Capital One (NYSE: COF) announced today that it received

approval from the Office of the Delaware State Bank Commissioner on

December 18, 2024, to complete its previously announced acquisition

of Discover Financial Services (NYSE: DFS) and its subsidiary bank,

Discover Bank, which is a Delaware-chartered bank. Both companies

have long-standing commitments to Delaware and to the region, and

this approval represents an important step toward the completion of

the merger.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241219703825/en/

Capital One anticipates that the transaction will close in early

2025, subject to the satisfaction of the remaining closing

conditions set forth in the merger agreement between the companies,

including approval by the stockholders of Discover and Capital One

and approval by the Board of Governors of the Federal Reserve

System and the Office of the Comptroller of the Currency.

Capital One first announced its proposed acquisition of Discover

in February 2024, which was followed by its July 2024 announcement

of a historic, five-year, $265 billion community benefits plan in

connection with the acquisition. The plan was conceived in

partnership with leading community groups and represents a

comprehensive package of community-focused solutions. It includes

$35 million in grants to Delaware-based nonprofit organizations, as

well as retention of Discover’s branch in Sussex County.

To learn more about Capital One’s Community Benefits Plan

proposal in connection with the Discover acquisition, visit

www.capitalonediscover.com/community-benefits-plan.

Further information on Capital One’s agreement to acquire

Discover Financial Services can be found at

www.capitalonediscover.com.

About Capital One

Capital One Financial Corporation (www.capitalone.com) is a

financial holding company which, along with its subsidiaries, had

$353.6 billion in deposits and $486.4 billion in total assets as of

September 30, 2024. Headquartered in McLean, Virginia, Capital One

offers a broad spectrum of financial products and services to

consumers, small businesses and commercial clients through a

variety of channels. Capital One, N.A. has branches and Cafés

located primarily in New York, Louisiana, Texas, Maryland, Virginia

and the District of Columbia. A Fortune 500 company, Capital One

trades on the New York Stock Exchange under the symbol “COF” and is

included in the S&P 100 index. Additional information about

Capital One can be found at Capital One About at

www.capitalone.com/about.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The Company issues the Discover® card, America’s cash rewards

pioneer, and offers personal loans, home loans, checking and

savings accounts and certificates of deposit through its banking

business. It operates the Discover Global Network® comprised of

Discover Network, with millions of merchants and cash access

locations; PULSE®, one of the nation’s leading ATM/debit networks;

and Diners Club International®, a global payments network with

acceptance around the world. For more information, visit

www.discover.com/company.

Forward Looking Statements

Information in this communication, other than statements of

historical facts, may constitute forward-looking statements, within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements may include, but are not limited to,

statements related to the expected timing of each company’s

respective special meeting of stockholders. Forward-looking

statements may be identified by terminology such as “may,” “will,”

“should,” “targets,” “scheduled,” “plans,” “intends,” “goal,”

“anticipates,” “expects,” “believes,” “forecasts,” “outlook,”

“estimates,” “potential,” or “continue” or negatives of such terms

or other comparable terminology. All forward-looking statements are

subject to risks, uncertainties and other factors that may cause

the actual results, performance or achievements of Capital One

Financial Corporation (“Capital One”) or Discover Financial

Services (“Discover”) to differ materially from any results

expressed or implied by such forward-looking statements. Such

factors include, among others, the possibility that the requisite

regulatory, stockholder or other approvals are not received or

other conditions to the closing are not satisfied on a timely basis

or at all, or the occurrence of any event, change or other

circumstances that could give rise to the termination of the merger

agreement. Additional factors which could affect future results of

Capital One and Discover can be found in Capital One’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, and Discover’s Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K

(and any amendments to those documents), in each case filed with

the SEC and available on the SEC’s website at http://www.sec.gov.

Capital One and Discover disclaim any obligation and do not intend

to update or revise any forward-looking statements contained in

this communication, which speak only as of the date hereof, whether

as a result of new information, future events or otherwise, except

as required by federal securities laws.

Important Information About the Transaction and Where to Find

It

Capital One filed a registration statement on Form S-4 (No.

333-278812) with the SEC on April 18, 2024, as amended on June 14,

2024 and July 26, 2024, to register the shares of Capital One’s

capital stock that will be issued to Discover stockholders in

connection with the proposed transaction. The registration

statement, which is not yet effective, includes a preliminary joint

proxy statement of Capital One and Discover that also constitutes a

preliminary prospectus of Capital One. If and when the registration

statement becomes effective and the joint proxy

statement/prospectus is in definitive form, such joint proxy

statement/prospectus will be sent to the stockholders of each of

Capital One and Discover in connection with the proposed

transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED JOINT PROXY

STATEMENT/PROSPECTUS (AND ANY OTHER AMENDMENTS OR SUPPLEMENTS TO

THESE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC

IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE

INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS

CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION REGARDING THE

PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security

holders may obtain free copies of these documents and other

documents filed with the SEC by Capital One or Discover through the

website maintained by the SEC at http://www.sec.gov or by

contacting the investor relations department of Capital One or

Discover at:

Capital One

Financial Corporation

Discover Financial

Services

1680 Capital One Drive

McLean, VA 22102

Attention: Investor Relations

investorrelations@capitalone.com

(703) 720-1000

2500 Lake Cook Road

Riverwoods, IL 60015

Attention: Investor Relations

investorrelations@discover.com

(224) 405-4555

Before making any voting or investment decision, investors

and security holders of Capital One and Discover are urged to read

carefully the entire registration statement and preliminary joint

proxy statement/prospectus, including any amendments thereto when

they become available, because they contain or will contain

important information about the proposed transaction. Free copies

of these documents may be obtained as described above.

Participants in Solicitation

Capital One, Discover and certain of their directors and

executive officers may be deemed participants in the solicitation

of proxies from the stockholders of each of Capital One and

Discover in connection with the proposed transaction. Information

regarding the directors and executive officers of Capital One and

Discover and other persons who may be deemed participants in the

solicitation of the stockholders of Capital One or of Discover in

connection with the proposed transaction will be included in the

joint proxy statement/prospectus related to the proposed

transaction, which will be filed by Capital One with the SEC.

Information about the directors and executive officers of Capital

One and their ownership of Capital One common stock can also be

found in Capital One’s definitive proxy statement in connection

with its 2024 annual meeting of stockholders, as filed with the SEC

on March 20, 2024, and other documents subsequently filed by

Capital One with the SEC. Information about the directors and

executive officers of Discover and their ownership of Discover

common stock can also be found in Discover’s definitive proxy

statement in connection with its 2024 annual meeting of

stockholders, as filed with the SEC on March 15, 2024, and other

documents subsequently filed by Discover with the SEC. Additional

information regarding the interests of such participants is

included in the preliminary joint proxy statement/prospectus and

other relevant documents regarding the proposed transaction filed

with the SEC when they become available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241219703825/en/

Media Relations Sie Soheili

sie.soheili@capitalone.com Matthew Towson

matthewtowson@discover.com Investor Relations Danielle

Dietz danielle.dietz@capitalone.com Erin Stieber

investorrelations@discover.com

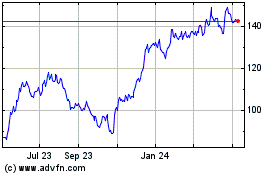

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Feb 2025 to Mar 2025

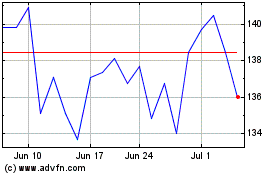

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Mar 2025