Murchinson Questions Nano Dimension’s Lack of Response to Reports of Suspected Connections Between Nano Management and Affiliates of a US-Sanctioned Kremlin-Related Russian Oligarch

November 17 2024 - 4:05PM

Business Wire

Believes Yoav Stern's Silence is Deafening

Murchinson Ltd. (collectively with its affiliates and funds it

advises and/or sub-advises, “Murchinson” or “we”), a significant

shareholder with approximately 7.1% of the outstanding shares of

Nano Dimension Ltd. (NASDAQ: NNDM) (“Nano” or the “Company”), today

issued the following statement:

“Recent media reports have revealed facts suggesting

questionable relationships between Nano’s leadership and affiliates of a sanctioned Russian

oligarch, further calling into question the Board’s

judgment and governance.1,2 Despite this reporting, CEO Yoav Stern

and the Board have remained silent.

Shareholders deserve answers and clarifications:

- Do Mr. Stern and the members of management deny being aware of

the alleged connections between the sanctioned person and the two

individuals who controlled DeepCube at the time Nano acquired it

for more than $70 million – Yaron Eitan and Andrew Intrater?

- Who were the beneficial owners of the mysterious Anakhnu

LLC?

- Were the Nano Board members (including Christopher J. Moran,

General Manager of Lockheed Martin Ventures) made aware of these

allegedly concerning connections (by Mr. Stern, CEO; by Mr. Eitan

and Dr. Eli David, Nano directors at the time of Nano’s acquisition

of DeepCube; or by external counsel)?

- Was the sensitive nature of AI technology in conjunction with

what media reports describe to be close affiliation with a

Kremlin-connected oligarch taken into consideration at the time of

acquisition given the importance of the U.S. defense sector to Nano

(as clients)?

- Why is Nano silent?

We urge Mr. Stern and the rest of the Nano Board to publicly

address these questions. Shareholders deserve transparency and to

be fully informed regarding material information that could impact

their voting decisions.”

About Murchinson

Founded in 2012 and based in Toronto, Canada, Murchinson is an

alternative asset management firm that serves institutional

investors, family offices and qualified clients. The firm has

extensive experience capturing the best returning opportunities

across global markets. Murchinson’s multi-strategy approach allows

it to execute investments at all points in the market cycle with

fluid allocation between strategies. Our team targets corporate

action, distressed investing, private equity and structured finance

situations, leveraging its broad market experience with a variety

of specialized products and sophisticated hedging techniques to

deliver alpha within a risk-averse mandate. Learn more at

www.murchinsonltd.com.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward‐looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Murchinson and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Murchinson undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is based on

public information and is for information purposes only in order to

provide the views of Murchinson and the matters which Murchinson

believes to be of concern to shareholders described herein. The

information is not tailored to specific investment objections, the

financial situations, suitability, or particular need of any

specific person(s) who may receive the information, and should not

be taken as advice in considering the merits of any investment

decision. The views expressed herein represent the views and

opinions of Murchinson, whose opinions may change at any time and

which are based on analyses of Murchinson and its advisors. In

addition, the information contained herein is being publicly

disclosed without prejudice and shall not be construed to prejudice

any of Murchinson’s rights, demands, grounds and/or remedies under

any contract and/or law.

1

https://www.realclearmarkets.com/articles/2024/11/07/close_cfius_due_diligence_is_necessary_ahead_of_desktop_metals_acquisition_1070746.html#google_vignette

2 https://www.savenanodimension.com/our-resources

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241117947307/en/

Okapi Partners LLC Bruce Goldfarb / Chuck Garske 212-297-0720

info@okapipartners.com Longacre Square Partners

murchinson@longacresquare.com

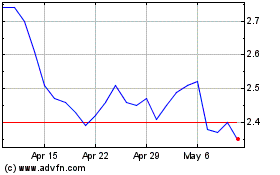

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Oct 2024 to Nov 2024

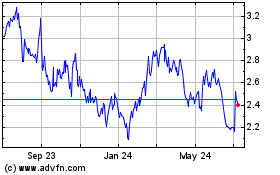

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Nov 2023 to Nov 2024