Dole plc (NYSE: DOLE) ("Dole" or the "Group" or the "Company")

today released its financial results for the three and six months

ended June 30, 2023.

Highlights for the three months ended June 30, 2023:

- Second quarter Revenue of $2.1 billion, an increase of

4.4%

- Second quarter Net Income of $52.3 million, an increase of

8.1%

- Second quarter Adjusted EBITDA1 of $122.7 million, an increase

of 9.7%

- Second quarter Adjusted Net Income of $48.4 million and

Adjusted Diluted EPS of $0.51

Financial Highlights - Unaudited

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

(U.S. Dollars in millions, except

per share amounts)

Revenue

2,141

2,051

4,130

4,021

Income from continuing operations2

63.7

59.6

98.7

88.2

Net Income

52.3

48.4

72.8

51.8

Net Income attributable to Dole plc

42.3

41.3

56.4

39.9

Diluted EPS from continuing operations

0.56

0.55

0.86

0.80

Diluted EPS

0.44

0.43

0.59

0.42

Adjusted EBITDA1

122.7

111.8

223.1

203.7

Adjusted Net Income1

48.4

52.4

80.7

92.9

Adjusted Diluted EPS1

0.51

0.55

0.85

0.98

______________________

1 Dole plc reports its financial results in accordance with U.S.

Generally Accepted Accounting Principles ("GAAP"). See full GAAP

financial results in the appendix. Adjusted EBIT, Adjusted EBITDA,

Adjusted Net Income, Adjusted Earnings Per Share and Net Debt are

non-GAAP financial measures. Refer to the appendix of this release

for an explanation and reconciliation of these and other non-GAAP

financial measures used in this release to comparable GAAP

financial measures.

2 Fresh Vegetables results are reported separately as

discontinued operations, net of income taxes, in our condensed

consolidated statements of operations, its assets and liabilities

are separately presented in our condensed consolidated balance

sheets, and its cash flows are included within the condensed

consolidated cash flows for all periods presented. Unless otherwise

noted, our discussion of our results included herein, outlook and

all supplementary tables, including non-GAAP financial measures,

are presented on a continuing operations basis.

Commenting on the results, Carl McCann, Executive Chairman,

said:

"We are very pleased with the strong result for the second

quarter, delivering Adjusted EBITDA growth of 9.7%. This result is

due to the dedication and efforts of all our people across the

Group.

As we progress through the second half of the year, our

performance for the first six months gives us confidence in

achieving our targeted Adjusted EBITDA for the full year of at

least $350.0 million.”

Group Results - Second Quarter

Revenue increased 4.4%, or $90.3 million, primarily due to

strong performance in the Fresh Fruit and Diversified EMEA

segments, offset partially by the Diversified Americas segment. On

a like-for-like basis3, revenue was 3.8%, or $77.9 million, ahead

of prior year.

Adjusted EBITDA increased 9.7%, or $10.9 million, primarily

driven by strong Fresh Fruit performance, offset partially by

headwinds in the Diversified Americas segment. On a like-for-like

basis, Adjusted EBITDA increased 9.2%, or $10.3 million.

Adjusted Net Income decreased $4.1 million, predominantly due to

higher interest expense, offset by the increases in Adjusted EBITDA

noted above. Adjusted Diluted EPS for the three months ended June

30, 2023 was $0.51 compared to $0.55 in the prior year.

_____________

3 Like-for-like basis refers to the measure excluding the impact

of foreign currency translation movements and acquisitions and

divestitures.

Selected Segmental Financial Information (Unaudited)

Three Months Ended

June 30, 2023

June 30, 2022

(U.S. Dollars in thousands)

Revenue

Adjusted EBITDA

Revenue

Adjusted EBITDA

Fresh Fruit

$

839,043

$

65,816

$

805,831

$

56,308

Diversified Fresh Produce - EMEA

915,629

42,603

849,848

38,434

Diversified Fresh Produce - Americas &

ROW

417,645

14,262

448,200

17,061

Intersegment

(31,143

)

—

(52,970

)

—

Total

$

2,141,174

$

122,681

$

2,050,909

$

111,803

Six Months Ended

June 30, 2023

June 30, 2022

(U.S. Dollars in thousands)

Revenue

Adjusted EBITDA

Revenue

Adjusted EBITDA

Fresh Fruit

$

1,637,953

$

135,027

$

1,555,634

$

116,705

Diversified Fresh Produce - EMEA

1,713,729

66,009

1,641,003

57,711

Diversified Fresh Produce - Americas &

ROW

840,396

22,032

911,892

29,269

Intersegment

(61,737

)

—

(87,389

)

—

Total

$

4,130,341

$

223,068

$

4,021,140

$

203,685

Fresh Fruit

Revenue increased 4.1%, or $33.2 million. Revenue was positively

impacted by higher worldwide pricing of bananas and pineapples and

worldwide increases in volumes of bananas sold, partially offset by

lower volumes of pineapples sold.

Adjusted EBITDA increased 16.9%, or $9.5 million. Adjusted

EBITDA was positively impacted by strong revenue performance,

partially offset by higher fruit sourcing costs and higher costs of

shipping, packaging and handling, as well as by lower commercial

cargo activity.

Diversified Fresh Produce – EMEA

Revenue increased 7.7%, or $65.8 million, primarily driven by

inflation-justified price increases across the segment and a

positive impact from acquisitions of $15.9 million. The impact of

foreign currency translation was not material in the quarter. On a

like-for-like basis, revenue was 6.0%, or $51.1 million, ahead of

prior year.

Adjusted EBITDA increased 10.8%, or $4.2 million, primarily

driven by strong performance across the segment, particularly

within the Spanish, Dutch, Irish and Czech businesses, as well as

by a favorable impact from acquisitions of $0.5 million, partially

offset by weaker trading results in the South African business. On

a like-for-like basis, Adjusted EBITDA was 10.0%, or $3.8 million,

ahead of prior year.

Diversified Fresh Produce – Americas & ROW

Revenue decreased 6.8%, or $30.6 million, primarily driven by

lower volumes across the segment, partially offset by continued

strong performance for potatoes and onions in North America and

inflation-justified price increases across the segment.

Adjusted EBITDA decreased 16.4%, or $2.8 million, primarily due

to a challenging quarter for berries, partially offset by strong

performance for potatoes and onions, as well as by strong trading

results within other commodities.

Capital Expenditures

Capital expenditures for the six months ended June 30, 2023 were

$41.0 million, which included investments in farm renovations and

ongoing investments in IT, logistics and efficiency projects in our

warehouses and processing facilities. This amount also includes

$5.4 million of capital expenditures related to discontinued

operations.

Net Debt

Net Debt as of June 30, 2023 was $1.0 billion.

Outlook for Fiscal Year 2023 (forward-looking

statement)

We are very pleased with the Group’s performance in the first

half of the year, delivering $223.0 million of Adjusted EBITDA.

In the first half of 2023, we have seen the benefit of improved

logistical efficiencies in several areas, which is helping to bring

more stability to our core fruit business. Partially offsetting

this benefit has been the anticipated reduction in commercial cargo

activity.

As we look out into the second half of the year and towards

2024, there is the potential for disruption in many of the key

growing regions in Central and South America due to the onset of El

Niño climatic conditions. However, we are monitoring the changing

weather patterns closely and believe we are well placed to deal

with potential challenges using our diverse sourcing network and

due to our advanced farming practices.

While the macro-economic environment remains difficult to

predict, in our business we have seen positives such as the

strengthening Euro relative to the U.S. Dollar, more open supply

chains, and moderation of inflation for certain input costs.

However, we do continue to be impacted by higher interest rates and

other foreign currency movements.

Overall, taking the above factors into account, we believe our

strong first half has put us in an excellent position to deliver a

good result for the year and we are now targeting an Adjusted

EBITDA for 2023 of at least $350.0 million.

The above outlook includes non-GAAP financial measures. Please

refer to the appendix of this release for an explanation and

reconciliation of our historical non-GAAP financial measures used

in this release to comparable GAAP financial measures.

Dividend

On August 16, 2023, the Board of Directors of Dole plc declared

a cash dividend for the second quarter of 2023 of $0.08 per share,

payable on October 5, 2023 to shareholders of record on September

14, 2023. A cash dividend of $0.08 per share was paid on July 6,

2023 for the first quarter of 2023.

About Dole plc

A global leader in fresh produce, Dole plc produces, markets,

and distributes an extensive variety of fresh fruits and vegetables

sourced locally and from around the world. Dedicated and passionate

in exceeding our customers’ requirements in over 75 countries, our

goal is to make the world a healthier and a more sustainable

place.

Webcast and Conference Call Information

Dole plc will host a conference call and simultaneous webcast at

08:00 a.m. Eastern Time today to discuss the second quarter 2023

financial results. The webcast can be accessed at

www.doleplc.com/investor-relations.

The conference call can be accessed live by dialing (646)

307-1963 in the US or +353 (1) 582 2023 in Ireland and +44 20 3481

4247 for UK and other international participants. The conference ID

is 4317462.

Forward-looking information

Certain statements made in this press release that are not

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements are based on management’s beliefs,

assumptions, and expectations of our future economic performance,

considering the information currently available to management.

These statements are not statements of historical fact. The words

“believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,”

“estimate,” “expect,” “intend,” “objective,” “seek,” “strive,”

“target” or similar words, or the negative of these words, identify

forward-looking statements. The inclusion of this forward-looking

information should not be regarded as a representation by us or any

other person that the future plans, estimates, or expectations

contemplated by us will be achieved. Such forward-looking

statements are subject to various risks and uncertainties and

assumptions relating to our operations, financial results,

financial condition, business prospects, growth strategy and

liquidity. Accordingly, there are, or will be, important factors

that could cause our actual results to differ materially from those

indicated in these statements. If one or more of these or other

risks or uncertainties materialize, or if our underlying

assumptions prove to be incorrect, our actual results may vary

materially from what we may have expressed or implied by these

forward-looking statements. We caution that you should not place

undue reliance on any of our forward-looking statements. Any

forward-looking statement speaks only as of the date on which such

statement is made, and we do not undertake any obligation to update

any forward-looking statement to reflect events or circumstances

after the date on which such statement is made except as required

by the federal securities laws.

Category: Financial

Appendix

Consolidated Statement of Operations - Unaudited

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Revenues, net

$

2,141,174

$

2,050,909

$

4,130,341

$

4,021,140

Cost of sales

(1,944,601

)

(1,885,400

)

(3,754,729

)

(3,703,836

)

Gross profit

196,573

165,509

375,612

317,304

Selling, marketing, general and

administrative expenses

(115,667

)

(110,365

)

(236,546

)

(219,909

)

Gain on disposal of businesses

—

—

—

242

Gain on asset sales

10,723

7,926

14,696

8,421

Operating income

91,629

63,070

153,762

106,058

Other income, net

1,129

8,102

2,904

10,566

Interest income

2,640

1,410

4,949

2,994

Interest expense

(19,748

)

(10,833

)

(41,460

)

(22,449

)

Income from continuing operations before

income taxes and equity earnings

75,650

61,749

120,155

97,169

Income tax expense

(16,593

)

(5,300

)

(27,587

)

(12,658

)

Equity method earnings

4,688

3,151

6,166

3,728

Income from continuing operations

63,745

59,600

98,734

88,239

Loss from discontinued operations, net of

income taxes

(11,438

)

(11,195

)

(25,944

)

(36,425

)

Net income

52,307

48,405

72,790

51,814

Less: Net income attributable to

noncontrolling interests

(10,032

)

(7,133

)

(16,356

)

(11,936

)

Net income attributable to Dole plc

$

42,275

$

41,272

$

56,434

$

39,878

Income (loss) per share - basic:

Continuing operations

$

0.57

$

0.55

$

0.86

$

0.80

Discontinued operations

(0.12

)

(0.12

)

(0.27

)

(0.38

)

Net income per share attributable to Dole

plc - basic

$

0.45

$

0.43

$

0.59

$

0.42

Income (loss) per share - diluted:

Continuing operations

$

0.56

$

0.55

$

0.86

$

0.80

Discontinued operations

(0.12

)

(0.12

)

(0.27

)

(0.38

)

Net income per share attributable to Dole

plc - diluted

$

0.44

$

0.43

$

0.59

$

0.42

Weighted-average shares:

Basic

94,909

94,878

94,904

94,878

Diluted

95,112

94,913

95,068

94,911

Consolidated Balance Sheets - Unaudited

June 30, 2023

December 31, 2022

ASSETS

(U.S. Dollars and shares in

thousands)

Cash and cash equivalents

$

231,075

$

228,840

Short-term investments

5,676

5,367

Trade receivables, net of allowances for

credit losses of $21,460 and $18,001, respectively

627,778

610,384

Grower advance receivables, net of

allowances for credit losses of $17,018 and $15,817,

respectively

112,517

106,864

Other receivables, net of allowances for

credit losses of $13,869 and $14,538, respectively

142,167

132,947

Inventories, net of allowances of $3,322

and $4,186, respectively

352,052

394,150

Prepaid expenses

53,656

48,995

Other current assets

33,495

15,034

Fresh Vegetables current assets held for

sale

390,697

62,252

Other assets held for sale

10,488

645

Total current assets

1,959,601

1,605,478

Long-term investments

16,572

16,498

Investments in unconsolidated

affiliates

125,828

124,234

Actively marketed property

29,393

31,007

Property, plant and equipment, net of

accumulated depreciation of $401,416 and $375,721, respectively

1,100,599

1,116,124

Operating lease right-of-use assets

322,461

293,658

Goodwill

502,309

497,453

DOLE brand

306,280

306,280

Other intangible assets, net of

accumulated amortization of $127,373 and $120,315, respectively

46,226

50,990

Fresh Vegetables non-current assets held

for sale

—

343,828

Other assets

139,580

142,180

Deferred tax assets, net

69,640

64,112

Total assets

$

4,618,489

$

4,591,842

LIABILITIES AND EQUITY

Accounts payable

$

650,967

$

640,620

Income taxes payable

30,041

11,558

Accrued liabilities

329,608

381,688

Bank overdrafts

20,285

8,623

Current portion of long-term debt, net

268,203

97,435

Current maturities of operating leases

61,458

57,372

Payroll and other tax

30,329

27,187

Contingent consideration

644

1,791

Pension and other postretirement

benefits

16,456

17,287

Fresh Vegetables current liabilities held

for sale

302,129

199,255

Dividends payable and other current

liabilities

32,198

17,698

Total current liabilities

1,742,318

1,460,514

Long-term debt, net

930,421

1,127,321

Operating leases, less current

maturities

269,274

246,723

Deferred tax liabilities, net

119,148

118,403

Income taxes payable, less current

portion

16,921

30,458

Contingent consideration, less current

portion

6,254

5,022

Pension and other postretirement benefits,

less current portion

119,663

124,646

Fresh Vegetables non-current liabilities

held for sale

—

116,380

Other long-term liabilities

43,871

43,390

Total liabilities

$

3,247,870

$

3,272,857

Redeemable noncontrolling interests

34,391

32,311

Stockholders’ equity:

Common stock — $0.01 par value; 300,000

shares authorized and 94,929 and 94,899 shares outstanding as of

June 30, 2023 and December 31, 2022

949

949

Additional paid-in capital

795,059

795,063

Retained earnings

510,306

469,249

Accumulated other comprehensive loss

(97,613

)

(104,133

)

Total equity attributable to Dole plc

1,208,701

1,161,128

Equity attributable to noncontrolling

interests

127,527

125,546

Total equity

1,336,228

1,286,674

Total liabilities, redeemable

noncontrolling interests and equity

$

4,618,489

$

4,591,842

Consolidated Statements of Cash Flows - Unaudited

Six Months Ended

June 30, 2023

June 30, 2022

Operating Activities

(U.S. Dollars in thousands)

Net income

$

72,790

$

51,814

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

58,007

64,770

Incremental charges on biological assets

related to the acquisition of Legacy Dole

—

34,944

Net (gain) on sale of assets and asset

write-offs

(14,696

)

(8,421

)

Stock-based compensation expense

2,768

1,981

Equity method earnings

(6,166

)

(3,728

)

Amortization of debt discounts and debt

issuance costs

3,186

2,953

Deferred tax (benefit)

(1,057

)

(9,212

)

Pension and other postretirement benefit

plan expense (benefit)

3,091

(89

)

Dividends received from equity method

investments

5,105

4,484

Other

(2,150

)

(5,310

)

Changes in operating assets and

liabilities:

Receivables, net of allowances

(22,828

)

9,031

Inventories

55,755

(9,375

)

Accrued and other current and long-term

liabilities

(79,959

)

(11,903

)

Net cash provided by operating

activities

73,846

121,939

Investing activities

Sales of assets

18,562

26,544

Capital expenditures

(41,005

)

(39,418

)

Acquisitions, net of cash acquired

(1,685

)

(4,923

)

Insurance proceeds

1,850

2,278

Purchases of investments

(1,150

)

(414

)

Sales (purchases) of unconsolidated

affiliates

1,498

(348

)

Other

8

4

Net cash used in investing activities

(21,922

)

(16,277

)

Financing activities

Proceeds from borrowings and

overdrafts

869,701

683,340

Repayments on borrowings and

overdrafts

(889,593

)

(754,133

)

Payment of debt issuance costs

—

(270

)

Dividends paid to shareholders

(15,184

)

(15,180

)

Dividends paid to noncontrolling

interests

(16,174

)

(14,588

)

Other noncontrolling interest activity,

net

(480

)

—

Payment of contingent consideration

(1,169

)

(696

)

Net cash used in financing activities

(52,899

)

(101,527

)

Effect of foreign exchange rate changes

on cash

3,210

(15,906

)

Increase (decrease) in cash and cash

equivalents

2,235

(11,771

)

Cash and cash equivalents at beginning of

period

228,840

250,561

Cash and cash equivalents at end of

period

$

231,075

$

238,790

Reconciliation from Net Income to Adjusted EBITDA -

Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item.

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

(U.S. Dollars in thousands)

Net income (Reported GAAP)

$

52,307

$

48,405

$

72,790

$

51,814

Loss from discontinued operations, net of

income taxes

11,438

11,195

25,944

36,425

Income from continuing operations

(Reported GAAP)

63,745

59,600

98,734

88,239

Income tax expense

16,593

5,300

27,587

12,658

Interest expense

19,748

10,833

41,460

22,449

Mark to market losses (gains)

1,035

(6,991

)

1,857

(8,129

)

(Gain) on asset sales

(10,387

)

(7,816

)

(14,554

)

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

—

17,431

—

34,944

Cyber-related incident

571

—

5,321

—

Other items 4

190

116

863

(752

)

Adjustments from equity method

investments

2,922

2,195

4,245

3,323

Adjusted EBIT (Non-GAAP)

94,417

80,668

165,513

144,916

Depreciation

23,142

25,696

47,445

48,229

Amortization of intangible assets

2,574

2,773

5,190

5,615

Depreciation and amortization adjustments

from equity method investments

2,548

2,666

4,920

4,925

Adjusted EBITDA (Non-GAAP)

$

122,681

$

111,803

$

223,068

$

203,685

__________________

4 For the three months ended June 30, 2023, other items is

comprised of $0.2 million of asset writedowns, net of insurance

proceeds. For the three months ended June 30, 2022, other items is

comprised of $0.1 million in asset writedowns, net of insurance

proceeds. For the six months ended June 30, 2023, other items is

comprised of $0.9 million of asset writedowns, net of insurance

proceeds. For the six months ended June 30, 2022, other items is

comprised of $0.5 million in insurance proceeds, net of asset

writedowns and $0.3 million in gains on disposal of a business.

Reconciliation from Net Income attributable to Dole plc

shareholders to Adjusted Net Income - Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item. Refer to the Appendix for

supplementary detail.

Three Months Ended

Six Months Ended

June 30, 2023

June 30, 2022

June 30, 2023

June 30, 2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income attributable to Dole plc

(Reported GAAP)

$

42,275

$

41,272

$

56,434

$

39,878

Loss from discontinued operations, net of

income taxes

11,438

11,195

25,944

36,425

Income from continuing operations

attributable to Dole plc

53,713

52,467

82,378

76,303

Adjustments:

Amortization of intangible assets

2,574

2,773

5,190

5,615

Mark to market losses (gains)

1,035

(6,991

)

1,857

(8,129

)

(Gain) on asset sales

(10,387

)

(7,816

)

(14,554

)

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

—

17,431

—

34,944

Cyber-related incident

571

—

5,321

—

Other items 5

190

116

863

(752

)

Adjustments from equity method

investments

623

612

742

1,290

Income tax on items above and discrete tax

items

797

(5,196

)

488

(7,127

)

NCI impact on items above

(736

)

(953

)

(1,629

)

(1,411

)

Adjusted Net Income for Adjusted EPS

calculation (Non-GAAP)

$

48,380

$

52,443

$

80,656

$

92,917

Adjusted earnings per share – basic

(Non-GAAP)

$

0.51

$

0.55

$

0.85

$

0.98

Adjusted earnings per share – diluted

(Non-GAAP)

$

0.51

$

0.55

$

0.85

$

0.98

Weighted average shares outstanding –

basic

94,909

94,878

94,904

94,878

Weighted average shares outstanding –

diluted

95,112

94,913

95,068

94,911

_____________________________

5 For the three months ended June 30, 2023, other items is

comprised of $0.2 million of asset writedowns, net of insurance

proceeds. For the three months ended June 30, 2022, other items is

comprised of $0.1 million in asset writedowns, net of insurance

proceeds. For the six months ended June 30, 2023, other items is

comprised of $0.9 million of asset writedowns, net of insurance

proceeds. For the six months ended June 30, 2022, other items is

comprised of $0.5 million in insurance proceeds, net of asset

writedowns and $0.3 million in gains on disposal of a business.

Supplemental Reconciliation from Net Income attributable to

Dole plc to Adjusted Net Income - Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item.

Three Months Ended June 30,

2023

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administrative expenses

Other operating

charges6

Operating Income

Reported (GAAP)

$

2,141,174

(1,944,601

)

196,573

9.2

%

(115,667

)

10,723

$

91,629

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

2,574

—

2,574

Mark to market losses (gains)

—

54

54

—

—

54

(Gain) on asset sales

—

—

—

—

(10,387

)

(10,387

)

Cyber-related incident

—

—

—

571

—

571

Other items

—

190

190

—

—

190

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,141,174

(1,944,357

)

196,817

9.2

%

(112,522

)

336

$

84,631

Three Months Ended June 30,

2022

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administrative expenses

Other

operating charges7

Operating Income

Reported (GAAP)

$

2,050,909

(1,885,400

)

165,509

8.1

%

(110,365

)

7,926

$

63,070

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

2,773

—

2,773

Mark to market losses (gains)

—

(1,269

)

(1,269

)

—

—

(1,269

)

(Gain) on asset sales

—

—

—

—

(7,816

)

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

—

17,431

17,431

—

—

17,431

Other items

—

116

116

—

—

116

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,050,909

(1,869,122

)

181,787

8.9

%

(107,592

)

110

$

74,305

_____________________

6 Other operating charges for the three months ended June 30,

2023 is comprised of gains on asset sales of $10.7 million, as

reported on the Dole plc GAAP Consolidated Statements of

Operations.

7 Other operating charges for the three months ended June 30,

2022 is comprised of gains on asset sales of $7.9 million, as

reported on the Dole plc the GAAP Consolidated Statements of

Operations.

Three Months Ended June 30,

2023

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax expense

Equity method earnings

Income from continuing

operations

Loss from discontinued

operations, net of income taxes

Reported (GAAP)

$

1,129

2,640

(19,748

)

(16,593

)

4,688

63,745

$

(11,438

)

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

11,438

Amortization of intangible assets

—

—

—

—

—

2,574

—

Mark to market losses (gains)

981

—

—

—

—

1,035

—

(Gain) on asset sales

—

—

—

—

—

(10,387

)

—

Cyber-related incident

—

—

—

—

—

571

—

Other items

—

—

—

—

—

190

—

Adjustments from equity method

investments

—

—

—

—

623

623

—

Income tax on items above and discrete tax

items

—

—

—

878

(81

)

797

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,110

2,640

(19,748

)

(15,715

)

5,230

59,148

$

—

Three Months Ended June 30,

2022

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax expense

Equity method earnings

Income from continuing

operations

Loss from discontinued

operations, net of income taxes

Reported (GAAP)

$

8,102

1,410

(10,833

)

(5,300

)

3,151

59,600

$

(11,195

)

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

11,195

Amortization of intangible assets

—

—

—

—

—

2,773

—

Mark to market losses (gains)

(5,722

)

—

—

—

—

(6,991

)

—

(Gain) on asset sales

—

—

—

—

—

(7,816

)

—

Incremental charges on biological assets

and inventory from the Acquisition

—

—

—

—

—

17,431

—

Other items

—

—

—

—

—

116

—

Adjustments from equity method

investments

—

—

—

—

612

612

—

Income tax on items above and discrete tax

items

—

—

—

(5,092

)

(104

)

(5,196

)

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

2,380

1,410

(10,833

)

(10,392

)

3,659

60,529

$

—

Three Months Ended June 30,

2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

52,307

$

(10,032

)

$

42,275

$

0.44

Loss from discontinued operations, net of

income taxes

11,438

—

11,438

Amortization of intangible assets

2,574

—

2,574

Mark to market losses (gains)

1,035

—

1,035

(Gain) on asset sales

(10,387

)

—

(10,387

)

Cyber-related incident

571

—

571

Other items

190

—

190

Adjustments from equity method

investments

623

—

623

Income tax on items above and discrete tax

items

797

—

797

NCI impact on items above

—

(736

)

(736

)

Adjusted (Non-GAAP)

$

59,148

$

(10,768

)

$

48,380

$

0.51

Weighted average shares outstanding –

diluted

95,112

Three Months Ended June 30,

2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

48,405

$

(7,133

)

$

41,272

$

0.43

Loss from discontinued operations, net of

income taxes

11,195

—

11,195

Amortization of intangible assets

2,773

—

2,773

Mark to market losses (gains)

(6,991

)

—

(6,991

)

(Gain) on asset sales

(7,816

)

—

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

17,431

—

17,431

Other items

116

—

116

Adjustments from equity method

investments

612

—

612

Income tax on items above and discrete tax

items

(5,196

)

—

(5,196

)

NCI impact on items above

—

(953

)

(953

)

Adjusted (Non-GAAP)

$

60,529

$

(8,086

)

$

52,443

$

0.55

Weighted average shares outstanding –

diluted

94,913

Supplemental Reconciliation from Net Income attributable to

Dole plc to Adjusted Net Income - Unaudited

The following information is provided to give quantitative

information related to items impacting comparability. Refer to the

'Non-GAAP Financial Measures' section of this document for

additional detail on each item.

Six Months Ended June 30,

2023

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administrative expenses

Other operating

charges8

Operating Income

Reported (GAAP)

$

4,130,341

(3,754,729

)

375,612

9.1

%

(236,546

)

14,696

$

153,762

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

5,190

—

5,190

Mark to market losses (gains)

—

(1,336

)

(1,336

)

—

—

(1,336

)

(Gain) on asset sales

—

—

—

—

(14,554

)

(14,554

)

Cyber-related incident

—

—

—

5,321

—

5,321

Other items

—

863

863

—

—

863

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

4,130,341

(3,755,202

)

375,139

9.1

%

(226,035

)

142

$

149,246

Six Months Ended June 30,

2022

(U.S. Dollars in thousands)

Revenues, net

Cost of sales

Gross profit

Gross Margin %

Selling, marketing, general

and administrative expenses

Other operating

charges9

Operating Income

Reported (GAAP)

$

4,021,140

(3,703,836

)

317,304

7.9

%

(219,909

)

8,663

$

106,058

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

Amortization of intangible assets

—

—

—

5,615

—

5,615

Mark to market losses (gains)

—

(5,357

)

(5,357

)

—

—

(5,357

)

(Gain) on asset sales

—

—

—

—

(7,816

)

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

—

34,944

34,944

—

—

34,944

Other items

—

(510

)

(510

)

—

(242

)

(752

)

Adjustments from equity method

investments

—

—

—

—

—

—

Income tax on items above and discrete tax

items

—

—

—

—

—

—

NCI impact on items above

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

4,021,140

(3,674,759

)

346,381

8.6

%

(214,294

)

605

$

132,692

__________________

8 Other operating charges for the six months ended June 30, 2023

is comprised of gains on asset sales of $14.7 million, as reported

on the Dole plc GAAP Consolidated Statements of Operations.

9 Other operating charges for the six months ended June 30, 2022

is comprised of gains on asset sales of $8.4 million and a gain on

disposal of businesses of $0.2 million, as reported on the Dole plc

GAAP Consolidated Statements of Operations.

Six Months Ended June 30,

2023

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax expense

Equity method earnings

Income from continuing

operations

Loss from discontinued

operations, net of income taxes

Reported (GAAP)

$

2,904

4,949

(41,460

)

(27,587

)

6,166

98,734

$

(25,944

)

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

25,944

Amortization of intangible assets

—

—

—

—

—

5,190

—

Mark to market losses (gains)

3,193

—

—

—

—

1,857

—

(Gain) on asset sales

—

—

—

—

—

(14,554

)

—

Cyber-related incident

—

—

—

—

—

5,321

—

Other items

—

—

—

—

—

863

—

Adjustments from equity method

investments

—

—

—

—

742

742

—

Income tax on items above and discrete tax

items

—

—

—

650

(162

)

488

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

6,097

4,949

(41,460

)

(26,937

)

6,746

98,641

$

—

Six Months Ended June 30,

2022

(U.S. Dollars in thousands)

Other income, net

Interest income

Interest expense

Income tax expense

Equity method earnings

Income from continuing

operations

Loss from discontinued

operations, net of income taxes

Reported (GAAP)

$

10,566

2,994

(22,449

)

(12,658

)

3,728

88,239

$

(36,425

)

Loss from discontinued operations, net of

income taxes

—

—

—

—

—

—

36,425

Amortization of intangible assets

—

—

—

—

—

5,615

—

Mark to market losses (gains)

(2,772

)

—

—

—

—

(8,129

)

—

(Gain) on asset sales

—

—

—

—

—

(7,816

)

—

Incremental charges on biological assets

and inventory from the Acquisition

—

—

—

—

—

34,944

—

Other items

—

—

—

—

—

(752

)

—

Adjustments from equity method

investments

—

—

—

—

1,290

1,290

—

Income tax on items above and discrete tax

items

—

—

—

(6,920

)

(207

)

(7,127

)

—

NCI impact on items above

—

—

—

—

—

—

—

Adjusted (Non-GAAP)

$

7,794

2,994

(22,449

)

(19,578

)

4,811

106,264

$

—

Six Months Ended June 30,

2023

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

72,790

$

(16,356

)

$

56,434

$

0.59

Loss from discontinued operations, net of

income taxes

25,944

—

25,944

Amortization of intangible assets

5,190

—

5,190

Mark to market losses (gains)

1,857

—

1,857

(Gain) on asset sales

(14,554

)

—

(14,554

)

Cyber-related incident

5,321

—

5,321

Other items

863

—

863

Adjustments from equity method

investments

742

—

742

Income tax on items above and discrete tax

items

488

—

488

NCI impact on items above

—

(1,629

)

(1,629

)

Adjusted (Non-GAAP)

$

98,641

$

(17,985

)

$

80,656

$

0.85

Weighted average shares outstanding –

diluted

95,068

Six Months Ended June 30,

2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income

Net income attributable to

noncontrolling interests

Net income attributable to

Dole plc

Diluted net income per

share

Reported (GAAP)

$

51,814

$

(11,936

)

$

39,878

$

0.42

Loss from discontinued operations, net of

income taxes

36,425

—

36,425

Amortization of intangible assets

5,615

—

5,615

Mark to market losses (gains)

(8,129

)

—

(8,129

)

(Gain) on asset sales

(7,816

)

—

(7,816

)

Incremental charges on biological assets

and inventory from the Acquisition

34,944

—

34,944

Other items

(752

)

—

(752

)

Adjustments from equity method

investments

1,290

—

1,290

Income tax on items above and discrete tax

items

(7,127

)

—

(7,127

)

NCI impact on items above

—

(1,411

)

(1,411

)

Adjusted (Non-GAAP)

$

106,264

$

(13,347

)

$

92,917

$

0.98

Weighted average shares outstanding –

diluted

94,911

Supplemental Reconciliation of Prior Year Segment Results to

Current Year Segment Results – Unaudited

Revenue for the Three Months

Ended

June 30, 2022

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

June 30, 2023

(U.S. Dollars in thousands)

Fresh Fruit

$

805,831

$

—

$

—

$

33,212

$

839,043

Diversified Fresh Produce - EMEA

849,848

(1,201

)

15,850

51,132

915,629

Diversified Fresh Produce - Americas &

ROW

448,200

(2,247

)

—

(28,308

)

417,645

Intersegment

(52,970

)

—

—

21,827

(31,143

)

Total

$

2,050,909

$

(3,448

)

$

15,850

$

77,863

$

2,141,174

Adjusted EBITDA for the Three

Months Ended

June 30, 2022

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

June 30, 2023

(U.S. Dollars in thousands)

Fresh Fruit

$

56,308

$

(100

)

$

—

$

9,608

$

65,816

Diversified Fresh Produce - EMEA

38,434

(173

)

513

3,829

42,603

Diversified Fresh Produce - Americas &

ROW

17,061

(99

)

438

(3,138

)

14,262

Total

$

111,803

$

(372

)

$

951

$

10,299

$

122,681

Revenue for the Six Months

Ended

June 30, 2022

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

June 30, 2023

(U.S. Dollars in thousands)

Fresh Fruit

$

1,555,634

$

—

$

—

$

82,319

$

1,637,953

Diversified Fresh Produce - EMEA

1,641,003

(54,561

)

18,102

109,185

1,713,729

Diversified Fresh Produce - Americas &

ROW

911,892

(5,033

)

—

(66,463

)

840,396

Intersegment

(87,389

)

—

—

25,652

(61,737

)

Total

$

4,021,140

$

(59,594

)

$

18,102

$

150,693

$

4,130,341

Adjusted EBITDA for the Six

Months Ended

June 30, 2022

Impact of Foreign Currency

Translation

Impact of Acquisitions and

Divestitures

Like-for-like Increase

(Decrease)

June 30, 2023

(U.S. Dollars in thousands)

Fresh Fruit

$

116,705

$

45

$

—

$

18,277

$

135,027

Diversified Fresh Produce - EMEA

57,711

(1,801

)

1,271

8,828

66,009

Diversified Fresh Produce - Americas &

ROW

29,269

(130

)

566

(7,673

)

22,032

Total

$

203,685

$

(1,886

)

$

1,837

$

19,432

$

223,068

Net Debt Reconciliation

Net Debt is the primary measure used by management to analyze

the Company’s capital structure. Net Debt is a non-GAAP financial

measure, calculated as cash and cash equivalents, less current and

long-term debt. It also excludes debt discounts and debt issuance

costs. The calculation of Net Debt as of June 30, 2023 is presented

below. Net Debt as of June 30, 2023 was $1.0 billion.

June 30, 2023

December 31, 2022

(U.S. Dollars in thousands)

Cash and cash equivalents (Reported

GAAP)

231,075

228,840

Debt (Reported GAAP):

Long-term debt, net

(930,421

)

(1,127,321

)

Current maturities

(268,203

)

(97,435

)

Bank overdrafts

(20,285

)

(8,623

)

Total debt, net

(1,218,909

)

(1,233,379

)

Less: Debt discounts and debt issuance

costs (Reported GAAP)

(16,125

)

(17,874

)

Total gross debt

(1,235,034

)

(1,251,253

)

Net Debt (Non-GAAP)

$

(1,003,959

)

$

(1,022,413

)

Supplemental Consolidated Income Statement by Quarter - for

the Year Ended December 31, 2022 - Unaudited

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

December 31,

2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Revenues, net

$

1,970,231

$

2,050,909

$

1,960,695

$

2,042,568

$

8,024,403

Cost of sales

(1,818,436

)

(1,885,400

)

(1,829,233

)

(1,891,456

)

(7,424,525

)

Gross profit

151,795

165,509

131,462

151,112

599,878

Selling, marketing, general and

administrative expenses

(109,544

)

(110,365

)

(103,349

)

(112,934

)

(436,192

)

Gain (loss) on disposal of businesses

242

—

—

(50

)

192

Impairment of property, plant and

equipment

—

—

—

(397

)

(397

)

Gain on asset sales

495

7,926

767

2,596

11,784

Operating income

42,988

63,070

28,880

40,327

175,265

Other income (expense), net

2,464

8,102

9,199

(9,165

)

10,600

Interest income

1,584

1,410

1,427

1,986

6,407

Interest expense

(11,616

)

(10,833

)

(15,677

)

(18,245

)

(56,371

)

Income from continuing operations before

income taxes and equity earnings

35,420

61,749

23,829

14,903

135,901

Income tax (expense) benefit

(7,358

)

(5,300

)

34,155

4,106

25,603

Equity method earnings

577

3,151

300

2,698

6,726

Income from continuing operations

28,639

59,600

58,284

21,707

168,230

Loss from discontinued operations, net of

income taxes

(25,230

)

(11,195

)

(11,704

)

(8,318

)

(56,447

)

Net income

3,409

48,405

46,580

13,389

111,783

Less: Net income attributable to

noncontrolling interests

(4,803

)

(7,133

)

(6,743

)

(6,608

)

(25,287

)

Net (loss) income attributable to Dole

plc

$

(1,394

)

$

41,272

$

39,837

$

6,781

$

86,496

Income (loss) per share - basic:

Continuing operations

$

0.26

$

0.55

$

0.54

$

0.16

$

1.51

Discontinued operations

(0.27

)

(0.12

)

(0.12

)

(0.09

)

(0.60

)

Net income (loss) per share attributable

to Dole plc - basic

$

(0.01

)

$

0.43

$

0.42

$

0.07

$

0.91

Income (loss) per share - diluted:

Continuing operations

$

0.26

$

0.55

$

0.54

$

0.16

$

1.51

Discontinued operations

(0.27

)

(0.12

)

(0.12

)

(0.09

)

(0.60

)

Net income (loss) per share attributable

to Dole plc - diluted

$

(0.01

)

$

0.43

$

0.42

$

0.07

$

0.91

Weighted-average shares:

Basic

94,878

94,878

94,891

94,899

94,886

Diluted

94,909

94,913

94,908

94,928

94,914

Supplemental Reconciliation from Net Income to Adjusted

EBITDA by Quarter - for the Year Ended December 31, 2022 -

Unaudited

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

December 31,

2022

(U.S. Dollars in thousands)

Net income (Reported GAAP)

$

3,409

$

48,405

$

46,580

$

13,389

$

111,783

Loss from discontinued operations, net of

income taxes

25,230

11,195

11,704

8,318

56,447

Income from continuing operations

(Reported GAAP)

28,639

59,600

58,284

21,707

168,230

Income tax expense (benefit)

7,358

5,300

(34,155

)

(4,106

)

(25,603

)

Interest expense

11,616

10,833

15,677

18,245

56,371

Mark to market losses (gains)

(1,138

)

(6,991

)

2,310

8,868

3,049

(Gain) on asset sales

—

(7,816

)

(530

)

(1,970

)

(10,316

)

Impairment on property, plant and

equipment

—

—

—

397

397

Incremental charges on biological assets

and inventory from the Acquisition

17,513

17,431

5,520

681

41,145

Other items

(868

)

116

(532

)

656

(628

)

Adjustments from equity method

investments

1,128

2,195

1,603

2,614

7,540

Adjusted EBIT (Non-GAAP)

64,248

80,668

48,177

47,092

240,185

Depreciation

22,533

25,696

25,315

25,159

98,703

Amortization of intangible assets

2,842

2,773

2,633

2,645

10,893

Depreciation and amortization adjustments

from equity method investments

2,260

2,666

3,073

2,616

10,615

Adjusted EBITDA (Non-GAAP)

$

91,883

$

111,803

$

79,198

$

77,512

$

360,396

Supplemental Reconciliation from Net Income attributable to

Dole plc shareholders to Adjusted Net Income by Quarter - for the

Year Ended December 31, 2022 - Unaudited

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

December 31,

2022

(U.S. Dollars and shares in

thousands, except per share amounts)

Net income (loss) attributable to Dole

plc (Reported GAAP)

$

(1,394

)

$

41,272

$

39,837

$

6,781

$

86,496

Loss from discontinued operations, net of

income taxes

25,230

11,195

11,704

8,318

56,447

Income from continuing operations

attributable to Dole plc

23,836

52,467

51,541

15,099

142,943

Adjustments:

Amortization of intangible assets

2,842

2,773

2,633

2,645

10,893

Mark to market (gains) losses

(1,138

)

(6,991

)

2,310

8,868

3,049

(Gain) on asset sales

—

(7,816

)

(530

)

(1,970

)

(10,316

)

Incremental charges on biological assets

and inventory from the Acquisition

17,513

17,431

5,520

681

41,145

Other items

(868

)

116

(532

)

1,053

(231

)

Adjustments from equity method

investments

678

612

628

662

2,580

Income tax on items above and discrete tax

items

(1,931

)

(5,196

)

(34,501

)

(8,876

)

(50,504

)

NCI impact on items above

(458

)

(953

)

(878

)

(898

)

(3,187

)

Adjusted Net Income for Adjusted EPS

calculation (Non-GAAP)

$

40,474

$

52,443

$

26,191

$

17,264

$

136,372

Adjusted earnings per share – basic

(Non-GAAP)

$

0.43

$

0.55

$

0.28

$

0.18

$

1.44

Adjusted earnings per share – diluted

(Non-GAAP)

$

0.43

$

0.55

$

0.28

$

0.18

$

1.44

Weighted average shares outstanding –

basic

94,878

94,878

94,891

94,899

94,886

Weighted average shares outstanding –

diluted

94,909

94,913

94,908

94,928

94,914

Supplemental Selected Segmental Financial Information by

Quarter - for the Year Ended December 31, 2022 - Unaudited

Revenue by Segment:

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

December 31,

2022

(U.S. Dollars in thousands)

Fresh Fruit

$

749,803

$

805,831

$

751,348

$

740,167

$

3,047,149

Diversified Fresh Produce - EMEA

791,155

849,848

759,964

751,594

3,152,561

Diversified Fresh Produce - Americas &

ROW

463,692

448,200

479,839

573,936

1,965,667

Intersegment

(34,419

)

(52,970

)

(30,456

)

(23,129

)

(140,974

)

Total

$

1,970,231

$

2,050,909

$

1,960,695

$

2,042,568

$

8,024,403

Adjusted EBITDA by

Segment:

Three Months Ended

Year Ended

March 31, 2022

June 30, 2022

September 30,

2022

December 31,

2022

December 31,

2022

(U.S. Dollars in thousands)

Fresh Fruit

$

60,397

$

56,308

$

49,382

$

39,460

$

205,547

Diversified Fresh Produce - EMEA

19,277

38,434

30,686

22,656

111,053

Diversified Fresh Produce - Americas &

ROW

12,209

17,061

(870

)

15,396

43,796

Total

$

91,883

$

111,803

$

79,198

$

77,512

$

360,396

Non-GAAP Financial Measures

Dole plc’s results are determined in accordance with U.S.

GAAP.

In addition to its results under U.S. GAAP, in this Press

Release we also present Dole plc’s Adjusted EBIT, Adjusted EBITDA,

Adjusted Net Income, Adjusted EPS, and Net Debt, which are

supplemental measures of financial performance that are not

required by, or presented in accordance with, U.S. GAAP

(collectively, the "non-GAAP financial measures"). We present these

non-GAAP financial measures, because we believe they assist

investors and analysts in comparing our operating performance

across reporting periods on a consistent basis by excluding items

that we do not believe are indicative of our core operating

performance. These non-GAAP financial measures have limitations as

analytical tools, and you should not consider them in isolation or

as a substitute for analysis of our operating results, cash flows

or any other measure prescribed by U.S. GAAP. Our presentation of

non-GAAP financial measures should not be construed as an inference

that our future results will be unaffected by any of the adjusted

items, or that any projections and estimates will be realized in

their entirety or at all. In addition, adjustment items that are

excluded from non-GAAP results can have a material impact on

equivalent GAAP earnings, financial measures and cash flows.

Adjusted EBIT is calculated from GAAP net income by: (1) adding

the loss from discontinued operations, net of income taxes; (2)

adding the income tax expense or subtracting the income tax

benefit; (3) adding interest expense; (4) adding mark to market

losses or subtracting mark to market gains related to unrealized

impacts from derivative instruments and foreign currency

denominated borrowings, realized impacts on noncash settled foreign

currency denominated borrowings, net foreign currency impacts on

liquidated entities and fair value movements on contingent

consideration; (5) other items which are separately stated based on

materiality, which during the three and six months ended June 30,

2023 and June 30, 2022, included adding or subtracting asset

write-downs from extraordinary events, net of insurance proceeds,

subtracting the gain or adding the loss on the disposal of business

interests, adding the incremental costs from the fair value uplift

for biological assets and inventory related to the acquisition of

Legacy Dole, subtracting the gain or adding the loss on the sale of

investments accounted for under the equity method, subtracting the

gain or adding the loss on asset sales for assets held for sale and

actively marketed property and adding costs incurred for the

cyber-related incident; and (6) the Company’s share of these items

from equity method investments.

Adjusted EBITDA is calculated from GAAP net income by: (1)

adding the loss from discontinued operations, net of income taxes;

(2) adding the income tax expense or subtracting the income tax

benefit; (3) adding interest expense; (4) adding depreciation

charges; (5) adding amortization charges on intangible assets; (6)

adding mark to market losses or subtracting mark to market gains

related to unrealized impacts from derivative instruments and

foreign currency denominated borrowings, realized impacts on

noncash settled foreign currency denominated borrowings, net

foreign currency impacts on liquidated entities and fair value

movements on contingent consideration; (7) other items which are

separately stated based on materiality, which during the three and

six months ended June 30, 2023 and June 30, 2022, included adding

or subtracting asset write-downs from extraordinary events, net of

insurance proceeds, subtracting the gain or adding the loss on the

disposal of business interests, adding the incremental costs from

the fair value uplift for biological assets and inventory related

to the acquisition of Legacy Dole, subtracting the gain or adding

the loss on the sale of investments accounted for under the equity

method, subtracting the gain or adding the loss on asset sales for

assets held for sale and actively marketed property and adding

costs incurred for the cyber-related incident; and (8) the

Company’s share of these items from equity method investments.

Adjusted Net Income is calculated from GAAP net income

attributable to Dole plc by: (1) adding the loss from discontinued

operations, net of income taxes; (2) adding amortization charges on

intangible assets; (3) adding mark to market losses or subtracting

mark to market gains related to unrealized impacts from derivative

instruments and foreign currency denominated borrowings, realized

impacts on noncash settled foreign currency denominated borrowings,

net foreign currency impacts on liquidated entities and fair value

movements on contingent consideration; (4) other items which are

separately stated based on materiality, which during the three and

six months ended June 30, 2023 and June 30, 2022, included adding

or subtracting asset write-downs from extraordinary events, net of

insurance proceeds, subtracting the gain or adding the loss on the

disposal of business interests, adding the incremental costs from

the fair value uplift for biological assets and inventory related

to the acquisition of Legacy Dole, subtracting the gain or adding

the loss on the sale of investments accounted for under the equity

method, subtracting the gain or adding the loss on asset sales for

assets held for sale and actively marketed property and adding

costs incurred for the cyber-related incident; (5) the Company’s

share of these items from equity method investments; (6) excluding

the tax effect of these items and discrete tax adjustments; and (7)

excluding the effect of these items attributable to non-controlling

interests.

Adjusted Earnings per Share is calculated from Adjusted Net

Income divided by diluted weighted average number of shares in the

applicable period.

Net Debt is a non-GAAP financial measure, calculated as GAAP

cash and cash equivalents, less GAAP current and long-term debt. It

also excludes GAAP debt discounts and debt issuance costs.

Dole is not able to provide a reconciliation for projected FY'23

results without taking unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230817799569/en/

Investor Contact: James O'Regan, Head of Investor

Relations, Dole plc joregan@totalproduce.com +353 1 887 2794

Media Contact: Brian Bell, Ogilvy brian.bell@ogilvy.com +353

87 2436 130

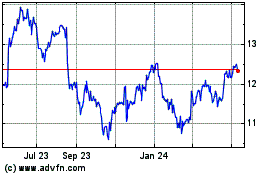

Dole (NYSE:DOLE)

Historical Stock Chart

From Jan 2025 to Feb 2025

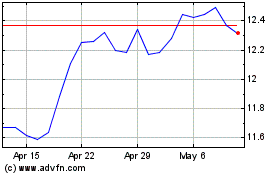

Dole (NYSE:DOLE)

Historical Stock Chart

From Feb 2024 to Feb 2025