false

0000764401

0000764401

2025-01-16

2025-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 16, 2025

Insteel Industries Inc.

(Exact Name of Registrant as Specified in Charter)

|

North Carolina

|

|

1-9929

|

|

56-0674867

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1373 Boggs Drive

Mount Airy, North Carolina 27030

(Address of Principal Executive Offices, and Zip Code)

(336) 786-2141

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock (No Par Value) |

IIIN |

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On January 16, 2025, Insteel Industries Inc. issued a news release regarding its financial results for its first quarter ended December 28, 2024. A copy of this release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information in Item 2.02 of this Current Report on Form 8-K, including the related information in Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

Exhibit 104

|

Cover Page Interactive Data File (embedded within Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

INSTEEL INDUSTRIES INC.

|

By:

|

/s/ Elizabeth C. Southern

|

|

Name:

|

Elizabeth C. Southern

|

|

Title:

|

Vice President Administration, Secretary and Chief Legal Officer

|

|

Date:

|

January 16, 2025

|

Exhibit 99.1

NEWS RELEASE

| FOR IMMEDIATE RELEASE |

Contact: |

Scot Jafroodi

Vice President,

Chief Financial Officer and Treasurer

Insteel Industries Inc.

(336) 786-2141

|

INSTEEL INDUSTRIES REPORTS FIRST QUARTER 2025 RESULTS

MOUNT AIRY, N.C., January 16, 2025 – Insteel Industries Inc. (NYSE: IIIN) (“Insteel” or the “Company”), the largest manufacturer of steel wire reinforcing products for concrete construction applications in the United States, today reported financial results for its first quarter of fiscal 2025, ended December 28, 2024.

First Quarter 2025 Highlights

|

●

|

Executed and integrated two acquisitions, strengthening our competitive position

|

|

●

|

Payment of special cash dividend totaling $19.4 million, or $1.00 per share

|

|

●

|

Net sales of $129.7 million

|

|

●

|

Gross profit of $9.5 million, or 7.3% of net sales

|

|

●

|

Net income of $1.1 million, or $0.06 per share

|

|

●

|

Operating cash flow of $19.0 million

|

|

●

|

Net cash balance of $36.0 million and no debt outstanding as of December 28, 2024

|

|

●

|

Improved demand environment and business outlook

|

First Quarter 2025 Results

Net earnings for the first quarter of fiscal 2025 remained unchanged from the prior year at $1.1 million or $0.06 per share. Results for the current quarter include $1.0 million in restructuring charges and acquisition-related costs, which collectively reduced net earnings per share by $0.04. Insteel’s first quarter results benefited from higher spreads between selling prices and raw material costs, as well as an improvement in demand for the Company’s concrete reinforcement products which were partially offset by an increase in selling, general and administrative expense.

Net sales increased 6.6% to $129.7 million from $121.7 million in the prior year quarter, driven by an 11.4% increase in shipments partially offset by a 4.3% decline in average selling prices. Shipments for the current quarter benefited from favorable demand trends in our infrastructure and commercial construction markets, as well as the incremental volume generated from our two recent acquisitions. On a sequential basis, shipments decreased 4.5% from the fourth quarter of fiscal 2024, reflecting the usual seasonal slowdown, while average selling prices increased 1.1%. Gross margin expanded by 210 basis points to 7.3%, from 5.2% in the prior year quarter, primarily due to a combination of wider spreads between selling prices and raw material costs and higher shipment volume. Contributions from the acquisitions made during the quarter were nil due to purchase accounting conventions and weak seasonality.

(MORE)

1373 BOGGS DRIVE, MOUNT AIRY, NC 27030/PHONE: (336) 786-2141/FAX: (336) 786-2144

WWW.INSTEEL.COM

Operating activities generated $19.0 million of cash during the quarter compared to $21.8 million in the prior year quarter, as both periods benefited from the relative changes in working capital. Working capital

provided $12.3 million in the current quarter, driven by the reduction in inventories and receivables, while providing $16.3 million in the prior year quarter.

Capital Allocation and Liquidity

Capital expenditures for the first quarter of fiscal 2025 decreased to $2.7 million from $12.3 million in the prior year quarter. Capital outlays for fiscal 2025 are expected to total up to approximately $22.0 million, primarily focused on cost and productivity improvement initiatives as well as recurring maintenance requirements.

On December 13, 2024, Insteel paid a special cash dividend totaling $19.4 million, or $1.00 per share,

in addition to its regular quarterly cash dividend of $0.03 per share and ended the quarter with $36.0 million of cash and no borrowings outstanding on its $100.0 million revolving credit facility.

Acquisitions of Engineered Wire Products, Inc and O’Brien Wire Products of Texas, Inc.

As previously announced, on October 21, 2024, Insteel, through its wholly-owned subsidiary, Insteel Wire

Products Company (“IWP”), acquired Engineered Wire Products, Inc. (“EWP”) for an adjusted purchase price of $67.0 million in an asset transaction. Under the terms of the purchase agreement, Insteel acquired, among other assets, EWP’s inventories and production equipment and EWP’s Upper Sandusky, Ohio and Warren, Ohio production facilities. EWP was a leading manufacturer of welded wire reinforcement products for use in nonresidential and residential construction. The transaction was funded from cash on hand. Subsequent to closing the transaction, the Warren, Ohio facility was closed and its orders were distributed to logical Insteel legacy facilities.

On November 26, 2024, Insteel, through its wholly-owned subsidiary, IWP, acquired O’Brien Wire Products of Texas, Inc. (“OWP”) for an adjusted purchase price of $5.1 million in an asset transaction. Under the terms of the purchase agreement, Insteel acquired certain inventories and all of OWP’s production equipment. OWP was a manufacturer of welded wire reinforcement products for use in nonresidential and residential construction located in Houston, Texas. The transaction was funded from cash on hand.

During the quarter, Insteel incurred $0.7 million of restructuring charges related to the consolidation of the Company’s welded wire manufacturing operations and $0.3 million of acquisition costs for legal, accounting and other professional fees associated with the recent acquisitions.

Outlook

“We are encouraged by recovering order activity we experienced during the first quarter, which is typically seasonally weak,” said H.O. Woltz III, Insteel’s President and CEO. “The improved start to the year, together with increasing contributions from our recent acquisitions, positions us well as we move into the balance of fiscal 2025. While we are optimistic that our markets will recover during 2025, we continue to face the headwinds of low-priced PC strand imports entering the U.S. market. We are addressing this issue with both the Biden Administration and the incoming Trump Administration.”

Mr. Woltz added, “Once again, our people did a remarkable job of integrating the acquisitions we completed during the first fiscal quarter. Within two weeks of closing, the legacy systems of the acquired companies were disabled and Insteel systems were up and running. While systems training will be ongoing, integration risk is substantially behind us, and we are well underway in capturing the significant cost reduction synergies that are available. Looking ahead to the remainder of fiscal 2025, we are focused on optimizing operations, taking advantage of emerging opportunities in our markets, and delivering long-term value to our shareholders.”

(MORE)

Conference Call

Insteel will hold a conference call at 10:00 a.m. ET today to discuss its first quarter financial results. A live webcast of this call can be accessed on Insteel’s website at https://investor.insteel.com and will be archived for replay.

About Insteel

Insteel is the nation’s largest manufacturer of steel wire reinforcing products for concrete construction applications. Insteel manufactures and markets prestressed concrete strand and welded wire reinforcement, including engineered structural mesh (“ESM”), concrete pipe reinforcement and standard welded wire reinforcement. Insteel’s products are sold primarily to manufacturers of concrete products and concrete

contractors for use, primarily, in nonresidential construction applications. Headquartered in Mount Airy, North Carolina, Insteel operates eleven manufacturing facilities located in the United States.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. When used in this news release, the words “believes,” “anticipates,” “expects,” “estimates,” “appears,” “plans,” “intends,” “may,” “should,” “could” and similar expressions are intended to identify forward-looking statements. Although we believe that our plans, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, they are subject to several risks and uncertainties, and we can provide no assurances that such plans, intentions or expectations will be implemented or achieved. Many of these risks and uncertainties are discussed in detail in our Annual Report on Form 10-K for the year ended September 28, 2024 and may be updated from time to time in our other filings with the U.S. Securities and Exchange Commission (the “SEC”).

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. All forward-looking statements speak only to the respective dates on which such statements are made, and we do not undertake any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events, except as may be required by law.

It is not possible to anticipate and list all risks and uncertainties that may affect our business, future operations or financial performance; however, they include, but are not limited to, the following: general economic and competitive conditions in the markets in which we operate; changes in the spending levels for nonresidential and residential construction and the impact on demand for our products; changes in the amount and duration of transportation funding provided by federal, state and local governments and the impact on spending for infrastructure construction and demand for our products; the cyclical nature of the steel and building material industries; credit market conditions and the relative availability of financing for us, our customers and the construction industry as a whole; the impact of rising interest rates on the cost of financing for our customers; fluctuations in the cost and availability of our primary raw material, hot-rolled carbon steel wire rod, from domestic and foreign suppliers; competitive pricing pressures and our ability to raise selling prices in order to recover increases in raw material or operating costs; changes in United States or foreign trade policy affecting imports or exports of steel wire rod or our products; unanticipated changes in customer demand, order patterns and inventory levels; the impact of fluctuations in demand and capacity utilization levels on our unit manufacturing costs; our ability to further develop the market for ESM and expand our shipments of ESM; legal, environmental, economic or regulatory developments that significantly impact our business or operating costs; unanticipated plant outages, equipment failures or labor difficulties; the impact of cybersecurity breaches and data leaks: and the “Risk Factors” discussed in our Annual Report on Form 10-K for the year ended September 28, 2024, and in other filings made by us with the SEC.

(MORE)

INSTEEL INDUSTRIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands except for per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

December 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

129,720 |

|

|

$ |

121,725 |

|

|

Cost of sales

|

|

|

120,191 |

|

|

|

115,455 |

|

|

Gross profit

|

|

|

9,529 |

|

|

|

6,270 |

|

|

Selling, general and administrative expense

|

|

|

7,887 |

|

|

|

6,367 |

|

|

Restructuring charges, net

|

|

|

696 |

|

|

|

- |

|

|

Acquisition costs

|

|

|

271 |

|

|

|

- |

|

|

Other income, net

|

|

|

(14 |

) |

|

|

(22 |

) |

|

Interest expense

|

|

|

13 |

|

|

|

29 |

|

|

Interest income

|

|

|

(786 |

) |

|

|

(1,659 |

) |

|

Earnings before income taxes

|

|

|

1,462 |

|

|

|

1,555 |

|

|

Income taxes

|

|

|

381 |

|

|

|

423 |

|

|

Net earnings

|

|

$ |

1,081 |

|

|

$ |

1,132 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Net earnings per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.06 |

|

|

$ |

0.06 |

|

|

Diluted

|

|

|

0.06 |

|

|

|

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

19,497 |

|

|

|

19,497 |

|

|

Diluted

|

|

|

19,550 |

|

|

|

19,573 |

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends declared per share

|

|

$ |

1.03 |

|

|

$ |

2.53 |

|

See accompanying notes to consolidated financial statements.

(MORE)

INSTEEL INDUSTRIES INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands)

| |

|

(Unaudited)

|

|

|

|

|

|

| |

|

December 28,

|

|

|

December 30,

|

|

|

September 28,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

35,951 |

|

|

$ |

85,615 |

|

|

$ |

111,538 |

|

|

Accounts receivable, net

|

|

|

49,442 |

|

|

|

43,354 |

|

|

|

58,308 |

|

|

Inventories

|

|

|

98,670 |

|

|

|

94,142 |

|

|

|

88,840 |

|

|

Other current assets

|

|

|

8,422 |

|

|

|

8,706 |

|

|

|

8,608 |

|

|

Total current assets

|

|

|

192,485 |

|

|

|

231,817 |

|

|

|

267,294 |

|

|

Property, plant and equipment, net

|

|

|

136,379 |

|

|

|

129,300 |

|

|

|

125,540 |

|

|

Intangibles, net

|

|

|

17,998 |

|

|

|

5,903 |

|

|

|

5,341 |

|

|

Goodwill

|

|

|

35,641 |

|

|

|

9,745 |

|

|

|

9,745 |

|

|

Other assets

|

|

|

22,196 |

|

|

|

13,803 |

|

|

|

14,632 |

|

|

Total assets

|

|

$ |

404,699 |

|

|

$ |

390,568 |

|

|

$ |

422,552 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

36,724 |

|

|

$ |

23,852 |

|

|

$ |

37,487 |

|

|

Accrued expenses

|

|

|

10,360 |

|

|

|

9,585 |

|

|

|

9,547 |

|

|

Total current liabilities

|

|

|

47,084 |

|

|

|

33,437 |

|

|

|

47,034 |

|

|

Other liabilities

|

|

|

25,965 |

|

|

|

23,536 |

|

|

|

24,663 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

|

19,431 |

|

|

|

19,448 |

|

|

|

19,452 |

|

|

Additional paid-in capital

|

|

|

86,919 |

|

|

|

84,425 |

|

|

|

86,671 |

|

|

Retained earnings

|

|

|

225,908 |

|

|

|

230,005 |

|

|

|

245,340 |

|

|

Accumulated other comprehensive loss

|

|

|

(608 |

) |

|

|

(283 |

) |

|

|

(608 |

) |

|

Total shareholders' equity

|

|

|

331,650 |

|

|

|

333,595 |

|

|

|

350,855 |

|

|

Total liabilities and shareholders' equity

|

|

$ |

404,699 |

|

|

$ |

390,568 |

|

|

$ |

422,552 |

|

(MORE)

INSTEEL INDUSTRIES INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| |

|

Three Months Ended

|

|

| |

|

December 28,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash Flows From Operating Activities:

|

|

|

|

|

|

|

|

|

|

Net earnings

|

|

$ |

1,081 |

|

|

$ |

1,132 |

|

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

4,429 |

|

|

|

3,709 |

|

|

Amortization of capitalized financing costs

|

|

|

13 |

|

|

|

13 |

|

|

Stock-based compensation expense

|

|

|

345 |

|

|

|

398 |

|

|

Deferred income taxes

|

|

|

777 |

|

|

|

3,348 |

|

|

Asset impairment charges

|

|

|

273 |

|

|

|

- |

|

|

Loss on sale and disposition of property, plant and equipment

|

|

|

3 |

|

|

|

- |

|

|

Increase in cash surrender value of life insurance policies over premiums paid

|

|

|

- |

|

|

|

(675 |

) |

|

Net changes in assets and liabilities (net of assets and liabilities acquired):

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

8,866 |

|

|

|

20,070 |

|

|

Inventories

|

|

|

2,640 |

|

|

|

9,164 |

|

|

Accounts payable and accrued expenses

|

|

|

754 |

|

|

|

(12,921 |

) |

|

Other changes

|

|

|

(198 |

) |

|

|

(2,404 |

) |

|

Total adjustments

|

|

|

17,902 |

|

|

|

20,702 |

|

|

Net cash provided by operating activities

|

|

|

18,983 |

|

|

|

21,834 |

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities:

|

|

|

|

|

|

|

|

|

|

Acquisition of businesses

|

|

|

(71,456 |

) |

|

|

- |

|

|

Capital expenditures

|

|

|

(2,667 |

) |

|

|

(12,268 |

) |

|

Decrease (increase) in cash surrender value of life insurance policies

|

|

|

184 |

|

|

|

(122 |

) |

|

Proceeds from sale of property, plant and equipment

|

|

|

- |

|

|

|

3 |

|

|

Proceeds from surrender of life insurance policies

|

|

|

- |

|

|

|

5 |

|

|

Net cash used for investing activities

|

|

|

(73,939 |

) |

|

|

(12,382 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Financing Activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from long-term debt

|

|

|

69 |

|

|

|

67 |

|

|

Principal payments on long-term debt

|

|

|

(69 |

) |

|

|

(67 |

) |

|

Cash dividends paid

|

|

|

(20,014 |

) |

|

|

(49,191 |

) |

|

Payment of employee tax withholdings related to net share transactions

|

|

|

- |

|

|

|

(20 |

) |

|

Cash received from exercise of stock options

|

|

|

- |

|

|

|

243 |

|

|

Repurchases of common stock

|

|

|

(617 |

) |

|

|

(539 |

) |

|

Net cash used for financing activities

|

|

|

(20,631 |

) |

|

|

(49,507 |

) |

| |

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

(75,587 |

) |

|

|

(40,055 |

) |

|

Cash and cash equivalents at beginning of period

|

|

|

111,538 |

|

|

|

125,670 |

|

|

Cash and cash equivalents at end of period

|

|

$ |

35,951 |

|

|

$ |

85,615 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental Disclosures of Cash Flow Information:

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

Income taxes, net

|

|

$ |

40 |

|

|

$ |

8 |

|

|

Non-cash investing and financing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment in accounts payable

|

|

|

1,352 |

|

|

|

1,846 |

|

|

Restricted stock units and stock options surrendered for withholding taxes payable

|

|

|

- |

|

|

|

20 |

|

|

Accrued liability related to holdback for business acquired

|

|

|

657 |

|

|

|

- |

|

v3.24.4

Document And Entity Information

|

Jan. 16, 2025 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Insteel Industries Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 16, 2025

|

| Entity, Incorporation, State or Country Code |

NC

|

| Entity, File Number |

1-9929

|

| Entity, Tax Identification Number |

56-0674867

|

| Entity, Address, Address Line One |

1373 Boggs Drive

|

| Entity, Address, City or Town |

Mount Airy

|

| Entity, Address, State or Province |

NC

|

| Entity, Address, Postal Zip Code |

27030

|

| City Area Code |

336

|

| Local Phone Number |

786-2141

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

IIIN

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000764401

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

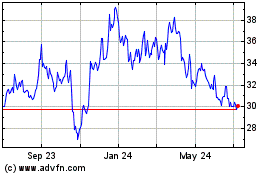

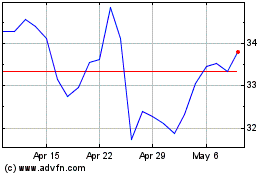

Insteel Industries (NYSE:IIIN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Insteel Industries (NYSE:IIIN)

Historical Stock Chart

From Feb 2024 to Feb 2025