Regulators Fine Bank of America $225 Million Over Prepaid Card Program for Unemployment Benefits

July 14 2022 - 3:30PM

Dow Jones News

By Michael Dabaie

Federal regulators said they fined Bank of America $225 million

over disbursement of state unemployment benefits during the

pandemic.

The Office of the Comptroller of the Currency said Thursday it

assessed a $125 million civil money penalty against Bank of America

N.A., alleging violations relating to the bank's administration of

a prepaid card program to distribute unemployment insurance and

other public benefit payments.

At the same time, the Consumer Financial Protection Bureau said

it fined Bank of America $100 million, saying the company botched

the disbursement of state unemployment benefits at the height of

the pandemic.

The bank administered the Unemployment Benefits Prepaid Card

Program on behalf of 12 states. The OCC said the bank failed to

adequately investigate and resolve consumer claims of unauthorized

transactions. The OCC said it also found other deficiencies in the

bank's administration of the program, including in operational

processes, risk management, and internal controls. Beginning in

2020, these deficiencies resulted in violations of law and harm to

consumers, OCC said.

"Bank of America was hired by states to administer unemployment

payments and the states were responsible for reviewing and

approving applications and directing us to issue payments. Bank of

America's support to the states enabled the government to

successfully issue more than $250 billion in pandemic unemployment

benefits to more than 14 million people and overall distributed

more pandemic relief to Americans than any other bank," Bank of

America said in a statement. "In addition, we provided assistance

to millions more by deferring mortgage, credit card and other

payments."

The CFPB said in a statement that "Bank of America automatically

and unlawfully froze people's accounts with a faulty fraud

detection program, and then gave them little recourse when there

was, in fact, no fraud."

The order requires the bank to provide remediation to consumers

whose access to unemployment benefits was denied or delayed. The

order also requires the bank to take corrective action to improve

its risk management and oversight, OCC said.

"This action arose despite the government's own acknowledgement

that the unemployment program expansion during the pandemic created

unprecedented criminal activity where illegal applicants were able

to get states to approve tens of billions of dollars in payments,"

Bank of America said.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

July 14, 2022 15:15 ET (19:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

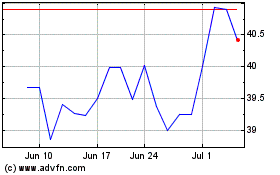

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2024 to May 2024

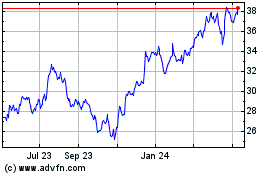

Bank of America (NYSE:BAC)

Historical Stock Chart

From May 2023 to May 2024