SECOND QUARTER 2023

HIGHLIGHTS

- OVERALL 2Q 2023 INVOICED SALES AMOUNTED TO €83.5 MILLION, A

DECREASE OF 28.5% VERSUS 2Q 2022, AND OF 9.4% VERSUS 2Q 2019, AS A

RESULT OF PERDURING MACROECONOMIC HEADWINDS AFFECTING THE

FURNISHINGS INDUSTRY. 2Q 2023 BRANDED INVOICED SALES, WHILE BEING

BELOW 2Q 2022, ARE UP 4.7% VS 2Q 2019.

- IMPROVED GROSS MARGIN AT 36.4% ON REVENUE, COMPARED TO 31.4%

IN 2Q 2022 AND 27.9% IN 2Q 2019. THE INCREASE IN GROSS MARGIN STEMS

FROM THE ADVANTAGES GAINED THROUGH IMPROVED PRICE DISCIPLINE AND

BETTER COST MANAGEMENT, WHICH HAVE OFFSET THE NEGATIVE IMPACT OF

REDUCED SALES VOLUME ON INDUSTRIAL PRODUCTION COSTS.

- IN THE SECOND QUARTER OF 2023, WE ACHIEVED OPERATING

BREAKEVEN. THIS COMPARES WITH AN OPERATING PROFIT OF €1.1 MILLION,

FROM €116.9 MILLION SALES IN THE 2Q OF 2022, AND AN OPERATING LOSS

OF (€7.8) MILLION FROM €92.2 MILLION SALES IN THE 2Q OF

2019.

- AS OF JUNE 30, 2023, WE HELD €44.5 MILLION IN CASH, COMPARED

TO €54.5 MILLION AS OF DECEMBER 31, 2022. OPERATING ACTIVITIES

GENERATED €1.6 MILLION IN CASH WHICH WAS MORE THAN OFFSET BY €7.6

MILLION IN INVESTMENTS, PRIMARILY ALLOCATED TO UPGRADING OUR

ITALIAN FACTORIES (€5.3 MILLION) AND OPENING NEW DIRECT STORES

(€2.0 MILLION). ADDITIONALLY, €5.2 MILLION OF CASH WAS USED FOR

LEASE PAYMENTS.

- IN THE CURRENT MARKET CONTEXT, COST AND CAPITAL EFFICIENCY

ARE CRUCIAL. WE LAUNCHED A SET OF INITIATIVES TO REDUCE COSTS AND

IMPROVE WORKING CAPITAL DISCIPLINE.

- WE CONTINUE TO EXPECT THE OVERALL ECONOMY AND THE FURNISHING

SECTOR TO REMAIN CHALLENGING THROUGHOUT THE REST OF 2023 AND THE

BEGINNING OF NEXT YEAR, WITH A POTENTIAL NEGATIVE IMPACT ON OUR

BUSINESS. WE REMAIN CONFIDENT IN THE STRENGTH OF OUR BRANDS

AND IN THE COMPANY’S LONG-TERM GROWTH PLAN.

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the second quarter ended June 30, 2023.

Pasquale Natuzzi, Chairman of the Group, commented: “Our

industry globally continues to be negatively affected by consumers’

decision to postpone their purchasing, as a result of eroding

spending power and shift of spending in favor of travelling and

dining out. Real estate, which is a primary driver for the

furnishing market, has been negatively affected by high interest

rates. This has been one of the main causes of the weak store

traffic we have been witnessing for more than 15 months. I feel

reassured by the work our Group is doing to weather this adverse

market conditions, both on the commercial front, where we have

launched multiple initiatives to regain growth, and on

cost/efficiency front, where our team has intensified the effort to

mitigate the impact on our P&L of this negative sales trend.

Our Group also worked on the innovation process with the objective

of having “fewer and bolder” innovations, that are brought to the

market according to a new global launch process, which leverages

some of the best practices of the automotive and high-tech

industry. A clear example of this new way of approaching innovation

is the “Wellbe” launch, that will take place globally starting from

October. Wellbe is an innovative line of upholstery, which

leverages our unique craftsmanship knowhow, rooted in our DNA, of

combining functionality with aesthetic. We used these competences

to offer our customer a product which is completely innovative in

its technical content, as well in the way it will be presented to

the market. Wellbe is part of our Comfortness® philosophy, which

aspires to offer products with superior comfort and wellness to our

customers.”

Antonio Achille, CEO of the Group, commented: “It is evident

that business environment continues to be particularly challenging

for the furniture industry. The fact that most analysts are

comparing actual sales with data from 2019, speaks about the

extraordinary cycle that the furnishing market has experienced over

the past four years. This negative market cycle has not yet reached

a turning point, so it is crucial for us to remain highly focused

on actions that will enable us to navigate through this challenging

phase effectively. In this context, regaining growth is absolutely

the priority. We are focusing on organic growth. With nearly 700

stores, in addition to galleries, our absolute priority is to

improve like-for-like sales, starting from our direct stores.

Leveraging the experience on our direct stores, we progressively

strive to help our franchisee partners, both operating standalone

stores and galleries, to increase their sales by providing them

with turn-key IT systems, training and clear guidelines on store

layout, merchandising and visual. Natuzzi has accelerated this

process, also thanks to the newly introduced Global Retail

Division, which has been created early this year and that has

reported significant progresses in terms of creating impact across

geographies.

To support this process, we have strengthened our marketing

team, with the introduction of Mr. Daniele Tranchini, who will be

responsible for the communication strategy and its deployment for

all our brands. Daniele brings more than 30 years of experience

with international marketing agencies, where he held leadership

positions, including J. Walter Thompson and Publicis where he

successfully acted as CEO for the Italian business, and Leo

Burnett-Italy, where he covered the role of Managing Director. We

are convinced that Daniele will bring the right energy and

expertise to boost our marketing and communications activities.

At the same time, we should not, as the saying goes, “waste a

crisis” and we should use this phase of adverse market conditions

to reduce costs and streamline our operations. Our strategic

objective is to optimize our “back of the house” increasing the

efficiency of our staff services and operations, so that, when, as

I am sure, we regain growth momentum, we will be poised to attain

significantly higher margins and return on investments compared to

the pre-Covid.

We have therefore launched specific actions to reduce costs and

improve working capital, with the objective of increasing cash

conversion. As part of this initiative, we are working to optimize

our supply chain, starting by pruning the unnecessary complexity of

our collections which will enable us to cost and working capital

benefits. We are also directly tackling SG&A, where we aim for

a substantial transformation of our organization to become more

agile and cost effective, both in HQ and in the main Regions.

In terms of our industrial operations, the restructuring of our

Italian facilities is advancing in accordance with our long-term

strategy. Since 2021, we have reduced the Italian workforce by 153

individuals, with 103 of them being factory workers. This reduction

reflects a well-coordinated and socially responsible effort to

enhance efficiency by aligning our production capacity with our

mid-term sales plan. Taking into account also our international

operations, we saw a reduction of 577 personnel within the Group

during the same period, with 528 of them being factory workers.

Let’s talk about our priority markets, starting from China. The

removal of covid travel restrictions allowed us to be back in the

market to visit our stores and meet with JV management. We are

actively cooperating with the JV local team to improve the

performance of our retail with a better execution of store layout,

merchandising and visual. These improvements are essential to deal

with the negative dynamic of the furniture market in China, also

linked to the emerging real estate crisis, which is affecting our

JV sales since the beginning of the year.

U.S. is the other main strategic market. As mentioned in our

last press release, we've taken proactive measures to strengthen

our commercial organization while simultaneously enhancing the

quality and cost-effectiveness of our regional services. This

initiative commenced in March with the appointment of a seasoned

manager, Scott Kruger, to lead our wholesale and gallery

business.

We've now taken another significant step by focusing Jason Camp

on the management and growth of our Retail, covering both Natuzzi

Italia and Natuzzi Editions brands. Retail represents our top

priorities for growth in the region. To facilitate this

realignment, we've entrusted Ottavio Milano, a seasoned executive

with over 30 years of experience within the Group, with the role of

President. Ottavio will oversee our staff functions, including

finance, customer care, HR, and more, ensuring that Scott and Jason

can fully concentrate on the commercial development of their

respective businesses, supporting them in functional relations with

the headquarters. Ottavio has achieved remarkable success in

turning around the South and Central America operations, a role he

continues to excel in. We have great confidence that this

organizational set up will not only drive business improvement in

the region but also enhance our service to our valued customers

The new organization is enabling us to accelerate our retail

efforts. We are actively promoting the implementation of the retail

excellence program to enhance organic growth in our Directly

Operated Stores (DOS) and further expand our retail footprint.

Organic growth is our priority. We have done significant steps

in standardizing and sharing our best practices, starting from our

DOS and to be extended also to our franchise partners. These

practices include: a defined store layout to efficiently walk our

customers through our products communicating the brand values in

our retail journey; a training to provide our sales force with a

consistent level of passion and knowledge so to offer the best

retail experience to customers. We also have turbo-boosted a

specific initiative to grow the trade business with the architects

and designers community. We are harmonizing our product

presentation through clear visual guidelines in order to achieve a

product blend within the sales area of a store, aimed to maximize

sales and conversion rate. Lastly, we developed an advanced

reporting system with the aim to analyze performance details of

each individual store, in real time.

During the year, we continued to extend our network of stores,

with 7 new openings of which 6 Natuzzi Italia stores located in San

Diego, Miami, Fort Worth, Manhasset, Atlanta and Houston and 1

Natuzzi Editions in Frisco, Dallas, counting both 5 fully owned

stores, 1 store in JV and 1 franchise. The location and the quality

of the new stores have been significant upgraded to reflect the

elevated positioning of our Brands, chiefly Natuzzi Italia. The

Natuzzi Italia Manhasset store, which opened in last July,

represents a vivid example of this journey. Located in North Shore

of Long Island, it is positioned at the focal point of the

prestigious Miracle Mile, the gate of Long Island’s premiere

destination for luxury shopping. The store has a commercial surface

of nearly 1.000 square meters with a signature architecture which

brings perfectly to live our ultimate Natuzzi Italia store

concept.

On the gallery/wholesale front, we are strengthening our

commercial coverage, with the introduction of 15 new independent

agents, which are progressively integrated into our team. We plan

to increase such commercial presence by engaging at least 10

further agents in the following months.

**********

In conclusion, it's evident that the current situation is

unlikely to see a rapid improvement. Given these conditions, it's

crucial that we establish clear and shared priorities. Our

strategic direction is now more defined than ever: we aim to

nurture our brands, with a focus on organic growth and retail in

our core markets, all while diligently reducing costs and enhancing

the agility of our organization to boost margins.

Our team is exceptionally united and fully committed to the

action plan designed to protect our top-line and continually

improve cost efficiency. We maintain our confidence in the

potential of our brands and remain steadfast in pursuing the growth

objectives outlined in our mid-term plan."

**********

2Q 2023 CONSOLIDATED REVENUE

2Q 2023 consolidated revenue amounted to €83.5 million, from

€116.9 million in 2Q 2022, sustained by the high level of

post-COVID backlog, and from €92.2 million in 2Q 2019. 2Q 2023

consolidated revenue has been affected by the persisting

macroeconomic and industry-specific challenges that continue to

affect the consumers’ spending capacity.

Excluding “other sales” of €2.4 million, 2Q 2023 invoiced sales

from upholstered and other home furnishings products amounted to

€81.1 million, compared to €112.0 million in 2Q 2022 and €88.4

million in 2Q 2019.

Revenues from upholstered and other home furnishings products

are hereafter described according to the main dimensions of the

Group’s business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. Branded/Unbranded business

The Group operates in the branded business (with Natuzzi Italia,

Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brand strategy:

- Natuzzi Italia, our luxury

furniture brand, offers products entirely designed and manufactured

in Italy and targets an affluent and more sophisticated global

consumer with a highly inspirational collection that is largely the

same across all our global stores to best represent our Brand.

Natuzzi Italia products are almost exclusively sold in mono-brand

stores (directly operated or franchises).

- Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania, Brazil). Natuzzi

Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi. The store merchandising of Natuzzi

Editions, starting from a common collection, is tailored to best

fit the opportunities of each market. The Natuzzi Editions products

are sold primarily through galleries and selected mono-brand

franchise stores.

In 2Q 2023, Natuzzi’s branded invoiced sales amounted to €74.5

million, from €98.7 million in 2Q 2022 and €71.2 million in the

pre-pandemic 2Q 2019.

The following is the contribution of each Brand to 2Q 2023

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €31.0 million,

from €53.6 million in 2Q 2022 and €31.6 million in 2Q 2019, mainly

as a result of the impact of the overstock and negative industry

momentum reported by our JV in China, the gradual reduction of

inventory among wholesalers, especially in North America, as well

as the difficult macroeconomic context and geopolitical instability

that continue to affect Europe.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €43.5 million,

from €45.1 million in 2Q 2022, almost entirely due to the weak

performance in Europe, affected by the difficult macroeconomic

context and geopolitical instability, that more than offset the

overall positive performance in the remaining markets. 2Q 2023

invoiced sales increased from €39.6 million in 2Q 2019.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €6.6 million in 2Q 2023, from €13.3 million in

2022 and from €17.2 million 2019 same period. The Company’s

strategy is to focus on selected large accounts and serve them with

a more efficient go-to-market model.

B. Key Markets

Here below a breakdown of 2Q 2023 upholstery and

home-furnishings invoiced sales compared to 2Q 2022, according to

the following geographic areas.

2Q 2023

2Q 2022

Delta €

Delta %

North America

24.7

31.3

(6.6

)

(21.2

%)

Greater China

6.6

13.3

(6.7

)

(50.0

%)

West & South Europe

26.7

40.6

(13.9

)

(34.2

%)

Emerging Markets

11.3

13.1

(1.8

)

(13.7

%)

Rest of the World*

11.8

13.7

(1.9

)

(14.1

%)

Total

81.1

112.0

(30.9

)

(27.6

%)

Figures in €/million, except percentage *Include South and

Central America, Rest of APAC.

The performance of invoiced sales in North America was curbed by

the weak sales of the wholesale channel, both branded and

unbranded, as wholesale distributors continue to be mainly focused

on reducing their stock rather than placing new orders.

In China the furniture industry is suffering from a perduring

negative headwind, caused by a more prudent consumers’ willingness

to invest in durables and by the emerging crisis of the real estate

market. Furthermore, the joint venture is still actively reducing

the inventory of Natuzzi Italia products that had accumulated

during 2022.

West & South Europe Region continues to be affected by a

difficult economic scenario, high inflation as well as uncertainty

deriving from geopolitical instability.

C. Distribution

During the first six months of 2023, the Group distributed its

branded collections in 100 countries, according to the following

table.

Direct Retail

FOS

Galleries

Total as of

June 30, 2023

North America

18(1)

8

153

179

West & South Europe

33

100

127

260

Greater China

21(2)

349

─

370

Emerging Markets

─

75

129

204

Rest of the World

4

86

88(3)

178

Total

76

618

497

1,191

(1) Included 3 DOS in the U.S. managed in joint venture with a

local partner. As the Natuzzi Group does not exert full control in

each of these DOS, we consolidate only the sell-in from such DOS.

(2) All directly operated by our joint venture in China. As the

Natuzzi Group owns a 49% stake in the joint venture and does not

control it, we consolidate only the sell-in from such DOS. (3) It

includes 11 Natuzzi galleries (store-in-store points of sale)

directly managed by the Mexican subsidiary of the Group. FOS =

Franchise stores managed by independent partners.

During 2Q 2023, Group’s invoiced sales from direct retail, DOS

and Concessions directly managed by the Group, amounted to €18.8

million, from €22.0 million in 2Q 2022 and from €16.3 million in 2Q

2019.

In 2Q 2023, invoiced sales from franchise stores amounted to

€33.4 million, down from €46.6 million in 2Q 2022 and increasing

from €23.7 million in 2Q 2019.

We continue executing our strategy to evolve to a Brand/Retailer

and improve the quality of our distribution network. The weight of

the invoiced sales generated by the retail network (Direct retail

and Franchise Operated Stores, or FOS) on total upholstered and

home furnishings business in 2Q 2023 was 64.3% compared to 61.2% in

2Q 2022 and 45.2% in 2Q 2019.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 2Q 2023, invoiced sales from the wholesale channel amounted

to €28.9 million, compared to €43.5 million in 2Q 2022 and €48.4

million in 2Q 2019. Such decrease is mainly attributable to lower

sales from our large distributors in North America that are

focusing on reducing their stock, thus postponing orders for new

products.

2Q 2023 GROSS MARGIN

In 2Q 2023, we had a gross margin of 36.4%, compared to 31.4% in

2Q 2022 and 27.9% in 2Q 2019, mainly due to a better price

discipline, improved brand and channel mix, a decrease in the

average consumption of raw materials and energy cost, which have

offset the negative impact of reduced sales volume on industrial

production costs. Enhancing gross margin is one of our top

strategic priorities.

2Q 2023 OPERATING EXPENSES

During 2Q 2023, operating expenses (which include selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables) were (€30.4) million (or

36.4% on revenue), compared to (€35.6) million (or 30.5% on

revenue) in 2Q 2022.

The decrease in the operating expenses was largely due to the

reduction in transportation costs (equal to €6.6 million, or 7.9%

on revenue, in 2Q 2023, compared to €12.9 million, or 11.1% on

revenue, in 2Q 2022) as result of lower volume delivered and

decreasing transportation rates.

While the Company is focused on controlling discretionary costs,

the low delivered sales in the quarter has not allowed to

adequately absorb fixed costs, resulting in the increase of the

weight of the overall operating expenses on revenue.

2Q 2023 NET FINANCE INCOME/(COSTS)

During 2Q 2023, the Company accounted for (€0.8) million of Net

Finance costs compared to Net Finance costs of (€1.4) million in 2Q

2022.

Rising interest rates continue to adversely impact our results

principally in terms of increased interest expense of rental

contracts as well as third-party financing, notwithstanding the

bank debt outstanding in the quarter on average decreased compared

to 2Q 2022. Specifically, during the quarter, the Company reported

Finance costs of (€2.7) million compared to Finance costs of (€2.0)

million in 2Q 2022.

KEY RESULTS: FIRST HALF OF 2023

During the first half of 2023, the Company reported the

following results:

- Total revenue of €169.6 million, a decrease of 28.0% compared

to first half of 2022 and a decrease of 14.5% compared to the

pre-pandemic first half of 2019.

- We had a gross margin of 36.0%, compared to 32.8% and 29.1%

reported in 2022 and 2019 first half, respectively. Excluding

(€1.1) million of labor-related accrual following the incentive

plan for workers who terminate their employment relationship, both

in Italy and abroad, 2023 first half gross margin would have been

36.6%.

- Depreciation and amortization for the period, which include the

depreciation charge of right-of-use assets related to the operating

leases and accounted for in the cost of sales, selling and

administrative expenses, amounted to €10.9 million, compared to

€10.7 million and €11.5 million in the first half of 2022 and 2019,

respectively.

- We had an operating loss of (€0.9) million, compared to an

operating profit of €2.5 million in 2022 first half and an

operating loss of (€10.8) million in 2019 first half. 2023

operating loss of (€0.9) million includes (€1.7) million of

non-recurring accruals, namely an accrual of (€0.4) million in

connection with the Company’s Stock Option Plan (SOP), (€0.2)

million accounted for in the operating expenses as incentive to

reduce the number of Italian employees, in addition to the already

mentioned (€1.1) million of labor-related accrual accounted for in

the cost of sales.

- Net finance costs were (€4.2) million, mainly as a result of

Finance costs of (€4.8) million, due to rising interest rates. 2023

Net Finance costs of (€4.2) million compare to net finance costs of

(€2.0) million in 2022 first half and net finance costs of (€4.6)

million in 2019 first half.

- We had a loss after tax for the period of (€3.7) million, which

compares to a profit after tax of €0.7 million in 2022 first half

and to a loss after tax of (€15.2) million for the first half of

2019.

BALANCE SHEET AND CASH FLOW

During the first half of 2023, €1.6 million of net cash were

provided by operating activities as a result of:

- A loss for the period of (€3.7) million;

- adjustments for non-monetary items of €13.1 million, of which

depreciation and amortization of €10.9 million;

- a (€3.3) contribution from working capital change, mainly as a

result of the decrease in trade and other payables for (€15.8)

million, (€2.3) for payments connected to the reduction of

workforce, partially offset by lower inventories for €6.8 million

and lower trade receivables and other assets for €8.2 million;

- interest and taxes paid of (€4.5) million.

During the first six months of 2023, (€4.6) million of cash were

used in investing activities, as a result of (€7.6) million of

capital expenditure partially offset by €3.0 million collected from

our JV in China following the share capital reduction.

In the same period, (€5.9) million of cash were used in

financing activities, due to the repayment of long-term borrowing

for (€2.1) million, (€1.8) million for short-term borrowing

repayment and (€5.2) million for lease-related payments, partially

offset by a new long-term subsidized borrowings of €3.2 million

received in connection with a program of public incentives aimed at

upgrading the Italian plants.

As a result, as of June 30, 2023, cash and cash equivalents was

€44.5 million, compared to €54.5 million as of December 31,

2022.

As of June 30, 2023, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€0.3) million,

compared to €7.9 million as of December 31, 2022.

*******

CONFERENCE CALL

The Company will host a conference call to discuss financial

information on Monday October 2, 2023, at 10:00 a.m. U.S. Eastern

time (4.00 p.m. Italy time, or 3.00 p.m. UK time).

To join the live conference call, interested persons will need

to either:

- dial-in the following number: Toll/International:

+1-412-717-9633, then passcode 39252103#; or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have option to listen via phone after

registering to the link.

*******

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the second quarter of 2023 and 2022

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

Second quarter ended

on

Change

Percentage of revenue

30-Jun-23

30-Jun-22

%

30-Jun-23

30-Jun-22

Revenue

83.5

116.9

-28.5%

100.0

%

100.0

%

Cost of Sales

(53.1

)

(80.2

)

-33.7%

-63.6

%

-68.6

%

Gross profit

30.4

36.7

-17.2%

36.4

%

31.4

%

Other income

2.4

1.8

2.8

%

1.5

%

Selling expenses

(22.8

)

(28.7

)

-20.5%

-27.3

%

-24.5

%

Administrative expenses

(9.8

)

(8.6

)

14.4%

-11.8

%

-7.3

%

Impairment on trade receivables

(0.0

)

(0.1

)

0.0

%

-0.1

%

Other expenses

(0.1

)

(0.0

)

-0.1

%

0.0

%

Operating profit/(loss)

0.0

1.1

0.0

%

0.9

%

Finance income

0.2

0.0

0.3

%

0.0

%

Finance costs

(2.7

)

(2.0

)

-3.2

%

-1.7

%

Net exchange rate gains/(losses)

1.6

0.6

2.0

%

0.5

%

Net finance income/(costs)

(0.8

)

(1.4

)

-1.0

%

-1.2

%

Share of profit/(loss) of equity-method investees

0.8

(0.2

)

1.0

%

-0.2

%

Profit/(Loss) before tax

0.1

(0.5

)

0.1

%

-0.4

%

Income tax expense/(benefit)

(0.4

)

(0.1

)

-0.5

%

-0.1

%

Profit/(Loss) for the period

(0.4

)

(0.6

)

-0.4

%

-0.5

%

Profit/(Loss) attributable to: Owners of the Company

(0.3

)

(1.0

)

Non-controlling interests

(0.0

)

0.4

Natuzzi S.p.A. and Subsidiaries

Unaudited consolidated statement of profit or loss for the six

months of 2023 and 2022 on the basis of IFRS-IAS (expressed in

millions Euro, except as otherwise indicated)

Six months ended on

Change

Percentage of revenue

30-Jun-23

30-Jun-22

%

30-Jun-23

30-Jun-22

Revenue

169.6

235.4

-28.0%

100.0

%

100.0

%

Cost of Sales

(108.6

)

(158.1

)

-31.3%

-64.0

%

-67.2

%

Gross profit

61.0

77.3

-21.1%

36.0

%

32.8

%

Other income

3.6

2.8

2.1

%

1.2

%

Selling expenses

(46.6

)

(60.2

)

-22.6%

-27.5

%

-25.6

%

Administrative expenses

(18.7

)

(16.9

)

10.8%

-11.0

%

-7.2

%

Impairment on trade receivables

(0.1

)

(0.4

)

0.0

%

-0.2

%

Other expenses

(0.1

)

(0.1

)

-0.1

%

0.0

%

Operating profit/(loss)

(0.9

)

2.5

-0.5

%

1.1

%

Finance income

0.3

0.0

0.2

%

0.0

%

Finance costs

(4.8

)

(3.7

)

-2.8

%

-1.6

%

Net exchange rate gains/(losses)

0.2

1.7

0.1

%

0.7

%

Net finance income/(costs)

(4.2

)

(2.0

)

-2.5

%

-0.9

%

Share of profit/(loss) of equity-method investees

2.0

0.8

1.2

%

0.3

%

Profit/(Loss) before tax

(3.1

)

1.3

-1.9

%

0.6

%

Income tax expense

(0.5

)

(0.6

)

-0.3

%

-0.3

%

Profit/(Loss) for the period

(3.7

)

0.7

-2.2

%

0.3

%

Profit/(Loss) attributable to: Owners of the Company

(3.6

)

(0.0

)

Non-controlling interests

(0.1

)

0.7

Natuzzi S.p.A. and Subsidiaries

Unaudited consolidated statements of financial position

(condensed)on the basis of IFRS-IAS(Expressed in millions of

Euro)

30-Jun-23

31-Dec-22

ASSETS Non-current assets

180.0

177.6

Current assets

162.8

191.0

TOTAL ASSETS

342.8

368.6

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

81.8

87.9

Non-controlling interests

4.4

4.7

Non-current liabilities

99.9

95.3

Current liabilities

156.7

180.8

TOTAL EQUITY AND LIABILITIES

342.8

368.6

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

30-Jun-23

31-Dec-22

Net cash provided by (used in) operating activities

1.6

18.7

Net cash provided by (used in) investing activities

(4.6

)

(4.6

)

Net cash provided by (used in) financing activities

(5.9

)

(13.5

)

Increase (decrease) in cash and cash equivalents

(9.0

)

0.5

Cash and cash equivalents, beginning of the year

52.7

52.2

Effect of movements in exchange rates on cash held

(0.8

)

(0.1

)

Cash and cash equivalents, end of the period

43.0

52.7

For the purpose of the statements of cash flow,

cash and cash equivalents comprise the following: (Expressed in

millions of Euro)

30-Jun-23

31-Dec-22

Cash and cash equivalents in the statement of financial position

44.5

54.5

Bank overdrafts repayable on demand

(1.5

)

(1.8

)

Cash and cash equivalents in the statement of cash flows

43.0

52.7

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve risks

and uncertainties that could cause the Company’s actual results to

differ materially from those stated or implied by such

forward-looking statements including, but not limited to, potential

risks and uncertainties described at page 3 of this document

relating to the supply-chain, the cost and availability of raw

material, production and shipping and the modernization of our

Italian manufacturing and those relating to the duration, severity

and geographic spread of the COVID-19 pandemic, actions that may be

taken by governmental authorities to contain the COVID-19 pandemic

or to mitigate its impact, the potential negative impact of

COVID-19 on the global economy, consumer demand and our supply

chain, and the impact of COVID-19 on the Company's financial

condition, business operations and liquidity, as well as the

geopolitical tensions and market uncertainties resulting from the

Russian invasion of Ukraine and current conflict. Additional

information about potential factors that could affect the Company’s

business and financial results is included in the Company’s filings

with the U.S. Securities and Exchange Commission, including the

Company’s most recent Annual Report on Form 20-F. The Company

undertakes no obligation to update any of the forward-looking

statements after the date of this press release.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. With a global retail network of 694

mono-brand stores and 497 galleries as of June 30, 2023, Natuzzi

distributes its collections worldwide. Natuzzi products embed the

finest spirit of Italian design and the unique craftmanship details

of the “Made in Italy”, where a predominant part of its production

takes place. Natuzzi has been listed on the New York Stock Exchange

since May 13, 1993. Always committed to social responsibility and

environmental sustainability, Natuzzi S.p.A. is ISO 9001 and 14001

certified (Quality and Environment), ISO 45001 certified (Safety on

the Workplace) and FSC® Chain of Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230929880563/en/

Natuzzi Investor Relations Piero Direnzo | tel. +39

080-8820-812 | pdirenzo@natuzzi.com Natuzzi Corporate

Communication Giacomo Ventolone (Press Office) | tel.

+39.335.7276939 | gventolone@natuzzi.com

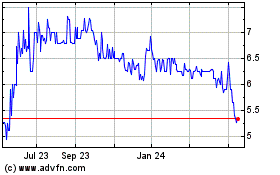

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

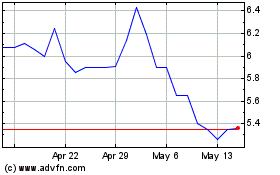

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024