Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ |

Filed by the Registrant |

☐ |

Filed by a party other

than the Registrant |

|

| CHECK THE APPROPRIATE BOX: |

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

| ☑ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material under §240.14a-12 |

Adtalem Global Education Inc.

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☑ |

|

No fee required |

| ☐ |

|

Fee paid previously with preliminary materials |

| ☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Table of Contents

About Us

#WEAREADTALEM

Adtalem Global Education is a leading healthcare

educator and provider of professional talent to vital healthcare, behavioral sciences, education and related sectors of the global

economy. Adtalem is the parent organization of American University of the Caribbean School of Medicine, Chamberlain University,

Ross University School of Medicine, Ross University School of Veterinary Medicine, and Walden University.

STUDENT FOCUSED

Empowering individuals is the meaning behind our name – Adtalem

Global Education. Adtalem (pronunciation: ad TAL em) is Latin for “To Empower.”

|

|

|

|

|

| MISSION |

|

VISION |

|

PURPOSE |

|

|

|

|

|

We provide global

access to knowledge

that transforms lives and

enables

careers. |

|

To create a dynamic global

community of life-long learners

who improve

the world. |

|

We empower students to

achieve their goals, find success,

and make

inspiring contributions

to our global community. |

| |

|

|

|

|

WE

ARE

5

institutions |

|

|

MORE

THAN

10,000

colleagues |

|

| |

|

|

|

|

WITH

A NETWORK OF NEARLY

275,000 alumni

located in all 50 states – addressing nursing and physician

shortages, particularly in underserved communities |

|

|

WITH

27

operating campuses |

|

As of October 1, 2022.

Table of Contents

Message from our President and CEO, Steve

Beard

October 14, 2022

To our Shareholders:

Fiscal year 2022 proved to be an important inflection point

for the company as we repositioned ourselves as a leading healthcare educator. The acquisition of Walden University and

the divestiture of our Financial Services segment brought clarity and simplicity to the portfolio and provided attractive

opportunities to realize synergies across our operating model. In our current configuration, we believe we are well positioned

to advance our mission of expanding access to high quality education. Our scale and focus are unique in the marketplace.

As demand for healthcare professionals continues to intensify, and improving health equity remains a priority, our ability

to deliver – at scale – a highly diverse cohort of practice-ready clinicians, has never been more valuable.

Our performance for the full year was in line with our revised expectations,

despite lingering headwinds from the pandemic. In addition to the strategic repositioning of the company and integration of Walden

University, we strengthened our financial position through the realization of cost synergies and margin expansion and executed

a thoughtful capital allocation strategy inclusive of debt repayment, share repurchases and select investments in differentiating

capabilities.

|

|

|

Our success was driven by our colleagues’ dedication to our mission.

We enjoy a committed and motivated workforce and are pleased to have been able to attract significant new talent to the organization

over the past year, including several key leadership appointments, despite a challenging labor market. Our colleagues’ openness

to change and willingness to adopt new, more efficient ways of serving our customers was impressive, and wholly reflects the passion

and expertise that is embedded throughout our organization.

STUDENT CENTRICITY IS OUR CORE FOCUS

Our students represent who we serve and how we serve —

they are our most valuable contribution to society, and they are at the center of all that we do. Their success in realizing their

academic and professional ambitions and making a positive impact on the world will always be our north star. In this spirit, expanding

equitable access to education for more students remains foundational to our organization. We believe that education can be a powerful

engine of economic mobility and social impact. And while we have tremendous respect and admiration for those institutions whose

value proposition is based on historical prestige and selectivity, we are intentional in seeking to serve an overlooked community

of learners – and do so with impressive outcomes. Over the past year we continued to focus on, and deliver against, this

commitment to produce highly trained, practice-ready professionals who are a collective force for good in the communities and

organizations they serve.

2022 Proxy Statement 1

Table of Contents

Message from our President and CEO, Steve Beard

In fiscal year 2022, Adtalem’s nursing programs across Chamberlain

University and Walden University proudly graduated more than 19,000 nurses with either a Bachelor of Science in Nursing (BSN),

Master of Science in Nursing, Doctor of Nursing or certificate in Nursing. Across our two medical institutions — American

University of the Caribbean School of Medicine and Ross University School of Medicine —we celebrated more than 750 physicians

at our graduation ceremonies; with combined first-time residency match rates achieving 96% for first-time eligible 2021-2022 graduates.1

At Ross University School of Veterinary Medicine, our pass rate on the North American Veterinary Licensing Exam®

(NAVLE) reached 83%, exceeding the American Veterinary Medical Association’s standard.2 As the number one

conferrer of MD and PhD degrees to African Americans, and BSN degrees to underrepresented minority students in the U.S., Adtalem’s

institutions are helping pave a path toward health equity.3 These outcomes, combined with more than 275,000 alumni

across our institutions, underscore both the scale of our impact and our commitment to delivering strong academic and professional

achievements.

ANSWERING THE CALL FOR HEALTHCARE TALENT

This next fiscal year represents an exciting opportunity to build upon

the groundwork we laid in fiscal year 2022: continuation of our multi-pronged capital allocation strategy, enhancement of our

competitive differentiating capabilities, expansion of new and existing partnerships with leading healthcare providers and consistent

delivery of strong academic outcomes.

As we look ahead to fiscal year 2023 and beyond, our sharpened focus,

financial strength and market-leading capacity to deliver against increasingly unmet demand for healthcare talent, uniquely positions

us to realize our growth ambitions and deliver more value for our stakeholders. I, and the entire leadership team, remain energized

by the opportunity to make an outsized impact on the communities in which we work, live and serve. We hope you share this excitement,

and on behalf of the entire Adtalem Global Education team and board of directors, we thank you for your continued confidence in

– and support of – our mission.

Steve Beard

President and CEO

| 1 |

Data Source: National Resident Matching Program®, Results and Data: 2022 Main Residency Match.

Adtalem data has been normalized for consistency with US methodology for comparison purposes and contains residencies attained

through the NRMP Main Match. |

| 2 |

https://veterinary.rossu.edu/about/accreditation |

| 3 |

MD degrees granted by the American University of the Caribbean School of Medicine and Ross University School of Medicine;

PhD degrees by Walden University; BSN degrees by Chamberlain University, analysis is based on FY2020 IPEDS data downloaded

on 10/18/2021. Under-represented minority includes students who identify as American Indian or Alaska Native, Black or African

American, Hispanic or Latino, Native Hawaiian or other Pacific Islander, or two or more races. |

2 Adtalem Global Education Inc.

Table of Contents

Notice of Annual Meeting of Shareholders

|

|

|

|

|

| DATE AND TIME |

|

PLACE |

|

RECORD DATE |

November 9, 2022

8:00 a.m. Eastern Standard Time

Online check-in will be available beginning at 7:45 a.m. Eastern

Standard Time. Please allow ample time for the online check-in process. |

|

The Annual Meeting will be held entirely online at: www.virtualshareholdermeeting.com/ATGE2022. |

|

September 23, 2022 |

| |

|

|

| ITEMS OF BUSINESS |

|

|

| |

|

Board Voting

Recommendation |

| Proposal No. 1: Elect the directors named in

the attached Proxy Statement to serve until the 2023 Annual Meeting of Shareholders |

|

FOR each director nominee |

| Proposal No. 2: Ratify selection of PricewaterhouseCoopers

LLP as independent registered public accounting firm |

|

FOR |

| Proposal No. 3: Say-on-pay: Advisory vote to

approve the compensation of our named executive officers |

|

FOR |

Shareholders will also consider such other business as may come properly

before the Annual Meeting or any adjournment thereof.

To participate in the 2022 Annual Meeting, you will need the 16-digit

control number included on your proxy card or in the instructions that accompanied your proxy materials.

This notice and Proxy Statement, voting instructions, and Adtalem Global

Education Inc.’s 2022 Annual Report to Shareholders are being mailed to shareholders beginning on or about October 14, 2022.

Douglas G. Beck

Senior Vice President, General Counsel and Corporate Secretary

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE

OF FOUR WAYS:

|

|

|

|

|

|

|

| VIA THE INTERNET |

|

BY TELEPHONE |

|

BY MAIL |

|

VIRTUALLY |

| Visit the web site listed on your proxy card |

|

Call the telephone number on your proxy card |

|

Sign, date, and return your proxy card in the enclosed envelope |

|

Attend the Annual Meeting online at www.virtualshareholdermeeting.com/

ATGE2022. |

| Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to Be Held on November 9, 2022. Our Proxy Statement and the Adtalem Global Education Inc. Annual Report

for 2022 are available online at www.proxyvote.com or at our investor relations website, http://investors.adtalem.com. |

2022 Proxy Statement 3

Table of Contents

Proxy

Summary

This summary highlights

selected information about the items to be voted on at the annual meeting. It does not contain all of the information that you

should consider in deciding how to vote. You should read the entire proxy statement carefully before voting.

OUR

BOARD OF DIRECTORS

Director Nominees

Diverse mix of backgrounds, current and former CEOs, marketing

and medical professionals, and a former finance executive at a leading global company.

|

|

|

|

|

|

Director

Since |

|

Other Public

Company Boards |

|

Committee Memberships |

| |

|

Name and Principal Occupation |

|

Age |

|

|

|

ACA |

AUD |

COM |

ER |

NG |

|

|

Stephen

W. Beard

President and CEO

Adtalem Global Education Inc.

|

|

51 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

William

W.

Burke

LEAD

INDEPENDENT

DIRECTOR

President and Founder,

Austin Highlands Advisors, LLC

|

|

63 |

|

2017 |

|

2 |

|

|

|

|

|

|

|

|

Charles

DeShazer

INDEPENDENT

Director, Clinicals Products

Google Health

|

|

63 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

Mayur

Gupta

INDEPENDENT

Chief Marketing Officer

Kraken, Inc.

|

|

45 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

Donna

J.

Hrinak

INDEPENDENT

Senior Vice President,

Corporate Affairs,

Royal Caribbean Group

|

|

71 |

|

2018 |

|

|

|

|

|

|

|

|

|

|

Georgette

Kiser

INDEPENDENT

Former Operating Executive,

The Carlyle Group

|

|

54 |

|

2018 |

|

3 |

|

|

|

|

|

|

|

|

Liam

Krehbiel1

INDEPENDENT

Chief Executive Officer and Founder,

Topography Hospitality, LLC

|

|

46 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

Michael

W.

Malafronte

INDEPENDENT

Senior Advisor,

Derby Copeland Capital

|

|

48 |

|

2016 |

|

|

|

|

|

|

|

|

|

|

Sharon

L.

O’Keefe

INDEPENDENT

Retired President,

University of Chicago Medical Center

|

|

70 |

|

2020 |

|

2 |

|

|

|

|

|

|

|

|

Kenneth

J.

Phelan

INDEPENDENT

Senior Advisor

Oliver Wyman Inc.

|

|

63 |

|

2020 |

|

1 |

|

|

|

|

|

|

|

|

Lisa

W. Wardell

Chairman of the Board

Adtalem Global Education Inc.

|

|

53 |

|

2008 |

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Academic Quality

Committee |

Audit and Finance

Committee |

Compensation

Committee |

External Relations

Committee |

Nominating &

Governance Committee |

Audit Committee

Financial Expert |

Committee

Chair |

| 1 |

It is anticipated that Mr. Krehbiel will join the Audit and Finance and External Relations committees

effective November 9, 2022. |

4 Adtalem Global Education Inc.

Table of Contents

Proxy Summary

Board Highlights

| SKILLS AND EXPERIENCE |

| |

|

2022 Proxy Statement 5

Table of Contents

Proxy Summary

CORPORATE

GOVERNANCE HIGHLIGHTS

Shareholder Engagement

We conduct regular outreach and engagement with our shareholders

and value their insight and feedback.

OUR OUTREACH

We reached out to our shareholders representing approximately

91% of shares owned.

Ongoing Enhancements

Our Board continually monitors best practices in corporate

governance and, consistent with feedback from shareholders and other stakeholders, has taken the following actions in recent years:

| |

|

|

2022 |

| |

|

|

| |

|

|

● Amended

our Director Nominating Process to consider expertise on climate change, climate-related risks, and cybersecurity

● Amended

the charters of our Audit and Finance, Compensation, and External Relations Committees to provide additional responsibility

and oversight of environmental, social and governance (“ESG”) matters

● Continued

to refresh our Board by adding a new director who is committed to improving equity in education for underserved communities

|

| |

|

|

|

| |

|

|

2021 |

| |

|

|

| |

|

|

● Refreshed our Board by adding three new

directors including our new CEO and directors with significant expertise in healthcare and digital marketing |

| |

|

|

|

| |

|

|

2020 |

| |

|

|

| |

|

|

● Refreshed

our Board by adding two new directors with significant expertise in healthcare and financial services

● Amended

the charter of our External Relations Committee to clarify its responsibilities for oversight of our sustainability strategy,

including environmental and social policies

|

| |

|

|

|

| |

|

|

2019 |

| |

|

|

| |

|

|

● Appointed

a Lead Independent Director when our CEO was appointed as our Chairman of the Board

● Enhanced

our proxy statement to focus on disclosures in key areas of investor interest

● Increased

stock ownership requirements for our executive officers

|

| |

|

|

|

| |

|

|

2018 |

| |

|

|

| |

|

|

● Broadened our shareholder outreach program

and increased Board involvement |

| |

|

|

|

| |

|

|

2017 |

| |

|

|

| |

|

|

● Adopted

proxy access (3%, 3 years, group up to 20 shareholders, greater of 2 directors or 20%)

● Amended

By-Laws to provide for majority voting with plurality carve out for contested elections

● Approved

Director resignation requirement upon change of principal job responsibilities

● Added

a Lead Independent Director requirement when our Chairman of the Board is not independent

● Adopted

outside Board service limits

|

6 Adtalem Global Education Inc.

Table of Contents

Proxy Summary

Ongoing Best Practices

| |

BOARD

COMMITTEES |

|

| |

|

| |

We have

five Board committees – Academic Quality, Audit and Finance, Compensation, External Relations, and Nominating &

Governance, each of which typically meets at least four times per year We have

five Board committees – Academic Quality, Audit and Finance, Compensation, External Relations, and Nominating &

Governance, each of which typically meets at least four times per year

The Chair

of each committee, in consultation with the committee members, determines the frequency and length of committee meetings The Chair

of each committee, in consultation with the committee members, determines the frequency and length of committee meetings

Our Board

and each of its committees are authorized to retain independent advisors at Adtalem’s expense Our Board

and each of its committees are authorized to retain independent advisors at Adtalem’s expense

|

| |

DIRECTOR

STOCK OWNERSHIP |

|

| |

|

| |

60% of

our non-employee directors’ annual compensation (excluding fees for other additional roles) is in the form of restricted

stock units (“RSUs”) 60% of

our non-employee directors’ annual compensation (excluding fees for other additional roles) is in the form of restricted

stock units (“RSUs”)

Our non-employee

directors (other than those who are affiliated with our shareholders) are subject to a policy requiring their ownership

of shares with a value equal to or in excess of three times their annual retainer Our non-employee

directors (other than those who are affiliated with our shareholders) are subject to a policy requiring their ownership

of shares with a value equal to or in excess of three times their annual retainer

|

| |

CONTINUOUS

IMPROVEMENT |

|

| |

|

| |

New directors

receive a tailored, two-day, live training program about Adtalem and its institutions from management New directors

receive a tailored, two-day, live training program about Adtalem and its institutions from management

Our directors

are encouraged to participate in director-oriented training programs Our directors

are encouraged to participate in director-oriented training programs

The Board

annually undergoes a self-assessment process to critically evaluate its performance at a committee and Board level The Board

annually undergoes a self-assessment process to critically evaluate its performance at a committee and Board level

|

| |

COMMUNICATION |

|

| |

|

| |

Our Board

engages in open and frank discussions with senior management Our Board

engages in open and frank discussions with senior management

Our directors

have access to all members of management Our directors

have access to all members of management

|

2022 Proxy Statement 7

Table of Contents

Proxy Summary

EXECUTIVE COMPENSATION HIGHLIGHTS

| ● | Strong

linkage of pay to individual, institutional, and financial performance |

| ● | Balanced

compensation program aligning performance to interests of shareholders, students, and

other stakeholders |

Our Compensation Framework

2022 COMPENSATION

SNAPSHOT

| |

|

|

Objective |

Time

Horizon |

Performance

Measures |

Additional Explanation |

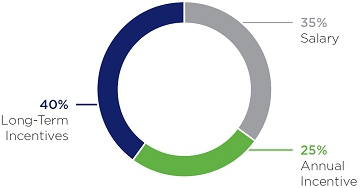

Salary

(cash) |

|

Base Salary |

Reflect experience, market competition and scope of responsibilities |

Reviewed Annually |

● Assessment of performance in prior year. |

● Represents 12% and 35% of Total Direct Compensation for Mr. Beard and

other NEOs (on average), respectively. |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Annual Incentive

(cash) |

|

MIP |

Reward

achievement of short-term operational business priorities |

1 year |

● Adjusted

Revenue*

● Adjusted

Earnings Per Share*

● Individual Goals |

● Represents 14% and 25% of Total Direct Compensation for Mr. Beard and

other NEOs (on average), respectively. |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

Long Term

Incentive

(equity) |

|

Stock Options |

Reward stock price growth and retain key talent |

4 year

ratable |

● Stock price growth |

● Represents 30% of NEO LTI granted in FY22.** |

| |

RSUs |

Align interests of management and shareholders, and retain key talent |

● Represents 20% of NEO LTI granted in FY22.** |

| |

ROIC PSUs |

Reward achievement of multi-year financial goals, align interests of management

and shareholders, and retain key talent

|

3 year cliff |

● ROIC |

● Represents 50% of NEO LTI granted in FY22.** |

| |

FCF PSUs

|

● FCF per share |

| * |

A portion of the Management Incentive Plan (“MIP”) payout for executive leadership of business

segments and business units is also based on the adjusted revenue and adjusted operating income at such executive’s

business segment or business unit. |

| ** |

The long-term equity award for Mr. Beard in fiscal year 2022 included stock options which represented 14% of his grant,

RSUs which represented 55% of his grant and PSUs which represented 31% of his grant. The fiscal year 2022 equity mix for Mr.

Beard resulted from negotiations of his compensation package with Adtalem in connection with his appointment as President

and Chief Executive Officer. |

8 Adtalem Global Education Inc.

Table of Contents

Proxy Summary

SUSTAINABILITY AND COMMUNITY RELATIONS

Adtalem is committed to a holistic approach to our communities,

providing quality learning and working opportunities, caring for the places where we operate, and conducting our business in a

transparent and responsible manner. We advanced our ESG strategy during fiscal year 2022 and remained steadfastly focused on our

overarching philosophy of stewardship.

| |

ADTALEM

GLOBAL EDUCATION SUSTAINABILITY COMMITMENT |

|

| |

|

| |

Adtalem Global Education operates in a sustainable, ethical and responsible manner as we increase access and equity in education and workforce training. Our solutions empower our students to help address workforce needs in the healthcare industry. Adtalem is committed to protecting the environment, increasing climate awareness and resilience, continuously enhancing our diverse and inclusive culture, and investing in the well-being of the communities where we teach, learn and work. |

| |

|

|

|

|

|

|

|

|

|

Environmental

Stewardship

In fiscal year 2020 we launched multi-year environmental

goals through 2024 that encompass our strategic approach to reducing our carbon footprint, embracing renewable energy

and enhancing waste management practices. Through these goals, Adtalem is addressing environmental issues that help safeguard

the environment and our communities.

|

|

Social

Practices

Our TEACH values—Teamwork, Energy, Accountability,

Community, and Heart—shape how we work together to fulfill our promise to students, members, and each other. Adtalem

has created diversity and inclusion councils and task forces at its institutions. These taskforces are addressing racism

as a public health crisis. We are committed to continuously reviewing the components of our educational programs, systems

and processes to ensure we are addressing systemic bias within our institutions, as well as partnering with organizations

that share our values to collectively address these challenges and have an intentional impact on the broader healthcare

industry.

|

|

Governance

Practices

Since 2016, under the leadership of Ms. Wardell, our

Chairman and former CEO, we have notably increased female and multicultural representation on our Board. We continue to

engage in active Board refreshment and added one new director in 2022, who through his work as a venture philanthropist

has improved educational opportunities for low-income students.

|

| |

|

|

|

|

|

|

|

|

|

Community

Engagement and Philanthropy

We support charitable and civic organizations across

the globe that share our values by way of the Adtalem Global Education Foundation and corporate philanthropy. Through

corporate giving efforts, Adtalem provided $376,457 to global community and civic partners in fiscal year 2022. Independent

from the corporate giving efforts, the Adtalem Global Education Foundation awarded grants totaling $1,081,680 to support

charitable, educational and research purposes.

|

|

Expanding

Educational Access

We have created sustainable strategies to engage and

support students from historically underrepresented groups and our intentional approach continues to yield industry-leading

results. In 2022, 83% of the total student population in our five degree-conferring institutions identified as female

and 50% as ethnically diverse. Combined, Adtalem’s medical institutions graduate more than 100 Black/African American

medical students annually, more than any U.S. medical school.

|

|

Empower

Scholarship Fund

The Empower Scholarship Fund is another avenue through

which we champion social responsibility efforts. Since 2016, the Empower Scholarship Fund has awarded 2,464 scholarships

totaling more than $4.6 million to support students. In fiscal year 2022, total Empower scholarship funds awarded were

$453,500.

|

2022 Proxy Statement 9

Table of Contents

Proxy Summary

DIVERSITY AND INCLUSION

At Adtalem, we are committed to driving diversity at the top

and creating an inclusive culture throughout the organization. To us, diversity and inclusion needs to be intentional to be impactful.

We don’t just welcome differences, we celebrate them. In fact, we believe bringing together diverse teams and innovative

ideas is the best way to serve our diverse students and we work collaboratively, committed to the idea that inclusion leads to

innovation and high performance. The Adtalem senior leadership team is over 44% diverse when considering gender and ethnicity.

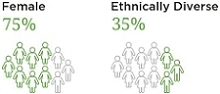

BOARD DATA

The composition of our Board reflects our commitment to diversity.

| EMPLOYEE

DATA |

|

|

|

STUDENT DATA |

| |

|

|

|

|

| Our global employee base is predominantly female and includes a strong

minority representation. |

|

|

|

The student population at our institutions is similarly diverse in gender and ethnicity. |

| |

|

|

|

|

|

|

|

|

|

Please note: Board data is as of October 1, 2022; leadership

and employee data is as of October 1, 2022 and represents those who chose to report. Student data is for fiscal year 2022 enrollment

at Adtalem’s institutions.

10 Adtalem Global Education Inc.

Table of Contents

Table of Contents

2022 Proxy Statement 11

Table of Contents

PROPOSAL NO. 1

Election of Directors

The Board has nominated eleven of Adtalem’s twelve sitting directors

and recommends their re-election, each for a term to expire at the 2023 Annual Meeting. All of the nominees have consented to

serve as directors if elected at the Annual Meeting. Mr. Lyle Logan has informed the Board that he is not standing for re-election

and will retire from the Board at the Annual Meeting. Mr. Logan has served on the Adtalem Board since 2007 and the Board is extremely

grateful for Mr. Logan’s service and commitment to Adtalem over the past fifteen years. Mr. Logan’s decision to not

stand for re-election is not the result of any disagreement with the Company.

It is intended that all shares represented by a proxy in the accompanying

form will be voted for the election of each of Stephen W. Beard, William W. Burke, Charles DeShazer, Mayur Gupta, Donna J. Hrinak,

Georgette Kiser, Liam Krehbiel, Michael W. Malafronte, Sharon L. O’Keefe, Kenneth J. Phelan, and Lisa W. Wardell as directors

unless otherwise specified in such proxy. A proxy cannot be voted for more than eleven persons. In the event that a nominee becomes

unable to serve as a director, the proxy committee (appointed by the Board) will vote for the substitute nominee that the Board

designates. The Board has no reason to believe that any of the nominees will become unavailable for election.

Each nominee for election as a director is listed below, along with

a brief statement of his or her current principal occupation, business experience and other information, including directorships

in other public companies held as of the date of this Proxy Statement or within the previous five years. Under the heading “Relevant

Experience,” we describe briefly the particular experience, qualifications, attributes, or skills that led to the conclusion

that these nominees should serve on the Board. As explained below under the caption “Director Nominating Process,”

the Nominating & Governance Committee looks at the Board as a whole, attempting to ensure that it possesses the characteristics

that the Board believes are important to effective governance.

Approval by Shareholders

The election of each of the eleven nominees for director listed below

requires the affirmative vote of a majority of the shares of Common Stock of Adtalem represented at the Annual Meeting. Adtalem

maintains a majority voting standard for uncontested elections (where the number of nominees is the same as the number of directors

to be elected), so for a nominee to be elected as a member of the Board, the nominee must receive the affirmative vote of a majority

of the shares of Common Stock of Adtalem represented at the Annual Meeting. Shareholders may not cumulate their votes in the election

of directors. If a nominee for re-election fails to receive the requisite majority vote where the election is uncontested, such

director must promptly tender his or her resignation to Adtalem’s Chairman or Adtalem’s General Counsel and Corporate

Secretary, subject to acceptance by the Board.

Unless otherwise indicated on the proxy, the shares will be voted FOR

each of the nominees identified below.

| The

Board

of

Directors

recommends

a

vote

FOR

each

of

the

nominees

identified

below. |

12 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of

Directors

BOARD COMPOSITION

Director Nominees

Career Highlights |

Stephen W. Beard,

Chief Executive

Officer

President and CEO, Adtalem Global Education

Age: 51

Director since: 2021

|

Mr. Beard was appointed Adtalem’s President and CEO and a director

on our Board in September 2021. Previously, Mr. Beard served as Adtalem’s Chief Operating Officer (COO), responsible for

the vision, leadership, and financial performance of Adtalem’s Financial Services vertical. In addition, Mr. Beard led the

company’s strategy, corporate development, government and regulatory affairs, investor relations, communications and civic

engagement activities and mobilized a variety of operational and corporate initiatives to accelerate Adtalem’s global performance.

Prior to taking on the responsibility of COO in 2019 and responsibility

for the Financial Services vertical in 2020, Mr. Beard served as Senior Vice President, General Counsel and Corporate Secretary

in 2018.

Prior to Adtalem, Mr. Beard was executive vice president, chief administrative

officer and general counsel of Heidrick & Struggles International, Inc. (NASDAQ:HSII), where he directed global legal operations

for the company and oversaw a variety of enterprise-level functions including strategy and corporate development.

Prior to joining Heidrick & Struggles, Mr. Beard was in private

practice with Schiff Hardin, LLP in Chicago, where he was a member of the firm’s corporate and securities group, advising

public and private companies in mergers and acquisitions, corporate finance and corporate governance matters.

Mr. Beard began his legal career as a law clerk for the Honorable Frank

Sullivan, Jr. (ret.), associate justice of the Indiana Supreme Court.

Mr. Beard has been active in a variety of community and civic matters

and currently serves on the board of the venture philanthropy fund, A Better Chicago.

Mr. Beard received his bachelor’s degree from the University of

Illinois at Urbana-Champaign and his juris doctor degree from the Maurer School of Law at Indiana University.

Relevant Experience

Mr. Beard’s experience as our CEO and his prior service as Adtalem’s

COO and General Counsel give him deep knowledge of Adtalem’s operations and strategy. Mr. Beard’s experience in refining

Adtalem’s portfolio strategy, executing the DeVry University, Carrington College and Adtalem Brazil divestitures, and spearheading

the acquisition of Walden University-coupled with his success in leading the Financial Services segment prior to its divestiture-have

played an integral role in positioning Adtalem for long-term growth.

2022 Proxy Statement 13

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

William W. Burke,

Lead Independent

Director

President and Founder, Austin Highlands Advisors,

LLC

Age: 63

Director since: 2017

Committees:

Audit and Finance (Chair)

Compensation

|

Mr. Burke has been a director of Adtalem since January 2017. He has

served as our Lead Independent Director since July 2019. Since November 2015, Mr. Burke has served as President of Austin Highlands

Advisors, LLC, a provider of corporate advisory services. He served as Executive Vice President & Chief Financial Officer

of IDEV Technologies, a peripheral vascular devices company, from November 2009 until the company was acquired by Abbott Laboratories

in August 2013. From August 2004 to December 2007, he served as Executive Vice President & Chief Financial Officer of ReAble

Therapeutics, a diversified orthopedic device company which was sold to The Blackstone Group in a going private transaction in

2006 and subsequently merged with DJO Incorporated in November 2007. Mr. Burke remained with ReAble Therapeutics until June 2008.

From 2001 to 2004, he served as Chief Financial Officer of Cholestech Corporation, a medical diagnostic products company.

Mr. Burke received his bachelor’s degree in Finance from The University

of Texas at Austin and an MBA from The Wharton School of the University of Pennsylvania.

Board Service

Mr. Burke has served on numerous public and private company boards including

serving as a board chairman and a lead independent director. Since June 2022, he has served on the board of directors of Ceribell

Inc., a privately-held medical technology company. He has served on the board of Tactile Systems Technology, Inc. (Nasdaq: TCMD)

since 2015 and currently serves as Chairman of the Board. Since 2021, he has served on the board of directors and as chair of

the audit committee of EQ Health Acquisition Corp. (NYSE:EQHA). He previously served on the board of Invuity, Inc. (acquired by

Stryker Corp. in 2018), LDR Holding Corporation (acquired by Zimmer Biomet in July 2016), and Medical Action Industries (acquired

by Owens & Minor in October 2014).

Relevant Experience

Mr. Burke’s experience as a senior executive and board member

of multiple public companies, and his extensive understanding of financing, acquisition and operating strategy, enhances the Board’s

capabilities from both a strategic and governance perspective.

14 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of

Directors

Career Highlights |

Dr. Charles DeShazer,

Independent

Director, Clinical Products, Google Health

Age: 63

Director since: 2021

Committees:

Academic Quality

External Relations

|

Dr. DeShazer is the Director, Clinical Products for Google Health where

he helps lead the design and implementation of an intelligent suite of tools that help healthcare providers deliver better patient

care. He previously was the Senior Vice President and Chief Medical Officer of Highmark, Inc., one of the largest insurance organizations

in the U.S. from 2017 to 2021. In this role he oversaw the company’s clinical strategy, overall medical leadership and provided

oversight of Highmark Inc.’s strategic direction and processes related to healthcare quality, efficiency and cost improvement.

Additionally, as the Chief Medical Officer for the primary division of Highmark Health, Dr. DeShazer also interacted regularly

with the smaller health division, Allegheny Health Network, as well as Penn State Health, a large academic health system governed

jointly by Penn State University and Highmark Health through a significant minority ownership investment. Prior to joining Highmark,

Dr. DeShazer served as the Chief Quality Officer for BayCare Health System from 2012 to 2016. From 2010 to 2012 he served as Vice

President, Medical Information, Quality and Transformation for Dean Health System.

Relevant Experience

Dr. DeShazer’s leadership experience across the healthcare services

ecosystem, coupled with his background as a board-certified M.D. in internal medicine, assists Adtalem and its Board in executing

on the strategy of becoming a leading healthcare educator and workforce solutions innovator to the rapidly evolving healthcare

industry.

2022 Proxy Statement 15

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Mayur Gupta,

Independent

Chief Marketing Officer, Kraken, Inc.

Age: 45

Director since: 2021

Committees:

Academic Quality

External Relations

|

Since April 2022, Mr. Gupta has been the Chief Marketing Officer for

Kraken, Inc., a U.S.-based cryptocurrency exchange and bank. Previously, he was the Chief Marketing & Strategy Officer for

Gannett Co., Inc., a subscription-led and digitally focused media and marketing solutions company (“Gannett”). Mr.

Gupta was responsible for leading the transformation and growth of Gannett from the largest news media company to a content subscription

platform. Mr. Gupta joined Gannett in September 2020. Mr. Gupta served on the board of Gannett from October 2019 until September

2020 when he stepped down from the board to become the Chief Marketing & Strategy Officer.

Prior to joining Gannett, Mr. Gupta served as the Chief Marketing Officer

for Freshly, a growing food-technology company, from January 2019 until September 2020, where he oversaw all consumer-faced marketing,

including driving growth, building the brand, and enhancing the company’s consumer insights. Before joining Freshly, Mr.

Gupta led digital initiatives at several companies, including from October 2016 to January 2019 as Vice President, Growth and

Marketing at Spotify, the media services provider, and from August 2015 to September 2016 as Executive Vice President, Chief Marketing

Officer and earlier as Senior Vice President, Omni-Channel Consumer Marketing and Head of Digital Platforms at Healthgrades, a

healthcare scheduling company. From August 2012 to July 2015, Mr. Gupta was the first Chief Marketing Technologist at Kimberly-Clark,

one of the largest consumer goods companies. For the preceding 12-years, from 2001 to 2012, he was a Technology Leader at SapientNitro

(now part of Publicis).

Mr. Gupta was named to Forbes World’s Most Influential Chief Marketing

Officers list for 2021.

Relevant Experience

Mr. Gupta’s expertise across the digital marketing space, in combination

with his background in technology, will help the Board drive the Company’s next phase of growth and impact. Mr. Gupta’s

ability to implement data-driven strategies to drive business growth and increase shareholder value will assist the Company in

developing its own growth plans.

16 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of

Directors

Career Highlights |

Donna J. Hrinak,

Independent

Senior Vice President, Corporate Affairs, Royal

Caribbean Group

Age: 71

Director since: 2018

Committees:

Nominating & Governance (Chair)

Audit and Finance

|

Ms. Hrinak has been a director of Adtalem since October 2018. Ms. Hrinak

has served as Senior Vice President, Corporate Affairs, Royal Caribbean Group since August 2020. Previously she served as President

of Boeing Latin America (2011-2020) where she opened Boeing’s first three offices in the region and oversaw all aspects

of operations, from commercial and defense product sales to research and technology. She came to Boeing from her role as Vice

President Global Public Policy and Governmental Affairs/Vice President for Public Policy at PepsiCo (2008-2011) and also held

a role at Kraft Foods (2006-2008), where she managed the Latin American and European Corporate Affairs teams. Prior to that, she

served as a Senior Counselor for Trade and Competition at the law firm of Steel Hector & Davis and held a role with the strategic

advisory firm of Kissinger McLarty Associates.

Before entering the private sector, Ms. Hrinak was a career officer

in the U.S. Foreign Service, and served as U.S. Ambassador to Brazil, Venezuela, Bolivia, and the Dominican Republic, as well

as Deputy Assistant Secretary in the State Department.

She holds a bachelor’s degree in Multidisciplinary Social Science

from Michigan State University and also attended The George Washington University and the University of Notre Dame School of Law.

Relevant Experience

Ms. Hrinak’s extensive experience at a senior level in both the

public and private sectors overseeing complex multi-cultural organizations brings insight to the Board directly applicable to

the organization’s international scope.

2022 Proxy Statement 17

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Georgette Kiser,

Independent

Former Operating Executive, The Carlyle Group

Age: 54

Director since: 2018

Committees:

External Relations (Chair)

Nominating & Governance

|

Ms. Kiser has been a director of Adtalem since May 2018. Ms. Kiser is

an operating executive/independent advisor who helps lead due diligence and technical strategies across various private equity

and venture capital firms. Previously, she was managing director and chief information officer (CIO) at The Carlyle Group, responsible

for leading the firm’s global technology and solutions organization and driving IT strategies. Prior to her role at The

Carlyle Group, she was in various executive roles at T. Rowe Price from 1996 to 2015, including Vice President and Head of Enterprise

Solutions and Capabilities. She was a consultant and Software Engineer at Martin Marietta Management Data Systems from 1993 to

1995, and a Software Design Engineer in the Aerospace Division of the General Electric Company from 1989 to 1993.

Ms. Kiser received a bachelor’s degree in Mathematics with a concentration

in Computer Science from the University of Maryland, a M.S. in Mathematics from Villanova University, and an MBA from the University

of Baltimore.

Board Service

Since 2019, Ms. Kiser has served on the boards of Aflac (NYSE: AFL),

a leading supplemental insurer, Jacobs (NYSE: JEC), a leading, global professional services company, and NCR Corporation (NYSE:

NCR), an American software, professional services, consulting and tech company. She serves on the audit and risk and compensation

committees for Aflac, the compensation committee and nominating and corporate governance committee for Jacobs, and on the governance

committee and chair of the risk committee at NCR.

Relevant Experience

Ms. Kiser’s experience in information technology at the senior

leadership level in organizations with an international reach brings expertise to Adtalem which will enhance both the Board’s

oversight of its business as well as Adtalem’s internal technology matters.

18 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Liam Krehbiel,

Independent

Chief Executive Officer and Founder, Topography

Hospitality, LLC

Age: 46

Director since: 2022

Committees:

Audit and Finance (expected November 2022)

External Relations (expected November 2022)

|

Mr. Krehbiel has been a director of Adtalem since June 2022. In 2021,

Mr. Krehbiel founded Topography Hospitality, LLC, and has served as its Chief Executive Officer since then. He is also the Co-managing

partner of Ballyfin Demesne, a luxury hotel in Ireland, which opened in 2011. In 2010, Mr. Krehbiel founded A Better Chicago,

a not-for-profit corporation and venture philanthropy fund, and currently serves as Chair of its Board. A Better Chicago’s

mission is to build a more equitable city for Chicago’s young people and future generations. Mr. Krehbiel served as the

Chief Executive Officer of A Better Chicago from 2010 until May 2019. From 2007 to 2010, Mr. Krehbiel was a management consultant

at Bain and Company. Prior to joining Bain, Mr. Krehbiel worked with the Edna McConnell Clark Foundation in New York.

Mr. Krehbiel received a Master of Business Administration degree with

a major in business administration and a double concentration in finance and marketing from Northwestern University’s Kellogg

School of Management. He received his Bachelor of Arts degree from Dartmouth College.

Board Service

In addition to serving as the Chair of A Better Chicago, Mr. Krehbiel

is a director of the Civic Consulting Alliance and a trustee of The Civic Federation.

Relevant Experience

Mr. Krehbiel’s commitment to improving equity in education for

underserved communities closely aligns with Adtalem’s mission of expanding access to education and improving health equity.

Mr. Krehbiel has spent most of his career as a venture philanthropist dramatically improving educational opportunities for low-income

students by funding and scaling the most effective schools and programs in the Chicago area. This experience adds depth and insight

as Adtalem continues to focus on serving its students and employers in the growing healthcare education industry.

2022 Proxy Statement 19

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Michael W. Malafronte,

Independent

Senior Advisor, Derby Copeland Capital

Former Managing Partner, International Value

Advisers and President of IVA Funds

Age: 48

Director since: 2016

Committees:

Compensation (Chair)

Audit and Finance

|

Mr. Malafronte has been a director of Adtalem since June 2016. Mr. Malafronte

has served as a Senior Advisor to Derby Copeland Capital since September 2022. Derby Copeland is a private equity firm that specializes

in opportunistic real estate related debt financing and equity investment. Mr. Malafronte is a Founding Partner of International

Value Advisers, LLC (“IVA”) and served as Managing Partner for 13 years until December 2020. He was responsible for

overseeing all aspects of IVA, including company strategy and managing resources. He also served as President of IVA Funds. Prior

to founding IVA in 2007, Mr. Malafronte was a Senior Vice President at Arnhold and S. Bleichroeder Advisers, LLC where he worked

for two years as a senior analyst for the First Eagle Funds, owned by Arnhold & S. Bleichroeder Advisers, LLC. There he worked

under Charles de Vaulx and Jean-Marie Eveillard within the Global Value Group for the value funds, including the First Eagle Overseas,

Global, U.S. Value Funds as well as the offshore funds, inclusive of the Sofire Fund Ltd. Similarly, he was responsible for covering

the oil and gas, media, real estate, financial services, and retail industries on a global basis, as well as companies within

the United Kingdom, Germany, and Japan. Moreover, Mr. Malafronte was responsible for covering the larger names within the portfolio

such as Pargesa Holdings, ConocoPhillips, Petroleo Brasileiro, SK Corp., News Corp., Dow Jones, and Comcast.

Prior to the First Eagle Funds, Mr. Malafronte worked for nine years

as a Portfolio Manager at Oppenheimer & Close, a dually-registered broker dealer and investment adviser; an adviser on three

domestic hedge funds, one offshore partnership and a registered investment adviser and broker dealer. While at Oppenheimer &

Close, Mr. Malafronte assisted in the launch of a domestic hedge fund in 1996 and an offshore partnership in 1998. Mr. Malafronte

was responsible for all facets of portfolio management for the investment partnerships, including idea generation, in-depth research,

and stock selection. In addition, he was also responsible for hiring and training both operations staff and research analysts.

Mr. Malafronte earned his bachelor’s degree in Finance from Babson

College.

Board Service

Mr. Malafronte has previously served on the boards of two publicly traded

companies: Bresler & Reiner Inc. (2002-2008) and Century Realty Trust (2005-2006).

Relevant Experience

Mr. Malafronte’s experience as a financial analyst covering institutions

globally, and as a founder of a global investment firm, provides the Board with a firm understanding of Adtalem’s shareholders’

perspective and deeply informs Adtalem’s financial planning.

20 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of

Directors

Career Highlights |

Sharon L. O’Keefe,

Independent

Retired President, University of Chicago Medical

Center

Age: 70

Director since: 2020

Committees:

Academic Quality

Nominating & Governance

|

Ms. O’Keefe served as the President of the University of Chicago

Medical Center from February 2011 through July 2020. From April 2009 through February 2011, Ms. O’Keefe served as President

of Loyola University Medical Center. Prior to her role at Loyola, she served from July 2002 to April 2009 as Chief Operating Officer

for Barnes Jewish Hospital, a member of BJC Healthcare, St. Louis. In addition, Ms. O’Keefe has served in a variety of senior

management roles at The Johns Hopkins Hospital, Montefiore Medical Center, University of Maryland Medical System, and Beth Israel

Deaconess Medical Center in Boston, a teaching affiliate of Harvard Medical School. She has also served as a healthcare consultant

with Ernst & Young. In addition, Ms. O’Keefe has served on the National Institutes of Health Advisory Board for Clinical

Research, the Finance Committee of the National Institutes of Health Advisory Board, the Board of Trustees of the Illinois Hospital

Association, and an Examiner for the Malcolm Baldrige National Quality Award.

Ms. O’Keefe holds a M.S. degree in Nursing from Loyola University

of Chicago and a B.S. degree in Nursing from Northern Illinois University.

Board Service

Since March 2022, Ms. O’Keefe has served on the board of directors

of Conva Tec Group PLC, a global medical products and technologies company focused on therapies for the management of chronic

conditions. Since July 2022, she has also served on the board of directors of Apollo Endosurgery, a medical technology company

focused on development of minimally invasive devices for advanced endoscopy therapies. From 2012 until February 2022, Ms. O’Keefe

served on the board of directors of Vocera Communications Inc., a provider of communication and clinical workforce solutions,

where she was a member of the compensation committee. Ms. O’Keefe previously served on the board of Aviv Reit Inc. from

2013 to 2015.

Relevant Experience

Ms. O’Keefe’s prior leadership roles at numerous medical

centers including the University of Chicago Medical Center and Loyola University of Chicago Medical Center provide the Board with

insights into how Adtalem can best serve the needs of our employer partners and drive superior student outcomes for our healthcare

and medical students and graduates.

2022 Proxy Statement 21

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Kenneth

J. Phelan,

Independent

Senior

Advisor, Oliver Wyman Inc.

Age: 63

Director since: 2020

Committees:

Compensation

External Relations

|

Mr. Phelan has been a Senior Advisor at Oliver Wyman Inc., a global

management consulting firm, since 2019. Prior to that he served as the first Chief Risk Officer for the U.S. Department of the

Treasury (“Treasury”) from 2014 to 2019. As Chief Risk Officer of the Treasury, he was responsible for establishing

and building the Treasury’s Office of Risk Management to provide senior Treasury and other administration officials with

analysis of key risks including credit, market, liquidity, operational, governance, and reputational risk. From 2018 to 2019,

Mr. Phelan also served as Acting Director for the Office of Financial Research, an independent bureau within the Treasury charged

with supporting the Financial Stability Oversight Council and conducting research about systemic risk. Prior to joining the Treasury,

Mr. Phelan served as the chief risk officer for RBS America from 2011 to 2014, as chief risk officer for Fannie Mae from 2009

to 2011, and as chief risk officer for Wachovia Corporation from 2008 to 2009. Earlier in his career, Mr. Phelan held a variety

of senior risk roles at JPMorgan Chase, UBS, and Credit Suisse.

Mr. Phelan holds a bachelor’s degree in Business Administration

and Finance from Old Dominion University, a M.S. in Economics from Trinity College, and a J.D. from Villanova University.

Board Service

Since 2019 Mr. Phelan has served as a director of Huntington Bancshares,

Inc. (NASDAQ. HBAN), a regional bank holding company whose primary subsidiary is The Huntington National Bank. Mr. Phelan is the

Chair of Huntington’s risk committee and serves on its human resources and compensation committee.

Relevant Experience

Mr. Phelan possesses broad risk oversight expertise and risk management

experience. His knowledge and experience strengthens the Board’s governance and risk oversight.

22 Adtalem Global Education Inc.

Table of Contents

Proposal No. 1 Election of Directors

Career Highlights |

Lisa

W. Wardell,

Chairman

Chairman

of the Board, Adtalem Global Education

Age: 53

Director since: 2008

|

Ms. Wardell has been a director of Adtalem since November 2008. She

is a business executive with more than 25 years of experience managing business strategy, operations, finance, and mergers and

acquisitions, while driving shareholder value, stakeholder engagement and company mission. After a successful five-year run as

Adtalem’s president and CEO (2016-2019) and then CEO and Chairman (2019-2021) and Executive Chairman (2021-2022), Ms. Wardell

currently serves as the Chairman. During her tenure as CEO, Ms. Wardell oversaw the strategic repositioning of Adtalem’s

portfolio, successfully acquiring and integrating companies in Adtalem’s financial services vertical, and leading turnarounds

and divestitures of Adtalem’s non-core assets. Through her commitment to high performance and positive social impact, Ms.

Wardell’s leadership has resulted in superior outcomes for Adtalem’s students and significant value creation for shareholders

and has positioned the company for long-term growth. Under her leadership, gender and ethnic diversity has increased at the Adtalem

Board to 67%. Ms. Wardell has also led the higher education sector in implementing new standards in transparency and financial

literacy, and in cultivating quality partnerships to fill critical global workforce needs.

Prior to Adtalem, Ms. Wardell was executive vice president and chief

operating officer for The RLJ Companies. During her tenure at RLJ, Ms. Wardell managed acquisitions and executed the formation

of RML Automotive, a dealership network spanning seven states with over $1 billion in annual revenues. She also worked extensively

in the media, entertainment, sports, gaming, and hotel industries which included assisting with the founding and managing of Our

Stories Films Studio and managing the now Charlotte Hornets (previously Charlotte Bobcats). Ms. Wardell also served on the board

of the NBAPA, Inc., the for-profit portion of the NBA Players Association from 2018 to 2021. Prior to joining The RLJ Companies,

Ms. Wardell was a principal at Katalyst Venture Partners, a private equity firm that invested in start-up technology companies,

and a senior consultant for Accenture in the organization’s communication and technology strategic services practice.

Ms. Wardell earned her bachelor’s degree from Vassar College and

her law degree from Stanford Law School. She earned her MBA in finance and entrepreneurial management from the Wharton School

of Business at the University of Pennsylvania.

Ms. Wardell has been featured on CNBC and Cheddar as well as in The

Wall Street Journal, Washington Post, Business Insider, Black Enterprise, and other publications.

Board Service

Ms. Wardell serves on the boards of American Express (NYSE:AXP) and

GIII Apparel Group, Ltd. (NasdaqGS:GIII). She serves as a vice chair on the executive committee of The Business Council, and as

a vice chair of the Kennedy Center Corporate Fund. A fierce advocate for diversity and inclusion and access to education at scale

across diverse communities, Ms. Wardell also is a member of the board of the Economic Club of Chicago, the Executive Leadership

Council, CEO Action for Diversity and Inclusion and the Fortune CEO Initiative.

Relevant Experience

Ms. Wardell’s prior roles as CEO and Executive Chairman give her

deep and current knowledge of Adtalem’s academic and business operations and strategy and make her an essential member of

the Board. Additionally, her experience as a senior business executive in private equity, operations, and strategy and financial

analysis, including mergers and acquisitions, give her important perspectives on the issues that come before the Board, which

includes business, strategic, financial, and regulatory matters.

2022 Proxy Statement 23

Table of Contents

Proposal

No. 1 Election of Directors

DIRECTOR

NOMINATING PROCESS

The

Nominating & Governance Committee is responsible for making recommendations of nominees for directors to the Board. The

Nominating & Governance Committee’s goal is to put before our shareholders candidates who, with the incumbent directors,

will constitute a board that has the characteristics necessary to provide effective oversight for the growing, complex, global

educational operations of Adtalem and reflect the broad spectrum of students and members that Adtalem serves. The Nominating &

Governance Committee seeks a diversity of thought, background, experience, and other characteristics in its candidates. To this

end, Adtalem’s Governance Principles provide that nominees are to be selected on the basis of, among other things, knowledge,

experience, skills, expertise, diversity, personal and professional integrity, business judgment, time availability in light of

other commitments, absence of conflicts of interest, and such other relevant factors that the Nominating & Governance

Committee considers appropriate in the context of the interests of Adtalem, its Board and its shareholders.

BOARD

SUCCESSION PLANNING

We

are committed to ensuring that our Board represents the right balance of experience, tenure, independence, age, and diversity.

Additionally, our Governance Principles provide that a director is required to retire from our Board when he or she reaches the

age of 75, although on the recommendation of the Nominating & Governance Committee, our Board may waive this requirement

if a waiver is in the best interests of Adtalem. Our Nominating & Governance Committee has led the gradual transformation

of our Board, with five of our ten independent directors joining the Board since 2020.

When

considering nominees, the Nominating & Governance Committee intends that the Board as a whole possesses, and individual

members possess at least two of, the following characteristics or expertise in the following areas:

| ● |

Leadership |

| ● |

Strategic vision |

| ● |

Business judgment |

| ● |

Management experience |

| ● |

Experience as a CEO or similar function |

| ● |

Experience as a CFO or accounting and finance

expertise |

| ● |

Industry knowledge |

| ● |

Healthcare, medical, and related education and

services |

| ● |

Education sector and accreditation |

| ● |

Cybersecurity |

| ● |

Mergers, acquisitions, joint ventures, and strategic

alliances |

| ● |

Public policy experience, particularly in higher

education |

| ● |

Regulatory experience |

| ● |

Human capital management and/or compensation

expertise |

| ● |

Global markets and international experience |

| ● |

Corporate governance |

| ● |

Climate change and climate risk experience |

BOARD

REFRESHMENT

| 6 New Directors |

|

| 2 Retirements |

|

ANNUAL

PROCESS FOR NOMINATION

| 1 |

Identify

Candidates |

|

● Directors

● Management

● Shareholders

● Independent Search Firm

|

| 2 |

Nominating & Governance

Committee Review |

|

● Review qualifications

● Consider diversity

● Examine Board composition and balance

● Review independence and potential

conflicts

● Meet with potential nominees

|

| 3 |

Recommend Slate |

|

|

| 4 |

Full Board Review and Nomination |

|

|

| 5 |

Shareholder Review and Election |

24 Adtalem

Global Education Inc.

Table of Contents

Proposal No. 1 Election

of Directors

The Nominating & Governance

Committee has implemented this policy by evaluating each prospective director nominee as well as each incumbent director on the

criteria described above, and in the context of the composition of the full Board, to determine whether he or she should be nominated

to stand for election or re-election. In screening director nominees, the Nominating & Governance Committee also reviews

potential conflicts of interest, including interlocking directorships and substantial business, civic, and social relationships

with other members of the Board that could impair the prospective nominee’s ability to act independently.

IDENTIFICATION AND CONSIDERATION

OF NEW NOMINEES

In identifying potential nominees

and determining which nominees to recommend to the Board, the Nominating & Governance Committee has retained the advisory

services of Russell Reynolds Associates, an international executive search firm. In connection with each vacancy, the Nominating &

Governance Committee develops a specific set of ideal characteristics for the vacant director position. The Nominating &

Governance Committee looks at director candidates that it has identified and any identified by shareholders on an equal basis

using these characteristics and the general considerations identified above.

SHAREHOLDER NOMINATIONS

The Nominating & Governance

Committee will not only consider nominees that it identifies, but will consider nominees submitted by shareholders in accordance

with the advance notice process for shareholder nominations identified in the By-Laws. Under this process, all shareholder nominees

must be submitted in writing to the attention of Adtalem’s General Counsel and Corporate Secretary, 500 West Monroe Street,

Suite 1300, Chicago, IL 60661, not less than 90 days prior to the anniversary of the immediately preceding annual meeting of shareholders.

As a result, a shareholder nomination must be submitted by 5:00 pm Central Daylight Time on August 11, 2023. Such shareholder’s

notice shall be signed by the shareholder of record who intends to make the nomination (or his duly authorized proxy) and shall

also include, among other things, the following information:

| ● |

the name and address, as

they appear on Adtalem’s books, of such shareholder and the beneficial owner or owners, if any, on whose behalf the

nomination is made; |

| ● |

the number of shares of Adtalem’s Common

Stock which are beneficially owned by such shareholder or beneficial owner or owners; |

| ● |

a representation that such shareholder is a

holder of record entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to make the nomination; |

| ● |

the name and residence address of the person

or persons to be nominated; |

| ● |

a description of all arrangements or understandings

between such shareholder or beneficial owner or owners and each nominee and any other person or persons (naming such person

or persons) pursuant to which the nomination is to be made by such shareholder; |

| ● |

such other information regarding each nominee

proposed by such shareholder as would be required to be disclosed in solicitations of proxies for elections of directors,

or would otherwise be required to be disclosed, in each case pursuant to Regulation 14A under the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), including any information that would be required to be included in a

proxy statement filed pursuant to Regulation 14A had the nominee been nominated by the Board; and |

| ● |

the written consent of each nominee to be named

in a proxy statement and to serve as a director if so elected. |

In addition to candidates submitted

through this advance notice By-Law process for shareholder nominations, shareholders may also request that a director nominee

be included in Adtalem’s proxy materials in accordance with the proxy access provision in the By-Laws. Any shareholder or

group of up to 20 shareholders holding both investment and voting rights to at least 3% of Adtalem’s outstanding Common

Stock continuously for at least three years may nominate the greater of (i) two or (ii) 20% of the Adtalem directors to be elected

at an annual meeting of shareholders. Such requests must be received not less than 120 days nor more than 150 days prior to the

anniversary date of the immediately preceding annual meeting of shareholders. As a result, any notice given by or on behalf of

a shareholder pursuant to these provisions of the By-Laws (and not pursuant to Rule 14a-18 of the Exchange Act) must be received

no earlier than June 12, 2023 and no later than July 12, 2023. However, if we hold our 2023 Annual Meeting of Shareholders more

than 30 days from the first anniversary of this year’s Annual Meeting, then in order for notice by the shareholder to be

timely, such notice must be received not later than the close of business on the tenth day following the day on which notice of

the date of the annual meeting was mailed or public disclosure of the date of the annual meeting was made, whichever first occurs.

2022 Proxy

Statement 25

Table of Contents

Proposal No. 1 Election

of Directors

In addition to candidates submitted

through the By-Laws process for shareholder nominations, shareholders may also recommend candidates by following the procedures

set forth below under the caption “Communications with Directors.”

Director

Independence

The Board annually reviews

the continuing independence of Adtalem’s non-employee directors under applicable laws and rules of the New York Stock Exchange

(“NYSE”). The Board, excluding any director who is the subject of an evaluation, reviews and evaluates director transactions

or relationships with Adtalem, including the results of any investigation, and makes a determination with respect to whether a

conflict or violation exists or will exist or whether a director’s independence is or would be impaired.

The Board has considered whether

each director has any material relationship with Adtalem (either directly or as a partner, shareholder, or officer of an organization

that has a relationship with Adtalem) and has otherwise complied with the requirements for independence under the applicable listing

standards of the NYSE.

As a result of this review,

the Board affirmatively determined that, with the exception of Ms. Wardell and Mr. Beard, all of Adtalem’s current directors,

and all of Adtalem’s former directors who served as a director during fiscal year 2022, are “independent” of

Adtalem and its management within the meaning of the applicable NYSE rules. Mr. Beard is considered an inside director because

of his employment as President and CEO of Adtalem. Ms. Wardell is considered an inside director because of her previous employment

as President and CEO of Adtalem.

The Board also considered the

relationship between Adtalem and The Northern Trust Company, discussed below in Certain Relationships and Related Person Transactions.

Mr. Logan, one of our current directors, is Executive Vice President and Managing Director, Global Financial Institutions Group,

with Northern Trust Global Investments, a business unit of The Northern Trust Company. In fiscal year 2022, Adtalem incurred approximately

$212,000 in fees to The Northern Trust Company, which were partially offset against compensating balance credits earned on an

average monthly outstanding balance of approximately $43 million. The Board concluded that the relationship is not a material

one for purposes of the NYSE listing standards and would not influence Mr. Logan’s actions or decisions as a director of

Adtalem.

BOARD

STRUCTURE AND OPERATIONS

Summary of

Board and Committee Structure

Adtalem’s Board held

eight meetings during fiscal year 2022, consisting of four regular meetings and four special meetings. Currently, the Board has

five standing committees: Academic Quality, Audit and Finance, Compensation, External Relations, and Nominating & Governance.

The following table identifies each standing committee, its members and chairs, its key responsibilities and the number of meetings

held during fiscal year 2022. Current copies of the charters of each of these committees, a current copy of Adtalem’s Governance

Principles, and a current copy of Adtalem’s Code of Conduct and Ethics can be found on Adtalem’s website, www.adtalem.com,

and are also available in print to any shareholder upon request from Adtalem’s General Counsel and Corporate Secretary,

500 West Monroe Street, Suite 1300, Chicago, IL 60661. The Board has determined that each of the members of the Audit and Finance,

Compensation, and Nominating & Governance committees is independent within the meaning of applicable laws and NYSE listing

standards in effect at the time of determination. The standing Audit and Finance Committee was established in accordance with

Section 3(a)(58)(A) of the Exchange Act, the rules and regulations of the SEC, and the listing standards of the NYSE.

26 Adtalem Global Education

Inc.

Table of Contents

Proposal

No. 1 Election of Directors

Academic

Quality Committee

| Members |

Meetings

in fiscal year 2022 |

| |

|

| Lyle Logan (Chair) |

4 |

| Charles DeShazer |

|

| Mayur Gupta |

|

| Sharon L. O’Keefe |

|

Key Responsibilities

| ● |

Supports improvement in academic

quality and assures that the academic perspective is heard and represented at the highest policy-setting level and incorporated

in all of Adtalem’s activities and operations |

| ● |

Reviews the academic programs, policies, and

practices of Adtalem’s institutions |

| ● |

Evaluates the academic quality and assessment

process and evaluates curriculum and programs |

Audit

and Finance Committee

| Members |

Meetings

in fiscal year 2022 |

Report |

| |

|

|

| William W. Burke (Chair) |