RBB Bancorp (the “Company”, “we”, “us” or “our”) (NASDAQ: RBB)

is pleased to announce the appointment of Ms. Diana Hanson as

Senior Vice President and Chief Accounting Officer of Royal

Business Bank (the “Bank”) and RBB Bancorp effective June 17, 2024.

With over 30 years of financial services industry experience, Ms.

Hanson brings a wealth of knowledge as a Chief Accounting Officer

and Corporate Controller at various financial institutions. Her

leadership and expertise in technical accounting, financial

reporting, accounting operations and internal controls over

financial reporting will be beneficial to the Company.

Prior to joining the Company, Ms. Hanson held the position of

SVP and Chief Accounting Officer & Corporate Controller at Banc

of California, Inc. for 3 years; SVP and Chief Accounting Officer

at First Choice Bancorp and First Choice Bank for 3 years; SVP and

Director of Accounting Policy, Division Controller and SOX Manager

at Pacific Western Bank for 7 years, and various other corporate

leadership roles in community banking.

“I am thrilled to have Diana join our team as Chief Accounting

Officer,” said Lynn Hopkins, Chief Financial Officer of RBB

Bancorp. “Diana is a remarkably talented finance executive and I

look forward to the tremendous contributions she will be able to

make here at our Company. As we strive to deliver value to our

customers, community, and shareholders, I am pleased we continue to

attract top-tier banking professionals to our team."

Commenting on her new appointment, Ms. Hanson stated, "I am

delighted to be part of the collaborative Royal Business Bank team.

The Company has demonstrated outstanding growth and performance

while delivering shareholder value and serving the Asian American

community. I look forward to helping the Company achieve success

for the benefit of its employees, clients and shareholders."

Ms. Hanson is a CPA (inactive) and began her career as an

auditor with Deloitte and Touche in Chicago, Illinois, and holds a

Bachelor of Science Degree in Accounting from Babson College in

Wellesley, Massachusetts.

Corporate Overview

RBB Bancorp is a community-based financial holding company

headquartered in Los Angeles, California. As of March 31, 2024, the

Company had total assets of $3.9 billion. Its wholly-owned

subsidiary, Royal Business Bank, is a full service commercial bank,

which provides consumer and business banking services to

predominately the Asian communities in Los Angeles County, Orange

County, and Ventura County in California, in Las Vegas, Nevada, in

Brooklyn, Queens, and Manhattan in New York, in Edison, New Jersey,

in the Chicago neighborhoods of Chinatown and Bridgeport, Illinois,

and on Oahu, Hawaii. Bank services include remote deposit,

E-banking, mobile banking, commercial and investor real estate

loans, business loans and lines of credit, commercial and

industrial loans, SBA 7A and 504 loans, 1-4 single family

residential loans, trade finance, a full range of depository

account products and wealth management services. The Bank has nine

branches in Los Angeles County, two branches in Ventura County, one

branch in Orange County, California, one branch in Las Vegas,

Nevada, three branches and one loan operation center in Brooklyn,

three branches in Queens, one branch in Manhattan in New York, one

branch in Edison, New Jersey, two branches in Chicago, Illinois,

and one branch in Honolulu, Hawaii. The Company's administrative

and lending center is located at 1055 Wilshire Blvd., Los Angeles,

California 90017, and its operations center is located at 7025

Orangethorpe Ave., Buena Park, California 90621. The Company's

website address is www.royalbusinessbankusa.com.

Safe Harbor

Certain matters set forth herein (including the exhibits hereto)

constitute forward-looking statements relating to the Company’s

current business plans and expectations and our future financial

position and operating results. These forward-looking statements

are subject to risks and uncertainties that could cause actual

results, performance and/or achievements to differ materially from

those projected. These risks and uncertainties include, but are not

limited to, the Bank’s ability to comply with the requirements of

the consent order we have entered into with the Federal Deposit

Insurance Corporation (“FDIC”) and the California Department of

Financial Protection and Innovation (“DFPI”) and the possibility

that we may be required to incur additional expenses or be subject

to additional regulatory action, if we are unable to timely and

satisfactorily comply with the consent order; the effectiveness of

the Company’s internal control over financial reporting and

disclosure controls and procedures; the potential for additional

material weaknesses in the Company’s internal controls over

financial reporting or other potential control deficiencies of

which the Company is not currently aware or which have not been

detected; business and economic conditions generally and in the

financial services industry, nationally and within our current and

future geographic markets, including the tight labor market,

ineffective management of the United States (“U.S.”) federal budget

or debt or turbulence or uncertainly in domestic of foreign

financial markets; the strength of the U.S. economy in general and

the strength of the local economies in which we conduct operations;

our ability to attract and retain deposits and access other sources

of liquidity; possible additional provisions for loan losses and

charge-offs; credit risks of lending activities and deterioration

in asset or credit quality; extensive laws and regulations and

supervision that we are subject to, including potential supervisory

action by bank supervisory authorities; increased costs of

compliance and other risks associated with changes in regulation,

including any amendments to the Dodd-Frank Wall Street Reform and

Consumer Protection Act; compliance with the Bank Secrecy Act and

other money laundering statutes and regulations; potential goodwill

impairment; liquidity risk; fluctuations in interest rates; risks

associated with acquisitions and the expansion of our business into

new markets; inflation and deflation; real estate market conditions

and the value of real estate collateral; environmental liabilities;

our ability to compete with larger competitors; our ability to

retain key personnel; successful management of reputational risk;

severe weather, natural disasters, earthquakes, fires; or other

adverse external events could harm our business; geopolitical

conditions, including acts or threats of terrorism, actions taken

by the U.S. or other governments in response to acts or threats of

terrorism and/or military conflicts, including the conflicts

between Russia and Ukraine and in the Middle East, which could

impact business and economic conditions in the U.S. and abroad;

public health crises and pandemics, and their effects on the

economic and business environments in which we operate, including

our credit quality and business operations, as well as the impact

on general economic and financial market conditions; general

economic or business conditions in Asia, and other regions where

the Bank has operations; failures, interruptions, or security

breaches of our information systems; climate change, including any

enhanced regulatory, compliance, credit and reputational risks and

costs; cybersecurity threats and the cost of defending against

them; our ability to adapt our systems to the expanding use of

technology in banking; risk management processes and strategies;

adverse results in legal proceedings; the impact of regulatory

enforcement actions, if any; certain provisions in our charter and

bylaws that may affect acquisition of the Company; changes in tax

laws and regulations; the impact of governmental efforts to

restructure the U.S. financial regulatory system; the impact of

future or recent changes in the FDIC insurance assessment rate and

the rules and regulations related to the calculation of the FDIC

insurance assessments; the effect of changes in accounting policies

and practices or accounting standards, as may be adopted from

time-to-time by bank regulatory agencies, the SEC, the Public

Company Accounting Oversight Board, the Financial Accounting

Standards Board or other accounting standards setters, including

Accounting Standards Update 2016-13 (Topic 326, “Measurement of

Current Losses on Financial Instruments, commonly referenced as the

Current Expected Credit Losses Model, which changed how we estimate

credit losses and may further increase the required level of our

allowance for credit losses in future periods; market disruption

and volatility; fluctuations in the Company’s stock price;

restrictions on dividends and other distributions by laws and

regulations and by our regulators and our capital structure;

issuances of preferred stock; our ability to raise additional

capital, if needed, and the potential resulting dilution of

interests of holders of our common stock; the soundness of other

financial institutions; our ongoing relations with our various

federal and state regulators, including the SEC, FDIC, FRB and

DFPI; our success at managing the risks involved in the foregoing

items and all other factors set forth in the Company’s public

reports, including its Annual Report as filed under Form 10-K for

the year ended December 31, 2023, and particularly the discussion

of risk factors within that document. The Company does not

undertake, and specifically disclaims any obligation, to update any

forward-looking statements to reflect occurrences or unanticipated

events or circumstances after the date of such statements except as

required by law. Any statements about future operating results,

such as those concerning accretion and dilution to the Company’s

earnings or shareholders, are for illustrative purposes only, are

not forecasts, and actual results may differ.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625594712/en/

Lynn Hopkins, Chief Financial Officer (657) 255-3282

lhopkins@rbbusa.com

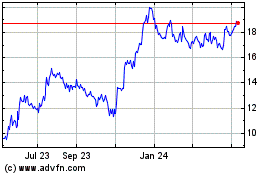

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Nov 2024 to Dec 2024

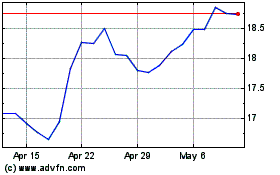

RBB Bancorp (NASDAQ:RBB)

Historical Stock Chart

From Dec 2023 to Dec 2024