false

0001764046

00-0000000

0001764046

2024-08-01

2024-08-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

August 1, 2024

Date of Report (date of earliest event

reported)

CLARIVATE PLC

(Exact name of registrant as specified in its

charter)

Jersey, Channel Islands

(State or other jurisdiction of incorporation or organization)

001-38911

(Commission

File Number)

N/A

(I.R.S.

Employer Identification No.)

70 St. Mary Axe

London

EC3A

8BE

United

Kingdom

(Address of Principal Executive Offices)

(44) 207-433-4000

Registrant’s telephone

number, including area code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Ordinary Shares, no par value |

CLVT |

New York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Jonathan Gear, Chief Executive Officer of Clarivate

Plc (the “Company”) will depart from his position and step down as a member of the board of directors (the “Board”),

effective August 9, 2024. Following such date, Mr. Gear will remain employed by the Company in a non-executive role until November 1,

2024. Mr. Gear’s departure is not the result of any disagreement with the Company on any matter relating to the Company’s

operations, policies or practices.

On August 6, 2024, the

Company announced that Matitiahu (Matti) Shem Tov, age 63, will assume the role of Chief Executive Officer and will join the Board, effective

as of August 9, 2024. Mr. Shem Tov has over 30 years of global leadership experience with deep expertise in software, data, and analytics,

as well as in driving innovation and growth. From June 2022 until March 2024, Mr. Shem Tov served as an operating partner at Lone View

Capital, a private equity firm. Prior to that, Mr. Shem Tov served as Chief Executive Officer of ProQuest LLC (“ProQuest”),

a provider of global data, analytics and software, to academic, research and national institutions, from September 2017 to June 2022,

including for a period following the Company’s acquisition of ProQuest in December 2021. From 2003 until 2017, Mr. Shem Tov served

as president and chief executive officer of Ex Libris Ltd., leading the company to become a prominent developer of cloud-based software

solutions for academic, national, and research institutions worldwide. Prior to joining Ex Libris, Mr. Shem Tov served as president of

Surecomp Limited, a global software company specializing in commercial banking solutions, after serving in various leadership roles across

the company. Mr. Shem Tov received his Bachelor of Arts and Master of Business Administration from Bar-Ilan University.

There are no transactions

between the Company and Mr. Shem Tov that are required to be disclosed under Item 404(a) of Regulation S-K.

The Company’s press

release dated August 6, 2024 announcing these management changes is attached hereto as Exhibit 99.1.

Gear Separation Agreement

In connection with the transition of his role,

on August 1, 2024, the Company entered into a separation agreement with Mr. Gear. Pursuant to the

terms of the separation agreement, subject to his execution and non-revocation of a release of claims and continued compliance with the

terms of his agreement (including his restrictive covenants), in connection with his termination of employment Mr. Gear will receive (i)

lump-sum cash payments equal to $4,375,000, (ii) a lump sum payment representing reimbursement for the average monthly cost of COBRA for

18 months, (iii) a pro-rated target annual bonus for 2024, (iv) accelerated vesting of any unvested RSUs that would have vested within

18-months of his separation, (v) vesting of his 2022 and 2023 PSUs, subject to achievement of the applicable performance conditions and

(vi) if applicable, a tax equalization payment to account for days of work in the United Kingdom.

Pursuant to the terms of his existing arrangements,

Mr. Gear is subject to certain restrictive covenants, including 12-month post-termination non-compete and non-solicit obligations, a perpetual

confidentiality obligation, a non-disparagement covenant and intellectual property assignment provisions.

The foregoing description of the separation agreement

with Mr. Gear contained herein does not purport to be complete and is qualified in its entirety by reference to the complete text of his

agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended September

30, 2024.

Chief Executive Officer Employment Agreement

In

connection with his appointment as Chief Executive Officer, on August 1, 2024, the

Company entered into an employment agreement with Mr. Shem Tov. The agreement provides that Mr. Shem Tov will receive an initial

annual base salary of $900,000, a target annual bonus opportunity under the Company’s annual incentive plan equal to 100% of

his base salary (pro-rated for 2024), an initial 2024 equity grant of 50% RSUs and 50% PSUs with a grant date target value equal

to $3,500,000, eligibilitiy for a 2025 annual equity grant of 50% RSUs and 50% PSUs with a grant date target value equal to

$6,000,000 (subject to his continued service through grant) and eligibility to participate in the other benefit plans generally

made available to the Company’s senior executives, including the Company’s Executive Severance Plan. In addition,

the agreement provides that on or around August 13, 2024, Mr. Shem Tov will receive a one-time equity sign-on bonus of RSU, with an

aggregate grant date value of $500,000, which will vest, subject to Mr. Shem Tov’ service to the Company (with specified

exceptions), on the first anniversary of the grant. In addition, if Mr. Shem Tov is required

to relocate to London or New York, a pro-rata portion of his outstanding and unvested RSUs will accelerate, reflecting the period of

time Mr. Shem Tov was employed in Israel.

The

foregoing description of Mr. Shem Tov’s employment agreement contained herein does not purport to be complete and is qualified in

its entirety by reference to the complete text of the agreement, a copy of which will be filed as an exhibit to the Company’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2024.

Executive Leadership Team Retention Awards

In order to incentivize certain Company executives

to continue to support the Company’s ongoing operational initiatives in the near term and to remain employed through the transition

in the executive leadership team, effective August 13, 2024 the Company awarded Jonathan Collins, Bar Veinstein, Henry Levy and Gordon

Samson a grant of RSUs with a grant date fair value of $1,000,000 or, in the case of Mr. Collins, $2,000,000 (the “Retention Awards”).

The Retention Awards will cliff-vest on the first anniversary of the grant date, subject to the grantee’s continued service through

such date (with specified exceptions).

Item 9.01. Financial

Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| |

CLARIVATE PLC |

| |

|

| Date: August 6, 2024 |

By: |

/s/ Melanie D. Margolin |

| |

Name: |

Melanie D. Margolin |

| |

Title: |

Executive Vice President, Chief Administrative and Legal Officer |

Exhibit 99.1

Press Release

Clarivate Appoints

Former ProQuest CEO Matti Shem Tov as the Company’s Next CEO

Chief Executive

Jonathan Gear to Step Down as CEO and Member of the Board

LONDON, U.K., August 6, 2024 – Clarivate Plc (NYSE: CLVT),

a leading global provider of transformative intelligence, today announced that the Board has appointed Matti Shem Tov, former CEO of ProQuest,

as the Company’s next CEO, effective August 9, 2024. Mr. Shem Tov will also join the Company’s Board of Directors. Jonathan

Gear, Chief Executive Officer, will step down as CEO and as a member of the Board at that time, and will transition into a non-executive

role until November 1, 2024.

“The Board and Jonathan have mutually agreed that now is the

right time for new leadership who can help take Clarivate to the next phase of its value creation journey,” said Andy Snyder, Chairman

of the Clarivate Board. “I want to thank Jonathan for his many contributions to the Company. Under his leadership, Clarivate restructured

into three end-market segments, which reinvigorated Clarivate’s product innovation investments and commitment to its customers,

added terrific talent to the leadership bench, and helped strengthen the Company’s balance sheet. As a result, Clarivate is now

well positioned to utilize the distinct expertise within each of our business segments to deliver exceptional and tailored solutions to

our customers globally. With this foundation and the investments we are making in product innovation, we are confident in our ability

to drive organic growth.”

Mr. Snyder continued, “I am also pleased to welcome Matti back

to Clarivate, where he will leverage his deep expertise in innovating and delivering new products to market to help launch Clarivate in

its new phase of accelerated organic growth. Given Matti’s decades of leadership experience, the Board and I are confident that

he is well suited to partner with our exceptional management team to lead Clarivate.”

“I am pleased to join Clarivate as its next CEO,” said

Mr. Shem Tov. “I have a tremendous amount of respect for Clarivate’s businesses and its mission of advancing innovation through

research and knowledge sharing to solve the world’s most complex challenges. I am looking forward to working closely with our committed

global colleagues and loyal customers to accelerate growth, increase product innovation and drive value creation for all our stakeholders.”

“It has been a privilege to lead this dedicated and passionate

team, and I am proud of what we have achieved together,” Mr. Gear said. “The Company has made strong progress managing and

integrating its portfolio of businesses while supporting the needs of customers and partners. After thorough discussions with the Board,

it’s clear that this is the right time to make this transition. I am confident that Clarivate has a strong future ahead and I look

forward to supporting the Company in my upcoming non-executive role.”

Mr. Shem Tov’s appointment follows a process led by the Board

of Directors and supported by Heidrick & Struggles, a leading global executive search firm.

Separately, Clarivate today reported results for the second quarter

ended June 30, 2024. Clarivate will host a conference call and webcast today at 9:00 a.m. Eastern Time to review the results for the second

quarter and discuss the announced leadership changes.

About Matti Shem Tov

Matti Shem Tov has over 30 years of global leadership experience with

deep expertise in software, data, and analytics, as well as in driving innovation and growth. From June 2022 until March 2024, Mr. Shem

Tov served as an operating partner at Lone View Capital, a private equity firm. Prior to that, Mr. Shem Tov served as Chief Executive

Officer of ProQuest LLC (“ProQuest”), a provider of global data, analytics and software, to academic, research and national

institutions, from September 2017 to June 2022, including for a period following Clarivate’s acquisition of ProQuest in December

2021. From 2003 until 2017, Mr. Shem Tov served as President and Chief Executive Officer of Ex Libris Ltd., leading the company to become

a prominent developer of cloud-based software solutions for academic, national and research institutions worldwide. Prior to joining Ex

Libris, Mr. Shem Tov served as President of Surecomp Limited, a global software company specializing in commercial banking solutions,

after serving in various leadership roles across the company. Mr. Shem Tov received his Bachelor of Arts and his Master of Business Administration

from Bar-Ilan University.

About Clarivate

Clarivate™ is a leading global provider of transformative intelligence.

We offer enriched data, insights & analytics, workflow solutions and expert services in the areas of Academia & Government, Intellectual

Property and Life Sciences & Healthcare. For more information, please visit www.clarivate.com

Forward-Looking Statements

This communication contains "forward-looking statements"

as defined in the Private Securities Litigation Reform Act of 1995. These statements, which express management's current views concerning

future business, events, trends, contingencies, financial performance, or financial condition, appear at various places in this communication

and may use words like "aim," "anticipate," "assume," "believe," "continue," "could,"

"estimate," "expect," "forecast," "future," "goal," "intend," "likely,"

"may," "might," "plan," "potential," "predict," "project," "see,"

"seek," "should," "strategy," "strive," "target," "will," and "would"

and similar expressions, and variations or negatives of these words. Forward-looking statements are neither historical facts nor assurances

of future performance. Instead, they are based only on management's current beliefs, expectations, and assumptions regarding the future

of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Because

forward-looking statements relate to the future, they are difficult to predict and many of which are outside of our control. Important

factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements

include those factors discussed under the caption "Risk Factors" in our most recent annual report on Form 10-K, along with our

other filings with the U.S. Securities and Exchange Commission ("SEC"). However, those factors should not be considered to be

a complete statement of all potential risks and uncertainties. Additional risks and uncertainties not known to us or that we currently

deem immaterial may also impair our business operations. Forward-looking statements are based only on information currently available

to our management and speak only as of the date of this communication. We do not assume any obligation to publicly provide revisions or

updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, except as otherwise

required by securities and other applicable laws. Please consult our public filings with the SEC or on our website at www.clarivate.com.

Investor Contact:

Mark Donohue, Head of Investor Relations

investor.relations@clarivate.com

215-243-2202

Media Contact:

Amy Bourke-Waite, Senior Director, Corporate Communications

newsroom@clarivate.com

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

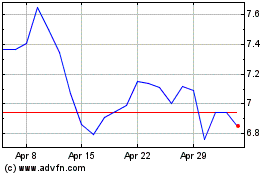

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Clarivate (NYSE:CLVT)

Historical Stock Chart

From Nov 2023 to Nov 2024