STRATA Skin Sciences, Inc. (“STRATA” or the “Company”) (NASDAQ:

SSKN), a medical technology company dedicated to developing,

commercializing, and marketing innovative products for the

treatment of dermatologic conditions, announces its financial

results for the quarter ended September 30, 2024 and provides a

corporate update.

Third Quarter 2024

Highlights

- Revenue in the third quarter of

2024 was $8.8 million (-1% YOY) vs. $8.9 million in the third

quarter of 2023

- Global net recurring revenue in the

third quarter of 2024 was $5.4 million (+2% YOY) vs. $5.3 million

in the third quarter of 2023

- Gross domestic XTRAC® recurring

billings were $4.8 million (-2% YOY) in the third quarter of 2024

vs. $4.9 million in the third quarter of 2023

- Revenue per domestic XTRAC® system

increased to $5,332 (+2% YOY) on 873 systems during the third

quarter vs. $5,233 per system on 929 systems in the prior year

period

- Adjusting for a one-time expense of

$1.8 million, total non-GAAP operating expenses in the third

quarter of 2024 were $5.2 million (-7% YOY) vs. $5.6 million in the

third quarter of 2023. The one-time item is an accrual following

the resolution of a New York state tax audit covering the period

from 2014 to 2017, which the Company recorded as a General and

Administrative expense

- Non-GAAP operating profit,

excluding the one-time accrual item described above, was $128,000

in the quarter, representing the first time the Company has

generated an operating profit since the Company’s major refinancing

in early 2018

- Domestic installed base of 873

XTRAC® devices under the Company’s recurring revenue business model

at September 30, 2024 vs. 882 XTRAC® devices at June 30, 2024 and

923 XTRAC® devices at December 31, 2023, as the Company continues

to realign its assets and remove underperforming accounts

- Domestic installed base of 135

TheraClear®X devices at September 30, 2024 vs. 117 TheraClear®X

devices at June 30, 2024 and 92 TheraClear®X devices at December

31, 2023

Recent Corporate Highlights

- Filed a complaint against

LaserOptek, Monarch Laser Services, and The Pinnacle Health Group,

citing unfair competition under federal and state laws regarding

the marketing and sales of competitive laser devices. Following a

joint stipulation by the parties, on November 8, 2024 a court order

was entered in the United States District Court for the Eastern

District of Pennsylvania enjoining LaserOptek, The Pinnacle Group,

and all those acting at their direction from engaging in any sales,

advertising, marketing or promotion of LaserOptek’s Pallas lasers

that states or implies, directly or indirectly, that treatments

with Pallas laser systems are reimbursable using CPT Codes

96920-96922. The court order also barred LaserOptek and The

Pinnacle Group from engaging in any sales, advertising, marketing

or promotion of LaserOptek’s Pallas lasers in the United States

that includes any false or misleading statements regarding the

Pallas lasers or STRATA’s lasers.

- Closed a registered direct offering

on July 23, 2024 that raised $2.1 million in gross proceeds through

the sale of 665,136 shares of common stock at an average purchase

price of $3.16/share, with participation from insiders and existing

institutional shareholders

- Received approval for the XTRAC

Momentum® 1.0 device in Japan and began immediate commercial

rollout through the Company’s Japanese strategic partner and

distributor JMEC Co., Ltd. Six Momentum units have already been

placed in Japan under the Company’s recurring revenue business

model that are included in the 19 XTRAC devices placed during

2024

- Announced a publication in the July

11, 2024 issue of the Journal of Cosmetic and Laser Therapy of a

multi-treatment study finding the TheraClear®X Acne Therapy System

reduced lesions and associated skin redness with improvement in

skin texture and pore size after one to three treatments while

being well tolerated, offering benefits as monotherapy and/or as an

adjuvant

- STRATA’s XTRAC® excimer laser was

the focus of two lectures at the 75th Annual Meeting of the Chubu

Branch of the Japanese Dermatological Association held in Nagoya,

Japan

- The XTRAC® excimer laser was

featured at the 2024 Fall Clinical Dermatology Conference

held in Las Vegas in a poster presentation titled, Targeted

308-nm Excimer Laser: A Safe and Effective Solution for

Inflammatory Skin Disorders. Additionally, numerous KOL

speakers emphasized the significance of excimer lasers as a proven

treatment option for psoriasis, vitiligo, and eczema

“The 2% year-over-year increase in revenue per

XTRAC® system in the third quarter of 2024 illustrates progress in

the Company’s turnaround. This increase compares favorably to

roughly flat revenue growth per system last quarter and a decline

of 10% in fiscal 2023 over fiscal 2022. This metric, along with

essentially flat year-over-year revenue and global net recurring

revenue in the third quarter, points to additional evidence that

our business has stabilized,” commented STRATA’s President and CEO

Dr. Dolev Rafaeli. “More importantly, gross margin as a percent of

revenue continued to strengthen for the third consecutive quarter,

reaching 60.3% in the third quarter, an improvement from 56.0% in

the prior year period and up from 58.5% in the second quarter of

2024. Additionally, total operating expenses declined to $5.2

million in the third quarter from $5.6 million in the third quarter

of 2023 and from $5.4 million in the second quarter of 2024.

Altogether, these trends allowed us to generate a non-GAAP

operating profit in the third quarter of 2024, the first time since

2018 that this has occurred.

“Our DTC efforts remain a key focus of our

turnaround strategy, and we continue to see signs of execution on

this front. During the third quarter we expanded the targeted

geographies and initiated Spanish language advertisement. Thus far

in 2024, we have scheduled over 1,900 DTC-driven new patient

appointments, as compared to 8 in 2023, and exceeded the 1,643

scheduled in fiscal 2019 before the Covid-19 pandemic sharply

curtailed office visits across the healthcare system.

“We continue to examine our installed base of

XTRAC® devices in an effort to maximize their utilization. Our

domestic base of installed XTRAC® devices declined from 882 at the

end of the second quarter to 873 at the end of the third quarter.

The combination of our renewed DTC marketing efforts and our

efforts to maximize utilization of our XTRAC® devices with our

dermatology partners helped us achieve the highest quarterly

average revenue per device from our XTRAC® installed base since the

end of 2022.

“TheraClear®X device placements continue to grow

and reached 135 in the third quarter, up from 117 at the end of the

second quarter. The adoption of the non-cash, insurance-reimbursed

billing has accelerated in 2024 after being non-existent in 2023,

as we have helped secure insurance pre-authorization for our

partnered clinics in over 2,000 patients. Additionally, published

studies, such as the one in the July 11, 2024 issue of the Journal

of Cosmetic and Laser Therapy, continue to point to improved

patient outcomes for the treatment of acne. At the recent 2024 Fall

Clinical Dermatology Conference, a poster presentation titled,

Targeted 308-nm Excimer Laser: A Safe and Effective Solution for

Inflammatory Skin Disorders was presented that also highlighted the

benefits of the TheraClear®X device

“We strengthened our balance sheet in July 2024

with a $2.1 million equity raise that had notable participation

from existing shareholders and management. This financing, along

with continued improving operating and financial performance,

should help lead us to profitability and sustainable cash flow

generation, which was the goal of our multifaceted strategy put in

motion at the beginning of 2024,” concluded Dr. Rafaeli.

Third Quarter 2024 Financial

Results

Revenue for the third quarter of 2024 was $8.8

million, as compared to revenue of $8.9 million for the third

quarter of 2023. Global recurring revenue for the third quarter of

2024 was $5.4 million, as compared to global recurring revenue of

$5.3 million for the third quarter of 2023. Equipment revenue was

$3.4 million for the third quarter of 2024, as compared to $3.6

million for the third quarter of 2023.

Gross profit for the third quarter of 2024 was

$5.3 million, or 60.3% of revenue, as compared to $5.0 million, or

56.0% of revenue, for the third quarter of 2023.

Selling and marketing costs for the third

quarter of 2024 were $3.0 million, as compared to $3.0 million for

the third quarter of 2023. General and administrative costs,

including the $1.8 million accrual for New York state taxes

previously referenced, for the third quarter of 2024 were $3.7

million, as compared to $2.3 million for the third quarter of

2023.

Net loss for the third quarter of 2024 was $2.1

million, or a net loss of $0.53 per basic and diluted common share,

as compared to a net loss of $1.1 million, or a net loss of $0.30

per basic and diluted common share, in the third quarter of

2023.

Cash, cash equivalents, and restricted cash at

September 30, 2024 were $8.4 million.

Third Quarter 2024 Earnings Conference

Call

STRATA management will host a conference call at

4:30 p.m. ET on Wednesday, November 13, 2024 to review financial

results and provide an update on corporate developments. Following

management’s formal remarks, there will be a question-and-answer

session.

To listen to the conference call, interested

parties within the U.S. should dial 1-844-481-2523 (domestic) or

1-412-317-0552 (international). All callers should dial in

approximately 10 minutes prior to the scheduled start time and ask

to be joined into the STRATA Skin Sciences, Inc. conference

call.

The conference call will also be available

through a live webcast that can be accessed at STRATA Skin Sciences

3Q24 Earnings Webcast.

A telephonic replay of the call will be

available until November 20, 2024 by dialing 1-877-344-7529 (or

1-412-317-0088 for international callers) and using replay access

code 4851779. To access the replay using an international dial-in

number, please see here.

A webcast earnings call replay will be available

approximately one hour after the live call and remain accessible

until May 13, 2025.

Non-GAAP Financial Measures

STRATA has determined to supplement its

consolidated financial statements, prepared in accordance with

accounting principles generally accepted in the United States of

America (“U.S. GAAP”), presented elsewhere within this report, with

certain non-GAAP measures of financial performance. These non-GAAP

measures include non-GAAP gross profit, which excludes the non-cash

expense of amortization of acquired intangible assets classified as

cost of revenues, and non-GAAP adjusted EBITDA, “Earnings Before

Interest, Taxes, Depreciation, and Amortization.”

These non-GAAP disclosures have limitations as

an analytical tool, should not be viewed as a substitute for Gross

Profit or Net Earnings (Loss) determined in accordance with U.S.

GAAP, should not be considered in isolation or as a substitute for

analysis of our results as reported under U.S. GAAP, nor are they

necessarily comparable to non-GAAP performance measures that may be

presented by other companies. STRATA considers these non-GAAP

measures in addition to its results prepared under current

accounting standards, but they are not a substitute for, nor

superior to, U.S. GAAP measures. These non-GAAP measures are

provided to enhance readers’ overall understanding of STRATA’s

current financial performance and to provide further information

for comparative purposes. This supplemental presentation should not

be construed as an inference that the Company's future results will

be unaffected by similar adjustments to Gross Profit or Net

Earnings (Loss) determined in accordance with U.S. GAAP.

Specifically, STRATA believes the non-GAAP measures provide useful

information to management and investors by isolating certain

expenses, gains, and losses that may not be indicative of the

Company’s core operating results and business outlook. In addition,

STRATA believes non-GAAP measures enhance the comparability of

results against prior periods.

Reconciliation to the most directly comparable

U.S. GAAP measure of all non-GAAP measures included in this press

release is as follows:

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Net loss |

$ |

(2,122 |

) |

|

$ |

(1,053 |

) |

|

$ |

(5,589 |

) |

|

$ |

(7,036 |

) |

| |

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,239 |

|

|

|

1,449 |

|

|

|

3,738 |

|

|

|

4,274 |

|

|

Amortization of operating lease right-of-use assets |

|

81 |

|

|

|

89 |

|

|

|

255 |

|

|

|

257 |

|

|

Loss on disposal of property and equipment |

|

19 |

|

|

|

31 |

|

|

|

38 |

|

|

|

55 |

|

|

Interest expense, net |

|

469 |

|

|

|

438 |

|

|

|

1,425 |

|

|

|

964 |

|

| Non-GAAP

EBITDA |

|

(314 |

) |

|

|

954 |

|

|

|

(133 |

) |

|

|

(1,486 |

) |

|

Employee retention credit |

|

— |

|

|

|

— |

|

|

|

(864 |

) |

|

|

— |

|

|

Stock-based compensation expense |

|

26 |

|

|

|

337 |

|

|

|

301 |

|

|

|

1,014 |

|

|

Inventory write-off |

|

— |

|

|

|

— |

|

|

|

141 |

|

|

|

— |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

909 |

|

| Non-GAAP adjusted

EBITDA |

$ |

(288 |

) |

|

$ |

1,291 |

|

|

$ |

(555 |

) |

|

$ |

437 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

XTRAC Gross Domestic Recurring Billings

XTRAC gross domestic recurring billings

represent the amount invoiced to partner clinics when treatment

codes are sold to the physician. It does not include normal GAAP

adjustments, which are deferred revenue from prior quarters

recorded as revenue in the current quarter, the deferral of revenue

from the current quarter recorded as revenue in future quarters,

adjustments for co-pay and other discounts. This excludes

international recurring revenues.

The following is a reconciliation of non-GAAP

XTRAC gross domestic billings to domestic recorded revenue for the

third quarter and first nine months of 2024 and 2023 (in

thousands), respectively:

|

|

Three Months Ended September 30, |

YTD |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Gross domestic recurring billings |

$ |

4,813 |

|

|

$ |

4,883 |

|

|

$ |

14,126 |

|

|

$ |

14,675 |

|

|

Co-Pay adjustments |

|

(84 |

) |

|

|

(85 |

) |

|

|

(247 |

) |

|

|

(256 |

) |

|

Other discounts |

|

(19 |

) |

|

|

(29 |

) |

|

|

(76 |

) |

|

|

(87 |

) |

|

Deferred revenue from prior quarters |

|

1,812 |

|

|

|

2,005 |

|

|

|

5,337 |

|

|

|

6,201 |

|

|

Deferral of revenue to future quarters |

|

(1,867 |

) |

|

|

(1,913 |

) |

|

|

(5,580 |

) |

|

|

(5,943 |

) |

|

GAAP Recorded domestic revenue |

$ |

4,655 |

|

|

$ |

4,861 |

|

|

$ |

13,560 |

|

|

$ |

14,589 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About STRATA Skin Sciences, Inc.

STRATA Skin Sciences is a medical technology

company dedicated to developing, commercializing, and marketing

innovative products for the in-office treatment of various

dermatologic conditions, such as psoriasis, vitiligo, and acne. Its

products include the XTRAC® excimer laser, VTRAC® lamp

systems, and the TheraClear®X Acne Therapy System.

STRATA is proud to offer these exciting

technologies in the U.S. through its unique Partnership Program.

STRATA’s popular partnership approach includes a fee per treatment

cost structure versus an equipment purchase, installation and use

of the device, on-site training for practice personnel, service and

maintenance of the equipment, dedicated account and customer

service associates, and co-op advertising support to help raise

awareness and promote the program within the practice.

Safe Harbor

This press release includes "forward-looking

statements" within the meaning of the Securities Litigation Reform

Act of 1995. These statements include but are not limited to the

Company’s plans, objectives, expectations and intentions and may

contain words such as “will,” “may,” “seeks,” and “expects,” that

suggest future events or trends. These statements, the Company’s

ability to launch and sell products recently acquired or to be

developed in the future, the Company’s ability to develop social

media marketing campaigns, direct to consumer marketing campaigns,

and the Company’s ability to build a leading franchise in

dermatology and aesthetics, are based on the Company’s current

expectations and are inherently subject to significant

uncertainties and changes in circumstances. Actual results may

differ materially from the Company’s expectations due to financial,

economic, business, competitive, market, regulatory, adverse market

conditions labor supply shortages, or supply chain interruptions

resulting from fiscal, political factors, international conflicts,

responses, or conditions affecting the Company, the medical device

industry and our customers and patients in general, as well as more

specific risks and uncertainties set forth in the Company’s SEC

reports on Forms 10-Q and 10-K. Given such uncertainties, any or

all these forward-looking statements may prove to be incorrect or

unreliable. The statements in this press release are made as of the

date of this press release, even if subsequently made available by

the Company on its website or otherwise. The Company does not

undertake any obligation to update or revise these statements to

reflect events or circumstances occurring after the date of this

press release. The Company urges investors to carefully review its

SEC disclosures available

at www.sec.gov and www.strataskinsciences.com.

Investor Contact:CORE

IR516-222-2560IR@strataskin.com

|

STRATA Skin Sciences, Inc. and SubsidiaryCondensed Consolidated

Balance Sheets(in thousands, except share and per share data) |

| |

| |

September 30, 2024 |

|

December 31, 2023 |

| |

(unaudited) |

|

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

7,062 |

|

|

$ |

6,784 |

|

|

Restricted cash |

|

1,334 |

|

|

|

1,334 |

|

|

Accounts receivable, net of allowance for credit losses of $159 and

$222 at September 30, 2024 and December 31, 2023, respectively |

|

4,443 |

|

|

|

4,440 |

|

|

Inventories |

|

2,744 |

|

|

|

2,673 |

|

|

Prepaid expenses and other current assets |

|

297 |

|

|

|

312 |

|

|

Total current assets |

|

15,880 |

|

|

|

15,543 |

|

| Property and equipment,

net |

|

10,387 |

|

|

|

11,778 |

|

| Operating lease right-of-use

assets |

|

1,348 |

|

|

|

626 |

|

| Intangible assets, net |

|

5,840 |

|

|

|

7,319 |

|

| Goodwill |

|

6,519 |

|

|

|

6,519 |

|

| Other assets |

|

231 |

|

|

|

231 |

|

|

Total assets |

$ |

40,205 |

|

|

$ |

42,016 |

|

| |

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

1,749 |

|

|

$ |

3,343 |

|

|

Accrued expenses and other current liabilities |

|

8,524 |

|

|

|

6,306 |

|

|

Deferred revenues |

|

2,421 |

|

|

|

2,120 |

|

|

Current portion of operating lease liabilities |

|

322 |

|

|

|

352 |

|

|

Current portion of contingent consideration |

|

1,030 |

|

|

|

53 |

|

|

Total current liabilities |

|

14,046 |

|

|

|

12,174 |

|

| Long-term debt, net |

|

15,153 |

|

|

|

15,044 |

|

| Deferred revenues and other

liabilities |

|

379 |

|

|

|

552 |

|

| Deferred tax liability |

|

186 |

|

|

|

186 |

|

| Operating lease liabilities,

net of current portion |

|

1,002 |

|

|

|

237 |

|

| Contingent consideration, net

of current portion |

|

96 |

|

|

|

1,135 |

|

|

Total liabilities |

|

30,862 |

|

|

|

29,328 |

|

| Commitments and contingencies

(Note 14) |

|

|

|

| Stockholders’ equity: |

|

|

|

| Series C convertible preferred

stock, $0.10 par value; 10,000,000 shares authorized, no shares

issued and outstanding |

|

— |

|

|

|

— |

|

| Common stock, $0.001 par

value; 150,000,000 shares authorized; 4,171,161 and 3,506,025

shares issued and outstanding at September 30, 2024 and

December 31, 2023, respectively |

|

4 |

|

|

|

4 |

|

|

Additional paid-in capital |

|

252,986 |

|

|

|

250,742 |

|

|

Accumulated deficit |

|

(243,647 |

) |

|

|

(238,058 |

) |

|

Total stockholders’ equity |

|

9,343 |

|

|

|

12,688 |

|

|

Total liabilities and stockholders’ equity |

$ |

40,205 |

|

|

$ |

42,016 |

|

|

|

|

|

|

|

|

|

|

|

STRATA Skin Sciences, Inc. and SubsidiaryCondensed Consolidated

Statements of Operations(in thousands, except share and per share

data)(unaudited) |

| |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

| Revenues, net |

$ |

8,797 |

|

|

$ |

8,852 |

|

|

$ |

23,986 |

|

|

$ |

24,669 |

|

| Cost of revenues |

|

3,490 |

|

|

|

3,898 |

|

|

|

10,662 |

|

|

|

11,009 |

|

|

Gross profit |

|

5,307 |

|

|

|

4,954 |

|

|

|

13,324 |

|

|

|

13,660 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Engineering and product development |

|

243 |

|

|

|

248 |

|

|

|

683 |

|

|

|

937 |

|

|

Selling and marketing |

|

3,048 |

|

|

|

3,038 |

|

|

|

9,080 |

|

|

|

10,196 |

|

|

General and administrative |

|

3,669 |

|

|

|

2,283 |

|

|

|

8,589 |

|

|

|

7,690 |

|

|

Total operating expenses |

|

6,960 |

|

|

|

5,569 |

|

|

|

18,352 |

|

|

|

18,823 |

|

|

Loss from operations |

|

(1,653 |

) |

|

|

(615 |

) |

|

|

(5,028 |

) |

|

|

(5,163 |

) |

| Other (expense) income: |

|

|

|

|

|

|

|

|

Loss on debt extinguishment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(909 |

) |

|

Interest expense |

|

(537 |

) |

|

|

(528 |

) |

|

|

(1,592 |

) |

|

|

(1,112 |

) |

|

Interest income |

|

68 |

|

|

|

90 |

|

|

|

167 |

|

|

|

148 |

|

|

Other income |

|

— |

|

|

|

— |

|

|

|

864 |

|

|

|

— |

|

|

Total other expense |

|

(469 |

) |

|

|

(438 |

) |

|

|

(561 |

) |

|

|

(1,873 |

) |

|

Net loss |

$ |

(2,122 |

) |

|

$ |

(1,053 |

) |

|

$ |

(5,589 |

) |

|

$ |

(7,036 |

) |

| |

|

|

|

|

|

|

|

| Net loss per share of common

stock, basic and diluted |

$ |

(0.53 |

) |

|

$ |

(0.30 |

) |

|

$ |

(1.52 |

) |

|

$ |

(2.02 |

) |

| Weighted average shares of

common stock outstanding, basic and diluted |

|

4,038,988 |

|

|

|

3,491,113 |

|

|

|

3,684,976 |

|

|

|

3,488,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STRATA Skin Sciences, Inc. and SubsidiaryCondensed Consolidated

Statements of Cash Flows(in thousands)(unaudited) |

| |

| |

Nine Months EndedSeptember 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

Net loss |

$ |

(5,589 |

) |

|

$ |

(7,036 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

3,738 |

|

|

|

4,274 |

|

|

Amortization of operating lease right-of-use assets |

|

255 |

|

|

|

257 |

|

|

Amortization of deferred financing costs and debt discount |

|

109 |

|

|

|

112 |

|

|

Change in allowance for credit losses |

|

(40 |

) |

|

|

(205 |

) |

|

Stock-based compensation expense |

|

301 |

|

|

|

1,014 |

|

|

Loss on disposal of property and equipment |

|

38 |

|

|

|

55 |

|

|

Inventory write-off |

|

141 |

|

|

|

— |

|

|

Loss on debt extinguishment |

|

— |

|

|

|

909 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

37 |

|

|

|

(126 |

) |

|

Inventories |

|

14 |

|

|

|

(209 |

) |

|

Prepaid expenses and other assets |

|

15 |

|

|

|

388 |

|

|

Accounts payable |

|

(1,638 |

) |

|

|

(268 |

) |

|

Accrued expenses and other liabilities |

|

2,176 |

|

|

|

(611 |

) |

|

Deferred revenues |

|

170 |

|

|

|

(165 |

) |

|

Operating lease liabilities |

|

(242 |

) |

|

|

(279 |

) |

|

Net cash used in operating activities |

|

(515 |

) |

|

|

(1,890 |

) |

| Cash flows from

investing activities: |

|

|

|

|

Purchase of property and equipment |

|

(1,132 |

) |

|

|

(3,301 |

) |

|

Net cash used in investing activities |

|

(1,132 |

) |

|

|

(3,301 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Payment of contingent consideration |

|

(18 |

) |

|

|

(42 |

) |

|

Proceeds from long-term debt |

|

— |

|

|

|

7,000 |

|

|

Issuance of stock |

|

1,943 |

|

|

|

— |

|

|

Payment of deferred financing costs |

|

— |

|

|

|

(97 |

) |

|

Net cash provided by financing activities |

|

1,925 |

|

|

|

6,861 |

|

|

Net increase in cash, cash equivalents and restricted cash |

|

278 |

|

|

|

1,670 |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

8,118 |

|

|

|

6,795 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

8,396 |

|

|

$ |

8,465 |

|

| |

|

|

|

| Cash and cash equivalents |

$ |

7,062 |

|

|

$ |

7,131 |

|

| Restricted cash |

|

1,334 |

|

|

|

1,334 |

|

|

Total cash, cash equivalents and restricted cash |

$ |

8,396 |

|

|

$ |

8,465 |

|

| |

|

|

|

| Supplemental

disclosure of cash flow information: |

|

|

|

|

Cash paid during the year for interest |

$ |

1,490 |

|

|

$ |

917 |

|

| |

|

|

|

| Supplemental schedule

of non-cash operating, investing and financing

activities: |

|

|

|

| Operating lease right-of-use

assets obtained in exchange for operating lease liabilities |

$ |

977 |

|

|

$ |

— |

|

| Transfer of property and

equipment to inventories |

$ |

226 |

|

|

$ |

234 |

|

| Accrued payment of contingent

consideration |

$ |

44 |

|

|

$ |

— |

|

| Modification of common stock

warrants |

$ |

— |

|

|

$ |

384 |

|

| Accrued exit fee recorded as

debt discount |

$ |

150 |

|

|

$ |

450 |

|

| Change in intangible assets

and fair value of contingent consideration |

$ |

— |

|

|

$ |

5,616 |

|

| |

|

|

|

|

|

|

|

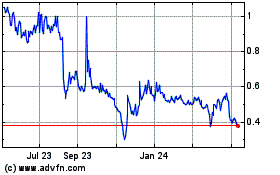

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Jan 2025 to Feb 2025

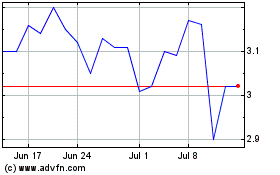

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Feb 2024 to Feb 2025