By Bradley Olson

Chevron Corp. and Exxon Mobil Corp. plan to significantly ramp

up production in the oil field at the heart of the American

fracking boom, the latest sign that the next era of shale drilling

is likely to be led by the major oil companies.

In the next five years, Chevron expects to more than double its

production in the Permian Basin in Texas and New Mexico to 900,000

barrels of oil and gas a day, the company said at an investor event

Tuesday. That is a nearly 40% increase from its previous

forecast.

"The shale game has become a scale game," Chevron Chief

Executive Mike Wirth said in an interview. "The race doesn't go to

the one who gets out of the starting blocks the fastest. The race

goes to the one who steadily builds the strongest machine."

Not to be outdone, Exxon on Tuesday announced plans to increase

its Permian output to one million barrels of oil and gas a day by

as early as 2024, a day before it was expected to disclose growth

at its own investor meeting Wednesday. BP PLC, Royal Dutch Shell

PLC and Occidental Petroleum Corp. are also focusing on the

region.

"We're increasingly confident about our Permian growth strategy

due to our unique development plans," Neil Chapman, Exxon's senior

vice president, said in a written statement.

Big oil's growing ambitions for the Permian follow a

long-established pattern in the oil patch: Wildcatters and small

exploration companies find ways to tap new reservoirs, then the big

companies move in.

Five years ago, Exxon, Chevron, BP, Shell and Occidental

collectively made up about 9% of crude production from modern

fracking techniques in the Permian. In October, the latest period

for which relevant figures are available, they made up about 16%,

according to data on ShaleProfile, an industry analytics

platform.

Those numbers are likely to grow significantly in the coming

years, and it wouldn't be a surprise for the big five to produce

far more of the booming area's crude within a decade, said Ed Hirs,

who teaches energy economics at the University of Houston.

"It's going to be extremely difficult for smaller companies to

compete with the oil giants," Mr. Hirs said.

As the energy giants continue their shale expansion, many have

gained favor with investors. Chevron is up 14% in the past year

even as crude prices have fallen, and all the biggest oil companies

have outperformed the S&P 500.

Chevron, which now has the lowest debt relative to its size

compared with any of its peers, says it can pay for its new

spending and dividends at a price of about $51 a barrel. The

company said that is the lowest among the big oil companies, citing

data from analytics firm Wood Mackenzie.

Chevron plans to avoid major spending increases in coming years

even if prices rise, executives said. It said it would hold annual

spending this year and next year between $18 billion and $20

billion, and allow it to grow slightly from 2021 to 2023 to a range

of $19 billion to $22 billion.

Many of the smaller companies that pioneered new technology to

help make the U.S. the world's top crude producer have begun to

struggle as they attempt to rein in spending and move closer to a

goal that has so far largely eluded them: profitability.

Dozens of companies including Continental Resources Inc. and

Pioneer Natural Resources Co. have reduced spending plans in

response to investor pressure. Collectively, spending among the

smaller companies is set to fall 11% this year, according to

Citigroup.

Many smaller oil firms face the challenge of having to drill

more to keep production rising, because shale wells produce a lot

in the beginning but then taper off quickly.

The spending cuts, coupled with the fact that some companies

have tapped a large proportion of their best wells, mean that

returns from shale drilling might have already peaked as wells

increasingly are less productive, according to Evercore ISI.

Meanwhile, the big companies are just getting started. Exxon is

now the largest operator in the Permian, with almost 50 rigs. The

company estimates its Permian wells can generate a 10% rate of

return at an oil price of $35 a barrel. While many companies

reduced fracking activity in the fourth quarter of last year, Exxon

increased it significantly to over 80 wells, more than double the

total in the fourth quarter of 2017, according to Rystad

Energy.

Chevron is raising its production guidance to 900,000 barrels of

oil and gas a day by 2023. Last year, it predicted 650,000 barrels

a day by 2023. The company is boosting production without adding to

its rig count, a testament to how size can lead to greater

efficiencies.

Chevron employed what could be described as a tortoise-and-hare

strategy in the Permian. While smaller companies at times paid more

than $40,000 an acre to gain rights to prime drilling

opportunities, Chevron held on to land it already owned in the

region, which decades ago was one of the world's biggest

traditional oil fields, without having to join in the buying

frenzy.

The company's land is now recognized as having unrivaled value.

Its shale portfolio, which includes its Permian holdings, is worth

more than $70 billion, the largest of any operator, according to

Rystad Energy. Chevron says the value has doubled in the past two

years.

Chevron built a database of more than 25,000 wells to study the

best techniques for drilling. That helped it avoid so-called

downspacing, a practice in which companies drill wells in close

proximity and that has been linked to reductions in productivity

per well, Mr. Wirth said.

Because of its size, Chevron has the ability to obtain

commitments for pipeline space, drill longer horizontal wells

across its huge swaths of land in the Permian, and keep a lid on

labor and other materials costs. The company can also apply new

technology and use techniques mastered in the Permian on land in

Canada, Argentina and Pennsylvania, he said.

"At times, we were criticized for not going faster," Mr. Wirth

said. "We were steadily building up the knowledge to do this well,

not to do it fast."

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

March 05, 2019 14:22 ET (19:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

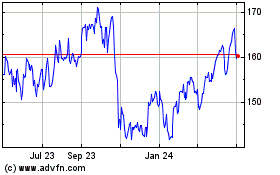

Chevron (NYSE:CVX)

Historical Stock Chart

From Aug 2024 to Sep 2024

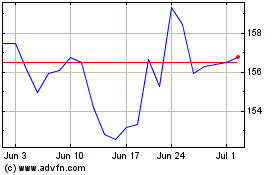

Chevron (NYSE:CVX)

Historical Stock Chart

From Sep 2023 to Sep 2024