As

filed with the Securities and Exchange Commission on January 28, 2025.

Registration

No. 333-[*]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

TREASURE

GLOBAL INC

(Exact

name of registrant as specified in its charter)

| Delaware |

|

36-4965082 |

(State

or other jurisdiction of

incorporation or organization) |

|

(I.R.S.

Employer

Identification

Number) |

| |

|

|

276

5th Avenue, Suite 704 #739

New

York, New York 10001

+6012

643 7688 |

| (Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

| |

Carlson

Thow

Chief

Executive Officer

Treasure

Global Inc

276

5th Avenue, Suite 704 #739

New

York, New York 10001

+6012

643 7688 |

| (Name,

address, including zip code, and telephone number, including area code, of agent for service) |

Copies

to:

Ross

D. Carmel, Esq.

Jeffrey

P. Wofford, Esq.

Sichenzia

Ross Ference Carmel LLP

1185

Avenue of the Americas, 31st Floor

New

York, New York 10036

Telephone:

(212) 930-9700 |

Approximate

date of commencement of proposed sale to the public: From time to time, after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

Accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Exchange Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE

INFORMATION IN THIS PRELIMINARY PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION

STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PRELIMINARY PROSPECTUS IS NOT AN OFFER TO SELL

THESE SECURITIES AND WE ARE NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JANUARY [*], 2025 |

Up

to 90,000,000 Shares of Common Stock

Treasure

Global Inc

This prospectus relates to the resale of up to

90,000,000 shares of our common stock (the “Selling Stockholder Shares”), par value $0.00001 per share by Alumni Capital

LP (“Alumni Capital” or the “Selling Stockholder”) that may be issued and sold to the Selling Stockholder pursuant

to the Purchase Agreement dated as of October 10, 2024 between us and Alumni Capital (the “Purchase Agreement”) and amended

by the Modification Agreement dated as of January 21, 2025. The Selling Stockholder Shares will be sold by us to the Selling Stockholder

upon the satisfaction of certain conditions set forth in the Purchase Agreement at a discounted purchase price per share calculated pursuant

to the terms of the Purchase Agreement.

See

“The Alumni Capital Transaction” for a description of the Purchase Agreement and “Selling Stockholder” for additional

information regarding Alumni Capital.

The

prices at which Alumni Capital may resell the Selling Stockholder Shares will be determined by the prevailing market price for the shares

or in negotiated transactions. We are not selling any securities under this prospectus and will not receive any of the proceeds from

the sale of Selling Stockholder Shares by the Selling Stockholder. However, we may receive up to $44,115,279 in proceeds from the sale

of shares of common stock to the Selling Stockholder pursuant to the Purchase Agreement, once the registration statement that includes

this prospectus is declared effective. You should read this prospectus and any additional prospectus supplement or amendment carefully

before you invest in our securities.

The

Selling Stockholder may sell or otherwise dispose of the Selling Stockholder Shares described in this prospectus in a number of different

ways and at varying prices. See “Plan of Distribution” for more information about how the Selling Stockholder may sell or

otherwise dispose of the Selling Stockholder Shares being registered pursuant to this prospectus. The Selling Stockholder is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

The

Selling Stockholder will pay all brokerage fees and commissions and similar expenses. We will pay the expenses (except brokerage fees

and commissions and similar expenses) incurred in registering the Selling Stockholder Shares, including legal and accounting fees. See

“Plan of Distribution.”

This

offering will terminate on the date that all of the Selling Stockholder Shares offered by this prospectus have been sold by the Selling

Stockholder.

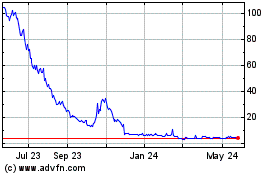

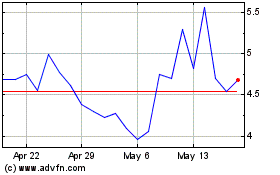

Our common stock is listed on

The Nasdaq Capital Market under the symbol “TGL.” The last reported sale price of our common stock on The Nasdaq Capital Market

on January 22, 2025, was $0.2306 per share.

We

are an “emerging growth company” and a “smaller reporting company” as defined in the Jumpstart Our Business Startups

Act of 2012 (the “JOBS Act”), and have elected to comply with certain reduced public company reporting requirements. See

“Summary-Implications of Being an Emerging Growth Company and Smaller Reporting Company.”

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully review and consider all

of the information set forth in this prospectus, including the risks and uncertainties described under “Risk Factors”

beginning on page 10 of this prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated _______________, 2025

TABLE

OF CONTENTS

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the placement

agent, have authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus.

If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the placement agent take

responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should

assume that the information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial condition, results of

operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which

such offer is unlawful.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution

of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States

are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus

applicable to that jurisdiction.

ABOUT

THIS PROSPECTUS

Throughout

this prospectus, unless otherwise designated or the context suggests otherwise,

| ● | all

references to the “Company,” “TGL,” the “registrant,” “we,” “our” or “us”

in this prospectus mean Treasure Global Inc and its subsidiaries; |

| ● | “year”

or “fiscal year” means the year ending June 30th; |

| ● | all

dollar or $ references, when used in this prospectus, refer to United States dollars; and |

| ● | all

RM or MYR references, when used in this prospectus, refer to Malaysian Ringgit. |

MARKET

DATA

Market

data and certain industry data and forecasts used throughout this prospectus were obtained from internal company surveys, market research,

consultant surveys, publicly available information, reports of governmental agencies and industry publications and surveys. Industry

surveys, publications, consultant surveys and forecasts generally state that the information contained therein has been obtained from

sources believed to be reliable, but the accuracy and completeness of such information is not guaranteed. To our knowledge, certain third-party

industry data that includes projections for future periods does not take into account the effects of the worldwide coronavirus pandemic.

Accordingly, those third-party projections may be overstated and should not be given undue weight. Forecasts are particularly likely

to be inaccurate, especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic

growth were used in preparing the forecasts we cite. Statements as to our market position are based on the most currently available data.

While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates involve risks and

uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors”

in this prospectus.

PROSPECTUS

SUMMARY

This

summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in

making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related

free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained

in the applicable prospectus supplement and any related free writing prospectus.

Our

Mission

Our

mission is to bring together the worlds of online e-commerce and offline physical retailers; widening consumer choice and rewarding loyalty,

while sustaining and enhancing our earning potential.

Our

Company

We

have created an innovative online-to-offline (“O2O”) e-commerce platform business model offering consumers and merchants

instant rebates and affiliate cashback programs, while providing a seamless e-payment solution with rebates in both e-commerce (i.e.,

online) and physical retailers/merchant (i.e., offline) settings.

Our

proprietary product is an internet application (or “App”) branded “ZCITY App,” which was developed through our

wholly owned subsidiary, ZCity Sdn. Bhd. (formerly known as Gem Reward Sdn. Bhd, name change effected on July 20, 2023) (“ZCITY”).

The ZCITY App was successfully launched in Malaysia in June 2020. ZCITY is equipped with the know-how and expertise to develop additional/add-on

technology-based products and services to complement the ZCITY App, thereby growing its reach and user base.

Through

simplifying a user’s e-payment gateway experience, as well as by providing great deals, rewards and promotions with every use,

we aim to make the ZCITY App Malaysia’s top reward and payment gateway platform. Our longer-term goal is for the ZCITY App and

its ever-developing technology to become one of the most well-known commercialized applications more broadly in Southeast Asia and Japan.

As of January 22, 2024, we had 2,707,272 registered

users and 2,027 registered merchants.

Our

Consumer Business

Consumers

in Southeast Asia (“SEA”) have access to a plethora of smart ordering, delivery and “loyalty” websites and apps,

but in our experience, SEA consumers very rarely receive personalized deals based on their purchases and behavior.

The

ZCITY App targets consumers through the provision of personalized deals based on consumers’ purchase history, location and preferences.

Our technology platform allows us to identify the spending trends of our customers (the when, where, why, and how much). We are able

to offer these personalized deals through the application of our proprietary artificial intelligence (“AI”) technology that

scours the available database to identify and create opportunities to extrapolate the greatest value from the data, analyze consumer

behavior and roll out attractive rewards-based campaigns for targeted audiences. We believe this AI technology is currently a unique

market differentiator for the ZCITY App.

We

operate our ZCITY App on the hashtag: “#RewardsOnRewards.” We believe this branding demonstrates to users the ability to

spend ZCITY App-based Reward Points (or “RP”) and “ZCITY Cash Vouchers” with discount benefits at checkout. Additionally,

users can use RP while they earn rewards from selected e-Wallet or other payment methods.

ZCITY

App users do not require any on-going credit top-up or need to provide bank card number with their binding obligations. We have partnered

with Malaysia’s leading payment gateway, iPay88, for secure and convenient transactions. Users can use our secure platform and

enjoy cashless shopping experiences with rebates when they shop with e-commerce and retail merchants through trusted and leading e-wallet

providers such as Touch’n Go eWallet, Boost eWallet, GrabPay eWallet and credit card/online banking like the “FPX”

(the Malaysian Financial Process Exchange) as well as more traditional providers such as Visa and Mastercard.

Our

ZCITY App also provides the following functions:

| 1. | Registration

and Account verification |

Users

may register as a ZCITY App user simply, using their mobile device. They can then verify their ZCITY App account by submitting a valid

email address to receive new user “ZCITY Newbie Rewards.”

| |

2. |

Geo-location-based

Homepage |

Based

on the users’ location, nearby merchants and exclusive offers are selected and directed to them on their homepage for a smooth,

user-friendly interaction.

Our

ZCITY App is affiliated with more than five local services providers such as Shopee and Lazada. The ZCITY App allows users to enjoy more

rewards when they navigate from the ZCITY App to a partner’s website.

| |

4. |

Bill

Payment & Prepaid service |

Users

can access and pay utility bills, such as water, phone, internet and TV bills, while generating instant discounts and rewards points

with each payment.

Users

can purchase their preferred e-Vouchers with instant discounts and rewards points with each checkout.

| |

6. |

User

Engagement through Gamification |

Users

can earn daily rewards by playing our ZCITY App minigame “Spin & Win” where they can earn further ZCITY RP, ZCITY e-Vouchers

as well as monthly grand prizes.

ZCITY

has collaborated with the Ministry of Domestic Trade and Cost of Living (KPDN) for the launch of the ‘Payung Rahmah’ program

(“ZCITY RAHMAH Package”). This program offers a comprehensive package of living essential e-vouchers on the ZCITY app for

items such as petrol, food, and bills. ZCITY users will be able to purchase vouchers for these items at reduced prices, thereby assisting

low-income Malaysians and helping to address this societal challenge.

| |

8. |

TAZTE

Smart F&B system |

ZCITY

App offers a “Smart F&B” system that provides a one stop solution and digitalization transformation for all registered

Food “F&B” outlets located in Malaysia. It also allows merchants to easily record transactions with QR Digital Payment

technology, set discounts and execute RP redemptions and rewards online on the ZCITY App.

Since

December 2022, we have been developing TAZTE. However, due to insufficient participation from merchant clients, management has decided

to discontinue the program as of June 2024.

Zstore

is ZCITY App’s e-mall service that offers group-buys and instant rebate to users with embedded AI and big data analytics to provide

an express shopping experience. The functionality and benefit of users to use the Zstore can be summarized within the chart below, which

also illustrates some of our key partnerships by category:

Reward

Points. Operating under the hashtag #RewardsOnRewards, we believe the ZCITY App reward points program

encourages users to sign up on the App, as well as increasing user engagement and spending on purchases/repeat purchases and engenders

user loyalty.

Furthermore,

we believe the simplicity of the steps to obtaining Reward Points (or “RP”) is an attractive incentive to user participation

in that participants receive:

| |

● |

200

RP for registration as a new user; |

| |

|

|

| |

● |

100

RP for referral of a new user; |

| |

|

|

| |

● |

Conversion

of Malaysian ringgit spent into RP; |

| |

|

|

| |

● |

50%

RP of every user paid amount; and |

| |

|

|

| |

● |

25%

RP of every referred user paid amount as a result of the referral. |

The

key objectives of our RP are:

| |

○ |

RP

are offered to users for increased social engagement. |

| |

○ |

RP

incentivizes users with every MYR spent in order to increase the spending potential and to build users loyalty. |

| |

○ |

Drives

loyalty and greater customer engagement. Every new user onboarded will get 200 RP as welcoming gift. |

| |

○ |

Rewards

users with RP when they refer a new user. |

Offline

Merchant

When

using our ZCITY App to make payment to a registered physical merchant, the system will automatically calculate the amount of RP to deduct.

The deducted RP amount is based on the percentage of profit sharing as with the merchant and the available RP of the user.

Online

Merchant

When

using our ZCITY App to pay utility bills or purchase any e-vouchers, our system shows the maximum RP deduction allowed and the user determines

the amount of discount deducted subject to maximum deductions described below and the number of RP owned by such user.

Different

features have different maximum deduction amounts. For example, for bill payments, the maximum deduction is up to 3% of the bill amount.

For e-vouchers, the maximum deduction is up to 5% of the voucher amount.

In

order to increase the spending power of the user, our ZCITY App RP program will credit RP to the user for all MYR paid.

Revenue

Model

ZCITY’s

revenues are generated from a diversified mix of:

| |

● |

e-commerce

activities for users; |

| |

|

|

| |

● |

services

to merchants to help them grow their businesses; and |

| |

|

|

| |

● |

membership

subscription fees. |

The

revenue streams consist of “Consumer Facing” revenues and “Merchant Facing” revenues.

The

revenue streams can be further categorized as following: (1) product and loyalty program revenue, (2) transaction revenue, and (3) agent

subscription revenue. Please see “Management’s Discussion and Analysis ̶ Revenue Recognition.”

Recent

Development

On

October 10, 2024, the Company entered into a service partnership agreement (the “Partnership Agreement”) with Octagram Investment

Limited (“OCTA”), a Malaysian company, to establish a strategic partnership pursuant to the terms and conditions set forth

in this Partnership Agreement. Pursuant to the Partnership Agreement, OCTA shall design, develop and deliver mini-game modules to be

integrated into the ZCity App, an E-Commerce platform owned by the Company. In addition, OCTA shall customize the mini-game modules based

on the Company’s detailed specification.

The

Company agreed to pay OCTA a total fee of $2,800,000.00 (“Service Fees”) to OCTA and/or its nominees, which was paid through

the issuance of 3,500,000 shares of our common stock to nominees of OCTA., as well as the payment of a flat fee of $10,000.00 per month,

starting from the delivery of the first mini-game module, for the ongoing technical support outlined in this Agreement. The number of

shares issued was based on a value of $0.80 per share. If however, on the date that is six months from the issuance date the 30-day VWAP

of our common stock is below $0.80 per share, then the Company shall issue to OCTA additional shares of our common stock equal to the

difference between (x) $2,800,000 divided by such 30-day VWAP and (y) 3,500,000.

On

November 1, 2024, the Company entered into a certain service agreement (the “Agreement”) with V GALLANT SDN BHD (“V

Gallant”), a private company incorporated in Malaysia. Pursuant to the Agreement, the Company engaged V Gallant for its generative

AI solutions and AI digital human technology services (the “Services”) in accordance with the terms and conditions therein.

The Company agreed to pay V Gallant a total consideration of USD16,000,000 (the “Fees”) to V Gallant and/or its nominees

for the Services and all associated hardware and software under the Agreement.

The

Fees shall be payable by the Company to V Gallant and/or its nominees via the issuance of shares of common stock, par value $0.00001

per share (“TGL Shares”) at a determined issuance price of $0.67 per TGL Share in the following manner: (1) the first instalment,

constituting a down payment of fifty percent (50%) of the Fees, being $8,000,000, shall be due upon execution of this Agreement; and

(2) the remainder, constituting fifty percent (50%) of the Fees, being $8,000,000, shall be paid in twelve (12) equal monthly instalments,

commencing from January 31, 2025, with each payment due on the last day of each calendar month, until December 31, 2025, unless otherwise

mutually agreed in writing by the TGL and V Gallant.

Nasdaq Non Compliance

On November 20, 2024, Company received a written

notice (the “Notice”) from Listing Qualifications Staff of Nasdaq stating that for the 30 consecutive business day period

between October 8, 2024 through November 19, 2024, the common stock of the Company had not maintained a minimum closing bid price of $1.00

per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price

Rule”). Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the Company was provided an initial period of 180 calendar days, or until

May 19, 2025 (the “Compliance Period”), to regain compliance with the Bid Price Rule.

To regain compliance, the closing bid price of

the Company’s common stock must meet or exceed $1.00 per share for a minimum of 10 consecutive trading days, unless extended by

Nasdaq under Nasdaq Rule 5810(c)(3)(H), prior to May 19, 2025.

If the Company does not regain compliance with

the Bid Price Rule by May 19, 2025, the Company may be eligible for an additional 180-day period to regain compliance. To qualify, the

Company would be required to meet the continued listing requirement for market value of publicly held shares and all other initial listing

standards for The Nasdaq Capital Market, with the exception of the Bid Price Rule, and would need to provide written notice of its intention

to cure the bid price deficiency during the second compliance period, by effecting a reverse stock split, if necessary.

If the Company cannot regain compliance during

the Compliance Period or any subsequently granted compliance period, the common stock of the Company will be subject to delisting. At

that time, the Company may appeal the delisting determination to a Nasdaq hearings panel.

The notice from Nasdaq has no immediate effect on the listing of the

Company’s common stock and its common stock will continue to be listed on The Nasdaq Capital Market under the symbol “TGL.”

The Company is currently evaluating its options for regaining compliance. There can be no assurance that the Company will regain compliance

with the Bid Price Rule or maintain compliance with any of the other Nasdaq continued listing requirements.

Corporate

Information

Treasure

Global Inc is a holding company incorporated on March 20, 2020, under the laws of the State of Delaware. TGL has no substantive operations

other than holding all of the outstanding shares of ZCity Sdn Bhd (formerly known as Gem Reward Sdn Bhd), which was established under

the laws of the Malaysia on June 6, 2017, through a reverse recapitalization.

Prior

to March 11, 2021, TGL and ZCITY were separate companies under the common control of Kok Pin “Darren” Tan, which resulted

from Mr. Tan’s prior 100% ownership of TGL and his prior 100% voting and investment control over ZCITY pursuant to the Beneficial

Shareholding Agreements. For a more detailed description of the Beneficial Shareholding Agreements and Mr. Tan’s common control

over TGL and ZCITY see Part I, Item 1. “Business - Corporate Structure.”

On

March 11, 2021, TGL and ZCITY were reorganized into a parent subsidiary structure pursuant to the Share Swap Agreement in which TGL exchanged

the swap shares for all of the issued and outstanding equity of ZCITY. Pursuant to the Share Swap Agreement, the purchase and sale of

the swap shares was completed on March 11, 2021, but the issuance of the swap shares did not occur until October 27, 2021 when TGL amended

its certificate of incorporation to increase the number of its authorized common stock to a number that was sufficient to issue the swap

shares. As a result of the Share Swap Agreement, (i) ZCITY became the 100% subsidiary of TGL and Kok Pin “Darren” Tan no

longer had any control over the ZCITY ordinary shares and (ii) Kok Pin “Darren,” the Initial ZCITY Stockholders and Chong

Chan “Sam” Teo owned 100% of the shares of TGL common stock (Kok Pin “Darren” Tan owning approximately 97%).

Subsequent to the date of the Share Swap Agreement, Kok Pin “Darren” Tan transferred 136,129 of his 142,858 shares of TGL

common stock (post-split) to 16 individuals and entities and currently owns less than 5% of our common stock.

Executive

Offices

Our principal executive offices are located at

276 5th Avenue, Suite 704 #739, New York, New York 10001 and B03-C-13A, Menara 3A, KL Eco City, No. 3 Jalan Bangsar, 59200

Kuala Lumpur, Wilayah Persekutuan, Malaysia. Our main telephone number is +6017 769 1121. Our corporate website address is https://treasureglobal.co.

Our ZCITY website address is https://zcity.io. The information included on our websites is not part of this prospectus. All the

websites are active. We do not incorporate the information on, or accessible through, our websites into this prospectus, and you should

not consider any information on, or accessible through, our websites as part of this prospectus.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier

of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to

an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross

revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous

three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will

remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will

no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date

of the first sale of our common stock pursuant to an effective registration statement under the Securities Act. For so long as we remain

an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are applicable

to other public companies that are not emerging growth companies.

These

exemptions include:

| ● | being

permitted to provide only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure; |

| |

● |

not

being required to comply with the requirement of auditor attestation of our internal controls over financial reporting; |

| |

● |

not

being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory

audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial

statements; |

| |

● |

reduced

disclosure obligations regarding executive compensation; and |

| |

● |

not

being required to hold a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments

not previously approved. |

We

have taken advantage of certain reduced reporting requirements in this prospectus. Accordingly, the information contained herein may

be different than the information you receive from other public companies in which you hold stock.

An

emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for

complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended

transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption

of such standards is required for other public reporting companies.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act, and have elected to take advantage of

certain of the scaled disclosure available for smaller reporting companies.

Summary

Risk Factors

Our

business is subject to numerous risks and uncertainties, any one of which could materially adversely affect our results of operations,

financial condition or business. These risks include, but are not limited to, those listed below. This list is not complete, and should

be read together with the section titled “Risk Factors” below:

| |

● |

There

is substantial doubt about our ability to continue as a going concern; |

| |

● |

We

have a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase

the risk that we will not be successful; |

| |

● |

If

we fail to raise capital when needed it will have a material adverse effect on our business, financial condition and results of operations; |

| |

● |

We

rely on email, internet search engines and application marketplaces to drive traffic to our ZCITY App, certain providers of which

offer products and services that compete directly with our products. If links to our applications and website are not displayed prominently,

traffic to our ZCITY App could decline and our business would be adversely affected; |

| |

● |

The

ecommerce market is highly competitive and if we do not have sufficient resources to maintain research and development, marketing,

sales and client support efforts on a competitive basis our business could be adversely affected; |

| |

● |

If

we are unable to expand our systems or develop or acquire technologies to accommodate increased volume or an increased variety of

operating systems, networks and devices broadly used in the marketplace our ZCITY App could be impaired; |

| |

● |

We

may not be able to successfully develop and promote new products or services which could result in adverse financial consequences; |

| |

● |

There

is no assurance that we will be profitable; |

| |

● |

We

rely on the performance of highly skilled personnel, and if we are unable to attract, retain and motivate well-qualified employees,

our business could be harmed; |

| |

● |

The

economy of Malaysia in general might not grow as quickly as expected, which could adversely affect our revenues and business prospects; |

| |

● |

We

face the risk that changes in the policies of the Malaysian government could have a significant impact upon the business we may be

able to conduct in Malaysia and the profitability of such business; |

| |

● |

Malaysia

is experiencing substantial inflationary pressures which may prompt the governments to take action to control the growth of the economy

and inflation that could lead to a significant decrease in our profitability; |

| |

● |

If

inflation increases significantly in SEA countries, our business, results of operations, financial condition and prospects could

be materially and adversely affected; |

| |

● |

Any

potential disruption in and other risks relating to our merchants’ supply chain could increase the costs of their products

or services to consumers, potentially causing consumers to limit their spending or seek products or services from alternative businesses

that may not be registered as a merchant with us, which may ultimately affect the total number of users using our platform and harm

our business, financial condition and results of operations; |

| |

● |

Geopolitical

conditions, including acts of war or terrorism or unrest in the regions in which we operate could adversely affect our business; |

| |

● |

Because

our principal assets are located outside of the United States and all of our directors and officers reside outside of the United

States, it may be difficult for you to enforce your rights based on U.S. Federal Securities Laws against us and our officers and

directors or to enforce a judgment of a United States court against us or our officers and directors; |

| |

● |

Privacy

regulations could have adverse consequences on our business; |

| |

● |

We

may not be able to continue to satisfy listing requirements of Nasdaq to maintain a listing of our common stock. |

SUMMARY

OF THE OFFERING

| Securities

offered by the Selling Stockholder |

|

Up

to 90,000,000 shares of common stock. |

| |

|

|

| Terms

of the Offering |

|

The

Selling Stockholder will sell the Selling Stockholder Shares at the prevailing market prices or privately negotiated prices. See

“Plan of Distribution” on page 16 of this prospectus. |

| |

|

|

| Selling

Stockholder |

|

The

Selling Stockholder will receive all of the proceeds from the sale of Selling Stockholder Shares for sale by it under this prospectus.

We will not receive proceeds from the sale of the Selling Stockholder Shares by the Selling Stockholder. However, we may receive

proceeds from the exercise of the Alumni Warrant at variable exercise prices and up to $44,115,279 in proceeds from the sale of our

common stock to the Selling Stockholder pursuant to the Purchase Agreement, once the registration statement that includes this prospectus

is declared effective. |

| |

|

|

| Use

of Proceeds |

|

Any

proceeds from the Selling Stockholder that we receive under the Purchase Agreement are expected to be used for general corporate

purposes, including working capital. See “Use of Proceeds” on page 13 of this prospectus. |

| |

|

|

| Risk

Factors |

|

An

investment in our common stock involves a high degree of risk. See the information contained in or incorporated by reference under

“Risk Factors” on page 10 of this prospectus supplement and under similar headings in the other documents that

are incorporated by reference herein, as well as the other information included in or incorporated by reference in this prospectus

supplement and the accompanying prospectus. |

| |

|

|

| The

Nasdaq Capital Market symbol |

|

TGL |

| |

|

|

| Transfer

Agent and Registrar |

|

VStock

Transfer LLC |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to purchase any of our securities, you should carefully consider

the risks and uncertainties described below, in the section titled “Risk Factors” in our Annual Report on Form 10-K, and

in other documents that we subsequently file with the SEC that update, supersede or supplement such information, which are incorporated

by reference into this prospectus supplement and accompanying base prospectus, and in any free writing prospectus that we have authorized

for use in connection with this offering. If any of these risks actually occur, our business, financial condition and results of operations

could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and

you could lose some or all of your investment. Additional risks not presently known to us or that we currently deem immaterial may also

impair our business operations. If any of these risks occur, the trading price of our ordinary shares could decline materially and you

could lose all or part of your investment. If any of these risks actually occur, our business, financial condition, results of operations

or cash flow could be harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of

your investment. Please also read carefully the section above titled “Cautionary Note Regarding Forward-Looking Statements.”

Risks

Related to this Offering

You

may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our ordinary shares or other securities convertible

into or exchangeable for our ordinary shares. We may not be able to sell shares or other securities in any other offering at a price

per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or

other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares

of our ordinary shares or other securities convertible into or exchangeable for our ordinary shares in future transactions may be higher

or lower than the price per share in this offering.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our shareholders will not have the

opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. The failure by our management to apply these funds effectively could harm our business. See “Use

of Proceeds” on page S-8 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains “forward-looking statements.” Forward-looking statements reflect the current view about future events.

When used in this prospectus, the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan” or the negative of these terms and similar expressions, as they relate

to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained

in this prospectus relating to our business strategy, our future operating results and liquidity and capital resources outlook. Forward-looking

statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because

forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are

neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on

any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking

statements include, without limitation:

| ● | Our

ability to effectively operate our business segments; |

| ● | Our

ability to manage our research, development, expansion, growth and operating expenses; |

| ● | Our

ability to evaluate and measure our business, prospects and performance metrics; |

| ● | Our

ability to compete, directly and indirectly, and succeed in a highly competitive and evolving industry; |

| ● | Our

ability to respond and adapt to changes in technology and customer behavior; |

| ● | Our

ability to protect our intellectual property and to develop, maintain and enhance a strong brand; and |

| ● | other

factors (including the risks contained in the section of this prospectus entitled “Risk Factors”) relating to our

industry, our operations and results of operations. |

Should

one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ

significantly from those anticipated, believed, estimated, expected, intended or planned.

Factors

or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of

them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including

the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements

to actual results.

THE

ALUMNI CAPITAL TRANSACTION

On October 10, 2024, we entered into the Purchase

Agreement with Alumni Capital which was subsequently amended by the Modification Agreement dated January 21, 2025 (the “Purchase

Agreement”). Pursuant to the Purchase Agreement, we may sell to Alumni Capital up to $50,000,000 (the “Commitment Amount”)

of shares of common stock from time to time during the term of the Purchase Agreement. Pursuant to the Purchase Agreement, we also agreed

to file a registration statement with the SEC, covering the resale of the shares of common stock issued or sold to Alumni Capital under

the Purchase Agreement under the Securities Act. We previously registered $1,000,000 of shares of common stock that may be sold to Alumni

Capital pursuant to the Purchase Agreement pursuant to our Registration Statement on Form S-3 (No. 333-278171) and then we registered

22,500,000 shares of our common stock that may be sold to Alumni Capital pursuant to the Purchase Agreement pursuant to our Registration

Statement on Form S-1 (No. 333-283309). We have sold Alumni Capital 22,328,993 shares of our common stock to Alumni Capital for approximately

$5,884,720 under the registration statements. This prospectus relates to up to 90,000,000 shares of our common stock that may be purchased

from time to time by Alumni Capital pursuant to the Purchase Agreement, to the extent the proceeds from such sales do not exceed $44,115,279.

In connection with the execution of the Purchase

Agreement on October 10, 2024, we have issued to Alumni Capital as a commitment fee, a three-year common stock purchase warrant (the “Alumni

Warrant”) to purchase a number of shares of common stock that is determined by a formula that is described below. The Alumni Warrant, as amended by the Modification Agreement dated January 21, 2025,

provides Alumni Capital with the right to purchase at any time until October 10, 2027, to purchase up to a number of shares of common

stock equal to (i) for the first $600,000 worth of shares exercised; $600,000 divided by the First Exercise Price. The First Exercise

Price of the Alumni Warrant on any given exercise date will be calculated by dividing $5,000,000 by the total number of outstanding shares

of our common stock as of such exercise date and (ii) for the remaining $4,400,000 worth of shares exercised; $4,400,000 divided by the

Second Exercise Price. The Second Exercise Price of the Alumni Warrant on any given exercise date will be calculated by dividing $8,500,000

by the total number of outstanding shares of our common stock as of such exercise date.

We

may, from time to time and at our sole discretion, direct Alumni Capital to purchase the Purchase Notice Securities upon the satisfaction

of certain conditions set forth in the Purchase Agreement at a purchase price per share based on the market price of our common stock

at the time of sale as computed under the Purchase Agreement. Alumni Capital may not assign its rights and obligations under the Purchase

Agreement.

The

Purchase Agreement prohibits us from directing Alumni Capital to purchase any Purchase Notice Securities if those shares, when aggregated

with all other ordinary shares then beneficially owned by Alumni Capital, would result in Alumni Capital and its affiliates owning in

excess of 4.99%, of our then issued and outstanding shares of common stock (the “Beneficial Ownership Limitation”).

Purchase

of Offered Shares Under the Purchase Agreement

Commencing

on the date that the Alumni Warrant is delivered to Alumni Capital and ending on the earlier of (x) the date on which the Company has

received the Commitment Amount pursuant to the Purchase Agreement and (y) December 31, 2025, we may from time to time direct Alumni Capital

to purchase such number of common stock set forth on a written notice from us (the “Purchase Notice”) at a price equal to

the Purchase Price, provided, however, that the amount of Purchase Notice Securities cannot exceed the Commitment Amount or the Beneficial

Ownership Limitation. We will deliver the Purchase Notice Securities concurrently with the delivery of a Purchase Notice, which will

be deemed delivered on the same business day if Alumni Capital receives the Purchase Notice Securities and the Purchase Notice by 8:00

a.m., New York time, or on the next business day if Alumni Capital receives the Purchase Notice Securities and the Purchase Notice after

8:00 a.m., New York time. Within five Business Days after the Purchase Notice Date, Alumni Capital shall pay to the Company an amount

equal to the Purchase Notice Securities multiplied by the Purchase Price (the “Closing Date”).

“Purchase

Price” means with respect to any date on which our common stock is sold pursuant to the Purchase Agreement (a “Closing Date”),

the lowest traded price for the ordinary shares for the five (5) consecutive Business Days immediately prior to such Closing Date multiplied

by 93%.

Effect

of Performance of the Purchase Agreement on our Stockholders

The

sale by Alumni Capital of a significant number of Selling Stockholder Shares at any given time could cause the market price of our Ordinary

Shares to decline and to be highly volatile. Sales of our Ordinary Shares to Alumni Capital, if any, will depend upon market conditions

and other factors to be determined by us, in our sole discretion. We may ultimately decide to sell to Alumni Capital all, some or none

of the Purchase Notice Securities that may be available for us to sell pursuant to the Purchase Agreement. If and when we do sell the

Purchase Notice Securities to Alumni Capital, Alumni Capital may resell all, some or none of those shares at any time or from time to

time in its discretion. Therefore, sales to Alumni Capital by us under the Purchase Agreement may result in substantial dilution to the

interests of our other shareholders. In addition, if we sell a substantial number of the Purchase Notice Securities to Alumni Capital

under the Purchase Agreement, or if investors expect that we will do so, the actual sales of Purchase Notice Securities or the mere existence

of our arrangement with Alumni Capital may make it more difficult for us to sell equity or equity-related securities in the future at

a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount

of any sales of the Purchase Notice Securities to Alumni Capital.

Pursuant

to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Alumni Capital to purchase up to $50,000,000

in shares of common stock, which is exclusive of the Alumni Warrants issued to Alumni Capital as consideration for its commitment to

purchase our shares of common stock under the Purchase Agreement. The Purchase Agreement generally prohibits us from issuing or selling

to Alumni Capital under the Purchase Agreement any common stock that, when aggregated with all other shares of common stock then beneficially

owned by Alumni Capital and its affiliates, would exceed the Beneficial Ownership Limitation. Currently, we have issued and sold 22,328,993

shares of common stock to Alumni Capital for approximately $5,884,720 under the Purchase Agreement. Alumni Capital has not exercised

any portion of the Alumni Warrant.

Capitalized

terms that are not defined herein may have meanings assigned to them in the Purchase Agreement.

USE

OF PROCEEDS

This

prospectus relates to the Selling Stockholder Shares that may be offered and sold from time to time by Alumni Capital. We will not receive

any proceeds from the resale of the Selling Stockholder Shares by Alumni Capital.

We

may receive proceeds from the exercise of the Alumni Warrant at variable exercise prices and up to $5 million in proceeds from the sale

of common stock to the Selling Stockholder pursuant to the Purchase Agreement.

We

intend to use the proceeds from sales under the Purchase Agreement or exercises of the Alumni Warrant, if any, for general corporate

purposes, which may include working capital, expenses related to research, clinical development and commercial efforts, and general and

administrative expenses. We currently have no binding agreements or commitments to complete any transaction for the possible acquisition

of new therapeutic candidates, though we are currently, and likely to continue, exploring possible acquisition candidates

MARKET

FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our

common stock is listed on The Nasdaq Capital Market under the symbol “TGL.”

As of January 27, 2025, 46,632,655 shares of our

common stock were issued and outstanding and were held by 38 stockholders of record.

We also have the

following outstanding warrants:

| ● | Warrants

to purchase 1,429 shares of our common stock issued to the underwriter in our initial public

offering with an exercise price of $350 per share; and |

| ● | The

Alumni Warrant (for which we have reserved 8 million shares of our common stock) |

DIVIDEND

POLICY

We

have not declared any cash dividends since inception and we do not anticipate paying any dividends in the foreseeable future. Instead,

we anticipate that all of our earnings will be used to provide working capital, to support our operations, and to finance the growth

and development of our business. The payment of dividends is within the discretion of the Board and will depend on our earnings, capital

requirements, financial condition, prospects, applicable Delaware law, which provides that dividends are only payable out of surplus

or current net profits, and other factors our Board might deem relevant. There are no restrictions that currently limit our ability to

pay dividends on our common stock other than those generally imposed by applicable state law.

PRINCIPAL

STOCKHOLDERS

The following table sets forth certain information,

as of January 27, 2025 with respect to the holdings of (1) each person who is the beneficial owner of more than 5% of Company voting stock,

(2) each of our directors, (3) each executive officer and (4) all of our current directors and executive officers as a group.

Beneficial ownership of the voting stock is determined

in accordance with the rules of the SEC and includes any shares of company voting stock over which a person exercises sole or shared voting

or investment power, or of which a person has a right to acquire ownership at any time within 60 days of January 27, 2025. Except as otherwise

indicated, we believe that the persons named in this table have sole voting and investment power with respect to all shares of voting

stock held by them. Applicable percentage ownership in the following table is based on 46,632,655 shares of common stock issued and outstanding

on of January 27, 2025 (excludes 1,429 shares of our common stock underlying the warrant issued to the underwriter in our initial public

offering and the shares underlying the Alumni Warrant), plus, for each individual, any securities that individual has the right to acquire

within 60 days of January 27, 2025.

To

the best of our knowledge, except as otherwise indicated, each of the persons named in the table has sole voting and investment power

with respect to the shares of our common stock beneficially owned by such person, except to the extent such power may be shared with

a spouse. To our knowledge, none of the shares listed below are held under a voting trust or similar agreement, except as noted. To our

knowledge, there is no arrangement, including any pledge by any person of securities of the Company, the operation of which may at a

subsequent date result in a change in control of the Company.

| Name and Address of Beneficial Owner(1) | |

Title | |

Common

Stock | | |

Percent of

Common

Stock | |

| Officers and Directors | |

| |

| | |

| |

| Carlson Thow | |

Chief Executive Officer and Executive Director | |

| - | | |

| | |

| Sook Lee Chin | |

Chief Financial Officer | |

| 13,116 | | |

| * | % |

| Kok Pin “Darren” Tan | |

Director | |

| - | | |

| | |

| Wei Ping Leong | |

Director | |

| - | | |

| | |

| Wai Kuan Chan | |

Director | |

| - | | |

| | |

| | |

| |

| | | |

| | |

| Officers and Directors as a Group (total of 5 persons) | |

| |

| 13,116 | | |

| * | % |

| | |

| |

| | | |

| | |

| 5%+ Stockholders | |

| |

| | | |

| | |

| V Invesco Fund (L) Limited | |

| |

| 3,571,520 | | |

| 7.7 | % |

| Ivy Ling Lin | |

| |

| 2,500,000 | | |

| 5.4 | % |

| Richard Low Kean Huat | |

| |

| 2,480,000 | | |

| 5.3 | % |

| Ho Yu Jing | |

| |

| 2,400,000 | | |

| 5.1 | % |

| Koh Chyi Teng | |

| |

| 2,310.200 | | |

| 5.0 | % |

| Lim Seh Ngoh | |

| |

| 2,250,099 | | |

| 4.8 | % |

| 5%+ Stockholders as a Group (total of 5 persons) | |

| |

| 15,511,851 | | |

| 33.3 | % |

| (1) | Unless

otherwise indicated, the principal address of the named directors and directors and 5% stockholders of the Company is care of Treasure

Global Inc., 276 5th Avenue, Suite 704 #739, New York, New York 10001. |

SELLING

STOCKHOLDER

This

prospectus relates to the possible resale from time to time by Alumni Capital of any or all of the Selling Stockholder Shares that may

be issued by us to Alumni Capital under the Purchase Agreement. For additional information regarding the issuance of Selling Stockholder

Shares covered by this prospectus, see the section titled “Alumni Capital Transaction” above. We are registering the Selling

Stockholder Shares pursuant to the provisions of the Purchase Agreement in order to permit the Selling Stockholder to offer the Selling

Stockholder Shares for resale from time to time. Except for the transactions contemplated by the Purchase Agreement, Alumni Capital has

not had any material relationship with us within the past three years. As used in this prospectus, the term “Selling Stockholder”

means Alumni Capital.

The

table below presents information regarding the Selling Stockholder and the Selling Stockholder Shares that it may offer from time to

time under this prospectus. This table is prepared based on information supplied to us by the Selling Stockholder, and reflects holdings

as of November 15, 2024. The number of shares in the column “Maximum Number of Selling Stockholder Shares to be Offered Pursuant

to this Prospectus” represents all of the Selling Stockholder Shares that the Selling Stockholder may offer under this prospectus.

The Selling Stockholder may sell some, all or none of its Selling Stockholder Shares in this offering. We do not know how long the Selling

Stockholder will hold the Selling Stockholder Shares before selling them, and we currently have no agreements, arrangements or understandings

with the Selling Stockholder regarding the sale of any of the Selling Stockholder Shares.

Beneficial ownership is determined in accordance

with Rule 13d-3(d) promulgated by the SEC under the Exchange Act, and includes Selling Stockholder Shares with respect to which the Selling

Stockholder has voting and investment power. The percentage of Ordinary Shares beneficially owned by the Selling Stockholder prior to

the offering shown in the table below is based on an aggregate of 46,632,655 shares of common stock outstanding on January 27, 2025. Because

the purchase price of the Selling Stockholder Shares issuable under the Purchase Agreement is determined on each purchase date, the number

of Selling Stockholder Shares that may actually be sold by us under the Purchase Agreement may be fewer than the number of Selling Stockholder

Shares being offered by this prospectus. The fourth column assumes the sale of all of the Selling Stockholder Shares offered by the Selling

Stockholder pursuant to this prospectus.

| | |

Number of

Ordinary Shares Owned

Prior to Offering | | |

Maximum

Number of

Ordinary Shares to be

Offered

Pursuant

to this | | |

Number of

Ordinary Shares Owned

After Offering | |

| Name of Selling Stockholder | |

Number(1) | | |

Percent | | |

Prospectus | | |

Number(2) | | |

Percent | |

| Alumni Capital LP(3) | |

| 29,735,176 | | |

| 38.94 | | |

| 90,000,000 | | |

| 29,735,176 | | |

| 17.87 | |

| * | Represents

beneficial ownership of less than 1% of the outstanding Ordinary Shares. |

| (1) | Includes 29,735,176 Warrant Shares underlying the Alumni Warrant, assuming

the exercise price is calculated with the current number of outstanding shares of 46,632,655. |

| (2) | Assumes

the sale of all Selling Stockholder Shares being offered pursuant to this prospectus. |

| (3) | The

business address of Alumni Capital LP is 80 S.W. 8th Street Suite 2000, Miami, FL 33131. The general partner of Alumni Capital LP is

Alumni Capital GP LLC. Ashkan Mapar is the manager of Alumni Capital GP LLC and as such has voting and disposition control over the Shares.

We have been advised that none of Alumni Capital LP, Alumni Capital GP LLC nor Ashkan Mapar is a member of the Financial Industry Regulatory

Authority (“FINRA”), or an independent broker-dealer, or an affiliate or associated person of a FINRA member or independent

broker-dealer. |

PLAN

OF DISTRIBUTION

The

22,500,000 Selling Stockholder Shares offered by this prospectus are being offered by the Selling Stockholder, Alumni Capital. The shares

may be sold or distributed from time to time by the Selling Stockholder directly to one or more purchasers or through brokers, dealers,

or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market

prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the Selling Stockholder Shares offered by this prospectus

could be effected in one or more of the following methods:

| ● | ordinary

brokers’ transactions; |

| ● | transactions

involving cross or block trades; |

| ● | through

brokers, dealers, or underwriters who may act solely as agents; |

| ● | “at

the market” into an existing market for the Selling Stockholder Shares; |

| ● | in

other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through

agents; |

| ● | in

privately negotiated transactions; or |

| ● | any

combination of the foregoing. |

In

order to comply with the securities laws of certain states, if applicable, the Selling Stockholder Shares may be sold only through registered

or licensed brokers or dealers. In addition, in certain states, the Selling Stockholder Shares may not be sold unless they have been

registered or qualified for sale in the state or an exemption from the state’s registration or qualification requirement is available

and complied with.

Alumni

Capital is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Alumni

Capital has informed us that it intends to use one or more registered broker-dealers to effectuate all sales, if any, of the Selling

Stockholder Shares that it has acquired and may in the future acquire from us pursuant to the Purchase Agreement. Such sales will be

made at prices and at terms then prevailing or at prices related to the then current market price. Each such registered broker-dealer

will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. Alumni Capital has informed us that each such broker-dealer

will receive commissions from Alumni Capital that will not exceed customary brokerage commissions.

Brokers,

dealers, underwriters or agents participating in the distribution of the Selling Stockholder Shares offered by this prospectus may receive

compensation in the form of commissions, discounts, or concessions from the purchasers, for whom the broker-dealers may act as agent,

of the Selling Stockholder Shares sold by the Selling Stockholder through this prospectus. The compensation paid to any such particular

broker-dealer by any such purchasers of Selling Stockholder Shares sold by the Selling Stockholder may be less than or in excess of customary

commissions. Neither we nor the Selling Stockholder can presently estimate the amount of compensation that any agent will receive from

any purchasers of Selling Stockholder Shares sold by the Selling Stockholder.

We

know of no existing arrangements between the Selling Stockholder or any other stockholder, broker, dealer, underwriter or agent relating

to the sale or distribution of the Selling Stockholder Shares offered by this prospectus.

We

may from time to time file with the SEC one or more supplements to this prospectus or amendments to the registration statement of which

this prospectus forms a part to amend, supplement or update information contained in this prospectus, including, if and when required

under the Securities Act, to disclose certain information relating to a particular sale of Selling Stockholder Shares offered by this

prospectus by the Selling Stockholder, including the names of any brokers, dealers, underwriters or agents participating in the distribution

of such ADSs by the Selling Stockholder, any compensation paid by the Selling Stockholder to any such brokers, dealers, underwriters

or agents, and any other required information.

We

will pay the expenses incident to the registration under the Securities Act of the offer and sale of the ADSs covered by this prospectus

by the Selling Stockholder.

We

also have agreed to indemnify Alumni Capital and certain other persons against certain liabilities in connection with the offering of

Selling Stockholder Shares offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable,

to contribute amounts required to be paid in respect of such liabilities. Alumni Capital has agreed to indemnify us against liabilities

under the Securities Act that may arise from certain written information furnished to us by Alumni Capital specifically for use in this

prospectus or, if such indemnity is unavailable, to contribute amounts required to be paid in respect of such liabilities. Insofar as

indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons,

we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act

and is therefore, unenforceable.

We

estimate that the total expenses for the offering will be approximately $80,000.

Alumni

Capital has represented to us that at no time prior to the date of the Purchase Agreement has Alumni Capital or its agents, representatives

or affiliates engaged in or effected, in any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Rule

200 of Regulation SHO of the Exchange Act) of the Selling Stockholder Shares, which establishes a net short position with respect to

the Selling Stockholder Shares. Alumni Capital has agreed that during the term of the Purchase Agreement, neither Alumni Capital, nor

any of its agents, representatives or affiliates will enter into or effect, directly or indirectly, any of the foregoing transactions.

We

have advised the Selling Stockholder that it is required to comply with Regulation M promulgated under the Exchange Act. With certain

exceptions, Regulation M precludes the Selling Stockholder, any affiliated purchasers, and any broker-dealer or other person who participates

in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the

subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order

to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability

of the securities offered by this prospectus.

This

offering will terminate on the date that all of the Selling Stockholder Shares offered by this prospectus have been sold by the Selling

Stockholder.

Listing

The

Selling Stockholder Shares are currently listed on The Nasdaq Stock Market under the symbol “TGL.”

EXPERTS

WWC, P.C., our independent certified public accounting

firm, has audited our consolidated financial statements included in our Annual Report on Form 10-K for the years ended

June 30, 2024, as set forth in their report, which is incorporated by reference in this prospectus and elsewhere in the registration

statement of which this prospectus forms a part. . Our consolidated financial statements are incorporated by reference in reliance

on WWC, P.C.’s report for the consolidated financial statements for the fiscal year ended June 30, 2024 and June 30, 2023, given

its authority as an expert in accounting and auditing.

LEGAL

MATTERS

Certain

legal matters with respect to the validity of the securities being offered by this prospectus will be passed upon by Sichenzia Ross Ference

Carmel LLP, New York, New York.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the shares of our common stock

offered by this prospectus. This prospectus, which constitutes a part of the registration statement, does not contain all of the information

set forth in the registration statement, some of which is contained in exhibits to the registration statement as permitted by the rules

and regulations of the SEC. For further information with respect to us and our common stock, we refer you to the registration statement,

including the exhibits filed as a part of the registration statement. Statements contained in this prospectus concerning the contents

of any contract or any other document is not necessarily complete. If a contract or document has been filed as an exhibit to the registration

statement, please see the copy of the contract or document that has been filed. Each statement in this prospectus relating to a contract

or document filed as an exhibit is qualified in all respects by the filed exhibit. You may obtain copies of this information by mail

from the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, at prescribed rates. You may obtain

information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website

that contains reports, proxy statements and other information about issuers, like us, that file electronically with the SEC. The address

of that website is www.sec.gov.

We

are subject to the information and reporting requirements of the Exchange Act and, in accordance with this law, are required to file

periodic reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information

are available for inspection and copying at the SEC’s public reference facilities and the website of the SEC referred to above.

We also maintain a website at https://treasureglobal.co. You may access these materials free of charge as soon as reasonably practicable

after they are electronically filed with, or furnished to, the SEC. Information contained on our website is not a part of this prospectus

and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important

part of this prospectus. The information incorporated by reference into this prospectus is deemed to be part of this prospectus, and

any information filed with the SEC after the date of this prospectus will automatically be deemed to update and supersede information

contained in this prospectus and any accompanying prospectus supplement.

The

following documents previously filed with the SEC are incorporated by reference in this prospectus:

| ● | The

Registrant’s Quarterly Report on Form 10-Q for fiscal quarter ended September 30, 2024, filed with the SEC on November 14, 2024; |

| ● | The

Registrant’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024, filed with the SEC on September 30, 2024; |

| ● | The

Registrant’s Current Reports on Form 8-K filed with the SEC on July 10, 2024, July 12, 2024, August 9, 2024, August 30, 2024, September 3, 2024, September 6, 2024, September 20, 2024, October 1, 2024, October 11, 2024, October 17, 2024, October 30, 2024, November 1, 2024,

November 22, 2024, November 22, 2024, November 22, 2024, November 25, 2024, November 27, 2024, to the extent the information in

such report is filed and not furnished; |

| ● | The

Registrant’s Information Statement on Schedule 14C with the SEC on December 26, 2024; and |

| ● | The

description of the Registrant’s common stock, which is contained in a registration statement on Form 8-A12B filed with the SEC

on August 10, 2022, under the Exchange Act, including any amendment or report filed for the purpose of updating such description. |

All

filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus

is a part and prior to the effectiveness of the registration statement shall be deemed to be incorporated by reference into this prospectus.

We