false

N-2

0001486298

0001486298

2023-01-01

2023-12-31

0001486298

BX:CommonSharesMember

2023-01-01

2023-12-31

0001486298

BX:InvestmentAndMarketRiskMember

2023-01-01

2023-12-31

0001486298

BX:BelowInvestmentGradeOrHighYieldInstrumentsRiskMember

2023-01-01

2023-12-31

0001486298

BX:CovenantLiteObligationsRiskMember

2023-01-01

2023-12-31

0001486298

BX:ValuationRiskMember

2023-01-01

2023-12-31

0001486298

BX:SwapRiskMember

2023-01-01

2023-12-31

0001486298

BX:CreditRisksMember

2023-01-01

2023-12-31

0001486298

BX:InterestsRateRiskMember

2023-01-01

2023-12-31

0001486298

BX:SystematicStrategiesRelatedToBondInvestmentsRiskMember

2023-01-01

2023-12-31

0001486298

BX:LIBORRiskMember

2023-01-01

2023-12-31

0001486298

BX:ForceMajeureRiskMember

2023-01-01

2023-12-31

0001486298

BX:EpidemicAndPandemicRiskMember

2023-01-01

2023-12-31

0001486298

BX:MarketDisruptionAndGeopoliticalRiskMember

2023-01-01

2023-12-31

0001486298

BX:LenderLiabilityRiskMember

2023-01-01

2023-12-31

0001486298

BX:CounterpartyRiskMember

2023-01-01

2023-12-31

0001486298

BX:PotentialConflictsOfInterestRiskMember

2023-01-01

2023-12-31

0001486298

BX:LimitationsOnTransactionsWithAffiliatesRiskMember

2023-01-01

2023-12-31

0001486298

BX:DependenceOnKeyPersonnelRiskMember

2023-01-01

2023-12-31

0001486298

BX:PrepaymentsRiskMember

2023-01-01

2023-12-31

0001486298

BX:UKExitFromTheEUMember

2023-01-01

2023-12-31

0001486298

BX:RepurchaseAgreementsRiskMember

2023-01-01

2023-12-31

0001486298

BX:ReverseRepurchaseAgreementsRiskMember

2023-01-01

2023-12-31

0001486298

BX:InvestmentsInEquitySecuritiesOrWarrantsIncidentalToInvestmentsInFixedIncomeInstrumentsMember

2023-01-01

2023-12-31

0001486298

BX:InflationDeflationRiskMember

2023-01-01

2023-12-31

0001486298

BX:USGovernmentDebtSecuritiesRiskMember

2023-01-01

2023-12-31

0001486298

BX:CyberSecurityRiskAndIdentityTheftRisksMember

2023-01-01

2023-12-31

0001486298

BX:PortfolioTurnoverRiskMember

2023-01-01

2023-12-31

0001486298

BX:GovernmentInterventionInTheFinancialMarketsMember

2023-01-01

2023-12-31

0001486298

BX:InflationAndSupplyChainRiskMember

2023-01-01

2023-12-31

0001486298

BX:RegulatoryRiskMember

2023-01-01

2023-12-31

0001486298

BX:DerivativesRiskMember

2023-01-01

2023-12-31

0001486298

BX:SeniorLoansRiskMember

2023-01-01

2023-12-31

0001486298

BX:SubordinatedLoansRiskMember

2023-01-01

2023-12-31

0001486298

BX:StructuredProductsRiskMember

2023-01-01

2023-12-31

0001486298

BX:CLORiskMember

2023-01-01

2023-12-31

0001486298

BX:LiquidityRiskMember

2023-01-01

2023-12-31

0001486298

BX:LeverageRiskMember

2023-01-01

2023-12-31

0001486298

BX:ForeignCurrencyRiskMember

2023-01-01

2023-12-31

0001486298

BX:PreferredSharesMember

2012-12-31

0001486298

BX:PreferredSharesMember

2012-01-01

2012-12-31

0001486298

BX:SeniorSecuritiesMember

2012-12-31

0001486298

BX:SeniorSecuritiesMember

2012-01-01

2012-12-31

0001486298

BX:PreferredSharesMember

2013-12-31

0001486298

BX:PreferredSharesMember

2013-01-01

2013-12-31

0001486298

BX:SeniorSecuritiesMember

2013-12-31

0001486298

BX:SeniorSecuritiesMember

2013-01-01

2013-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2014-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2014-01-01

2014-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2015-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2015-01-01

2015-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2016-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2016-01-01

2016-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2017-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2017-01-01

2017-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2018-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2018-01-01

2018-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2019-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2019-01-01

2019-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2020-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2020-01-01

2020-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2021-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2021-01-01

2021-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2022-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2022-01-01

2022-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2023-12-31

0001486298

BX:RevolvingCreditsFacilityMember

2023-01-01

2023-12-31

0001486298

BX:CommonSharesMember

2019-01-01

2019-03-29

0001486298

BX:CommonSharesMember

2019-03-29

0001486298

BX:CommonSharesMember

2019-03-30

2019-06-28

0001486298

BX:CommonSharesMember

2019-06-28

0001486298

BX:CommonSharesMember

2019-06-29

2019-09-30

0001486298

BX:CommonSharesMember

2019-09-30

0001486298

BX:CommonSharesMember

2019-10-01

2019-12-31

0001486298

BX:CommonSharesMember

2019-12-31

0001486298

BX:CommonSharesMember

2020-01-01

2020-03-31

0001486298

BX:CommonSharesMember

2020-03-31

0001486298

BX:CommonSharesMember

2020-04-01

2020-06-30

0001486298

BX:CommonSharesMember

2020-06-30

0001486298

BX:CommonSharesMember

2020-07-01

2020-09-30

0001486298

BX:CommonSharesMember

2020-09-30

0001486298

BX:CommonSharesMember

2020-10-01

2020-12-31

0001486298

BX:CommonSharesMember

2020-12-31

0001486298

BX:CommonSharesMember

2021-01-01

2021-03-31

0001486298

BX:CommonSharesMember

2021-03-31

0001486298

BX:CommonSharesMember

2021-04-01

2021-06-30

0001486298

BX:CommonSharesMember

2021-06-30

0001486298

BX:CommonSharesMember

2021-07-01

2021-09-30

0001486298

BX:CommonSharesMember

2021-09-30

0001486298

BX:CommonSharesMember

2021-10-01

2021-12-31

0001486298

BX:CommonSharesMember

2021-12-31

0001486298

BX:CommonSharesMember

2022-01-01

2022-03-31

0001486298

BX:CommonSharesMember

2022-03-31

0001486298

BX:CommonSharesMember

2022-04-01

2022-06-30

0001486298

BX:CommonSharesMember

2022-06-30

0001486298

BX:CommonSharesMember

2022-07-01

2022-09-30

0001486298

BX:CommonSharesMember

2022-09-30

0001486298

BX:CommonSharesMember

2022-10-01

2022-12-30

0001486298

BX:CommonSharesMember

2022-12-30

0001486298

BX:CommonSharesMember

2023-01-01

2023-03-31

0001486298

BX:CommonSharesMember

2023-03-31

0001486298

BX:CommonSharesMember

2023-04-01

2023-06-30

0001486298

BX:CommonSharesMember

2023-06-30

0001486298

BX:CommonSharesMember

2023-07-01

2023-09-29

0001486298

BX:CommonSharesMember

2023-09-29

0001486298

BX:CommonSharesMember

2023-09-30

2023-12-29

0001486298

BX:CommonSharesMember

2023-12-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22393

Blackstone Senior Floating Rate 2027 Term Fund

(exact name of Registrant as specified in charter)

345 Park Avenue, 31st Floor

New York, New York 10154

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

Marisa Beeney

Blackstone Alternative Credit Advisors LP

345 Park Avenue, 31st Floor

New York, New York 10154

Registrant’s telephone number, including area code: (877) 876-1121

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Item 1. Report to Stockholders.

Table of Contents

| Manager Commentary |

2 |

| Fund Summary |

4 |

| Portfolio of Investments |

13 |

| Statements of Assets and Liabilities |

66 |

| Statements of Operations |

67 |

| Statements of Changes in Net Assets |

68 |

| Statements of Cash Flows |

69 |

| Financial Highlights |

70 |

| Notes to Financial Statements |

78 |

| Report of Independent Registered Public Accounting Firm |

96 |

| Summary of Dividend Reinvestment Plan |

97 |

| Additional Information |

98 |

| Summary of Updated Information Regarding the Funds |

100 |

| Summary of Fund Expenses |

127 |

| Senior Securities |

128 |

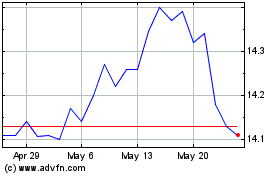

| Market and Net Asset Value Information |

130 |

| Privacy Procedures |

133 |

| Trustees & Officers |

144 |

| Blackstone Credit & Insurance Funds |

Manager Commentary |

December 31, 2023 (Unaudited)

To Our Shareholders:

Credit markets staged a recovery in 2023

as resilent economic momentum seemed to have overpowered fears of a recession driven by the Federal Reserve (the “Fed”). In

addition to positive credit fundamentals, returns were further boosted by market technicals as limited new issue supply drove demand into

secondary markets. The return to positive performance across both US loans and high yield came despite another year of historic rate volatility

and geopolitical headwinds. These elements led to periods of market weakness through the year, including after March’s regional

banking stress, although a strong December rally after indications by Fed Chairman Powell that a pivot was on the horizon drove markets

to finish the year with double-digit returns.i

The US loan market

gained 2.87% in the fourth quarter, driving the index to its second-highest annual return of 13.32% for 2023.i The

US high yield market lagged loans for most of the year; however, a late-year rally led to gains of 7.16% for high yield in the fourth quarter

and 13.45% for the year.ii Spreads decreased to 459 basis points (“bps”) and

346 bps in loans and high yield, respectively, over the fourth quarter as data continued to highlight moderating inflation and economic

resilience, diminishing recession fears.iii

In both markets,

contracting net supply amid repayments, private credit refinancings (loans), and rising star upgrades (high yield) supported prices for

secondary market assets. Average loan prices rose to their highest level of the year at $96.23 on December 31,iv while

high yield bond prices increased nearly seven points from their 2023 low in October to close the year at $93.07.v

| 12-Month Total Returns as of December 31, 2023 |

|

| US Loans (Morningstar LSTA US Leveraged Loan Index) |

13.32% |

| US High Yield Bonds (Bloomberg High Yield Index) |

13.45% |

| 3-month Treasury Bills (Bloomberg U.S. Treasury Bellwethers: 3 Month) |

5.16% |

| 10-year Treasuries (Bloomberg U.S. Treasury Bellwethers: 10 Year) |

3.21% |

| US Aggregate Bonds (Bloomberg U.S. Aggregate Index) |

5.53% |

| US Investment Grade Bonds (Bloomberg U.S. Corporate Investment Grade Index) |

8.52% |

| Emerging Markets (Bloomberg EM USD Aggregate Index) |

9.09% |

| US Large Cap Equities (S&P 500® Index) |

24.23% |

Sources: Bloomberg, Barclays, S&P/LCD

Past Performance is no guarantee of future results. Index performance

is shown for illustrative purposes only. You cannot invest directly in an index.

Having largely stalled during 2022’s

volatility, institutional loan gross issuance rebounded slightly to $234 billion in 2023vi as borrowers flooded the market

with amend-to-extend and refinancing transactions. Net new money deals remained scarce given the decline in the M&A market, and the

year’s supply was less than a third of the loan market’s historic peak of $615 billion in 2021.vii High yield issuance

surged in November to finish the year at $176 billion, 72% ahead of 2022, although as with loans, refinancings rather than new money supply

dominated.viii

Shifting to demand, recession fears caused

investors to pull $17 billion from loan funds over the year versus a more muted $7 billion for high yield, which was primarily propped

up by fourth quarter inflows as recession fears subsided.ix

Collateralized loan obligiation (“CLO”)

demand largely offset the retail loan fund outflows, although CLO new issuance of $113 billion for the year was down $13 billion from

2022, hampered by a still-challenged CLO equity arbitrage. Top-rated CLO spreads compressed over the final quarter, and again in January

2024, spurring new issuance over that period. The JPMorgan CLOIE Index returned 10.54% for the year, which was ahead of US investment

grade but lagged both senior loans and high yield bonds.x

From a fundamental perspective, higher

interest burdens due to higher rates have eroded corporate free cash flow and interest coverage ratios, although a combination of macroeconomic

resilience, healthy corporate balance sheets heading into this cycle, and efforts by corporate borrowers to push out the near-term maturity

wall kept both loan and high yield defaults in line with long-term averages at 3.15% and 2.84%, respectively, in 2023.xi

As we move further into 2024, we believe

floating rate loans, CLO debt, and high yield are likely to remain attractive even if the Fed begins cutting rates, given historically

attractive all-in yields, moderate expected default rates and supportive technicals.

Corporate borrowers had a busy start to

the year, again focused on refinancing near-term maturities. Through January 2024, the loan market has already seen the strongest wave

of repricing transactions since early 2021, after the rally pushed over 40% of the market above par.xii Incremental net new

issue loan supply would slow down repricing activity, and there are hopes that pent-up demand from private equity dry powder may spur

a pick-up in M&A and leveraged buy-out activity, but this will take time to materialize and it is expected that some of these will

be funded via direct lending.

From a macro perspective, inflation has

been heading lower, but we expect central banks may be more patient cutting rates to ensure inflation is truly tamed.xiii The

US economy has proved surprisingly resilient to the Fed’s aggressive tightening cycle, and we expect a relatively benign corporate

default backdrop over the year ahead.

That said, we remain cautious of the potential

for elevated rates to cause growth to slow. As a result, we expect increased dispersion between companies able to weather an elevated

rate environment and those whose balance sheets will come under more pressure. In addition, corporate borrowers face refinancing near-term

maturities at substantially higher debt costs, although we believe private credit lenders may step in to offer a potential alternative

refinancing solution in certain cases.xiv

We expect increased dispersion may create

opportunities for active managers with strong credit selection ability to identify mispriced credits. We believe that thematic investing

and targeting larger, cash-flow generative businesses in defensive and high-growth sectors, where we have built dedicated expertise and

where defaults have typically been more muted, will hopefully give us an edge during the next part of this cycle.

| 2 |

www.blackstone-credit.com |

| Blackstone Credit & Insurance Funds |

Manager Commentary |

December 31, 2023 (Unaudited)

At Blackstone Credit & Insurance,

we value your continued investment and confidence in us and in our family of funds. Additional information about our funds is available

on our website at www.blackstone-credit.com.

Sincerely,

Blackstone Liquid Credit Strategies LLC

All figures are approximate and as

of December 31, 2023, unless otherwise indicated. The words “we”, “us”, and “our” refer to BSL, BGX

and BGB, unless the context requires otherwise. In all other instances, including with respect to current and forward-looking views and

opinions of the market and BSL, BGX and BGB's portfolio and performance positioning, these terms refer to BSL's, BGX's and BGB's adviser,

Blackstone Liquid Credit Strategies LLC.

Certain information contained in

this communication constitutes “forward-looking statements” within the meaning of the federal securities laws and the Private

Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology,

such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,”

“may,” “can,” “will,” “should,” “seeks,” “approximately,” “predicts,”

“intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,”

“identified” or the negative versions of these words or other comparable words thereof. These may include BSL's, BGX's and

BGB's financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future

operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified

but not yet closed investments. Such forward-looking statements are inherently uncertain and there are or may be important factors that

could cause actual outcomes or results to differ materially from those indicated in such statements. BSL, BGX and BGB believe these factors

include but are not limited to those described under the section entitled “Risk Factors” in their prospectuses and annual

reports for the most recent fiscal year, and any such updated factors included in their periodic filings with the Securities and Exchange

Commission (the “SEC”), which are accessible on the SEC's website at www.sec.gov. These factors should not be construed as

exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or BSL's, BGX's

and BGB's prospectus and other filings). Except as otherwise required by federal securities laws, BSL, BGX and BGB undertake no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

| i | Morningstar LSTA US Leveraged Loan Index and Bloomberg US High

Yield Index as of December 31, 2023. |

| ii | Pitchbook LCD, as of January 2, 2024. |

| iii | Morningstar LSTA US Leveraged Loan Index, Bloomberg US High Yield Index, as of December 31, 2023. |

| iv | Pitchbook LCD, as of December 31, 2023. |

| v | Bloomberg US High Yield Index, as of December 31, 2023. |

| vi | Pitchbook LCD as of December 31, 2023 |

| vii | LCD, as of December 31, 2023. |

| viii | Bloomberg US High Yield Index, Outlook sources: JPM: High Yield

Bond and LL Outlook (11/22/2023); MS: U.S. Credit Strategy Outlook (11/28/2023); BAML: Global Credit Strategy Year Ahead (11/20/2023);

Barclays: Global Credit Alpha (11/16/2023); DB: 2024 Credit Outlook (11/29/2023). as of December 31, 2023. |

| ix | JP Morgan, Lipper, as of December 31, 2023. |

| x | JP Morgan CLOIE Index, as of December 31, 2023. |

| xi | Historical total returns and spreads for Loans and High Yield are sourced from Morningstar

LSTA US Leveraged Loan Index and Bloomberg Barclays High Yield Index. Historical default rates represent JP Morgan’s full year last

twelve months par-weighted default rates. Historical loan, high yield, and CLO new-issuance data are sourced from LCD. Outlook sources:

JPM: High Yield Bond and LL Outlook (11/22/2023); MS: U.S. Credit Strategy Outlook (11/28/2023); BAML: Global Credit Strategy Year Ahead

(11/20/2023); Barclays: Global Credit Alpha (11/16/2023); DB: 2024 Credit Outlook (11/29/2023). Loan Issuance: JPM, MS, BAML, and DB figures

include repricing; Barclays figures are the midpoint of their projected range. Default rates are on a par-weighted basis. CLO issuance

forecast represents U.S. CLO amount. |

| xii | JP Morgan Morning Intelligence, as of January 8, 2024. |

| xiii | Blackstone’s Views and Opinions, as of December 4, 2023. |

| xiv | Pitchbook LCD, Morningstar LSTA US Leveraged Loan Index, as of November 30, 2023. |

| Annual Report | December 31, 2023 |

3 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

Blackstone Senior Floating Rate 2027 Term Fund

Fund Overview

Blackstone Senior Floating Rate 2027 Term

Fund (“BSL” or herein, the “Fund”) is a closed-end term fund that trades on the New York Stock Exchange under

the symbol “BSL”. BSL’s primary investment objective is to seek high current income, with a secondary objective to seek

preservation of capital, consistent with its primary goal of high current income. Under normal market conditions, the Fund invests at

least 80% of its Managed Assets in senior, secured floating rate loans (“Senior Loans”). BSL may also invest in second-lien

loans and high yield bonds and employs financial leverage, which may increase risk to the Fund. The Fund has a limited term, and absent

shareholder approval to extend the life of the Fund, the Fund will dissolve on or about May 31, 2027.

Portfolio Management Commentary

Fund Performance

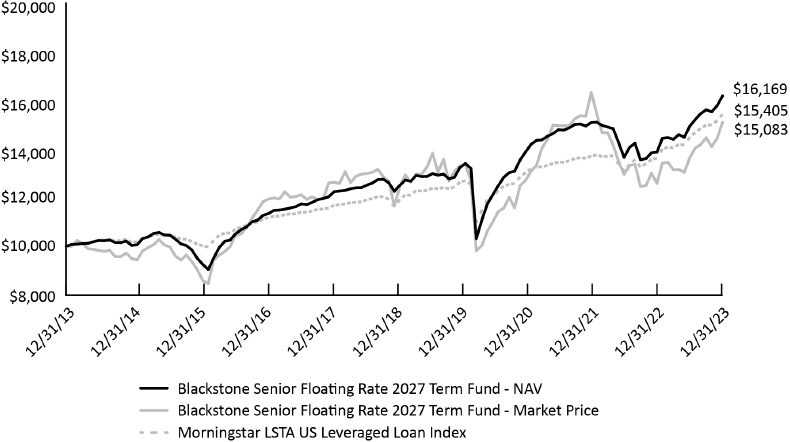

As of December 31, 2023, BSL outperformed

its benchmark, the Morningstar LSTA US Leveraged Loan Index (“Morningstar LLI”), on a Net Asset Value (“NAV”)

per share basis for the one-year, ten-year and since inception periods and underperformed its benchmark for the three-year and five-year

periods. On a share price basis, the Fund outperformed its benchmark for the one-year and three-year periods and underperformed for the

five-year, ten-year, and since inception periods. The shares of the Fund traded at an average discount to NAV of 10.6% for the twelve-months

ended December 31, 2023, compared to its peer group average discount of 9.8% over the same period.

NAV Performance Factors

We believe the Fund’s outperformance

relative to the benchmark for the twelve months ended December 31, 2023, was primarily attributable to leverage, the Fund’s credit

selection within its loan allocation, and the Fund’s CLO allocation. By issuer, the largest positive contributors to total return

were CoreLogic, Global Medical Response, and National Mentor Holdings, and the most significant detractors were Carestream Health, Output

Services Group, and Lumen Technologies.

Portfolio Activity and Positioning

During the year, we continued to dynamically

manage the Fund. The Fund’s largest sector overweights were Financial Services, Healthcare Providers & Services and Professional

Services. The largest sector underweights were Software, Specialty Retail and Chemicals. The Fund increased its allocation to first lien

broadly syndicated senior loans while reducing its exposure to high yield bonds.

| 4 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

Performance Summary

Performance quoted represents

past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. The returns

shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end

performance, visit www.blackstone-credit.com.

Value of a $10,000 Investment

BSL Total Return (as of December 31, 2023)

| |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

| NAV* |

16.64%** |

5.24% |

5.71% |

4.92% |

5.54% |

| Market Price* |

19.88% |

5.88% |

5.30% |

4.20% |

4.48% |

| Morningstar LSTA US Leveraged Loan Index |

13.32% |

5.76% |

5.80% |

4.42% |

4.91% |

| * | NAV is equal to the total assets attributable to common shareholders

less liabilities divided by the number of common shares outstanding. Market Price is the price at which a share can currently be traded

in the market. Market Price is based on the close price at 4 p.m. ET and does not represent the returns an investor would receive if

shares were traded at other times. Return assumes distributions are reinvested pursuant to the Fund’s dividend reinvestment plan.

Performance data quoted represents past performance and does not guarantee future results. |

| ** | Excludes adjustments in accordance with accounting principles

generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported

to the market as of December 31, 2023 may differ from the net asset value for financial reporting purposes. |

| Annual Report | December 31, 2023 |

5 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

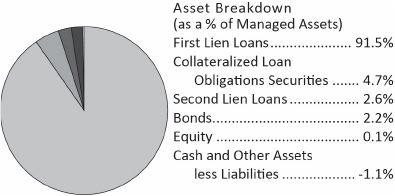

BSL’s Portfolio Composition*

| * | Numbers may not sum to 100.00% due to rounding. The Fund’s

Cash and Other represents net cash and other assets and liabilities, which includes amounts payable for investments purchased but not

yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased

but not yet settled exceeded the amount of cash on hand. The Fund uses sales proceeds or funds from its leverage program to settle amounts

payable for investments purchased, but such amounts are not reflected in the Fund’s net cash. |

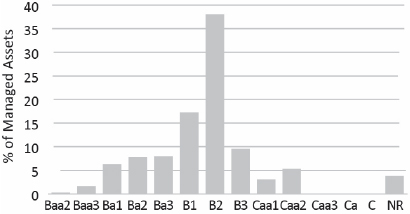

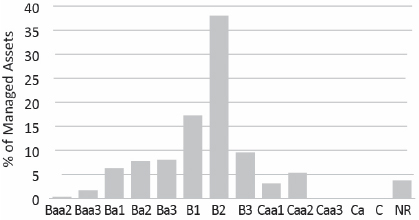

BSL’s Moody’s Rating*

| * | For more information on Moody's ratings and descriptions refer

to https://ratings.moodys.io/ratings. |

Portfolio Characteristics

| Average All-In Rate |

9.10% |

| Current Dividend Yield^ |

10.25% |

| Effective Duration^^ |

0.18 yr |

| Average Position* |

0.21% |

| Leverage* |

32.01% |

| ^ | Using current dividend rate of $0.114/share and market price/share

as of December 31, 2023. |

| ^^ | Loan durations are based on the actual remaining time until

the underlying base rate is reset for each individual loan. |

| * | As a percentage of Managed Assets. |

Top 10 Issuers*

| Focus Financial Partners LLC |

0.9% |

| Global Medical Response, Inc. |

0.9% |

| Mitchell International, Inc. |

0.8% |

| Endure Digital Inc |

0.8% |

| Project Alpha Intermediate Holding Inc |

0.8% |

| Peraton Corp. |

0.8% |

| Auris Luxembourg III S.a r.l. |

0.8% |

| Atlas CC Acquisition Corp. |

0.8% |

| UPC Financing Partnership |

0.8% |

| Trans Union LLC |

0.7% |

| Top 10 Issuer |

8.1% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change

and are not recommendations to buy or sell any security.

Top 5 Industries*^

| Software |

10.9% |

| Financial Services |

6.6% |

| Health Care Providers & Services |

6.5% |

| Professional Services |

5.6% |

| Commercial Services & Supplies |

4.5% |

| Top 5 Industries |

34.1% |

| * | As a percentage of Managed Assets. |

| ^ | GICS Industry Classification Schema. |

| 6 |

www.blackstone-credit.com |

| Blackstone Long-Short Credit Income Fund |

Fund Summary |

December 31, 2023 (Unaudited)

Blackstone Long-Short Credit Income Fund

Fund Overview

Blackstone Long Short Credit Income Fund

(“BGX” or herein, the “Fund”) is a closed-end fund that trades on the New York Stock Exchange under the symbol

“BGX”. BGX’s primary investment objective is to provide current income, with a secondary objective of capital appreciation.

BGX will take long positions in investments which we believe offer the potential for attractive returns under various economic and interest

rate environments. BGX may also take short positions in investments which we believe will under-perform due to a greater sensitivity to

earnings growth of the issuer, default risk or the general level and direction of interest rates. BGX must hold no less than 70% of its

Managed Assets in first- and second-lien secured loans (“Secured Loans”), but may also invest in unsecured loans and high

yield bonds.

Portfolio Management Commentary

Fund Performance

As of December 31, 2023, BGX outperformed

a composite weighting of the Morningstar LLI and the Bloomberg U.S. High Yield Index (“Bloomberg HYI”) (85% loans, 15% high

yield bonds) on a NAV per share basis for the one-year, ten-year, and since inception periods and underperformed its benchmark for the

three-year and five-year periods. On a share price basis, the Fund outperformed its benchmark for the one-year period and underperformed

for the three-year, five-year, ten-year, and since inception periods. The shares of the Fund traded at an average discount to NAV of 12.8%

for the twelve-months ended December 31, 2023, compared to its peer group average discount of 10.0% over the same period.

As of December 31, 2023, BGX outperformed

its prior benchmark, a composite weighting of the Morningstar LLI and the Bloomberg HYI (70% loans, 30% high yield bonds), on a NAV per

share basis for the one-year, ten-year, and since inception periods and underperformed its prior benchmark for the three-year and five-year

periods. On a share price basis, the Fund outperformed its prior benchmark for the one-year period and underperformed for the three-year,

five-year, ten-year, and since inception periods.

NAV Performance Factors

We believe the Fund’s outperformance

relative to the benchmark for the twelve months ended December 31, 2023, was primarily attributable to leverage, the Fund’s credit

selection within its loan allocation, and the Fund’s CLO allocation. By issuer, the largest positive contributors to total return

were CoreLogic, Global Medical Response, and Mitchell International, and the most significant detractors were Carestream Health, Lumen

Technologies, and Output Services Group.

Portfolio Activity and Positioning

During the period, we continued to dynamically

manage the Fund. The Fund’s largest sector overweights were Financial Services, Aerospace & Defense, and Healthcare Providers

& Services. The largest sector underweights were Software, Chemicals and Specialty Retail. The Fund increased its allocation to broadly

syndicated loans while reducing its exposure to high yield bonds.

| Annual Report | December 31, 2023 |

7 |

| Blackstone Long-Short Credit Income Fund |

Fund Summary |

December 31, 2023 (Unaudited)

Performance Summary

Performance quoted represents

past performance, which may be higher or lower than current performance. Past performance is not indicative of future results. The returns

shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end

performance, visit www.blackstone-credit.com.

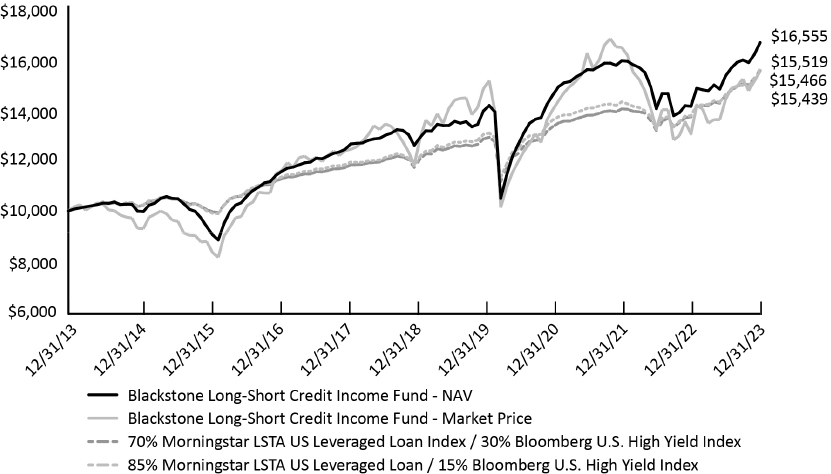

Value of a $10,000 Investment

BGX Total Return (as of December 31, 2023)

| |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

| NAV* |

17.64%** |

4.51% |

5.70% |

5.17% |

5.62% |

| Market Price* |

18.77% |

3.48% |

5.52% |

4.44% |

4.14% |

| 70% Morningstar LSTA US LLI / 30% Bloomberg U.S. HYI |

13.39% |

4.66% |

5.70% |

4.49% |

4.85% |

| 85% Morningstar LLI / 15% Bloomberg HYI*** |

13.36% |

5.21% |

5.75% |

4.46% |

4.70% |

| * | NAV is equal to the total assets attributable to common shareholders

less liabilities divided by the number of common shares outstanding. Market Price is the price at which a share can currently be traded

in the market. Market Price is based on the close price at 4 p.m. ET and does not represent the returns an investor would receive if

shares were traded at other times. Return assumes distributions are reinvested pursuant to the Fund’s dividend reinvestment plan.

Performance data quoted represents past performance and does not guarantee future results. |

| ** | Excludes adjustments in accordance with accounting principles

generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported

to the market as of December 31, 2023 may differ from the net asset value for financial reporting purposes. |

| *** | Effective June 1, 2023, BGX changed its benchmark from a composite

weighting of the Morningstar LLI and the Bloomberg U.S. High Yield Index (“Bloomberg HYI”) (70% loans, 30% high yield bonds)

to a composite weighting of the Morningstar LLI and the Bloomberg HYI (85% loans, 15% high yield bonds) in order to reflect the midpoint

of the Fund’s possible exposure to high yield bond investments, rather than the maximum level. |

| 8 |

www.blackstone-credit.com |

| Blackstone Long-Short Credit Income Fund |

Fund Summary |

December 31, 2023 (Unaudited)

BGX’s Portfolio Composition*

| * | Numbers may not sum to 100.00% due to rounding. The Fund’s Cash and Other represents net cash

and other assets and liabilities, which includes amounts payable for investments purchased but not yet settled and amounts receivable

for investments sold but not yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the

amount of cash on hand. The Fund uses sales proceeds or funds from its leverage program to settle amounts payable for investments purchased,

but such amounts are not reflected in the Fund’s net cash. |

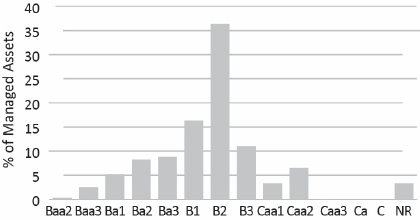

BGX’s Moody’s Rating Distribution*

| * | For more information on Moody's ratings and descriptions refer to https://ratings.moodys.io/ratings. |

Portfolio Characteristics

| Average All-In Rate |

8.93% |

| Current Dividend Yield^ |

10.79% |

| Effective Duration^^ |

0.40 yr |

| Average Position* |

0.23% |

| Leverage* |

31.62% |

| ^ | Using current dividend rate of $0.103/share and market price/share

as of December 31, 2023. |

| ^^ | Loan durations are based on the actual remaining time until

the underlying base rate is reset for each individual loan. |

| * | As a percentage of Managed Assets. |

Top 10 Issuers*

| Mitchell International, Inc. |

0.9% |

| UPC Financing Partnership |

0.9% |

| Atlas CC Acquisition Corp. |

0.9% |

| Global Medical Response, Inc. |

0.8% |

| Project Alpha Intermediate Holding Inc |

0.8% |

| Peraton Corp. |

0.8% |

| Clover Clo |

0.8% |

| Allied Universal Holdco LLC |

0.8% |

| Focus Financial Partners LLC |

0.8% |

| LTI Holdings, Inc. |

0.8% |

| Top 10 Issuer |

8.3% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change

and are not recommendations to buy or sell any security.

Top 5 Industries*^

| Software |

9.9% |

| Financial Services |

7.1% |

| Health Care Providers & Services |

6.0% |

| Hotels, Restaurants & Leisure |

5.4% |

| Aerospace & Defense |

5.2% |

| Top 5 Industries |

33.6% |

| * | As a percentage of Managed Assets. |

| ^ | GICS Industry Classification Schema. |

| Annual Report | December 31, 2023 |

9 |

| Blackstone Strategic Credit 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

Blackstone Strategic Credit 2027 Term Fund

Fund Overview

Blackstone Strategic Credit 2027 Term

Fund (“BGB” or herein, the “Fund”) is a closed-end term fund that trades on the New York Stock Exchange under

the symbol “BGB”. BGB’s primary investment objective is to seek high current income, with a secondary objective to seek

preservation of capital, consistent with its primary goal of high current income. BGB invests primarily in a diversified portfolio of

loans and other fixed income instruments of predominantly U.S. corporate issuers, including first- and second-lien loans (“Senior

Secured Loans”) and high yield corporate bonds of varying maturities. BGB must hold no less than 80% of its Managed Assets in credit

investments comprised of corporate fixed income instruments and other investments (including derivatives) with similar economic characteristics.

The Fund has a limited term and will dissolve on or about September 15, 2027, absent shareholder approval to extend such term.

Portfolio Management Commentary

Fund Performance

As of December 31, 2023, BGB outperformed

a composite weighting of the Morningstar LLI and the Bloomberg HYI (75% loans, 25% high yield bonds) on a NAV per share basis for the

one-year, ten-year, and since inception periods and underperformed its benchmark for the three-year and five-year periods. On a share

price basis, the Fund outperformed its benchmark for the one-year and three-year periods and underperformed for the five-year, ten-year,

and since inception periods. The shares of the Fund traded at an average discount to NAV of 12.2% for the twelve-months ended December

31, 2023, compared to its peer group average discount of 10.1% over the same period.

NAV Performance Factors

We believe the Fund’s outperformance

relative to the benchmark for the twelve months ended December 31, 2023, was primarily attributable to leverage and credit selection within

its loan allocation. By issuer, the largest positive contributors to total return were CoreLogic, Global Medical Response and National

Mentor Holdings, and the most significant detractors were Carestream Health, Output Services Group and Loyalty Ventures.

Portfolio Activity and Positioning

During the period, we continued to dynamically

manage the Fund. The Fund’s largest sector overweights were Healthcare Providers & Services, Professional Services and Financial

Services. The largest sector underweights were Specialty Retail, Containers & Packaging and Chemicals. The Fund increased its allocation

to broadly syndicated loans while reducing its exposure to high yield bonds.

| 10 |

www.blackstone-credit.com |

| Blackstone Strategic Credit 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

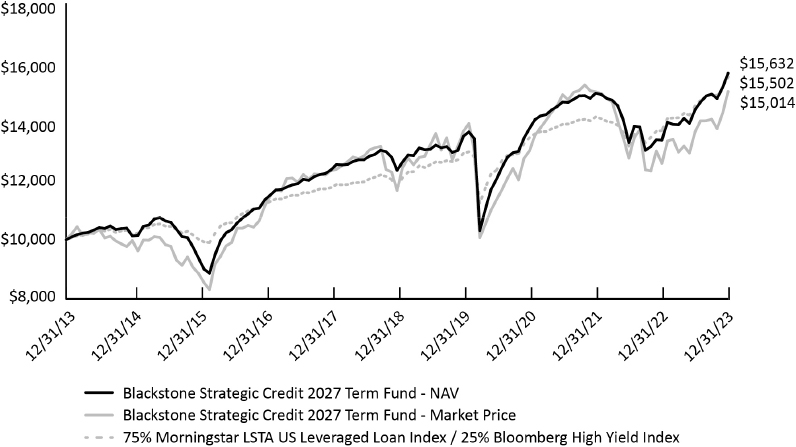

Performance Summary

Performance quoted represents past

performance, which may be higher or lower than current performance. Past performance is not indicative of future results. The returns

shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund shares. To obtain the most recent month-end

performance, visit www.blackstone-credit.com.

Value of a $10,000 Investment

BGB Total Return (as of December 31, 2023)

| |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

| NAV* |

16.91%** |

4.34% |

4.83% |

4.57% |

4.87% |

| Market Price* |

19.36% |

4.92% |

5.17% |

4.15% |

3.41% |

| 75% Morningstar LSTA US LLI / 25% Bloomberg HYI |

13.38% |

4.84% |

5.72% |

4.48% |

4.66% |

| * | NAV is equal to the total assets attributable to common shareholders

less liabilities divided by the number of common shares outstanding. Market Price is the price at which a share can currently be traded

in the market. Market Price is based on the close price at 4 p.m. ET and does not represent the returns an investor would receive if

shares were traded at other times. Return assumes distributions are reinvested pursuant to the Fund’s dividend reinvestment plan.

Performance data quoted represents past performance and does not guarantee future results. |

| ** | Excludes adjustments in accordance with accounting principles

generally accepted in the United States of America and as such, the net asset value and total return for shareholder transactions reported

to the market as of December 31, 2023 may differ from the net asset value for financial reporting purposes. |

| Annual Report | December 31, 2023 |

11 |

| Blackstone Strategic Credit 2027 Term Fund |

Fund Summary |

December 31, 2023 (Unaudited)

BGB’s Portfolio Composition*

| * | Numbers may not sum to 100.00% due to rounding. The Fund’s

Cash and Other represents net cash and other assets and liabilities, which includes amounts payable for investments purchased but not

yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased

but not yet settled exceeded the amount of cash on hand. The Fund uses sales proceeds or funds from its leverage program to settle amounts

payable for investments purchased, but such amounts are not reflected in the Fund’s net cash. |

BGB’s Moody’s Rating Distribution*

| * | For more information on Moody's ratings and descriptions refer

to https://ratings.moodys.io/ratings. |

Portfolio Characteristics

| Average All-In Rate |

8.61% |

| Current Dividend Yield^ |

9.96% |

| Effective Duration^^ |

0.62 yr |

| Average Position* |

0.22% |

| Leverage* |

36.68% |

| ^ | Using current dividend rate of $0.094/share and market price/share

as of December 31, 2023. |

| ^^ | Loan durations are based on the actual remaining time until

the underlying base rate is reset for each individual loan. |

| * | As a percentage of Managed Assets. |

Top 10 Issuers*

| Carnival Corp |

1.0% |

| Mitchell International, Inc. |

0.8% |

| UPC Financing Partnership |

0.8% |

| Peraton Corp. |

0.8% |

| Atlas CC Acquisition Corp. |

0.8% |

| Pro Mach Group, Inc. |

0.8% |

| Access CIG LLC |

0.8% |

| Project Alpha Intermediate Holding Inc |

0.8% |

| Global Medical Response, Inc. |

0.8% |

| Amwins Group Inc |

0.8% |

| Top 10 Issuer |

8.2% |

| * | As a percentage of Managed Assets. |

Portfolio holdings and distributions are subject to change

and are not recommendations to buy or sell any security.

Top 5 Industries*^

| Software |

8.8% |

| Health Care Providers & Services |

6.2% |

| Hotels, Restaurants & Leisure |

5.8% |

| Professional Services |

4.6% |

| Aerospace & Defense |

4.6% |

| Top 5 Industries |

30.0% |

| * | As a percentage of Managed Assets. |

| ^ | GICS Industry Classification Schema. |

| 12 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| FLOATING RATE LOAN INTERESTS(a)

- 138.23% | |

| | | |

| | |

| Aerospace & Defense - 6.22% | |

| | | |

| | |

| Amentum Government Services Holdings LLC, First Lien Term Loan, 3M US SOFR + 4.00%, 02/15/2029 | |

$ | 1,361,309 | | |

$ | 1,364,372 | |

| Atlas CC Acquisition Corp., First Lien B Term Loan, 3M US SOFR + 4.25%, 0.75% Floor, 05/25/2028 | |

| 1,988,216 | | |

| 1,856,954 | |

| Atlas CC Acquisition Corp., First Lien C Term Loan, 3M US SOFR + 4.25%, 0.75% Floor, 05/25/2028 | |

| 404,383 | | |

| 377,686 | |

| Avolon TLB Borrower 1 (US) TL, First Lien Term Loan, 1M US SOFR + 2.50%, 06/22/2028 | |

| 735,380 | | |

| 737,892 | |

| Dynasty Acquisition Co., Inc., First Lien Term Loan, 1M US SOFR + 4.00%, 08/24/2028 | |

| 158,802 | | |

| 159,411 | |

| LSF11 Trinity BidCo, Inc., First Lien Term Loan, First Lien

Term Loan, 6M US SOFR + 4.00%, 06/14/2030(b) | |

| 1,055,419 | | |

| 1,063,334 | |

| Nordam Group LLC, First Lien Initial Term Loan, 1M US SOFR + 5.50%, 04/09/2026 | |

| 1,676,400 | | |

| 1,544,803 | |

| Peraton Corp., First Lien B Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 02/01/2028 | |

| 2,281,669 | | |

| 2,290,225 | |

| Standard Aero, Ltd., First Lien Term Loan, 1M US SOFR + 4.00%, 08/24/2028 | |

| 68,058 | | |

| 68,319 | |

| TransDigm Inc., TLI, First Lien Term Loan, 3M US SOFR + 3.25%, 08/24/2028 | |

| 1,509,172 | | |

| 1,517,932 | |

| Vertex Aerospace Corp., First Lien Term Loan, 1M US SOFR + 3.75%, 12/06/2028 | |

| 852,129 | | |

| 854,110 | |

| | |

| | | |

| 11,835,038 | |

| Air Freight & Logistics - 2.11% | |

| | | |

| | |

| Clue Opco LLC, First Lien Term Loan, 3M US SOFR + 4.50%, 09/20/2030 | |

| 1,280,000 | | |

| 1,217,063 | |

| Rinchem Company, Inc., First Lien Term Loan, 3M US SOFR + 4.25%, 03/02/2029 | |

| 1,356,563 | | |

| 1,172,158 | |

| WWEX UNI TopCo Holdings LLC, First Lien Initial Term Loan, 3M US SOFR + 4.00%, 0.75% Floor, 07/26/2028 | |

| 1,655,881 | | |

| 1,627,466 | |

| | |

| | | |

| 4,016,687 | |

| Automobile Components - 2.70% | |

| | | |

| | |

| Belron Finance US LLC, First Lien Term Loan, 6M US L + 0.00%,

0.50% Floor, 04/18/2029(b) | |

| 362,159 | | |

| 363,970 | |

| Burgess Point Purchaser Corp., First Lien Term Loan, 1M US SOFR + 5.25%, 07/25/2029 | |

| 1,457,280 | | |

| 1,385,174 | |

| Clarios Global LP, TL, First Lien Term Loan, 3M US SOFR + 3.75%, 05/06/2030 | |

| 1,396,110 | | |

| 1,400,996 | |

| First Brands Group LLC, First Lien Term Loan, 3M US SOFR + 5.00%, 1.00% Floor, 03/30/2027 | |

| 867,192 | | |

| 862,319 | |

| First Brands Group, LLC, First Lien 2018 New Tranche E Term Loan, 3M US L + 2.50%, | |

| | | |

| | |

| 03/30/2027 | |

| 467,781 | | |

| 464,857 | |

| Phinia Inc., TL, First Lien Term Loan,

6M US SOFR + 3.75%, 07/03/2028(b) | |

| 651,700 | | |

| 655,366 | |

| | |

| | | |

| 5,132,682 | |

| Beverages - 0.80% | |

| | | |

| | |

| Triton Water Holdings, Inc., First Lien Initial Term Loan, 3M US SOFR + 3.50%, 0.50% Floor, 03/31/2028 | |

| 1,530,468 | | |

| 1,518,989 | |

| | |

| | | |

| | |

| Biotechnology - 0.97% | |

| | | |

| | |

| Grifols Worldwide Operations, TLB, First Lien Term Loan, 3M US SOFR + 2.00%, 11/15/2027 | |

| 1,846,054 | | |

| 1,848,362 | |

| | |

| | | |

| | |

| Building Products - 2.49% | |

| | | |

| | |

| CP Atlas Buyer, Inc., First Lien B Term Loan, 3M US SOFR + 3.50%, 0.50% Floor, 11/23/2027 | |

| 1,052,696 | | |

| 1,038,327 | |

| LBM Acquisition LLC, First Lien Initial Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 12/17/2027 | |

| 1,045,086 | | |

| 1,035,126 | |

| LHS Borrower, LLC, TL, First Lien Term Loan, 1M US SOFR + 4.75%, 0.50% Floor, 02/16/2029 | |

| 151,447 | | |

| 137,343 | |

| Oscar Acquisitionco LLC, First Lien Term Loan, 3M US SOFR + 4.50%, 0.50% Floor, 04/29/2029 | |

| 1,110,569 | | |

| 1,101,646 | |

| Tailwind Smith Cooper Intermediate Corp., First Lien Initial Term Loan, 3M US SOFR + 5.00%, 05/28/2026 | |

| 1,466,281 | | |

| 1,421,926 | |

| | |

| | | |

| 4,734,368 | |

| Capital Markets - 6.22% | |

| | | |

| | |

| Advisor Group Holdings, Inc., First Lien Term Loan, 1M US SOFR + 4.50%, 08/17/2028 | |

| 1,204,181 | | |

| 1,209,546 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

13 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| Capital Markets (continued) | |

| | | |

| | |

| Apex Group Treasury, Ltd., First Lien USD Term Loan, 3M US SOFR + 3.75%, 0.50% Floor, 07/27/2028 | |

$ | 1,443,518 | | |

$ | 1,439,909 | |

| AqGen Island Holdings, Inc., First Lien Term Loan, 3M US SOFR + 6.50%, 08/02/2029 | |

| 1,865,513 | | |

| 1,801,386 | |

| Aretec Group, Inc., First Lien Term Loan, 1M US SOFR + 4.50%, 08/09/2030 | |

| 1,181,934 | | |

| 1,182,738 | |

| Citadel Securities LP, First Lien Term Loan, 1M US SOFR + 2.50%, 07/29/2030 | |

| 437,333 | | |

| 438,882 | |

| CITCO FUNDING LLC TL 1L, First Lien Term Loan, 6M US SOFR + 3.25%, 04/27/2028 | |

| 478,794 | | |

| 481,114 | |

| Focus Financial Partners LLC, First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 3.50%, 06/30/2028 | |

| 537,429 | | |

| 539,492 | |

| 3M US L + 2.50%, 0.50% Floor, 06/30/2028 | |

| 1,978,449 | | |

| 1,982,041 | |

| Minotaur Acquisition, Inc., First Lien B Term Loan, 1M US SOFR + 4.75%, 03/27/2026 | |

| 1,302,109 | | |

| 1,304,082 | |

| The Citco Group Limited, TLB, First Lien Term Loan, 3M US SOFR + 3.50%, 04/27/2028 | |

| 1,456,680 | | |

| 1,463,053 | |

| | |

| | | |

| 11,842,243 | |

| Chemicals - 2.18% | |

| | | |

| | |

| Ecovyst Catalyst Technologies LLC, First Lien Term Loan, 3M US SOFR + 2.50%, 0.50% Floor, 06/09/2028 | |

| 1,639,848 | | |

| 1,644,570 | |

| Geon Performance Solutions LLC, First Lien Term Loan, 3M US SOFR + 4.75%, 0.75% Floor, 08/18/2028 | |

| 1,139,275 | | |

| 1,140,699 | |

| Nouryon Finance B.V., TLB, First Lien Term Loan, 3M US SOFR + 4.00%, 04/03/2028 | |

| 423,397 | | |

| 425,514 | |

| Nouryon USA LLC, First Lien Term Loan, 1M US SOFR + 4.00%, 04/03/2028 | |

| 940,158 | | |

| 945,005 | |

| | |

| | | |

| 4,155,788 | |

| Commercial Services & Supplies - 6.50% | |

| | | |

| | |

| Action Environmental Group, Inc., First Lien Term Loan, 3M US

SOFR + 4.50%, 0.50% Floor, 10/24/2030(b) | |

| 977,416 | | |

| 982,303 | |

| Allied Universal Holdco LLC, TLB, First Lien Term Loan, 3M US SOFR + 4.75%, 05/12/2028 | |

| 1,510,000 | | |

| 1,513,420 | |

| Aramark Intermediate HoldCo Corp., First Lien U.S. B-4 Term Loan, 1M US SOFR + 1.75%, 01/15/2027 | |

| 700,000 | | |

| 700,217 | |

| Belfor Holdings, Inc., First Lien Term Loan, 1M US SOFR + 3.75%, 0.50% Floor, 11/01/2030 | |

| 295,578 | | |

| 296,873 | |

| Covanta 11/21 TLB, First Lien Term Loan, 3M US L + 2.50%, 11/30/2028 | |

| 1,291,527 | | |

| 1,292,838 | |

| Covanta 11/21 TLC, First Lien Term Loan, 1M US SOFR + 2.50%, 11/30/2028 | |

| 98,467 | | |

| 98,567 | |

| Covanta Holding Corporation, TL, First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 3.00%, 11/30/2028 | |

| 29,070 | | |

| 29,142 | |

| 1M US SOFR + 3.00%, 11/30/2028 | |

| 386,624 | | |

| 387,591 | |

| DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 1M US SOFR + 6.75%, 0.75% Floor, 03/30/2029 | |

| 601,071 | | |

| 544,970 | |

| Garda World Security Corp., First Lien B-2 Term Loan, 1M US SOFR + 4.25%, 10/30/2026 | |

| 1,101,356 | | |

| 1,104,715 | |

| HOMESERVE USA HOLDING CORP. TLB 1L, First Lien Term Loan, 1M US SOFR + 3.00%, 10/21/2030 | |

| 353,882 | | |

| 355,430 | |

| Justrite Safety Group, First Lien Delayed Draw Term Loan, 1M US SOFR + 4.50%, 06/28/2026 | |

| 74,274 | | |

| 72,881 | |

| Justrite Safety Group, First Lien Initial Term Loan, 1M US SOFR + 4.50%, 06/28/2026 | |

| 1,370,300 | | |

| 1,344,607 | |

| Revspring, Inc., First Lien Initial Term Loan, 3M US SOFR + 4.00%, 10/11/2025 | |

| 1,254,000 | | |

| 1,249,818 | |

| Strategic Materials Holding Corp., Second Lien Initial Term

Loan, 3M US SOFR + 7.75%, 1.00% Floor, 10/31/2025(c) | |

| 800,000 | | |

| 18,200 | |

| TMF Sapphire Bidco B.V., TLB, First Lien Term Loan, 1M US SOFR + 5.00%, 05/03/2028 | |

| 290,909 | | |

| 293,454 | |

| TRC Companies, First Lien Term Loan, 3M US SOFR + 3.75%, 12/08/2028 | |

| 569,273 | | |

| 569,273 | |

| TRC Companies, Second Lien Term Loan, 1M US SOFR + 6.75%, 12/07/2029(b) | |

| 713,846 | | |

| 674,585 | |

| United Site Cov-Lite, First Lien Term Loan, 3M US SOFR + 4.25%, 12/15/2028 | |

| 1,076,712 | | |

| 845,833 | |

| | |

| | | |

| 12,374,717 | |

| Communications Equipment - 0.05% | |

| | | |

| | |

| MLN US HoldCo LLC, First Lien B Term Loan, 3M US SOFR + 4.50%, 11/30/2025 | |

| 854,492 | | |

| 99,689 | |

| | |

| | | |

| | |

| Construction & Engineering - 4.36% | |

| | | |

| | |

| Aegion Corp., First Lien Initial Term Loan, 1M US SOFR + 4.75%, 0.75% Floor, 05/17/2028 | |

| 1,427,479 | | |

| 1,430,448 | |

See Notes to Financial Statements.

| 14 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| Construction & Engineering (continued) | |

| | | |

| | |

| APi Group DE, Inc., First Lien Term Loan, 1M US SOFR + 2.50%, 01/03/2029 | |

$ | 906,058 | | |

$ | 907,920 | |

| Brookfield WEC Holdings, Inc., First Lien Initial (2021) Term Loan, 1M US SOFR + 2.75%, 0.50% Floor, 08/01/2025 | |

| 1,315,697 | | |

| 1,320,690 | |

| TK Elevator Midco GmbH, First Lien Facility B1 Term Loan, 6M US L + 3.50%, 0.50% Floor, 07/30/2027 | |

| 1,602,662 | | |

| 1,608,271 | |

| Tutor Perini Corp., First Lien B Term Loan, 1M US L + 4.75%, 1.00% Floor, 08/18/2027 | |

| 1,405,244 | | |

| 1,376,704 | |

| Victory Buyer LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 0.50% Floor, 11/19/2028 | |

| 1,729,443 | | |

| 1,647,294 | |

| | |

| | | |

| 8,291,327 | |

| Construction Materials - 1.03% | |

| | | |

| | |

| Quickrete Holdings, Inc., First Lien Initial Term Loan, 1M US SOFR + 2.625%, 02/01/2027 | |

| 1,484,536 | | |

| 1,494,282 | |

| Summit Materials LLC, First Lien Term Loan, 6M US SOFR + 3.00%, 11/30/2028 | |

| 203,957 | | |

| 204,850 | |

| Tamko Building Products LLC, First Lien Term Loan, 3M US SOFR + 3.50%, 09/20/2030 | |

| 251,130 | | |

| 252,648 | |

| | |

| | | |

| 1,951,780 | |

| Containers & Packaging - 2.55% | |

| | | |

| | |

| Berry Global, Inc., First Lien Term Loan, 3M US SOFR + 1.75%, 07/01/2026 | |

| 180,024 | | |

| 180,811 | |

| Proampac Pg Borrower LLC, First Lien Term Loan, 1M US SOFR + 4.75%, 0.50% Floor, 09/15/2028 | |

| 1,604,740 | | |

| 1,609,755 | |

| Reynolds Consumer Products LLC, First Lien Initial Term Loan, 1M US SOFR + 1.75%, 02/04/2027 | |

| 1,483,943 | | |

| 1,488,580 | |

| Tekni-Plex, Inc., First Lien Tranche B-3 Initial Term Loan, 3M US SOFR + 4.00%, 0.50% Floor, 09/15/2028 | |

| 1,573,827 | | |

| 1,571,537 | |

| | |

| | | |

| 4,850,683 | |

| Distributors - 0.48% | |

| | | |

| | |

| S&S Holdings LLC, First Lien Initial Term Loan, 3M US SOFR + 5.00%, 0.50% Floor, 03/11/2028 | |

| 925,371 | | |

| 907,442 | |

| | |

| | | |

| | |

| Diversified Consumer Services - 3.07% | |

| | | |

| | |

| Loyalty Ventures, Inc., First Lien Term Loan, PRIME + 3.50%,

11/03/2027(c) | |

| 490,359 | | |

| 6,742 | |

| McKissock Investment Holdings, LLC, First Lien Term Loan, 3M US SOFR + 5.00%, 03/12/2029 |

| 227,934 | | |

| 228,219 | |

| Prime Security Services Borrower, LLC, TL, First Lien Term Loan, 3M US SOFR + 2.50%, 10/13/2030 | |

| 634,649 | | |

| 637,276 | |

| Spring Education Group, Inc., TL, First Lien Term Loan, 6M US SOFR + 4.75%, 10/04/2030 | |

| 441,122 | | |

| 442,941 | |

| St. George's University Scholastic Services LLC, First Lien Term Loan B Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 02/10/2029 | |

| 1,756,182 | | |

| 1,758,597 | |

| TruGreen LP, First Lien Term Loan, 1M US SOFR + 4.00%, 0.75% Floor, 11/02/2027 | |

| 1,089,615 | | |

| 1,054,475 | |

| Weld North Education LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 0.50% Floor, 12/21/2027 | |

| 1,711,021 | | |

| 1,713,340 | |

| | |

| | | |

| 5,841,590 | |

| Diversified REITs - 0.25% | |

| | | |

| | |

| Iron Mountain, Inc., First Lien Term Loan, 6M US L + 0.00%, 01/31/2031 | |

| 468,543 | | |

| 469,276 | |

| | |

| | | |

| | |

| Diversified Telecommunication Services - 4.73% | |

| | | |

| | |

| Level 3 Financing, Inc., First Lien Term Loan, First Lien Term

Loan, 6M US SOFR + 1.75%, 03/01/2027(b) | |

| 1,502,467 | | |

| 1,449,881 | |

| Lumen Technologies, Inc., First Lien Term Loan, First Lien Term

Loan, 6M US L + 0.00%, 03/15/2027(b) | |

| 1,436,201 | | |

| 998,160 | |

| Radiate Holdco, LLC,, First Lien Term Loan, 1M US SOFR + 3.25%, 09/25/2026 | |

| 1,283,627 | | |

| 1,033,923 | |

| Telenet Financing USD LLC, First Lien Term Loan, 1M US SOFR + 2.00%, 04/30/2028 | |

| 1,942,903 | | |

| 1,935,860 | |

| UPC Financing Partnership, First Lien Facility AT Term Loan, 1M US SOFR + 2.25%, 04/30/2028 | |

| 2,182,983 | | |

| 2,178,890 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

15 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| Diversified Telecommunication Services (continued) | |

| | | |

| | |

| Zacapa S.A.R.L., First Lien Term Loan, 3M US SOFR + 4.00%, 03/22/2029 | |

$ | 1,409,550 | | |

$ | 1,408,767 | |

| | |

| | | |

| 9,005,481 | |

| Electric Utilities - 1.07% | |

| | | |

| | |

| Generation Bridge Northeast LLC, First Lien Term Loan, 1M US SOFR + 4.25%, 08/22/2029 | |

| 590,424 | | |

| 593,500 | |

| Vistra Operations Co. LLC, First Lien 2018 Incremental Term Loan, 1M US SOFR + 2.00%, 12/31/2025 | |

| 1,447,059 | | |

| 1,448,933 | |

| | |

| | | |

| 2,042,433 | |

| Electrical Equipment - 0.86% | |

| | | |

| | |

| INNIO Group Holding GmbH Term Loan, First Lien Term Loan, 6M US SOFR + 4.50%, 10/31/2028 | |

| 184,930 | | |

| 185,315 | |

| Madison IAQ LLC, First Lien Initial Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 06/21/2028 | |

| 1,446,310 | | |

| 1,443,844 | |

| | |

| | | |

| 1,629,159 | |

| Electronic Equipment, Instruments & Components - 1.91% | |

| | | |

| | |

| Chariot Buyer LLC, First Lien Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 11/03/2028 | |

| 352,730 | | |

| 352,352 | |

| Coherent Corp., First Lien Term Loan, 1M US SOFR + 2.75%, 0.50% Floor, 07/02/2029 | |

| 1,047,206 | | |

| 1,053,097 | |

| LTI Holdings, Inc., First Lien Term Loan, 1M US SOFR + 4.75%, 07/24/2026 | |

| 414,068 | | |

| 402,164 | |

| LTI Holdings, Inc., Second Lien Initial Term Loan, 1M US SOFR + 6.75%, 09/06/2026 | |

| 468,085 | | |

| 421,473 | |

| Miron Technologies, Inc., First Lien Term Loan, 3M US SOFR + 2.75%, 10/20/2028 | |

| 1,391,584 | | |

| 1,398,020 | |

| | |

| | | |

| 3,627,106 | |

| Entertainment - 1.25% | |

| | | |

| | |

| CE Intermediate I LLC, First Lien Term Loan, 3M US SOFR + 3.50%, 0.50% Floor, 11/10/2028 | |

| 855,840 | | |

| 849,421 | |

| EP Purcasher, LLC, First Lien Term Loan, 3M US SOFR + 3.50%, 11/06/2028 | |

| 1,541,775 | | |

| 1,531,491 | |

| | |

| | | |

| 2,380,912 | |

| Financial Services - 2.54% | |

| | | |

| | |

| FleetCor Technologies Operating Co. LLC, First Lien Term Loan, 1M US SOFR + 1.75%, | |

| | | |

| | |

| 04/28/2028 | |

| 1,184,825 | | |

| 1,187,142 | |

| Mitchell International, Inc., First Lien Term Loan, 1M US SOFR + 3.75%, 10/15/2028 | |

| 1,497,108 | | |

| 1,498,620 | |

| Mitchell International, Inc., Second Lien Term Loan, 1M US SOFR + 6.50%, 10/15/2029 | |

| 862,371 | | |

| 849,168 | |

| Polaris Newco LLC, First Lien Dollar Term Loan, 1M US SOFR + 4.00%, 0.50% Floor, 06/02/2028 | |

| 1,318,674 | | |

| 1,302,685 | |

| | |

| | | |

| 4,837,615 | |

| Food Products - 2.28% | |

| | | |

| | |

| CH Guenther 11/21 TL, First Lien Term Loan, 1M US SOFR + 3.00%,

12/08/2028(b) | |

| 1,270,176 | | |

| 1,273,352 | |

| Froneri International, Ltd., First Lien Facility B2 Term Loan, 1M US SOFR + 2.25%, 01/29/2027 | |

| 1,723,805 | | |

| 1,727,769 | |

| Snacking Investments BidCo Pty, Ltd., First Lien Initial US Term Loan, 3M US SOFR + 4.00%, 1.00% Floor, 12/18/2026 | |

| 1,154,001 | | |

| 1,155,686 | |

| Sovos Brands Intermediate, Inc., First Lien Term Loan, 3M US SOFR + 3.50%, 0.75% Floor, 06/08/2028 | |

| 188,049 | | |

| 188,993 | |

| | |

| | | |

| 4,345,800 | |

| Ground Transportation - 2.97% | |

| | | |

| | |

| Avis Budget Car Rental LLC, First Lien Term Loan, 1M US SOFR + 1.75%, 08/06/2027 | |

| 1,332,648 | | |

| 1,331,648 | |

| Kenan Advantage Group, Inc., First Lien U.S. B-1 Term Loan, 6M US SOFR + 4.18%, 0.75% Floor, 03/24/2026 | |

| 1,337,493 | | |

| 1,335,039 | |

| Uber Technologies, Inc., TLB, First Lien Term Loan, 3M US SOFR + 2.75%, 03/03/2030 | |

| 1,242,891 | | |

| 1,247,944 | |

See Notes to Financial Statements.

| 16 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| Ground Transportation (continued) | |

| | | |

| | |

| XPO, Inc., TLB, First Lien Term Loan, 1M US SOFR + 2.00%, 05/24/2028 | |

$ | 1,731,298 | | |

$ | 1,740,717 | |

| | |

| | | |

| 5,655,348 | |

| Health Care Equipment & Supplies - 2.07% | |

| | | |

| | |

| Auris Luxembourg III SARL, First Lien Facility B2 Term Loan, 6M US SOFR + 0.00%, 02/27/2026 | |

| 2,266,932 | | |

| 2,243,696 | |

| Carestream Health, Inc. TL 1L, First Lien Term Loan, 3M US L + 7.50%, 09/30/2027 | |

| 150,441 | | |

| 117,580 | |

| Femur Buyer, Inc., First Lien Initial Term Loan, 3M US SOFR + 4.50%, 03/05/2026 | |

| 636,149 | | |

| 575,078 | |

| Resonetics LLC, First Lien Initial Term Loan, 3M US SOFR + 4.00%, 0.75% Floor, 04/28/2028 | |

| 994,924 | | |

| 996,998 | |

| | |

| | | |

| 3,933,352 | |

| Health Care Providers & Services - 9.31% | |

| | | |

| | |

| Covenant Surgical Partners, Inc., First Lien Delayed Draw Term Loan, 3M US SOFR + 4.00%, 07/01/2026 | |

| 269,360 | | |

| 210,909 | |

| Covenant Surgical Partners, Inc., First Lien Initial Term Loan, 1M US L + 4.00%, 07/01/2026 | |

| 1,293,219 | | |

| 1,012,591 | |

| DaVita, Inc., First Lien B Term Loan, 1M US SOFR + 1.75%, 08/12/2026 | |

| 953,610 | | |

| 954,377 | |

| Electron Bidco, Inc., First Lien Term Loan, 1M US SOFR + 3.00%, 11/01/2028 | |

| 988,656 | | |

| 992,363 | |

| Global Medical Response, Inc., First Lien 2018 New Term Loan, 1M US SOFR + 4.25%, 1.00% Floor, 03/14/2025 | |

| 2,306,684 | | |

| 1,817,160 | |

| Global Medical Response, Inc., First Lien 2020 Refinancing Term Loan, 3M US SOFR + 4.25%, 1.00% Floor, 10/02/2025 | |

| 696,410 | | |

| 549,005 | |

| Heartland Dental, LLC, TL, First Lien Term Loan, 1M US SOFR + 5.00%, 04/28/2028 | |

| 1,169,296 | | |

| 1,168,934 | |

| Midwest Physcn Admin Srvcs LLC, TL, First Lien Term Loan, 3M US SOFR + 3.25%, 03/12/2028 | |

| 937,475 | | |

| 853,102 | |

| NAPA Management Services Corp., First Lien Term Loan, 3M US SOFR + 5.25%, 0.75% Floor, 02/23/2029 | |

| 1,145,490 | | |

| 1,057,310 | |

| National Mentor Holdings, Inc., TL, First Lien Term Loan, 3M US SOFR + 3.75%, 03/02/2028 | |

| 804,692 | | |

| 735,118 | |

| National Mentor Holdings, Inc., TLC, First Lien Term Loan, 3M US SOFR + 3.75%, 03/02/2028 | |

| 23,078 | | |

| 21,083 | |

| Onex TSG Intermediate Corp., First Lien Initial Term Loan, 3M US SOFR + 4.75%, 0.75% Floor, 02/28/2028 | |

| 1,381,190 | | |

| 1,366,514 | |

| Outcomes Group Holdings, Inc., Second Lien Initial Term Loan, 3M US SOFR + 7.50%, 10/26/2026(b) | |

| 162,722 | | |

| 150,518 | |

| Pathway Vet Alliance LLC, First Lien 2021 Replacement Term Loan, 1M US SOFR + 3.75%, 03/31/2027 | |

| 1,507,467 | | |

| 1,332,933 | |

| Pediatric Associates Holding Co. LLC, First Lien Term Loan, 3M US SOFR + 3.25%, 0.50% Floor, 12/29/2028 | |

| 1,420,220 | | |

| 1,377,613 | |

| Phoenix Guarantor, Inc., First Lien Tranche B-3 Term Loan, 1M US SOFR + 3.50%, 03/05/2026 | |

| 1,038,733 | | |

| 1,040,193 | |

| Radiology Partners, Inc., First Lien Term Loan, 1M US SOFR + 4.25%, 07/09/2025 | |

| 1,260,716 | | |

| 1,023,153 | |

| Radnet Management, Inc., First Lien Initial Term Loan, 1M US SOFR + 3.00%, 0.75% Floor, 04/23/2028 | |

| 566,215 | | |

| 568,729 | |

| Surgery Center Holdings, INC., Term Loan, First Lien Term Loan, 6M US SOFR + 4.00%, 12/19/2030 | |

| 310,874 | | |

| 312,526 | |

| U.S. Anesthesia Partners, Inc., First Lien Term Loan, 1M US SOFR + 4.25%, 0.50% Floor, 10/01/2028 | |

| 1,278,078 | | |

| 1,172,994 | |

| | |

| | | |

| 17,717,125 | |

| Health Care Technology - 2.58% | |

| | | |

| | |

| Gainwell Acquisition Corp., First Lien Term Loan, 3M US SOFR + 4.00%, 0.75% Floor, 10/01/2027 | |

| 1,131,800 | | |

| 1,103,505 | |

| GHX Ultimate Parent Corp, TL, First Lien Term Loan, 3M US SOFR + 4.75%, 06/30/2027 | |

| 1,194,073 | | |

| 1,198,802 | |

| Project Ruby Ultimate Parent Corp., First Lien Closing Date Term Loan, 1M US SOFR + 3.25%, 0.75% Floor, 03/10/2028 | |

| 732,195 | | |

| 732,979 | |

See Notes to Financial Statements.

| Annual Report | December 31, 2023 |

17 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| Health Care Technology (continued) | |

| | | |

| | |

| Verscend Holding Corp., First Lien B-1 Term Loan, 1M US SOFR + 4.00%, 08/27/2025 | |

$ | 1,873,201 | | |

$ | 1,881,780 | |

| | |

| | | |

| 4,917,066 | |

| Hotels, Restaurants & Leisure - 6.19% | |

| | | |

| | |

| 1011778 BC Unlimited Liability Company, First Lien Term Loan, 1M US SOFR + 2.25%, 0.50% Floor, 09/23/2030 | |

| 888,369 | | |

| 889,795 | |

| Bally's Corp., First Lien Term Loan, 3M US SOFR + 3.25%, 0.50% Floor, 10/02/2028 | |

| 1,371,972 | | |

| 1,304,032 | |

| BCPE Grill Parent, Inc.TLB, First Lien Term Loan, 1M US SOFR + 4.75%, 09/30/2030 | |

| 436,000 | | |

| 428,551 | |

| Caesars Entertainment, Inc., First Lien Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 02/06/2030 | |

| 1,320,602 | | |

| 1,325,864 | |

| Carnival Corp., First Lien Term Loan, 1M US SOFR + 3.25%, 0.75% Floor, 10/18/2028 | |

| 1,372,799 | | |

| 1,376,808 | |

| Entain PLC, First Lien Term Loan, 3M US L + 7.51%, 0.50% Floor, 10/31/2029 | |

| 1,300,779 | | |

| 1,304,844 | |

| Fertitta Entertainment, LLC, First Lien Term Loan, 1M US SOFR + 4.00%, 01/27/2029 | |

| 1,138,413 | | |

| 1,140,371 | |

| Flutter Financing B.V., First Lien Term Loan, 3M US SOFR + 3.25%, 0.50% Floor, 07/22/2028 | |

| 508,673 | | |

| 511,074 | |

| Flutter Financing B.V., TL, First Lien Term Loan, 3M US SOFR + 2.25%, 11/25/2030 | |

| 1,341,295 | | |

| 1,346,325 | |

| IRB Holding Corp., First Lien Term Loan, 3M US SOFR + 3.00%, 0.75% Floor, 12/15/2027 | |

| 1,690,458 | | |

| 1,695,284 | |

| Whatabrands LLC, First Lien Initial B Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 08/03/2028 | |

| 452,275 | | |

| 453,609 | |

| | |

| | | |

| 11,776,557 | |

| Household Durables - 0.70% | |

| | | |

| | |

| Culligan 11/23 Incre CovLi TL 1L, First

Lien Term Loan, 6M US SOFR + 4.50%, 07/31/2028(d) | |

| 1,332,978 | | |

| 1,341,310 | |

| | |

| | | |

| | |

| Independent Power and Renewable Electricity Producers - 0.78% | |

| | | |

| | |

| Calpine Corp., First Lien Term Loan, 1M US SOFR + 2.00%, 04/05/2026 | |

| 1,332,558 | | |

| 1,336,829 | |

| Eastern Power LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 1.00% Floor, 10/02/2025 | |

| 155,996 | | |

| 153,765 | |

| | |

| | | |

| 1,490,594 | |

| Insurance - 3.27% | |

| | | |

| | |

| AmWINS Group, Inc., First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 2.25%, 0.75% Floor, 02/19/2028 | |

| 1,436,202 | | |

| 1,440,245 | |

| 1M US SOFR + 2.75%, 0.75% Floor, 02/19/2028 | |

| 224,956 | | |

| 225,870 | |

| Baldwin Risk Partners, LLC, First Lien Initial Term Loan, 1M US SOFR + 3.50%, 10/14/2027 | |

| 1,347,577 | | |

| 1,349,820 | |

| Hyperion Refinance S.a r.l. TL, First Lien Term Loan, 3M US SOFR + 0.00%, 0.50% Floor, 04/18/2030 | |

| 1,459,882 | | |

| 1,465,050 | |

| NFP Corp., First Lien Closing Date Term Loan, 1M US SOFR + 3.25%, 02/16/2027 | |

| 1,400,089 | | |

| 1,408,951 | |

| USI, Inc., First Lien Term Loan, 3M US SOFR + 3.25%, 09/27/2030 | |

| 324,701 | | |

| 325,613 | |

| | |

| | | |

| 6,215,549 | |

| Interactive Media & Services - 1.73% | |

| | | |

| | |

| Adevinta ASA, First Lien Facility B2 Term Loan, 3M US SOFR + 2.75%, 0.75% Floor, 06/26/2028 | |

| 207,821 | | |

| 210,569 | |

| Foundational Education Group, Inc., First Lien Term Loan, 3M

US SOFR + 3.75%, 08/31/2028(b) | |

| 34,393 | | |

| 33,705 | |

| LI Group Holdings, Inc., First Lien 2021 Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 03/11/2028 | |

| 1,290,593 | | |

| 1,294,626 | |

| MH Sub I LLC, First Lien Term Loan, 1M US SOFR + 4.25%, 05/03/2028 | |

| 1,114,400 | | |

| 1,097,684 | |

| MH Sub I LLC, Second Lien 2021 Replacement Term Loan, 1M US SOFR + 6.25%, 02/23/2029 | |

| 705,038 | | |

| 662,104 | |

| | |

| | | |

| 3,298,688 | |

| IT Services - 6.40% | |

| | | |

| | |

| Access CIG LLC, First Lien Term Loan, 1M US SOFR + 5.00%, 0.50% Floor, 08/18/2028 | |

| 748,125 | | |

| 750,310 | |

| Access CIG LLC, Second Lien Initial Term Loan, 3M US SOFR + 7.75%, 02/27/2026 | |

| 1,074,290 | | |

| 1,073,393 | |

| AG Group Holdings, Inc., First Lien Term Loan, 3M US SOFR + 4.00%, 12/29/2028 | |

| 1,342,713 | | |

| 1,335,167 | |

See Notes to Financial Statements.

| 18 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

December 31, 2023

| | |

Principal Amount | | |

Value | |

| IT Services (continued) | |

| | | |

| | |

| Dcert Buyer, Inc., Second Lien First Amendment Refinancing Term Loan, 6M US SOFR + 7.00%, 02/19/2029 | |

$ | 1,881,655 | | |

$ | 1,721,714 | |

| Newfold Digital Holdings Group, Inc., First Lien Initial Term Loan, 6M US SOFR + 3.50%, 0.75% Floor, 02/10/2028 | |

| 2,344,619 | | |

| 2,303,226 | |

| Park Place Technologies LLC, First Lien Closing Date Term Loan, 1M US SOFR + 5.00%, 1.00% Floor, 11/10/2027 | |

| 881,094 | | |

| 879,204 | |

| Skopima Merger Sub Inc., First Lien Initial Term Loan, 1M US SOFR + 4.00%, 05/12/2028 | |

| 810,301 | | |

| 808,782 | |

| Vaco Holdings, LLC, First Lien Term Loan, 3M US SOFR + 5.00%, 01/21/2029 | |

| 1,426,396 | | |

| 1,411,241 | |

| Virtusa Corp., First Lien Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 02/11/2028 | |

| 1,492,327 | | |

| 1,497,774 | |

| World Wide Technology Holding Co., LLC, TL, First Lien Term Loan, 1M US SOFR + 3.25%, 03/01/2030 | |

| 408,342 | | |

| 410,386 | |

| | |

| | | |

| 12,191,197 | |

| Leisure Products - 0.13% | |

| | | |

| | |

| Recess Holdings, Inc., First Lien Term

Loan, 3M US SOFR + 4.00%, 1.00% Floor, 03/29/2027(b) | |

| 240,760 | | |

| 242,867 | |

| | |

| | | |

| | |

| Life Sciences Tools & Services - 2.64% | |

| | | |

| | |

| Catalent Pharma Solutions, Inc., First Lien Term Loan, 1M US SOFR + 2.00%, 0.50% Floor, 02/22/2028 | |

| 836,794 | | |

| 822,883 | |

| Curia Global, Inc., First Lien 2021 Term Loan, 3M US SOFR + 3.75%, 0.75% Floor, 08/30/2026 | |

| 1,513,154 | | |

| 1,366,098 | |

| IQVIA INC., TL, First Lien Term Loan, 3M US SOFR + 2.00%, 01/02/2031 | |

| 195,192 | | |

| 196,221 | |

| Loire UK Midco 3, Ltd., First Lien Facility B2 Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 04/21/2027 |

|

| 927,893 | | |

| 908,640 | |

| Maravai Intermediate Holdings LLC, First Lien Term Loan, 1M US L + 3.25%, 0.50% Floor, 10/19/2027 | |

| 343,825 | | |

| 336,663 | |

| Parexel International Corporation, First Lien Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 11/15/2028 | |

| 1,381,479 | | |

| 1,391,322 | |

| | |

| | | |

| 5,021,827 | |

| Machinery - 3.84% | |

| | | |

| | |

| Asp Blade Holdings, Inc. TLB, First Lien Term Loan, 3M US SOFR + 4.00%, 0.50% Floor, 10/13/2028 | |

| 239,551 | | |

| 214,848 | |

| Bettcher Industries, Inc., First Lien Term Loan, 1M US SOFR + 4.00%, 12/14/2028 | |

| 832,239 | | |

| 829,380 | |