Combined Cumulative Subscriptions & Bookings Backlog of $661

Million Represents a 2x increase Year-Over-Year

SoundHound AI, Inc. (Nasdaq: SOUN), a global leader in voice

artificial intelligence, today reported its financial results for

the fourth quarter and full year 2023.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240229968938/en/

SoundHound AI Reports Record Quarter with

80% Q4 Revenue Growth to $17.1 Million; Adjusted EBITDA Improved by

80% Year-Over-Year in Q4 (Graphic: Business Wire)

“This was a breakthrough year in which SoundHound rapidly

integrated powerful new generative AI capabilities. Our real-world

voice AI applications are already live and driving consumer

engagement across vehicles, devices, and customer service

businesses,” said Keyvan Mohajer, CEO and Co-Founder of SoundHound

AI. “We also acquired SYNQ3, establishing SoundHound as the largest

voice AI provider for restaurants. Our pace and agility amid this

AI revolution has put us ahead of the field when it comes to

delivering real commercial value.”

Fourth Quarter and Full Year Financial Highlights

- Fourth quarter revenue was $17.1 million, an increase of 80%

year-over-year

- Fourth quarter gross margin was 77%, an increase of 6

percentage points year-over-year

- Fourth quarter earnings per share was a net loss of ($0.07),

compared to ($0.15) in the prior year, improved by 53%

- Adjusted EBITDA (non-GAAP) was ($3.7) million, compared to

($18.8) million in the prior year, improved by 80%

- Full year revenue was $45.9 million, an increase of 47%

year-over-year

- Full year gross margin was 75%, an increase of 6 percentage

points year-over-year

- Full year earnings per share was a net loss of ($0.40),

compared to ($0.74) in the prior year, and improved by 46%

- Adjusted EBITDA (non-GAAP) was ($35.9) million, compared to

($72.8) million in the prior year, and improved by 51%

- Combined Cumulative Subscriptions and Bookings Backlog1

customer metric grew to $661 million, up 2x compared to the prior

year comparable measure

- Achieved an annual run rate of ~3.5 billion queries, up roughly

50% year-over-year

“We finished the year strong by accelerating revenue and

meaningfully increasing our penetration in the marketplace,” said

Nitesh Sharan, CFO of SoundHound AI. ”We have fortified our balance

sheet and taken prudent measures to strengthen our bottom line to

ensure we can continue to capitalize on the tremendous customer

demand for our AI solutions.”

Business Highlights

Customer and partners announcements

- Notable, first-of-its-kind revenue contribution in Q4 from a

preeminent AI chip company

- Signed contract with a large auto OEM to significantly extend

and increase unit volumes through 2037

- Won a deal with a prominent US-based EV maker to voice-enable

their full fleet of market-leading vehicles

- SoundHound Chat AI was announced as the world’s first voice

assistant with integrated generative AI to go into full production

with an automaker. Stellantis’ DS Automobiles will be deploying the

technology across all models in 13 languages across 18

countries

- Three additional automotive brands, Peugeot, Opel, and

Vauxhall, announced SoundHound Chat AI pilots in Europe

- Custom branded AI voice assistant went live with a new line of

vehicles from Togg, a growing Turkish EV car maker

- Telly’s revolutionary dual screen smart TV integrated

SoundHound AI voice assistant

- Expanded our portfolio of renowned restaurant brands with

enterprise restaurants brands: Jersey Mike's, Krispy Kreme, White

Castle, and Church's Chicken

- Expanded agreement with White Castle to go live in 100

drive-thru lanes by the end of this year and announced partnership

with Samsung to revolutionize next-gen display technology for voice

AI drive-thrus

- In 2023, more than 100 customers adopted our AI restaurant

solutions, including mid market brands such as Beef O’Brady’s,

Blake’s Lotaburger, Bozzelli's Italian Deli, Bubbakoos Burritos,

Chicken Shack, CoreLife Eatery, Dog Haus, Naz’s Halal, and Noi

Thai

- Expanded our ecosystem for customer service by adding Oracle

MICROS Simphony Point-of-Sale for Restaurants, Toast Point-of-Sale

system, and integration with Olo, a leading restaurant SaaS

platform

- SoundHound AI is now working with audio experts HME to make its

solutions compatible with its world class NEXEO® headsets. HME

serves QSRs drive-thrus in over 140 countries, enabling them to

fulfill more than 30 million orders every day

Acquisition of SYNQ3

- The combination with SYNQ3 expands SoundHound AI’s customer

service offering, creating the largest voice AI provider for

restaurants and extending the company’s market reach by an order of

magnitude

- The newly joined entity brings nearly two decades of

SoundHound’s innovation with decades of SYNQ3’s industry expertise

and established customer relationships - accelerating the

deployment of leading-edge generative AI capabilities to the

industry

- SYNQ3 comes with more than 20 national and multinational

chains, such as Chipotle, Casey’s, Applebees, Panda Express, Papa

John’s, and Five Guys

Product launches

- Dynamic Interaction with Generative AI, an extension of the

company’s groundbreaking multimodal Dynamic Interaction

interface

- Smart Answering became generally available, our service that

lets any business handle customer service calls with voice AI

- Employee Assist, our voice AI product for restaurant employees

using advanced voice technology to coach in-store employees through

actions and provide fast answers to critical questions

- SoundHound Chat AI for Automotive, giving drivers and

passengers seamless access to a vast array of information domains

enabled by complex conversational capabilities

- Vehicle Intelligence, SoundHound’s voice AI-enabled solution

for instant hands-free access to car manual

- SoundHound Chat AI, a powerful new voice assistant that

delivers best-in-class voice AI by combining SoundHound and

third-party Generative AI models

1)

See section ‘Certain Defined

Terms' at the end of this press release for additional

information.

Fourth Quarter 2023 Financial Measures

Three Months Ended

(thousands, except per share data)

December 31, 2023

December 31, 20222

Change in %

Revenues

$

17,147

$

9,501

80

%

Operating expenses:

Cost of revenues

$

3,911

$

2,755

42

%

Sales and marketing

4,469

6,744

-34

%

Research and development

12,713

21,528

-41

%

General and administrative

7,641

7,427

3

%

Restructuring

806

-

N/A

Total operating expenses

$

29,540

$

38,454

-23

%

Operating loss

$

(12,393

)

$

(28,953

)

57

%

Net loss

$

(18,003

)

$

(30,881

)

42

%

Net loss per share

$

(0.07

)

$

(0.15

)

0.08

Adjusted EBITDA1

$

(3,676

)

$

(18,821

)

80

%

Full Year 2023 Financial Measures

Twelve Months Ended

(thousands, except per share data)

December 31, 2023

December 31, 20222

Change in %

Revenues

$

45,873

$

31,129

47

%

Operating expenses:

Cost of revenues

$

11,307

$

9,599

18

%

Sales and marketing

18,893

20,367

-7

%

Research and development

51,439

76,392

-33

%

General and administrative

28,285

30,443

-7

%

Restructuring

4,557

-

N/A

Total operating expenses

$

114,481

$

136,801

-16

%

Operating loss

$

(68,608

)

$

(105,672

)

35

%

Net loss

$

(88,937

)

$

(116,713

)

24

%

Net loss per share

$

(0.40

)

$

(0.74

)

0.34

Adjusted EBITDA1

$

(35,896

)

$

(72,843

)

51

%

1)

Please see table below for a reconciliation from GAAP to non-GAAP.

2)

Note: the Company identified corrections related to historical

financial transactions for certain prior periods, which have been

revised. These amounts had no impact on revenue, EPS or adjusted

EBITDA for the period noted. Specifically, for the three months

ended December 31, 2022, general and administrative expense and

total net loss both increased by $201. For the 12 months ended

December 31, 2022, general and administrative expense increased by

$265 and other income and expense increased by $1,075, resulting in

total net loss increasing by $1,340. Further details were included

in the company's Form 10-Q filed on November 15, 2023 for the

quarterly period ended September 30, 2023.

Summary of Liquidity and Cash Flows

The company’s total cash was approximately $109 million at

December 31, 2023. Current total cash balance is in excess of $200

million.

Condensed Cash Flow Statement

Year Ended

(thousands)

December 31, 2023

December 31, 2022

Cash flows:

Net cash used in operating activities

$

(68,265

)

$

(94,019

)

Net cash used in investing activities

(392

)

(1,329

)

Net cash provided by financing

activities

168,237

82,001

Net change in cash and cash

equivalents1

$

99,560

$

(13,347

)

1)

Foreign exchange impact on cash of ($20) for the period ending

December 31, 2023 not shown on chart.

Business Outlook 2024 and 2025

SoundHound expects full year 2024 revenue to be in a range of

$63 to $77 million, with a midpoint target of $70 million. The

company is also introducing a 2025 outlook, in which it expects its

growth to accelerate with revenue exceeding $100 million, achieving

positive adjusted EBITDA.

Additional Information

For more information please see the company’s SEC filings which

can be obtained on the company’s website at

investors.soundhound.com. The financial statements will be posted

on the website, and will be included when we file our 10-K. The

financial data presented in this press release should be considered

preliminary until the company files its 10-K.

Conference Call and Webcast

Keyvan Mohajer, Co-Founder and CEO, and Nitesh Sharan, CFO will

host a live audio conference call and webcast today at 2:00 p.m.

Pacific Time/5:00 p.m. Eastern Time. A live webcast and replay will

also be accessible at investors.soundhound.com.

About SoundHound AI

SoundHound (Nasdaq: SOUN), a global leader in conversational

intelligence, offers voice AI solutions that let businesses offer

incredible conversational experiences to their customers. Built on

proprietary technology, SoundHound’s voice AI delivers

best-in-class speed and accuracy in numerous languages to product

creators across automotive, TV, and IoT, and to customer service

industries via groundbreaking AI-driven products like Smart

Answering, Smart Ordering, and Dynamic Interaction™, a real-time,

multimodal customer service interface. Along with SoundHound Chat

AI, a powerful voice assistant with integrated Generative AI,

SoundHound powers millions of products and services, and processes

billions of interactions each year for world class businesses.

Forward-Looking Statements and Other Disclosures

This press release contains forward-looking statements, which

are not historical facts, within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. In some cases, you can

identify forward-looking statements by the use of words such as

“may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,”

“believe,” “estimate,” “predict,” “potential,” “continue,”

“likely,” “will,” “would” and variations of these terms and similar

expressions, or the negative of these terms or similar expressions.

These forward-looking statements include, but are not limited to,

statements concerning our expected financial performance, our

ability to implement our business strategy and anticipated business

and operations, the potential utility of and market for our

products and services, our ability to achieve revenue from our

cumulative bookings backlog and subscription bookings backlog, and

guidance for financial results for 2024 and 2025. Such

forward-looking statements are necessarily based upon estimates and

assumptions that, while considered reasonable by us and our

management, are inherently uncertain. As a result, readers are

cautioned not to place undue reliance on these forward-looking

statements. Our actual results may differ materially from those

expressed or implied by these forward-looking statements as a

result of risks and uncertainties impacting SoundHound’s business

including, our ability to successfully launch and commercialize new

products and services and derive significant revenue, our ability

to develop the bespoke products and services required under the

contracts included in our bookings backlog, including, but not

limited to, our ability to convert customer adoption of Smart

Ordering into realized revenue, our ability to predict or measure

supply chain disruptions at our customers, our market opportunity

and our ability to acquire new customers and retain existing

customers, the timing and impact of our growth initiatives, level

of product service failures that could lead our customers to use

competitors’ services, our ability to predict direct and indirect

customer demand for our existing and future products, our ability

to hire, retain and motivate employees, the effects of competition,

including price competition within our industry segment,

technological, regulatory and legal developments that uniquely or

disproportionately impact our industry segment, developments in the

economy and financial markets and those other factors described in

our risk factors set forth in our filings with the Securities and

Exchange Commission from time to time, including our Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. We do not intend to update or alter our forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by applicable law.

Certain Defined Terms

Cumulative Subscriptions & Bookings Backlog: The Company has

updated this metric to incorporate its customer subscriptions

activity with previously disclosed Cumulative bookings backlog.

Cumulative bookings backlog takes into account the prior quarter

end balance of bookings backlog plus new bookings in the current

quarter minus associated revenue recognized from bookings from

prior periods. Cumulative bookings backlog is derived from

committed customer contracts and this definition remains the same

as the previous one. Subscriptions backlog refers to potential

revenue achievable for the company with current customers where the

company is the leading or exclusive provider, and assuming a 4-year

ramp up during which time our technologies are being implemented

and assuming a successful full roll out of our technologies over a

total 5-year duration. Reasonable assumptions about adoption

percentages are included, with lower percentages applied to pilot

and proof-of-concept customers.

Non-GAAP Measures of Financial Performance

To supplement the company’s financial statements, which are

presented on the basis of U.S. generally accepted accounting

principles (GAAP), the following non-GAAP measure of financial

performance is included in this release: adjusted EBITDA. We define

Adjusted EBITDA as the company’s GAAP net loss excluding (i)

interest and other expense, net, (ii) depreciation and amortization

expense, (iii) income taxes, (iv) stock-based compensation, (v)

acquisition-related expenses, and (vi) restructuring expense. A

reconciliation of GAAP to this adjusted non-GAAP financial measure

is included below. When analyzing the company's operating results,

investors should not consider non-GAAP measures as substitutes for

the comparable financial measures prepared in accordance with

GAAP.

The Company does not present a quantitative reconciliation of

the forward-looking non-GAAP financial measures and Adjusted

EBITDA, to the most directly comparable GAAP financial measure (or

otherwise present such forward-looking GAAP measures) because it is

impractical to forecast certain items without unreasonable efforts

due to the uncertainty and inherent difficulty of predicting,

within a reasonable range, the occurrence and financial impact of

and the periods in which such items may be recognized.

Fourth Quarter Reconciliation of GAAP Net Loss to Non-GAAP

Adjusted EBITDA

Three Months Ended

(thousands)

December 31, 2023

December 31, 2022

GAAP net loss

$

(18,003

)

$

(30,881

)

Adjustments:

OI&E and other1

$

4,003

$

644

Income taxes

1,607

1,284

Depreciation and amortization

372

840

Stock-based compensation

6,486

9,292

Restructuring

806

-

Acquisition-related expenses

1,053

-

Adjusted EBITDA (non-GAAP)

$

(3,676

)

$

(18,821

)

1)

Includes other income/(expense)

of $1.5 and $0.5 million for the three months ended December 31,

2023 and 2022, respectively.

Full Year Reconciliation of GAAP Net Loss to Non-GAAP

Adjusted EBITDA

Year Ended

(thousands)

December 31, 2023

December 31, 2022

GAAP net loss

$

(88,937

)

$

(116,713

)

Adjustments:

OI&E and other2

$

16,415

$

8,152

Income taxes

3,914

2,889

Depreciation and amortization

2,313

4,037

Stock-based compensation

24,789

28,792

Restructuring

4,557

-

Acquisition-related expenses

1,053

$

-

Adjusted EBITDA (non-GAAP)

$

(35,896

)

$

(72,843

)

2)

Includes other income/(expense) of $1.2 and ($1.3) million for the

years ended December 31, 2023 and 2022, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229968938/en/

Investors: Scott Smith 408-724-1498 IR@SoundHound.com

Media: Fiona McEvoy 415-610-6590 PR@SoundHound.com

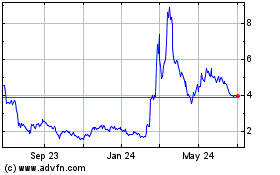

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

SoundHound AI (NASDAQ:SOUN)

Historical Stock Chart

From Dec 2023 to Dec 2024