Preferred Bank Revises Second Quarter Earnings

August 11 2008 - 4:00PM

PR Newswire (US)

LOS ANGELES, Aug. 11 /PRNewswire-FirstCall/ -- Preferred Bank

(NASDAQ:PFBC), an independent commercial bank focusing on the

Chinese-American and diversified Southern California mainstream

market, today reported a revision to its net income for the quarter

ended June 30, 2008. Revised net income totaled $18,000 for the

second quarter of 2008, a 99.7% decrease from net income of $7.0

million for the same period in 2007 while diluted earnings per

share decreased 100.0% to $0.00 for the quarter compared to $0.65

for the second quarter of 2007. The revision was due to the

recording of an income tax expense of $430,000 for a valuation

allowance against the net deferred tax asset related to the Bank's

$1.9 million charge for other-than-temporary impairment ("OTTI") on

its FHLMC preferred stock. This OTTI charge was a capital item in

nature. During the process of preparing our Quarterly Report on

Form 10-Q, the Bank determined that it was necessary to establish a

valuation allowance against a portion of the net deferred tax asset

related to the impairment charge. The valuation allowance was

established to reduce the net deferred tax asset to the amount that

management believes is more likely than not to be realized as of

June 30, 2008. Preferred bank has filed its Quarterly Report on

Form 10-Q with the Federal Deposit Insurance Corporation today and

this report may also be found on its website at

http://www.preferredbank.com/. About Preferred Bank Preferred Bank

is one of the largest independent commercial banks in California

focusing on the Chinese-American market. The bank is chartered by

the State of California, and its deposits are insured by the

Federal Deposit Insurance Corporation, or FDIC, to the maximum

extent permitted by law. The Company conducts its banking business

from its main office in Los Angeles, California, and through ten

full-service branch banking offices in Alhambra, Century City,

Chino Hills, City of Industry, Torrance, Arcadia, Irvine, Diamond

Bar, Santa Monica and Valencia, California. Preferred Bank offers a

broad range of deposit and loan products and services to both

commercial and consumer customers. The bank provides personalized

deposit services as well as real estate finance, commercial loans

and trade finance to small and mid-sized businesses, entrepreneurs,

real estate developers, professionals and high net worth

individuals. Preferred Bank continues to benefit from the

significant migration to Southern California of ethnic Chinese from

China and other areas of East Asia. While its business is not

solely dependent on the Chinese-American market, it represents an

important element of the bank's operating strategy, especially for

its branch network and deposit products and services. Preferred

Bank believes it is well positioned to compete effectively with the

smaller Chinese-American community banks, the larger commercial

banks and other major banks operating in Southern California by

offering a high degree of personal service and responsiveness,

experienced multi-lingual staff and substantial lending limits.

Forward-Looking Statements This press release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements about the Bank's future

financial and operating results, the Bank's plans, objectives,

expectations and intentions and other statements that are not

historical facts. Such statements are based upon the current

beliefs and expectations of the Bank's management and are subject

to significant risks and uncertainties. Actual results may differ

from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government's monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank's 2007 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation which can

be found on Preferred Bank's website. The forward-looking

statements in this press release speak only as of the date of the

press release, and the Bank assumes no obligation to update the

forward-looking statements or to update the reasons why actual

results could differ from those contained in the forward-looking

statements. For additional information about Preferred Bank, please

visit the Bank's website at http://www.preferredbank.com/. For

Further Information: AT THE COMPANY: AT FINANCIAL RELATIONS BOARD:

Edward J. Czajka Lasse Glassen Chief Financial Officer General

Information (213) 891-1188 (213) 486-6546 DATASOURCE: Preferred

Bank CONTACT: Edward J. Czajka, Chief Financial Officer of

Preferred Bank, +1-213-891-1188; or Lasse Glassen of FINANCIAL

RELATIONS BOARD, +1-213-486-6546, , for Preferred Bank Web site:

http://www.preferredbank.com/

Copyright

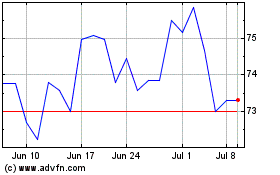

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

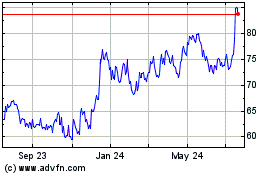

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Nov 2023 to Nov 2024