GEO GROUP INC false 0000923796 0000923796 2024-12-03 2024-12-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 3, 2024

THE GEO GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Florida |

|

1-14260 |

|

65-0043078 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

| 4955 Technology Way, Boca Raton, Florida |

|

33431 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (561) 893-0101

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.01 Par Value |

|

GEO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

The slide presentation furnished hereto as Exhibit 99.1, and incorporated herein by reference, will be presented to certain existing investors of The GEO Group, Inc. (the “Company”) beginning on December 3, 2024, and may be used by the Company in various other presentations to existing and prospective investors and analysts on or after December 3, 2024.

The information furnished in this Item 7.01, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. The filing of this Item 7.01 of this Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation FD.

| Section 9 |

Financial Statements and Exhibits |

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

THE GEO GROUP, INC. |

|

|

|

|

| December 3, 2024 |

|

|

|

By: |

|

/s/ Mark J. Suchinski |

| Date |

|

|

|

|

|

Mark J. Suchinski |

|

|

|

|

|

|

Senior Vice President and Chief Financial Officer |

|

|

|

|

|

|

(Principal Financial Officer) |

3

- Confidential - Investor Conference

Presentation December 2024 Exhibit 99.1

Forward-Looking Statements This

presentation contains forward-looking statements regarding future events and future performance of GEO that involve risks and uncertainties that could materially and adversely affect actual results, including statements regarding GEO’s

financial guidance for the full year and fourth quarter of 2024, statements regarding GEO’s focus on reducing net debt, deleveraging its balance sheet, positioning itself to explore options to return capital to shareholders in the future, and

pursuing a disciplined allocation of capital to enhance long-term value for shareholders, executing on GEO’s strategic priorities, pursuing quality growth opportunities, and the upside this could have on GEO’s quarterly run-rate, and

GEO’s ability to scale up the delivery of diversified services to support the future needs of its government agency partners. Forward-looking statements generally can be identified by the use of forward-looking terminology such as

“may,” “will,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” or “continue” or the negative of such

words and similar expressions. Risks and uncertainties that could cause actual results to vary from current expectations and forward-looking statements contained in this press release include, but are not limited to: (1) GEO’s ability to meet

its financial guidance for 2024 given the various risks to which its business is exposed; (2) GEO’s ability to deleverage and repay, refinance or otherwise address its debt maturities in an amount and on terms commercially acceptable to GEO,

and on the timeline it expects or at all; (3) GEO’s ability to identify and successfully complete any potential sales of company-owned assets and businesses or potential acquisitions of assets or businesses on commercially advantageous terms

on a timely basis, or at all; (4) changes in federal and state government policy, orders, directives, legislation and regulations that affect public-private partnerships with respect to secure, correctional and detention facilities, processing

centers and reentry centers, including the timing and scope of implementation of President Biden's Executive Order directing the U.S. Attorney General not to renew the U.S. Department of Justice contracts with privately operated criminal detention

facilities; (5) changes in federal immigration policy; (6) public and political opposition to the use of public-private partnerships with respect to secure correctional and detention facilities, processing centers and reentry centers; (7) any

continuing impact of the COVID-19 global pandemic on GEO and GEO's ability to mitigate the risks associated with COVID-19; (8) GEO’s ability to sustain or improve company-wide occupancy rates at its facilities; (9) fluctuations in GEO’s

operating results, including as a result of contract terminations, contract renegotiations, changes in occupancy levels and increases in GEO’s operating costs; (10) general economic and market conditions, including changes to governmental

budgets and its impact on new contract terms, contract renewals, renegotiations, per diem rates, fixed payment provisions, and occupancy levels; (11) GEO’s ability to address inflationary pressures related to labor related expenses and other

operating costs; (12) GEO’s ability to timely open facilities as planned, profitably manage such facilities and successfully integrate such facilities into GEO’s operations without substantial costs; (13) GEO’s ability to win

management contracts for which it has submitted proposals and to retain existing management contracts; (14) risks associated with GEO’s ability to control operating costs associated with contract start-ups; (15) GEO’s ability to

successfully pursue growth opportunities and continue to create shareholder value; (16) GEO’s ability to obtain financing or access the capital markets in the future on acceptable terms or at all; and (17) other factors contained in

GEO’s Securities and Exchange Commission periodic filings, including its Form 10-K, 10-Q and 8-K reports, many of which are difficult to predict and outside of GEO’s control. Non-GAAP Financial Measures This presentation includes

Adjusted EBITDA and other non-GAAP financial measures such as Net Debt and Net Leverage. The non-GAAP measures provided herein may not be directly comparable to similar measures used by other companies in the Company’s industry, as other

companies may define such measures differently. The non-GAAP measures presented herein are not measurements of financial performance under GAAP, and should not be considered as alternatives to, and should only be considered together with, the

Company’s financial results in accordance with GAAP. The Company does not consider these non-GAAP financial measures to be a substitute for, or superior to, the information provided by GAAP financial results. A reconciliation of Non-GAAP

measures is included in GEO’s 3Q24 Earnings Release and Supplemental. 1 Important Notices and Disclaimers

Company Overview

GEO is the Leading Diversified Secure

and Community Reentry Services with a 40% share of the market * Based on total beds including idle and under development for U.S. headquartered companies only Figures are an approximation based on company disclosures and websites 70,200 18,000

Employees 11,000 Employees Revenues Employees Facility Bed Capacity 57,000 76,000 Beds 80,000 Beds

Founded in 1984 Initial Public

Offering (IPO) in 1994 Listed on NYSE in 1996 Included in Major Indexes: S&P 600 Russell 2000 18,000+ Employees Company History

Diversified U.S. Facility Footprint

300 GEO Facilities and Offices

International Services 4 International

Facilities 21 Secure Transportation Depots (U.K.) Healthcare Services at 13 Public Prisons (Australia)

Financial Overview

Financial Highlights Revenues ($ in

millions) Net Income ($ in millions) Adjusted EBITDA ($ in millions) * 2024E Based on Mid-point of FY2024 Financial Guidance issued on November 7, 2024 (1)Reflects $87 million pre-tax Loss on Extinguishment of Debt in 2Q2024 as a result of

GEO’s April 2024 debt refinancing.

Cash and Debt Balances Cash and

Marketable Securities ($ in millions) Consolidated Debt ($ in millions) In the third quarter of 2024, we retired approximately $71 million dollars of our Term Loan

Revenues by Segment GEO Care 25%

GEO Secure Services 75% YTD2024 Revenue = $1.82 Billion

Federal Government 61% Revenues By

Customer (YTD2024) Long-term relationships with top customers – 30+ Years with Federal Gov’t * Includes ICE Alternatives to Detention-ISAP Contract Diversified Long-Term, High-Quality Customer Relationships

FY2024 Guidance Net Income

Attributable to GEO (1) $40 Million - $45 Million + Net Interest Expense $182 Million - $184 Million + Loss on Extinguishment of Debt, pre-tax $87 Million + Income Taxes (including income tax provision on equity in earnings of affiliates) $12.5

Million - $14.5 Million + Depreciation and Amortization $126 Million – $127 Million + Non-Cash Stock Based Compensation $16 Million + Other Non-Cash $6.5 Million Adjusted EBITDA $470 Million - $480 Million Net Income Attributable to GEO Per

Diluted Share $0.30 - $0.34 Adjust Net Income Per Diluted Share $0.80 - $0.84 Weighted Average Common Shares Outstanding - Diluted 134 Million CAPEX Growth $12 Million - $13 Million Technology $25 Million - $27 Million Facility Maintenance $43

Million - $45 Million Capital Expenditures $80 Million - $85 Million Total Debt, Net $1.675 Billion - $1.625 Billion Total Leverage, Net * 3.5x - 3.5x (1) Net of ~$26M of tax benefits related to loss on extinguishment of debt and interest deduction

for shares of common stock as a result of the convertible note exchange * Total Net Leverage is calculated using the midpoint of Adjusted EBITDA guidance range.

Segment Trends

Incoming Administration’s

Immigration Enforcement Policies Detention Capacity Electronic Monitoring Secure Transportation Available capacity at existing residential reentry centers Growth in Non-Residential Programs Demand for Diversified Government Services Segment Trends

ICE USMS Continued Capacity Needs Facilities strategically located to support USMS needs Aging State prison infrastructure Correctional Staffing challenges Reentry Services State Correctional Agencies

The majority of Public Prison

Facilities have Significant Deferred Maintenance Needs According to a May 2023 DOJ OIG Report, the Federal Bureau of Prisons has approximately 123 facilities requiring an estimated $2 billion in maintenance costs1 In late 2018, it was estimated by

CGL, a criminal justice consulting and construction firm, that more than 80% of U.S. state prisons are 20 years old or older, representing approximately $69 billion in replacement costs.2 After decades of funding challenges, some states have begun

to address their aging infrastructure needs with expensive prison construction projects New York City ($8 billion – 4,200 bed facility)4 Indiana ($1.2 billion – 4,200-bed facility)3 Alabama ($1 billion – 4,000-bed facility)3 Fulton

County, GA ($1.7 billion – 4,500-bed facility)5 Nebraska ($350 million – 1,500-bed facility)3 Aging Prison Infrastructure *Sources: DOJ OIG Report on BOP Efforts to Maintain and Construct Institutions Correctional News (September/October

2018) Billion-dollar prisons: why the US is pouring money into new construction As Conditions Worsen at Rikers, New Commission Revives Push to Close It Fulton County Reconsiders New $1.7B Jail

U.S. Marshals Service (USMS) Stable

USMS Detention Populations (2014 –2023) Source: 2014-2021 figures are taken from the USMS FY2023 Performance Budget (https://www.justice.gov/file/1493071/download#:~:text=The%20USMS%20requests%20a%20total,for%20FPD%20in%20FY%202023.) Source:

2022 & 2023 Figures are based USMS FY2024 Performance Budget (https://www.justice.gov/d9/2023-03/usms_fpd_-_fy_2024_pb_narrative_-_omb_cleared_-_3-13-2023.pdf) ~43% Contractor Beds

U.S. Immigration and Customs

Enforcement 41.67% 56.99% 1.34% 1.10% 0.25% UNSUPERVISED NON-DETAINED DOCKET 7,000,000 – 8,000,0002 GOTAWAYS/OVERSTAYS/OTHER 9,574,500 DETAINED 38,8003 INTENSIVE SUPERVISION APPEARANCE PROGRAM (ISAP) PARTICIPANTS 182,5003 Sources: 1)

https://www.fairus.org/sites/default/files/2023-06/2023%20Illegal%20Alien%20Population%20Estimate_2.pdf 2) https://www.axios.com/2024/03/02/data-biden-border-crisis-immigration-8-million-detention 3) ICE Data (ice.gov/detain/detention-management)

and GEO 3Q24 Earnings Call *Chart based on disclosure from the National Immigration Center for Enforcement

U.S. Immigration and Customs

Enforcement FEDERAL SEGMENT Intensive Supervision Appearance Program (ISAP) (December 2022 – YTD 2024) Source: TRAC Alternatives to Detention Data (trac.syr.edu/immigration/detentionstats/atd_pop_table.html) and ICE Data

(ice.gov/detain/detention-management)

U.S. Immigration and Customs

Enforcement Private Sector 90% Public Sector 10% Current ICE Processing Center Beds Breakdown * GEO 42% * Approximations based on contract guarantee bed counts Source: ICE Data (ice.gov/detain/detention-management) Other 58% Private Sector Beds ICE

Processing Center Beds

Available Beds in Inventory *

Currently Idle Cheyenne Mountain, CO Facility is included in Facilities Under Contract/Underutilized Beds Idle Facilities * Location Ownership Bed Count Prospective Customers D. Ray James Facility GA Owned 1,900 North Lake Facility MI Owned 1,800

Flightline Facility TX Owned 1,800 Big Spring Facility TX Owned 1,732 Rivers Facility NC Owned 1,450 Delaney Hall Facility NJ Owned 1,054 ~10,000 Underutilized Beds * Location Ownership Bed Count ICE/USMS Facilities Currently Under Contract Multiple

States Owned/Leased ~ 8,000 TOTAL = ~ 18,000 Idle Facilities * Location Ownership Bed Count Prospective Customers D. Ray James Facility GA Owned 1,900 North Lake Facility MI Owned 1,800 Flightline Facility TX Owned 1,800 Big Spring Facility TX Owned

1,732 Rivers Facility NC Owned 1,450 Delaney Hall Facility NJ Owned 1,054 ~10,000 Underutilized Beds * Location Ownership Bed Count ICE/USMS Facilities Currently Under Contract Multiple States Owned/Leased ~ 8,000 TOTAL = ~ 18,000

Appendix

Capital Structure (as of 3Q2024)

Asset Value (as of 3Q2024) Based on

internal valuation of replacement cost for facilities. Secure services and youth facilities valued at $125,000 per bed; Re-entry facilities valued at $75,000 per bed Cost basis for real property is $2,693 million and NBV of real property $1,792

million Estimated based upon historical asset sales Excludes Headquarters’ Mortgage and Finance leases

Income Statement

Balance Sheet

Environmental, Social &

Governance (ESG) Overview

Ongoing review of GEO’s

health services operations, in the U.S. and internationally Ongoing review of health services key performance indicators Ongoing review of patient demographics Ongoing review of GEO’s bylaws, Code of Business Conduct and Ethics, and corporate

governance guidelines Annual review of GEO’s Political Activities and Contributions Policy and Report Annual review of GEO’s political contributions and lobbying expenditures Board Oversight Human Rights Committee Annual review of Human

Rights & ESG Report Ongoing review of ESG initiatives Ongoing review of diversity metrics Periodic review of GEO’s engagement with investors and external stakeholders Ongoing review of GEO’s cyber security capabilities and privacy

practices, periodic review of potential cyber vulnerabilities and remediation measures Risk management of cybersecurity threats Ongoing review and evaluation of GEO’s environmental sustainability initiatives Ongoing review of GEO Continuum of

Care Ongoing review of in-custody rehabilitation programs Ongoing review of reentry programs Ongoing review of post-release support services Criminal Justice & Rehabilitation Committee Health Services Committee Cybersecurity & Environmental

Oversight Committee Nominating & Corporate Governance Committee

To implement best practices that

follow recognized global Human Rights standards and respect the dignity and basic human rights of all individuals in our care. To be the leading provider of enhanced in-custody rehabilitation programs and post-release support services through our

award-winning GEO Continuum of Care ®. To provide quality support services that foster a safe and humane environment, deliver high-quality medical care, and adhere to independent accreditation standards. To provide development opportunities to

our workforce and to instill an organizational culture rooted in diversity, inclusion, and respect. To advance environmental sustainability in our facilities by investing in energy conservation measures and following independent Green Building

certification standards. GEO’s ESG Objectives

Diversity We are proud to be a

diversified employer. Women comprise 51% of our domestic workforce and play a significant role in our leadership and management. Across GEO, under-represented minorities account for 69% of our U.S. workforce. Employee Training We have a robust

training program for staff at all levels of the organization. In 2023, our U.S. Secure Services division completed approximately 1.3 million staff training hours Diversified Employer

GEO’s Environmental

Sustainability Policy Statement is disclosed in Annual ESG Report. GEO also provides disclosures on energy consumption statistics, water usage metrics, and Greenhouse Gas (GHG) Scope 1 and Scope 2 Emissions and Intensity Ratios. GEO has conducted

Sustainability and Energy Improvement Audits at select GEO facilities. As a result of these audits, GEO will invest approximately $25 million to retrofit, modify, and upgrade lighting, water, laundry, and HVAC systems at select Secure Services

facilities. Environmentally Responsible

Disclosures in our Human Rights and

ESG Report demonstrate the high quality of medical services provided across GEO’s Secure Services facilities in the U.S. In 2023, GEO Health Services oversaw approximately 719,000 medical encounters, including intake health screenings,

physical exams, chronic care visits, off-site consultations, sick calls, dental visits, and mental health visits. Our facilities are highly rated by leading accreditation entities: World Class Health Care The American Correctional Association The

Nation Commission of Correctional Health Care

GEO Continuum of Care® focuses

on integrating in-custody evidence-based rehabilitation with post-release services aimed at reducing recidivism. GEO Continuum of Care®: Rehabilitator of Lives GEO Continuum of Care 2023 Milestones: Completed approximately 4.6 million hours of

rehabilitation programming Awarded approximately 3,100 GEDs and high school equivalency degrees Awarded over 9,200 vocational training certifications Awarded approximately 8,100 substance abuse treatment completions Achieved over 46,000 behavioral

program completions and more than 36,000 individual cognitive behavioral sessions Provided Post-Release support services to more than 3,100 individuals with over 700 attaining employment. Since 2016, GEO has allocated approximately $9.6 million in

grants to returning citizens to assist them with community needs.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

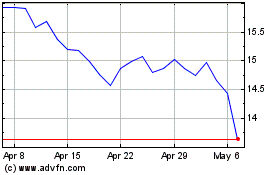

Geo (NYSE:GEO)

Historical Stock Chart

From Nov 2024 to Dec 2024

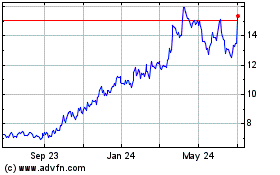

Geo (NYSE:GEO)

Historical Stock Chart

From Dec 2023 to Dec 2024