Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 29 2023 - 8:55AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE

ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Commission File Number: 001-36206

BIT Mining Limited

428 South Seiberling Street

Akron, Ohio 44306

United States of America

+1 (346) 204-8537

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form 40-F ¨

EXHIBITS

Exhibit 99.1 – BIT Mining Limited Agrees to Sell its Mining Pool Business

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

BIT MINING LIMITED |

| |

|

| |

By: |

/s/ Xianfeng Yang |

| |

Name: |

Xianfeng Yang |

| |

Title: |

Chief Executive Officer |

Date: December 29, 2023

Exhibit 99.1

BIT Mining Limited Agrees to Sell its Mining

Pool Business

AKRON, Ohio, December 29, 2023 /PRNewswire/ – BIT Mining Limited

(NYSE: BTCM) (“BIT Mining,” “the Company,” “we,” “us,” or “our company”),

a leading technology-driven cryptocurrency mining company, today announced that it has agreed to sell its entire mining pool business

operated under BTC.com (the “Business”) to Esport – Win Limited, a Hong Kong limited liability company, for a total

consideration of US$5 million. The sale of the Business is expected to result in an increase of approximately US$16 million in the total

shareholders’ equity of BIT Mining, since the Business has approximately US$11 million in cryptocurrency net liability. The sale

does not include or affect any of BIT Mining’s other businesses.

The sale of the Business is subject to certain closing conditions and

applicable regulatory approvals and is expected to close upon satisfaction of the closing conditions.

The Business generated revenues of US$593.2 million, or 91.2% of BIT

Mining’s total revenues, in the year ended December 31, 2022. However, in accordance with the Company’s business model, a

considerable amount of mining rewards is payable to each pool participant in exchange for the computing power they contribute to the mining

pool. As disclosed in the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2022, the cost and expense

of mining pool services for the full year 2022 was US$595.8 million. Consequently, the Business recorded a full-year net operating loss

of US$2.6 million. The Company expects the sale to result in improved profitability and a solid cash position.

Xianfeng Yang, Chief Executive Officer of BIT Mining, commented, “By

selling the loss-making mining pool business, we will be more resilient with our core resources focused on advancing the research and

development of our existing businesses. Meanwhile, the cash proceeds from the transaction and our company’s enhanced profitability

outlook will further strengthen our position to explore new areas with greater potential and room for future expansion . Moving forward,

we will strive to unlock considerable synergistic potential across our existing business segments, propelling our company’s technology-driven

growth and creating long-term value for our shareholders.”

About BIT Mining Limited

BIT Mining (NYSE: BTCM) is a leading technology-driven cryptocurrency

mining company with operations in cryptocurrency mining, data center operation and mining machine manufacturing. The Company is strategically

creating long-term value across the industry with its cryptocurrency ecosystem. Anchored by its cost-efficient data centers that strengthen

its profitability with steady cash flow, the Company also conducts self-mining operations that enhance its marketplace resilience by leveraging

self-developed and purchased mining machines to seamlessly adapt to dynamic cryptocurrency pricing. The Company also owns 7-nanometer

BTC chips and has strong capabilities in the development of LTC/DOGE miners and ETC miners.

Forward-Looking Statements

This news release contains forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “target,” “going forward,” “outlook” and

similar statements. Such statements are based upon management’s current expectations and current market and operating

conditions and relate to events that involve known or unknown risks, uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control, which may cause the Company’s actual results, performance or

achievements to differ materially from those in the forward-looking statements. Important factors that could cause BIT

Mining’s actual results to differ materially from those indicated in the forward-looking statements. Further information

regarding these and other risks, uncertainties or factors is included in the Company’s filings with the U.S. Securities and

Exchange Commission. The Company does not undertake any obligation to update any forward-looking statement as a result of new

information, future events or otherwise, except as required under law.

For more information:

BIT Mining Limited

ir@btcm.group

ir.btcm.group

www.btcm.group

Piacente Financial Communications

Brandi Piacente

Tel: +1 (212) 481-2050

Email: BITMining@thepiacentegroup.com

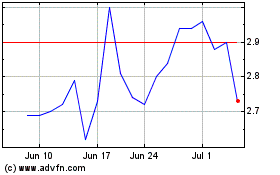

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bit Mining (NYSE:BTCM)

Historical Stock Chart

From Nov 2023 to Nov 2024