000078516112/312024Q2FALSExbrli:sharesiso4217:USDiso4217:USDxbrli:sharesehc:stateehc:hospitalxbrli:pureehc:bedehc:entity00007851612024-01-012024-06-3000007851612024-07-2400007851612024-04-012024-06-3000007851612023-04-012023-06-3000007851612023-01-012023-06-3000007851612024-06-3000007851612023-12-310000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-06-300000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000785161us-gaap:CommonStockMember2024-03-310000785161us-gaap:AdditionalPaidInCapitalMember2024-03-310000785161us-gaap:RetainedEarningsMember2024-03-310000785161us-gaap:TreasuryStockCommonMember2024-03-310000785161us-gaap:NoncontrollingInterestMember2024-03-3100007851612024-03-310000785161us-gaap:RetainedEarningsMember2024-04-012024-06-300000785161us-gaap:NoncontrollingInterestMember2024-04-012024-06-300000785161us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000785161us-gaap:CommonStockMember2024-04-012024-06-300000785161us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000785161us-gaap:CommonStockMember2024-06-300000785161us-gaap:AdditionalPaidInCapitalMember2024-06-300000785161us-gaap:RetainedEarningsMember2024-06-300000785161us-gaap:TreasuryStockCommonMember2024-06-300000785161us-gaap:NoncontrollingInterestMember2024-06-300000785161us-gaap:CommonStockMember2023-03-310000785161us-gaap:AdditionalPaidInCapitalMember2023-03-310000785161us-gaap:RetainedEarningsMember2023-03-310000785161us-gaap:TreasuryStockCommonMember2023-03-310000785161us-gaap:NoncontrollingInterestMember2023-03-3100007851612023-03-310000785161us-gaap:RetainedEarningsMember2023-04-012023-06-300000785161us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000785161us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000785161us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000785161us-gaap:CommonStockMember2023-06-300000785161us-gaap:AdditionalPaidInCapitalMember2023-06-300000785161us-gaap:RetainedEarningsMember2023-06-300000785161us-gaap:TreasuryStockCommonMember2023-06-300000785161us-gaap:NoncontrollingInterestMember2023-06-3000007851612023-06-300000785161us-gaap:CommonStockMember2023-12-310000785161us-gaap:AdditionalPaidInCapitalMember2023-12-310000785161us-gaap:RetainedEarningsMember2023-12-310000785161us-gaap:TreasuryStockCommonMember2023-12-310000785161us-gaap:NoncontrollingInterestMember2023-12-310000785161us-gaap:RetainedEarningsMember2024-01-012024-06-300000785161us-gaap:NoncontrollingInterestMember2024-01-012024-06-300000785161us-gaap:CommonStockMember2024-01-012024-06-300000785161us-gaap:TreasuryStockCommonMember2024-01-012024-06-300000785161us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300000785161us-gaap:CommonStockMember2022-12-310000785161us-gaap:AdditionalPaidInCapitalMember2022-12-310000785161us-gaap:RetainedEarningsMember2022-12-310000785161us-gaap:TreasuryStockCommonMember2022-12-310000785161us-gaap:NoncontrollingInterestMember2022-12-3100007851612022-12-310000785161us-gaap:RetainedEarningsMember2023-01-012023-06-300000785161us-gaap:NoncontrollingInterestMember2023-01-012023-06-300000785161us-gaap:CommonStockMember2023-01-012023-06-300000785161us-gaap:TreasuryStockCommonMember2023-01-012023-06-300000785161us-gaap:AdditionalPaidInCapitalMember2023-01-012023-06-300000785161srt:MinimumMember2024-06-300000785161srt:MaximumMember2024-06-300000785161ehc:MedicareMember2024-04-012024-06-300000785161ehc:MedicareMember2023-04-012023-06-300000785161ehc:MedicareMember2024-01-012024-06-300000785161ehc:MedicareMember2023-01-012023-06-300000785161ehc:MedicareAdvantageMember2024-04-012024-06-300000785161ehc:MedicareAdvantageMember2023-04-012023-06-300000785161ehc:MedicareAdvantageMember2024-01-012024-06-300000785161ehc:MedicareAdvantageMember2023-01-012023-06-300000785161ehc:ManagedCareMember2024-04-012024-06-300000785161ehc:ManagedCareMember2023-04-012023-06-300000785161ehc:ManagedCareMember2024-01-012024-06-300000785161ehc:ManagedCareMember2023-01-012023-06-300000785161ehc:MedicaidMember2024-04-012024-06-300000785161ehc:MedicaidMember2023-04-012023-06-300000785161ehc:MedicaidMember2024-01-012024-06-300000785161ehc:MedicaidMember2023-01-012023-06-300000785161ehc:OtherThirdpartyPayorsMember2024-04-012024-06-300000785161ehc:OtherThirdpartyPayorsMember2023-04-012023-06-300000785161ehc:OtherThirdpartyPayorsMember2024-01-012024-06-300000785161ehc:OtherThirdpartyPayorsMember2023-01-012023-06-300000785161ehc:WorkersCompensationMember2024-04-012024-06-300000785161ehc:WorkersCompensationMember2023-04-012023-06-300000785161ehc:WorkersCompensationMember2024-01-012024-06-300000785161ehc:WorkersCompensationMember2023-01-012023-06-300000785161ehc:PatientsMember2024-04-012024-06-300000785161ehc:PatientsMember2023-04-012023-06-300000785161ehc:PatientsMember2024-01-012024-06-300000785161ehc:PatientsMember2023-01-012023-06-300000785161ehc:OtherIncomeSourceMember2024-04-012024-06-300000785161ehc:OtherIncomeSourceMember2023-04-012023-06-300000785161ehc:OtherIncomeSourceMember2024-01-012024-06-300000785161ehc:OtherIncomeSourceMember2023-01-012023-06-300000785161ehc:HospitalInAugustaGeorgiaMemberus-gaap:CorporateJointVentureMemberus-gaap:SubsequentEventMember2024-07-010000785161ehc:HospitalInAugustaGeorgiaMemberus-gaap:CorporateJointVentureMemberus-gaap:SubsequentEventMember2024-07-012024-07-010000785161srt:ScenarioForecastMemberehc:HospitalInAugustaGeorgiaMemberus-gaap:CorporateJointVentureMember2024-01-012024-09-300000785161ehc:HospitalInBowieMarylandMemberus-gaap:CorporateJointVentureMember2023-07-010000785161ehc:HospitalInBowieMarylandMemberus-gaap:CorporateJointVentureMember2023-06-302023-06-300000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-01-012024-06-300000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MinimumMember2024-01-012024-06-300000785161us-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MaximumMember2024-01-012024-06-300000785161ehc:TheCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2024-06-300000785161ehc:TheCreditAgreementMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-310000785161ehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4625Due2031Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4625Due2031Memberus-gaap:SeniorNotesMember2024-06-300000785161us-gaap:NotesPayableOtherPayablesMember2024-06-300000785161us-gaap:NotesPayableOtherPayablesMember2023-12-310000785161ehc:FaceAmountMember2024-06-300000785161ehc:NetAmountMember2024-06-300000785161ehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2024-07-152024-07-150000785161ehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2024-07-150000785161srt:ScenarioForecastMemberehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2024-07-012024-09-300000785161ehc:RedeemableNoncontrollingInterestMember2023-12-310000785161ehc:RedeemableNoncontrollingInterestMember2022-12-310000785161ehc:RedeemableNoncontrollingInterestMember2024-01-012024-06-300000785161ehc:RedeemableNoncontrollingInterestMember2023-01-012023-06-300000785161ehc:RedeemableNoncontrollingInterestMember2024-06-300000785161ehc:RedeemableNoncontrollingInterestMember2023-06-300000785161us-gaap:FairValueMeasurementsRecurringMember2024-06-300000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-06-300000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-06-300000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2024-06-300000785161us-gaap:FairValueMeasurementsRecurringMember2023-12-310000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2024-06-300000785161us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000785161us-gaap:FairValueMeasurementsRecurringMemberus-gaap:OtherCurrentAssetsMember2023-12-310000785161us-gaap:OtherNoncurrentAssetsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000785161us-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-06-300000785161us-gaap:FairValueMeasurementsNonrecurringMember2024-01-012024-06-300000785161us-gaap:FairValueMeasurementsNonrecurringMember2023-04-012023-06-300000785161us-gaap:FairValueMeasurementsNonrecurringMember2024-04-012024-06-300000785161us-gaap:CarryingReportedAmountFairValueDisclosureMemberehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2024-06-300000785161us-gaap:EstimateOfFairValueFairValueDisclosureMemberehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2024-06-300000785161us-gaap:CarryingReportedAmountFairValueDisclosureMemberehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2023-12-310000785161us-gaap:EstimateOfFairValueFairValueDisclosureMemberehc:SeniorNotes05.75Due2025Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4.50Due2028Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000785161us-gaap:CarryingReportedAmountFairValueDisclosureMemberehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2024-06-300000785161us-gaap:EstimateOfFairValueFairValueDisclosureMemberehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2024-06-300000785161us-gaap:CarryingReportedAmountFairValueDisclosureMemberehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2023-12-310000785161us-gaap:EstimateOfFairValueFairValueDisclosureMemberehc:SeniorNotes04.750Due2030Memberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4625Due2031Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes4625Due2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-06-300000785161ehc:SeniorNotes4625Due2031Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000785161ehc:SeniorNotes4625Due2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000785161us-gaap:NotesPayableOtherPayablesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300000785161us-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000785161us-gaap:NotesPayableOtherPayablesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000785161us-gaap:NotesPayableOtherPayablesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000785161us-gaap:LetterOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-06-300000785161us-gaap:LetterOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-06-300000785161us-gaap:LetterOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000785161us-gaap:LetterOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000785161us-gaap:RestrictedStockMember2024-01-012024-06-300000785161us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-06-300000785161us-gaap:RestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-06-300000785161us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RestrictedStockMember2024-01-012024-06-300000785161us-gaap:EmployeeStockOptionMember2024-01-012024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-10315

______________________________

Encompass Health Corporation

(Exact name of Registrant as specified in its Charter)

| | | | | |

| Delaware | 63-0860407 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| |

9001 Liberty Parkway

Birmingham, Alabama 35242

(Address of Principal Executive Offices)

(205) 967-7116

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

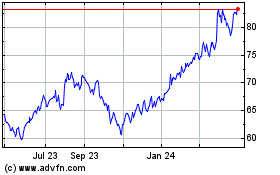

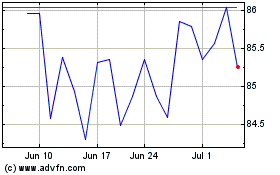

| Common Stock, par value $0.01 per share | EHC | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-Accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☒

The registrant had 100,625,306 shares of common stock outstanding, net of treasury shares, as of July 24, 2024.

TABLE OF CONTENTS

NOTE TO READERS

As used in this report, the terms “Encompass Health,” “we,” “us,” “our,” and the “Company” refer to Encompass Health Corporation and its consolidated subsidiaries, unless otherwise stated or indicated by context. This drafting style is suggested by the Securities and Exchange Commission and is not meant to imply that Encompass Health Corporation, the publicly traded parent company, owns or operates any specific asset, business, or property. The hospitals, operations, and businesses described in this filing are primarily owned and operated by subsidiaries of the parent company. In addition, we use the term “Encompass Health Corporation” to refer to Encompass Health Corporation alone wherever a distinction between Encompass Health Corporation and its subsidiaries is required or aids in the understanding of this filing.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report contains historical information, as well as forward-looking statements that involve known and unknown risks and relate to, among other things, future events, changes to Medicare reimbursement and other healthcare laws and regulations from time to time, our business strategy, labor cost trends, our dividend and stock repurchase strategies, our financial plans, our growth plans, our future financial performance, our projected business results, or our projected capital expenditures. In some cases, the reader can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “targets,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties, many of which are beyond our control. Any forward-looking statement is based on information current as of the date of this report and speaks only as of the date on which such statement is made. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, the factors described below could cause, and in the case of the COVID-19 pandemic has already caused, actual results to differ materially from those estimated by us.

•Each of the factors discussed in Item 1A, Risk Factors, of our Annual Report on Form 10-K for the year ended December 31, 2023, as well as uncertainties and factors discussed elsewhere in this Form 10-Q, including in the “Executive Overview—Key Challenges” section of Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in our other filings from time to time with the SEC, or in materials incorporated therein by reference.

•We are highly concentrated in our primary line of business, particularly with respect to Medicare regulations and reimbursement.

•Reductions or delays in, or suspension of, reimbursement for our services by governmental or private payors, including our inability to obtain and retain favorable arrangements with third-party payors, could decrease our revenues and adversely affect other operating results.

•Restrictive interpretations of the regulations governing the claims that are reimbursable by Medicare could decrease our revenues and adversely affect other operating results.

•Reimbursement claims are subject to various audits and such audits may lead to assertions that we have been overpaid or have submitted improper claims, and these assertions have in the past and will in the future require us to incur additional costs to respond to requests for records and defend the validity of payments and to refund any amounts determined to have been overpaid.

•The use by governmental agencies and contractors of statistical sampling and extrapolation may substantially expand claims of overpayment or noncompliance.

•Substantive and procedural deficiencies in the administrative appeals process associated with denied Medicare reimbursement claims, including from various Medicare audit programs, have in the past and could in the future delay or reduce our reimbursement for services previously provided, including through recoupment from other claims due to us from Medicare.

•Efforts to reduce payments to healthcare providers undertaken by third-party payors and conveners could adversely affect our revenues or profitability.

•Changes in our payor mix or the acuity of our patients could reduce our revenues or profitability.

•Changes in the rules and regulations of the healthcare industry at the federal, state, and local levels, including those contemplated now and in the future as part of healthcare reform and deficit reduction (such as the Inpatient Rehabilitation Facility Review Choice Demonstration, the re-basing of payment systems, the introduction of site neutral payments or case-mix weightings across post-acute settings, and other payment system reforms) could decrease revenues and increase the costs of complying with the rules and regulations and have done so in the past from time to time.

•Alternative payment models and value-based purchasing initiatives could decrease our patient volumes and reimbursement rate or increase costs associated with our operations.

•Compliance with the extensive and frequently changing laws and regulations applicable to healthcare providers, including those related to patient care, coding and billing, data privacy and security, consumer protection, anti-trust, and employment practices, requires substantial time, effort and expense, and if we fail to comply, we could incur

penalties and significant costs of investigating and defending asserted claims, whether meritorious or not, or be required to make significant changes to our operations.

•Our inability to maintain proper local, state and federal licensing, including compliance with the Medicare conditions of participation and provider enrollment requirements could decrease our revenues.

•Incidents affecting the proper operation, availability, or security of our or our vendors’ or partners’ information systems, including the patient information stored there, or business continuity could cause substantial losses and adversely affect our operations and governmental mandates to increase use of electronic records and interoperability exacerbate that risk.

•Any adverse outcome of various lawsuits, claims, and legal or regulatory proceedings, including disclosed and undisclosed qui tam suits, could be difficult to predict and could adversely affect our financial results or condition or our operations, and we could experience increased costs of defending and insuring against alleged professional liability and other claims.

•Our inability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures consistent with our growth strategy, including realization of anticipated revenues, cost savings, productivity improvements arising from the related operations and avoidance of unanticipated difficulties, costs or liabilities that could arise from acquisitions or integrations could adversely affect our financial results or condition.

•Our inability to attract and retain nurses, therapists, and other healthcare professionals in a highly competitive environment with often severe staffing shortages and potential union activity could increase staffing costs and adversely affect other financial and operating results and has done so in the past.

•Competitive pressures in the healthcare industry, including from large acute-care hospitals that would typically serve as referral sources for us, and our response to those pressures could adversely affect our revenues or other financial results.

•Medicare quality reporting requirements could adversely affect our operating costs or Medicare reimbursement.

•Our inability to provide a consistently high quality of care, including as represented in metrics published by Medicare, could decrease our revenues.

•Our inability to maintain or develop relationships with patient referral sources, including our joint venture hospitals, or managed care payors could decrease our revenues.

•Acute-care hospitals that participate in joint ventures with us may experience, and in the past some have experienced, operational or financial challenges that, in turn, affect our joint venture inpatient rehabilitation hospitals.

•A pandemic, epidemic, or other widespread outbreak of an infectious disease or other public health crisis, and governmental responses to those events, could decrease our patient volumes, pricing, and revenues, lead to staffing and supply shortages and associated cost increases, otherwise interrupt operations, or lead to increased litigation risk and, in the case of the COVID-19 pandemic, has already done so in many instances.

•A regional or global socio-political, weather, or other catastrophic event could severely disrupt our business, particularly in areas such as Texas or Florida where we have a concentration of hospitals.

•Regulatory and other efforts to promote a transition to a lower-carbon economy may result in significant operational and financial challenges for us.

•Our inability to maintain infectious disease prevention and control efforts that are required and effectively minimize the spread among patients and employees could decrease our patient volumes and revenues, lead to staffing shortages or otherwise interrupt operations, or lead to increased litigation risk.

•Our debt and the associated restrictive covenants could have negative consequences for our business and limit our ability to execute aspects of our business plan successfully.

•The price of our common stock could adversely affect our willingness and ability to repurchase shares.

•We may be unable or unwilling to continue to declare and pay dividends on our common stock.

•General conditions in the economy and capital markets, including inflation, any disruption, instability, or uncertainty related to armed conflict or an act of terrorism, a governmental impasse over approval of the United States federal budget or an increase to the debt ceiling, an international trade war, or a sovereign debt crisis could adversely affect our financial results or condition, including access to the capital markets.

The cautionary statements referred to in this section also should be considered in connection with any subsequent written or oral forward-looking statements that may be issued by us or persons acting on our behalf. We undertake no duty to update these forward-looking statements, even though our situation may change in the future. Furthermore, we cannot guarantee future results, events, levels of activity, performance, or achievements.

PART I. FINANCIAL INFORMATION

Item 1.Financial Statements (Unaudited)

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| (In Millions, Except Per Share Data) |

| Net operating revenues | $ | 1,301.2 | | | $ | 1,187.1 | | | $ | 2,617.2 | | | $ | 2,347.5 | |

| Operating expenses: | | | | | | | |

| Salaries and benefits | 700.5 | | | 636.2 | | | 1,412.1 | | | 1,265.2 | |

| Other operating expenses | 189.9 | | | 172.7 | | | 393.8 | | | 350.6 | |

| Occupancy costs | 14.2 | | | 14.3 | | | 28.2 | | | 28.1 | |

| Supplies | 57.6 | | | 52.0 | | | 116.1 | | | 105.8 | |

| General and administrative expenses | 50.5 | | | 55.4 | | | 100.7 | | | 98.8 | |

| Depreciation and amortization | 72.9 | | | 72.6 | | | 143.2 | | | 136.5 | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | 1,085.6 | | | 1,003.2 | | | 2,194.1 | | | 1,985.0 | |

| | | | | | | |

| Interest expense and amortization of debt discounts and fees | 34.3 | | | 36.3 | | | 69.5 | | | 72.7 | |

| Other income | (3.3) | | | (2.7) | | | (8.7) | | | (6.3) | |

| Equity in net income of nonconsolidated affiliates | (1.4) | | | (0.9) | | | (2.1) | | | (1.3) | |

| Income from continuing operations before income tax expense | 186.0 | | | 151.2 | | | 364.4 | | | 297.4 | |

| Provision for income tax expense | 38.3 | | | 32.8 | | | 76.6 | | | 64.7 | |

| Income from continuing operations | 147.7 | | | 118.4 | | | 287.8 | | | 232.7 | |

| Loss from discontinued operations, net of tax | (1.2) | | | (1.2) | | | (2.5) | | | (2.2) | |

| Net and comprehensive income | 146.5 | | | 117.2 | | | 285.3 | | | 230.5 | |

| | | | | | | |

| | | | | | | |

| Less: Net and comprehensive income attributable to noncontrolling interests | (32.4) | | | (25.8) | | | (58.7) | | | (51.4) | |

| Net and comprehensive income attributable to Encompass Health | $ | 114.1 | | | $ | 91.4 | | | $ | 226.6 | | | $ | 179.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 99.9 | | | 99.5 | | | 99.9 | | | 99.5 | |

| Diluted | 102.0 | | | 101.1 | | | 102.1 | | | 101.0 | |

Earnings per common share: | | | | | | | |

Basic earnings per share attributable to Encompass Health common shareholders: | | | | | | | |

Continuing operations | $ | 1.14 | | | $ | 0.92 | | | $ | 2.28 | | | $ | 1.81 | |

Discontinued operations | (0.01) | | | (0.01) | | | (0.03) | | | (0.02) | |

Net income | $ | 1.13 | | | $ | 0.91 | | | $ | 2.25 | | | $ | 1.79 | |

Diluted earnings per share attributable to Encompass Health common shareholders: | | | | | | | |

Continuing operations | $ | 1.13 | | | $ | 0.91 | | | $ | 2.24 | | | $ | 1.79 | |

Discontinued operations | (0.01) | | | (0.01) | | | (0.02) | | | (0.02) | |

Net income | $ | 1.12 | | | $ | 0.90 | | | $ | 2.22 | | | $ | 1.77 | |

| | | | | | | |

Amounts attributable to Encompass Health common shareholders: | | | | | | | |

| Income from continuing operations | $ | 115.3 | | | $ | 92.6 | | | $ | 229.1 | | | $ | 181.3 | |

| Loss from discontinued operations, net of tax | (1.2) | | | (1.2) | | | (2.5) | | | (2.2) | |

| Net income attributable to Encompass Health | $ | 114.1 | | | $ | 91.4 | | | $ | 226.6 | | | $ | 179.1 | |

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

1

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| June 30,

2024 | | December 31,

2023 |

| | (In Millions) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 154.4 | | | $ | 69.1 | |

Restricted cash | 27.7 | | | 35.1 | |

Accounts receivable | 589.7 | | | 611.6 | |

| Other current assets | 166.3 | | | 126.0 | |

| Total current assets | 938.1 | | | 841.8 | |

| Property and equipment, net | 3,438.9 | | | 3,301.0 | |

| Operating lease right-of-use assets | 216.3 | | | 208.5 | |

| Goodwill | 1,284.0 | | | 1,281.3 | |

| Intangible assets, net | 303.0 | | | 278.2 | |

| | | |

| Other long-term assets | 208.4 | | | 191.6 | |

Total assets(1) | $ | 6,388.7 | | | $ | 6,102.4 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 32.5 | | | $ | 24.8 | |

| Current operating lease liabilities | 26.6 | | | 24.1 | |

| Accounts payable | 164.2 | | | 170.0 | |

| | | |

| Accrued expenses and other current liabilities | 471.2 | | | 437.5 | |

| Total current liabilities | 694.5 | | | 656.4 | |

| Long-term debt, net of current portion | 2,684.1 | | | 2,687.8 | |

| Long-term operating lease liabilities | 202.0 | | | 196.1 | |

| Deferred income tax liabilities | 91.2 | | | 87.0 | |

| Other long-term liabilities | 186.9 | | | 177.9 | |

Total liabilities(1) | 3,858.7 | | | 3,805.2 | |

| Commitments and contingencies | | | |

| | | |

| Redeemable noncontrolling interests | 48.6 | | | 42.0 | |

| Shareholders’ equity: | | | |

| Encompass Health shareholders’ equity | 1,839.4 | | | 1,647.5 | |

| Noncontrolling interests | 642.0 | | | 607.7 | |

| Total shareholders’ equity | 2,481.4 | | | 2,255.2 | |

Total liabilities(1) and shareholders’ equity | $ | 6,388.7 | | | $ | 6,102.4 | |

(1)Our consolidated assets as of June 30, 2024 and December 31, 2023 include total assets of variable interest entities of $204.1 million and $207.7 million, respectively, which cannot be used by us to settle the obligations of other entities. Our consolidated liabilities as of June 30, 2024 and December 31, 2023 include total liabilities of the variable interest entities of $45.1 million and $42.2 million, respectively. See Note 2, Variable Interest Entities.

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

2

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Shareholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2024 |

| | (In Millions) |

| | Encompass Health Common Shareholders | | | | |

| | Number of Common

Shares Outstanding | | Common Stock | | Capital in Excess of Par Value | | Accumulated Income | | | | Treasury Stock | | Noncontrolling

Interests | | Total |

| Balance at beginning of period | 100.7 | | | $ | 1.2 | | | $ | 1,797.2 | | | $ | 503.7 | | | | | $ | (560.2) | | | $ | 620.4 | | | $ | 2,362.3 | |

| Net income | — | | | — | | | — | | | 114.1 | | | | | — | | | 30.9 | | | 145.0 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Dividends declared ($0.15 per share) | — | | | — | | | 0.1 | | | (15.4) | | | | | — | | | — | | | (15.3) | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 13.6 | | | — | | | | | — | | | — | | | 13.6 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | — | | | | | — | | | (27.6) | | | (27.6) | |

| Capital contributions from consolidated affiliates | — | | | — | | | — | | | — | | | | | — | | | 18.2 | | | 18.2 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Repurchases of common stock in open market | (0.2) | | | — | | | — | | | — | | | | | (16.8) | | | — | | | (16.8) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | 0.2 | | | — | | | (4.1) | | | (0.1) | | | | | 6.1 | | | 0.1 | | | 2.0 | |

| Balance at end of period | 100.7 | | | $ | 1.2 | | | $ | 1,806.8 | | | $ | 602.3 | | | | | $ | (570.9) | | | $ | 642.0 | | | $ | 2,481.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2023 |

| | (In Millions) |

| | Encompass Health Common Shareholders | | | | |

| | Number of Common Shares Outstanding | | Common Stock | | Capital in Excess of Par Value | | Accumulated Income | | | | Treasury Stock | | Noncontrolling Interests | | Total |

| Balance at beginning of period | 100.2 | | | $ | 1.2 | | | $ | 1,739.1 | | | $ | 188.3 | | | | | $ | (545.1) | | | $ | 542.2 | | | $ | 1,925.7 | |

| Net income | — | | | — | | | — | | | 91.4 | | | | | — | | | 23.6 | | | 115.0 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Dividends declared ($0.15 per share) | — | | | — | | | — | | | (15.1) | | | | | — | | | — | | | (15.1) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 15.6 | | | — | | | | | — | | | — | | | 15.6 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | — | | | | | — | | | (27.5) | | | (27.5) | |

| Capital contributions from consolidated affiliates | — | | | — | | | — | | | — | | | | | — | | | 4.1 | | | 4.1 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | — | | | — | | | 0.3 | | | — | | | | | (0.4) | | | — | | | (0.1) | |

| Balance at end of period | 100.2 | | | $ | 1.2 | | | $ | 1,755.0 | | | $ | 264.6 | | | | | $ | (545.5) | | | $ | 542.4 | | | $ | 2,017.7 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

3

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Shareholders’ Equity (Continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2024 |

| | (In Millions) |

| | Encompass Health Common Shareholders | | | | |

| | Number of Common

Shares Outstanding | | Common Stock | | Capital in Excess of Par Value | | Accumulated Income | | | | Treasury Stock | | Noncontrolling

Interests | | Total |

| Balance at beginning of period | 100.3 | | | $ | 1.2 | | | $ | 1,787.0 | | | $ | 406.5 | | | | | $ | (547.2) | | | $ | 607.7 | | | $ | 2,255.2 | |

| Net income | — | | | — | | | — | | | 226.6 | | | | | — | | | 55.7 | | | 282.3 | |

| Receipt of treasury stock | (0.2) | | | — | | | — | | | — | | | | | (12.1) | | | — | | | (12.1) | |

Dividends declared ($0.30 per share) | — | | | — | | | 0.2 | | | (30.8) | | | | | — | | | — | | | (30.6) | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 22.9 | | | — | | | | | — | | | — | | | 22.9 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | — | | | | | — | | | (58.1) | | | (58.1) | |

| Capital contributions from consolidated affiliates | — | | | — | | | — | | | — | | | | | — | | | 36.6 | | | 36.6 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Repurchases of common stock in open market | (0.2) | | | — | | | — | | | — | | | | | (16.8) | | | — | | | (16.8) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | 0.8 | | | — | | | (3.3) | | | — | | | | | 5.2 | | | 0.1 | | | 2.0 | |

| Balance at end of period | 100.7 | | | $ | 1.2 | | | $ | 1,806.8 | | | $ | 602.3 | | | | | $ | (570.9) | | | $ | 642.0 | | | $ | 2,481.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended June 30, 2023 |

| | (In Millions) |

| | Encompass Health Common Shareholders | | | | |

| | Number of Common Shares Outstanding | | Common Stock | | Capital in Excess of Par Value | | Accumulated Income | | | | Treasury Stock | | Noncontrolling Interests | | Total |

| Balance at beginning of period | 99.8 | | | $ | 1.1 | | | $ | 1,730.2 | | | $ | 115.7 | | | | | $ | (536.7) | | | $ | 516.0 | | | $ | 1,826.3 | |

| Net income | — | | | — | | | — | | | 179.1 | | | | | — | | | 47.1 | | | 226.2 | |

| | | | | | | | | | | | | | | |

| Receipt of treasury stock | (0.1) | | | — | | | — | | | — | | | | | (7.7) | | | — | | | (7.7) | |

Dividends declared ($0.30 per share) | — | | | — | | | — | | | (30.2) | | | | | — | | | — | | | (30.2) | |

| | | | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 23.5 | | | — | | | | | — | | | — | | | 23.5 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Distributions declared | — | | | — | | | — | | | — | | | | | — | | | (58.7) | | | (58.7) | |

| Capital contributions from consolidated affiliates | — | | | — | | | — | | | — | | | | | — | | | 38.0 | | | 38.0 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Other | 0.5 | | | 0.1 | | | 1.3 | | | — | | | | | (1.1) | | | — | | | 0.3 | |

| Balance at end of period | 100.2 | | | $ | 1.2 | | | $ | 1,755.0 | | | $ | 264.6 | | | | | $ | (545.5) | | | $ | 542.4 | | | $ | 2,017.7 | |

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

4

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| | Six Months Ended June 30, |

| | 2024 | | 2023 |

| | (In Millions) |

| Cash flows from operating activities: | | | |

| Net income | $ | 285.3 | | | $ | 230.5 | |

| Loss from discontinued operations, net of tax | 2.5 | | | 2.2 | |

| Adjustments to reconcile net income to net cash provided by operating activities— | | | |

| | | |

| Depreciation and amortization | 143.2 | | | 136.5 | |

| | | |

| | | |

| | | |

| Stock-based compensation | 22.9 | | | 23.5 | |

| Deferred tax expense | 4.2 | | | 0.3 | |

| | | |

| | | |

| Other, net | 14.2 | | | 3.1 | |

| Change in assets and liabilities, net of acquisitions— | | | |

| Accounts receivable | 0.9 | | | 11.5 | |

| Other assets | (48.4) | | | (8.4) | |

| Accounts payable | 1.8 | | | 4.0 | |

| | | |

| | | |

| Other liabilities | 32.3 | | | 34.3 | |

| Net cash used in operating activities of discontinued operations | (2.7) | | | (2.9) | |

| Total adjustments | 168.4 | | | 201.9 | |

| Net cash provided by operating activities | 456.2 | | | 434.6 | |

| Cash flows from investing activities: | | | |

| | | |

| Purchases of property, equipment, and intangible assets | (296.3) | | | (221.7) | |

| | | |

| | | |

| Proceeds from sale of restricted investments | 17.0 | | | 1.0 | |

| | | |

| Other, net | (8.8) | | | (11.8) | |

| | | |

| Net cash used in investing activities | (288.1) | | | (232.5) | |

| | | |

| |

| | | |

| |

| Cash flows from financing activities: | | | |

| | | |

| Principal borrowings on notes | — | | | 20.0 | |

| Principal payments on debt, including pre-payments | (2.4) | | | (5.7) | |

| Borrowings on revolving credit facility | 50.0 | | | 60.0 | |

| Payments on revolving credit facility | (50.0) | | | (115.0) | |

| Principal payments under finance lease obligations | (10.7) | | | (9.5) | |

| | | |

| Taxes paid on behalf of employees for shares withheld | (12.1) | | | (7.7) | |

| Contributions from noncontrolling interests of consolidated affiliates | 33.3 | | | 46.3 | |

| Dividends paid on common stock | (30.8) | | | (30.5) | |

| Distributions paid to noncontrolling interests of consolidated affiliates | (52.5) | | | (59.4) | |

| Repurchases of common stock, including fees and expenses | (16.8) | | | — | |

| | | |

| Other, net | 1.8 | | | — | |

| | | |

| Net cash used in financing activities | (90.2) | | | (101.5) | |

| | | |

| | | |

| |

| | | |

| |

| Increase in cash, cash equivalents, and restricted cash | 77.9 | | | 100.6 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 104.2 | | | 53.4 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 182.1 | | | $ | 154.0 | |

| | | |

| | | |

| | | |

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

5

Encompass Health Corporation and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Continued)

(Unaudited)

| | | | | | | | | | | |

| | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| (In Millions) |

| Reconciliation of Cash, Cash Equivalents, and Restricted Cash | | | |

Cash and cash equivalents at beginning of period | $ | 69.1 | | | $ | 21.8 | |

Restricted cash at beginning of period | 35.1 | | | 31.6 | |

| | | |

| | | |

Cash, cash equivalents, and restricted cash at beginning of period | $ | 104.2 | | | $ | 53.4 | |

| | | |

Cash and cash equivalents at end of period | $ | 154.4 | | | $ | 117.5 | |

Restricted cash at end of period | 27.7 | | | 36.5 | |

| | | |

| | | |

Cash, cash equivalents, and restricted cash at end of period | $ | 182.1 | | | $ | 154.0 | |

| | | |

| Supplemental schedule of noncash operating, investing, and financing activities: | | | |

| | | |

| Accrued purchases of property, equipment, and intangible assets | $ | (3.4) | | | $ | 19.0 | |

| Operating lease additions and adjustments | 24.9 | | | 7.6 | |

| Joint venture contributions | 11.8 | | | 18.0 | |

The accompanying notes to condensed consolidated financial statements are an integral part of these condensed statements.

6

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

1.Basis of Presentation

Encompass Health Corporation (the “Company” or “Encompass Health”), incorporated in Delaware in 1984, including its subsidiaries, is a provider of inpatient rehabilitation services. Our national network of inpatient rehabilitation hospitals stretches across 37 states and Puerto Rico, with concentrations of hospitals in Florida and Texas. As of June 30, 2024, we operate 163 inpatient rehabilitation hospitals. We are the sole owner of 99 of these hospitals. We retain 50.0% to 97.5% ownership in the remaining 64 jointly owned hospitals.

The accompanying unaudited condensed consolidated financial statements of Encompass Health Corporation and Subsidiaries should be read in conjunction with the consolidated financial statements and accompanying notes contained in Encompass Health’s Annual Report on Form 10-K filed with the United States Securities and Exchange Commission on February 28, 2024 (the “2023 Form 10‑K”). The unaudited condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the SEC applicable to interim financial information. Certain information and note disclosures included in financial statements prepared in accordance with generally accepted accounting principles in the United States of America have been omitted in these interim statements, as allowed by such SEC rules and regulations. The condensed consolidated balance sheet as of December 31, 2023 has been derived from audited financial statements, but it does not include all disclosures required by GAAP. However, we believe the disclosures are adequate to make the information presented not misleading. Certain prior year amounts may have been reclassified for comparative purposes to conform to the current-year financial statement presentation.

The unaudited results of operations for the interim periods shown in these financial statements are not necessarily indicative of operating results for the entire year. In our opinion, the accompanying condensed consolidated financial statements recognize all adjustments of a normal recurring nature considered necessary to fairly state the financial position, results of operations, and cash flows for each interim period presented.

Net Operating Revenues—

Our Net operating revenues disaggregated by payor source are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Medicare | $ | 841.6 | | | $ | 763.2 | | | $ | 1,695.3 | | | $ | 1,520.7 | |

Medicare Advantage | 224.2 | | | 198.1 | | | 448.4 | | | 384.5 | |

Managed care | 138.7 | | | 133.5 | | | 281.1 | | | 260.6 | |

| Medicaid | 43.0 | | | 48.8 | | | 88.1 | | | 96.2 | |

| Other third-party payors | 10.7 | | | 10.6 | | | 20.3 | | | 21.5 | |

| Workers’ compensation | 6.8 | | | 7.3 | | | 13.8 | | | 13.0 | |

| Patients | 3.7 | | | 4.0 | | | 7.6 | | | 6.6 | |

| Other income | 32.5 | | | 21.6 | | | 62.6 | | | 44.4 | |

| Total | $ | 1,301.2 | | | $ | 1,187.1 | | | $ | 2,617.2 | | | $ | 2,347.5 | |

See Note 1, Summary of Significant Accounting Policies, to the consolidated financial statements accompanying the 2023 Form 10-K for our policy related to Net operating revenues.

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

Noncontrolling Interests in Consolidated Affiliates—

Effective July 1, 2024, we expanded our existing joint venture with Piedmont Healthcare (“Piedmont”), which we control, by contributing the assets and operations of our previously wholly-owned 70-bed hospital in Augusta, Georgia. Piedmont contributed approximately $90 million on July 1, 2024, which indirectly resulted in Piedmont obtaining a 50% ownership interest in the hospital. As a result of this transaction, we expect to record a post-tax gain of approximately $23 million increasing Capital in excess of par value on the condensed consolidated statement of shareholders’ equity for the nine months ending September 30, 2024.

On July 1, 2023, we entered into a joint venture agreement with the University of Maryland Rehabilitation Institute of Southern Maryland, LLC (“UM Rehab”) to operate our previously wholly-owned 60-bed hospital in Bowie, Maryland. As a condition of the joint venture agreement, UM Rehab paid $26.3 million on June 30, 2023, for a 50% ownership interest in the hospital which became effective on July 1, 2023. This payment is included in Contributions from noncontrolling interests of consolidated affiliates on the condensed consolidated statement of cash flows for the six months ended June 30, 2023.

Recent Accounting Pronouncements—

In November 2023, the FASB issued ASU 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures,” which requires all public entities, including entities with a single reportable segment, to provide disclosure of (1) significant segment expenses that are regularly provided to the chief operating decision maker (“CODM”) and included within each reported measure of segment profit or loss, (2) the amount and description of the composition of other segment items which reconcile to segment profit or loss, and (3) the title and position of the entity’s CODM and an explanation of how the CODM uses the reported measure(s) of segment profit or loss in assessing segment performance and allocating resources. ASU 2023-07 is effective for our annual periods beginning January 1, 2024 and interim periods beginning January 1, 2025. Early adoption is permitted with retrospective application required for all prior periods presented in the financial statements. We are currently evaluating the requirements of this standard and any potential impact it may have on our condensed consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures,” which intends to improve the transparency of income tax disclosures by requiring companies to (1) disclose consistent categories and greater disaggregation of information in the effective rate reconciliation and (2) provide information on income taxes paid disaggregated by jurisdiction. ASU 2023-09 is effective for our annual periods beginning January 1, 2025, with early adoption permitted. We are required to apply the guidance prospectively but have the option to apply it retrospectively. We are currently evaluating the requirements of this standard and any potential impact it may have on our condensed consolidated financial statements.

We do not believe any other recently issued, but not yet effective, accounting standards will have a material effect on our condensed consolidated financial position, results of operations, or cash flows.

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

2.Variable Interest Entities

As of June 30, 2024 and December 31, 2023, we consolidated eight limited partnership-like entities that are variable interest entities (“VIEs”) and of which we are the primary beneficiary. Our ownership percentages in these entities range from 50.0% to 75.0% as of June 30, 2024. Through partnership and management agreements with or governing each of these entities, we manage all of these entities and handle all day-to-day operating decisions. Accordingly, we have the decision making power over the activities that most significantly impact the economic performance of our VIEs and an obligation to absorb losses or receive benefits from the VIE that could potentially be significant to the VIE. These decisions and significant activities include, but are not limited to, marketing efforts, oversight of patient admissions, medical training, nurse and therapist scheduling, provision of healthcare services, billing, collections, and creation and maintenance of medical records. The terms of the agreements governing each of our VIEs prohibit us from using the assets of each VIE to satisfy the obligations of other entities.

The carrying amounts and classifications of the consolidated VIEs’ assets and liabilities, which are included in our condensed consolidated balance sheets, are as follows (in millions):

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 0.5 | | | $ | 0.2 | |

Accounts receivable | 36.7 | | | 36.7 | |

| Other current assets | 5.1 | | | 5.0 | |

| | | |

| Total current assets | 42.3 | | | 41.9 | |

| Property and equipment, net | 133.9 | | | 128.8 | |

| Operating lease right-of-use assets | 1.3 | | | 1.4 | |

| Goodwill | 15.9 | | | 15.9 | |

| Intangible assets, net | 1.1 | | | 1.2 | |

| Other long-term assets | 9.6 | | | 18.5 | |

| | | |

| Total assets | $ | 204.1 | | | $ | 207.7 | |

| Liabilities | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 0.9 | | | $ | 0.9 | |

| | | |

| Accounts payable | 8.2 | | | 7.6 | |

| Accrued expenses and other current liabilities | 21.5 | | | 18.7 | |

| | | |

| Total current liabilities | 30.6 | | | 27.2 | |

| Long-term debt, net of current portion | 13.1 | | | 13.6 | |

| Long-term operating lease liabilities | 1.4 | | | 1.4 | |

| | | |

| Total liabilities | $ | 45.1 | | | $ | 42.2 | |

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

3.Long-term Debt

Our long-term debt outstanding consists of the following (in millions):

| | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Credit Agreement— | | | |

| Advances under revolving credit facility | $ | — | | | $ | — | |

| | | |

| Bonds payable— | | | |

5.75% Senior Notes due 2025 | 349.0 | | | 348.5 | |

4.50% Senior Notes due 2028 | 786.7 | | | 785.0 | |

4.75% Senior Notes due 2030 | 782.8 | | | 781.5 | |

4.625% Senior Notes due 2031 | 392.0 | | | 391.5 | |

| Other notes payable | 76.7 | | | 66.0 | |

| Finance lease obligations | 329.4 | | | 340.1 | |

| 2,716.6 | | | 2,712.6 | |

| Less: Current portion | (32.5) | | | (24.8) | |

| Long-term debt, net of current portion | $ | 2,684.1 | | | $ | 2,687.8 | |

The following chart shows scheduled principal payments due on long-term debt for the next five years and thereafter (in millions):

| | | | | | | | | | | | | | |

| | Face Amount | | Net Amount |

| July 1 through December 31, 2024 | | $ | 12.7 | | | $ | 12.7 | |

| 2025 | | 387.4 | | | 386.3 | |

| 2026 | | 36.0 | | | 36.0 | |

| 2027 | | 43.2 | | | 43.2 | |

| 2028 | | 831.7 | | | 818.4 | |

| 2029 | | 40.5 | | | 40.5 | |

| Thereafter | | 1,404.8 | | | 1,379.5 | |

| Total | | $ | 2,756.3 | | | $ | 2,716.6 | |

On July 15, 2024, we issued notice for redemption of $150 million of the outstanding principal balance of our 5.75% Senior Notes due 2025 (the “2025 Notes”). The associated redemption date will be August 15, 2024, and the redemption price will be 100.0% of par, plus accrued and unpaid interest pursuant to the terms of the 2025 Notes. We plan to use cash on hand to fund the redemption. As a result of this redemption, we expect to record an approximate $0.4 million loss on early extinguishment of debt in the third quarter of 2024.

4.Redeemable Noncontrolling Interests

The following is a summary of the activity related to our Redeemable noncontrolling interests (in millions):

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Balance at beginning of period | $ | 42.0 | | | $ | 35.6 | |

| Net income attributable to noncontrolling interests | 3.0 | | | 4.3 | |

| Distributions declared | (4.9) | | | (0.6) | |

| Contribution to joint venture | 8.5 | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Balance at end of period | $ | 48.6 | | | $ | 39.3 | |

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

The following table reconciles the net income attributable to nonredeemable Noncontrolling interests, as recorded in the shareholders’ equity section of the condensed consolidated balance sheets, and the net income attributable to Redeemable noncontrolling interests, as recorded in the mezzanine section of the condensed consolidated balance sheets, to the Net and comprehensive income attributable to noncontrolling interests presented in the condensed consolidated statements of comprehensive income (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to nonredeemable noncontrolling interests | $ | 30.9 | | | $ | 23.6 | | | $ | 55.7 | | | $ | 47.1 | |

| Net income attributable to redeemable noncontrolling interests | 1.5 | | | 2.2 | | | 3.0 | | | 4.3 | |

| Net income attributable to noncontrolling interests | $ | 32.4 | | | $ | 25.8 | | | $ | 58.7 | | | $ | 51.4 | |

See also Note 5, Fair Value Measurements.

5.Fair Value Measurements

Our financial assets and liabilities that are measured at fair value on a recurring basis are as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Fair Value Measurements at Reporting Date Using |

| As of June 30, 2024 | Fair Value | | Quoted Prices in Active Markets for Identical Assets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Valuation Technique (1) |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Equity securities (2) | $ | 117.3 | | | $ | 4.0 | | | $ | 113.3 | | | $ | — | | | M |

| | | | | | | | | |

| Redeemable noncontrolling interests | 48.6 | | | — | | | — | | | 48.6 | | | I |

| As of December 31, 2023 | | | | | | | | | |

| | | | | | | | | |

Equity securities (2) | $ | 126.2 | | | $ | 4.0 | | | $ | 122.2 | | | $ | — | | | M |

| | | | | | | | | |

| Redeemable noncontrolling interests | 42.0 | | | — | | | — | | | 42.0 | | | I |

(1) The two valuation techniques are: market approach (M) and income approach (I).

(2) As of June 30, 2024, $37.4 million are included in Other current assets and $79.9 million are included in Other long-term assets in the condensed consolidated balance sheet. As of December 31, 2023, $37.6 million are included in Other current assets and $88.6 million are included in Other long-term assets in the condensed consolidated balance sheet.

There are assets and liabilities that are not required to be measured at fair value on a recurring basis. However, these assets may be recorded at fair value as a result of impairment charges or other adjustments made to the carrying value of the applicable assets. During the three and six months ended June 30, 2024 and 2023, we did not record any material gains or losses related to these assets.

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

As discussed in Note 1, Summary of Significant Accounting Policies, “Fair Value Measurements,” to the consolidated financial statements accompanying the 2023 Form 10‑K, the carrying value equals fair value for our financial instruments that are not included in the table below and are classified as current in our condensed consolidated balance sheets. The carrying amounts and estimated fair values for all of our other financial instruments are presented in the following table (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | As of June 30, 2024 | | As of December 31, 2023 |

| | Carrying Amount | | Estimated Fair Value | | Carrying Amount | | Estimated Fair Value |

| Long-term debt: | | | | | | | |

| | | | | | | |

| | | | | | | |

5.75% Senior Notes due 2025 | $ | 349.0 | | | $ | 349.0 | | | $ | 348.5 | | | $ | 349.3 | |

4.50% Senior Notes due 2028 | 786.7 | | | 759.0 | | | 785.0 | | | 763.6 | |

4.75% Senior Notes due 2030 | 782.8 | | | 748.4 | | | 781.5 | | | 755.0 | |

4.625% Senior Notes due 2031 | 392.0 | | | 367.4 | | | 391.5 | | | 369.4 | |

| Other notes payable | 76.7 | | | 76.7 | | | 66.0 | | | 66.0 | |

| Financial commitments: | | | | | | | |

| Letters of credit | — | | | 36.3 | | | — | | | 31.9 | |

Fair values for our long-term debt and financial commitments are determined using inputs, including quoted prices in nonactive markets, that are observable either directly or indirectly, or Level 2 inputs within the fair value hierarchy. See Note 1, Summary of Significant Accounting Policies, “Fair Value Measurements,” to the consolidated financial statements accompanying the 2023 Form 10‑K.

6.Share-Based Payments

During the six months ended June 30, 2024, we issued a total of 0.5 million restricted stock awards to members of our management team and our board of directors. Of the restricted stock awards issued to members of our management team, 0.2 million contain only a service condition, while the remainder contain a service and/or performance condition as well as a market condition for certain members of management. For the awards that include a performance and market condition, the number of shares that will ultimately be granted to employees may vary based on the Company’s performance during the applicable three-year performance measurement period and the applicable three-year market condition measurement period. Additionally, we granted 0.1 million stock options to members of our management team. The fair value of these awards and options was determined using the policies described in Note 1, Summary of Significant Accounting Policies, and Note 14, Share-Based Payments, to the consolidated financial statements accompanying the 2023 Form 10‑K.

7.Income Taxes

Our Provision for income tax expense of $38.3 million and $76.6 million for the three and six months ended June 30, 2024, respectively, primarily resulted from the application of our estimated effective blended federal and state income tax rate partially offset by tax benefits resulting from share-based compensation windfalls. Our Provision for income tax expense of $32.8 million and $64.7 million for the three and six months ended June 30, 2023, respectively, primarily resulted from the application of our estimated effective blended federal and state income tax rate.

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

8.Earnings per Common Share

The following table sets forth the computation of basic and diluted earnings per common share (in millions, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Basic: | | | | | | | |

| Numerator: | | | | | | | |

| Income from continuing operations | $ | 147.7 | | | $ | 118.4 | | | $ | 287.8 | | | $ | 232.7 | |

| Less: Net income attributable to noncontrolling interests included in continuing operations | (32.4) | | | (25.8) | | | (58.7) | | | (51.4) | |

| Less: Income allocated to participating securities | (0.8) | | | (0.6) | | | (1.6) | | | (1.2) | |

| | | | | | | |

| Income from continuing operations attributable to Encompass Health common shareholders | 114.5 | | | 92.0 | | | 227.5 | | | 180.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Loss from discontinued operations attributable to Encompass Health common shareholders | (1.2) | | | (1.2) | | | (2.5) | | | (2.2) | |

| Net income attributable to Encompass Health common shareholders | $ | 113.3 | | | $ | 90.8 | | | $ | 225.0 | | | $ | 177.9 | |

| Denominator: | | | | | | | |

Basic weighted average common shares outstanding | 99.9 | | | 99.5 | | | 99.9 | | | 99.5 | |

Basic earnings per share attributable to Encompass Health common shareholders: | | | | | | | |

Continuing operations | $ | 1.14 | | | $ | 0.92 | | | $ | 2.28 | | | $ | 1.81 | |

Discontinued operations | (0.01) | | | (0.01) | | | (0.03) | | | (0.02) | |

Net income | $ | 1.13 | | | $ | 0.91 | | | $ | 2.25 | | | $ | 1.79 | |

| | | | | | | |

| Diluted: | | | | | | | |

| Numerator: | | | | | | | |

| Income from continuing operations | $ | 147.7 | | | $ | 118.4 | | | $ | 287.8 | | | $ | 232.7 | |

| Less: Net income attributable to noncontrolling interests included in continuing operations | (32.4) | | | (25.8) | | | (58.7) | | | (51.4) | |

| | | | | | | |

| | | | | | | |

| Income from continuing operations attributable to Encompass Health common shareholders | 115.3 | | | 92.6 | | | 229.1 | | | 181.3 | |

| | | | | | | |

| | | | | | | |

| Loss from discontinued operations attributable to Encompass Health common shareholders | (1.2) | | | (1.2) | | | (2.5) | | | (2.2) | |

| Net income attributable to Encompass Health common shareholders | $ | 114.1 | | | $ | 91.4 | | | $ | 226.6 | | | $ | 179.1 | |

| Denominator: | | | | | | | |

Diluted weighted average common shares outstanding | 102.0 | | | 101.1 | | | 102.1 | | | 101.0 | |

Diluted earnings per share attributable to Encompass Health common shareholders: | | | | | | | |

Continuing operations | $ | 1.13 | | | $ | 0.91 | | | $ | 2.24 | | | $ | 1.79 | |

Discontinued operations | (0.01) | | | (0.01) | | | (0.02) | | | (0.02) | |

Net income | $ | 1.12 | | | $ | 0.90 | | | $ | 2.22 | | | $ | 1.77 | |

Encompass Health Corporation and Subsidiaries

Notes to Condensed Consolidated Financial Statements

The following table sets forth the reconciliation between basic weighted average common shares outstanding and diluted weighted average common shares outstanding (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Basic weighted average common shares outstanding | 99.9 | | | 99.5 | | | 99.9 | | | 99.5 | |

| | | | | | | |

| | | | | | | |

Restricted stock awards, dilutive stock options, and restricted stock units | 2.1 | | | 1.6 | | | 2.2 | | | 1.5 | |

| Diluted weighted average common shares outstanding | 102.0 | | | 101.1 | | | 102.1 | | | 101.0 | |

See Note 17, Earnings per Common Share, to the consolidated financial statements accompanying the 2023 Form 10‑K for additional information related to our common stock.

9.Contingencies and Other Commitments

We provide services in the highly regulated healthcare industry. Furthermore, operating inpatient rehabilitation hospitals requires significant staffing and involves intensive therapy for individuals suffering from significant physical or cognitive disabilities or injuries. As a result, various lawsuits, claims, and legal and regulatory proceedings have been and can be expected to be instituted or asserted against us. The resolution of any such lawsuits, claims, or legal and regulatory proceedings could materially and adversely affect our financial position, results of operations, and cash flows in a given period.

Other Matters—

The False Claims Act allows private citizens, called “relators,” to institute civil proceedings on behalf of the United States alleging violations of the False Claims Act. These lawsuits, also known as “whistleblower” or “qui tam” actions, can involve significant monetary damages, fines, attorneys’ fees and the award of bounties to the relators who successfully prosecute or bring these suits to the government. Qui tam cases are sealed at the time of filing, which means knowledge of the information contained in the complaint typically is limited to the relator, the federal government, and the presiding court. The defendant in a qui tam action may remain unaware of the existence of a sealed complaint or its specific claims for years. While the complaint is under seal, the government reviews the merits of the case and may conduct a broad investigation and seek discovery from the defendant and other parties before deciding whether to intervene in the case and take the lead on litigating the claims. The court lifts the seal when the government makes its decision on whether to intervene. If the government decides not to intervene, the relator may elect to continue to pursue the lawsuit individually on behalf of the government. It is possible that qui tam lawsuits have been filed against us, which suits remain under seal, or that we are unaware of such filings or precluded by existing law or court order from discussing or disclosing the filing of such suits. We may be subject to liability under one or more undisclosed qui tam cases brought pursuant to the False Claims Act.

It is our obligation as a participant in Medicare and other federal healthcare programs to routinely conduct audits and reviews of the accuracy of our billing systems and other regulatory compliance matters. As a result of these reviews, we have made, and will continue to make, disclosures to the United States Department of Health and Human Services Office of Inspector General and the Centers for Medicare & Medicaid Services relating to amounts we suspect represent over-payments from these programs, whether due to inaccurate billing or otherwise. Some of these disclosures have resulted in, and may in the future result in, Encompass Health refunding amounts to Medicare or other federal healthcare programs.

Other Commitments—

We are a party to service and other contracts in connection with conducting our business. Minimum amounts due under these agreements are $32.3 million for the remainder of 2024, $40.3 million in 2025, $29.9 million in 2026, $24.9 million in 2027, $22.4 million in 2028, and $62.3 million thereafter. These contracts primarily relate to software licensing and support and contract services.

Item 2.Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) relates to Encompass Health Corporation and its subsidiaries and should be read in conjunction with our condensed consolidated financial statements included under Part I, Item 1, Financial Statements (Unaudited), of this report. In addition, the following MD&A should be read in conjunction with our audited consolidated financial statements for the year ended December 31, 2023, Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, Part I, Item 1, Business, and Item 1A, Risk Factors, included in our Annual Report on Form 10-K for the year ended December 31, 2023 filed on February 28, 2024 (collectively, the “2023 Form 10‑K”).

This MD&A is designed to provide the reader with information that will assist in understanding our condensed consolidated financial statements, the changes in certain key items in those financial statements from period to period, and the primary factors that accounted for those changes, as well as how certain accounting principles affect our condensed consolidated financial statements. See “Cautionary Statement Regarding Forward-Looking Statements” beginning on page ii of this report, which is incorporated herein by reference for a description of important factors that could cause actual results to differ from expected results. See also Item 1A, Risk Factors, of this report and to the 2023 Form 10‑K.

Executive Overview

Our Business

We are the nation’s largest owner and operator of inpatient rehabilitation hospitals in terms of patients treated, revenues, and number of hospitals. We provide specialized rehabilitative treatment on an inpatient basis. We operate hospitals in 37 states and Puerto Rico, with concentrations in Florida and Texas. As of June 30, 2024, we operate 163 inpatient rehabilitation hospitals. For additional information about our business, see Item 1, Business, and Item 1A, Risk Factors, of the 2023 Form 10‑K.

2024 Overview

During the three and six months ended June 30, 2024, Net operating revenues increased 9.6% and 11.5%, respectively, over the same periods of 2023 due primarily to volume growth. See “Results of Operations” section of this Item for additional volume information.

In our continued development and expansion efforts during 2024, we:

•began operating our new 50-bed inpatient rehabilitation hospital in Kissimmee, Florida in May 2024;

•began operating our new 40-bed inpatient rehabilitation hospital in Atlanta, Georgia with our joint venture partner Piedmont in May 2024;

•began operating our new 40-bed inpatient rehabilitation hospital in Louisville, Kentucky with our joint venture partner Baptist Health in June 2024;

•continued our capacity expansions by adding 115 new beds to existing hospitals (inclusive of our new 40-bed satellite inpatient rehabilitation hospital in Ballwin, Missouri which began operating in May 2024); and

•announced or continued the development of the following hospitals:

| | | | | | | | | | | | | | | |

| Expected open date | Number of New Beds |

| 2024 | 2025 | 2026 | |

De novo projects(1) | | | | | |

Johnston, Rhode Island(3) | 3Q24 | 50 | — | — | |

| Fort Mill, South Carolina | 3Q24 | 39 | — | — | |

| Houston, Texas | 4Q24 | 61 | — | — | |

Athens, Georgia(2) | 1Q25 | — | 40 | — | |

Fort Myers, Florida(2) | 2Q25 | — | 60 | — | |

| Daytona Beach, Florida | 2Q25 | — | 50 | — | |

| St. Petersburg, Florida | 3Q25 | — | 50 | — | |

| Lake Worth, Florida | 3Q25 | — | 50 | — | |

| Danbury, Connecticut | 3Q25 | — | 40 | — | |

| Amarillo, Texas | | — | — | 50 | |

| Concordville, Pennsylvania | | — | — | 50 | |

| Norristown, Pennsylvania | | — | — | 50 | |

Loganville, Georgia(2) | | — | — | 40 | |

| Irmo, South Carolina | | — | — | 50 | |

| Palm Beach Gardens, Florida | | — | — | 50 | |

| Avondale, Arizona | | — | — | 60 | |

| San Antonio, Texas | | — | — | 50 | |

Remote and satellite hospitals (included in bed additions)(1) | | | | | |

| Wildwood, Florida (in The Villages, Florida) | | — | 50 | — | |

| Other bed additions | | ~110 | ~80 | ~80 | |

(1) Opening dates are tentative

(2) Expected joint venture

(3) Opened in July 2024

We also continued our shareholder distributions during the six months ended June 30, 2024 by paying a quarterly cash dividend of $0.15 per share on our common stock in January 2024, April 2024, and July 2024, respectively. On July 24, 2024, our board of directors approved an increase in our quarterly dividend and declared a cash dividend of $0.17 per share, payable on October 15, 2024 to stockholders of record on October 1, 2024. In addition, we repurchased 0.2 million shares of our common stock in the open market for $16.8 million during the six months ended June 30, 2024. For additional information see the “Liquidity and Capital Resources” section of this Item.

Business Outlook

We remain highly optimistic regarding the intermediate and long-term prospects of our business. Demographic trends, such as population aging, should continue to increase long-term demand for the services we provide. While we treat patients of all ages, most of our patients are 65 and older, and the number of Medicare enrollees is expected to grow approximately 3% per year for the foreseeable future, reaching approximately 73 million people over the age of 65 by 2030. More specifically, the average age of our Medicare patients is approximately 77, and the population group ranging in ages from 75 to 79 is expected to grow at approximately 5% per year through 2026. We believe the demand for the services we provide will continue to increase as the U.S. population ages. We believe these factors align with our strengths in, and focus on, inpatient rehabilitation services.

We are committed to delivering high-quality, cost-effective patient care. As the nation’s largest owner and operator of inpatient rehabilitation hospitals in terms of patients treated, revenues, and number of hospitals, we believe we differentiate ourselves from our competitors based on, among other things, the quality of our clinical outcomes, our cost-effectiveness, our financial strength, and our extensive application of technology. We also believe our competitive strengths discussed in Item 1, Business, “Competitive Strengths,” of the 2023 Form 10‑K, give us the ability to adapt and succeed in a healthcare industry facing regulatory uncertainty around attempts to improve outcomes and reduce costs.