UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: October 2024

Commission File Number: 001-34984

FIRST MAJESTIC SILVER CORP.

(Translation of registrant's name into English)

Suite 1800 - 925 West Georgia Street

Vancouver, British Columbia V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F [ ] Form 40-F [ X ]

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

|

| (Registrant) |

|

| |

|

| /s/ Samir Patel |

|

| Samir Patel |

|

| General Counsel & Corporate Secretary |

|

| |

|

| October 17, 2024 |

|

NEWS RELEASE

| New York - AG |

October 17, 2024 |

| Toronto - AG |

|

| Frankfurt - FMV |

|

First Majestic Produces 5.5 Million AgEq Oz in Q3 2024 Consisting of 2.0 Million Silver Ounces and 41,761 Gold Ounces

Vancouver, BC, Canada - First Majestic Silver Corp. (NYSE:AG) (TSX:AG) (FSE:FMV) (the "Company" or "First Majestic") announces that total production in the third quarter of 2024 from the Company's three producing underground mines in Mexico, the Santa Elena Silver/Gold Mine, the San Dimas Silver/Gold Mine, and the La Encantada Silver Mine, reached 5.5 million silver equivalent ("AgEq") ounces, consisting of 2.0 million silver ounces and 41,761 gold ounces. In the first nine months of 2024, the Company produced 6.0 million silver ounces and 117,036 gold ounces for total production of 15.9 million AgEq ounces, or approximately 72% of the midpoint of the Company's revised 2024 production guidance of 21.4 to 22.6 million AgEq ounces. The Company's financial results for the third quarter of 2024 are scheduled to be released on Thursday, November 7, 2024.

Q3 2024 HIGHLIGHTS

• Higher Q3 Silver Equivalent Production: The Company produced 5.5 million AgEq ounces in Q3 2024 representing a 4% increase when compared to 5.3 million AgEq ounces produced in the previous quarter, primarily due to increased gold production at San Dimas and Santa Elena.

• Continued Active Exploration Program: The Company completed a total of 50,020 metres ("m") of drilling across its mines in Mexico and its Jerritt Canyon Gold Mine in Nevada, U.S.A. during the third quarter, representing a continued increase in exploration compared to Q2. Throughout the quarter, 28 drill rigs were active consisting of 14 rigs at San Dimas, nine rigs at Santa Elena, three rigs at Jerritt Canyon and two rigs at La Encantada.

• High-Grade Gold and Silver Discovery: The Company announced the discovery of a new, high-grade gold and silver vein hosted system - the Navidad system - at the Santa Elena property (see news release dated July 30, 2024). The new discovery was made adjacent to the Company's 100%-owned, and currently producing, Ermitaño mine. First Majestic is focusing its exploration efforts on Navidad as seven of the nine active rigs at Santa Elena have been allocated to drilling this new vein system.

• Jerritt Canyon Mine Exploration Program Commenced: Jerritt Canyon's 2024 exploration program commenced at the beginning of the third quarter. The exploration program is focused on new, never explored before, targets on the recently permitted U.S. Forest Lands on First Majestic's large Nevada land package (30,821 hectares, 119 square miles).

• Safety Performance: In Q3 2024, the consolidated Total Reportable Incident Frequency Rate ("TRIFR") was 0.50, consistent with the previous quarter and well below the Company's target KPI of <0.90, while the Lost Time Incident Frequency Rate ("LTIFR") remained positive at 0.12 and below the Company's target KPI of <0.30 for 2024.

• San Dimas Hydroelectric plant, Las Truchas, at Full Capacity: As a result of a period of continued rain this year following extended drought conditions, the Company's Las Truchas hydroelectric plant, in Durango, is back at full capacity. Las Truchas provides reliable, efficient and renewable energy at lower costs, and with a lower carbon footprint, to the San Dimas mine.

• Conversion to Liquefied Natural Gas ("LNG") at San Dimas: As part of its ongoing cost and carbon reduction initiatives, First Majestic is actively reviewing the replacement of the diesel generators used for on-site back-up power at San Dimas with LNG units. This will generate substantial cost-savings and will result in a reduction in carbon emissions of up to 25%, when back-up power is required.

• First Mint Inauguration: First Mint, LLC, the Company's 100%-owned and operated minting facility in Nevada, USA, celebrated its Grand Opening on September 26, 2024. While commissioning and silver bullion sales commenced in March, the inauguration celebrated the mint's progress to-date on implementing innovative production and fulfillment processes at the state-of-the-art facility. The mint commissioned several pieces of new equipment including coin presses and lasers for coin manufacturing, and is on track to receiving ISO 9001 certification. First Mint enables First Majestic to turn its mined silver into an array of finished bullion products for direct sale to the public and offers manufacturing capacity for third-party demand. More information is available at www.firstmint.com.

"Santa Elena continues to deliver strong performance, quarter after quarter" said Keith Neumeyer, President & CEO. "The continued impressive operational results at Santa Elena, along with the recent Navidad discovery make this a truly world-class district. Our team is also focused on improving operational performance at San Dimas; we are encouraged by the recent agreement reached with the union and are working hard to finish the year on a strong note. During Q3, we built up water inventory levels at the La Encantada plant and increased throughput rates to in excess of 3,000 tpd by the end of the quarter. We anticipate Q4 to be a stronger quarter at La Encantada, enabling us to meet our revised annual production guidance for the year."

Production Details Table:

| Q3 |

Q3 |

Y/Y |

|

Q2 |

Q/Q |

| 2024 |

2023 |

Change |

Consolidated Production Results |

2024 |

Change |

| 678,397 |

670,203 |

1% |

Ore processed/tonnes milled |

674,570 |

1% |

| 5,490,416 |

6,285,790 |

(13)% |

Total production - Silver equivalent ounces |

5,289,439 |

4% |

| 1,967,574 |

2,461,868 |

(20)% |

Silver ounces produced |

2,104,181 |

(6)% |

| 41,761 |

46,720 |

(11)% |

Gold ounces produced |

39,339 |

6% |

Quarterly Mine-by-Mine Production Table:

| Mine |

Ore

Processed |

Tonnes

per Day |

Ag Grade

(g/t) |

Au Grade

(g/t) |

Ag

Recovery |

Au

Recovery |

Ag Oz

Produced |

Au Oz

Produced |

AgEq Oz

Produced |

| Santa Elena |

259,919 |

2,856 |

68 |

3.50 |

67% |

94% |

376,203 |

27,435 |

2,685,375 |

| San Dimas |

195,279 |

2,146 |

188 |

2.12 |

89% |

95% |

1,046,340 |

12,582 |

2,110,905 |

| La Encantada |

223,200 |

2,453 |

110 |

0.01 |

69% |

90% |

545,031 |

59 |

550,042 |

| Jerritt Canyon* |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

N/A |

1,684 |

144,093 |

*Jerritt Canyon was placed on temporary suspension in March 2023. In-circuit recovery efforts performed in Q3 2024 resulted in production of 1,684 gold ounces.

- Certain amounts shown may not add exactly to the total amount due to rounding differences.

- The Ag:Au ratio used in the calculation of silver equivalent ounces was 84:1.

Santa Elena Silver/Gold Mine:

• Santa Elena produced 2,685,375 AgEq ounces, 4% above the prior quarter, consisting of 376,203 ounces of silver and 27,435 ounces of gold.

• The mill processed a total of 259,919 tonnes of ore, slightly higher than the prior quarter with average silver and gold head grades relatively consistent at 68 g/t and 3.50 g/t, respectively.

• Consolidated silver and gold recoveries averaged 67% and 94%, respectively, during the quarter. Silver recovery increased 1% while gold recovery remained consistent when compared to the prior quarter. Metallurgical recoveries remained strong due to the continuous operational optimization of the new dual-circuit plant.

• During the quarter, nine drill rigs consisting of seven surface rigs and two underground rigs completed 14,796 metres of drilling on the property, following on the 15,591 m and 9,991 m drilled in Q2 and Q1 this year, respectively.

San Dimas Silver/Gold Mine:

• San Dimas produced 2,110,905 AgEq ounces during the quarter consisting of 1,046,340 ounces of silver and 12,582 ounces of gold. Silver production decreased by 8%, while gold production increased by 4%, when compared to the prior quarter. The decrease in silver production was driven by lower silver grades and silver recoveries offset by an increase in ore tonnes processed. The increase in gold production was driven by an increase in processed ore, offset by a slightly lower gold grade.

• The mill processed a total of 195,279 tonnes of ore, an increase of 7% compared to the prior quarter, with average silver and gold grades of 188 g/t and 2.12 g/t, respectively, compared with 210 g/t and 2.15 g/t in Q2.

• Silver and gold recoveries during the quarter averaged 89% and 95%, respectively, compared to 92% and 95% in the previous quarter.

• The West Block, Central Block and Sinaloa Graben areas contributed approximately 29%, 40% and 31%, respectively, of the total production during the quarter.

• Negotiations with the unionized workers continued throughout the quarter, and an agreement was reached in August. Labour and operating efficiencies have improved as a result, and management anticipates improved production levels in Q4 at San Dimas.

• During the quarter, a total of 14 drill rigs consisting of four surface rigs and 10 underground rigs completed 29,172 m of drilling on the property, following on the 31,249 m and 26,363 m drilled in Q2 and Q1 this year, respectively.

La Encantada Silver Mine:

• During the quarter, La Encantada produced 545,031 ounces of silver, representing a 7% decrease compared to the prior quarter primarily due to a decrease in silver grade offset by an increase in silver recovery.

• Water inventory levels at the plant achieved capacity by the end of the quarter, enabling plant ore throughput rates to return to targeted levels. As a result, in the month of September alone, La Encantada produced 232,968 ounces of silver, or approximately 43% of the total Q3 silver production at the mine. Management anticipates Q4 production at La Encantada to revert to historical levels.

• The mill processed a total of 223,200 tonnes of ore with an average silver grade of 110 g/t. Stope production from the new Beca Zone contributed 88,444 tonnes with average silver grades of 111 g/t.

• Silver recovery for the quarter was 69%, representing a 15% increase when compared to 60% recovery in the prior quarter.

• During the quarter, two surface drill rigs completed 1,862 m of drilling on the property, representing a 207% increase when compared to the prior quarter.

Q3 2024 EARNINGS AND DIVIDEND ANNOUNCEMENT

The Company is planning to release its third quarter 2024 unaudited financial results, announce its third quarter dividend payment, and the shareholder record and payable dates for the dividend, on November 7, 2024.

Gonzalo Mercado, P.Geo., the Company's Vice President of Exploration and Technical Services and a "Qualified Person" as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

ABOUT FIRST MAJESTIC

First Majestic is a publicly traded mining company focused on silver and gold production in Mexico and the United States. The Company presently owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine and the La Encantada Silver Mine as well as a portfolio of development and exploration assets, including the Jerritt Canyon Gold project located in northeastern Nevada, U.S.A.

First Majestic is proud to offer a portion of its silver production for sale to the public. Bars, ingots, coins and medallions are available for purchase online at www.firstmint.com, at some of the lowest premiums available.

On September 5, 2024, First Majestic and Gatos Silver, Inc. announced that they entered into a definitive merger agreement pursuant to which First Majestic will acquire all of the issued and outstanding shares of Gatos Silver's common stock. The proposed transaction would consolidate three world-class, producing silver mining districts in Mexico to create a leading intermediate primary silver producer. Information relating to the proposed transaction can be found on the Company's website.

For further information, contact info@firstmajestic.com, visit our website at www.firstmajestic.com or call our toll-free number 1.866.529.2807.

FIRST MAJESTIC SILVER CORP.

"signed"

Keith Neumeyer, President & CEO

Cautionary Note Regarding Forward Looking Statements

This news release contains "forward‐looking information" and "forward-looking statements" under applicable Canadian and U.S. securities laws (collectively, "forward‐looking statements"). These statements relate to future events or the Company's future performance, business prospects or opportunities that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management made in light of management's experience and perception of historical trends, current conditions and expected future developments. Forward-looking statements in this news release include, but are not limited to, statements with respect to: timing for the release of the Company's Q3 2024 unaudited financial results; the substantial cost-savings and reduction in carbon emissions expected from converting to LNG at San Dimas with respect to back-up power; La Encantada experiencing a stronger Q4 in terms of production as compared with Q3, enabling the Company to meet its revised 2024 production guidance; expected improvements in production levels at San Dimas for Q4 2024; and timing for the announcement of the Company's third quarter dividend payment and the shareholder record and payable dates in connection with such dividend payment. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance (often, but not always, using words or phrases such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "forecast", "potential", "target", "intend", "could", "might", "should", "believe" and similar expressions) are not statements of historical fact and may be "forward‐looking statements".

Actual results may vary from forward-looking statements. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause actual results to materially differ from those expressed or implied by such forward-looking statements, including but not limited to: the duration and effects of the coronavirus and COVID-19, and any other pandemics on our operations and workforce, and the effects on global economies and society; general economic conditions including inflation risks; actual results of exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; commodity prices; variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour relations; relations with local communities; changes in national or local governments; changes in applicable legislation or application thereof; delays in obtaining approvals or financing or in the completion of development or construction activities; exchange rate fluctuations; requirements for additional capital; government regulation; environmental risks; reclamation expenses; outcomes of pending litigation; limitations on insurance coverage as well as those factors discussed in the section entitled "Description of the Business - Risk Factors" in the Company's most recent Annual Information Form for the year ended December 31, 2023 filed with the Canadian securities regulatory authorities under the Company's SEDAR+ profile at www.sedarplus.ca, and in the Company's Annual Report on Form 40-F for the year ended December 31, 2023 filed with the United States Securities and Exchange Commission on EDGAR at www.sec.gov/edgar. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended.

The Company believes that the expectations reflected in these forward‐looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward‐looking statements included herein should not be unduly relied upon. These statements speak only as of the date hereof. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws.

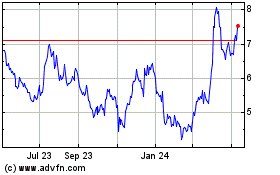

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Nov 2024 to Dec 2024

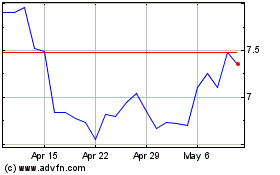

First Majestic Silver (NYSE:AG)

Historical Stock Chart

From Dec 2023 to Dec 2024