February 19, 2025Full Year and Q4 Group performance

highlights

- Sales of EUR 18.0

billion in 2024, comparable sales growth 1%; EUR 5.0 billion in Q4,

comparable sales growth 1%, despite double-digit decline in

China

- Comparable order

intake increased 1% in 2024; up 2% in Q4, despite double-digit

decline in China

- Income from

operations was EUR 529 million in 2024; EUR 199 million in Q4

- Adjusted EBITA

margin increased 90 basis points to 11.5% of sales in 2024; up 60

basis points to 13.5% in Q4

- Net cash flow from

operating activities was EUR 1,569 million in 2024; EUR 1,459

million in Q4

- Free cash flow was

EUR 906 million in 2024; EUR 1,285 million in Q4

- Finalized Philips

Respironics recall-related medical monitoring and personal injury

settlements in US

- Proposed dividend

maintained at EUR 0.85 per share, in shares or cash

- Increased

productivity savings target for 2023-2025 from EUR 2 billion to EUR

2.5 billion, EUR 800 million in 2025

- Outlook for 2025

published

Roy Jakobs, CEO of Royal Philips:“We delivered better

care for more people by enhancing execution and focusing on driving

improvements in profitability and cash flow, as well as order and

sales growth. We strengthened our fundamentals and resolved

significant US litigation relating to the Respironics recall.

Despite double-digit declines in demand in both consumer and

health systems in China, we returned to positive order growth and

continued to drive margin expansion and cash-flow generation. With

our strong balance sheet we are pleased to offer shareholders the

option to receive the dividend in shares or cash.

Within a persistently challenging macro environment, our focus

remains on executing our value creation plan, bringing

industry-leading innovations to the market and driving a

simplified, more agile operating model. We strengthened our team

and culture of impact with care, with patient safety and quality as

our number one priority.

Looking ahead, we remain confident in our long-term plan and

will continue to work closely with customers as we build on our

strong innovation pipeline and focus on execution excellence to

drive profitable growth.”

Group and segment performance Comparable order intake

increased 2% in the quarter, with strong performance in the North

America and Growth geographies, partly offset by a double-digit

decline in demand in China. Group comparable sales increased 1% in

the quarter, with solid growth of 5% in the rest of the world,

largely offset by a double-digit decline in China, where market

conditions are expected to remain uncertain.

Adjusted EBITA increased 60 basis points to 13.5% in Q4, driven

by operational improvements and productivity measures. Free cash

flow increased to EUR 1.3 billion in the quarter, driven by

Respironics insurance proceeds, partly offset by phasing in working

capital.

For the full year, comparable order intake and sales increased

1%, up 4% excluding China. Adjusted EBITA increased 90 basis points

to 11.5% and free cash flow was EUR 0.9 billion.

Diagnosis & Treatment comparable sales decreased 1%

in Q4, due to a double-digit decline in China, offsetting solid

growth elsewhere. Adjusted EBITA margin was 12.1% in Q4, driven by

productivity, mix and pricing. For the full year, the Diagnosis

& Treatment businesses recorded 1% comparable sales growth, on

the back of 11% growth in 2023, and an Adjusted EBITA margin of

11.6%.

Connected Care comparable sales increased 7% in Q4, on

the back of a low comparison base. Adjusted EBITA margin was 15.0%

in Q4, in line with last year. For the full year, the Connected

Care businesses recorded a 2% comparable sales increase and an

Adjusted EBITA margin of 9.6%.

Personal Health comparable sales decreased 2% in Q4 due

to a double-digit decline in China, more than offsetting a strong

performance elsewhere. Adjusted EBITA margin was 18.0% in Q4,

including lower sales in China. For the full year, Personal Health

comparable sales decreased 1% and the Adjusted EBITA margin was

16.7%. Innovation highlights

- FDA clearance of the

Philips CT 5300, featuring AI-based reconstruction software to

reduce radiation dose and improve image quality, and of the Philips

Spectral CT 7500 RT, enabling personalized radiation therapy

planning.

- Expansion of

Philips' strategic collaboration with Amazon Web Services to offer

an integrated diagnostics portfolio in the cloud, such as AI

advanced visualization solutions that unify diagnostic workflows,

improve access to critical insights, and drive better outcomes

across clinical specialties, including radiology, digital pathology

and cardiology.

- Philips and Mayo

Clinic will collaborate using their proprietary AI technologies to

target breakthroughs in ease-of-use and efficiency to bring high-

quality diagnostic MRI and better care to patients with heart

disease. Philips also announced partnerships with Hôpital Fondation

Rothschild in Paris for imaging platforms and health informatics

and with Erasmus Medical Center in Rotterdam for ultrasound

solutions and services.

- Together with its

clinical partners, Philips continues to advance minimally invasive

procedures to treat patients based on new technologies and methods,

enrolling the first patients in the THOR clinical trial, which

integrates two critical peripheral artery disease treatments into a

single device. Achieving a significant milestone in the WE-TRUST

clinical trial, Philips has now included one-third of the targeted

564 patients to evaluate how a new imaging method could impact

workflow and improve outcomes for stroke patients.

- Philips renewed its

mid-range Sonicare electric toothbrushes, Series 5000-7000, in

Europe and launched new localized products in China, including the

On-The-Go Compact Shaver, which earned a top ranking for new

product sales from leading online retailer JD.com.

- Peer-reviewed life

cycle assessment results were published in the leading sector

publication Radiology, following close collaboration between the

Vanderbilt University Medical Center radiology department and

Philips. The analysis underscores the importance of joining forces

to tackle significant operational and sustainability challenges,

such as reducing the cost of care and reducing carbon

footprint.

Leadership and culture

Philips is strengthening its culture of impact with care, acting

with integrity with patient safety and quality as the number one

priority. Philips continues to simplify its operating model, with

end-to-end Businesses holding single accountability, supported by

leaner central Functions and strong customer-facing organizations

in the Regions and countries.

Since the start of the three-year plan, 75% of executive hires

across the company have come from a health technology background.

Recent appointments to the Executive Committee include leaders for

Precision Diagnosis, International Region, and Greater China

Region, plus a new Chief Financial Officer on the Board of

Management.

Productivity

Productivity initiatives are ahead of plan and delivered savings

of EUR 163 million in Q4: operating model savings of EUR 47

million, procurement savings of EUR 56 million, and other programs

savings of EUR 59 million. Since 2023, productivity initiatives

have delivered savings of more than EUR 1.7 billion.

Philips is raising its productivity savings target for the

2023-2025 period from EUR 2 billion to EUR 2.5 billion, driven by

cost efficiencies and further simplification of its operating

model, with EUR 800 million to be delivered in 2025.

Outlook Philips remains focused on successfully executing

its three-year plan to drive operational improvements and create

value with sustainable impact, within a challenging macro

environment. For 2025, Philips expects:

- 1%-3% comparable

sales growth, including a mid- to high-single-digit decline in

China

- Adjusted EBITA

margin increasing 30-80 bps to 11.8%-12.3%

- Free cash flow

before payment of the USD 1.1 billion cash-out relating to the US

medical monitoring and personal injury settlements will be at the

lower end of the range of EUR 1.4 billion to EUR 1.6 billion. Net

of this cash-out, free cash flow will be EUR 0.4 billion to EUR 0.6

billion.

We anticipate comparable sales growth to be back-end-loaded in

the year, with a mid-single-digit decline in Q1 mainly due to lower

demand in China and royalties phasing, with correspondingly lower

Adjusted EBITA margin.

The outlook includes the impact of the recently announced

US-China tariffs. It excludes ongoing Philips Respironics-related

legal proceedings, including the investigation by the US Department

of Justice.

Respironics Recall

In December 2024, Philips Respironics obtained final approval

for the recall-related medical monitoring settlement, and in

February 2025, the personal injury settlement became final

following a successful registration process. The aggregate amount

of the settlements is USD 1.1 billion; payment is expected in the

first half of 2025.

Capital allocation

Philips intends to submit to the 2025 Annual General Meeting of

Shareholders a proposal to declare a dividend of EUR 0.85 per

common share, in shares or cash at the option of the shareholder,

with a maximum of 50% of the total dividend distribution to all

shareholders being available for payment in cash. If more than 50%

of the total dividend is requested by the shareholders to be paid

out in cash, those shareholders who have chosen to receive their

dividend in cash will receive their cash dividend on a pro-rata

basis, the remainder being paid out in shares.

Click here to view the release online

For further information, please contact: Michael

Fuchs Philips Global External Relations Tel.: +31 6 1486 9261

E-mail: michael.fuchs@philips.com Ben Zwirs Philips Global

External Relations Tel.: +31 6 1521 3446 E-mail:

ben.zwirs@philips.com Dorin Danu Philips Investor Relations

Tel.: +31 20 59 77055 E-mail: dorin.danu@philips.com About Royal

Philips Royal Philips (NYSE: PHG, AEX: PHIA) is a leading

health technology company focused on improving people’s health and

well-being through meaningful innovation. Philips’ patient- and

people-centric innovation leverages advanced technology and deep

clinical and consumer insights to deliver personal health solutions

for consumers and professional health solutions for healthcare

providers and their patients in the hospital and the home.

Headquartered in the Netherlands, the company is a leader in

diagnostic imaging, ultrasound, image-guided therapy, monitoring

and enterprise informatics, as well as in personal health. Philips

generated 2024 sales of EUR 18 billion and employs approximately

67,800 employees with sales and services in more than 100

countries. News about Philips can be found at

www.philips.com/newscenter.

Forward-looking statements and other important information

Forward-looking statements This document and the related oral

presentation, including responses to questions following the

presentation, contain certain forward-looking statements with

respect to the financial condition, results of operations and

business of Philips and certain of the plans and objectives of

Philips with respect to these items. Examples of forward- looking

statements include statements made about our strategy, estimates of

sales growth, future Adjusted EBITA*), future restructuring and

acquisition-related charges and other costs, future developments in

Philips’ organic business and the completion of acquisitions and

divestments. Forward-looking statements can be identified generally

as those containing words such as “anticipates”, “assumes”,

“believes”, “estimates”, “expects”, “should”, “will”, “will likely

result”, “forecast”, “outlook”, “projects”, “may” or similar

expressions. By their nature, these statements involve risk and

uncertainty because they relate to future events and circumstances

and there are many factors that could cause actual results and

developments to differ materially from those expressed or implied

by these statements.

These factors include but are not limited to: macro-economic and

geopolitical changes, including protectionism measures such as

announced and proposed tariffs and retaliatory trade measures in

response thereto; Philips’ ability to keep pace with the changing

health technology environment; Philips’ ability to gain leadership

in health informatics and artificial intelligence in response to

developments in the health technology industry; integration of

acquisitions and their delivery on business plans and value

creation expectations; ability to meet expectations with respect to

ESG-related matters; securing and maintaining Philips’ intellectual

property rights, and unauthorized use of third-party intellectual

property rights; failure of products and services to meet quality

or security standards, adversely affecting patient safety and

customer operations; the resilience of our supply chain; challenges

in simplifying our organization and our ways of working; attracting

and retaining personnel; breach of cybersecurity; challenges in

driving operational excellence and speed in bringing innovations to

market; treasury and financing risks; tax risks; reliability of

internal controls; compliance with regulations and standards

involving quality, product safety, (cyber) security and artificial

intelligence; and compliance with business conduct rules and

regulations including privacy, existing and upcoming ESG disclosure

and due diligence requirements. As a result, Philips’ actual future

results may differ materially from the plans, goals and

expectations set forth in such forward-looking statements. For a

discussion of factors that could cause future results to differ

from such forward-looking statements, see also the Risk management

chapter included in the Annual Report 2023. Reference is also made

to section Risk management in the Philips semi-annual report 2024.

Third-party market share data Statements regarding market

share contained in this document, including those regarding

Philips’ competitive position, are based on outside sources such as

specialized research institutes, as well as industry and dealer

panels, in combination with management estimates. Where information

is not yet available to Philips, market share statements may also

be based on estimates and projections prepared by management and/or

based on outside sources of information. Management’s estimates of

rankings are based on order intake or sales, depending on the

business. Market Abuse Regulation This press release

contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation. Use of non-IFRS information

In presenting and discussing the Philips Group’s financial

position, operating results and cash flows, management uses certain

non-IFRS financial measures. These non-IFRS financial measures

should not be viewed in isolation as alternatives to the equivalent

IFRS measure and should be used in conjunction with the most

directly comparable IFRS measures. Non-IFRS financial measures do

not have standardized meaning under IFRS and therefore may not be

comparable to similar measures presented by other issuers. A

reconciliation of these non-IFRS measures to the most directly

comparable IFRS measures is contained in this document. Further

information on non-IFRS measures can be found in the Annual Report

2023. Presentation All amounts are in millions of euros

unless otherwise stated. Due to rounding, amounts may not add up

precisely to totals provided. All reported data is unaudited.

Financial reporting is in accordance with the accounting policies

as stated in the Annual Report 2023. Prior-period amounts have been

reclassified to conform to the current-period presentation; this

includes immaterial organizational changes. Effective Q1 2024,

Philips has revised the order intake policy to reflect the full

contract value for software contracts that start generating revenue

within an 18-month horizon, instead of only the next

18-months-to-revenue horizon. This change has been implemented to

better align with the specific business model of our software

businesses, simplify the order intake process, and better align

with peers. Prior-period comparable order intake percentages have

been restated accordingly. This revision has not resulted in any

material changes to the order intake percentages for the periods

presented. Per share calculations have been adjusted

retrospectively for all periods presented to reflect the issuance

of shares in the second quarter of 2024 in connection with the 2023

share dividend. *) Non-IFRS financial measure. Refer to

Reconciliation of non-IFRS information.

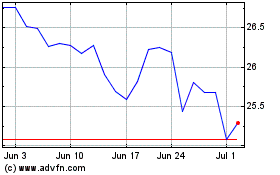

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Feb 2024 to Feb 2025