Terns Pharmaceuticals, Inc. (“Terns” or the “Company”) (Nasdaq:

TERN), a clinical-stage biopharmaceutical company developing a

portfolio of small-molecule product candidates to address serious

diseases, including oncology and obesity, today announced the

pricing of its upsized underwritten public offering of 11,919,048

shares of its common stock at a public offering price of $10.50 per

share, and, in lieu of common stock to certain investors,

pre-funded warrants to purchase 2,380,952 shares of its common

stock at a public offering price of $10.4999 per pre-funded

warrant, in each case before underwriting discounts and

commissions. The gross proceeds from the offering, before deducting

underwriting discounts and commissions and other offering expenses

payable by Terns, are expected to be approximately $150.15 million,

excluding any exercise of the underwriters’ option to purchase

additional shares. Terns has granted the underwriters a 30-day

option to purchase up to an additional 2,145,000 shares of common

stock at the public offering price, less underwriting discounts and

commissions. The offering is expected to close on September 12,

2024, subject to customary closing conditions. All of the

securities are being offered by Terns.

Jefferies and TD Cowen are acting as lead book-running managers

for the proposed offering. BMO Capital Markets and UBS Investment

Bank are also acting as bookrunners for the proposed offering.

Citizens JMP and Mizuho are acting as co-lead managers for the

proposed offering.

Terns intends to use the net proceeds from the proposed

offering, to fund research, clinical trials, development and

manufacturing of the Company’s key product candidates, including

TERN-701, TERN-601 and other programs, including Terns’ TERN-800

series, and for working capital and general corporate purposes.

A shelf registration statement on Form S-3 (File No. 333-269508)

relating to the securities offered in the public offering was filed

with the Securities and Exchange Commission (the “SEC”) on February

1, 2023 and declared effective on February 10, 2023. The offering

will be made only by means of a prospectus supplement and

accompanying prospectus that form a part of the registration

statement. A preliminary prospectus supplement and accompanying

prospectus relating to the offering have been filed with the SEC

and are available on the SEC’s website located at www.sec.gov. A

final prospectus supplement relating to the offering will be filed

with the SEC. Copies of the preliminary prospectus supplement,

final prospectus supplement, and accompanying prospectus relating

to this offering, when available, may be obtained from Jefferies

LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, New York, NY 10022, by telephone at 877-821-7388 or by

email at prospectus_department@jefferies.com or TD Securities (USA)

LLC, 1 Vanderbilt Avenue, New York, NY 10017, by telephone at

855-495-9846, or by email at

TD.ECM_Prospectus@tdsecurities.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification of these securities under the

securities laws of any such state or other jurisdiction.

About Terns Pharmaceuticals

Terns Pharmaceuticals, Inc. is a clinical-stage

biopharmaceutical company developing a portfolio of small-molecule

product candidates to address serious diseases, including oncology

and obesity. Terns’ pipeline contains three clinical stage

development programs including an allosteric BCR-ABL inhibitor, a

small-molecule GLP-1 receptor agonist, a THR-β agonist, and a

preclinical GIPR modulator discovery effort, prioritizing a GIPR

antagonist nomination candidate.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements about

Terns Pharmaceuticals, Inc. (the “Company,” “we,” “us,” or “our”)

within the meaning of the federal securities laws, including the

anticipated closing date of the proposed public offering and the

Company’s anticipated use of proceeds of the proposed public

offering. All statements other than statements of historical facts

contained in this press release are forward-looking statements. In

some cases, you can identify forward-looking statements by

terminology such as “aim,” “anticipate,” “assume,” “believe,”

“contemplate,” “continue,” “could,” “design,” “due,” “estimate,”

“expect,” “goal,” “intend,” “may,” “objective,” “plan,”

“positioned,” “potential,” “predict,” “seek,” “should,” “target,”

“will,” “would” and other similar expressions that are predictions

of or indicate future events and future trends, or the negative of

these terms or other comparable terminology. The Company has based

these forward-looking statements largely on its current

expectations, estimates, forecasts and projections about future

events and financial trends that it believes may affect its

financial condition, results of operations, business strategy and

financial needs. In light of the significant uncertainties in these

forward-looking statements, you should not rely upon

forward-looking statements as predictions of future events. These

statements are subject to risks and uncertainties that could cause

the actual results and the implementation of the Company’s plans to

vary materially, including the risks associated with the

initiation, cost, timing, progress, results and utility of the

Company’s current and future research and development activities

and preclinical studies and clinical trials. These risks are not

exhaustive. For a detailed discussion of the risk factors that

could affect the Company and the offering, please refer to the risk

factors identified in the Company’s SEC reports, including but not

limited to its Annual Report on Form 10-K for the year ended

December 31, 2023, and its prospectus supplement. Except as

required by law, the Company undertakes no obligation to update

publicly any forward-looking statements for any reason.

Contacts for Terns

InvestorsJustin Nginvestors@ternspharma.com

MediaJenna UrbanBerry & Company Public

Relationsmedia@ternspharma.com

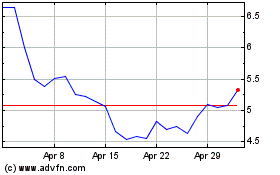

Terns Pharmaceuticals (NASDAQ:TERN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Terns Pharmaceuticals (NASDAQ:TERN)

Historical Stock Chart

From Nov 2023 to Nov 2024