omniQ Corporation (OTC PINK: OMQS) ("omniQ" or "the Company"), a

leading provider of Artificial Intelligence (AI)-based solutions,

today reported substantial progress towards achieving financial

stability in its quarterly earnings for Q1 2024. The Company has

demonstrated a commendable reduction in operational costs and

enhanced sales performance, underscoring its commitment to

excellence and shareholder value.

FINANCIAL HIGHLIGHTS:

- Strong

Revenue Growth: Our first quarter revenue increased by 14%

to $18.3M, compared to the last quarter of 2023.

- Record

Gross Margin: We achieved a record-high gross margin of

28% in Q1, a significant improvement from 21% in the same quarter

last year and 13% in the last quarter of 2023.

- Improved

Profitability: Our gross profit for the quarter soared by

142% from Q4 2023, reaching $5.0 million.

- Reduced

Expenses: Selling, general, and administrative (SG&A)

expenses were reduced by 18%, contributing to an overall 18%

decrease in total operating expenses compared to Q1 of last

year.

- Focusing

on Profitability: Our operating loss decreased by 37%,

from $2 million in Q1 2023 to $1.3M in Q1 2024. Net loss also

decreased by $1.4 million or 40% in the same period of 2023.

FIRST QUARTER 2024 FINANCIAL RESULTS

Our focus remains on growth and profitability.

In the first quarter of 2024, our company demonstrated robust sales

performance, with operations generating revenues of $18.3

million—an increase of $2.2 million or 14% from the previous

quarter. This period also saw a significant reduction in

operational losses, decreasing by 1.4 million or 18% compared to Q4

2023. Looking at year-over-year, it is even stronger. Operational

losses are down 37% to $1.3 million compared to a $2 million loss

in the same quarter of the previous year.

Furthermore, the basic loss per share from

continuing operations improved notably, reduced to ($0.20) from

($0.45) per share in Q1 2023. Our comprehensive loss, which

includes the effects of foreign currency translation, was reduced

by $1.2 million, or 39%. A key component of these improvements was

our effective cost management strategy, which led to an 18%

reduction in selling, general, and administrative expenses,

totaling $5.6 million, down from $6.8 million in the first quarter

of the prior year, primarily due to our aggressive cost savings

plan.

These efforts not only demonstrate our

commitment to operational excellence but also reflect our focus on

enhancing shareholder value, evidenced by a 37% reduction in

operational losses year-over-year.

ADDITIONAL Q1 AND RECENT EVENTS

Strategic Expansion in Airport and Security

Operations:

- DFW

Airport Upgrade: Continuing enhancements in our airport

business with advanced AI-Machine Vision solution upgrade at

Dallas-Fort Worth International Airport.

- Homeland

Security: Integrated AI-Machine Vision solutions purchased

for a critical homeland security project.

Fintech Developments:

- Deployed

self-service interactive consumer management kiosks at Israel’s

largest energy company.

- Secured a

contract with a major U.S.-based restaurant chain for our

self-ordering platform.

- Implemented a

new fintech solution at Ben-Gurion Airport, improving traveler

experience with self-ordering kiosks.

- Won contract to

supply proprietary fintech solutions to one of Israel’s largest

fast food (QSR) chains.

Strong IoT Business:

- Secured over $5

million in purchase orders from one of the largest U.S. food and

drug chains and Nestle International.

- Upgrading

systems across 450 sporting goods stores for a major U.S.

retailer.

Strategic Business Moves:

- New Product

Launch: Introduced seeQ, our new product with capabilities that are

currently purchased by AI machine-vision customers, with a

strategic plan to expand to new markets. This is a SaaS product,

creating an ongoing stream of revenue.

- Acquired

Codeblocks Ltd., a leading fintech software developer, expanding

our strategic capabilities in the fast-growing fintech market.

SHAREHOLDER UPDATE

As we navigate through a transformative period

at OMNIQ Corp., we wish to update you on several critical aspects

of our strategy and operational focus. First, we have submitted an

application to list the trading of our common stock to the OTCQX

marketplace from the current listing on the OTC PINK marketplace.

The listing of the Company’s common shares on OTCQX remains subject

to the approval of OTCQX and the satisfaction of applicable listing

requirements. The Company meets several of the OTCQX listing

requirements, and the Company confirms that the uplisting of the

Company’s common stock to the OTCQX would not change the trading

symbol or cusip number. No action by the OMNIQ stockholders is

required.OTCQX is the top tier of three markets organized by OTC

Markets Group Inc. for trading over-the-counter securities and is

designed for established, investor-focused U.S. and international

companies. In the event that we do not meet the OTCQX

standards related to our market cap, we intend to OTCQB.

“We view the current

situation as a temporary phase in our ongoing strategy focused on

growth and profitability. We are actively executing our strategic

plan and exploring every avenue to ensure a swift return to a

national exchange listing. In the interim, OMNIQ will continue

trading on the OTC market and we have taken steps to be listed on

the OTCQX, the premier tier of the OTC markets, reflecting our

commitment to high standards and transparency,” said Shai

Lustgarten, CEO of OMNIQ,

“Please be assured

that OMNIQ remains diligent in fulfilling all SEC requirements and

filings. Our commitment to growth is unwavering, as evidenced by

our consistent acquisition of new customers and the expansion of

our business with existing Fortune 100 customers. We are confident

in the strength of our partnerships and our proven business model,

which we believe will drive our return to profitability and sustain

our long-term success.”

Next, we will discuss our Strategic plan for

operational efficiency. Our management team is deeply committed to

enhancing operational efficiency. We have implemented strategic

measures aimed at reducing costs and increasing revenues. These

initiatives are designed to streamline our operations and optimize

our resource allocation, setting a robust path towards sustained

profitability. This includes measures such as concentrating our

sales efforts toward higher profit products, reducing operational

costs without reducing operational efficiency, expanding product

lines in large-growing markets, utilizing existing relationships

and coming out with products that add value to those customers on a

subscription basis, and more. This plan is showing results when

looking at our Q1 financial numbers and we are expecting to see

further improvements in Q2 and beyond until we regain

profitability.

Now, we’ll talk about Fintech. The fintech

market is experiencing rapid growth, driven by increasing demand

for technology-driven financial solutions. This expansion presents

significant opportunities for OMNIQ, as our innovative solutions

are well-aligned with the current market needs and we believe that

we are in a good position to provide these solutions to both new

and existing customers.

Across the industries we operate in, trends such

as digital transformation, AI integration, and automated solutions

are influencing market dynamics. We are actively leveraging these

trends to enhance our product offerings and stay ahead in

competitive markets. OMNIQ continues to distinguish itself from

competitors through advanced technology solutions and strategic

partnerships. We believe that our focus on customer-centric

innovations and operational excellence positions us strongly

against competitors in all our markets.

Finally, we are pleased to announce the

appointment of a new board member, Israel Singer who brings

extensive experience and expertise. This addition will undoubtedly

strengthen our board’s strategic oversight and contribute to our

overall corporate governance.

“This quarter, omniQ

has made significant strides towards financial stability. We've

successfully streamlined operations and managed costs effectively,

leading to a noticeable decrease in losses. Our focused efforts are

not only improving our bottom line but also driving substantial

growth in sales. This progress is a clear indicator of our

commitment to operational excellence and value creation for our

shareholders’” – CEO Shai Lustgarten

ABOUT OMNIQ:

OMNIQ Corp. is at the forefront of technological

innovation, focusing on advanced AI technologies for computer and

machine vision image processing. The company develops a variety of

products including data collection systems, real-time surveillance,

and monitoring tools. These products are essential for sectors like

supply chain management, homeland security, public safety, and

traffic & parking management, helping to ensure the secure and

efficient movement of people, goods, and information through

critical locations such as airports, warehouses, and national

borders.

OMNIQ serves a diverse clientele, including

government agencies and Fortune 500 companies across industries

such as manufacturing, retail, distribution, healthcare,

transportation, logistics, food and beverage, and the oil, gas, and

chemical sectors. By integrating OMNIQ's cutting-edge solutions,

these organizations are better equipped to manage the complexities

of their industries, enhancing their operational capabilities.

Financially, OMNIQ is strategically positioned

in rapidly growing markets. The Company is making significant

inroads into the Global Safe City market, projected to reach $67.1

billion by 2028, the smart parking market, expected to grow to

$16.4 billion by 2030, and the fast-casual restaurant sector,

anticipated to reach $209 billion by 2027, and the fintech market

projected to grow to $1,152 billion by 2032. These market

projections indicate strong potential for growth and the increasing

demand for advanced AI technology solutions in these sectors.

INFORMATION ABOUT FORWARD LOOKING

STATEMENTS

“Safe Harbor” Statement under the Private

Securities Litigation Reform Act of 1995. Statements in this press

release relating to plans, strategies, economic performance and

trends, projections of results of specific activities or

investments, and other statements that are not descriptions of

historical facts may be forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934.

This release contains “forward-looking

statements” that include information relating to future events and

future financial and operating performance. The words “anticipate,”

“may,” “would,” “will,” “expect,” “estimate,” “can,” “believe,”

“potential” and similar expressions and variations thereof are

intended to identify forward-looking statements. Forward-looking

statements should not be read as a guarantee of future performance

or results and will not necessarily be accurate indications of the

times at, or by, which that performance or those results will be

achieved. Forward-looking statements are based on information

available at the time they are made and/or management’s good faith

belief as of that time with respect to future events and are

subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

or suggested by the forward-looking statements.

Examples of forward-looking statements include,

among others, statements made in this press release regarding the

closing of the private placement and the use of proceeds received

in the private placement. Important factors that could cause these

differences include, but are not limited to: fluctuations in demand

for the Company’s products particularly during the current health

crisis, the introduction of new products, the Company’s ability to

maintain customer and strategic business relationships, the impact

of competitive products and pricing, growth in targeted markets,

the adequacy of the Company’s liquidity and financial strength to

support its growth, the Company’s ability to manage credit and debt

structures from vendors, debt holders and secured lenders, the

Company’s ability to successfully integrate its acquisitions, and

other information that may be detailed from time-to-time in OMNIQ

Corp.’s filings with the United States Securities and Exchange

Commission. Examples of such forward-looking statements in this

release include, among others, statements regarding revenue growth,

driving sales, operational and financial initiatives, cost

reduction and profitability, and simplification of operations. For

a more detailed description of the risk factors and uncertainties

affecting OMNIQ Corp., please refer to the Company’s recent

Securities and Exchange Commission filings, which are available at

SEC.gov. OMNIQ Corp. undertakes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise, unless otherwise required

by law.

ContactIR@omniq.com

OMNIQ CORP.CONDENSED

CONSOLIDATED BALANCE SHEETS

| |

|

As of |

|

| (In

thousands, except share and per share data) |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

(UNAUDITED) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

881 |

|

|

$ |

1,678 |

|

|

Accounts receivable, net |

|

|

18,429 |

|

|

|

18,654 |

|

|

Inventory |

|

|

5,676 |

|

|

|

6,028 |

|

|

Prepaid expenses |

|

|

806 |

|

|

|

969 |

|

|

Other current assets |

|

|

319 |

|

|

|

25 |

|

|

Total current assets |

|

|

26,111 |

|

|

|

27,354 |

|

| |

|

|

|

|

|

|

|

|

|

Property and equipment, net of accumulated depreciation of $1,782

and $1,030 respectively |

|

|

981 |

|

|

|

1,066 |

|

|

Goodwill |

|

|

2,891 |

|

|

|

1,788 |

|

|

Trade name, net of accumulated amortization of $4,888 and $4,564,

respectively |

|

|

1,312 |

|

|

|

1,377 |

|

|

Customer relationships, net of accumulated amortization of $11,950

and $11,001, respectively |

|

|

3,575 |

|

|

|

3,777 |

|

|

Other intangibles, net of accumulated amortization of $1,675 and

$2,216, respectively |

|

|

478 |

|

|

|

504 |

|

|

Right of use lease asset |

|

|

1,548 |

|

|

|

1,862 |

|

|

Other assets |

|

|

1,965 |

|

|

|

1,758 |

|

| Total

Assets |

|

$ |

38,861 |

|

|

$ |

39,486 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

57,145 |

|

|

$ |

56,741 |

|

|

Line of credit |

|

|

391 |

|

|

|

240 |

|

|

Accrued payroll and sales tax |

|

|

2,311 |

|

|

|

1,537 |

|

|

Notes payable – current portion |

|

|

9,451 |

|

|

|

10,196 |

|

|

Lease liability – current portion |

|

|

758 |

|

|

|

885 |

|

|

Other current liabilities |

|

|

2,430 |

|

|

|

3,106 |

|

|

Total current liabilities |

|

|

72,486 |

|

|

|

72,705 |

|

| |

|

|

|

|

|

|

|

|

|

Long term liabilities |

|

|

|

|

|

|

|

|

|

Accrued interest and accrued liabilities, related party |

|

|

73 |

|

|

|

73 |

|

|

Notes payable, less current portion |

|

|

1,392 |

|

|

|

265 |

|

|

Lease liability |

|

|

820 |

|

|

|

1,011 |

|

|

Other long-term liabilities |

|

|

619 |

|

|

|

452 |

|

|

Total liabilities |

|

|

75,390 |

|

|

|

74,506 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity (deficit) |

|

|

|

|

|

|

|

|

|

Series A Preferred stock; $0.001 par value; 2,000,000 shares

designated, 0 shares issued and outstanding |

|

|

- |

|

|

|

0 |

|

|

Series B Preferred stock; $0.001 par value; 1 share designated, 0

shares issued and outstanding |

|

|

- |

|

|

|

0 |

|

|

Series C Preferred stock; $0.001 par value; 3,000,000 shares

designated, 502,000 shares issued and outstanding,

respectively |

|

|

1 |

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock; $0.001 par value; 15,000,000 shares authorized;

10,690,211 and 10,675,802 shares issued and outstanding,

respectively. |

|

|

11 |

|

|

|

11 |

|

|

Additional paid-in capital |

|

|

78,639 |

|

|

|

78,340 |

|

|

Accumulated (deficit) |

|

|

(115,972 |

) |

|

|

(113,923 |

) |

|

Accumulated other comprehensive income |

|

|

792 |

|

|

|

551 |

|

|

Total OmniQ stockholders’ equity (deficit) |

|

|

(36,529 |

) |

|

|

(35,020 |

) |

| |

|

|

|

|

|

|

|

|

|

Total liabilities and equity (deficit) |

|

$ |

38,861 |

|

|

$ |

39,486 |

|

OMNIQ CORP.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS(UNAUDITED)

| |

|

For the Three months ended March 31, |

|

| (In

thousands, except share and per share data) |

|

2024 |

|

|

2023 |

|

| Revenues |

|

$ |

18,317 |

|

|

$ |

27,821 |

|

| |

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

|

13,259 |

|

|

|

22,099 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit |

|

|

5,058 |

|

|

|

5,722 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

Research & Development |

|

|

405 |

|

|

|

423 |

|

|

Selling, general and administrative |

|

|

5,565 |

|

|

|

6,766 |

|

|

Depreciation |

|

|

116 |

|

|

|

108 |

|

|

Amortization |

|

|

231 |

|

|

|

436 |

|

| Total operating expenses |

|

|

6,317 |

|

|

|

7,733 |

|

| Loss from operations |

|

|

(1,259 |

) |

|

|

(2,011 |

) |

| |

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(917 |

) |

|

|

(938 |

) |

|

Other (expenses) income |

|

|

31 |

|

|

|

(751 |

) |

| Total other expenses |

|

|

(886 |

) |

|

|

(1,689 |

) |

| Net Loss Before Income

Taxes |

|

|

(2,145 |

) |

|

|

(3,700 |

) |

| Provision for Income

Taxes |

|

|

|

|

|

|

|

|

|

Current |

|

|

47 |

|

|

|

193 |

|

| Total Provision for Income

Taxes |

|

|

47 |

|

|

|

193 |

|

| |

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(2,098 |

) |

|

$ |

(3,507 |

) |

| Foreign currency translation

adjustment |

|

|

241 |

|

|

|

457 |

|

| Comprehensive loss |

|

$ |

(1,857 |

) |

|

$ |

(3,050 |

) |

| Reconciliation of net loss to

net loss attributable to common shareholders |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(2,098 |

) |

|

$ |

(3,507 |

) |

| Less: Dividends attributable

to non-common stockholders’ of OmniQ Corp |

|

|

(7 |

) |

|

|

(8 |

) |

| Net loss attributable to

common stockholders’ of OmniQ Corp |

|

$ |

(2,105 |

) |

|

$ |

(3,515 |

) |

| Net (loss) per share - basic

attributable to common stockholders’ of OmniQ Corp |

|

$ |

(0.20 |

) |

|

$ |

(0.45 |

) |

| Weighted average number of

common shares outstanding - basic |

|

|

10,688,340 |

|

|

|

7,749,870 |

|

OMNIQ

Corp.RECONCILIATION OF GAAP MEASURES TO

NON-GAAPMEASURES

| |

|

The three months ended |

| (In thousands) |

|

March 31, |

|

Adjusted EBITDA Calculation |

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

| Net loss |

|

|

(2,098 |

) |

|

|

|

(3,507 |

) |

| Depreciation &

amortization |

|

|

347 |

|

|

|

|

544 |

|

| Interest expense |

|

|

917 |

|

|

|

|

938 |

|

| Income taxes |

|

|

(47 |

) |

|

|

|

(193 |

) |

| Stock compensation |

|

|

517 |

|

|

|

|

516 |

|

| Nonrecurring loss events |

|

|

(232 |

) |

|

|

|

1,036 |

|

| Adjusted EBITDA |

|

|

(596 |

) |

|

|

|

(666 |

) |

| |

|

|

|

|

|

|

|

| Total revenues, net |

|

|

18,317 |

|

|

|

|

27,821 |

|

| Adjusted EBITDA as a % of

total revenues, net |

|

|

(3.26 |

%) |

|

|

|

(2.39 |

%) |

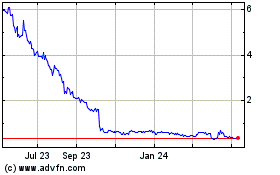

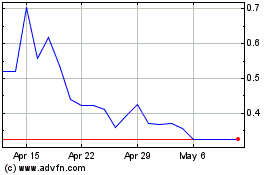

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Jan 2025 to Feb 2025

OMNIQ (NASDAQ:OMQS)

Historical Stock Chart

From Feb 2024 to Feb 2025