CareTrust REIT, Inc. (NYSE: CTRE), a healthcare real estate

investment trust specializing in skilled nursing and assisted

living real estate investments, is proud to announce the

celebration of its 10-year anniversary. In separate press releases,

on this significant milestone, CareTrust REIT has announced two

strategic transactions totaling approximately $180 million, further

proving its commitment to growth and excellence in the healthcare

sector.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240604777578/en/

Portfolio Star Ratings vs. National

Average (Source: Center for Medicare and Medicaid Services)

A Decade of Commitment to Quality Care and Shareholder

Value

Over the past ten years, CareTrust REIT has grown from a

spin-off of assets leased to a single tenant to a trusted capital

partner to dozens and a high performer in the healthcare real

estate market. Dave Sedgwick, CareTrust REIT Chief Executive

Officer, said, “Our results are a testament to the unwavering

dedication and hard work of our board and team, both past and

present. We owe our success to the outstanding operators leasing

our properties. Their expertise and commitment to providing

high-quality care to their patients and employees have been

instrumental in our ability to deliver strong performance and value

to our loyal shareholders.”

With respect to the strength of the CareTrust portfolio and

corresponding shareholder benchmarks, Mr. Sedgwick said, “A decade

ago, our founding President and Chief Executive Officer Greg

Stapley put a team together who had deep operating understanding

and experience because he understood that the value of skilled

nursing and seniors housing real estate is incredibly sensitive to

the capabilities of the operators. We cannot thank Greg enough for

his vision and for the foundation he laid at CareTrust.”

Mr. Sedgwick continued, “Building a REIT ‘by operators, for

operators’ informs who we lease to, how we underwrite, and how we

asset manage. When I personally ran facilities before CareTrust, I

knew intimately that quality care, of both your patients and

employees, precedes sustainable financial stability. Because our

tenants have complete control over the operations of our

properties, leasing to operators who excel at both their ‘mission’

and a sustainable ‘margin’ is vital.”

CareTrust REIT's dedication to delivering value to shareholders

is reflected in its impressive financial achievements over the past

decade, including a total shareholder return of 247% since

inception.

Looking Forward

Mr. Sedgwick commented on the multi-decade demographic wave of

seniors that is now starting to break. He said, “It is incredible

to realize that the number of Americans who are 85 years and older

will almost double in just 10 years. When you couple that projected

growth in demand with the trend of shrinking supply of facilities,

the term ‘tsunami,’ seems appropriate. CareTrust is exceptionally

positioned to ride this wave.”

In speaking about the near-term investment outlook, James

Callister, Chief Investment Officer, said, “The investment

environment continues to be very healthy for us. We have growing

relationships with some of the best operators in the country.

Today, we are quoting a reloaded pipeline of approximately $460

million.” Bill Wagner, Chief Financial Officer, said, “When you

look at where our cost of equity is compared to our cost of debt

today and you have visibility into a historic pace and pipeline of

investments, our financing strategy is self-evident. We have issued

2.5 million shares under our ATM program quarter-to-date at a gross

price of $24.90 for gross proceeds of $62.3 million bringing the

total outstanding share count to 144.6 million shares. Today’s cash

on hand is approximately $230 million. Together with full

availability under our revolver, we have tremendous flexibility to

fund growth for the foreseeable future.”

Mr. Sedgwick, concluded, “As we celebrate this 10-year

milestone, I extend my deepest gratitude to our team and operators

for their invaluable contributions to our success. We also thank

our loyal shareholders, bankers, brokers, and other friends of

CareTrust for their continued support and confidence in our mission

to create long-term value by matching great operators with great

opportunities. We are just getting started.”

About CareTrust™

CareTrust REIT, Inc. is a self-administered, publicly-traded

real estate investment trust engaged in the ownership, acquisition,

development and leasing of skilled nursing, seniors housing and

other healthcare-related properties. With a nationwide portfolio of

long-term net-leased properties, and a growing portfolio of quality

operators leasing them, CareTrust REIT is pursuing both external

and organic growth opportunities across the United States. More

information about CareTrust REIT is available at

www.caretrustreit.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995:

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements that are

not historical statements of fact and statements regarding the

Company’s intent, belief or expectations, including, but not

limited to, statements regarding the following: industry and

demographic conditions, the investment environment, the Company’s

investment pipeline, and financing strategy.

Words such as “anticipate,” “believe,” “could,” “expect,”

“estimate,” “intend,” “may,” “plan,” “seek,” “should,” “will,”

“would,” and similar expressions, or the negative of these terms,

are intended to identify such forward-looking statements, though

not all forward-looking statements contain these identifying words.

The Company’s forward-looking statements are based on management’s

current expectations and beliefs, and are subject to a number of

risks and uncertainties that could lead to actual results differing

materially from those projected, forecasted or expected. Although

the Company believes that the assumptions underlying these

forward-looking statements are reasonable, they are not guarantees

and the Company can give no assurance that its expectations will be

attained. Factors which could have a material adverse effect on the

Company’s operations and future prospects or which could cause

actual results to differ materially from expectations include, but

are not limited to: (i) the ability and willingness of our tenants

to meet and/or perform their obligations under the triple-net

leases we have entered into with them, including without

limitation, their respective obligations to indemnify, defend and

hold us harmless from and against various claims, litigation and

liabilities; (ii) the risk that we may have to incur additional

impairment charges related to our assets held for sale if we are

unable to sell such assets at the prices we expect; (iii) the

impact of healthcare reform legislation, including minimum staffing

level requirements, on the operating results and financial

conditions of our tenants; (iv) the ability of our tenants to

comply with applicable laws, rules and regulations in the operation

of the properties we lease to them; (v) the ability and willingness

of our tenants to renew their leases with us upon their expiration,

and the ability to reposition our properties on the same or better

terms in the event of nonrenewal or in the event we replace an

existing tenant, as well as any obligations, including

indemnification obligations, we may incur in connection with the

replacement of an existing tenant; (vi) the availability of and the

ability to identify (a) tenants who meet our credit and operating

standards, and (b) suitable acquisition opportunities and the

ability to acquire and lease the respective properties to such

tenants on favorable terms; (vii) the ability to generate

sufficient cash flows to service our outstanding indebtedness;

(viii) access to debt and equity capital markets; (ix) fluctuating

interest rates; (x) the impact of public health crises, including

significant COVID-19 outbreaks as well as other pandemics or

epidemics; (xi) the ability to retain our key management personnel;

(xii) the ability to maintain our status as a real estate

investment trust (“REIT”); (xiii) changes in the U.S. tax law and

other state, federal or local laws, whether or not specific to

REITs; (xiv) other risks inherent in the real estate business,

including potential liability relating to environmental matters and

illiquidity of real estate investments; and (xv) any additional

factors included in our Annual Report on Form 10-K for the year

ended December 31, 2023 and our Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024, including in the section entitled

“Risk Factors” in Item 1A of such reports, as such risk factors may

be amended, supplemented or superseded from time to time by other

reports we file with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604777578/en/

CareTrust REIT, Inc. (949) 542-3130 ir@caretrustreit.com

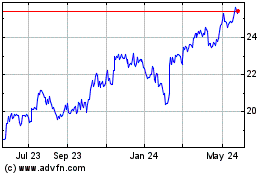

CareTrust REIT (NYSE:CTRE)

Historical Stock Chart

From Oct 2024 to Nov 2024

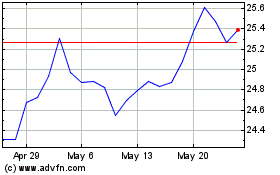

CareTrust REIT (NYSE:CTRE)

Historical Stock Chart

From Nov 2023 to Nov 2024