuring

(2.1

)

11.0

-0.6

%

2.4

%

Finance income

0.9

0.9

0.3

%

0.2

%

Finance costs

(9.3

)

(8.5

)

-2.8

%

-1.8

%

Net exchange rate gains/(losses)

(0.1

)

2.4

0.0

%

0.5

%

Net finance income/(costs)

(8.5

)

(5.2

)

-2.6

%

-1.1

%

Share of profit/(loss) of equity-method investees

2.9

0.4

0.9

%

0.1

%

Profit/(Loss) before tax

(15.1

)

3.6

-4.6

%

0.8

%

Income tax expense

(1.1

)

(2.3

)

-0.3

%

-0.5

%

Profit/(Loss) for the period

(16.2

)

1.3

-4.9

%

0.3

%

Profit/(Loss) attributable to: Owners of the Company

(16.1

)

(0.5

)

Non-controlling interests

(0.1

)

1.8

Natuzzi S.p.A. and

Subsidiaries Unaudited consolidated statements of financial

position (condensed)on the basis of IFRS-IAS(Expressed in millions

of Euro)

31-Dec-23

31-Dec-22

ASSETS Non-current assets

188.6

177.6

Current assets

149.7

191.0

TOTAL ASSETS

338.3

368.6

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

68.9

87.9

Non-controlling interests

4.3

4.7

Non-current liabilities

110.4

95.3

Current liabilities

154.7

180.8

TOTAL EQUITY AND LIABILITIES

338.3

368.6

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

31-Dec-23 31-Dec-22 Net cash provided

by (used in) operating activities

3.2

18.7

Net cash provided by (used in) investing activities

(7.9

)

(4.6

)

Net cash provided by (used in) financing activities

(15.7

)

(13.5

)

Increase (decrease) in cash and cash equivalents

(20.4

)

0.5

Cash and cash equivalents, beginning of the year

52.7

52.2

Effect of movements in exchange rates on cash held

(0.8

)

(0.1

)

Cash and cash equivalents, end of the period

31.6

52.7

For the purpose of the statements of cash flow, cash and

cash equivalents comprise the following: (Expressed in millions

of Euro)

31-Dec-23 31-Dec-22 Cash and cash

equivalents in the statement of financial position

33.6

54.5

Bank overdrafts repayable on demand

(2.0

)

(1.8

)

Cash and cash equivalents in the statement of cash flows

31.6

52.7

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve risks

and uncertainties that could cause the Company’s actual results to

differ materially from those stated or implied by such

forward-looking statements including, but not limited to, potential

risks and uncertainties described at page 3 of this document

relating to the supply-chain, the cost and availability of raw

material, production and shipping and the modernization of our

Italian manufacturing and those relating to the duration, severity

and geographic spread of the COVID-19 pandemic, actions that may be

taken by governmental authorities to contain the COVID-19 pandemic

or to mitigate its impact, the potential negative impact of

COVID-19 on the global economy, consumer demand and our supply

chain, and the impact of COVID-19 on the Company's financial

condition, business operations and liquidity, as well as the

geopolitical tensions and market uncertainties resulting, among the

others, from the Russian invasion of Ukraine and current conflict

and the recent conflict in the Middle East. Additional information

about potential factors that could affect the Company’s business

and financial results is included in the Company’s filings with the

U.S. Securities and Exchange Commission, including the Company’s

most recent Annual Report on Form 20-F. The Company undertakes no

obligation to update any of the forward-looking statements after

the date of this press release.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. With a global retail network of 678

monobrand stores in addition to 665 galleries as of December 31,

2023, Natuzzi distributes its collections worldwide. Natuzzi

products embed the finest spirit of Italian design and the unique

craftmanship details of the “Made in Italy”, where a predominant

part of its production takes place. Natuzzi has been listed on the

New York Stock Exchange since May 13, 1993. Always committed to

social responsibility and environmental sustainability, Natuzzi

S.p.A. is ISO 9001 and 14001 certified (Quality and Environment),

ISO 45001 certified (Safety on the Workplace) and FSC® Chain of

Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240405801047/en/

For information: Natuzzi

Investor Relations Piero Direnzo | tel. +39 080-8820-812 |

pdirenzo@natuzzi.com Natuzzi Corporate Communication

Giancarlo Renna (Communication Manager) | tel. +39. 342.3412261 |

grenna@natuzzi.com Giacomo Ventolone (Press Office) | tel.

+39.335.7276939 | gventolone@natuzzi.com

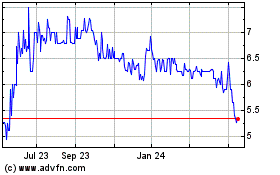

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

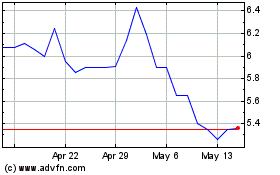

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024