UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of February 2024

Commission File Number: 001-40459

Ero Copper Corp.

(Translation of registrant's name into English)

625 Howe Street, Suite 1050

Vancouver, British Columbia V6C 2T6

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [ X ]

Exhibit 99.1 of this Form 6-K is incorporated by reference as an additional exhibit to the registrant’s Registration Statement on Form F-10 (File NO. 333-274097)

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Ero Copper Corp. |

| | | |

| Date: February 21, 2024 | By: | /s/ Deepk Hundal |

| | | Name: Deepk Hundal |

| | | Title: SVP, General Counsel and Corporate Secretary |

| | | |

EXHIBIT 99.1

Ero Copper Announces 2023 Production Results and Provides 2024 Guidance

(all amounts in US dollars, unless otherwise noted)

VANCOUVER, British Columbia, Feb. 21, 2024 (GLOBE NEWSWIRE) -- Ero Copper Corp. (TSX: ERO, NYSE: ERO) ("Ero" or the “Company”) is pleased to announce its 2023 production results, 2024 guidance and three-year production outlook.

HIGHLIGHTS

Record Gold Production Driven by Successful Completion of the NX 60 Initiative

- The Xavantina Operations produced 59,222 ounces of gold in 2023, exceeding the increased guidance range of 55,000 to 59,000 ounces, issued on November 2, 2023, and the original 2023 guidance range of 50,000 to 53,000 ounces

- Average processed gold grades of 15.13 grams per tonne ("gpt") represented a 98.8% increase in gold grades as compared to 2022

Caraíba Mill Expansion Design Capacity Reached by Year-End

- The Caraíba Operations produced 43,857 tonnes of copper in concentrate for the full year, slightly below guidance of 44,000 to 47,000 tonnes

- Although the Caraíba mill expansion design capacity was achieved by year-end, throughput volumes and copper production for the fourth quarter and full year were impacted by approximately one week of additional unplanned downtime related to the integration of the expansion circuit

2024 Guidance

- Consolidated copper production is expected to be 59,000 to 72,000 tonnes in concentrate at C1 cash costs between $1.50 to $1.75 per pound of copper produced

- The Xavantina Operations are expected to produce 55,000 to 60,000 ounces of gold at average C1 cash costs between $550 to $650 per ounce of gold produced and all-in sustaining costs ("AISC") between $1,050 and $1,150 per ounce of gold produced

- Total capital expenditures are expected to decrease year-on-year to a range of $299 to $349 million in 2024, primarily due to the completion of the Tucumã Project, which remains on track to commence production during the second half of the year. As a result, capital spend is expected to be weighted towards the first half of 2024

Three-Year Production Outlook

- Consolidated copper production is projected to more than double to 95,000 to 105,000 tonnes in 2025, as the Tucumã Mine is expected to achieve its first full year of production

- Following the successful completion of the NX 60 initiative in 2023, the Xavantina Operations are expected to sustain annual gold production levels of 55,000 to 60,000 ounces through 2026

Commenting on the production results and 2024 guidance, David Strang, Chief Executive Officer, said: “Our 2023 production performance reflects the strong execution of our organic growth strategy, highlighted by the successful completion of the NX 60 initiative, which resulted in a 39% year-on-year increase in gold production. Although the completion of the mill expansion project at our Caraíba Operations necessitated additional plant downtime, culminating in full-year copper production that slightly missed our expectations, this milestone is pivotal for supporting higher sustained ore production volumes from the Pilar Mine over the long term.

“We have carried this strategic momentum into 2024 as we transition from construction to commissioning at the Tucumã Project, where we anticipate initial copper concentrate production in the second half of this year. With consolidated copper production on track to increase at least 35% this year and more than double in 2025, we are actively advancing our longer-term growth initiatives. These include construction of the new external shaft at the Caraíba Operations, continued nickel exploration throughout the Curaçá Valley, and preparing for the first phase of work at the Furnas Project.

"I am proud of the progress our team has made in executing major growth initiatives announced just over two years ago. We are committed to building upon this track record as we position Ero to deliver peer-leading growth in the years ahead."

FOURTH QUARTER AND FULL-YEAR 2023 PRODUCTION RESULTS

Caraíba Operations

- Throughput volumes increased 12.8% year-on-year to over 3.2 million tonnes, despite lower-than-expected processed tonnage in Q4 2023 due to mill downtime related to the integration of the expansion circuit

- Processed copper grades and metallurgical recoveries were in-line with expectations, averaging 1.49% and 91.4%, respectively, for the year

Xavantina Operations

- Processed gold grades increased 98.8% to average 15.13 gpt for the year, more than offsetting lower year-on-year mill throughput volumes

| | | | | | | 2023 Guidance |

| | | Q4 2023 | | Full Year 2023 | | Original | | Updated |

| Caraíba Operations | | | | | | | | |

| Tonnes Processed | | 812,202 | | 3,231,667 | | 3,300,000 | | — |

| Grade (% Cu) | | 1.59 | | 1.49 | | 1.50 | | — |

| Recovery Rate (%) | | 91.0 | | 91.4 | | 91.5 | | — |

| Cu Production (tonnes) | | 11,760 | | 43,857 | | 44,000 - 47,000 | | 44,000 - 47,000 |

| | | | | | | | | |

| Xavantina Operations | | | | | | | | |

| Tonnes Processed | | 34,416 | | 136,002 | | 175,000 | | — |

| Grade (gpt Au) | | 17.18 | | 15.13 | | 10.00 | | — |

| Recovery Rate (%) | | 88.7 | | 89.5 | | 92.0 | | — |

| Au Production (oz) | | 16,867 | | 59,222 | | 50,000 - 53,000 | | 55,000 - 59,000 |

2024 PRODUCTION GUIDANCE AND THREE-YEAR PRODUCTION OUTLOOK

The Company's 2024 production guidance and three-year production outlook reflect the ongoing execution of its organic growth strategy, including the successful completion of the Xavantina Operations' NX 60 initiative as well as the anticipated completion of the Tucumã Project, which remains on track to commence production in the second half of this year. As a result, the Company expects to deliver sustained annual gold production of 55,000 to 60,000 ounces through 2026 and more than double copper production to 95,000 to 105,000 tonnes in concentrate in 2025.

At the Caraíba Operations, copper production is projected to range from 42,000 to 47,000 tonnes through 2026, with higher mill throughput volumes expected to offset lower forecast mined and processed copper grades. Following the anticipated completion of the Pilar Mine's new external shaft in late 2026, the Company expects mined and processed copper grades to increase as mining from the high-grade Deepening Extension Zone ramps up.

Copper production from the Tucumã Operations is expected to increase from 17,000 to 25,000 tonnes in the second half of 2024 to 53,000 to 58,000 tonnes in 2025, when the mine achieves its first full year of production. The Tucumã mill is expected to sustain nameplate throughput levels of approximately 4.0 million tonnes per annum beginning in 2025 with strong mined and processed copper grades projected through 2026.

At the Xavantina Operations, higher mill throughput levels are expected to offset lower mined and processed gold grades over the next three years. In 2024, gold production is expected to be slightly weighted towards the first half of the year due to higher anticipated gold grades compared to the second half of the year.

| | | 2024 | | 2025 | | 2026 |

| Copper (tonnes) | | | | | | |

| Caraíba Operations | | 42,000 - 47,000 | | 42,000 - 47,000 | | 42,000 - 47,000 |

| Tucumã Operations | | 17,000 - 25,000 | | 53,000 - 58,000 | | 48,000 - 53,000 |

| Total Copper | | 59,000 - 72,000 | | 95,000 - 105,000 | | 90,000 - 100,000 |

| | | | | | | |

| Gold (ounces) | | | | | | |

| Xavantina Operations | | 55,000 - 60,000 | | 55,000 - 60,000 | | 55,000 - 60,000 |

Note: Guidance is based on estimates and assumptions including, but not limited to, mineral reserve estimates, grade and continuity of interpreted geological formations and metallurgical recovery performance. Please refer to the Company’s SEDAR+ and EDGAR filings, including the most recent Annual Information Form ("AIF"), for a detailed summary of risk factors.

2024 COST GUIDANCE

2024 copper C1 cash cost guidance on a consolidated basis is $1.50 to $1.75 per pound of copper produced. This range incorporates several key updates relative to previous 2024 C1 cash cost projections:

- The foreign exchange rate has been adjusted from 5.30 to 5.00 Brazilian Real (BRL) per U.S. Dollar (USD), reflecting the BRL's continued strength

- Guidance includes higher concentrate treatment and refining charges based on Q4 2023 levels, which have shown a favorable downward trend year-to-date

- Consumable cost assumptions have been refreshed higher to align with consumable pricing observed in Q4 2023

- The Company has assumed the Caraíba Operations will export 100% of its copper concentrate in 2024, up from the 50% previously assumed

Furthermore, in light of changes to the Caraíba Operations' copper concentrate sales channels, the Company has updated its copper C1 cash cost calculation methodology1. This change will be offset by an equal increase in reported realized copper prices.

At the Xavantina Operations, the C1 cash cost guidance range of $550 to $650 per ounce of gold produced reflects improved fixed cost efficiencies driven by higher expected gold production, partially offsetting the impact of planned decreases to mined and processed gold grades. The AISC guidance range for 2024 is $1,050 to $1,150 per ounce of gold produced.

2024 cost guidance assumes a foreign exchange rate of 5.00 USD:BRL, a gold price of $1,900 per ounce, and a silver price of $23.00 per ounce.

| Copper C1 Cash Cost ($/lb) | | |

| Caraíba Operations | | $1.80 - $2.00 |

| Tucumã Operations | | $0.90 - $1.10 |

| Consolidated Copper Operations | | $1.50 - $1.75 |

| | | |

| Gold C1 Cash Cost ($/oz) | | $550 - $650 |

| Gold All-In Sustaining Cost ($/oz) | | $1,050 - $1,150 |

Note: C1 Cash Costs and AISC are non-IFRS measures. Please see the Notes section of this press release for additional information.

1. For further details, please refer to the definition of "C1 Cash Cost of Copper Produced (per lb)" the Notes section below.

2024 CAPITAL EXPENDITURE GUIDANCE

2024 capital expenditures are expected to decrease to a range of $299 to $349 million due to the anticipated completion of the Tucumã Project, which is on track to commence production in the second half of the year. As a result, capital spend is expected to be weighted towards the first half of 2024.

The table below includes an estimated $30 to $40 million of consolidated exploration expenditures. This estimate includes approximately $20 million designated for drilling activities at the Caraíba Operations, including expenditures related to the Curaçá Valley nickel exploration program. Additionally, the Company has budgeted approximately $6 million for the first phase of work at the Furnas Project.

The 2024 capital expenditure guidance assumes an exchange rate of 5.10 USD:BRL for the Tucumã Project based on designated foreign exchange hedges with a weighted average ceiling and floor of 5.10 and 5.23 USD:BRL, respectively. All other capital expenditures assume an exchange rate of 5.00 USD:BRL. Figures presented below are in USD millions.

| Caraíba Operations | | |

| Growth | | $80 - $90 |

| Sustaining | | $100 - $110 |

| Total | | $180 - $200 |

| | | |

| Tucumã Project | | |

| Growth | | $65 - $75 |

| Capitalized Ramp-Up Costs | | $4 - $6 |

| Sustaining | | $2 - $5 |

| Total | | $71 - $86 |

| | | |

| Xavantina Operations | | |

| Growth | | $3 - $5 |

| Sustaining | | $15 - $18 |

| Total | | $18 - $23 |

| | | |

| Consolidated Exploration Programs | | $30 - $40 |

| | | |

| Consolidated Capital Expenditures | | |

| Growth | | $148 - $170 |

| Capitalized Ramp-Up Costs | | $4 - $6 |

| Sustaining | | $117 - $133 |

| Exploration | | $30 - $40 |

| Total | | $299 - $349 |

NOTES

Alternative Performance (Non-IFRS) Measures

The Company utilizes certain alternative performance (non-IFRS) measures to monitor its performance, including C1 cash cost of copper produced (per lb), C1 cash cost of gold produced (per ounce), and AISC of gold produced (per ounce). These performance measures have no standardized meaning prescribed within generally accepted accounting principles under IFRS and, therefore, amounts presented may not be comparable to similar measures presented by other mining companies. These non-IFRS measures are intended to provide supplemental information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

C1 Cash Cost of Copper Produced (per lb)

C1 cash cost of copper produced (per lb) is a non-IFRS performance measure used by the Company to manage and evaluate the operating performance of its copper mining segment and is calculated as C1 cash costs divided by total pounds of copper produced during the period. C1 cash costs comprise the total cost of production, including expenses related to transportation, and treatment and refining charges. These costs are net of by-product credits, incentive payments and certain tax credits associated with sales invoiced to the Company's Brazilian customers.

Effective Q4 2023, the Company is including freight parity charged by its customers as part of treatment, refining and other costs within the calculation of C1 cash costs. This charge was previously presented as a reduction in realized copper price.

While the C1 cash cost of copper produced per pound is widely reported in the mining industry as a performance benchmark, it does not have a standardized meaning and is disclosed as a supplement to IFRS measures.

C1 Cash Cost of Gold produced (per ounce) and AISC of Gold produced (per ounce)

C1 cash cost of gold produced (per ounce) is a non-IFRS performance measure used by the Company to manage and evaluate the operating performance of its gold mining segment and is calculated as C1 cash costs divided by total ounces of gold produced during the period. C1 cash cost includes total cost of production, net of by-product credits and incentive payments. C1 cash cost of gold produced per ounce is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplemental to IFRS measures.

AISC of gold produced (per ounce) is an extension of C1 cash cost of gold produced (per ounce) discussed above and is also a key performance measure used by management to evaluate operating performance of its gold mining segment. AISC of gold produced (per ounce) is calculated as AISC divided by total ounces of gold produced during the period. AISC includes C1 cash costs, site general and administrative costs, accretion of mine closure and rehabilitation provision, sustaining capital expenditures, sustaining leases, and royalties and production taxes. AISC of gold produced (per ounce) is widely reported in the mining industry as benchmarks for performance but does not have a standardized meaning and is disclosed in supplement to IFRS measures.

ABOUT ERO COPPER CORP

Ero is a high-margin, high-growth, low carbon-intensity copper producer with operations in Brazil and corporate headquarters in Vancouver, B.C. The Company's primary asset is a 99.6% interest in the Brazilian copper mining company, Mineração Caraíba S.A. ("MCSA"), 100% owner of the Company's Caraíba Operations (formerly known as the MCSA Mining Complex), which are located in the Curaçá Valley, Bahia State, Brazil and include the Pilar and Vermelhos underground mines and the Surubim open pit mine, and the Tucumã Project (formerly known as Boa Esperança), an IOCG-type copper project located in Pará, Brazil. The Company also owns 97.6% of NX Gold S.A. ("NX Gold") which owns the Xavantina Operations (formerly known as the NX Gold Mine), comprised of an operating gold and silver mine located in Mato Grosso, Brazil. Additional information on the Company and its operations, including technical reports on the Caraíba Operations, Xavantina Operations and Tucumã Project, can be found on SEDAR+ at www.sedarplus.ca/landingpage/ and on EDGAR (www.sec.gov). The Company’s shares are publicly traded on the Toronto Stock Exchange and the New York Stock Exchange under the symbol “ERO”.

FOR MORE INFORMATION, PLEASE CONTACT

Courtney Lynn, SVP, Corporate Development, Investor Relations & Sustainability

(604) 335-7504

info@erocopper.com

CAUTION REGARDING FORWARD LOOKING INFORMATION AND STATEMENTS

This press release contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). Forward-looking statements include statements that use forward-looking terminology such as “may”, “could”, “would”, “will”, “should”, “intend”, “target”, “plan”, “expect”, “budget”, “estimate”, “forecast”, “schedule”, “anticipate”, “believe”, “continue”, “potential”, “view” or the negative or grammatical variation thereof or other variations thereof or comparable terminology. Forward-looking statements may include, but are not limited to, statements with respect to the Company's expected production, operating costs and capital expenditures at the Caraíba Operations, the Tucumã Project and the Xavantina Operations; estimated completion dates for certain milestones, including initial production at the Tucumã Project and completion of the Pilar Mine's new external shaft at the Caraíba Operations; the ability of the Company to realize benefits associated with the Pilar Mine's new external shaft; the ability of the Company to achieve copper production levels as currently projected at the Tucumã Project; the commencement of, and budget for, the first phase of work pursuant to the Furnas Project earn-in agreement and execution of the definitive earn-in agreement with Vale Base Metals in accordance with the terms of the binding letter of intent; and any other statement that may predict, forecast, indicate or imply future plans, intentions, levels of activity, results, performance or achievements.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events, conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking statements, including, without limitation, risks discussed in this press release and in the Company's AIF under the heading “Risk Factors”. The risks discussed in this press release and in the AIF are not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Although the Company has attempted to identify important factors that could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking statements, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those anticipated, estimated or intended.

Forward-looking statements are not a guarantee of future performance. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involves statements about the future and are inherently uncertain, and the Company’s actual results, achievements or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to herein and in the AIF under the heading “Risk Factors”.

The Company’s forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may be difficult to predict and beyond the Company’s control. In connection with the forward-looking statements contained in this press release and in the AIF, the Company has made certain assumptions about, among other things: continued effectiveness of the measures taken by the Company to mitigate the possible impact of COVID-19 on its workforce and operations; favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to advance the production, development and exploration of the Company’s properties and assets; future prices of copper, gold and other metal prices; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Project being as described in the respective technical report for each property; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although the Company believes that the assumptions inherent in forward-looking statements are reasonable as of the date of this press release, these assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties, contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially different from those projected in the forward-looking statements. The Company cautions that the foregoing list of assumptions is not exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed in, or implied by, the forward-looking statements contained in this press release. Many assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct.

Forward-looking statements contained herein are made as of the date of this press release and the Company disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or results or otherwise, except as and to the extent required by applicable securities laws.

CAUTIONARY NOTES REGARDING MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

In accordance with applicable Canadian securities regulatory requirements, all mineral reserve and mineral resource estimates of the Company disclosed or incorporated by reference in this press release have been prepared in accordance with NI 43-101 and are classified in accordance with CIM Standards. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. For example, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in NI 43-101. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this press release may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Mineral resources which are not mineral reserves do not have demonstrated economic viability. Pursuant to the CIM Standards, mineral resources have a higher degree of uncertainty than mineral reserves as to their existence as well as their economic and legal feasibility. Inferred mineral resources, when compared with measured or indicated mineral resources, have the least certainty as to their existence, and it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Pursuant to NI 43-101, inferred mineral resources may not form the basis of any economic analysis. Accordingly, readers are cautioned not to assume that all or any part of a mineral resource exists, will ever be converted into a mineral reserve, or is or will ever be economically or legally mineable or recovered.

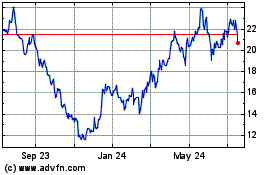

Ero Copper (NYSE:ERO)

Historical Stock Chart

From Oct 2024 to Nov 2024

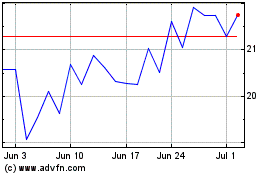

Ero Copper (NYSE:ERO)

Historical Stock Chart

From Nov 2023 to Nov 2024