Company Projects Full-Year 2024 Revenue of

$343–$345 Million and Reaffirms Adjusted EBITDA Margin of 42% or

Greater

Announces Redemption of Public Warrants and

Private Placement Warrants

Grindr Inc. (NYSE: GRND) (“Grindr” or the “Company”), the Global

Gayborhood in Your Pocket™, today announced that it is providing

notice to holders of its outstanding public warrants and private

placement warrants (collectively, the “warrants”) that it will

redeem the warrants at a redemption price of $0.10 per warrant at

5:00 p.m. New York City time on February 24, 2025 (the “Redemption

Date”). Holders of the warrants may instead elect to exercise their

warrants until 5:00 p.m. New York City time on the Redemption Date.

At the time of this press release, Grindr has 18,799,825 public

warrants and 18,560,000 private placement warrants outstanding.

Redemption of Outstanding

Warrants

Pursuant to the terms of the warrant agreement, Grindr is

entitled to redeem all, but not less than all, of the outstanding

warrants at a redemption price of $0.10 per warrant if the last

reported sales price of its common stock, for any 20 trading days

within the 30 trading-day period ending on the third trading day

prior to the date on which the notice of redemption is given,

equals or exceeds $10.00 per share and is less than $18.00 per

share. This share price condition was met as of January 17, 2025,

three trading days prior to the redemption notice being provided on

January 23, 2025.

At the Company’s request, the warrant agent is delivering a

notice of redemption to each of the registered holders of the

warrants on behalf of the Company.

If a holder of warrants does not wish for its warrants to be

redeemed, such holder may exercise its warrants until 5:00 p.m. New

York City time on the Redemption Date. In connection with the

redemption warrant holders may elect to (i) exercise their warrants

for cash at an exercise price of $11.50 per share of the Company’s

common stock; or (ii) exercise their warrants on a “cashless basis”

in accordance with subsection 6.1.2 of the warrant agreement, in

which case, the holder will receive a number of shares of the

Company’s common stock to be determined in accordance with the

terms of the warrant agreement and based on the Redemption Date and

the volume-weighted average price of the Company’s common stock

during the ten trading days immediately following January 23, 2025,

the date on which the redemption notice was sent to holders of

warrants. In no event will the number of shares of common stock

issued in connection with an exercise on a cashless basis in

accordance with subsection 6.1.2 of the warrant agreement exceed

0.361 shares of common stock per warrant. Any warrants that remain

unexercised as of 5:00 p.m., New York City time, on the Redemption

Date, will be void and no longer exercisable, and the holders of

those warrants will be entitled to receive $0.10 per warrant.

Holders of warrants in “street name” should immediately contact

their broker to determine their broker’s procedure for exercising

their warrants since the process to exercise is voluntary.

The public warrants are listed on the New York Stock Exchange

under the ticker symbol “GRND.WS.” Grindr understands from the New

York Stock Exchange that, as a result of the redemption of the

outstanding warrants, the warrants will cease to be listed on the

New York Stock Exchange, effective at the close of trading on

February 21, 2025, which is the trading day prior to the Redemption

Date.

None of Grindr, its board of directors or employees have made or

are making any representation or recommendation to any warrant

holder as to whether or not to exercise or refrain from exercising

any warrants.

The shares of common stock underlying the warrants have been

registered by Grindr under the Securities Act of 1933, as amended,

and are covered by a registration statement filed with, and

declared effective by, the Securities and Exchange Commission

(Registration No. 333-268782).

Questions concerning redemption and exercise of the warrants can

be directed to Continental Stock Transfer & Trust Company, by

mail at One State Street, 30th Floor, New York, NY 10004-1571, or

by telephone at 800-509-5586. For a copy of the notice of

redemption sent to the holders of the warrants and a prospectus

relating to the shares of common stock issuable upon exercise of

the warrants, please send an email request to IR@grindr.com or

visit our website at

https://investors.grindr.com/overview/default.aspx.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities of Grindr, nor shall

there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful.

Updated Financial

Outlook

Grindr also announced today that it expects full year 2024

revenue growth to exceed the Company’s previously provided outlook

of at least 29% revenue growth year-over-year. Grindr now expects

full year 2024 revenue to be between $343 and $345 million,

representing revenue growth of 32%-33% year-over-year. Grindr also

announced today that it reaffirms its previously provided outlook

for Adjusted EBITDA margin of 42% or greater for full year

2024.

The increase in revenue growth versus the financial outlook was

driven by a combination of outperformance in Grindr’s direct ad

sales business, which significantly exceeded expectations in

December 2024, and continued strength on the direct revenue side

(subscriptions and add ons). Financial results for the fourth

quarter and full year 2024 are expected to be reported in March

2025.

Forward Looking

Statements

This press release contains statements that may constitute

forward-looking statements within the meaning of the federal

securities laws and within the meaning of the “safe harbor”

provisions of the United States Private Securities Litigation

Reform Act of 1995. In some cases, you can identify these

forward-looking statements by the use of terminology such as

“anticipates,” “approximately,” “believes,” “continues,” “could,”

“estimates,” “expects,” “goal,” “intends,” “may,” “outlook,”

“plans,” “potential,” “predicts,” “projects,” “seeks,” “should,”

“upcoming,” “will” or the negative version of these words or other

comparable words or phrases. These forward-looking statements

include, among others, statements regarding the Company’s expected

revenue growth and Adjusted EBITDA margin for full year 2024, the

delisting of the warrants on the trading day prior to the

Redemption Date, and its expected reporting of financial results

for the fourth quarter and full year 2024 in March 2025.

Forward-looking statements are predictions, projections and other

statements about future events that are based on current

expectations and assumptions and, as a result, are not guarantees

of future performance and are subject to risks and uncertainties

that may cause actual results to differ materially from

expectations discussed in the forward-looking statements. Many

factors could cause actual future events to differ materially from

the forward-looking statements in this press release, including

those discussed in the section titled “Risk Factors” in annual

reports on Form 10-K and quarterly reports on Form 10-Q that we

file with the Securities and Exchange Commission from time to time.

Any forward-looking statement speaks only as of the date on which

it is made, and you should not place undue reliance on

forward-looking statements. Except to the extent required by

applicable law, we are under no obligation (and expressly disclaim

any such obligation) to update or revise our forward-looking

statements, whether as a result of new information, future events,

or otherwise.

Non-GAAP Financial

Measures

We use Adjusted EBITDA and Adjusted EBITDA margin, which are

non-GAAP measures, to understand and evaluate our core operating

performance. These non-GAAP financial measures, which may differ

from similarly titled measures used by other companies, are

presented to enhance investors’ overall understanding of our

financial performance and should not be considered a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP.

Adjusted EBITDA adjusts for the impact of items that we do not

consider indicative of the operational performance of our business.

We define Adjusted EBITDA as net income (loss) excluding income tax

provision (benefit); interest expense, net; depreciation and

amortization; stock-based compensation expense; transaction-related

costs; gain (loss) in fair value of warrant liability; and

severance expense, litigation-related costs, and other items, in

each case that are unrelated to our core ongoing business

operations. Adjusted EBITDA Margin is calculated by dividing

Adjusted EBITDA for a period by revenue for the same period. We

exclude the above items as some are non-cash in nature and others

may not be representative of normal operating results. While we

believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful

in evaluating our business, this information should be considered

as supplemental in nature and is not meant as a substitute for the

related financial information prepared and presented in accordance

with GAAP.

At this time, we are not able to estimate our expected net

income (loss) or net income (loss) margin for the full year ended

December 31, 2024, or to reconcile the guidance provided for

Adjusted EBITDA margin to net income (loss) margin for the full

year 2024 without unreasonable efforts due to the variability and

complexity of the charges excluded from Adjusted EBITDA.

Accordingly, we are relying on the forward-looking exception

provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude these

reconciliations. The variability of the charges, including

stock-based compensation and income tax provision (benefit), could

have a significant and potentially unpredictable impact on our GAAP

financial results.

Trademarks

This press release may contain trademarks of Grindr. Solely for

convenience, trademarks referred to in this press release may

appear without the ® or TM symbols, but such references are not

intended to indicate, in any way, that Grindr will not assert, to

the fullest extent under applicable law, its rights to these

trademarks.

About Grindr Inc.

With more than 14.5 million average monthly active users, Grindr

has grown to become the Global Gayborhood in Your Pocket™, on a

mission to make a world where the lives of our global community are

free, equal, and just. Available in 190 countries and territories,

Grindr is often the primary way for its users to connect, express

themselves, and discover the world around them. Since 2015 Grindr

for Equality has advanced human rights, health, and safety for

millions of LGBTQ+ people in partnership with organizations in

every region of the world. Grindr has offices in West Hollywood,

the Bay Area, Chicago, and New York. The Grindr app is available on

the App Store and Google Play.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123991727/en/

Investors: IR@grindr.com

Media: Press@grindr.com

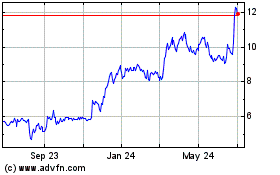

Grindr (NYSE:GRND)

Historical Stock Chart

From Dec 2024 to Jan 2025

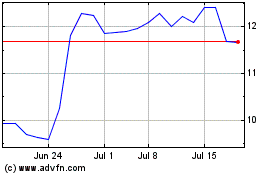

Grindr (NYSE:GRND)

Historical Stock Chart

From Jan 2024 to Jan 2025