First Quarter 2023

Highlights

- 1Q 2023 Invoiced Sales Amounted to €86.1 Million, a Decrease

of 27.4% Versus the 1Q 2022, Confirming the Headwinds of the Last

Part of 2022. 1Q 2022, Which Reported Double Digit Growth vs 1Q

2021, Was the Last Quarter of the 18-Month Expansionary Phase That

Started in the Aftermath of the COVID-19 Pandemic.

- Branded Sales Amounted to €77.5 Million, 21.6% Below 1Q

2022. Branded Sales Were 92.3% on Total Sales In 1Q 2023, Compared

to 86.8% in 1Q 2022.

- Gross Margin of 35.6%, Compared to 34.3% in 1Q 2022. Net of

the One-Off (€0.9) Million Accrual to Reduce Workforce Gross Margin

Would Have Been Equal To 36.6%. 1Q 2023 Gross Margin Compares to

30.1% in the Pre-Pandemic 1Q 2019.

- 1Q 2023 Operating Loss of (€0.9) Million Due to a Lower

Operating Leverage Partially Offset By a €7.6 Million Reduction in

the Operating Expenses. Net of the One-Off (€0.9) Million Accrual

to Reduce Workforce, Operations Would Break Even.

- Retail Expansion Continued in 1Q 2023 With 2 DOS Opened in

the U.S., 1 DOS in JV in the U.S. and 1 DOS in JV in China as Well

as 5 Additional FOS, of Which 3 in China, 1 in the U.S. and 1 in

Australia.

- Cash of €43.8 Million as of March 31, 2023, Compared to

€54.5 Million as of December 31, 2022.

- Headwinds From Challenging Business Conditions Continue to

Affect Store Traffic and Written Sales; This Might Adversely Impact

Our Operations in the Short-Term, While the Group Confirms Its

Long-Term Plans. We Are Focusing on Supporting Our Commercial Teams

to Regain Growth, While Working to Adapt Our Fix Cost

Structure.

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the first quarter ended March 31, 2023.

Pasquale Natuzzi, Chairman of the Group, commented: “Our sales

results are not at the level we aspire to as we continue to face

challenging market conditions and a more prudent approach by our

customers, resulting in a weaker store traffic and reduced orders

from large distributors. Globally our industry is transitioning

from the expansionary phase, started in 2021, which created growth

for the sector but also led to unprecedented over-stocking at the

different level of the distribution value chain. The perduring of

this economic scenario confirms the importance of the work that our

team is doing to ensure a tight control on discretionary costs

together with a more effective capital allocation. We are

confirming those investments which are pivotal for the execution of

our mid-term plan, chiefly to support retail new openings and our

factory modernization.”

Antonio Achille, CEO of the Group, commented: “The context in

which we are operating continues being challenging not only for the

global economy but specifically for our industry. Indeed, perduring

effects of the ongoing war in Ukraine, high inflation

notwithstanding record increases in interest rates by major central

banks, and stock market volatility continue to represent a drag to

consumer spending attitude for durables. In addition, and with

specific reference to the furnishings industry, high interest rates

have resulted in a freezing of the housing market, which is a

primary driver for furnishing new demand. The overstock is

gradually easing but is not solved yet and still represents a

burden for the introduction of new collections. Our mid-term plan,

which states that growth will come from Brand and Retail in core

markets, remains the compass for our commercial strategy and

investments.

In a context of softer demand, our attention to protect the

marginality of our business is very high.

Notwithstanding the lower delivered sales, we were able to

improve gross margin over last year first quarter and the

operations would have broken-even excluding the one-off (€0.9)

million accrual accounted for in the quarter to right-size our

workforce abroad. We intend to continue in this direction so to

free up resources that can be invested in business development.

The sales of the first quarter confirm a slow-down in two of our

main markets, the U.S. and China, where we are implementing a clear

action plan to revert the current business trend and to align

SG&A costs.

In North American, which is fundamental for the execution of our

long-term plan, we have implemented a profound reorganization of

our commercial structure by strengthening our wholesale team, with

the introduction of a new seasoned manager, Scott Kruger, and

increasing our commercial reach also with the activation of

independent agencies. At the same time, we have been empowering our

retail team with enhanced approaches and tools, developed by our

newly established Global Retail Division, so to improve the

like-for-like performance of the existing stores and create the

conditions for the planned retail expansion.

We are also putting an extra focus on the Chinese market, which

is a strategic region for our long-term growth plan. Our JV in

China, in which we have a 49% stake, is focusing its activities in

supporting local franchisee partners to improve the sale

performances and implementing with renewed rigor our dual-brand

strategy.

Across geographies we are taking a series of commercial actions

with the aim of creating a short-term impact. These actions

include: a global merchandise strategy, aiming at having a product

assortment in line with the potential and profile of each store; a

more comprehensive price architecture so to widen the price range

covered by our product collection and attract new potential

customers; a new and more impactful in-store communication so to

better engage the customer.

We are also accelerating the development of our contract

business with a dedicated organization so to leverage the strength

of our brands and our collections, as well as our R&D and

production. Natuzzi Italia is the primary focus for this global

opportunity. The newly established contract team has reported

encouraging initial wins both in residential and commercial

opportunities.

Despite the negative economics context, we remain focused on our

transformative journey to become a branded company, selling its

products mainly through retail. While year-to-date order flow is

below our expectation, it is worth highlighting that the branded

portion of the business is above the level of 2019. Furthermore,

year-to-date written sales generated by our brands continue to

increase their share on the overall business, 92% versus 90% one

year earlier and 76% in the pre-pandemic 2019 same period.

We keep on expanding our retail network to accelerate growth,

improve profitability and have a better control of the brand. Today

we can rely on 710 Natuzzi stores, of which 382 are located in

Greater China. During the first three months of the year, 3 new DOS

opened in the U.S., namely, 1 Natuzzi Italia store in Miami,

acquired from an historical franchisee, 1 Natuzzi Italia store in

San Diego, and 1 Natuzzi Editions in Frisco operated in joint

venture with a local partner. Furthermore, a new Natuzzi Italia

store, directly operated by our joint venture, opened in China.

Lastly, we added 5 new franchise Natuzzi stores to our existing

network, of which 3 in China, 1 in the U.S. and 1 in Australia.

We are progressing in actively seeking opportunities to sell

those assets, mainly in the U.S., that are no longer in line with

our strategic plans, and whose proceeds could be actively invested

to increase efficiency in our industrial operations and add more

DOS to our network.

Our long-term plan remains the same; however, we need to

recognize that for the industry the change of pace has been quite

evident, and therefore we remain extremely vigilant to ensure a

tight cost control and high financial discipline to navigate

through the current headwinds.”

**********

1Q 2023 CONSOLIDATED REVENUE

1Q 2023 consolidated revenue amounted to €86.1 million, from

€118.5 million in 1Q 2022 and from €106.2 million in 1Q 2019, as a

result of macroeconomic and industry-specific challenges.

Excluding “other sales” of €2.1 million, 1Q 2023 invoiced sales

from upholstered and other home furnishings products amounted to

€84.0 million, as compared to €113.8 million in 1Q 2022 and €101.1

million in 1Q 2019.

Revenue from upholstered and other home furnishings products are

hereafter described according to the main dimensions of the Group’s

business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. BRANDED/UNBRANDED BUSINESS

The Group operates in the branded business (with the Natuzzi

Italia, Natuzzi Editions and Divani&Divani by Natuzzi) and the

unbranded business, the latter with collections dedicated to

large-scale distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brand strategy:

i) Natuzzi Italia, our

luxury furniture brand, offers products entirely designed and

manufactured in Italy and targets an affluent and more

sophisticated global consumer with a highly inspirational

collection that is largely the same across all our global stores to

best represent our Brand. Natuzzi Italia products are almost

exclusively sold in mono-brand stores (directly operated or

franchises).

ii) Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania, Brazil). Natuzzi

Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi. The store merchandising of Natuzzi

Editions, starting from a common collection, is tailored to best

fit the opportunities of each market. The Natuzzi Editions products

are sold primarily through galleries and selected mono-brand

franchise stores.

In 1Q 2023, Natuzzi’s branded invoiced sales amounted to €77.5

million, from €98.9 million in 1Q2022 and the same level as in the

pre-pandemic 1Q 2019 (€77.5 million). During the quarter, the

branded portion of the business represented 92.3% of sales of

upholstered and other home furnishings products compared to 86.8%

in 1Q 2022 and 76.7% in 1Q 2019.

The following is the contribution of each Brand to 1Q 2023

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €31.6 million,

from €43.5 million in 1Q 2022 and €35.1 million in 1Q 2019, mainly

as a result of the impact of the overstock in China.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €45.9 million,

from €55.4 million in 1Q 2022, mainly due to the de-stocking

process, especially in North America and China. 1Q 2023 invoiced

sales increased from €42.4 million in 1Q 2019.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €6.5 million in 1Q 2023, from €15.0 million

and from €23.6 million in 2022 and 2019 first quarter,

respectively. The Company’s strategy is to focus on selected large

accounts and serve them with a more efficient go-to-market model.

In addition, the Company intends to increase the leverage of

industrial partnership with the outsourcer in Vietnam, in an effort

to recover market shares in this low-end segment of the market.

B. KEY MARKETS

Here below a breakdown of 1Q 2023 upholstery and

home-furnishings invoiced sales compared to 1Q 2022, according to

the following geographic areas.

1Q 2023

1Q 2022

Delta €

Delta %

North America

23.3

35.0

(11.7

)

(33.4

%)

Greater China

4.4

14.7

(10.3

)

(69.9

%)

West & South Europe

32.4

36.8

(4.4

)

(12.1

%)

Emerging Markets

13.2

13.1

0.1

0.5

%

Rest of the World*

10.7

14.2

(3.5

)

(24.7

%)

Total

84.0

113.8

(29.9

)

(26.2

%)

Figures in €/million, except percentage

*Include South and Central America, Rest of APAC.

The performance of invoiced sales in the North America was

curbed by the weak sales of the wholesale channel, both branded and

unbranded, as wholesale distributors continue to be mainly focused

on reducing their stock rather than placing new orders.

As for the Chinese market, the level of sales reflects a more

focus of our joint venture in selling stocked products accumulated

in 2022 as a result of the low traffic in our points of sales

caused by the perduring level of contagions in the region for most

of last year.

C. DISTRIBUTION

During the first three months of 2023, the Group distributed its

branded collections in 91 countries, according to the following

table.

Direct Retail

FOS

Galleries

Total as of March 31,

2023

North America

18(1)

7

151

176

West & South Europe

33

102

127

262

Greater China

25(2)

357

─

382

Emerging Markets

─

76

131

207

Rest of the World

4

88

88(3)

180

Total

80

630

497

1,207

(1) Included 3 DOS managed in joint venture with a local

partner. As the Natuzzi Group does not exert full control in each

of these DOS, we consolidate only the sell-in from such DOS.

(2) All directly operated by our joint venture in China. As the

Natuzzi Group owns a 49% stake in the Joint Venture and does not

control it, we consolidate only the sell-in from such DOS.

(3) It includes 11 Natuzzi galleries (store-in-store points of

sale) directly managed by the Mexican subsidiary of the Group.

FOS = Franchise stores managed by independent partners.

During 1Q 2023, Group’s invoiced sales from direct retail, DOS

and Concessions directly managed by the Group, amounted to €18.0

million, from €18.6 million in 1Q 2022 and from €17.8 million in 1Q

2019.

In 1Q 2023, invoiced sales from franchise stores amounted to

€33.8 million, compared to €43.8 million in 1Q 2022 and €24.1

million in 1Q 2019.

We continue executing our strategy to become a Brand Retailer

and improve the quality of our distribution network. The weight of

the invoiced sales generated by the retail network (Direct retail

and Franchise Operated Stores, or FOS) on total upholstered and

home furnishings business in 1Q 2023 was 61.7% compared to 54.8% in

1Q 2022 and 41.4% in 1Q 2019.

The Group also sells its products through the wholesale channel,

consisting primarily of Natuzzi-branded galleries in multi-brand

stores, as well as mass distributors selling unbranded products.

During 1Q 2022, invoiced sales from the wholesale channel amounted

to €32.2 million, compared to €51.5 million in 1Q 2022 and €59.3

million in 1Q 2019. Such decrease is mainly attributable to lower

sales from our large distributors in North America that are

focusing on reducing their stock, thus postponing orders for new

products.

1Q 2023 GROSS MARGIN

In 1Q 2023, we had a gross margin of 35.6%, as compared to 34.3%

in 1Q 2022 and 30.1% in 1Q 2019, mainly due to a favorable sales

and channel mix, a decrease in the average consumption of raw

materials, as well as effective price adjustments (that were not

yet effective in 2022 first quarter) in response to inflationary

pressure, partially offset by lower delivered sales in the

quarter.

During the first quarter of 2023, the Company accrued (€0.9)

million of labor-related cost following the reduction plan to

reduce the number of workers at our factories, mainly in China and

Romania. Excluding such accrual, gross margin would have been equal

to 36.6%.

1Q 2023 OPERATING EXPENSES

During 1Q 2023, operating expenses (which include selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables) were (€31.5) million (or

36.6% on revenue), compared to (€39.1) million (or 33.0% on

revenue) in 1Q 2022.

The €7.6 million decrease in the operating expenses was largely

due to the reduction in transportation costs (equal to €7.9

million, or 9.2% on revenue, in 1Q 2023, compared to €14.1 million,

or 11.9% on revenue, in 1Q 2022) as well as to lower custom duties

compared to 1Q 2022 (equal to €1.1 million in 1Q 2023, compared to

€1.9 million in 1Q 2022). While the Company is focused on

controlling discretionary costs, the low delivered sales in the

quarter has not allowed to adequately absorb fixed costs, resulting

in the increase of the weight of the operating expenses on

revenue.

1Q 2023 NET FINANCE INCOME/(COSTS)

During 1Q 2023, the Company accounted for (€3.4) million of Net

Finance costs compared to Net Finance costs of (€0.7) million in 1Q

2022.

Rising interest rates continue to adversely impact our results

principally in terms of increased interest expense of rental

contracts as well as third-party financing, notwithstanding the

average bank debt outstanding in the quarter significantly

decreased compared to 1Q 2022. As a consequence, during the

quarter, the Company reported Finance costs of (€2.1) million

compared to Finance costs of (€1.8) million in 1Q 2022.

In addition, the strengthening of the Euro occurred during the

quarter toward major currencies has resulted in a net exchange rate

loss of (€1.4) million, (compared to a net exchange rate gain of

€1.1 million in 1Q 2022), mainly deriving from the difference

between invoice exchange rates and collection/payment exchange

rates.

BALANCE SHEET AND CASH FLOW

During 1Q 2023, (€5.0) million of net cash were used in

operating activities as a result of:

- A loss for the period of (€3.3) million;

- adjustments for non-monetary items of €6.3 million, of which

depreciation and amortization of €5.5 million;

- a (€5.6) contribution from working capital change, mainly as a

result of the decrease in trade and other payables for (€10.4)

million, (€1.2) for payments connected to the reduction of

workforce, partially offset by lower inventories for €2.1 million

and lower trade receivables and other assets for €4.5 million;

- interest and taxes paid of (€2.4) million.

During the first three months of 2023, (€0.2) million of cash

were used in investing activities, as a result of (€3.2) million of

capital expenditure partially offset by €3.0 million collected from

our JV in China following the share capital reduction.

In the same period, (€4.3) million of cash were used in

financing activities, due to the repayment of long-term borrowing

for (€1.1) million, (€0.2) million for short-term borrowing

repayment and (€3.0) million for lease repayment.

As a result, as of March 31, 2023, cash and cash equivalents was

€43.8 million, compared to €54.5 million as of December 31,

2022.

As of March 31, 2023, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€0.8) million,

compared to €7.9 million as of December 31, 2022.

*******

CONFERENCE CALL

The Company will host a conference call to discuss financial

information on Monday, June 5, 2023, at 10:00 a.m. U.S. Eastern

time (4.00 p.m. Italy time, or 3.00 p.m. UK time).

To join the live conference call, interested persons will need

to either:

- dial-in the following number: Toll/International:

+1-412-717-9633, then passcode 39252103#; or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have option to listen via phone after

registering to the link.

*******

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the first quarter of 2023 and 2022

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

First quarter ended on Change

Percentage of revenue

31-Mar-23

31-Mar-22

%

31-Mar-23

31-Mar-22

Revenue

86.1

118.5

-27.4

%

100.0

%

100.0

%

Cost of Sales

(55.4

)

(77.9

)

-28.8

%

-64.4

%

-65.7

%

Gross profit

30.6

40.6

-24.6

%

35.6

%

34.3

%

Other income

1.3

1.0

1.5

%

0.9

%

Selling expenses

(23.8

)

(31.5

)

-24.5

%

-27.7

%

-26.6

%

Administrative expenses

(8.9

)

(8.3

)

7.1

%

-10.3

%

-7.0

%

Impairment on trade receivables

(0.0

)

(0.3

)

-0.1

%

-0.3

%

Other expenses

(0.1

)

(0.1

)

-0.1

%

-0.1

%

Operating profit/(loss)

(0.9

)

1.5

-1.0

%

1.2

%

Finance income

0.1

0.0

0.1

%

0.0

%

Finance costs

(2.1

)

(1.8

)

-2.4

%

-1.5

%

Net exchange rate gains/(losses)

(1.4

)

1.1

-1.7

%

0.9

%

Gain from disposal and loss of control of a subsidiary

—

—

0.0

%

0.0

%

Net finance income/(costs)

(3.4

)

(0.7

)

-4.0

%

-0.6

%

Share of profit/(loss) of equity-method investees

1.1

1.0

1.3

%

0.8

%

Profit/(Loss) before tax

(3.2

)

1.8

-3.7

%

1.5

%

Income tax expense

(0.1

)

(0.5

)

-0.1

%

-0.4

%

Profit/(Loss) for the period

(3.3

)

1.3

-3.9

%

1.1

%

Profit/(Loss) attributable to: Owners of the Company

(3.2

)

1.0

Non-controlling interests

(0.1

)

0.3

Natuzzi S.p.A. and Subsidiaries Unaudited

consolidated statements of financial position (condensed)on the

basis of IFRS-IAS(Expressed in millions of Euro)

31-Mar-23

31-Dec-22

ASSETS Non-current assets

180.0

177.6

Current assets

171.3

191.0

TOTAL ASSETS

351.3

368.6

EQUITY AND LIABILITIES Equity attributable to Owners

of the Company

83.4

87.9

Non-controlling interests

4.6

4.7

Non-current liabilities

99.6

95.3

Current liabilities

163.6

180.8

TOTAL EQUITY AND LIABILITIES

351.3

368.6

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

31-Mar-23

31-Dec-22

Net cash provided by (used in) operating

activities

(5.0)

18.7

Net cash provided by (used in) investing activities

(0.2)

(4.6)

Net cash provided by (used in) financing activities

(4.3)

(13.5)

Increase (decrease) in cash and cash equivalents

(9.4)

0.5

Cash and cash equivalents, beginning of the year

52.7

52.2

Effect of movements in exchange rates on cash held

(0.6)

(0.1)

Cash and cash equivalents, end of the period

42.7

52.7

For the purpose of the statements of cash flow,

cash and cash equivalents comprise the following: (Expressed in

millions of Euro)

31-Mar-23

31-Dec-22

Cash and cash equivalents in the statement of financial position

43.8

54.5

Bank overdrafts repayable on demand

(1.1)

(1.8)

Cash and cash equivalents in the statement of cash flows

42.7

52.7

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

STATEMENTS

Certain statements included in this press release constitute

forward-looking statements within the meaning of the safe harbor

provisions of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements may be expressed in a variety of ways, including the use

of future or present tense language. Words such as “estimate,”

“forecast,” “project,” “anticipate,” “likely,” “target,” “expect,”

“intend,” “continue,” “seek,” “believe,” “plan,” “goal,” “could,”

“should,” “would,” “may,” “might,” “will,” “strategy,” “synergies,”

“opportunities,” “trends,” “ambition,” “objective,” “aim,”

“future,” “potentially,” “outlook” and words of similar meaning may

signify forward-looking statements. These statements involve risks

and uncertainties that could cause the Company’s actual results to

differ materially from those stated or implied by such

forward-looking statements including, but not limited to, potential

risks and uncertainties described at page 3 of this document

relating to the supply-chain, the cost and availability of raw

material, production and shipping and the modernization of our

Italian manufacturing and those relating to the duration, severity

and geographic spread of the COVID-19 pandemic, actions that may be

taken by governmental authorities to contain the COVID-19 pandemic

or to mitigate its impact, the potential negative impact of

COVID-19 on the global economy, consumer demand and our supply

chain, and the impact of COVID-19 on the Company's financial

condition, business operations and liquidity, as well as the

geopolitical tensions and market uncertainties resulting from the

Russian invasion of Ukraine and current conflict. Additional

information about potential factors that could affect the Company’s

business and financial results is included in the Company’s filings

with the U.S. Securities and Exchange Commission, including the

Company’s most recent Annual Report on Form 20-F. The Company

undertakes no obligation to update any of the forward-looking

statements after the date of this press release.

About Natuzzi S.p.A.

Founded in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of

the most renowned brands in the production and distribution of

design and luxury furniture. With a global retail network of 710

mono-brand stores and 497 galleries as of March 31, 2023, Natuzzi

distributes its collections worldwide. Natuzzi products embed the

finest spirit of Italian design and the unique craftmanship details

of the “Made in Italy”, where a predominant part of its production

takes place. Natuzzi has been listed on the New York Stock Exchange

since May 13, 1993. Always committed to social responsibility and

environmental sustainability, Natuzzi S.p.A. is ISO 9001 and 14001

certified (Quality and Environment), ISO 45001 certified (Safety on

the Workplace) and FSC® Chain of Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230602005283/en/

Natuzzi Investor Relations Piero Direnzo | tel. +39

080-8820-812 | pdirenzo@natuzzi.com

Natuzzi Corporate Communication Giacomo Ventolone (Press

Office) | tel. +39.335.7276939 | gventolone@natuzzi.com

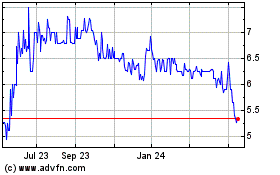

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

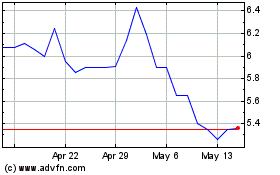

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024