Asbury Automotive Group, Inc. (NYSE: ABG) (the “Company”), one

of the largest automotive retail and service companies in the U.S.,

today announced its board of directors increased the Company’s

common stock repurchase authorization by $108 million to a total of

$200 million.

“Our robust cash flow and strong balance sheet, enabled by our

business model execution, continues to power our capital allocation

strategy,” said David Hult, Asbury’s President and Chief Executive

Officer.

For full year 2022, the Company repurchased approximately 1.6

million shares of its common stock for $287 million. Year-to-date

2023, the Company also repurchased approximately 115,000 shares for

$20 million.

Under the share repurchase program, the shares of common stock

of the Company may be purchased from time to time in the open

market, in privately negotiated transactions or in other manners as

permitted by federal securities laws and other legal and

contractual requirements. The extent to which the Company

repurchases its shares, the number of shares and the timing of any

repurchase will depend on such factors as Asbury’s stock price,

general economic and market conditions, the potential impact on its

capital structure, the expected return on competing uses of capital

such as strategic dealership acquisitions and capital investments

and other considerations. The program does not require the Company

to repurchase any specific number of shares, and may be modified,

suspended or terminated at any time without further notice.

About Asbury Automotive Group,

Inc.

Asbury Automotive Group, Inc. (NYSE: ABG), a Fortune 500 company

headquartered in Duluth, GA, is one of the largest automotive

retailers in the U.S. In December 2020, Asbury embarked on a

five-year plan to increase revenue and profitability strategically

through organic and acquisitive growth as well as their innovative

Clicklane digital vehicle purchasing platform, with its

guest-centric approach as Asbury’s constant North Star. Asbury

currently operates 139 dealerships, consisting of 187 franchises,

representing 31 domestic and foreign brands of vehicles. Asbury

also operates Total Care Auto, Powered by Landcar, a leading

provider of service contracts and other vehicle protection

products, seven stand-alone used vehicle stores, 32 collision

repair centers, an auto auction, and a used vehicle wholesale

business. Asbury offers an extensive range of automotive products

and services, including new and used vehicles; parts and service,

which includes vehicle repair and maintenance services, replacement

parts and collision repair services; and finance and insurance

products, including arranging vehicle financing through third

parties and aftermarket products, such as extended service

contracts, guaranteed asset protection debt cancellation, and

prepaid maintenance.

For additional information, visit www.asburyauto.com.

Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements are statements other than

historical fact, and may include statements relating to goals,

plans, objectives, projections regarding Asbury's financial

position, liquidity, results of operations, cash flows, leverage,

market position and dealership portfolio, revenue enhancement

strategies, operational improvements, projections regarding the

expected benefits of Clicklane, management’s plans, projections and

objectives for future operations, scale and performance,

integration plans and expected synergies from acquisitions, capital

allocation strategy, business strategy and expectations of our

management with respect to, among other things: changes in general

economic and business conditions, including increases in interest

rates and rising fuel prices, any impact of COVID-19 on the

automotive industry in general, the automotive retail industry in

particular and our customers, suppliers, vendors and business

partners; our relationships with vehicle manufacturers; our ability

to maintain our margins; operating cash flows and availability of

capital; capital expenditures; the amount of our indebtedness; the

completion of any future acquisitions and divestitures; future

return targets; future annual savings; general economic trends,

including consumer confidence levels, interest rates, inflation,

and fuel prices; and automotive retail industry trends. These

statements are based on management's current expectations and

beliefs and involve significant risks and uncertainties that may

cause results to differ materially from those set forth in the

statements. These risks and uncertainties include, among other

things, our inability to realize the benefits expected from

recently completed transactions; our inability to promptly and

effectively integrate completed transactions and the diversion of

management’s attention from ongoing business and regular business

responsibilities; our inability to complete future acquisitions or

divestitures and the risks resulting therefrom; any impact from the

COVID-19 pandemic on our industry and business, market factors,

Asbury's relationships with, and the financial and operational

stability of, vehicle manufacturers and other suppliers, acts of

God, acts of war or other incidents and the shortage of

semiconductor chips and other components, which may adversely

impact supply from vehicle manufacturers and/or present retail

sales challenges; risks associated with Asbury's indebtedness and

our ability to comply with applicable covenants in our various

financing agreements, or to obtain waivers of these covenants as

necessary; risks related to competition in the automotive retail

and service industries, general economic conditions both nationally

and locally, governmental regulations, legislation, including

changes in automotive state franchise laws, adverse results in

litigation and other proceedings, and Asbury's ability to execute

its strategic and operational strategies and initiatives, including

its five-year strategic plan, Asbury's ability to leverage gains

from its dealership portfolio, Asbury's ability to capitalize on

opportunities to repurchase its debt and equity securities or

purchase properties that it currently leases, and Asbury's ability

to stay within its targeted range for capital expenditures. There

can be no guarantees that Asbury's plans for future operations will

be successfully implemented or that they will prove to be

commercially successful.

These and other risk factors that could cause actual results to

differ materially from those expressed or implied in our

forward-looking statements are and will be discussed in Asbury's

filings with the U.S. Securities and Exchange Commission from time

to time, including its most recent annual report on Form 10-K and

any subsequently filed quarterly reports on Form 10-Q. These

forward-looking statements and such risks, uncertainties and other

factors speak only as of the date of this press release. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005979/en/

Investors & Reporters May Contact: Joe Sorice

Manager, Investor Relations (770) 418-8211 ir@asburyauto.com

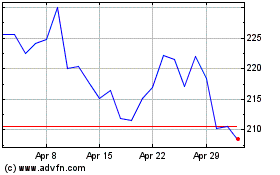

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Aug 2024 to Sep 2024

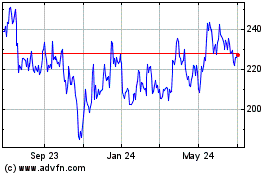

Asbury Automotive (NYSE:ABG)

Historical Stock Chart

From Sep 2023 to Sep 2024