Full Year Net Income of $199.2 million

and Diluted Earnings Per Share (EPS) of $1.81

2023 Results Include $14.1 Million of After-tax

Maui Wildfire-Related Expenses and an $11.0 Million After-tax Loss

Resulting from ASB’s Fourth Quarter Balance Sheet Repositioning

- Core Businesses Continue to Perform Well

- Utility Continuing to Progress Resilience Work in West

Maui

- ASB’s Balance Sheet Repositioning Strengthens Balance Sheet and

Positions Bank for Improved Net Interest Margin and

Profitability

- Strong Credit Quality and Capital Position at ASB

Hawaiian Electric Industries, Inc. (NYSE: HE) (HEI) today

reported full year 2023 consolidated net income for common stock of

$199.2 million and EPS of $1.81 compared to $241.1 million and EPS

of $2.20 for 2022. Net income for the year included $14.1 million

of after-tax wildfire-related expenses, and an $11.0 million

after-tax loss on the sale of investment securities executed by

American Savings Bank (ASB) in the fourth quarter. The loss

resulted from selling low-yielding securities in order to reduce

high cost deposits, strengthening the bank’s balance sheet while

positioning the bank for improved profitability. Core net income

and EPS1 for the year were $224.3 million and $2.04, respectively,

compared to $235.0 million and $2.14 for 2022. For the fourth

quarter of 2023, consolidated net income for common stock was $48.8

million and EPS was $0.44 compared to $57.3 million and EPS of

$0.52 for the fourth quarter of 2022. Core net income and EPS1 for

the fourth quarter were $53.4 million and $0.48, respectively.

There were no core net income adjustments for the fourth quarter of

2022.

“Although 2023 was one of the most challenging years ever for

our company and the communities we serve, I am encouraged by the

collaborative efforts of so many in our state to prioritize Maui’s

recovery following the devastating August wildfires. Our hearts

continue to be with the people of Maui, and we remain committed to

supporting the recovery and rebuild effort,” said Scott Seu, HEI

president and CEO.

“Our core businesses delivered solid results under challenging

circumstances, and both the utility and bank remain focused on

supporting our communities and customers. The utility is continuing

to execute on its plans to modernize its generation system and make

our electric grids more resilient.

“The bank continues to be well-positioned with strong capital,

excellent credit quality, lending capacity and ample liquidity. In

addition, the sale of investment securities executed in the fourth

quarter further positions ASB for improved profitability and net

interest margin while strengthening the balance sheet.”

HAWAIIAN ELECTRIC COMPANY (HAWAIIAN ELECTRIC)

EARNINGS2

Full Year Results:

Hawaiian Electric’s full-year net income was $194.0 million

compared to $188.9 million in 2022, with the increase primarily

driven by the following after-tax items:

- $34 million higher revenues, including $27 million from the

annual revenue adjustment (ARA) mechanism, $5 million from the

fossil fuel cost risk-sharing mechanism and $4 million from the

major project interim recovery (MPIR) mechanism, partially offset

by lower performance incentive mechanism revenue;

- $6 million higher allowance for funds used during construction

(AFUDC) related to increased capital expenditures;

- $4 million in higher interest income; and

- $2 million in research and development tax credits.

These items were offset by the following after-tax items:

- $28 million in higher operations and maintenance (O&M)

expenses, including $8 million of labor and associated costs for

the Maui windstorm and wildfire response. The remaining increase in

O&M included higher transmission and distribution maintenance,

and higher outside services costs;

- $7 million higher interest expense due to increased borrowings;

and

- $6 million higher depreciation expense due to increasing

investments to integrate more renewable energy and improve customer

reliability and system efficiency.

Excluding incremental after-tax Maui windstorm and

wildfire-related expenses, Hawaiian Electric’s core net income3 for

2023 was $195.1 million. The incremental after-tax Maui windstorm

and wildfire-related expenses (excluding the One ‘Ohana Initiative

contribution) of $1.1 million were comprised of $29.6 million of

expenses, net of $17.5 million of insurance-related recoveries and

$10.9 million of deferral treatment of costs pursuant to the Public

Utilities Commission’s decision allowing Hawaiian Electric to defer

these costs.

Fourth Quarter Results:

Hawaiian Electric’s net income for the fourth quarter of 2023

was $58.2 million, compared to $48.6 million in the fourth quarter

of 2022, with the variance primarily driven by the following

after-tax items: $9 million of combined deferral treatment and

insurance recoveries, net of expenses, related to the Maui

windstorm and wildfires, $8 million higher revenues, including $7

million from the ARA mechanism and $1 million from the MPIR

mechanism; $2 million in research and development tax credits and

$1 million higher AFUDC; partially offset by $8 million of higher

operation and maintenance expenses primarily related to

transmission and distribution, bad debt and other outside services.

Normalizing for the deferral treatment and insurance recoveries,

and excluding incremental after-tax Maui windstorm and

wildfire-related expenses, Hawaiian Electric’s core net income3 for

the fourth quarter of 2023 was $48.9 million.

Utility Dividend Declaration

On February 9, 2024 Hawaiian Electric’s Board of Directors

declared a $13 million quarterly cash dividend to its sole common

stockholder, HEI. This is down from approximately $30 million

declared in each of the previous three consecutive quarters. With

the suspension of HEI’s dividend to its common stockholders, cash

needs at the HEI parent company are limited relative to cash needs

prior to the dividend suspension, and reducing the utility’s

dividend to HEI allows more cash to be kept at the utility,

supporting its ability to perform needed restoration work in West

Maui, make critical capital investments supporting wildfire

mitigation and in other electrical infrastructure while capital

markets access remains limited.

AMERICAN SAVINGS BANK EARNINGS

Full Year Results:

ASB’s full year 2023 net income was $53.4 million, compared to

$80.0 million in 2022. Net income for the year included $8.3

million of Maui wildfire-related expenses after tax, and an $11.0

million after-tax loss on the sale of investment securities

recorded in the fourth quarter. The loss resulted from selling

low-yielding securities in order to reduce high cost deposits,

strengthening the bank’s balance sheet while positioning the bank

for improved profitability. Core net income4 for the year was $72.6

million.

Net interest income was $252.0 million in 2023 compared to

$252.6 million in 2022, with higher interest and dividend income

approximately offset by the impacts of higher funding costs.

Noninterest income for 2023 was $45.4 million compared to $57.0

million in 2022. The decrease in noninterest income was primarily

due to a $15.0 million pre-tax ($11.0 million after-tax) loss on

sale of investment securities recorded in the fourth quarter. The

sale of investment securities was executed in order to reposition

the balance sheet by divesting securities with below-market yields

to pay down higher cost funding, positioning ASB for improved net

interest margin and profitability.

As of December 31, 2023 and compared to December 31, 2022:

- Total earning assets were $9.2 billion, up 0.50%;

- Total loans were $6.2 billion, up 3.4%; and

- Total deposits were $8.1 billion, approximately flat.

The average cost of funds was 0.93% for the full year 2023, 77

basis points higher than the prior year as higher interest rates

and a shift in funding mix increased funding costs.

ASB’s return on average equity for the full year 2023 was 11.0%

compared to 14.1% in 2022. Return on average assets for the full

year was 0.55% in 2023 compared to 0.86% in 2022. Core return on

average equity and core return on average assets4 were 14.9% and

0.75%, respectively.

Fourth Quarter Results:

Net income for the fourth quarter of 2023 was $3.2 million, and

included $2.0 million of after-tax Maui wildfire-related expenses

as well as the aforementioned loss on sale of securities. This

compared to $17.9 million in the fourth quarter of 2022. Core net

income4 for the fourth quarter was $16.2 million.

For the fourth quarter 2023, return on average equity was 2.7%,

compared to 15.7% in the fourth quarter of 2022. Core return on

average equity5 for the quarter was 13.7%. Return on average assets

was 0.13% for the fourth quarter of 2023, compared to 0.76% in the

same quarter last year. Core return on average assets5 was 0.67%.

Please refer to ASB’s news release issued on January 30, 2024 for

additional information on ASB.

HOLDING AND OTHER COMPANIES

The holding and other companies’ net loss was $48.1 million in

2023 compared to $27.8 million in 2022. The higher net loss for the

year was primarily due to the after-tax $6.2 million gain on sale

of an equity method investment recorded in 2022 at Pacific Current,

higher interest expense, lower Pacific Current net income and

wildfire-related expenses. Core net loss for the year was $43.4

million compared to $34.0 million in 20225. The fourth quarter net

loss was $12.6 million compared to $9.2 million in the fourth

quarter of 2022. The higher net loss compared to the prior year

quarter was primarily due to lower Pacific Current net income,

higher interest expense and wildfire-related expenses. Core net

loss for the fourth quarter of 2023 was $11.7 million5. There were

no core adjustments to net income for the fourth quarter of

2022.

EARNINGS RELEASE, WEBCAST AND CONFERENCE CALL TO DISCUSS

EARNINGS

HEI will conduct a webcast and conference call to review its

fourth quarter and full year 2023 consolidated financial results

today at 11:30 a.m. Hawaii time (4:30 p.m. Eastern).

To listen to the conference call, dial 1-888-660-6377 (U.S.) or

1-929-203-0797 (international) and enter passcode 2393042. Parties

may also access presentation materials (which include

reconciliation of non-GAAP measures) and/or listen to the

conference call by visiting the conference call link on HEI’s

website at www.hei.com under “Investor Relations,” sub-heading

“News and Events — Events and Presentations.”

A replay will be available online and via phone. The online

replay will be available on HEI’s website about two hours after the

event. The audio replay will also be available about two hours

after the event through February 27, 2024. To access the audio

replay, dial 1-800-770-2030 (U.S.) or 1-647-362-9199

(international) and enter passcode 2393042.

HEI and Hawaiian Electric Company, Inc. (Hawaiian Electric)

intend to continue to use HEI’s website, www.hei.com, as a means of

disclosing additional information; such disclosures will be

included in the Investor Relations section of the website.

Accordingly, investors should routinely monitor the Investor

Relations section of HEI’s website, in addition to following HEI’s,

Hawaiian Electric’s and ASB’s press releases, HEI’s and Hawaiian

Electric’s Securities and Exchange Commission (SEC) filings and

HEI’s public conference calls and webcasts. Investors may sign up

to receive e-mail alerts via the “Investor Relations” section of

the website. The information on HEI’s website is not incorporated

by reference into this document or into HEI’s and Hawaiian

Electric’s SEC filings unless, and except to the extent,

specifically incorporated by reference.

Investors may also wish to refer to the Public Utilities

Commission of the State of Hawaii (PUC) website at

https://hpuc.my.site.com/cdms/s/ to review documents filed with,

and issued by, the PUC. No information on the PUC website is

incorporated by reference into this document or into HEI’s and

Hawaiian Electric’s SEC filings.

_________________________

1 Core net income, core EPS, core return on average equity and

core return on average assets are non-GAAP measures which, for

2023, exclude Maui wildfire-related after-tax costs and, except for

the utility, the after-tax loss on sale of securities resulting

from the bank’s balance sheet repositioning executed in the fourth

quarter; and for 2022, exclude the gain on sale of an equity method

investment recorded in the first quarter at Pacific Current. See

“Explanation of HEI’s Use of Certain Unaudited Non-GAAP Measures”

and the related GAAP reconciliations. 2 Utility amounts indicated

as after-tax in this earnings release are based upon adjusting

items using a current year composite statutory tax rate of 25.75%.

3 Refer to footnote 1. 4 Refer to footnote 1. 5 Refer to footnote

1.

ABOUT HEI

The HEI family of companies provides the energy and financial

services that empower much of the economic and community activity

of Hawaii. HEI’s electric utility, Hawaiian Electric, supplies

power to approximately 95% of Hawaii’s population and is

undertaking an ambitious effort to decarbonize its operations and

the broader state economy. Its banking subsidiary, ASB, is one of

Hawaii’s largest financial institutions, providing a wide array of

banking and other financial services and working to advance

economic growth, affordability and financial fitness. HEI also

helps advance Hawaii’s sustainability goals through investments by

its non-regulated subsidiary, Pacific Current. For more

information, visit www.hei.com.

NON-GAAP MEASURES

Core net income is a non-GAAP measure which, for 2023, excludes

Maui wildfire-related after-tax costs and, except for the utility,

the after-tax loss on sale of investment securities resulting from

the balance sheet repositioning transaction executed in the fourth

quarter; and for 2022, excludes the gain on sale of an equity

method investment recorded in the first quarter at Pacific Current.

See “Explanation of HEI’s Use of Certain Unaudited Non-GAAP

Measures” and related GAAP reconciliations at the end of this

release.

FORWARD-LOOKING STATEMENTS

This release may contain “forward-looking statements,” which

include statements that are predictive in nature, depend upon or

refer to future events or conditions, and usually include words

such as “will,” “expects,” “anticipates,” “intends,” “plans,”

“believes,” “predicts,” “estimates” or similar expressions. In

addition, any statements concerning future financial performance,

ongoing business strategies or prospects or possible future actions

are also forward-looking statements. Forward-looking statements are

based on current expectations and projections about future events

and are subject to risks, uncertainties and the accuracy of

assumptions concerning HEI and its subsidiaries, the performance of

the industries in which they do business and economic, political

and market factors, among other things. These forward-looking

statements are not guarantees of future performance.

Forward-looking statements in this release should be read in

conjunction with the “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors” discussions (which are incorporated

by reference herein) set forth in HEI’s Annual Report on Form 10-K

for the year ended December 31, 2022, HEI’s Quarterly Report on

Form 10-Q for the quarter ended September 30, 2023, and HEI’s other

periodic reports that discuss important factors that could cause

HEI’s results to differ materially from those anticipated in such

statements and (i) extreme weather events, including windstorms and

other natural disasters, particularly those driven or exacerbated

by climate change, which could increase the risk of the Utilities’

equipment being damaged, becoming inoperable or contributing to a

wildfire; (ii) the impact of the Maui windstorm and wildfires

including the potential liabilities from the many lawsuits filed

against the Company and potential regulatory penalties which may

result in significant costs that may be unrecoverable through

insurance and/or rates; (iii) an increase in insurance premiums and

the inability to fully recover premiums through rates or the

potential inability to obtain wildfire and general liability

insurance coverage at reasonable rates, if available at all; (iv)

the uncertainties surrounding the Company’s access to capital and

credit markets due to the uncertainties associated with the costs

related to the Maui windstorm and wildfires; (v) the material

reduction or extended delay in dividends or other distributions

from one or more operating subsidiaries to HEI; (vi) further

downgrades by securities rating agencies in their ratings of the

securities of HEI and Hawaiian Electric and their impact on results

of financing efforts; (vii) the risks of suffering losses and

incurring liabilities that are uninsured (e.g., damages to the

Utilities’ transmission and distribution system and losses from

business interruption) or underinsured (e.g., losses not covered as

a result of insurance deductibles or other exclusions or exceeding

policy limits), and the risks associated with the operation of

transmission and distribution assets and power generation

facilities, including public and employee safety issues, and assets

causing or contributing to wildfires. These forward-looking

statements speak only as of the date of the report, presentation or

filing in which they are made. Except to the extent required by the

federal securities laws, HEI, Hawaiian Electric, ASB and their

subsidiaries undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Hawaiian Electric Industries, Inc. (HEI)

and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended

December 31

Years ended

December 31

(in thousands, except per share

amounts)

2023

2022

2023

2022

Revenues

Electric utility

$

854,106

$

924,951

$

3,269,521

$

3,408,587

Bank

102,947

89,218

394,663

321,068

Other

4,298

4,944

17,982

12,330

Total revenues

961,351

1,019,113

3,682,166

3,741,985

Expenses

Electric utility

768,682

849,558

2,967,363

3,109,396

Bank

86,282

66,753

317,051

219,550

Other

10,411

9,788

45,148

31,966

Total expenses

865,375

926,099

3,329,562

3,360,912

Operating income (loss)

Electric utility

85,424

75,393

302,158

299,191

Bank

16,665

22,465

77,612

101,518

Other

(6,113

)

(4,844

)

(27,166

)

(19,636

)

Total operating income

95,976

93,014

352,604

381,073

Retirement defined benefits credit—other

than service costs

1,207

883

4,768

4,411

Interest expense, net—other than on

deposit liabilities and other bank borrowings

(34,273

)

(27,462

)

(125,532

)

(103,402

)

Allowance for borrowed funds used during

construction

1,403

1,015

5,201

3,416

Allowance for equity funds used during

construction

4,091

3,143

15,164

10,574

Interest income

4,125

—

9,105

—

Loss on sales of investment securities and

gain (loss) on sales of equity-method investment

(15,609

)

—

(15,609

)

8,123

Income before income taxes

56,920

70,593

245,701

304,195

Income taxes

7,658

12,772

44,573

61,167

Net income

49,262

57,821

201,128

243,028

Preferred stock dividends of

subsidiaries

473

473

1,890

1,890

Net income for common stock

$

48,789

$

57,348

$

199,238

$

241,138

Basic earnings per common share

$

0.44

$

0.52

$

1.82

$

2.20

Diluted earnings per common

share

$

0.44

$

0.52

$

1.81

$

2.20

Dividends declared per common

share

$

—

$

0.35

$

1.08

$

1.40

Weighted-average number of common

shares outstanding

110,134

109,471

109,739

109,434

Weighted-average shares assuming

dilution

110,301

109,774

110,038

109,778

Net income (loss) for common stock by

segment

Electric utility

$

58,183

$

48,621

$

193,952

$

188,929

Bank

3,231

17,897

53,362

79,989

Other

(12,625

)

(9,170

)

(48,076

)

(27,780

)

Net income for common stock

$

48,789

$

57,348

$

199,238

$

241,138

Comprehensive income (loss) attributable

to HEI

$

117,463

$

74,864

$

245,916

$

(42,357

)

Return on average common equity (%)

(twelve months ended)

8.8

10.5

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in HEI

filings with the SEC.

Hawaiian Electric Company, Inc. (Hawaiian

Electric) and Subsidiaries

CONSOLIDATED STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended

December 31

Years ended

December 31

($ in thousands, except per barrel

amounts)

2023

2022

2023

2022

Revenues

$

854,106

$

924,951

$

3,269,521

$

3,408,587

Expenses

Fuel oil

329,728

391,071

1,211,420

1,265,614

Purchased power

172,779

186,757

671,769

793,584

Other operation and maintenance

126,373

126,342

533,557

497,601

Depreciation

60,924

59,503

243,705

235,424

Taxes, other than income taxes

78,878

85,885

306,912

317,173

Total expenses

768,682

849,558

2,967,363

3,109,396

Operating income

85,424

75,393

302,158

299,191

Allowance for equity funds used during

construction

4,091

3,143

15,164

10,574

Retirement defined benefits credit—other

than service costs

1,076

959

4,303

3,835

Interest expense and other charges,

net

(22,575

)

(19,681

)

(86,140

)

(76,416

)

Allowance for borrowed funds used during

construction

1,403

1,015

5,201

3,416

Interest income

2,330

—

6,454

—

Income before income taxes

71,749

60,829

247,140

240,600

Income taxes

13,067

11,709

51,193

49,676

Net income

58,682

49,120

195,947

190,924

Preferred stock dividends of

subsidiaries

229

229

915

915

Net income attributable to Hawaiian

Electric

58,453

48,891

195,032

190,009

Preferred stock dividends of Hawaiian

Electric

270

270

1,080

1,080

Net income for common stock

$

58,183

$

48,621

$

193,952

$

188,929

Comprehensive income attributable to

Hawaiian Electric

$

58,337

$

54,552

$

193,940

$

195,070

OTHER ELECTRIC UTILITY INFORMATION

Kilowatthour sales (millions)

Hawaiian Electric

1,604

1,603

6,138

6,212

Hawaii Electric Light

272

269

1,043

1,053

Maui Electric

264

282

1,046

1,089

2,140

2,154

8,227

8,354

Average fuel oil cost per barrel

$

132.47

$

152.05

$

126.73

$

141.49

Return on average common equity (%)

(twelve months ended)1

8.2

8.2

1 Simple average.

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in Hawaiian

Electric filings with the SEC.

American Savings Bank, F.S.B.

STATEMENTS OF INCOME DATA

(Unaudited)

Three months ended

Years ended December 31

(in thousands)

December 31, 2023

September 30, 2023

December 31, 2022

2023

2022

Interest and dividend income

Interest and fees on loans

$

72,340

$

71,540

$

60,331

$

276,688

$

207,830

Interest and dividends on investment

securities

15,587

14,096

14,315

58,095

58,044

Total interest and dividend income

87,927

85,636

74,646

334,783

265,874

Interest expense

Interest on deposit liabilities

17,961

14,446

3,755

48,905

7,327

Interest on other borrowings

8,721

8,598

4,775

33,892

5,974

Total interest expense

26,682

23,044

8,530

82,797

13,301

Net interest income

61,245

62,592

66,116

251,986

252,573

Provision for credit losses

304

8,835

2,729

10,357

2,037

Net interest income after provision for

credit losses

60,941

53,757

63,387

241,629

250,536

Noninterest income

Fees from other financial services

4,643

4,703

4,764

19,034

19,830

Fee income on deposit liabilities

5,104

4,924

4,640

19,131

18,762

Fee income on other financial products

2,664

2,440

2,628

10,616

10,291

Bank-owned life insurance

1,707

2,303

1,872

7,390

2,533

Mortgage banking income

209

341

62

910

1,692

Gain on sale of real estate

—

—

776

495

1,778

Loss on sale of investment securities,

net

(14,965

)

—

—

(14,965

)

—

Other income, net

693

627

606

2,799

2,086

Total noninterest income

55

15,338

15,348

45,410

56,972

Noninterest expense

Compensation and employee benefits

28,797

29,902

30,361

118,297

113,839

Occupancy

5,422

5,154

7,030

21,703

24,026

Data processing

5,305

5,133

4,537

20,545

17,681

Services

5,032

3,627

2,967

13,943

10,679

Equipment

3,114

3,125

2,937

11,842

10,100

Office supplies, printing and postage

1,019

1,022

1,142

4,315

4,398

Marketing

1,167

984

1,091

4,001

3,968

Other expense

9,250

7,399

6,034

28,992

20,576

Total noninterest expense

59,106

56,346

56,099

223,638

205,267

Income before income taxes

1,890

12,749

22,636

63,401

102,241

Income taxes

(1,341

)

1,384

4,739

10,039

22,252

Net income

$

3,231

$

11,365

$

17,897

$

53,362

$

79,989

Comprehensive income (loss)

$

70,585

$

(22,866

)

$

29,282

$

97,705

$

(218,844

)

OTHER BANK INFORMATION (annualized %,

except as of period end)

Return on average assets

0.13

0.47

0.76

0.55

0.86

Return on average equity

2.74

9.19

15.73

10.98

14.08

Return on average tangible common

equity

3.32

11.02

19.20

13.22

16.46

Net interest margin

2.63

2.70

2.91

2.74

2.89

Efficiency ratio

96.42

72.30

68.86

75.20

66.31

Net charge-offs to average loans

outstanding

0.15

0.07

0.06

0.12

0.03

As of period end

Nonaccrual loans to loans receivable held

for investment

0.46

0.16

0.28

Allowance for credit losses to loans

outstanding

1.20

1.23

1.21

Tangible common equity to tangible

assets

4.7

3.9

4.1

Tier-1 leverage ratio

7.7

7.7

7.8

Dividend paid to HEI (via ASB Hawaii,

Inc.) ($ in millions)

$

—

$

14.0

$

10.0

$

39.0

$

42.0

This information should be read in conjunction with the

consolidated financial statements and the notes thereto in HEI

filings with the SEC.

Explanation of HEI’s Use of Certain Unaudited Non-GAAP

Measures

HEI, Hawaiian Electric and ASB management use certain non-GAAP

measures to evaluate the performance of HEI, the utility and bank.

Management believes these non-GAAP measures provide useful

information and are a better indicator of the companies’ core

operating activities. Core earnings and other financial measures as

presented here may not be comparable to similarly titled measures

used by other companies. The accompanying tables provide a

reconciliation of reported GAAP1 earnings to non-GAAP core earnings

for adjusted diluted EPS (for HEI consolidated); return on average

common equity (for HEI consolidated and Hawaiian Electric); and

returns on average equity, average tangible equity and average

assets (for ASB).

The reconciling adjustments from GAAP1 earnings to core earnings

for 2023 are limited to the costs related to the recent Maui

wildfires and, except for the utility, the loss on sale of

investment securities from the balance sheet repositioning

transaction executed in the fourth quarter. The reconciling

adjustments from GAAP1 earnings to core earnings for 2022 are

limited to the gain on sale of an equity method investment recorded

in the first quarter at Pacific Current. Management does not

consider these items to be representative of the company’s

fundamental core earnings.

Reconciliation of GAAP1 to non-GAAP

Measures

Hawaiian Electric Industries, Inc. (HEI)

and Subsidiaries

Unaudited

(in thousands)

Three months ended

December 31, 2023

Year ended

December 31, 2023

Year ended

December 31, 2022

Maui

wildfire-related costs

Pretax expenses:

Legal expenses

$

24,125

$

34,876

$

—

Outside services expenses

8,688

14,822

—

Provision for credit losses

—

5,900

—

One `Ohana Initiative Contribution

—

75,000

—

Other expenses

1,343

5,185

—

Interest expenses

1,645

2,600

—

Pretax expenses

35,801

138,383

—

Insurance recovery

(29,580

)

(104,580

)

—

Deferral of cost

(14,692

)

(14,692

)

—

Wildfire-related expenses, excluding

insurance recovery and deferral

(8,471

)

19,111

—

Pretax loss on sale of investment

securities

14,965

14,965

—

Gain on sale of equity method investment

at Pacific Current

—

—

(8,123

)

Income tax benefits2

(1,858

)

(9,050

)

1,947

After-tax adjustments

$

4,636

$

25,026

$

(6,176

)

HEI consolidated

net income

GAAP net income (as reported)

$

48,789

$

199,238

$

241,138

Excluding special items related to the

Maui wildfire (after tax):

Legal expenses

17,909

25,886

—

Outside services expenses

6,430

10,976

—

Provision for credit losses

—

4,319

—

One `Ohana Initiative Contribution

—

55,688

—

Other expenses

993

3,832

—

Interest expenses

1,222

1,931

—

After tax expenses

26,554

102,632

—

Insurance recovery

(21,963

)

(77,651

)

—

Deferral of cost

(10,909

)

(10,909

)

—

Maui wildfire-related expenses, net of

insurance recoveries and approved deferral treatment (after

tax)

(6,318

)

14,072

—

Gain on sale of equity method

investment (after tax)

—

—

(6,176

)

Loss on sale of investment securities

(after tax)

10,954

10,954

—

Total core net income adjustments

(after tax)

4,636

25,026

(6,176

)

Non-GAAP (core) net income

$

53,425

$

224,264

$

234,962

GAAP Diluted earnings per share (as

reported)

$

0.44

$

1.81

$

2.20

Non-GAAP (core) Diluted earnings per

share

$

0.48

$

2.04

$

2.14

Years ended December 31,

2023

2022

Ratios

(%)

Based on GAAP1

Return on average equity

8.8

10.5

Based on Non-GAAP (core)

Return on average equity

9.9

10.2

1

Accounting principles generally accepted

in the United States of America

2

Current year composite statutory tax rate

of 25.75% is used for Utility and corporate amounts and current

year composite statutory tax rate of 26.80% is used for ASB

amounts.

Note: Other segment (Holding and Other Companies)

wildfire-related expenses (legal, outside services and other) are

included in “Expenses-Other” and interest expense is included in

“Interest expense, net—other than on deposit liabilities and other

bank borrowings” on the HEI and subsidiaries’ Consolidated

Statements of Income Data. See Electric Utilities and Bank tables

below for more detail.

Reconciliation of GAAP1 to

non-GAAP Measures

Hawaiian Electric Company, Inc. and

Subsidiaries

Unaudited

(in thousands)

Three months ended

December 31, 2023

Year ended

December 31, 2023

Maui windstorm

and wildfire-related costs

Pretax expenses:

Legal expenses2

$

18,486

$

24,737

Outside services expenses2

5,826

10,532

One `Ohana Initiative Contribution

—

75,000

Other expenses2

834

3,316

Interest expenses3

720

1,223

Pretax expenses

25,866

114,808

Insurance recovery

(23,613

)

(98,613

)

Deferral of cost

(14,692

)

(14,692

)

Total Maui windstorm and

wildfire-related expenses, net of insurance recoveries and approved

deferral treatment

(12,439

)

1,503

Income tax benefits4

3,203

(387

)

After-tax expenses

$

(9,236

)

$

1,116

Hawaiian Electric

consolidated net income

GAAP net income (as reported)

$

58,183

$

193,952

Excluding special items related to the

Maui windstorm and wildfires (after tax):

Legal expenses

13,726

18,367

Outside services expenses

4,326

7,820

One `Ohana Initiative Contribution

—

55,688

Other expenses

619

2,462

Interest expenses

534

908

Maui windstorm and wildfire-related cost

(after tax)

19,205

85,245

Insurance recovery (after tax)

(17,532

)

(73,220

)

Deferral of cost (after tax)

(10,909

)

(10,909

)

Total Maui windstorm and wildfire- related

expenses, net of insurance recoveries and approved deferral

treatment (after tax)

(9,236

)

1,116

Non-GAAP (core) net income

$

48,947

$

195,068

Years ended December 31,

2023

2022

Ratios

(%)

Based on GAAP1

Return on average equity

8.2

8.2

Based on Non-GAAP (core)

Return on average equity

8.2

8.2

1

Accounting principles generally accepted

in the United States of America.

2

Legal, outside services and other are

included in “Other operation and maintenance” on the Hawaiian

Electric and subsidiaries Consolidated Statements of Income

Data.

3

Interest expense is included in “Interest

expense and other charges, net” on the Hawaiian Electric and

subsidiaries Consolidated Statements of Income Data.

4

Current year composite statutory tax rate

of 25.75% is used for Utility amounts.

Reconciliation of GAAP1 to non-GAAP

Measures

American Savings Bank F.S.B.

Unaudited

(in thousands)

Three months ended

December 31, 2023

Year ended

December 31, 2023

Maui

wildfire-related costs and loss on sale of

securities

Pretax expenses:

Provision for credit losses

$

—

$

5,900

Professional services expense

2,405

3,705

Other expenses

309

1,666

Pretax Maui wildfire-related

costs

2,714

11,271

Pretax loss on sale of investment

securities

14,965

14,965

Income tax benefits

(4,738

)

(7,031

)

After-tax expenses

$

12,941

$

19,205

ASB net

income

GAAP (as reported)

$

3,231

$

53,362

Excluding expense related to Maui wildfire

and securities loss (after tax):

Provision for credit losses

—

4,319

Professional services expense

1,760

2,712

Other expenses

227

1,220

Loss on sale of investment securities

10,954

10,954

Maui wildfire-related cost and

securities loss (after tax)

12,941

19,205

Non-GAAP (core) net income

$

16,172

$

72,567

Three months ended

December 31, 2023

Year ended

December 31, 2023

Ratios

(annualized %)

Based on GAAP1

Return on average assets

0.13

0.55

Return on average equity

2.74

10.98

Return on average tangible common

equity

3.32

13.22

Efficiency ratio

96.42

75.20

Based on Non-GAAP (core)

Return on average assets

0.67

0.75

Return on average equity

13.73

14.94

Return on average tangible common

equity

16.63

17.98

Efficiency ratio

73.94

69.88

1

Accounting principles generally accepted

in the United States of America

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213153280/en/

Mateo Garcia Director, Investor Relations Telephone: (808)

543-7300 E-mail: ir@hei.com

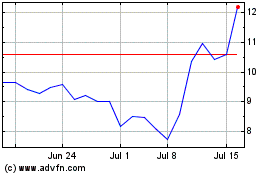

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hawaiian Electric Indust... (NYSE:HE)

Historical Stock Chart

From Dec 2023 to Dec 2024