Reservoir Added to Membership of the Russell 2000® Index

July 05 2022 - 8:00AM

Reservoir Media, Inc. (NASDAQ: RSVR), an award-winning independent

music company today announced that Reservoir has been added as a

member of the US small-cap Russell 2000® Index, effective

after the US market opened on June 27, as part of the 2022 Russell

indexes reconstitution. Membership in the Russell 2000® Index,

which remains in place for one year, is based on membership in the

broad-market Russell 3000® Index. The stock also was

automatically added to the appropriate growth and value indexes.

“We are pleased to be added to the Russell

indexes as we approach our first full year as a public company,”

said Golnar Khosrowshahi, Founder and Chief Executive Officer of

Reservoir. She continued, “This is a significant achievement for

the Company, showcasing Reservoir’s growth strategy, and will

ultimately increase awareness of our business as we continue to

execute on our strategic initiatives.”

Russell indexes are widely used by investment

managers and institutional investors for index funds and as

benchmarks for active investment strategies. Approximately $12

trillion in assets are benchmarked against Russell’s US indexes.

Russell indexes are part of FTSE Russell, a leading global index

provider.

For more information on the Russell 2000® Index

and the Russell indexes reconstitution, go to the “Russell

Reconstitution” section on the FTSE Russell website.

ABOUT RESERVOIR

Reservoir is an independent music company based

in New York City and with offices in Los Angeles, Nashville,

Toronto, London, and Abu Dhabi. Reservoir is the first

female-founded and led publicly traded independent music company in

the U.S. Founded as a family-owned music publisher in 2007,

Reservoir has grown to represent over 140,000 copyrights and 36,000

master recordings with titles dating as far back as 1900 and

hundreds of #1 releases worldwide. Reservoir holds a regular Top 10

U.S. Market Share according to Billboard’s Publishers Quarterly,

was twice named Publisher of the Year by Music Business Worldwide’s

The A&R Awards and won Independent Publisher of the Year at the

2020 and 2022 Music Week Awards.

Reservoir also represents a multitude of

recorded music through Chrysalis Records, Tommy Boy Records, and

Philly Groove Records and manages artists through its ventures with

Blue Raincoat Music and Big Life Management.

ABOUT FTSE RUSSELL

FTSE Russell is a global index leader that provides innovative

benchmarking, analytics and data solutions for investors worldwide.

FTSE Russell calculates thousands of indexes that measure and

benchmark markets and asset classes in more than 70 countries,

covering 98% of the investable market globally.

FTSE Russell index expertise and products are used extensively

by institutional and retail investors globally. Approximately $20

trillion is currently benchmarked to FTSE Russell indexes. For over

30 years, leading asset owners, asset managers, ETF providers and

investment banks have chosen FTSE Russell indexes to benchmark

their investment performance and create ETFs, structured products

and index-based derivatives.

A core set of universal principles guides FTSE Russell index

design and management: a transparent rules-based methodology is

informed by independent committees of leading market participants.

FTSE Russell is focused on applying the highest industry standards

in index design and governance and embraces the IOSCO Principles.

FTSE Russell is also focused on index innovation and customer

partnerships as it seeks to enhance the breadth, depth and reach of

its offering.

FTSE Russell is wholly owned by London Stock Exchange Group.

For more information, visit www.ftserussell.com.

Media ContactReservoir Media, Inc.Suzy

ArrabitoVice President, Marketing &

Communicationssa@reservoir-media.comwww.reservoir-media.com

Investor ContactAlpha IR GroupAlec Buchmelter or

Alec Steinberg RSVR@alpha-ir.com

Source: Reservoir Media, Inc.

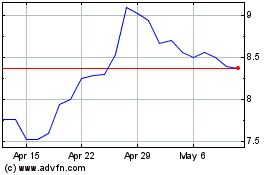

Reservoir Media (NASDAQ:RSVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

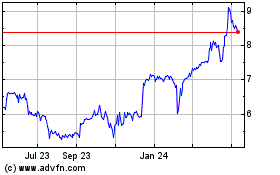

Reservoir Media (NASDAQ:RSVR)

Historical Stock Chart

From Feb 2024 to Feb 2025