false

0001771515

0001771515

2024-12-18

2024-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event reported):

December 18, 2024

Grocery Outlet Holding Corp.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-38950 |

47-1874201 |

(State or other jurisdiction of

incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

5650 Hollis Street,

Emeryville, California |

|

94608 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (510) 845-1999 |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

GO |

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Christopher M. Miller – Appointment

as Executive Vice President, Chief Financial Officer

On December 18, 2024, Grocery Outlet Holding

Corp. (the "Company" or "Grocery Outlet") issued a press release announcing the appointment of Chirstopher M. Miller

as the Company's Executive Vice President and Chief Financial Officer, effective January 6, 2025. Mr. Miller will report to

Eric J. Lindberg, Jr., the Company's Chairman of the Board and Interim President and Chief Executive Officer.

Mr. Miller, age 64, has served as Chief Financial

Officer at Shamrock Foods Company, the largest family-held food service distributor in the western United States, since January 2023.

From January 2007 to June 2022, he held several roles of increasing responsibility at Core-Mark Holding Co. (formerly Nasdaq:

CORE), a public company that was acquired by Performance Food Group Company (NYSE: PFGC) in September 2021 and the leading marketer

of fresh food and broad-line supply solutions to the convenience retail industry in North America. Most recently, he served as Core-Mark’s

Executive Vice President and Chief Financial Officer from January 2021 to June 2022. Prior to that role, he served as Core-Mark’s

Senior Vice President and Chief Financial Officer from May 2016 to January 2021, and Vice President and Chief Accounting Officer

from January 2007 to May 2016. Prior to joining Core-Mark, Mr. Miller was employed by Cost Plus World Market (formerly

known as Cost Plus Inc. and formerly Nasdaq: CPWM), a national specialty retailer, where he served as Vice President and Corporate Controller

from 2002 to 2006. Mr. Miller previously served as Chief Financial Officer of Echo Outsourcing from 2000 to 2002, in various financial

roles at Levi Strauss & Co. from 1996 to 2000, and in other financial and accounting roles since 1983. Mr. Miller received

a Bachelor of Business Administration degree in accounting from Dowling College and was a Certified Public Accountant.

In connection with his appointment, Mr. Miller

will:

| · | receive an annual base salary of $550,000; |

| · | be eligible to receive an annual cash bonus (with a target bonus of 60% of his base salary); |

| · | receive a signing bonus of $100,000; and |

| · | be eligible to receive (i) annual equity grants under the Company's 2019 Incentive Plan (with a target

grant value of 200% of his base salary, with 60% and 40% of the total equity grant value to be issued in performance stock units and restricted

stock units ("RSUs"), respectively), and (ii) an additional new hire grant of RSUs with a grant value of $400,000, in each

case as determined and approved by the Board or a committee thereof. All equity grants will be subject to the terms of the Company's 2019

Incentive Plan and the applicable award agreement. |

Mr. Miller’s base salary and annual

cash bonus will be prorated from the day he commences employment. In addition, Mr. Miller will be entitled to participate in the

Company's Executive Severance Plan through March 31, 2027. The Company and Mr. Miller will also enter into the Company's standard

Indemnification Agreement.

Interim Chief Financial

Officer

On December 18,

2024, and in connection with Mr. Miller’s appointment, the Company and Lindsay E. Gray mutually agreed that she will cease

service as the Company’s Interim Chief Financial Officer and principal financial officer, effective January 6, 2025, and that

she will continue to serve as the Company’s Senior Vice President, Accounting and principal accounting officer.

Item 7.01 Regulation FD Disclosure.

On December 18, 2024, the Company issued

a press release announcing Mr. Miller’s appointment as Executive Vice President and Chief Financial Officer of the Company,

effective January 6, 2025. A copy of the press release is attached to this report as Exhibit 99.1 and is incorporated herein

by reference.

The information in Item 7.01 of this current report

on Form 8-K (including Exhibit 99.1 furnished herewith) shall not be deemed "filed" for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned hereunto duly authorized.

| |

|

Grocery Outlet Holding Corp. |

| |

|

|

|

| Date: |

December 18, 2024 |

By: |

/s/ Luke D. Thompson |

| |

|

Name: |

Luke D. Thompson |

| |

|

Title: |

Executive Vice President, General Counsel and Secretary |

Exhibit 99.1

Grocery Outlet Holding Corp. Announces Appointment

of New Chief Financial Officer

Christopher Miller to join Grocery Outlet on

January 6, 2025

EMERYVILLE,

Calif., Dec. 18, 2024 (GLOBE NEWSWIRE) -- Grocery Outlet Holding Corp. (NASDAQ: GO) (“Grocery Outlet” or the

“Company”), today announced the appointment of Christopher Miller as Executive Vice President and Chief Financial Officer,

effective January 6, 2025. He will report directly to Eric Lindberg, Grocery Outlet’s Chairman of the Board and Interim President

and Chief Executive Officer.

Mr. Miller joins Grocery Outlet from Shamrock Foods Company, the

largest family-held food service distributor in the western United States, where he was the company’s CFO for nearly two years.

Prior to that, he spent over 15 years at Core-Mark Holding Co., the leading marketer of fresh food and broad-line supply solutions to

the convenience retail industry in North America, holding various financial and leadership roles, including EVP and Chief Financial Officer

and VP and Chief Accounting Officer. In addition, Mr. Miller’s background also includes a variety of finance and accounting

roles with retail and consumer products companies including Cost Plus World Market, Levi Strauss & Co., and Hermes.

“We are thrilled to welcome Chris Miller to the Grocery Outlet

team,” Mr. Lindberg said. “Chris is an accomplished CFO who brings a wealth of finance, accounting, business strategy,

and public company experience to the table that we are confident will benefit our independent operators, shareholders, and our business

as we continue to grow. We look forward to working with him to shape the future of Grocery Outlet.”

“Grocery Outlet is an exceptional company with a powerful business

model and an incredible culture that I can’t wait to be part of,” Mr. Miller said. “I’m excited to get to

work as we chart an exciting next chapter for the company.”

Upon Mr. Miller’s appointment, Lindsay Gray, who has been

serving as Interim CFO for the Company since March of this year, will continue her role of Senior Vice President, Accounting (Principal

Accounting Officer), which she held prior to the appointment as Interim CFO. “We would like to thank Lindsay for stepping up and

leading as Interim CFO during a pivotal year for the business, and we are fortunate to have her continued leadership over our accounting

and reporting function moving forward,” Mr. Lindberg said.

Forward-Looking Statements:

This

news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements

contained in this release other than statements of historical fact, including statements regarding our future operating results and financial

position, our business strategy and plans, market trends and leadership changes. These forward-looking statements are subject to a number

of risks, uncertainties and assumptions that may cause actual results to differ materially from those expressed or implied by any forward-looking

statements, including: the availability and supply of opportunistic products and other trending products at attractive pricing; our ability

to grow comparable store sales; risks related to new store growth and remodeled stores; inflation and other supply pricing impacts; the

success of our brand and product marketing; failure to maintain our supply and distribution networks; risks to cash flows and liquidity;

evolving retail competition, including online; catastrophic events and other factors discussed under "Risk Factors" in the

Company's most recent annual report on Form 10-K and in other subsequent reports the Company files with the United States Securities

and Exchange Commission (the "SEC"). The Company's periodic filings are accessible on the SEC's website at www.sec.gov.

Moreover, the Company operates in a very competitive

and rapidly changing environment, and new risks emerge from time to time. Although the Company believes that the expectations reflected

in the forward-looking statements are reasonable, and our expectations based on third-party information and projections are from sources

that management believes to be reputable, the Company cannot guarantee that future results, levels of activity, performance or achievements.

These forward-looking statements are made as of the date of this release or as of the date specified herein and the Company has based

these forward-looking statements on current expectations and projections about future events and trends. Except as required by law, the

Company does not undertake any duty to update any of these forward-looking statements after the date of this news release or to conform

these statements to actual results or revised expectations.

About

Grocery Outlet:

Based in Emeryville, California, Grocery Outlet is a high-growth, extreme value retailer of quality, name-brand

consumables and fresh products sold primarily through a network of independently operated stores. Grocery Outlet and its subsidiaries

have more than 520 stores in California, Washington, Oregon, Pennsylvania, Tennessee, Idaho, Nevada, Maryland, North Carolina, New

Jersey, Georgia, Ohio, Alabama, Delaware, Kentucky and Virginia.

INVESTOR

RELATIONS CONTACT:

Christine Chen

(510) 877-3192

cchen@cfgo.com

John Rouleau

(203) 682-4810

John.Rouleau@icrinc.com

MEDIA CONTACT:

Layla Kasha

(510) 379-2176

lkasha@cfgo.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

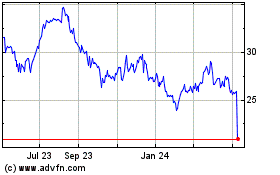

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Grocery Outlet (NASDAQ:GO)

Historical Stock Chart

From Jan 2024 to Jan 2025