Statement of Changes in Beneficial Ownership (4)

July 01 2022 - 5:04PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Taylor Ryan P. |

2. Issuer Name and Ticker or Trading Symbol

Reservoir Media, Inc.

[

RSVR

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

See Remarks |

|

(Last)

(First)

(Middle)

C/O RESERVOIR MEDIA, INC., 75 VARICK STREET, 9TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

6/29/2022 |

|

(Street)

NEW YORK, NY 10013

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, $0.0001 par value | 6/29/2022 | | A(1) | | 11940 | A | $0 | 11940 | D | |

| Common Stock, $0.0001 par value | 6/29/2022 | | P | | 39605 | A | $6.5983 (2) | 172070 | I | By Richmond Hill Capital Partners, LP (3) |

| Common Stock, $0.0001 par value | 6/30/2022 | | P | | 7319 | A | $6.4877 (4) | 179389 | I | By Richmond Hill Capital Partners, LP (3) |

| Common Stock, $0.0001 par value | 6/29/2022 | | P | | 92413 | A | $6.5983 (5) | 401498 | I | By Essex Equity Joint Investment Vehicle, LLC (6) |

| Common Stock, $0.0001 par value | 6/30/2022 | | P | | 17078 | A | $6.4877 (7) | 418576 | I | By Essex Equity Joint Investment Vehicle, LLC (6) |

| Common Stock, $0.0001 par value | | | | | | | | 13592793 (8)(9) | I | By ER Reservoir LLC (8)(9) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | Represents Restricted Stock Units ("RSUs") awarded under the Reservoir Media, Inc. 2021 Omnibus Incentive Plan. Each RSU represents a contingent right to receive one share of common stock, $0.0001 par value per share, of Reservoir Media, Inc. (the "Issuer"). The RSUs will vest on July 28, 2022, subject to the Reporting Person's continued service on the board of directors of the Issuer on such date. |

| (2) | The 39,605 shares of common stock, par value $0.0001 per share (the "Shares"), of the Issuer reported on this Form 4 were purchased in multiple trades at prices ranging from $6.10 to $6.74 per Share. The price reported above reflects the weighted average purchase price per Share. The Reporting Person hereby undertakes to provide to the Securities and Exchange Commission staff, the Issuer or any security holder of the Issuer, upon request, full information regarding the number of Shares purchased and prices at which the transactions were effected. |

| (3) | The amount of securities shown in this row is owned directly by Richmond Hill Capital Partners, LP ("RHCP"). Ryan P. Taylor is the managing member of the general partner of RHCP and the manager of the general partner of Richmond Hill Investment Co., LP, the investment adviser to RHCP, and may be deemed to be a beneficial owner of the Shares owned by RHCP. Mr. Taylor disclaims any beneficial ownership of any of the Issuer's securities reported herein for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the ?Exchange Act?) or otherwise, except to the extent of his pecuniary interest therein, and the inclusion of the Shares in this Report shall not be deemed an admission of beneficial ownership of the reported Shares for purposes of Section 16 of the Exchange Act, or for any other purpose. |

| (4) | The 7,319 Shares reported on this Form 4 were purchased in multiple trades at prices ranging from $6.39 to $6.50 per Share. The price reported above reflects the weighted average purchase price per Share. The Reporting Person hereby undertakes to provide to the Securities and Exchange Commission staff, the Issuer or any security holder of the Issuer, upon request, full information regarding the number of Shares purchased and prices at which the transactions were effected. |

| (5) | The 92,413 Shares reported on this Form 4 were purchased in multiple trades at prices ranging from $6.10 to $6.74 per Share. The price reported above reflects the weighted average purchase price per Share. The Reporting Person hereby undertakes to provide to the Securities and Exchange Commission staff, the Issuer or any security holder of the Issuer, upon request, full information regarding the number of Shares purchased and prices at which the transactions were effected. |

| (6) | The amount of securities shown in this row is owned directly by Essex Equity Joint Investment Vehicle, LLC ("EEJIV"). Ryan P. Taylor owns an equity interest in an entity that may be deemed to have a pecuniary interest in the Shares owned by EEJIV and therefore may be deemed to be a beneficial owner of the Shares owned by EEJIV. Mr. Taylor disclaims any beneficial ownership of any of the Issuer's securities reported herein for purposes of Section 16 of the Exchange Act or otherwise, except to the extent of his pecuniary interest therein, and the inclusion of the Shares in this Report shall not be deemed an admission of beneficial ownership of the reported Shares for purposes of Section 16 of the Exchange Act, or for any other purpose. |

| (7) | The 17,078 Shares reported on this Form 4 were purchased in multiple trades at prices ranging from $6.39 to $6.50 per Share. The price reported above reflects the weighted average purchase price per Share. The Reporting Person hereby undertakes to provide to the Securities and Exchange Commission staff, the Issuer or any security holder of the Issuer, upon request, full information regarding the number of Shares purchased and prices at which the transactions were effected. |

| (8) | The amount of securities shown in this row is owned directly by ER Reservoir LLC (the "Fund"). Ryan P. Taylor is the manager of the general partner of a manager of the Fund and may be deemed to be a beneficial owner of the Shares owned by the Fund. The Fund received these securities in connection with the agreement and plan of merger, dated as of April 14, 2021, by and among Reservoir Media, Inc. (formerly known as Roth CH Acquisition II Co. ("RMI")), Roth CH II Merger Sub Corp. ("Merger Sub") and Reservoir Holdings, Inc. ("Reservoir"), pursuant to which Merger Sub merged with and into Reservoir, with Reservoir surviving the merger as a wholly-owned subsidiary of RMI (the "Business Combination"). (Con't in FN9) |

| (9) | (Con't from FN8) The Fund received these Shares as consideration for the Business Combination. Mr. Taylor disclaims any beneficial ownership of any of the Issuer's securities reported herein for purposes of Section 16 of the Exchange Act or otherwise, except to the extent of his pecuniary interest therein, and the inclusion of the Shares in this Report shall not be deemed an admission of beneficial ownership of the reported Shares for purposes of Section 16 of the Exchange Act, or for any other purpose. |

Remarks:

May Be Deemed Member of 10% Owner Group |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Taylor Ryan P.

C/O RESERVOIR MEDIA, INC.

75 VARICK STREET, 9TH FLOOR

NEW YORK, NY 10013 | X |

|

| See Remarks |

Signatures

|

| /s/ Golnar Khosrowshahi, as attorney-in-fact for Ryan P. Taylor | | 7/1/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

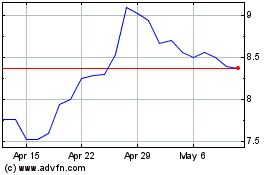

Reservoir Media (NASDAQ:RSVR)

Historical Stock Chart

From Jan 2025 to Feb 2025

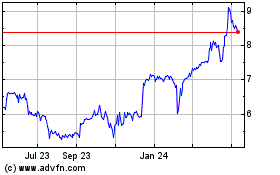

Reservoir Media (NASDAQ:RSVR)

Historical Stock Chart

From Feb 2024 to Feb 2025