- Net revenue of $92.0 million in Q2, GAAP gross margin of

54.6% and non-GAAP gross margin of 60.2%

MaxLinear, Inc. (Nasdaq: MXL), a leading provider of radio

frequency (RF), analog, digital and mixed-signal integrated

circuits, today announced financial results for the second quarter

ended June 30, 2024.

Second Quarter Financial Highlights

GAAP basis:

- Net revenue was $92.0 million, down 3% sequentially and down

50% year-over-year.

- GAAP gross margin was 54.6%, compared to 51.7% in the prior

quarter, and 55.9% in the year-ago quarter.

- GAAP operating expenses were $91.0 million in the second

quarter 2024, or 99% of net revenue, compared to $123.9 million in

the prior quarter, or 130% of net revenue, and $108.8 million in

the year-ago quarter, or 59% of net revenue.

- GAAP loss from operations was 44% of net revenue, compared to

loss from operations of 78% of net revenue in the prior quarter,

and loss from operations of 3% of net revenue in the year-ago

quarter.

- Net cash flow used in operating activities was $2.7 million,

compared to net cash flow provided by operating activities of $16.0

million in the prior quarter, and net cash flow provided by

operating activities of $30.6 million in the year-ago quarter.

- GAAP diluted loss per share was $0.47, compared to diluted loss

per share of $0.88 in the prior quarter, and diluted loss per share

of $0.05 in the year-ago quarter.

Non-GAAP basis:

- Non-GAAP gross margin was 60.2%. This compares to 60.6% in the

prior quarter, and 61.0% in the year-ago quarter.

- Non-GAAP operating expenses were $74.8 million, or 81% of net

revenue, compared to $74.8 million or 78% of net revenue in the

prior quarter, and $82.5 million or 45% of net revenue in the

year-ago quarter.

- Non-GAAP loss from operations was 21% of net revenue, compared

to loss of 18% in the prior quarter, and income of 16% in the

year-ago quarter.

- Non-GAAP diluted loss per share was $0.25, compared to loss of

$0.21 in the prior quarter, and earnings of $0.34 in the year-ago

quarter.

Management Commentary

“In conclusion, we are excited and confident in our progress in

the infrastructure market with our wireless and optical

interconnect products, even as we await a broadband recovery,” said

Kishore Seendripu, PhD, Chairman and CEO. “In addition, our

Ethernet, storage, Wi-Fi7, and fiber PON gateway products are all

in the market today addressing additional new TAM, have strong

customer traction, and are poised for meaningful growth. We are

optimizing our efforts around these opportunities, which will be

transformative for our future business while driving maximum value

for our customers and shareholders.”

Third Quarter 2024 Business Outlook

The company expects net revenue in the third quarter of 2024 to

be approximately $70 million to $90 million. The Company also

estimates the following:

- GAAP gross margin of approximately 52.5% to 55.5%;

- Non-GAAP gross margin of approximately 57.0% to 60.0%;

- GAAP operating expenses of approximately $102 million to $108

million;

- Non-GAAP operating expenses of approximately $70 million to $76

million;

- GAAP and non-GAAP interest and other expense of approximately

$0 to $2.0 million each; and

- GAAP and non-GAAP diluted share count of approximately 84.1

million each.

Webcast and Conference Call

MaxLinear will host its second quarter financial results

conference call today, July 24, 2024 at 1:30 p.m. Pacific Time

(4:30 p.m. Eastern Time). To access this call, dial US toll free:

1-877-407-3109 / International: 1-201-493-6798. A live webcast of

the conference call will be accessible from the investor relations

section of the MaxLinear website at

https://investors.maxlinear.com, and will be archived and available

after the call at https://investors.maxlinear.com until August 7,

2024. A replay of the conference call will also be available until

August 7, 2024 by dialing US toll free: 1-877-660-6853 /

International: 1-201-612-7415 and Conference ID#: 13747243.

Cautionary Note Concerning Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include, among others,

statements concerning our future financial performance (including

our current guidance for third quarter 2024 net revenue, and GAAP

and non-GAAP amounts for each of the following: gross margins,

operating expenses, interest and other expenses, and diluted share

counts); our potential growth and revenue opportunities; market

trends; settlement of bonus awards for our 2024 performance period;

and statements by our Chairman and CEO. These forward-looking

statements involve known and unknown risks, uncertainties, and

other factors that may cause actual results to be materially

different from any future results expressed or implied by the

forward-looking statements and our future financial performance and

operating results forecasts generally. Forward-looking statements

are based on management’s current, preliminary expectations and are

subject to various risks and uncertainties. In particular, our

future operating results are substantially dependent on our

assumptions about market trends and conditions. Additional risks

and uncertainties affecting our business, future operating results

and financial condition include, without limitation; risks relating

to our terminated merger with Silicon Motion and related

arbitration and class action complaint and the risks related to

potential payment of damages; the effect of intense and increasing

competition; impacts of global economic conditions; the cyclical

nature of the semiconductor industry; a significant variance in our

operating results and impact on volatility in our stock price, and

our ability to sustain our current level of revenue, which has

declined, and/or manage future growth effectively, and the impact

of excess inventory in the channel on our customers’ expected

demand for certain of our products; the geopolitical and economic

tensions among the countries in which we conduct business;

increased tariffs, export controls or imposition of other trade

barriers; our ability to obtain or retain government authorization

to export certain of our products or technology; risks related to

the loss of, or a significant reduction in orders from major

customers; costs of legal proceedings or potential violations of

regulations; information technology failures; a decrease in the

average selling prices of our products; failure to penetrate new

applications and markets; development delays and consolidation

trends in our industry; inability to make substantial research and

development investments; delays or expenses caused by undetected

defects or bugs in our products; substantial quarterly and annual

fluctuations in our revenue and operating results; failure to

timely develop and introduce new or enhanced products; order and

shipment uncertainties; failure to accurately predict our future

revenue and appropriately budget expenses; lengthy and expensive

customer qualification processes; customer product plan

cancellations; failure to maintain compliance with government

regulations; failure to attract and retain qualified personnel; any

adverse impact of rising interest rates on us, our customers, and

our distributors and related demand; risks related to compliance

with privacy, data protection and cybersecurity laws and

regulations; risks related to conforming our products to industry

standards; risks related to business acquisitions and investments;

claims of intellectual property infringement; our ability to

protect our intellectual property; risks related to security

vulnerabilities of our products; use of open source software in our

products; and failure to manage our relationships with, or negative

impacts from, third parties.

In addition to these risks and uncertainties, investors should

review the risks and uncertainties contained in our filings with

the Securities and Exchange Commission (SEC), including our Current

Reports on Form 8-K, as well as the information to be set forth

under the caption "Risk Factors" in MaxLinear's Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2024. All

forward-looking statements are based on the estimates, projections

and assumptions of management as of July 24, 2024, and MaxLinear is

under no obligation (and expressly disclaims any such obligation)

to update or revise any forward-looking statements whether as a

result of new information, future events, or otherwise.

Use of Non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

presented on a basis consistent with GAAP, we disclose certain

non-GAAP financial measures, including non-GAAP gross margin,

non-GAAP operating expenses, non-GAAP operating expenses as a

percentage of net revenue, non-GAAP income (loss) from operations

as percentage of revenue, non-GAAP interest and other expenses,

non-GAAP diluted earnings (loss) per share, and non-GAAP diluted

share count. These supplemental measures exclude the effects of (i)

stock-based compensation expense; (ii) accruals related to our

performance-based bonus plan for 2024, which we intend to settle in

shares of our common stock; (iii) accruals related to our

performance-based bonus plan for 2023, which we settled in shares

of common stock in February 2024; (iv) amortization of purchased

intangible assets; (v) research and development funded by others;

(vi) acquisition and integration costs related to our acquisitions,

including costs incurred related to the termination of the

previously pending (now terminated) merger with Silicon Motion;

(vii) impairment of intangible assets; (viii) severance and other

restructuring charges; (ix) other non-recurring interest and other

income (expenses), net attributable to acquisitions; and (x)

non-cash income tax benefits and expenses. Non-GAAP financial

measures are not meant to be considered in isolation or as a

substitute for the comparable GAAP financial measures. Non-GAAP

financial measures are subject to limitations, and should be read

only in conjunction with the company’s consolidated financial

statements prepared in accordance with GAAP. Non-GAAP financial

measures do not have any standardized meaning and are therefore

unlikely to be comparable to similarly titled measures presented by

other companies. We believe that these non-GAAP measures have

limitations in that they do not reflect all of the amounts

associated with our GAAP results of operations. We compensate for

the limitations of non-GAAP financial measures by relying upon GAAP

results to gain a complete picture of our performance.

We believe that non-GAAP financial measures can provide useful

information to both management and investors by excluding certain

non-cash and other one-time expenses that we believe are not

indicative of our core operating results. Among other uses, our

management uses non-GAAP measures to compare our performance

relative to forecasts and strategic plans and to benchmark our

performance externally against competitors. In addition,

management’s incentive compensation will be determined in part

using these non-GAAP measures because we believe non-GAAP measures

better reflect our core operating performance.

The following are explanations of each type of adjustment that

we incorporate into non-GAAP financial measures:

Stock-based compensation expense relates to equity incentive

awards granted to our employees, directors, and consultants. Our

equity incentive plans are important components of our employee

incentive compensation arrangements and are reflected as expenses

in our GAAP results. Stock-based compensation expense has been and

will continue to be a significant recurring expense for MaxLinear.

While we include the dilutive impact of equity awards in weighted

average shares outstanding, the expense associated with stock-based

awards reflects a non-cash charge that we exclude from non-GAAP net

income or loss.

Performance-based equity consists of accruals related to our

executive and non-executive bonus programs, and have been excluded

from our non-GAAP net income or loss for all periods reported.

Bonus payments for the 2023 performance periods were settled

through the issuance of shares of common stock under our equity

incentive plans in February 2024. We currently expect that bonus

awards under our fiscal 2024 program will be settled in common

stock in the first quarter of fiscal 2025.

Expenses incurred in relation to acquisitions include

amortization of purchased intangible assets, acquisition and

integration costs primarily consisting of professional and

consulting fees, including costs incurred related to the

termination of the previously pending (now terminated) merger with

Silicon Motion; and accretion of discount on contingent

consideration to interest expense.

Research and development funded by others represents proceeds

received under contracts for jointly funded R&D projects to

develop technology that may be commercialized into a product in the

future. Initially such proceeds may not yet be recognized in GAAP

results if, pursuant to contract terms, the Company may be required

to repay all or a portion of the funds provided by the other party

under certain conditions. Management believes it is not probable

that it will trigger such conditions. Once such conditions have

been resolved, the proceeds are recognized in GAAP results, and

accordingly, reversed from non-GAAP results.

Impairment losses are related to abandonment of acquired or

purchased intangible assets.

Restructuring charges incurred are related to our restructuring

plans which eliminate redundancies and primarily include severance

and restructuring costs related to impairment of leased

right-of-use assets or from exiting certain facilities.

Income tax benefits and expense adjustments are those that do

not affect cash income taxes payable.

Reconciliations of non-GAAP measures for the historic periods

disclosed in this press release appear below. Because of the

inherent uncertainty associated with our ability to project future

charges, we are also unable to predict their probable significance,

particularly related to stock-based compensation and its related

tax effects as well as potential impairments, a quantitative

reconciliation is not available without unreasonable efforts and

accordingly, in reliance on the exception provided by Item

10(e)(1)(i)(B) of Regulation S-K, we have not provided a

reconciliation for non-GAAP guidance provided for the third quarter

2024.

About MaxLinear, Inc.

MaxLinear, Inc. (Nasdaq:MXL) is a leading provider of radio

frequency (RF), analog, digital and mixed-signal integrated

circuits for access and connectivity, wired and wireless

infrastructure, and industrial and multi-market applications.

MaxLinear is headquartered in Carlsbad, California. For more

information, please visit www.maxlinear.com.

MXL is MaxLinear’s registered trademark. Other trademarks

appearing herein are the property of their respective owners.

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Net revenue

$

91,990

$

95,269

$

183,938

Cost of net revenue

41,804

46,001

81,065

Gross profit

50,186

49,268

102,873

Operating expenses:

Research and development

56,541

64,766

70,657

Selling, general and administrative

33,600

36,488

33,717

Restructuring charges

865

22,630

4,436

Total operating expenses

91,006

123,884

108,810

Loss from operations

(40,820

)

(74,616

)

(5,937

)

Interest income

1,871

1,822

1,903

Interest expense

(2,706

)

(2,711

)

(2,591

)

Other income (expense), net

329

1,434

1,865

Total other income (expense), net

(506

)

545

1,177

Loss before income taxes

(41,326

)

(74,071

)

(4,760

)

Income tax benefit

(2,060

)

(1,762

)

(409

)

Net loss

$

(39,266

)

$

(72,309

)

$

(4,351

)

Net loss per share:

Basic

$

(0.47

)

$

(0.88

)

$

(0.05

)

Diluted

$

(0.47

)

$

(0.88

)

$

(0.05

)

Shares used to compute net loss per

share:

Basic

83,477

82,349

80,446

Diluted

83,477

82,349

80,446

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per

share data)

Six Months Ended

June 30, 2024

June 30, 2023

Net revenue

$

187,259

$

432,380

Cost of net revenue

87,805

189,200

Gross profit

99,454

243,180

Operating expenses:

Research and development

121,307

137,948

Selling, general and administrative

70,088

72,370

Impairment losses

—

2,438

Restructuring charges

23,495

9,084

Total operating expenses

214,890

221,840

Income (loss) from operations

(115,436

)

21,340

Interest income

3,693

2,536

Interest expense

(5,417

)

(5,078

)

Other income (expense), net

1,763

1,541

Total other income (expense), net

39

(1,001

)

Income (loss) before income taxes

(115,397

)

20,339

Income tax provision (benefit)

(3,822

)

15,157

Net income (loss)

$

(111,575

)

$

5,182

Net income (loss) per share:

Basic

$

(1.35

)

$

0.06

Diluted

$

(1.35

)

$

0.06

Shares used to compute net income (loss)

per share:

Basic

82,913

79,961

Diluted

82,913

81,520

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

Operating Activities

Net loss

$

(39,266

)

$

(72,309

)

$

(4,351

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Amortization and depreciation

13,600

16,684

18,707

Amortization of debt issuance costs and

accretion of discount on debt and leases

665

688

625

Stock-based compensation

17,359

17,061

17,197

Deferred income taxes

(2,053

)

(2,685

)

758

Loss on disposal of property and

equipment

55

390

2,001

Unrealized holding gain on investments

—

—

(1,807

)

Impairment of leased right-of-use

assets

700

2,038

—

(Gain) loss on extinguishment of lease

liabilities

16

(569

)

—

Gain on foreign currency and other

(398

)

(968

)

(209

)

Excess tax benefits on stock based

awards

(152

)

(1,367

)

(791

)

Changes in operating assets and

liabilities:

Accounts receivable, net

41,290

44,389

33,098

Inventory

1,387

3,783

23,433

Prepaid expenses and other assets

1,281

(2,044

)

(1,314

)

Accounts payable, accrued expenses and

other current liabilities

(24,280

)

12,009

(26,378

)

Accrued compensation

(5,855

)

8,707

(3,348

)

Accrued price protection liability

(3,603

)

(6,451

)

(23,164

)

Lease liabilities

(2,540

)

(2,505

)

(2,914

)

Other long-term liabilities

(902

)

(881

)

(965

)

Net cash provided by (used in) operating

activities

(2,696

)

15,970

30,578

Investing Activities

Purchases of property and equipment

(3,013

)

(8,342

)

(5,037

)

Purchases of intangible assets

(2,775

)

(368

)

(4,894

)

Cash used in acquisitions, net of cash

acquired

—

—

(2,719

)

Net cash used in investing activities

(5,788

)

(8,710

)

(12,650

)

Financing Activities

Net proceeds from issuance of common

stock

1,579

—

3,073

Minimum tax withholding paid on behalf of

employees for restricted stock units

447

(2,103

)

(2,965

)

Net cash provided by (used in) financing

activities

2,026

(2,103

)

108

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(335

)

(583

)

(1,229

)

Increase (decrease) in cash, cash

equivalents and restricted cash

(6,793

)

4,574

16,807

Cash, cash equivalents and restricted cash

at beginning of period

192,930

188,356

208,836

Cash, cash equivalents and restricted cash

at end of period

$

186,137

$

192,930

$

225,643

MAXLINEAR, INC.

UNAUDITED GAAP CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

Six Months Ended

June 30, 2024

June 30, 2023

Operating Activities

Net income (loss)

$

(111,575

)

$

5,182

Adjustments to reconcile net income (loss)

to cash provided by operating activities:

Amortization and depreciation

30,284

37,909

Impairment losses

—

2,438

Amortization of debt issuance costs and

accretion of discount on debt and leases

1,353

1,173

Stock-based compensation

34,420

33,645

Deferred income taxes

(4,738

)

8,886

Loss on disposal of property and

equipment

445

2,041

Unrealized holding gain on investments

—

(1,959

)

Impairment of leased right-of-use

assets

2,738

—

Gain on extinguishment of lease

liabilities

(553

)

—

(Gain) loss on foreign currency

(1,366

)

153

Excess tax benefits on stock-based

awards

(1,519

)

(1,298

)

Changes in operating assets and

liabilities:

Accounts receivable, net

85,679

16,167

Inventory

5,170

34,392

Prepaid expenses and other assets

(763

)

(5,652

)

Accounts payable, accrued expenses and

other current liabilities

(12,271

)

(27,264

)

Accrued compensation

2,852

3,862

Accrued price protection liability

(10,054

)

(33,041

)

Lease liabilities

(5,045

)

(6,009

)

Other long-term liabilities

(1,783

)

2,112

Net cash provided by operating

activities

13,274

72,737

Investing Activities

Purchases of property and equipment

(11,355

)

(10,253

)

Purchases of intangible assets

(3,143

)

(5,524

)

Cash used in acquisitions, net of cash

acquired

—

(12,384

)

Net cash used in investing activities

(14,498

)

(28,161

)

Financing Activities

Net proceeds from issuance of common

stock

1,579

3,076

Minimum tax withholding paid on behalf of

employees for restricted stock units

(1,656

)

(9,138

)

Net cash used in financing activities

(77

)

(6,062

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(918

)

(1,228

)

Increase (decrease) in cash, cash

equivalents and restricted cash

(2,219

)

37,286

Cash, cash equivalents and restricted cash

at beginning of period

188,356

188,357

Cash, cash equivalents and restricted cash

at end of period

$

186,137

$

225,643

MAXLINEAR, INC.

UNAUDITED GAAP CONDENSED

CONSOLIDATED BALANCE SHEETS

(in thousands)

June 30, 2024

March 31, 2024

June 30, 2023

Assets

Current assets:

Cash and cash equivalents

$

185,108

$

191,882

$

224,579

Short-term restricted cash

1,006

1,028

1,042

Short-term investments

—

—

20,488

Accounts receivable, net

84,940

126,230

155,834

Inventory

94,738

96,125

126,152

Prepaid expenses and other current

assets

31,789

29,414

26,396

Total current assets

397,581

444,679

554,491

Long-term restricted cash

23

20

22

Property and equipment, net

65,422

68,338

73,845

Leased right-of-use assets

24,883

27,468

35,112

Intangible assets, net

61,786

64,939

91,203

Goodwill

318,588

318,588

318,456

Deferred tax assets

74,228

72,176

56,757

Other long-term assets

30,686

34,417

31,594

Total assets

$

973,197

$

1,030,625

$

1,161,480

Liabilities and stockholders’

equity

Current liabilities

$

190,277

$

223,854

$

241,729

Long-term lease liabilities

21,522

23,897

30,712

Long-term debt

122,684

122,529

122,064

Other long-term liabilities

21,459

22,362

20,928

Stockholders’ equity

617,255

637,983

746,047

Total liabilities and stockholders’

equity

$

973,197

$

1,030,625

$

1,161,480

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF

NON-GAAP ADJUSTMENTS

(in thousands, except per

share data)

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

GAAP gross profit

$

50,186

$

49,268

$

102,873

Stock-based compensation

173

181

246

Performance based equity

(37

)

72

(16

)

Amortization of purchased intangible

assets

5,089

8,221

9,117

Non-GAAP gross profit

55,411

57,742

112,220

GAAP R&D expenses

56,541

64,766

70,657

Stock-based compensation

(10,088

)

(10,441

)

(12,237

)

Performance based equity

1,789

(4,929

)

273

Research and development funded by

others

—

(1,000

)

(1,000

)

Non-GAAP R&D expenses

48,242

48,396

57,693

GAAP SG&A expenses

33,600

36,488

33,717

Stock-based compensation

(7,097

)

(6,439

)

(4,713

)

Performance based equity

722

(2,427

)

193

Amortization of purchased intangible

assets

(592

)

(591

)

(709

)

Acquisition and integration costs

(102

)

(664

)

(3,714

)

Non-GAAP SG&A expenses

26,531

26,367

24,774

GAAP restructuring expenses

865

22,630

4,436

Restructuring charges

(865

)

(22,630

)

(4,436

)

Non-GAAP restructuring expenses

—

—

—

GAAP loss from operations

(40,820

)

(74,616

)

(5,937

)

Total non-GAAP adjustments

21,458

57,595

35,690

Non-GAAP income (loss) from operations

(19,362

)

(17,021

)

29,753

GAAP interest and other income (expense),

net

(506

)

545

1,177

Non-recurring interest and other income

(expense), net

65

73

68

Non-GAAP interest and other income

(expense), net

(441

)

618

1,245

GAAP loss before income taxes

(41,326

)

(74,071

)

(4,760

)

Total non-GAAP adjustments

21,523

57,668

35,758

Non-GAAP income (loss) before income

taxes

(19,803

)

(16,403

)

30,998

GAAP income tax benefit

(2,060

)

(1,762

)

(409

)

Adjustment for non-cash tax

benefits/expenses

3,205

2,762

3,508

Non-GAAP income tax provision

1,145

1,000

3,099

GAAP net loss

(39,266

)

(72,309

)

(4,351

)

Total non-GAAP adjustments before income

taxes

21,523

57,668

35,758

Less: total tax adjustments

3,205

2,762

3,508

Non-GAAP net income (loss)

$

(20,948

)

$

(17,403

)

$

27,899

Shares used in computing GAAP and non-GAAP

basic net income (loss) per share

83,477

82,349

80,446

Shares used in computing GAAP diluted net

loss per share

83,477

82,349

80,446

Dilutive common stock equivalents

—

—

1,252

Shares used in computing non-GAAP diluted

net income (loss) per share

83,477

82,349

81,698

Non-GAAP basic net income (loss) per

share

$

(0.25

)

$

(0.21

)

$

0.35

Non-GAAP diluted net income (loss) per

share

$

(0.25

)

$

(0.21

)

$

0.34

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF

NON-GAAP ADJUSTMENTS

(in thousands, except per

share data)

Six months ended

June 30, 2024

June 30, 2023

GAAP gross profit

$

99,454

$

243,180

Stock-based compensation

354

456

Performance based equity

35

75

Amortization of purchased intangible

assets

13,310

18,438

Non-GAAP gross profit

113,153

262,149

GAAP R&D expenses

121,307

137,948

Stock-based compensation

(20,529

)

(23,692

)

Performance based equity

(3,140

)

(3,362

)

Research and development funded by

others

(1,000

)

(2,000

)

Non-GAAP R&D expenses

96,638

108,894

GAAP SG&A expenses

70,088

72,370

Stock-based compensation

(13,536

)

(9,497

)

Performance based equity

(1,705

)

(1,551

)

Amortization of purchased intangible

assets

(1,183

)

(1,637

)

Acquisition and integration costs

(766

)

(5,315

)

Non-GAAP SG&A expenses

52,898

54,370

GAAP impairment losses

—

2,438

Impairment losses

—

(2,438

)

Non-GAAP impairment losses

—

—

GAAP restructuring expenses

23,495

9,084

Restructuring charges

(23,495

)

(9,084

)

Non-GAAP restructuring expenses

—

—

GAAP income (loss) from operations

(115,436

)

21,340

Total non-GAAP adjustments

79,053

77,545

Non-GAAP income (loss) from operations

(36,383

)

98,885

GAAP interest and other income (expense),

net

39

(1,001

)

Non-recurring interest and other income

(expense), net

138

179

Non-GAAP interest and other income

(expense), net

177

(822

)

GAAP income (loss) before income taxes

(115,397

)

20,339

Total non-GAAP adjustments

79,191

77,724

Non-GAAP income (loss) before income

taxes

(36,206

)

98,063

GAAP income tax provision (benefit)

(3,822

)

15,157

Adjustment for non-cash tax

benefits/expenses

5,967

(5,351

)

Non-GAAP income tax provision

2,145

9,806

GAAP net income (loss)

(111,575

)

5,182

Total non-GAAP adjustments before income

taxes

79,191

77,724

Less: total tax adjustments

5,967

(5,351

)

Non-GAAP net income (loss)

$

(38,351

)

$

88,257

Shares used in computing GAAP and non-GAAP

basic net income (loss) per share

82,913

79,961

Shares used in computing GAAP diluted net

income (loss) per share

82,913

81,520

Dilutive common stock equivalents

—

—

Shares used in computing non-GAAP diluted

net income (loss) per share

82,913

81,520

Non-GAAP basic net income (loss) per

share

$

(0.46

)

$

1.10

Non-GAAP diluted net income (loss) per

share

$

(0.46

)

$

1.08

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL MEASURES

AS A PERCENTAGE OF NET

REVENUE

Three Months Ended

June 30, 2024

March 31, 2024

June 30, 2023

GAAP gross margin

54.6

%

51.7

%

55.9

%

Stock-based compensation

0.2

%

0.2

%

0.1

%

Performance based equity

—

%

0.1

%

—

%

Amortization of purchased intangible

assets

5.5

%

8.6

%

5.0

%

Non-GAAP gross margin

60.2

%

60.6

%

61.0

%

GAAP R&D expenses

61.5

%

68.0

%

38.4

%

Stock-based compensation

(11.0

)%

(11.0

)%

(6.7

)%

Performance based equity

1.9

%

(5.2

)%

0.2

%

Research and development funded by

others

—

%

(1.1

)%

(0.5

)%

Non-GAAP R&D expenses

52.4

%

50.8

%

31.4

%

GAAP SG&A expenses

36.5

%

38.3

%

18.3

%

Stock-based compensation

(7.7

)%

(6.8

)%

(2.6

)%

Performance based equity

0.8

%

(2.6

)%

0.1

%

Amortization of purchased intangible

assets

(0.6

)%

(0.6

)%

(0.4

)%

Acquisition and integration costs

(0.1

)%

(0.7

)%

(2.0

)%

Non-GAAP SG&A expenses

28.8

%

27.7

%

13.5

%

GAAP restructuring expenses

0.9

%

23.8

%

2.4

%

Restructuring charges

(0.9

)%

(23.8

)%

(2.4

)%

Non-GAAP restructuring expenses

—

%

—

%

—

%

GAAP loss from operations

(44.4

)%

(78.3

)%

(3.2

)%

Total non-GAAP adjustments

23.3

%

60.5

%

19.4

%

Non-GAAP income (loss) from operations

(21.1

)%

(17.9

)%

16.2

%

GAAP interest and other income (expense),

net

(0.6

)%

0.6

%

0.6

%

Non-recurring interest and other income

(expense), net

0.1

%

0.1

%

—

%

Non-GAAP interest and other income

(expense), net

(0.5

)%

0.7

%

0.6

%

GAAP loss before income taxes

(44.9

)%

(77.8

)%

(2.6

)%

Total non-GAAP adjustments before income

taxes

23.4

%

60.5

%

19.4

%

Non-GAAP income (loss) before income

taxes

(21.5

)%

(17.2

)%

16.9

%

GAAP income tax benefit

(2.2

)%

(1.9

)%

(0.2

)%

Adjustment for non-cash tax

benefits/expenses

3.5

%

2.9

%

1.9

%

Non-GAAP income tax provision

1.2

%

1.1

%

1.7

%

GAAP net loss

(42.7

)%

(75.9

)%

(2.4

)%

Total non-GAAP adjustments before income

taxes

23.4

%

60.5

%

19.4

%

Less: total tax adjustments

3.5

%

2.9

%

1.9

%

Non-GAAP net income (loss)

(22.8

)%

(18.3

)%

15.2

%

MAXLINEAR, INC.

UNAUDITED RECONCILIATION OF

GAAP TO NON-GAAP FINANCIAL MEASURES

AS A PERCENTAGE OF NET

REVENUE

Six months ended

June 30, 2024

June 30, 2023

GAAP gross margin

53.1

%

56.2

%

Stock-based compensation

0.2

%

0.1

%

Performance based equity

—

%

—

%

Amortization of purchased intangible

assets

7.1

%

4.3

%

Non-GAAP gross margin

60.4

%

60.6

%

GAAP R&D expenses

64.8

%

31.9

%

Stock-based compensation

(11.0

)%

(5.5

)%

Performance based equity

(1.7

)%

(0.8

)%

Research and development funded by

others

(0.5

)%

(0.5

)%

Non-GAAP R&D expenses

51.6

%

25.2

%

GAAP SG&A expenses

37.4

%

16.7

%

Stock-based compensation

(7.2

)%

(2.2

)%

Performance based equity

(0.9

)%

(0.4

)%

Amortization of purchased intangible

assets

(0.6

)%

(0.4

)%

Acquisition and integration costs

(0.4

)%

(1.2

)%

Non-GAAP SG&A expenses

28.3

%

12.6

%

GAAP impairment losses

—

%

0.6

%

Impairment losses

—

%

(0.6

)%

Non-GAAP impairment losses

—

%

—

%

GAAP restructuring expenses

12.6

%

2.1

%

Restructuring charges

(12.6

)%

(2.1

)%

Non-GAAP restructuring expenses

—

%

—

%

GAAP income (loss) from operations

(61.7

)%

4.9

%

Total non-GAAP adjustments

42.2

%

17.9

%

Non-GAAP income (loss) from operations

(19.4

)%

22.9

%

GAAP interest and other income (expense),

net

—

%

(0.2

)%

Non-recurring interest and other income

(expense), net

0.1

%

—

%

Non-GAAP interest and other income

(expense), net

0.1

%

(0.2

)%

GAAP income (loss) before income taxes

(61.6

)%

4.7

%

Total non-GAAP adjustments

42.3

%

18.0

%

Non-GAAP income (loss) before income

taxes

(19.3

)%

22.7

%

GAAP income tax provision (benefit)

(2.0

)%

3.5

%

Adjustment for non-cash tax

benefits/expenses

3.2

%

(1.2

)%

Non-GAAP income tax provision

1.2

%

2.3

%

GAAP net income (loss)

(59.6

)%

1.2

%

Total non-GAAP adjustments before income

taxes

42.3

%

18.0

%

Less: total tax adjustments

3.2

%

(1.2

)%

Non-GAAP net income (loss)

(20.5

)%

20.4

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724295764/en/

MaxLinear, Inc. Investor Relations Contact:

Leslie Green Tel: +1 650-312-9060 lgreen@maxlinear.com

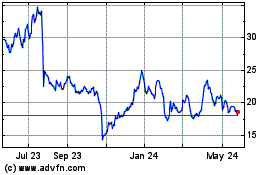

MaxLinear (NASDAQ:MXL)

Historical Stock Chart

From Dec 2024 to Jan 2025

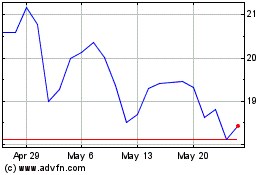

MaxLinear (NASDAQ:MXL)

Historical Stock Chart

From Jan 2024 to Jan 2025