Amended Statement of Beneficial Ownership (sc 13d/a)

February 06 2023 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under

the Securities Exchange Act of 1934

(Amendment No. 1)*

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND

AMENDMENTS THERETO FILED PURSUANT TO RULE 13d-2(a)

TERAWULF

Inc.

(Name of Issuer)

Common

stock, par value $0.001 per share

(Title of Class of

Securities)

88080T

104

(CUSIP Number)

Bayshore Capital LLC

53 Palmeras Street, Suite 601

San Juan, Puerto Rico

00901

410-770-9500

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices

and Communications)

January 30,

2023

(Date of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Act”), or otherwise subject to the liabilities of Section 18 of the Act but

shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 88080T 104 |

SCHEDULE 13D |

Page 2 of 7 |

| 1 |

NAME

OF REPORTING PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Bayshore Capital LLC |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) x |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

OO |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Puerto Rico |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE

VOTING POWER

17,513,644 |

| 8 |

SHARED

VOTING POWER

-0- |

| 9 |

SOLE

DISPOSITIVE POWER

17,513,644 |

| 10 |

SHARED

DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

17,513,644(1) |

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.9%(1) |

|

| 14 |

TYPE

OF REPORTING PERSON

OO |

|

| |

|

|

|

|

| 1 | Based

on 145,577,629 shares of common stock, par value $0.001 per share (“Common Stock”),

of TeraWulf Inc. (the “Issuer”) issued and outstanding as of January

27, 2023, as set forth in the Issuer’s prospectus supplement, dated February 1, 2023.

Aggregate amount beneficially owned includes 1,587,302 warrants, exercisable at any time

at the option of the holder thereof for an equal number of fully paid and non-assessable

shares of the Issuer’s Common Stock. |

|

CUSIP No. 88080T 104 |

SCHEDULE 13D |

Page 3 of 7 |

| 1 |

NAME

OF REPORTING PERSON OR

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON

Bryan Pascual |

|

| 2 |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) x |

| 3 |

SEC

USE ONLY

|

|

| 4 |

SOURCE

OF FUNDS

OO |

|

| 5 |

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨ |

| 6 |

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States of America |

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE

VOTING POWER

17,763,644 |

| 8 |

SHARED

VOTING POWER

-0- |

| 9 |

SOLE

DISPOSITIVE POWER

17,763,644 |

| 10 |

SHARED

DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

17,763,644 (2) |

|

| 12 |

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨ |

| 13 |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.1%(2) |

|

| 14 |

TYPE

OF REPORTING PERSON

IN |

|

| |

|

|

|

|

| 2 | Based on 145,577,629 shares of Common Stock of the Issuer issued

and outstanding as of January 27, 2023, as set forth in the Issuer’s prospectus supplement, dated February 1, 2023. Aggregate amount

beneficially owned includes 2,500 shares of the Issuer’s Series A Convertible Preferred Stock, convertible into Common Stock at

a rate of 100 shares per $1,000 of liquidation preference, and 1,587,302 warrants, exercisable at any time at the option of the holder

thereof for an equal number of fully paid and non-assessable shares of the Issuer’s Common Stock. |

|

CUSIP No. 88080T 104 |

SCHEDULE 13D |

Page 4 of 7 |

Item 1. Security and Issuer.

This

Amendment (“Amendment”) amends and supplements the original Schedule 13D filed with the Securities and Exchange

Commission (the “Commission”) on December 23, 2021, as amended by Amendment No. 1 thereto, filed

with the Commission on March 15, 2022, Amendment No. 2 thereto, filed with the Commission on September 2, 2022, Amendment

No. 3 thereto, filed with the Commission on October 4, 2022 and Amendment No. 4 thereto, filed with the Commission on

October 14, 2022, and the Amendment thereto, filed with the Commission on December 16, 2022 (as amended, the “Original

Schedule 13D”) and is filed by (i) Bayshore Capital LLC, a Puerto Rico limited liability company (“Bayshore”),

and (ii) Mr. Bryan Pascual (each, a “Reporting Person” and, collectively, the “Reporting

Persons”), relating to the shares of the common stock, par value $0.001 per share (the “Common Stock”),

of TeraWulf Inc. (formerly known as Telluride Holdco, Inc.),

a Delaware corporation (the “Issuer”). Capitalized terms used but not defined herein shall have the meaning

set forth in the Schedule 13D.

This Amendment is being filed to disclose the

entry by the Bayshore into the Voting and Support Agreement, dated as of January 30, 2023

Item 2. Identity and Background.

No material change.

Item 3. Source and Amount of Funds or Other Consideration.

On

January 30, 2023, in order to increase the number of shares available for issuance by the Issuer in a public offering of common

stock, the Issuer entered into an exchange agreement (the “Exchange Agreement”) with Stammtisch Investments

LLC, a Delaware limited liability company (“Stammtisch”), pursuant to which Stammtisch exchanged shares of

Common Stock for warrants exercisable to purchase shares of Common Stock (the “Exchange Warrants”).

The

Exchange Warrants will be immediately exercisable after the Issuer’s stockholders approve amendments to increase the Issuer’s

authorized shares of Common Stock from 200,000,000 to 400,000,000 (the “Common Stock Increase Amendment”).

The

Issuer is also seeking the approval of its stockholders at a special meeting (the “Special

Meeting”) to (i) increase the maximum number of authorized shares of preferred stock, with the par value of

$0.001 per share, from 25,000,000 to 100,000,000 (together with the Common Stock Increase Amendment, the “Share Increase

Amendments”) and (ii) remove the restriction on stockholder action by written consent (the “Written

Consent Amendment” and, together with the Share Increase Amendments, the “Charter

Amendments”).

As

an inducement for Stammtisch to enter into the Exchange Agreement, the Issuer entered into a Voting and Support Agreement, dated January 30,

2023, with Bayshore, Paul Prager, Stammtisch, Lucky Liefern LLC, Heorot Power Holdings LLC, Somerset Operating Company LLC, Allin WULF

LLC, Lake Harriet Holdings, LLC, Nazar Khan, Revolve Capital LLC, and Opportunity Four of Parabolic Ventures Holdings LLC A DE Series (the

“Voting and Support Agreement”). Pursuant to the Voting and Support Agreement, Bayshore and such other

stockholders agreed with the Issuer to vote in support of the Charter Amendments at the Special Meeting. References to, and descriptions

of, the Voting and Support Agreement set forth above are qualified in their entirety by reference to the full text of the Voting and

Support Agreement which is filed as Exhibit 1 hereto, and is incorporated into this Schedule 13D by reference.

Item 4. Purpose of Transaction.

The

information set forth under Item 3 above is incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

Item 5 is amended as follows:

References to percentage ownerships of the Common

Stock in this Schedule 13D are based on 145,577,629 shares of Common Stock of the Issuer, issued and outstanding as of January 27,

2023, as set forth in the Issuer’s prospectus supplement, dated February 1, 2023.

|

CUSIP No. 88080T 104 |

SCHEDULE 13D |

Page 5 of 7 |

| (i) | As of the date of this Amendment, Bayshore

may be deemed to be the beneficial owner of 17,513,644 shares of the Common Stock (approximately

11.9% of the Common Stock), which it holds directly. |

Bayshore may be deemed to have sole voting

and dispositive power with respect to such shares of the Common Stock.

| (ii) | As of the date of this Schedule 13D,

Mr. Bryan Pascual may be deemed to be the beneficial owner of 17,763,644 shares of the

Common Stock (approximately 12.1% of the Common Stock). Of such 17,763,644 shares of the

Common Stock, Mr. Bryan Pascual has a beneficial ownership interest with respect to

the 17,513,644 shares of the Common Stock by virtue of the BJP Revocable Trust’s position

as the controlling member of Bayshore, and with respect to 250,000 shares of the Common Stock

into which the shares of Series A Convertible Preferred Stock held by the BJP Revocable

Trust were convertible as of March 21, 2022. Mr. Bryan Pascual may be deemed to

have sole voting and dispositive power with respect to the 17,763,644 shares of the Common

Stock. |

Item 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

The information set forth under Item 3 above

is incorporated herein by reference.

Item 7. Material

to be Filed as Exhibits.

| Exhibit 1 | Voting and Support Agreement, dated as of January 30,

2023, between Terawulf Inc., Paul Prager, Stammtisch Investments LLC, Lucky Liefern LLC, Heorot Power Holdings LLC, Somerset Operating

Company LLC, Allin WULF LLC, Lake Harriet Holdings, LLC, Nazar Khan, Bayshore Capital LLC, Revolve Capital LLC, Opportunity Four of Parabolic

Ventures Holdings LLC A DE Series. |

|

CUSIP No. 88080T 104 |

SCHEDULE 13D |

Page 6 of 7 |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 6, 2023

| |

BAYSHORE

CAPITAL LLC |

| |

|

| |

By: |

/s/ Bryan Pascual |

| |

|

Bryan

Pascual |

| |

|

Chief Executive Officer, President, Secretary |

| |

|

| |

By: |

/s/ Bryan Pascual |

| |

|

Bryan Pascual |

Attention. Intentional misstatements or omissions of fact constitute

Federal criminal violations (see 18 U.S.C. 1001).

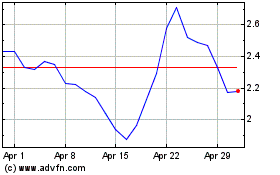

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Feb 2025 to Mar 2025

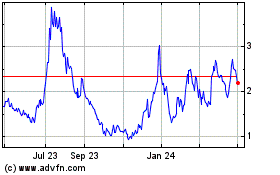

TeraWulf (NASDAQ:WULF)

Historical Stock Chart

From Mar 2024 to Mar 2025