UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 001-35466

GasLog Ltd.

(Translation of registrant’s name into English)

c/o GasLog LNG Services Ltd.

69 Akti Miaouli, 18537

Piraeus, Greece

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F 🗹

Form 40-F ¨

| Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): |

¨ |

| |

|

| Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): |

¨ |

The press release issued by GasLog Ltd. on November

16, 2023, relating to its results for the three-month period ended September 30, 2023 is attached hereto as Exhibit 99.1.

EXHIBIT LIST

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: November 16, 2023 |

|

| |

|

| |

GASLOG LTD., |

| |

|

| |

|

by |

/s/ Paolo Enoizi |

|

| |

|

|

Name: |

Paolo Enoizi |

|

| |

|

|

Title: |

Chief Executive Officer |

|

Exhibit 99.1

GasLog Ltd. Reports Financial Results for the

Three-Month Period Ended September 30, 2023

Hamilton,

Bermuda, November 16, 2023, GasLog Ltd. and its subsidiaries (“GasLog”, “Group” or “Company”)

(NYSE: GLOG-PA), an international owner, operator and manager of liquefied natural gas (“LNG”) carriers, today

reported its financial results for the quarter ended September 30, 2023.

Recent Developments

Merger Agreement with GasLog Partners

On April 6, 2023, GasLog entered into an Agreement

and Plan of Merger (the “Merger Agreement”) with GasLog Partners LP (“GasLog Partners” or the “Partnership”),

GasLog Partners GP LLC, the general partner of the Partnership and Saturn Merger Sub LLC, a wholly owned subsidiary of GasLog (“Merger

Sub”). Pursuant to the Merger Agreement, (i) Merger Sub would merge with and into the Partnership, with the Partnership surviving

as a direct subsidiary of GasLog, and (ii) GasLog would acquire the outstanding common units of the Partnership not beneficially

owned by GasLog for overall consideration of $8.65 per common unit in cash (the “Transaction”), consisting in part of a special

distribution by the Partnership of $3.28 per common unit in cash (the “Special Distribution”) that would be distributed to

the Partnership’s unitholders in connection with the closing of the Transaction and the remainder to be paid by GasLog as merger

consideration at the closing of the Transaction.

The conflicts committee (the “Conflicts Committee”)

of the Partnership’s board of directors, comprised solely of independent directors and advised by its own independent legal and

financial advisors, unanimously recommended that the Partnership’s board of directors approve the Merger Agreement and determined

that the Transaction was in the best interests of the Partnership and the holders of its common units unaffiliated with GasLog. Acting

upon the recommendation and approval of the Conflicts Committee, the Partnership’s board of directors unanimously approved the Merger

Agreement and the Transaction and recommended that the common unitholders of the Partnership vote in favor of the Transaction.

The

Transaction was approved at the special meeting of the common unitholders of the Partnership held on July 7, 2023, based on the affirmative

vote (in person and in proxy) of the holders of at least a majority of the common units of the Partnership entitled to vote thereon, voting

as a single class, subject to a cutback for certain unitholders beneficially owning more than 4.9% of the outstanding common units (as

provided for in the Partnership’s Seventh Amended and Restated Agreement of Limited Partnership and described in the proxy statement

of the Partnership dated June 5, 2023 as filed with the Securities Exchange Commission (“SEC”)). The payment date for

the Special Distribution was July 12, 2023. The Transaction closed on July 13, 2023 at 6:30 a.m. Eastern Time (the

“Effective Time”) upon the filing of the certificate of merger with the Marshall Islands Registrar of Corporations. At the

Effective Time, each common unit that was issued and outstanding immediately prior to the Effective Time (other than common units that,

as of immediately prior to the Effective Time, were held by GasLog) was converted into the right to receive $5.37 in cash, without interest

and reduced by any applicable tax withholding, for each common unit. Accordingly, holders of common units not already beneficially owned

by GasLog who held their common units both on the Special Distribution record date of July 10, 2023 (subject to the applicability

of due-bill trading) and at the Effective Time received overall consideration of $8.65 per common unit. Trading in the Partnership’s

common units on the New York Stock Exchange (“NYSE”) was suspended on July 13, 2023, and delisting of the common units

took place on July 24, 2023. The Partnership’s 8.625% Series A Cumulative Redeemable Perpetual Fixed to Floating Rate

Preference Units (the “Partnership’s Series A Preference Units”), 8.200% Series B Cumulative Redeemable Perpetual

Fixed to Floating Rate Preference Units (the “Partnership’s Series B Preference Units”) and 8.500% Series C

Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units (the “Partnership’s Series C Preference Units”)

remain outstanding and continue to trade on the NYSE.

The merger consideration was partially financed

by the borrowing of a term loan in an aggregate principal amount of $50.0 million under a Bridge Facility Agreement dated July 3,

2023 (the “Bridge Facility Agreement”), among Merger Sub, as the original borrower, GasLog, as guarantor, DNB (UK) Ltd., as

arranger and bookrunner, the lenders party thereto and DNB Bank ASA, London Branch, as agent, with the Partnership succeeding to the obligations

of Merger Sub upon the consummation of the Transaction. The aggregate principal amount outstanding under the Bridge Facility Agreement

was repaid in full, together with accrued and unpaid interest, on July 26, 2023.

New Charter Agreements

During

the third quarter of 2023, GasLog Partners extended by one year the time charter agreement of the Methane Alison Victoria,

a steam turbine propulsion (“Steam”) LNG carrier, with CNTIC VPower Energy Ltd. (“CNTIC VPower”), an independent

Chinese energy company, with the contract now to expire in 2024. In addition, GasLog Partners signed a multi-year time charter agreement

for the Solaris, a tri-fuel diesel electric engine propulsion (“TFDE”) LNG carrier, with KE Fuel International Co., Ltd.

(“Kansai”) and a multi-year time charter agreement for the Methane Rita Andrea, a Steam LNG carrier, with an Asian

LNG buyer. Post-quarter end, GasLog extended by five years the time charter agreement of the GasLog Singapore, a TFDE LNG carrier,

with New Fortress Energy Transport Partners LLC (“NFE Transport Partners LLC”), with the contract now due to expire in 2030.

In addition, GasLog Partners signed a multi-year time charter agreement for the GasLog Santiago, a TFDE LNG carrier, with a major

energy exploration company.

New $2.8 billion Five-year Sustainability-linked

Senior Secured Reducing Revolving Credit Facility

On November 2, 2023, GasLog, signed a new

Five-Year Sustainability-Linked Senior Secured Reducing Revolving Credit Facility in the amount of $2.8 billion (the “Facility”).

This financing, involving 14 international banks, includes decarbonization and social key performance targets as a component of the Facility

pricing. The Facility refinances all outstanding debt of $2.1 billion secured by 23 LNG carriers across both GasLog and GasLog Partners

LP, following the acquisition by GasLog on July 13, 2023 of all the outstanding common units of GasLog Partners LP not already beneficially

owned by GasLog. The 23 LNG carriers (12 GasLog vessels and 11 GasLog Partners vessels) included in the Facility are comprised of ten

dual-fuel two-stroke engine propulsion (“X-DF”) LNG carriers, ten TFDE LNG carriers and three Steam LNG carriers. The Facility

has a five-year tenor, includes two one-year extension options and simplifies GasLog’s debt structure, providing incremental available

liquidity to the company while reducing interest cost and debt service requirements. Citibank, N.A., London Branch and BNP Paribas acted

as joint

coordinators on the Facility. DNB Bank ASA, London Branch has been appointed

as agent and security agent and ABN AMRO BANK N.V. as sustainability co-ordinator. Alpha Bank S.A., Credit Suisse AG, a UBS Group Company,

Danish Ship Finance A/S, ING Bank N.V., London Branch, National Bank of Greece S.A., Nordea Bank ABP, Filial I Norge, Oversea-Chinese

Banking Corporation Limited, DNB (UK) Limited and Standard Chartered Bank (Singapore) Limited acted as bookrunners and mandated lead arrangers

alongside the coordinators, the agent and the sustainability co-ordinator. National Australia Bank Limited and Skandinaviska Enskilda

Banken AB (Publ) were mandated lead arrangers. The transaction was completed on November 13, 2023, with GasLog drawing down an

amount of $2.1 billion and $672.0 million remaining available for general corporate purposes.

GasLog Dividend Declarations

On

November 15, 2023, the board of directors of GasLog declared a quarterly cash dividend of $0.25 per common share of GasLog to GasLog’s shareholders of record as of November 16, 2023.

On

November 15, 2023, the board of directors of GasLog declared a dividend on GasLog’s 8.75% Series A Cumulative

Redeemable Perpetual Preference Shares (“GasLog’s Preference Shares”) of $0.546875 per share payable on January 2, 2024, to holders of record as of December 29, 2023.

GasLog Partners Dividend Declarations

On

November 15, 2023, the board of directors of GasLog Partners approved and declared a distribution on the

Partnership’s Series A Preference Units of $0.5390625 per preference unit, a distribution on the Partnership’s

Series B Preference Units of $0.7274123 per preference unit and a distribution on the Partnership’s Series C

Preference Units of $0.53125 per preference unit. The cash distributions are payable on December 15, 2023 to all unitholders of

record as of December 8, 2023.

GasLog Quarterly Financial Results

| Amounts in thousands of U.S. dollars | |

For the three months ended | |

| | |

September 30,

2022 | | |

September 30,

2023 | |

| Revenues | |

$ | 241,918 | | |

$ | 229,018 | |

| Profit for the period | |

$ | 109,123 | | |

$ | 46,451 | |

| Adjusted EBITDA1 | |

$ | 192,861 | | |

$ | 177,320 | |

| Adjusted Profit1 | |

$ | 84,762 | | |

$ | 57,311 | |

1

Adjusted EBITDA and Adjusted Profit are non-GAAP financial measures and should not be used in isolation or

as substitutes for GasLog’s financial results presented in accordance with International Financial Reporting Standards (“IFRS”).

For the definitions and reconciliations of these measures to the most directly comparable financial measures calculated and presented

in accordance with IFRS, please refer to Exhibit II at the end of this press release.

There

were 2,865 available days for the quarter ended September 30, 2023, as compared to 3,199 available days for the quarter ended September 30,

2022. Available days represent total calendar days in the period after deducting off-hire days where vessels are undergoing dry-dockings

and unavailable days (for example, days before and after a dry-docking where the vessel has limited practical ability for chartering opportunities).

The decrease in available days was attributable to the Floating Storage Regasification Unit (“FSRU”) conversion of the Alexandroupolis

that started in February 2023, the increase in off-hire days for scheduled dry-dockings and repairs (nil dry-docking off-hire days

in the three-month period ended September 30, 2022, compared to 79 scheduled dry-docking and repair off-hire days in the three-month

period ended September 30, 2023), the sale of the Methane Shirley Elisabeth in September 2022 and the sale of the GasLog

Athens in July 2023.

Revenues were $229.0 million for the quarter ended

September 30, 2023 ($241.9 million for the quarter ended September 30, 2022). The decrease in revenues is mainly attributable

to the decrease in available days explained above. This decrease was partially offset by a net increase in revenues from our vessels operating

in the spot and short-term markets in the third quarter of 2023.

Profit for the period was $46.5 million for the

quarter ended September 30, 2023 ($109.1 million for the quarter ended September 30, 2022). The decrease in profit is mainly

attributable to the decrease of $29.9 million in gain from the marked-to-market valuation of our derivative financial instruments carried

at fair value through profit or loss due to changes in the forward yield curve, the increase of $17.2 million in financial costs, mainly

attributable to the increase in interest expense on loans, all as a result of the increased interest rates in the third quarter of 2023

as compared to the same period in 2022 and the decrease of $12.9 million in revenues, as discussed above, partially offset by the decrease

of $6.1 million in realized loss from derivatives held for trading.

Adjusted

EBITDA was $177.3 million for the quarter ended September 30, 2023 ($192.9 million for the quarter ended September 30,

2022). The decrease in Adjusted EBITDA is mainly attributable to the decrease in revenues of $12.9 million, as discussed above, the increase

of $1.7 million in general and administrative expenses and the increase of $1.1 million in vessel operating and supervision costs.

Adjusted

Profit was $57.3 million for the quarter ended September 30, 2023 ($84.8 million for the quarter ended September 30,

2022). The decrease in Adjusted Profit is mainly attributable to the decrease in Adjusted EBITDA and the increase in financial costs,

partially offset by the increase in financial income, all as a result of the increase in interest rates in the third quarter of 2023 as

compared to the same period in 2022 and the decrease in realized loss from derivatives held for trading.

As of September 30, 2023, GasLog had $172.8

million of cash and cash equivalents. An additional amount of $38.6 million of time deposits

with an original duration greater than three months was classified under

short-term cash deposits.

As

of September 30, 2023, GasLog had an aggregate of $2.9 billion of indebtedness outstanding under its credit facilities and bond agreements,

of which $332.3 million is repayable within one year. Current bank borrowings include an amount of $148.2 million with respect to the

credit facility of up to $450.0 million of GAS-four Ltd., GAS-sixteen Ltd. and GAS-seventeen Ltd. with Credit Suisse AG, Nordea Bank Abp,

filial I Norge, Iyo Bank Ltd., Singapore Branch and the Development Bank of Japan, Inc. (the “2019 GasLog Partners Facility”)

which matures in February 2024 (and which was refinanced under the Facility). Furthermore, as of September 30, 2023,

we also had an aggregate of $400.9 million of lease liabilities, of which $70.8 million is payable within one year.

As of September 30, 2023, the total remaining

balance of the contract prices of the four LNG carriers on order was $597.6 million, of which $330.9 million is due within 12 months and

will be funded by the four sale and leaseback agreements entered into on July 6, 2022 with CMB Financial Leasing Co., Ltd. (“CMBFL”).

As

of September 30, 2023, GasLog’s current assets totaled $263.3 million, while current liabilities totaled $588.1 million,

resulting in a negative working capital position of $324.8 million. Current liabilities include $148.2 million relating to the 2019 GasLog

Partners Facility which matures in February 2024, as mentioned above, and $66.6 million of unearned revenue in relation to hires

received in advance of September 30, 2023 (which represents a non-cash liability that will be recognized as revenue in October 2023

as the services are rendered).

Management monitors the Company’s liquidity

position throughout the year to ensure that it has access to sufficient funds to meet its forecast cash requirements, including newbuilding

and debt service commitments, and to monitor compliance with the financial covenants within its loan and bond facilities. We anticipate

that our primary sources of funds for at least twelve months from the date of this report will be available cash, cash from operations,

existing and future borrowings and future sale and leaseback transactions. We believe that these anticipated sources of funds will be

sufficient to meet our liquidity needs and to comply with our financial covenants for at least twelve months from the date of this report

and therefore it is appropriate to prepare the financial statements on a going concern basis.

GasLog Partners Quarterly Financial Results

| Amounts in thousands of U.S. dollars | |

For the three months ended | |

| | |

September 30,

2022 | | |

September 30,

2023 | |

| Revenues | |

$ | 95,679 | | |

$ | 100,747 | |

| Profit for the period | |

$ | 42,651 | | |

$ | 30,939 | |

Revenues were $100.7 million for the third quarter

of 2023 ($95.7 million for the same period in 2022). The increase of $5.0 million is mainly attributable to a net increase in revenues

from our vessels operating in the spot market in the third quarter of 2023, partially offset by a decrease in revenues resulting from

the 57 off-hire days due to the scheduled dry-dockings and repairs of two of our vessels in the third quarter of 2023 (compared to nil

in the same period in 2022) and the sale of the Methane Shirley Elisabeth in September 2022.

Profit was $30.9 million for the third quarter

of 2023 ($42.7 million for the same period in 2022). The decrease in profit of $11.8 million is mainly attributable to an increase of

$4.1 million in financial costs, a decrease of $3.1 million in gain on derivatives, an increase of $2.5 million in general and administrative

expenses and an increase of $1.7 million in voyage expenses and commissions.

As of September 30, 2023, GasLog Partners

had $68.8 million of cash and cash equivalents. An additional amount of $9.0 million of time deposits with an original duration greater

than three months was classified under short-term cash deposits.

As of September 30, 2023, GasLog Partners

had an aggregate of $763.3 million of bank borrowings outstanding under its credit facilities, of which $216.0 million was repayable within

one year.

As of September 30, 2023, GasLog Partners’

current assets totaled $109.6 million and current liabilities totaled $301.8 million, resulting in a negative working capital position

of $192.2 million. Current liabilities include $26.4 million of unearned revenue in relation to hires received in advance (which represents

a non-cash liability that will be recognized as revenues after September 30, 2023, as the services are rendered). Current liabilities

also include $148.2 million of current bank borrowings related to the 2019 GasLog Partners Facility, which matures in February 2024

(and which was refinanced under the Facility).

GasLog Partners Preference Unit Repurchase Programme

In the quarter ended September 30, 2023, there

were no repurchases of preference units under GasLog Partners’ preference unit repurchase programme.

GasLog 8.75% Series A Cumulative Redeemable Perpetual Preference

Shares Repurchase Programme

On August 2, 2023, the board of directors

of GasLog approved a preference share repurchase programme of up to $35.0 million of GasLog’s Preference Shares, effective immediately.

Under the terms of the preference repurchase programme, GasLog may repurchase GasLog’s Preference Shares from time to time, at GasLog's

discretion, on the open market, in privately negotiated transactions or through redemptions. Any repurchases are subject to market conditions,

applicable legal requirements and other considerations. GasLog is not obligated under the preference repurchase programme to repurchase

any specific dollar amount or number of GasLog’s Preference Shares, and the preference repurchase programme may be modified, suspended

or discontinued at any time or never utilized.

In the third quarter of 2023, and since the inception

of the repurchase programme, GasLog has repurchased an aggregate of 46,388 of

GasLog’s Preference Shares at a weighted average price of $24.59

per preference share. The total amount paid during the quarter ended September 30, 2023 for repurchases of GasLog’s Preference

Shares was $1.1 million, including commissions.

Fleet Update

Owned Fleet

As of November 16, 2023, GasLog’s fleet

consisted of the following vessels:

| Vessel Name |

|

Year

Built |

|

Cargo

Capacity

(cbm) |

|

Charterer |

|

Propulsion |

|

Charter

Expiration(1) |

|

Optional

Period(2) |

| 1 |

Alexandroupolis (3) |

|

2010 |

|

153,600 |

|

n/a |

|

TFDE |

|

n/a |

|

n/a |

| 2 |

Methane Jane Elizabeth* |

|

2006 |

|

145,000 |

|

Cheniere (4) |

|

Steam |

|

March 2024 |

|

2025 (4) |

| 3 |

GasLog Seattle* |

|

2013 |

|

155,000 |

|

Energy Trading Company (5) |

|

TFDE |

|

March 2024 |

|

— |

| 4 |

GasLog Savannah |

|

2010 |

|

155,000 |

|

Multinational Oil and Gas Company |

|

TFDE |

|

July 2024 |

|

2025 (6) |

| 5 |

Methane Alison Victoria* |

|

2007 |

|

145,000 |

|

CNTIC VPower |

|

Steam |

|

October 2024 |

|

2025 (7) |

| 6 |

GasLog Greece* |

|

2016 |

|

174,000 |

|

Shell |

|

TFDE |

|

March 2026 |

|

2031 (8) |

| 7 |

Methane Rita Andrea* |

|

2006 |

|

145,000 |

|

Asian LNG buyer |

|

Steam |

|

March 2026 |

|

— |

| 8 |

GasLog Santiago* |

|

2013 |

|

155,000 |

|

Trafigura (9) |

|

TFDE |

|

December 2023 |

|

— |

| |

|

|

|

|

|

|

Major Energy Exploration Company |

|

|

|

March 2026 |

|

2027 (10) |

| 9 |

GasLog Glasgow* |

|

2016 |

|

174,000 |

|

Shell |

|

TFDE |

|

June 2026 |

|

2031 (8) |

| 10 |

GasLog Genoa |

|

2018 |

|

174,000 |

|

Shell |

|

X-DF |

|

March 2027 |

|

2030-2033 (8) |

| 11 |

GasLog Windsor |

|

2020 |

|

180,000 |

|

Centrica (11) |

|

X-DF |

|

April 2027 |

|

2029-2033 (11) |

| 12 |

GasLog Westminster |

|

2020 |

|

180,000 |

|

Centrica |

|

X-DF |

|

July 2027 |

|

2029-2033 (11) |

| 13 |

GasLog Georgetown |

|

2020 |

|

174,000 |

|

Cheniere |

|

X-DF |

|

November 2027 |

|

2030-2034 (6) |

| 14 |

GasLog Galveston |

|

2021 |

|

174,000 |

|

Cheniere |

|

X-DF |

|

January 2028 |

|

2031-2035 (6) |

| 15 |

GasLog Wellington |

|

2021 |

|

180,000 |

|

Cheniere |

|

X-DF |

|

June 2028 |

|

2031-2035 (6) |

| 16 |

GasLog Winchester |

|

2021 |

|

180,000 |

|

Cheniere |

|

X-DF |

|

August 2028 |

|

2031-2035 (6) |

| 17 |

GasLog Geneva* |

|

2016 |

|

174,000 |

|

Shell |

|

TFDE |

|

September 2028 |

|

2031 (8) |

| 18 |

GasLog Gibraltar* |

|

2016 |

|

174,000 |

|

Shell |

|

TFDE |

|

October 2028 |

|

2031 (8) |

| 19 |

GasLog Gladstone |

|

2019 |

|

174,000 |

|

Shell |

|

X-DF |

|

January 2029 |

|

2032-2035 (8) |

| 20 |

Methane Becki Anne* |

|

2010 |

|

170,000 |

|

Shell |

|

TFDE |

|

March 2029 |

|

— |

| 21 |

GasLog Warsaw |

|

2019 |

|

180,000 |

|

Endesa (12) |

|

X-DF |

|

May 2029 |

|

2035-2041 (12) |

| 22 |

Solaris* |

|

2014 |

|

155,000 |

|

Kansai |

|

TFDE |

|

April 2030 |

|

— |

| 23 |

GasLog Singapore |

|

2010 |

|

155,000 |

|

NFE Transport Partners LLC |

|

TFDE |

|

June 2030 |

|

— |

| 24 |

GasLog Wales |

|

2020 |

|

180,000 |

|

Jera (13) |

|

X-DF |

|

March 2032 |

|

2035-2038 (13) |

Bareboat Vessels

As of November 16, 2023, GasLog’s bareboat

fleet consisted of the following vessels:

|

Vessel Name |

|

Year

Built |

|

Cargo

Capacity

(cbm) |

|

Charterer |

|

Propulsion |

|

Charter

Expiration(1) |

|

Optional

Period(2) |

| 1 |

GasLog Sydney* |

|

2013 |

|

155,000 |

|

Centrica |

|

TFDE |

|

May 2024 |

|

— |

| 2 |

GasLog Skagen |

|

2013 |

|

155,000 |

|

Tokyo LNG (14) |

|

TFDE |

|

September 2024 |

|

— |

| 3 |

GasLog Saratoga |

|

2014 |

|

155,000 |

|

Mitsui (15) |

|

TFDE |

|

September 2024 |

|

— |

| 4 |

GasLog Shanghai* |

|

2013 |

|

155,000 |

|

Woodside (16) |

|

TFDE |

|

March 2025 |

|

2026 (16) |

| 5 |

Methane Heather Sally* |

|

2007 |

|

145,000 |

|

SEA Charterer (17) |

|

Steam |

|

July 2025 |

|

— |

| 6 |

GasLog Hong Kong |

|

2018 |

|

174,000 |

|

TotalEnergies (18) |

|

X-DF |

|

December 2025 |

|

2028 (18) |

| 7 |

GasLog Salem |

|

2015 |

|

155,000 |

|

Gunvor (19) |

|

TFDE |

|

March 2026 |

|

— |

| 8 |

Methane Julia Louise |

|

2010 |

|

170,000 |

|

Shell |

|

TFDE |

|

March 2026 |

|

2029-2031 (8) |

| 9 |

GasLog Houston |

|

2018 |

|

174,000 |

|

Shell |

|

X-DF |

|

May 2028 |

|

2031-2034 (8) |

| * | Indicates the Partnership’s owned and bareboat fleet as of November 16, 2023. |

| (1) | Indicates the expiration of the initial term. |

| (2) | The period shown reflects the expiration of the minimum optional

period and the maximum optional period. |

| (3) | The vessel GasLog Chelsea was renamed to Alexandroupolis

in 2023. The vessel is currently undergoing conversion into an FSRU. |

| (4) | The vessel is chartered to Cheniere Marketing International LLP, a wholly owned subsidiary of Cheniere Energy, Inc. (“Cheniere”).

Cheniere has the right to extend the charters of (a) the GasLog Georgetown, the GasLog Galveston, the GasLog Wellington

and the GasLog Winchester by three consecutive periods of three years, two years and two years and (b) the Methane Jane

Elizabeth by an additional period of one year, provided that Cheniere gives us advance notice of the declarations. |

| (5) | The vessel is chartered to a Swiss-headquartered energy trading

company. |

| (6) | The charterer has the right to extend the charter by an additional

period of one year, provided that the charterer gives us advance notice of the declaration. |

| (7) | CNTIC VPower may extend the term of the related charter by an

additional period of one year, provided that the charterer gives us advance notice of declaration. |

| (8) | The vessel is chartered to a wholly owned subsidiary of Shell plc (“Shell”). Shell has the right to extend the charters

of (a) the GasLog Genoa, the GasLog Houston and the GasLog Gladstone by two additional periods of three years,

(b) the Methane Julia Louise for a period of either three or five years, (c) the GasLog Greece and the GasLog

Glasgow for a period of five years and (d) the GasLog Geneva and the GasLog Gibraltar for a period of three years,

provided that Shell gives us advance notice of the declarations. |

| (9) | The vessel is chartered to Trafigura Maritime Logistics PTE

Ltd. (“Trafigura”). |

| (10) | The charterer has the right to extend the charter by an additional

period of one year, provided that the charterer gives us advance notice of the declaration. |

| (11) | The vessel is chartered to Pioneer Shipping Limited, a wholly owned subsidiary of Centrica plc (“Centrica”). Centrica

has the right to extend the charter by three additional periods of two years, provided that Centrica gives us advance notice of declaration. |

| (12) | “Endesa” refers to Endesa S.A. Endesa has the right

to extend the charter of the GasLog Warsaw by two additional periods of six years, provided that Endesa gives us advance notice

of declaration. |

| (13) | “Jera” refers to LNG Marine Transport Limited, the principal LNG shipping entity of Japan’s Jera Co., Inc.

Jera has the right to extend the charter by two additional periods of three years, provided that Jera gives us advance notice of declaration. |

| (14) | The vessel is chartered to Tokyo LNG Tanker Co. Ltd. (“Tokyo

LNG”). |

| (15) | The vessel is chartered to Mitsui & Co., Ltd.

(“Mitsui”). |

| (16) | The vessel is chartered to Woodside Energy Shipping Singapore

Pte. Ltd. (“Woodside”). The charterer has the right to extend the charter by an additional period of one year, provided that

the charterer gives us advance notice of declaration. |

| (17) | The vessel is chartered to a Southeast Asian charterer (“SEA

Charterer”). |

| (18) | The vessel is chartered to TotalEnergies Gas & Power

Limited, a wholly owned subsidiary of TotalEnergies SE (“TotalEnergies”). TotalEnergies has the right to extend the charter

for a period of three years, provided that TotalEnergies provides us with advance notice of declaration. |

| (19) | The vessel is chartered to Clearlake Shipping Pte. Ltd., a wholly

owned subsidiary of Gunvor Group Ltd. (“Gunvor”). |

Future Deliveries

As of November 16, 2023, GasLog has four newbuildings

on order at Daewoo Shipbuilding and Marine Engineering Co., Ltd., which was acquired by Hanwha Ocean Co. Ltd., an affiliate of the

Hanwha Group:

| LNG Carrier |

|

Expected

Delivery |

|

Cargo

Capacity

(cbm) |

|

Charterer |

|

Propulsion(1) |

|

Estimated Charter

Expiration(2) |

|

| Hull No. 2532 |

|

Q3 2024 |

|

174,000 |

|

Multinational Oil and Gas Company |

|

MEGI |

|

2031 |

|

| Hull No. 2533 |

|

Q3 2024 |

|

174,000 |

|

Mitsui |

|

MEGI |

|

2033 |

|

| Hull No. 2534 |

|

Q3 2025 |

|

174,000 |

|

Woodside |

|

MEGI |

|

2035 |

|

| Hull No. 2535 |

|

Q4 2025 |

|

174,000 |

|

Woodside |

|

MEGI |

|

2035 |

|

____________

| (1) | M-type, Electronically controlled Gas Injection (“MEGI”) engine. |

| (2) | Charter expiration to be determined based upon actual date of delivery. |

Forward-Looking Statements

All statements in this press release that are not

statements of historical fact are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation

Reform Act of 1995. Forward-looking statements include statements that address activities, events or developments that GasLog and the

Partnership expect, project, believe or anticipate will or may occur in the future, particularly in relation to our operations, cash flows,

financial position, liquidity and cash available for dividends or distributions, plans, strategies, business prospects and changes and

trends in our business and the markets in which we operate. We caution that these forward-looking statements represent our estimates and

assumptions only as of the date of this press release, about factors that are beyond our ability to control or predict, and are not intended

to give any assurance as to future results. Any of these factors or a combination of these factors could materially affect future results

of operations and the ultimate accuracy of the forward-looking statements. Other factors that might cause future results and outcomes

to differ include, but are not limited to, the other risks

and uncertainties described in GasLog's Annual Report on Form 20-F

filed with the SEC on March 3, 2023 and the Partnership's Annual Report on Form 20-F filed with the SEC on March 6, 2023,

each available at http://www.sec.gov. Accordingly, you should not unduly rely on any forward-looking statements.

We undertake no obligation to update or revise

any forward-looking statements contained in this press release, whether as a result of new information, future events, a change in our

views or expectations or otherwise, except as required by applicable law. New factors emerge from time to time, and it is not possible

for us to predict all of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which

any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking

statement.

EXHIBIT I - Unaudited Interim Financial Information of GasLog

Ltd. and its Subsidiaries

GasLog Ltd. and its Subsidiaries

Unaudited condensed consolidated statements

of financial position

As of December 31, 2022 and September 30,

2023

(Amounts expressed in thousands of U.S. Dollars)

| |

|

December 31, 2022 |

|

September 30, 2023 |

| Assets |

|

|

|

|

| Non-current assets |

|

|

|

|

| Goodwill |

|

9,511 |

|

9,511 |

| Investment in associates |

|

28,823 |

|

43,209 |

| Deferred financing costs |

|

8,778 |

|

8,273 |

| Other non-current assets |

|

2,092 |

|

3,767 |

| Derivative financial instruments, non-current portion |

|

13,225 |

|

— |

| Tangible fixed assets |

|

4,514,663 |

|

3,945,404 |

| Vessels under construction |

|

210,099 |

|

476,560 |

| Right-of-use assets |

|

416,485 |

|

494,056 |

| Total non-current assets |

|

5,203,676 |

|

4,980,780 |

| Current assets |

|

|

|

|

| Trade and other receivables |

|

22,897 |

|

31,705 |

| Dividends receivable and other amounts due from related parties |

|

61 |

|

455 |

| Derivative financial instruments, current portion |

|

25,383 |

|

159 |

| Inventories |

|

8,483 |

|

8,509 |

| Prepayments and other current assets |

|

7,262 |

|

11,014 |

| Short-term cash deposits |

|

36,000 |

|

38,582 |

| Cash and cash equivalents |

|

368,286 |

|

172,828 |

| Total current assets |

|

468,372 |

|

263,252 |

| Total assets |

|

5,672,048 |

|

5,244,032 |

| Equity and liabilities |

|

|

|

|

| Equity |

|

|

|

|

| Preference shares |

|

46 |

|

46 |

| Share capital |

|

954 |

|

954 |

| Contributed surplus |

|

658,888 |

|

1,038,226 |

| Reserves |

|

16,464 |

|

14,494 |

| Retained earnings |

|

108,685 |

|

162,579 |

| Equity attributable to owners of the Group |

|

785,037 |

|

1,216,299 |

| Non-controlling interests |

|

936,741 |

|

280,045 |

| Total equity |

|

1,721,778 |

|

1,496,344 |

| Current liabilities |

|

|

|

|

| Trade accounts payable |

|

19,725 |

|

12,562 |

| Ship management creditors |

|

14 |

|

94 |

| Amounts due to related parties |

|

26 |

|

192 |

| Derivative financial instruments, current portion |

|

2,834 |

|

10,380 |

| Other payables and accruals |

|

166,932 |

|

161,749 |

| Borrowings, current portion |

|

294,977 |

|

332,305 |

| Lease liabilities, current portion |

|

48,548 |

|

70,837 |

| Total current liabilities |

|

533,056 |

|

588,119 |

| Non-current liabilities |

|

|

|

|

| Derivative financial instruments, non-current portion |

|

5,498 |

|

8,656 |

| Borrowings, non-current portion |

|

3,004,767 |

|

2,590,309 |

| Lease liabilities, non-current portion |

|

287,828 |

|

330,061 |

| Other non-current liabilities |

|

119,121 |

|

230,543 |

| Total non-current liabilities |

|

3,417,214 |

|

3,159,569 |

| Total equity and liabilities |

|

5,672,048 |

|

5,244,032 |

GasLog Ltd. and its Subsidiaries

Unaudited condensed consolidated statements

of profit or loss

For

the three and nine months ended September 30, 2022 and 2023

(Amounts

expressed in thousands of U.S. Dollars)

| |

|

For the three months ended |

|

For the nine months ended |

|

| |

|

|

|

|

|

| |

|

September

30, 2022 |

|

September

30, 2023 |

|

September

30, 2022 |

|

September

30, 2023 |

|

| Revenues |

|

241,918 |

|

229,018 |

|

671,737 |

|

688,083 |

|

| Voyage expenses and commissions |

|

(3,757 |

) |

(4,500 |

) |

(11,084 |

) |

(14,218 |

) |

| Vessel operating and supervision costs |

|

(39,091 |

) |

(40,180 |

) |

(125,174 |

) |

(118,591 |

) |

| Depreciation |

|

(57,233 |

) |

(61,355 |

) |

(170,074 |

) |

(177,489 |

) |

| Impairment loss |

|

— |

|

— |

|

(56,911 |

) |

(11,740 |

) |

| Loss on disposal of non-current assets |

|

(167 |

) |

(749 |

) |

(744 |

) |

(2,058 |

) |

| General and administrative expenses |

|

(5,706 |

) |

(10,667 |

) |

(22,608 |

) |

(27,873 |

) |

| Profit from operations |

|

135,964 |

|

111,567 |

|

285,142 |

|

336,114 |

|

| Financial costs |

|

(49,338 |

) |

(66,500 |

) |

(126,173 |

) |

(194,554 |

) |

| Financial income |

|

1,081 |

|

2,815 |

|

1,493 |

|

12,740 |

|

| Gain/(loss) on derivatives |

|

21,611 |

|

(2,090 |

) |

67,342 |

|

8,383 |

|

| Share of (loss)/profit of associates |

|

(195 |

) |

659 |

|

740 |

|

2,184 |

|

| Total other expenses, net |

|

(26,841 |

) |

(65,116 |

) |

(56,598 |

) |

(171,247 |

) |

| Profit for the period |

|

109,123 |

|

46,451 |

|

228,544 |

|

164,867 |

|

| Attributable to: |

|

|

|

|

|

|

|

|

|

| Owners of the Group |

|

77,917 |

|

39,513 |

|

168,441 |

|

104,341 |

|

| Non-controlling interests |

|

31,206 |

|

6,938 |

|

60,103 |

|

60,526 |

|

| |

|

109,123 |

|

46,451 |

|

228,544 |

|

164,867 |

|

GasLog Ltd. and its Subsidiaries

Unaudited condensed consolidated statements of cash flows

For the nine months ended September 30, 2022 and 2023

(Amounts expressed in thousands of U.S. Dollars)

| |

|

For the nine months ended |

| |

|

September 30,

2022 |

|

September 30,

2023 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

| Profit for the period |

|

|

228,544 |

|

|

164,867 |

|

| Adjustments for: |

|

|

|

|

|

|

|

| Depreciation |

|

|

170,074 |

|

|

177,489 |

|

| Impairment loss |

|

|

56,911 |

|

|

11,740 |

|

| Loss on disposal of non-current assets |

|

|

744 |

|

|

2,058 |

|

| Share of profit of associates |

|

|

(740 |

) |

|

(2,184 |

) |

| Financial income |

|

|

(1,493 |

) |

|

(12,740 |

) |

| Financial costs |

|

|

126,173 |

|

|

194,554 |

|

| Gain on derivatives (excluding realized loss/gain on forward foreign exchange contracts held for trading) |

|

|

(71,218 |

) |

|

(5,621 |

) |

| Unrealized foreign exchange losses on short-term cash deposits |

|

|

— |

|

|

62 |

|

| Share-based compensation |

|

|

612 |

|

|

1,357 |

|

| |

|

|

509,607 |

|

|

531,582 |

|

| Movements in working capital |

|

|

(37,361 |

) |

|

(28,624 |

) |

| Net cash provided by operating activities |

|

|

472,246 |

|

|

502,958 |

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

| Payments for tangible fixed assets and vessels under construction |

|

|

(125,847 |

) |

|

(171,416 |

) |

| Proceeds from sale and sale and leasebacks of tangible fixed assets, net |

|

|

177,032 |

|

|

331,998 |

|

| Proceeds from FSRU forthcoming sale |

|

|

92,780 |

|

|

107,088 |

|

| Other investments |

|

|

(579 |

) |

|

(13,377 |

) |

| Payments for right-of-use assets |

|

|

— |

|

|

(8,998 |

) |

| Dividends received from associate |

|

|

— |

|

|

750 |

|

| Purchase of short-term cash deposits |

|

|

(25,000 |

) |

|

(117,144 |

) |

| Maturity of short-term cash deposits |

|

|

— |

|

|

114,500 |

|

| Financial income received |

|

|

1,004 |

|

|

12,489 |

|

| Net cash provided by investing activities |

|

|

119,390 |

|

|

255,890 |

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

| Proceeds from loans and bonds, net of discount |

|

|

333,248 |

|

|

152,960 |

|

| Loan and bond repayments |

|

|

(648,553 |

) |

|

(533,207 |

) |

| Principal elements of lease payments |

|

|

(29,835 |

) |

|

(45,689 |

) |

| Interest paid |

|

|

(122,105 |

) |

|

(175,978 |

) |

| Release of cash collaterals for swaps |

|

|

990 |

|

|

— |

|

| Payment of loan and bond issuance costs |

|

|

(4,652 |

) |

|

(2,612 |

) |

| Proceeds from interest rate swaps termination |

|

|

— |

|

|

35,789 |

|

| Payment of equity raising costs |

|

|

(20 |

) |

|

— |

|

| Merger consideration – Transaction |

|

|

— |

|

|

(197,528 |

) |

| Dividends paid (common and preference) |

|

|

(79,362 |

) |

|

(187,170 |

) |

| Repurchase of GasLog’s and GasLog Partners’ preference shares/units |

|

|

(38,740 |

) |

|

(1,142 |

) |

| Net cash used in financing activities |

|

|

(589,029 |

) |

|

(954,577 |

) |

| Effects of exchange rate changes on cash and cash equivalents |

|

|

(856 |

) |

|

271 |

|

| Increase/(decrease) in cash and cash equivalents |

|

|

1,751 |

|

|

(195,458 |

) |

| Cash and cash equivalents, beginning of the period |

|

|

282,246 |

|

|

368,286 |

|

| Cash and cash equivalents, end of the period |

|

|

283,997 |

|

|

172,828 |

|

EXHIBIT II

GasLog Ltd. and its Subsidiaries

Non-GAAP Financial Measures:

EBITDA, Adjusted EBITDA and Adjusted Profit

EBITDA is defined

as earnings before depreciation, amortization, financial income and costs, gain/loss on derivatives and taxes. Adjusted EBITDA is defined

as EBITDA before foreign exchange gains/losses, impairment loss, gain/loss on disposal of non-current assets, restructuring costs

and the costs relating to the 2021 take-private transaction with BlackRock’s Global Energy & Power Infrastructure team

and the Transaction (collectively such costs, the “Transaction Costs”). Adjusted Profit represents earnings before write-off

and accelerated amortization of unamortized loan fees/bond fees and premium/discount, foreign exchange gains/losses, unrealized foreign

exchange losses on cash and bond, impairment loss, swap optimization costs (with respect to cash collateral amendments), gain/loss on

disposal of non-current assets, restructuring costs, Transaction Costs and non-cash gain/loss on derivatives that includes (if any) (a) unrealized

gain/loss on derivative financial instruments held for trading, (b) recycled loss of cash flow hedges reclassified to profit or loss

and (c) ineffective portion of cash flow hedges. EBITDA, Adjusted EBITDA and Adjusted Profit are non-GAAP financial measures that

are used as supplemental financial measures by management and external users of financial statements, such as investors, to assess our

financial and operating performance. We believe that these non-GAAP financial measures assist our management and investors by increasing

the comparability of our performance from period to period. We believe that including EBITDA, Adjusted EBITDA and Adjusted Profit assists

our management and investors in (i) understanding and analyzing the results of our operating and business performance, (ii) selecting

between investing in us and other investment alternatives and (iii) monitoring our ongoing financial and operational strength in

assessing whether to purchase and/or to continue to hold our common shares. This is achieved by excluding the potentially disparate effects

between periods of, in the case of EBITDA and Adjusted EBITDA, financial costs, gain/loss on derivatives, taxes, depreciation and amortization;

in the case of Adjusted EBITDA, foreign exchange gains/losses, impairment loss, gain/loss on disposal of non-current assets, restructuring

costs and Transaction Costs; and in the case of Adjusted Profit, write-off and accelerated amortization of unamortized loan/bond fees

and premium/discount, foreign exchange gains/losses, unrealized foreign exchange losses on cash and bond, impairment loss, swap optimization

costs (with respect to cash collateral amendments), gain/loss on disposal of non-current assets, restructuring costs, Transaction Costs

and non-cash gain/loss on derivatives, which items are affected by various and possibly changing financing methods, financial market conditions,

capital structure and historical cost basis, and which items may significantly affect results of operations between periods.

EBITDA, Adjusted EBITDA and Adjusted Profit have limitations as analytical

tools and should not be considered as alternatives to, or as substitutes for, or superior to, profit, profit from operations, or any other

measure of operating performance presented in accordance with IFRS. Some of these limitations include the fact that they do not reflect

(i) our cash expenditures or future requirements for capital expenditures or contractual commitments, (ii) changes in, or cash

requirements for, our working capital needs and (iii) the cash requirements necessary to service interest or principal payments on

our debt. Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will have to be replaced

in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. EBITDA, Adjusted EBITDA and

Adjusted Profit are not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows and other

companies in our industry may calculate these measures differently than we do, limiting their usefulness as a comparative measure.

In evaluating Adjusted EBITDA and Adjusted Profit, you should be aware

that in the future we may incur expenses that are the same as, or similar to, some of the adjustments in this presentation. Our presentation

of Adjusted EBITDA and Adjusted Profit should not be construed as an inference that our future results will be unaffected by the excluded

items. Therefore, the non-GAAP financial measures as presented below may not be comparable to similarly titled measures of other companies

in the shipping or other industries.

GasLog Ltd. and its Subsidiaries

Reconciliation

of Profit to EBITDA and Adjusted EBITDA:

(Amounts expressed in thousands of U.S. Dollars)

| |

|

For the three months ended |

|

For the nine months ended |

|

| |

|

September 30,

2022 |

|

September 30,

2023 |

|

September 30,

2022 |

|

September 30,

2023 |

|

| Profit for the period |

|

|

109,123 |

|

|

46,451 |

|

|

228,544 |

|

|

164,867 |

|

| Depreciation |

|

|

57,233 |

|

|

61,355 |

|

|

170,074 |

|

|

177,489 |

|

| Financial costs |

|

|

49,338 |

|

|

66,500 |

|

|

126,173 |

|

|

194,554 |

|

| Financial income |

|

|

(1,081 |

) |

|

(2,815 |

) |

|

(1,493 |

) |

|

(12,740 |

) |

| (Gain)/loss on derivatives |

|

|

(21,611 |

) |

|

2,090 |

|

|

(67,342 |

) |

|

(8,383 |

) |

| EBITDA |

|

|

193,002 |

|

|

173,581 |

|

|

455,956 |

|

|

515,787 |

|

| Foreign exchange (gains)/losses, net |

|

|

(304 |

) |

|

725 |

|

|

(232 |

) |

|

1,613 |

|

| Restructuring costs |

|

|

(4 |

) |

|

(10 |

) |

|

1,685 |

|

|

126 |

|

| Transaction Costs |

|

|

— |

|

|

2,275 |

|

|

840 |

|

|

4,607 |

|

| Impairment loss |

|

|

— |

|

|

— |

|

|

56,911 |

|

|

11,740 |

|

| Loss on disposal of non-current assets |

|

|

167 |

|

|

749 |

|

|

744 |

|

|

2,058 |

|

| Adjusted EBITDA |

|

|

192,861 |

|

|

177,320 |

|

|

515,904 |

|

|

535,931 |

|

GasLog Ltd. and its Subsidiaries

Reconciliation of Profit to Adjusted Profit:

(Amounts expressed in thousands of U.S. Dollars)

| |

|

For the three months ended |

|

For the nine months ended |

|

| |

|

September 30,

2022 |

|

September 30,

2023 |

|

September 30,

2022 |

|

September 30,

2023 |

|

| Profit for the period |

|

|

109,123 |

|

|

46,451 |

|

|

228,544 |

|

|

164,867 |

|

| Non-cash (gain)/loss on derivatives |

|

|

(24,890 |

) |

|

4,896 |

|

|

(85,544 |

) |

|

5,666 |

|

| Write-off of unamortized loan fees |

|

|

294 |

|

|

1,848 |

|

|

1,444 |

|

|

3,524 |

|

| Foreign exchange (gains)/losses, net |

|

|

(304 |

) |

|

725 |

|

|

(232 |

) |

|

1,613 |

|

| Restructuring costs |

|

|

(4 |

) |

|

(10 |

) |

|

1,685 |

|

|

126 |

|

| Transaction Costs |

|

|

— |

|

|

2,275 |

|

|

840 |

|

|

4,607 |

|

| Impairment loss |

|

|

— |

|

|

— |

|

|

56,911 |

|

|

11,740 |

|

| Loss on disposal of non-current assets |

|

|

167 |

|

|

749 |

|

|

744 |

|

|

2,058 |

|

| Unrealized foreign exchange losses/(gains), net on cash |

|

|

376 |

|

|

377 |

|

|

856 |

|

|

(271 |

) |

| Adjusted Profit |

|

|

84,762 |

|

|

57,311 |

|

|

205,248 |

|

|

193,930 |

|

EXHIBIT III –Unaudited Interim Financial Information of

GasLog Partners LP

GasLog Partners LP

Unaudited condensed consolidated statements of financial position

As of December 31, 2022 and September 30, 2023

(All amounts expressed in thousands of U.S. Dollars)

| |

December 31, 2022 |

|

September 30, 2023 |

|

| Assets |

|

|

|

|

| Non-current assets |

|

|

|

|

| Other non-current assets |

169 |

|

1,788 |

|

| Derivative financial instruments—non-current portion |

1,136 |

|

— |

|

| Tangible fixed assets |

1,677,771 |

|

1,490,672 |

|

| Right-of-use assets |

93,325 |

|

137,331 |

|

| Total non-current assets |

1,772,401 |

|

1,629,791 |

|

| Current assets |

|

|

|

|

| Trade and other receivables |

11,185 |

|

19,663 |

|

| Inventories |

2,894 |

|

3,155 |

|

| Due from related parties |

— |

|

2,536 |

|

| Prepayments and other current assets |

3,392 |

|

6,394 |

|

| Derivative financial instruments—current portion |

2,440 |

|

— |

|

| Short-term cash deposits |

25,000 |

|

9,000 |

|

| Cash and cash equivalents |

198,122 |

|

68,808 |

|

| Total current assets |

243,033 |

|

109,556 |

|

| Total assets |

2,015,434 |

|

1,739,347 |

|

| Partners’ equity and liabilities |

|

|

|

|

| Partners’ equity |

|

|

|

|

| Common unitholders |

668,953 |

|

528,645 |

|

| General partner |

12,608 |

|

8,519 |

|

| Preference unitholders |

279,349 |

|

280,048 |

|

| Total partners’ equity |

960,910 |

|

817,212 |

|

| Current liabilities |

|

|

|

|

| Trade accounts payable |

9,300 |

|

5,641 |

|

| Due to related parties |

2,873 |

|

822 |

|

| Derivative financial instruments—current portion |

— |

|

92 |

|

| Other payables and accruals |

57,266 |

|

50,795 |

|

| Borrowings—current portion |

90,358 |

|

216,047 |

|

| Lease liabilities—current portion |

17,433 |

|

28,420 |

|

| Total current liabilities |

177,230 |

|

301,817 |

|

| Non-current liabilities |

|

|

|

|

| Borrowings—non-current portion |

831,588 |

|

547,263 |

|

| Lease liabilities—non-current portion |

45,136 |

|

72,634 |

|

| Other non-current liabilities |

570 |

|

421 |

|

| Total non-current liabilities |

877,294 |

|

620,318 |

|

| Total partners’ equity and liabilities |

2,015,434 |

|

1,739,347 |

|

GasLog Partners LP

Unaudited condensed consolidated statements

of profit or loss

For the three and nine months ended September 30,

2022 and 2023

(All amounts expressed in thousands of U.S.

Dollars)

| |

|

For the three months ended |

|

For the nine months ended |

|

| |

|

September 30,

2022 |

|

September 30,

2023 |

|

September 30,

2022 |

|

September 30,

2023 |

|

| |

|

|

|

|

|

|

|

|

|

| Revenues |

|

95,679 |

|

100,747 |

|

266,060 |

|

296,777 |

|

| Voyage expenses and commissions |

|

(1,383 |

) |

(3,128 |

) |

(5,016 |

) |

(7,766 |

) |

| Vessel operating costs |

|

(16,744 |

) |

(17,969 |

) |

(54,365 |

) |

(49,649 |

) |

| Depreciation |

|

(20,696 |

) |

(25,625 |

) |

(64,907 |

) |

(73,152 |

) |

| General and administrative expenses |

|

(4,263 |

) |

(6,843 |

) |

(13,334 |

) |

(18,709 |

) |

| Loss on disposal of vessel |

|

(166 |

) |

— |

|

(166 |

) |

(1,033 |

) |

| Impairment loss on vessels |

|

— |

|

— |

|

(28,027 |

) |

(142 |

) |

| Profit from operations |

|

52,427 |

|

47,182 |

|

100,245 |

|

146,326 |

|

| Financial costs |

|

(13,381 |

) |

(17,450 |

) |

(31,940 |

) |

(51,847 |

) |

| Financial income |

|

612 |

|

1,287 |

|

872 |

|

7,079 |

|

| Gain/(loss) on derivatives |

|

2,993 |

|

(80 |

) |

9,216 |

|

1,459 |

|

| Total other expenses, net |

|

(9,776 |

) |

(16,243 |

) |

(21,852 |

) |

(43,309 |

) |

| Profit for the period |

|

42,651 |

|

30,939 |

|

78,393 |

|

103,017 |

|

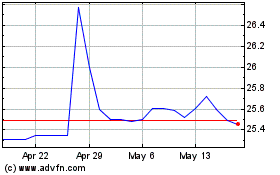

GasLog (NYSE:GLOG-A)

Historical Stock Chart

From Oct 2024 to Nov 2024

GasLog (NYSE:GLOG-A)

Historical Stock Chart

From Nov 2023 to Nov 2024