Viridian Therapeutics, Inc. (NASDAQ: VRDN), a biotechnology

company focused on discovering and developing potential

best-in-class medicines for serious and rare diseases, today

announced the pricing of an underwritten public offering of shares

of its common stock and, in lieu of common stock to certain

investors, shares of Series B non-voting convertible preferred

stock. Viridian is selling a total of 10,666,600 shares of common

stock at a public offering price of $18.75 per share and 20,000

shares of Series B non-voting convertible preferred stock at a

public offering price of $1,250.06250 per share, which are

convertible into 1,333,400 shares of common stock, subject to

beneficial ownership conversion limits. In addition, Viridian has

granted the underwriters a 30-day option to purchase an additional

1,800,000 shares of common stock at the public offering price, less

underwriting discounts and commissions. The gross proceeds to

Viridian from the offering are expected to be approximately $225.0

million, before deducting underwriting discounts and commissions

and estimated offering expenses payable by Viridian and assuming no

exercise of the underwriters’ option to purchase additional

shares.

All of the shares to be sold in the underwritten public offering

are being offered by Viridian. The offering is expected to close on

or about September 13, 2024, subject to customary closing

conditions.

Viridian intends to use the proceeds from the proposed

underwritten public offering of its shares of common stock and

Series B preferred stock, together with its cash, cash equivalents

and short-term investments, to further its clinical development

programs, as well as for working capital and general corporate

purposes.

Jefferies, Goldman Sachs & Co. LLC, Stifel and RBC Capital

Markets are acting as joint book-running managers for the offering.

Wedbush PacGrow is acting as co-manager for this offering.

A registration statement relating to these securities has been

filed with the Securities and Exchange Commission (SEC) and became

effective on September 9, 2022. A final prospectus supplement and

accompanying base prospectus relating to and describing the terms

of the offering will be filed with the SEC. The securities

described above have not been qualified under any state blue sky

laws. This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction. The offering will only be

made by means of a prospectus, copies of which may be obtained at

the SEC’s website at www.sec.gov, or by request to Jefferies LLC

(Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, New York, New York 10022; telephone: 877-821-7388; email:

Prospectus_Department@Jefferies.com); Goldman Sachs & Co. LLC

(Attention: Prospectus Department, 200 West Street, New York, NY

10282, telephone: 1-866-471-2526, facsimile: 212-902-9316 or by

emailing Prospectus-ny@ny.email.gs.com); or Stifel, Nicolaus &

Company, Incorporated (Attention: Prospectus Department, One

Montgomery Street, Suite 3700, San Francisco, CA 94104, by

telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com).

About Viridian Therapeutics, Inc.

Viridian is a biopharmaceutical company focused on engineering

and developing potential best-in-class medicines for patients with

serious and rare diseases. Viridian’s expertise in antibody

discovery and protein engineering enables the development of

differentiated therapeutic candidates for previously validated drug

targets in commercially established disease areas.

Viridian is advancing multiple candidates in the clinic for the

treatment of patients with thyroid eye disease (TED). The company

is conducting a pivotal program for veligrotug, including two

global phase 3 clinical trials (THRIVE and THRIVE-2), to evaluate

its efficacy and safety in patients with active and chronic TED.

Viridian is also advancing VRDN-003 as a potential best-in-class

subcutaneous therapy for the treatment of TED, including two

ongoing global phase 3 clinical trials, REVEAL-1 and REVEAL-2, to

evaluate the efficacy and safety of VRDN-003 in patients with

active and chronic TED.

In addition to its TED franchise, Viridian is advancing a novel

portfolio of neonatal Fc receptor (FcRn) inhibitors, including

VRDN-006 and VRDN-008, which has the potential to be developed in

multiple autoimmune diseases.

Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements may be identified by the use of words such

as, but not limited to, “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or other similar terms or expressions that concern the

company’s expectations, plans and intentions. Forward-looking

statements include, without limitation, statements regarding the

underwritten public offering; the company’s expectations with

respect to the use of the net proceeds from the underwritten public

offering; the company’s belief that VRDN-003 may be a best-in-class

subcutaneous therapy for the treatment of TED; and the potential

for the company’s novel portfolio of FcRn inhibitors to be

developed in multiple autoimmune diseases. Forward-looking

statements are neither historical facts nor assurances of future

performance. Instead, they are based on the company’s current

beliefs, expectations and assumptions. New risks and uncertainties

may emerge from time to time, and it is not possible to predict all

risks and uncertainties. No representations or warranties

(expressed or implied) are made about the accuracy of any such

forward-looking statements. Such forward-looking statements are

subject to a number of material risks and uncertainties including

but not limited to: the satisfaction of customary closing

conditions related to the underwritten public offering; and other

risks and uncertainties identified in the company’s filings with

the SEC, including those risks set forth under the caption “Risk

Factors” in the company’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2024, filed with the SEC on August 8, 2024,

and other subsequent disclosure documents filed with the SEC. Any

forward-looking statement speaks only as of the date on which it

was made. Neither the company, nor its affiliates, advisors or

representatives, undertake any obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise, except as required by law.

These forward-looking statements should not be relied upon as

representing the company’s views as of any date subsequent to the

date hereof.

Source: Viridian Therapeutics, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911242094/en/

Investor & Media Contact: Louisa Stone, 617-272-4604

Manager, Investor Relations IR@viridiantherapeutics.com

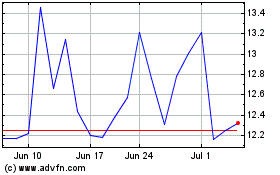

Viridian Therapeutics (NASDAQ:VRDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

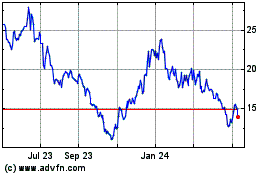

Viridian Therapeutics (NASDAQ:VRDN)

Historical Stock Chart

From Nov 2023 to Nov 2024