RBB Bancorp Declares Quarterly Cash Dividend of $0.16 Per Common Share

July 18 2024 - 4:15PM

RBB Bancorp (NASDAQ: RBB) and its subsidiaries, Royal

Business Bank ("the Bank") and RBB Asset Management

Company ("RAM"), collectively referred to herein as "the

Company", announced that its Board of Directors has declared a

quarterly cash dividend of $0.16 per common share. The

dividend is payable on August 12, 2024 to common shareholders

of record as of July 31, 2024.

Corporate Overview

RBB Bancorp is a bank holding company headquartered in Los

Angeles, California. As of March 31, 2024, the Company had total

assets of $3.9 billion. Its wholly-owned subsidiary, the Bank, is a

full service commercial bank, which provides business banking

services to predominately the Asian communities in Los Angeles

County, Orange County, and Ventura County in California, in Las

Vegas, Nevada, in Brooklyn, Queens, and Manhattan in New York, in

Edison, New Jersey, in the Chicago neighborhoods of Chinatown and

Bridgeport, Illinois, and on Oahu, Hawaii. Bank services include

remote deposit, E-banking, mobile banking, commercial and investor

real estate loans, business loans and lines of credit, commercial

and industrial loans, SBA 7A and 504 loans, 1-4 single family

residential loans, trade finance, a full range of depository

account products and wealth management services. The Bank has nine

branches in Los Angeles County, two branches in Ventura County, one

branch in Orange County, California, one branch in Las Vegas,

Nevada, three branches and one loan operation center in Brooklyn,

three branches in Queens, one branch in Manhattan in New York, one

branch in Edison, New Jersey, two branches in Chicago, Illinois,

and one branch in Honolulu, Hawaii. The Company's administrative

and lending center is located at 1055 Wilshire Blvd., Los Angeles,

California 90017, and its finance and operations center is located

at 7025 Orangethorpe Ave., Buena Park, California 90621. The

Company's website address is www.royalbusinessbankusa.com.

Contacts

Lynn Hopkins, EVP/Chief Financial Officer, (657)

255-3282

Safe Harbor

Certain matters set forth herein (including the exhibits

hereto) constitute forward-looking statements relating to the

Company’s current business plans and expectations and our future

financial position and operating results. These forward-looking

statements are subject to risks and uncertainties that could cause

actual results, performance and/or achievements to differ

materially from those projected. These risks and uncertainties

include, but are not limited to, the Bank’s ability to comply with

the requirements of the Consent Order we have entered into with the

FDIC and the DFPI and the possibility that we may be required to

incur additional expenses or be subject to additional regulatory

action, if we are unable to timely and satisfactorily comply with

the consent order; the effectiveness of the Company’s internal

control over financial reporting and disclosure controls and

procedures; the potential for additional material weaknesses in the

Company’s internal controls over financial reporting or other

potential control deficiencies of which the Company is not

currently aware or which have not been detected; business and

economic conditions generally and in the financial services

industry, nationally and within our current and future geographic

markets, including the tight labor market, ineffective management

of the U.S. federal budget or debt or turbulence or uncertainly in

domestic of foreign financial markets; the strength of the United

States economy in general and the strength of the local economies

in which we conduct operations; our ability to attract and retain

deposits and access other sources of liquidity; possible additional

provisions for loan losses and charge-offs; credit risks of lending

activities and deterioration in asset or credit quality; extensive

laws and regulations and supervision that we are subject to,

including potential supervisory action by bank supervisory

authorities; increased costs of compliance and other risks

associated with changes in regulation, including any amendments to

the Dodd-Frank Wall Street Reform and Consumer Protection Act;

compliance with the Bank Secrecy Act and other money laundering

statutes and regulations; potential goodwill impairment; liquidity

risk; fluctuations in interest rates; the transition away from the

London Interbank Offering Rate (LIBOR) and related uncertainty as

well as the risks and costs related to our adopted alternative

reference rate, including the Secured Overnight Financing Rate

(SOFR); risks associated with acquisitions and the expansion of our

business into new markets; inflation and deflation; real estate

market conditions and the value of real estate collateral;

environmental liabilities; our ability to compete with larger

competitors; our ability to retain key personnel; successful

management of reputational risk; severe weather, natural disasters,

earthquakes, fires; or other adverse external events could harm our

business; geopolitical conditions, including acts or threats of

terrorism, actions taken by the United States or other governments

in response to acts or threats of terrorism and/or military

conflicts, including the conflicts between Russia and Ukraine and

in the Middle East, which could impact business and economic

conditions in the United States and abroad; public health crises

and pandemics, and their effects on the economic and business

environments in which we operate, including our credit quality and

business operations, as well as the impact on general economic and

financial market conditions; general economic or business

conditions in Asia, and other regions where the Bank has

operations; failures, interruptions, or security breaches of our

information systems; climate change, including any enhanced

regulatory, compliance, credit and reputational risks and costs;

cybersecurity threats and the cost of defending against them; our

ability to adapt our systems to the expanding use of technology in

banking; risk management processes and strategies; adverse results

in legal proceedings; the impact of regulatory enforcement actions,

if any; certain provisions in our charter and bylaws that may

affect acquisition of the Company; changes in tax laws and

regulations; the impact of governmental efforts to restructure the

U.S. financial regulatory system; the impact of future or recent

changes in FDIC insurance assessment rate of the rules and

regulations related to the calculation of the FDIC insurance

assessment amount; the effect of changes in accounting policies and

practices or accounting standards, as may be adopted from

time-to-time by bank regulatory agencies, the SEC, the Public

Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters, including

Accounting Standards Update 2016-13 (Topic 326, “Measurement of

Current Losses on Financial Instruments," commonly referenced as

the Current Expected Credit Losses Model), which changed how we

estimate credit losses and may further increase the required level

of our allowance for credit losses in future periods; market

disruption and volatility; fluctuations in the Company’s stock

price; restrictions on dividends and other distributions by laws

and regulations and by our regulators and our capital structure;

issuances of preferred stock; our ability to raise additional

capital, if needed, and the potential resulting dilution of

interests of holders of our common stock; the soundness of other

financial institutions; our ongoing relations with our various

federal and state regulators, including the SEC, FDIC, FRB and

DFPI; our success at managing the risks involved in the foregoing

items and all other factors set forth in the Company’s public

reports, including its Annual Report as filed under Form 10-K for

the year ended December 31, 2023, and particularly the discussion

of risk factors within that document. The Company does not

undertake, and specifically disclaims any obligation, to update any

forward-looking statements to reflect occurrences or unanticipated

events or circumstances after the date of such statements except as

required by law. Any statements about future operating results,

such as those concerning accretion and dilution to the Company’s

earnings or shareholders, are for illustrative purposes only, are

not forecasts, and actual results may differ.

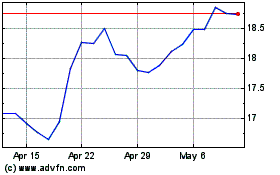

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Nov 2024 to Dec 2024

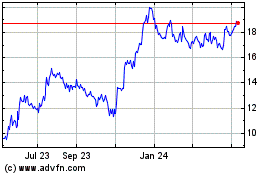

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Dec 2023 to Dec 2024